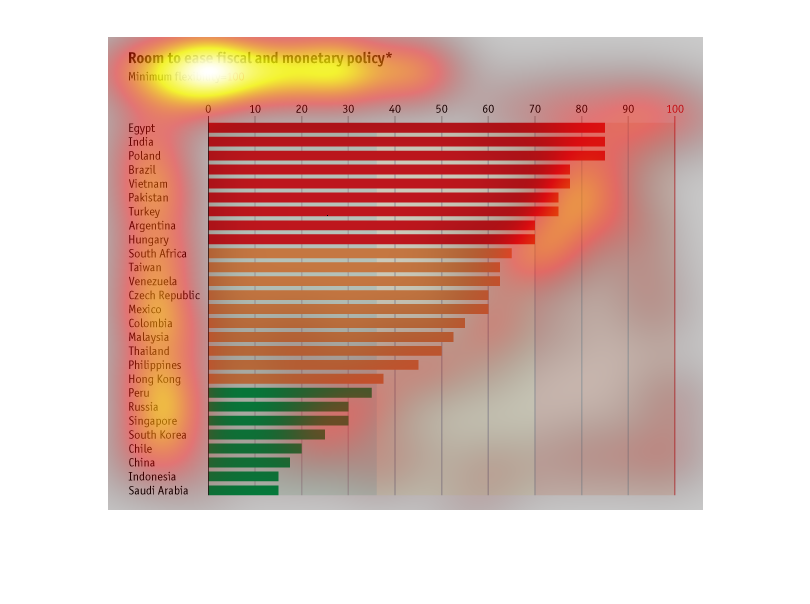

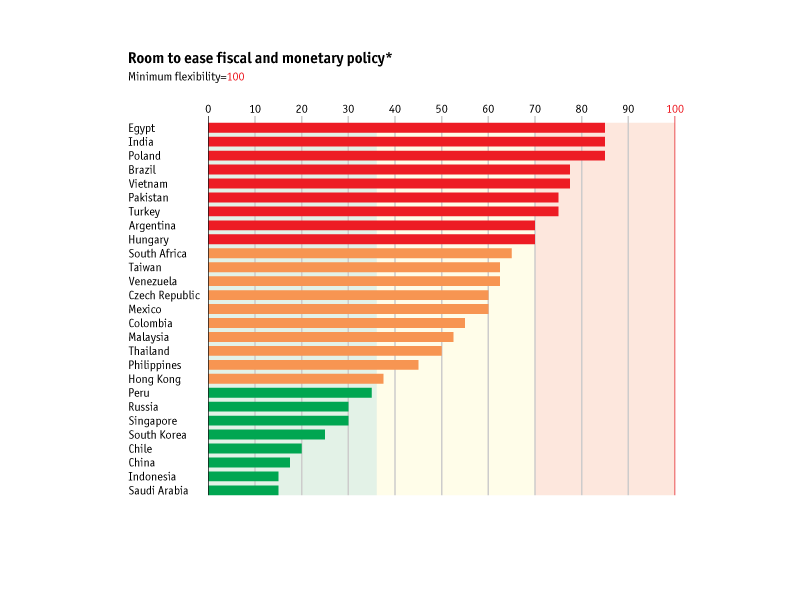

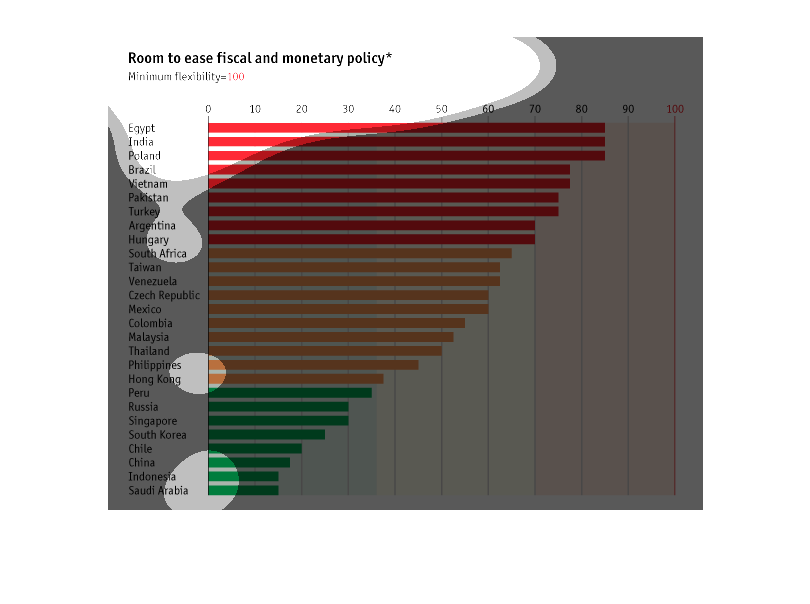

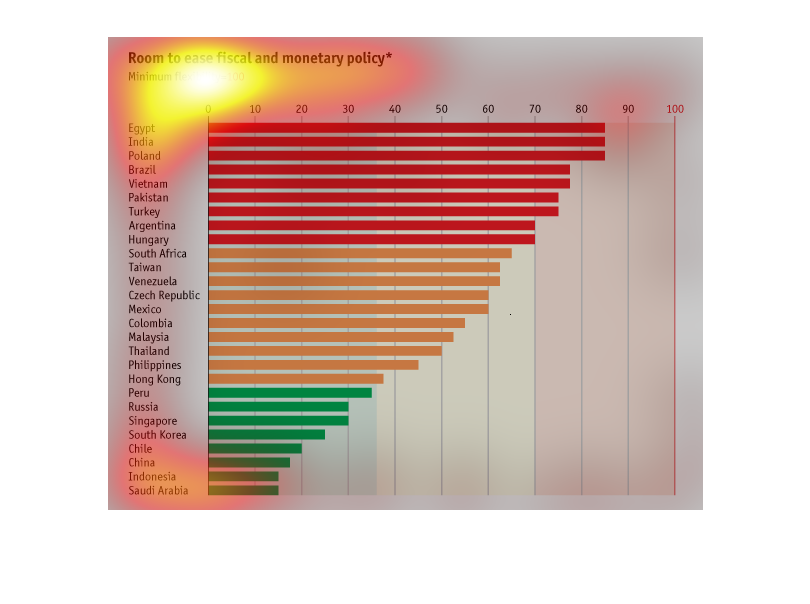

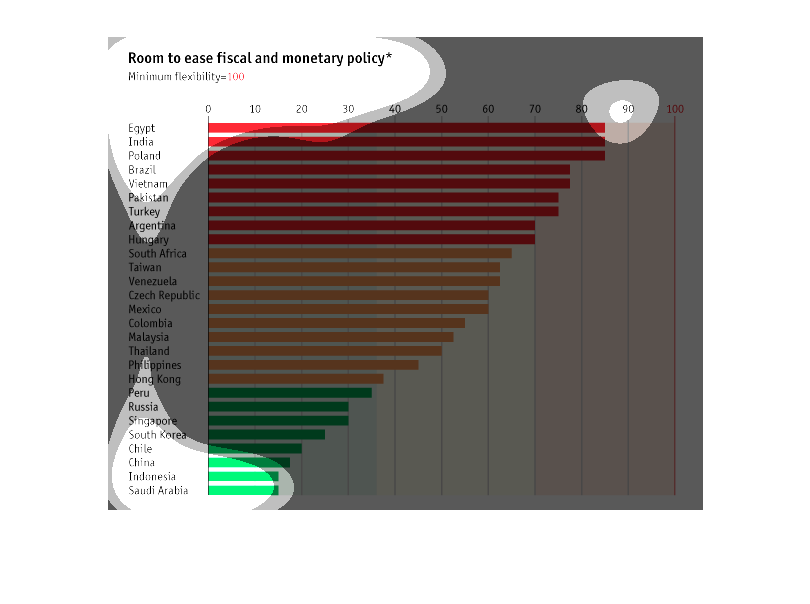

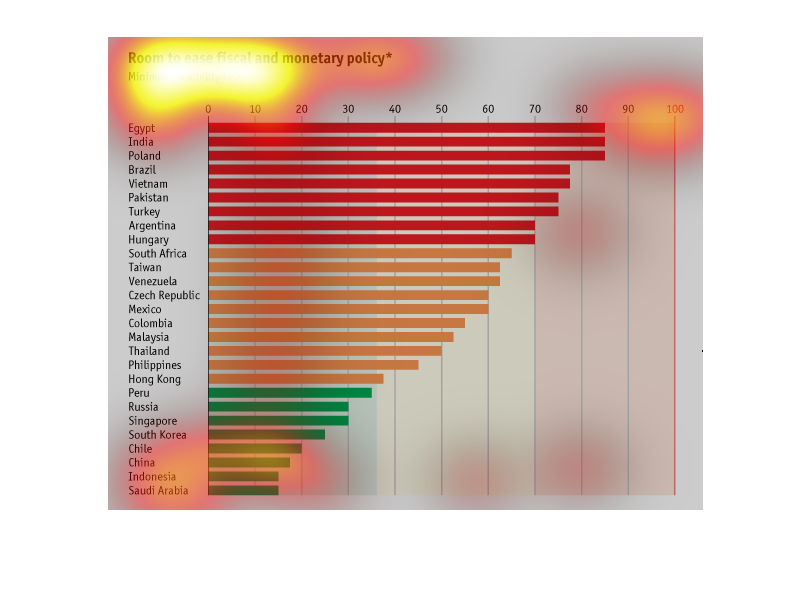

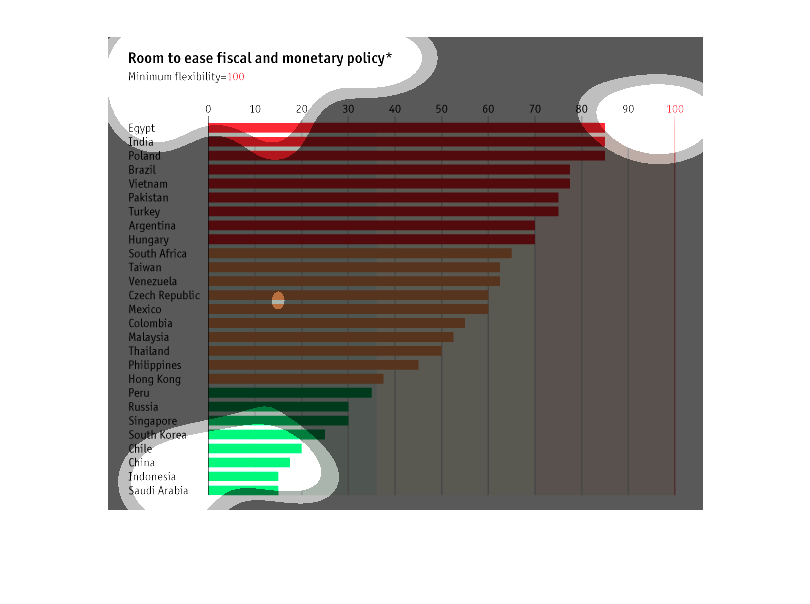

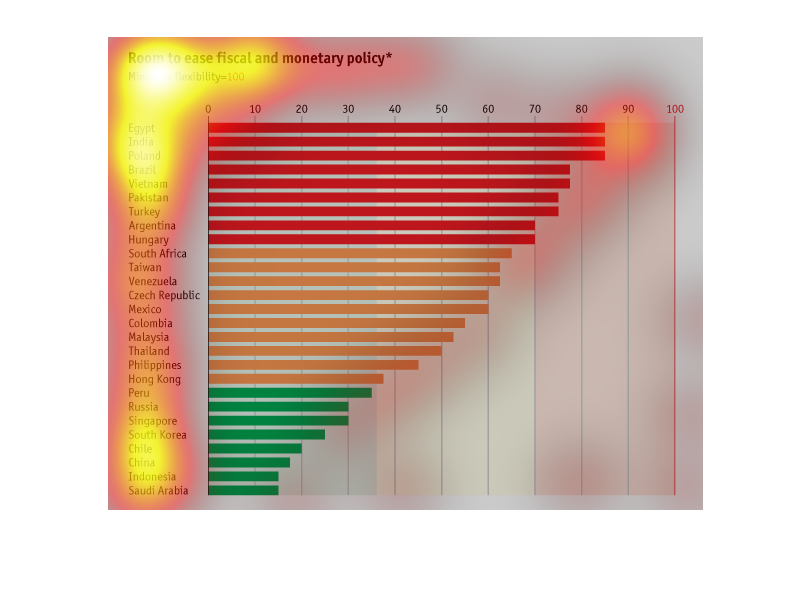

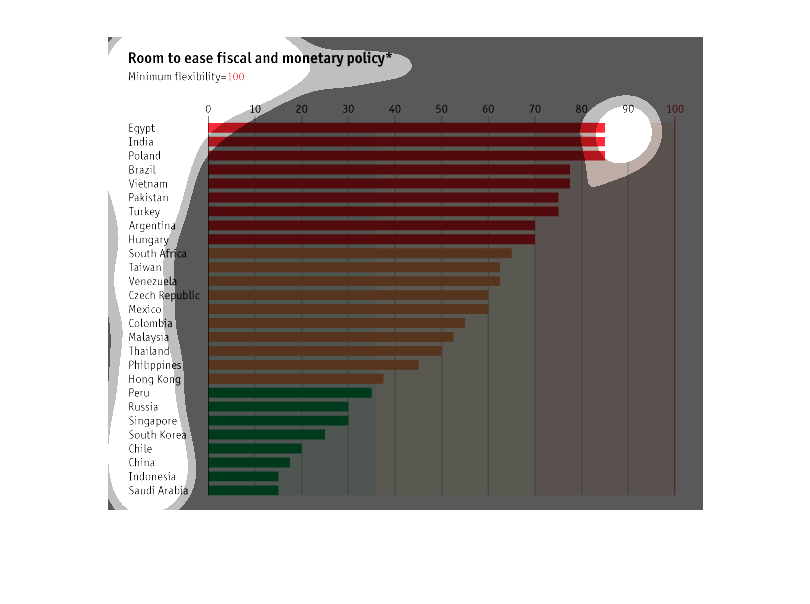

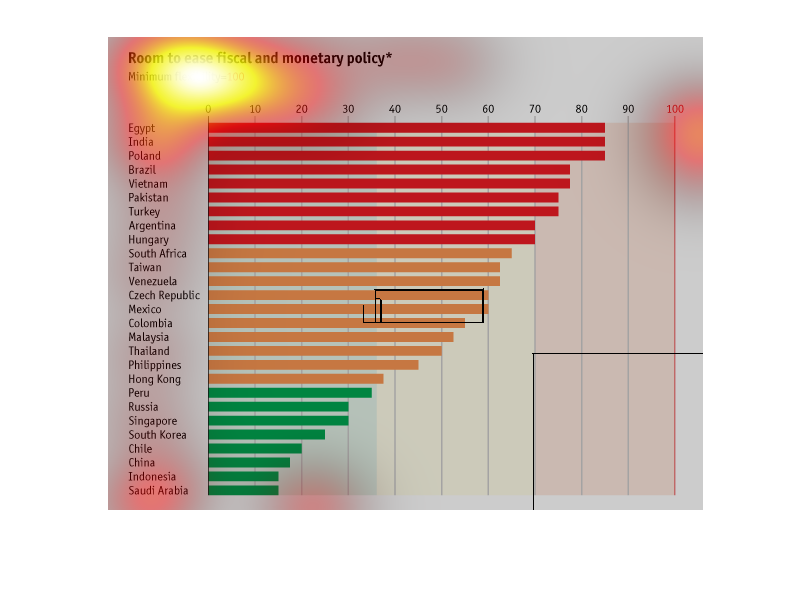

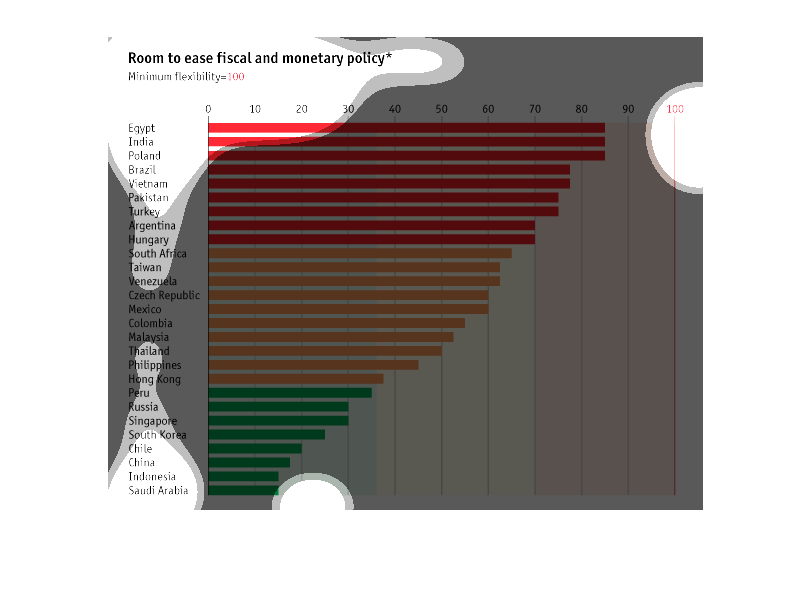

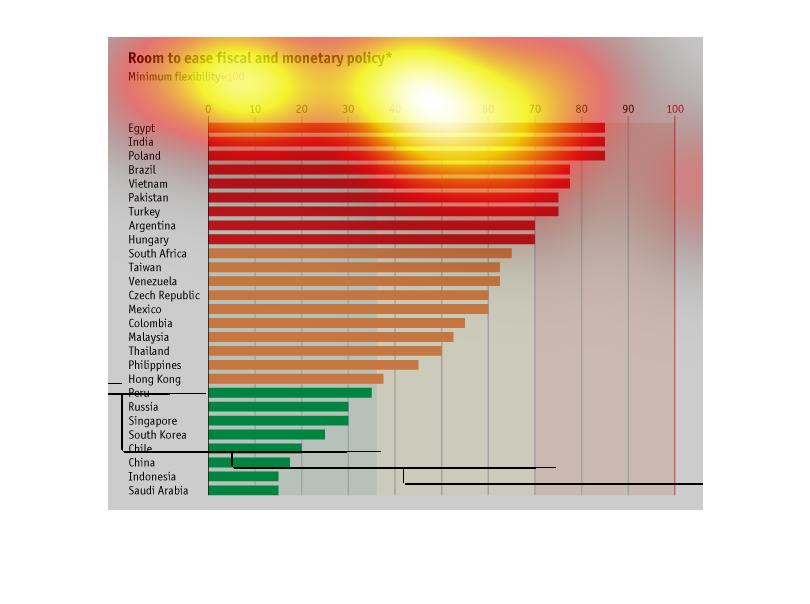

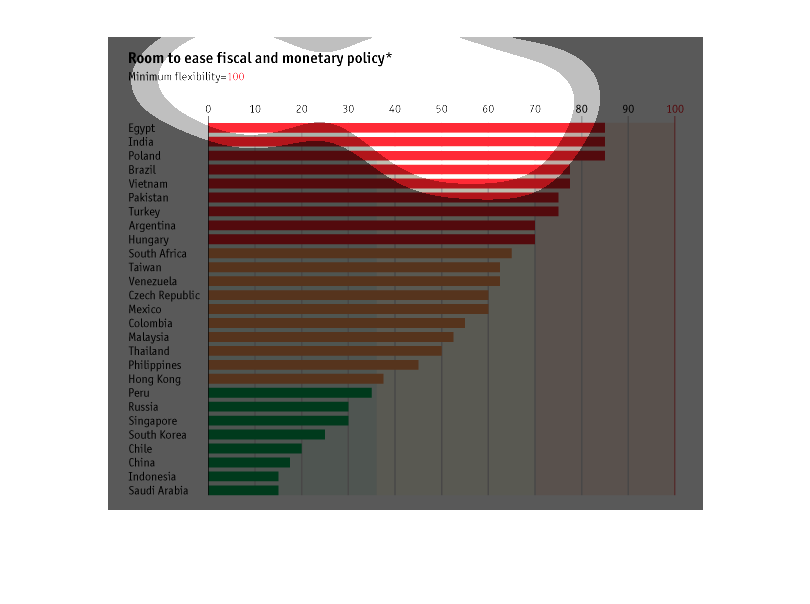

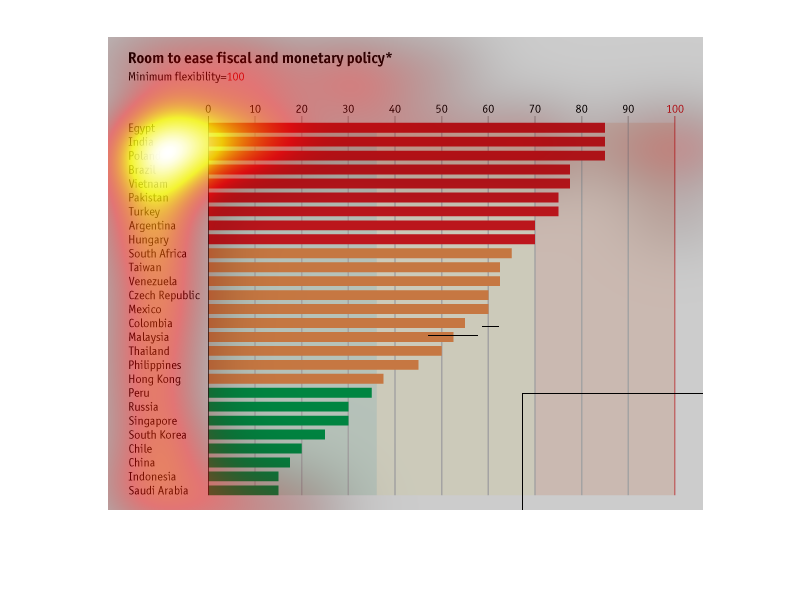

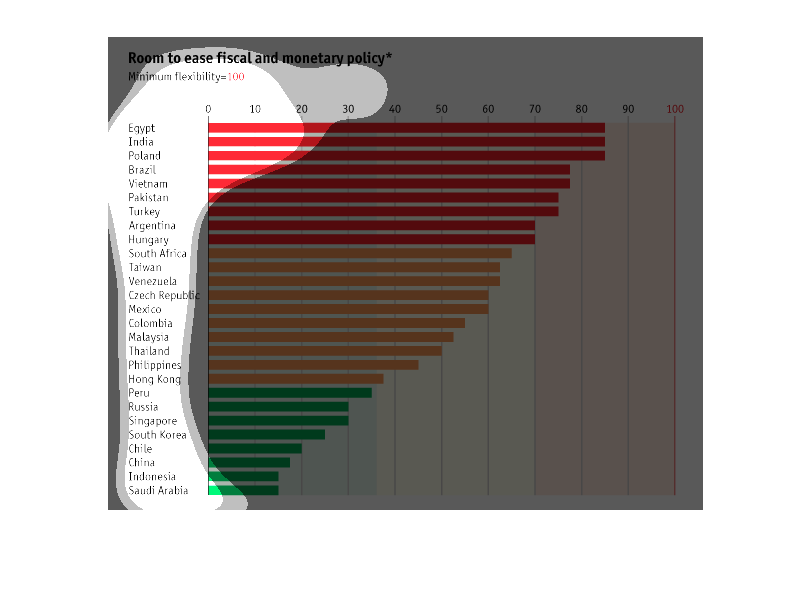

