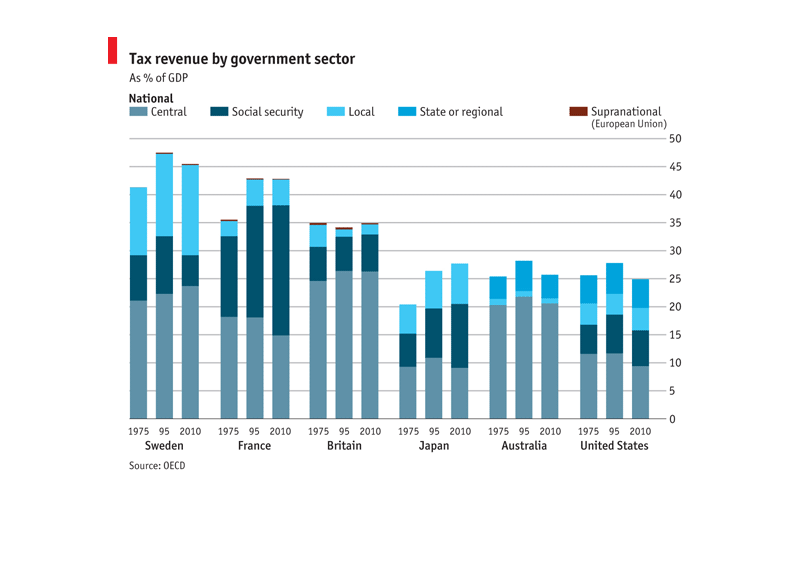