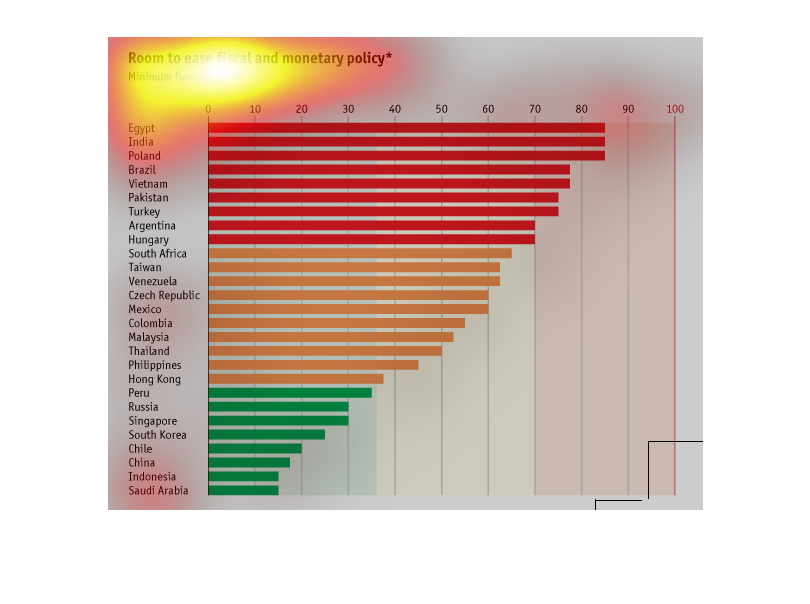

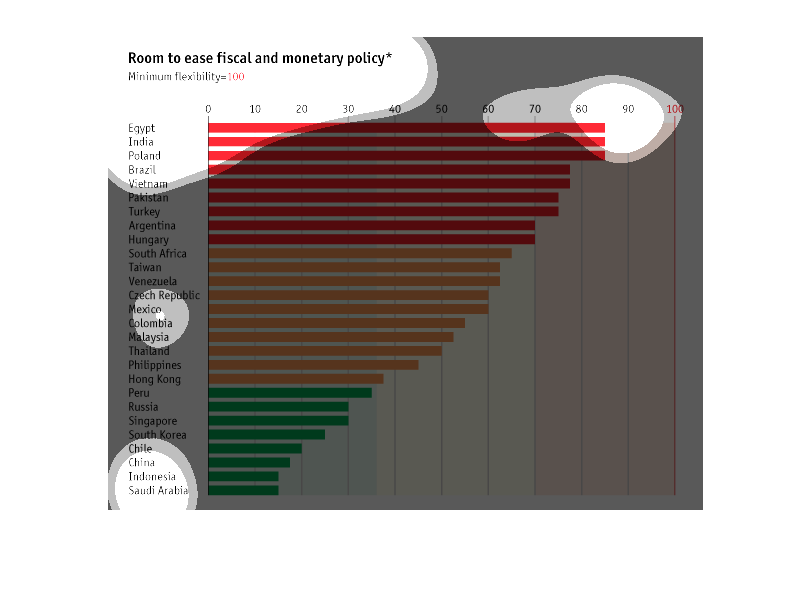

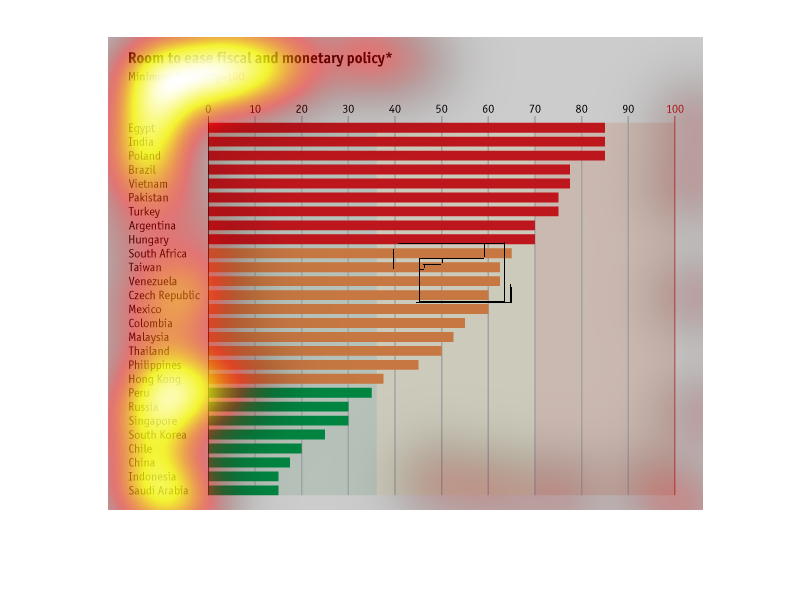

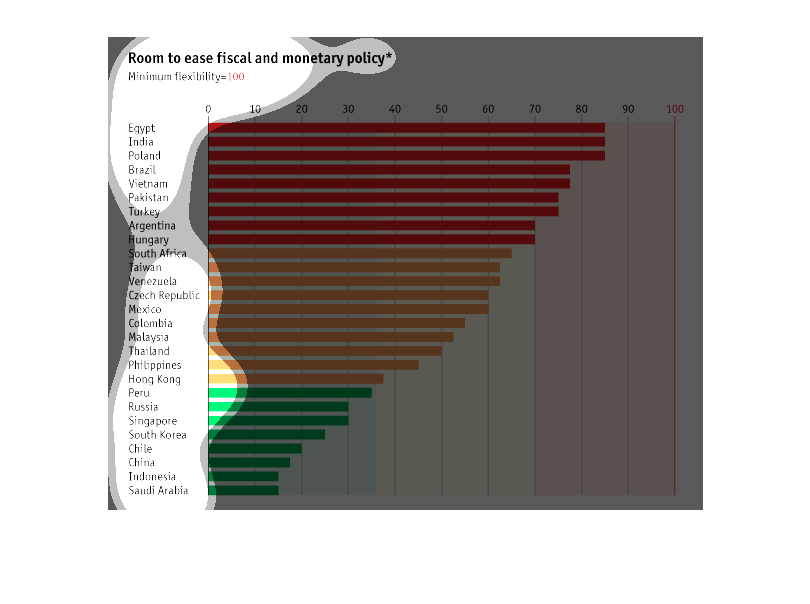

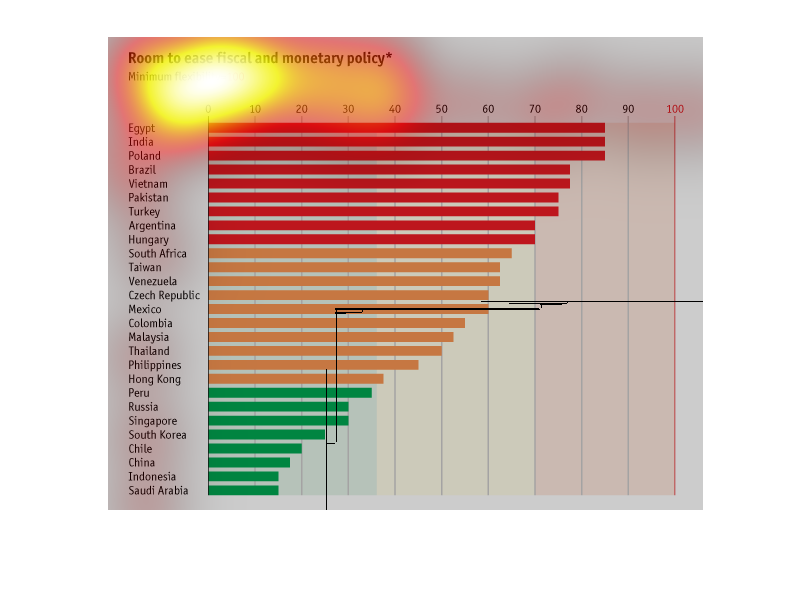

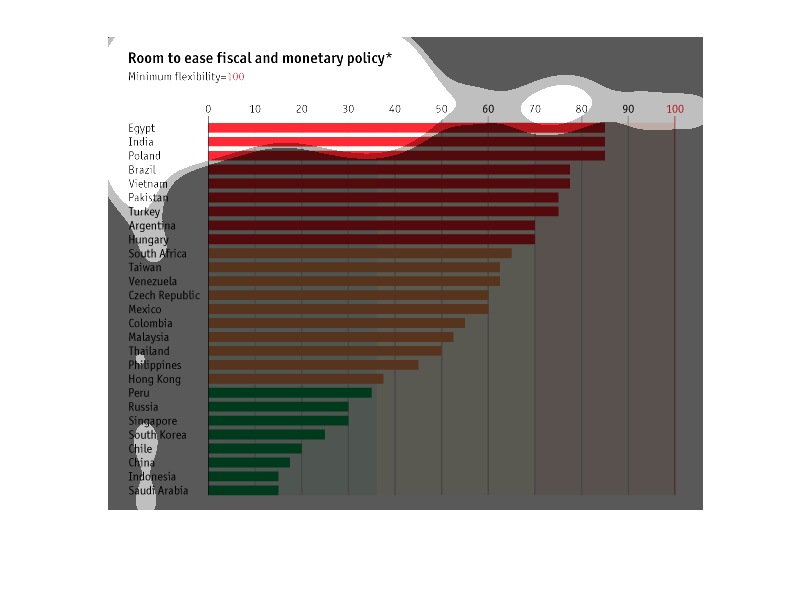

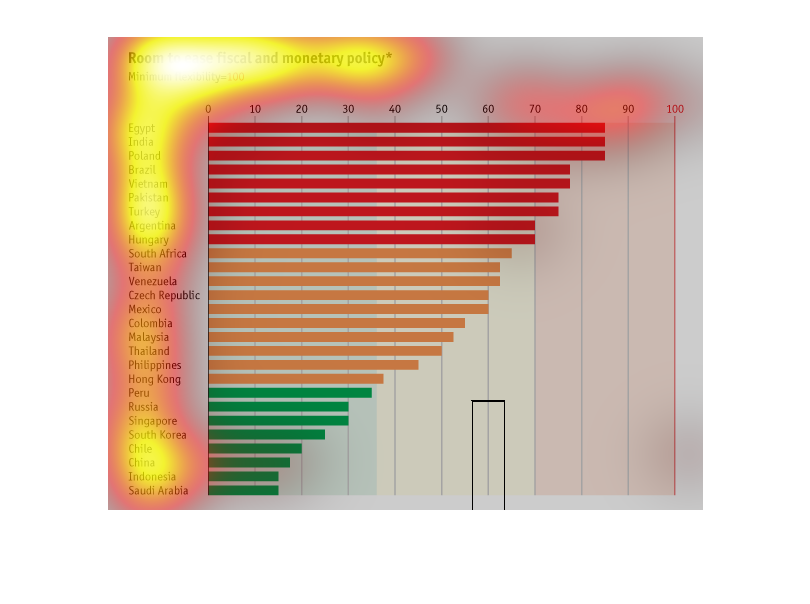

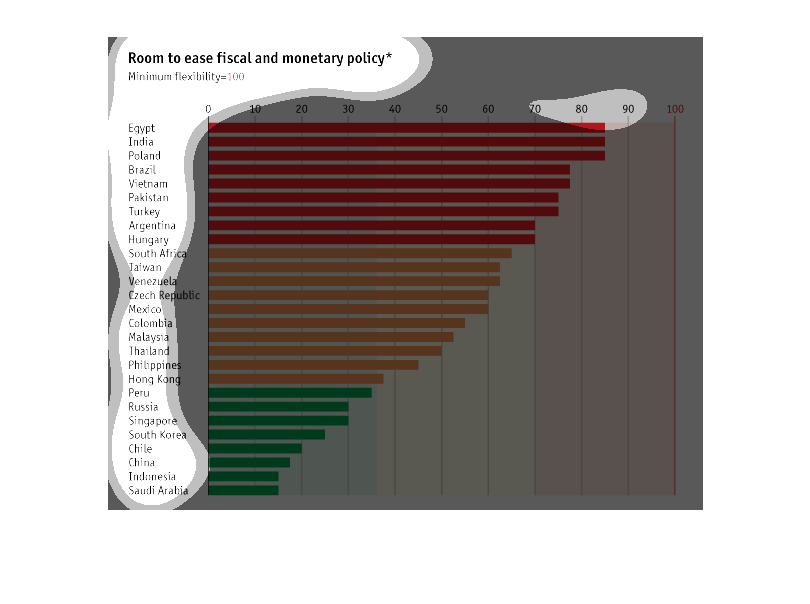

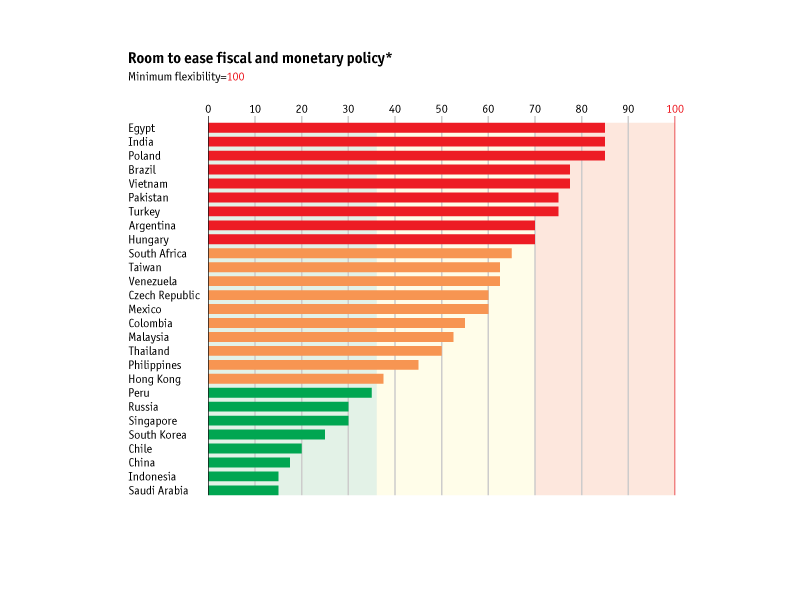

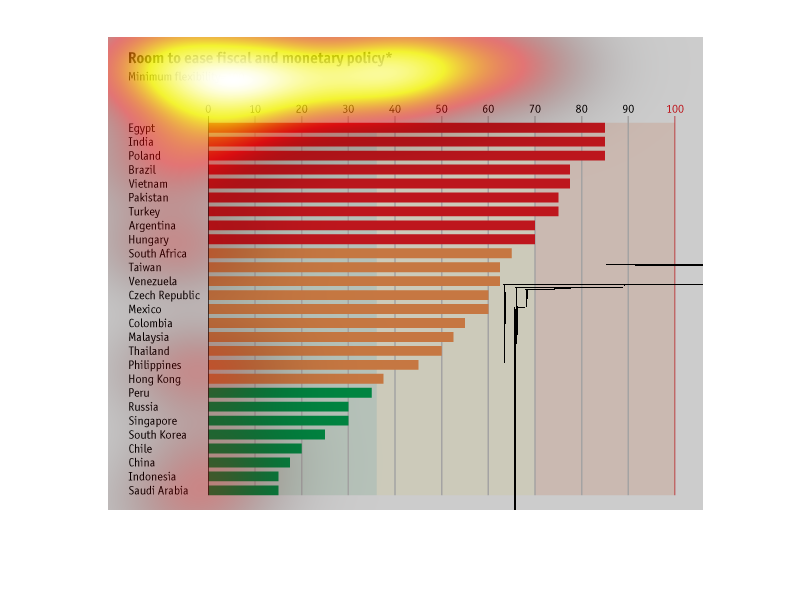

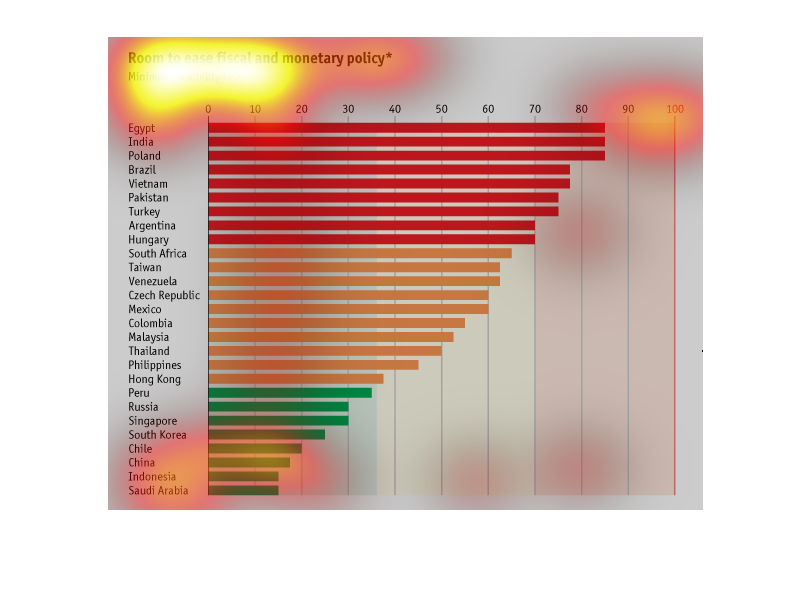

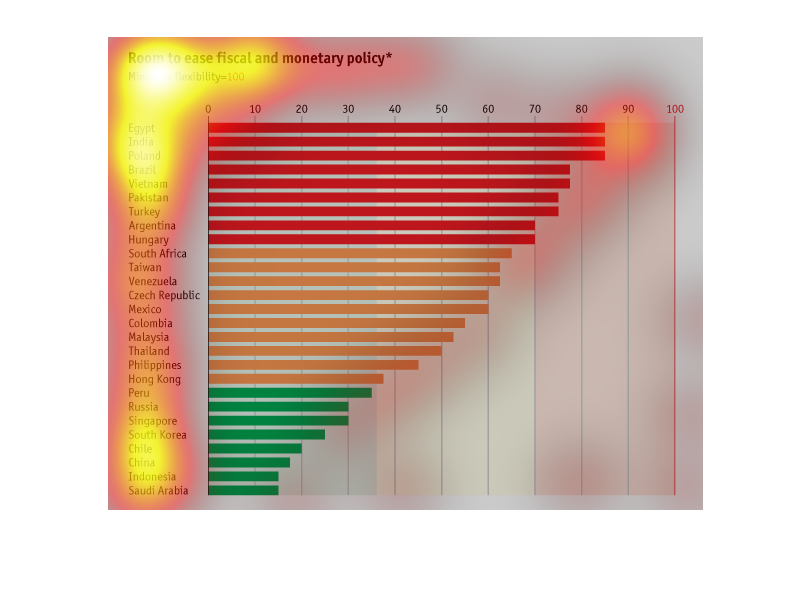

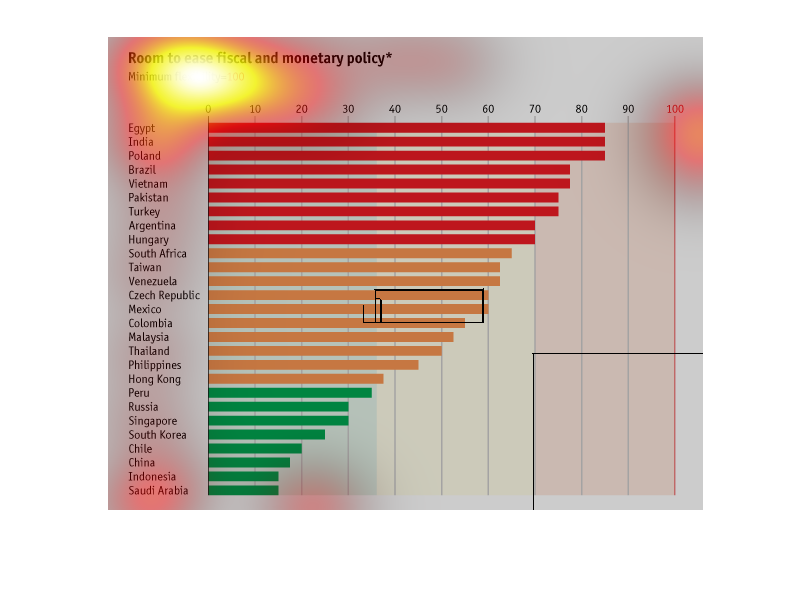

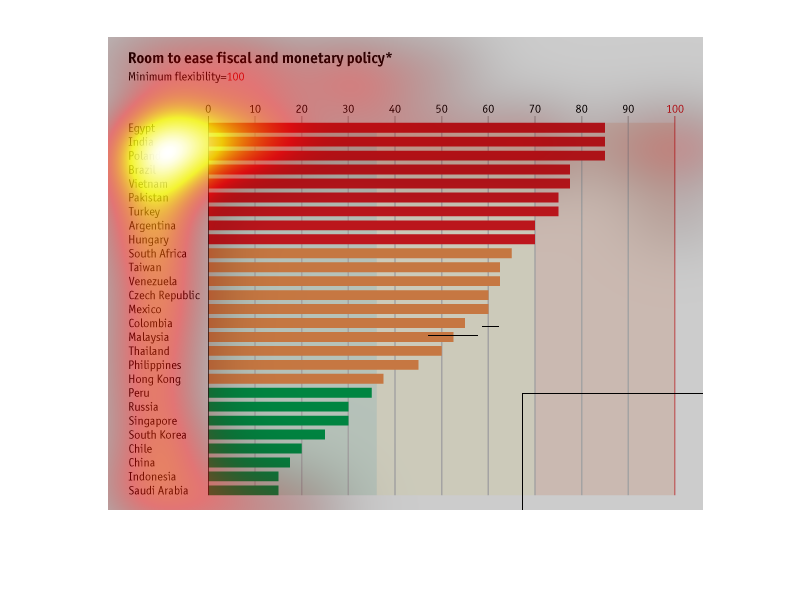

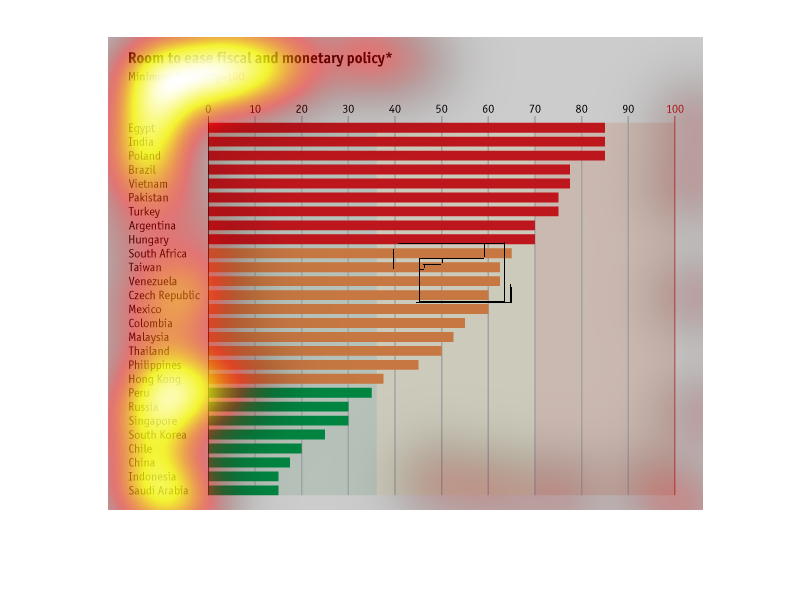

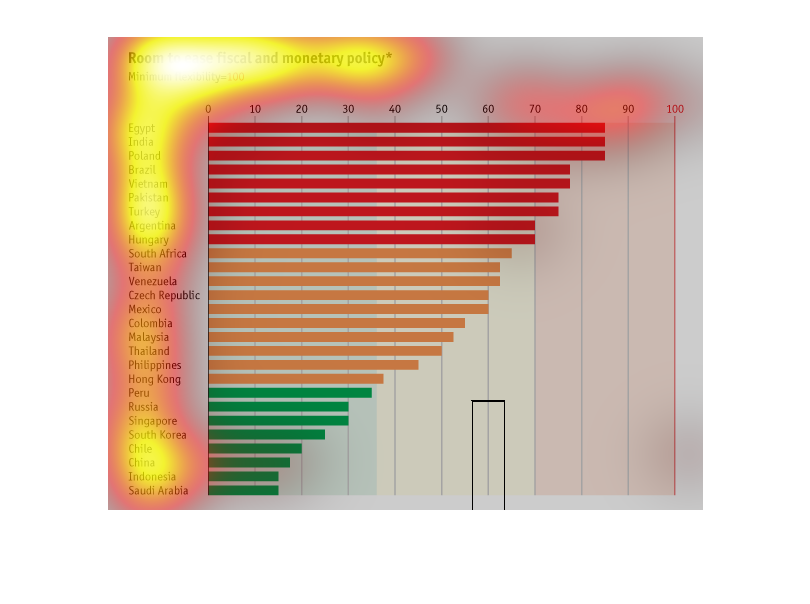

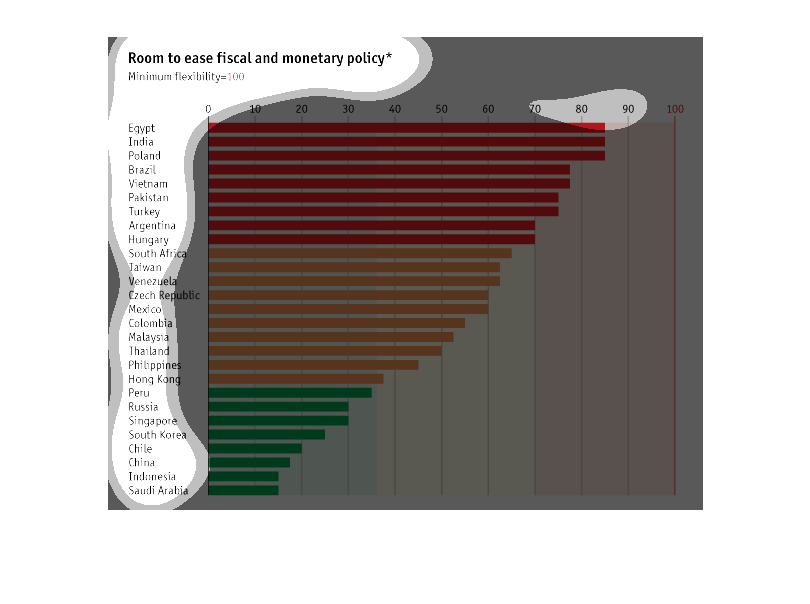

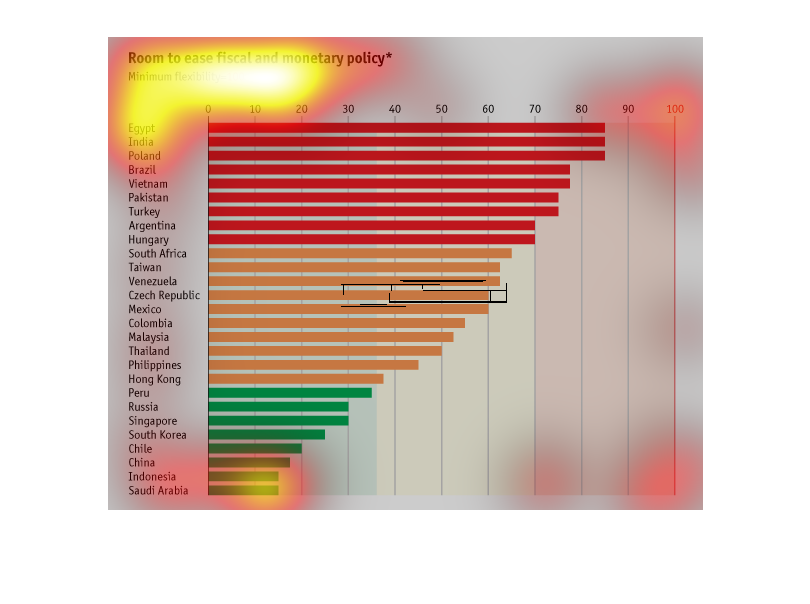

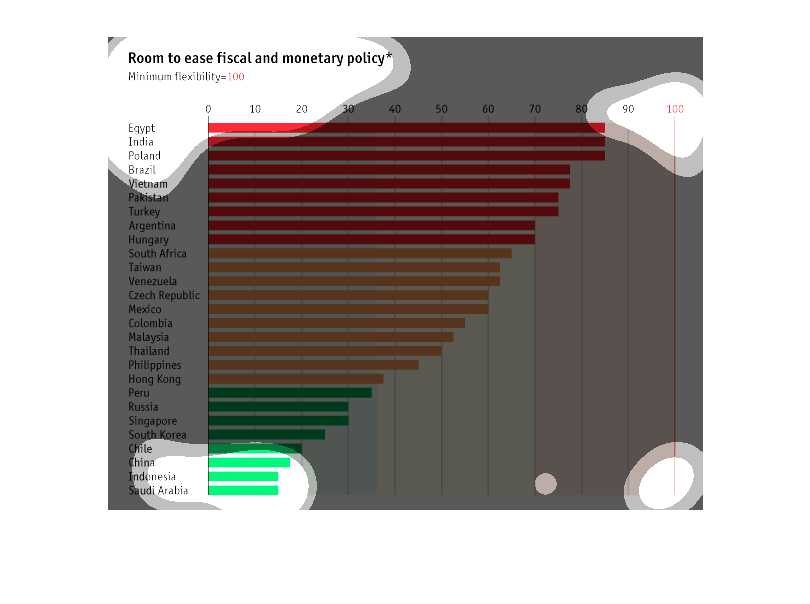

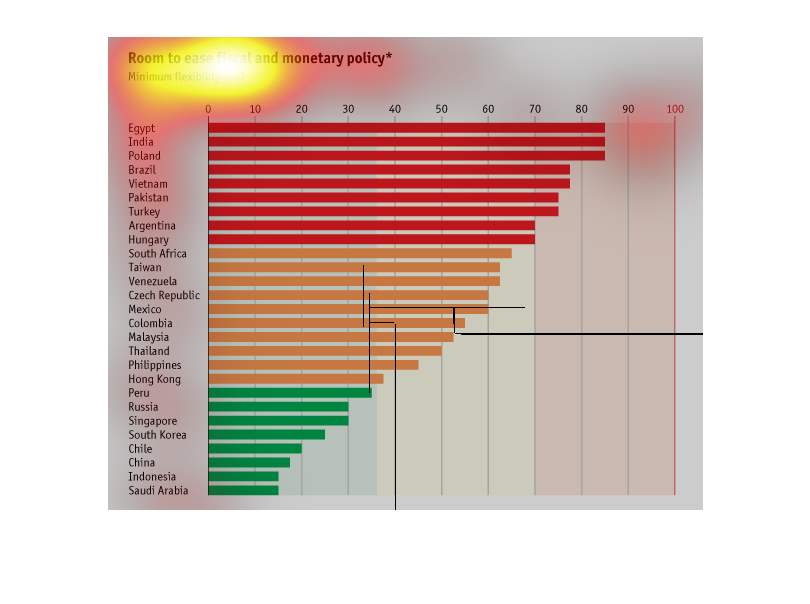

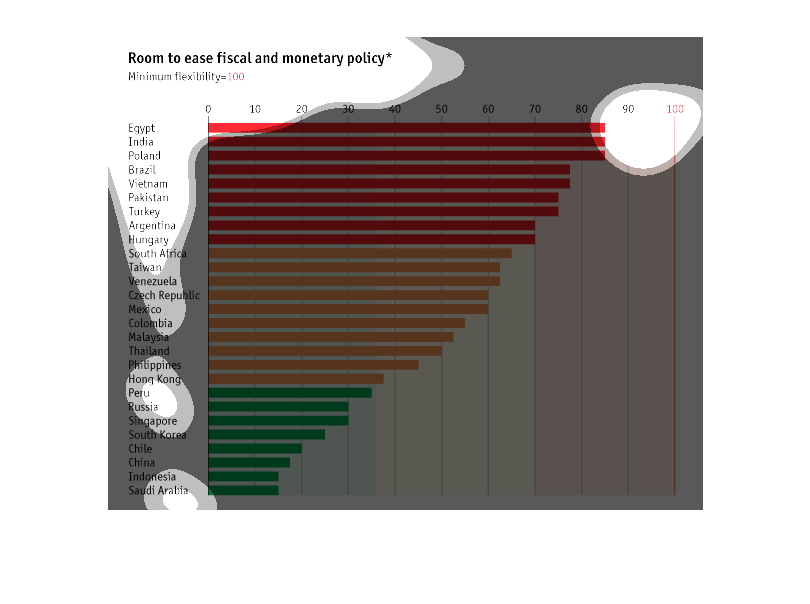

This chart describes and depicts the amount of room to ease fiscal monetary policy of groups

of countries across the planet with minimum flexibility at 100.

The chart ranks companies on their ability to ease fiscal and monetary policy. Egypt, India,

and Poland show the highest minimum flexibility at 85% while Saudi Arabia and Indonesia show

the lowest at 15%.

This graph shows the room to ease fiscal and monetary policy for a number of countries. The

minimum flexibility was equal to 100. Egypt, India, and Poland lead the graph, with scores

around 85. China, Indonesia, and Saudi Arabia are closer to the end of the graph, with scores

near 10-15.

This chart describes the room that various countries have to ease fiscal and monetary policies.

The range varies with Egypt, India and Poland having the least room and china, Indonesia and

Saudi Arabia having the most

The chart lists countries based on their room to ease fiscal and monetary Policy. Egypt, India

and Poland have the least flexibility with scores over 80. Saudi Arabia, Indonesia and China

are the most flexible with scores close to 15.

This chart shows the available wiggle-room to ease monetary policy by country based on consumer

prices, interest rate, currency exchange rates, account balance, budget and debt.

A graph describing room to ease fiscal and monetary policy. Egypt, India and Poland all tie

for room to ease. While Saudi Araba and Indonesia tie for least amount of room.

This chart the flexibility of fiscal and monetary policy in a variety of countries. Egypt

and India are at the top of this chart and have the most room to ease fiscal and monetary

policy, while Saudi Arabia and Indonesia have the smallest amount. Mexico and Colombia fall

somewhere in the middle.

Room to ease fiscal and monetary policy. Minimum flexibility to equivalent to 100. Saudi Arabia,

Indonesia, China, Chile, South Korea, Singapore, Russia, and Peru are all in the lowest part

of the graph (in the green). Hong Kong, Philippines, Thailand, Malaysia, Columbia, Mexico,

Czech Republic, Venezuela, Taiwan, and South Africa are all intermediate (the orange). South

Africa, Hungary, Argentina, Turkey, Pakistan, Vietnam, Brazil, Poland, India, and Egypt are

at the top of the chart near 100 (in the red).

This graph charts the room to ease fiscal and monetary policy. The minimal flexibility is

10. It includes countries all over the world and is charted up to 100 units.

This graph lists nations of the world and attributes a score to each which represents the

degree to which they are flexible in regards to modifying their overall monetary and fiscal

policies, specifically with the goal of easing specific policy aspects. Nations such as Egypt,

India, Poland, Brazil, etc. have the most flexibility, around 60-80%, while countries with

the least flexibility include Saudi Arabia, Indonesia, China, Chile, and so on.

The graph is outlining the flexibility (or "wiggle-room") within various countries' financial

policies. The highest scoring on this graph is Egypt while the lowest scoring is Saudi Arabia.

This graph shows the amount of room to ease fiscal and monetary policy divided into multiple

countries across the world. The minimum flexibility is labeled as 100.

The bar graph shows the "Room to ease fiscal and monetary policy" for a number of different

countries. Countries are located mostly in Asia and South America, with a handful of European

countries on the list. Countries are visually broken up into three categories represented

by three different colors: red, yellow, and green.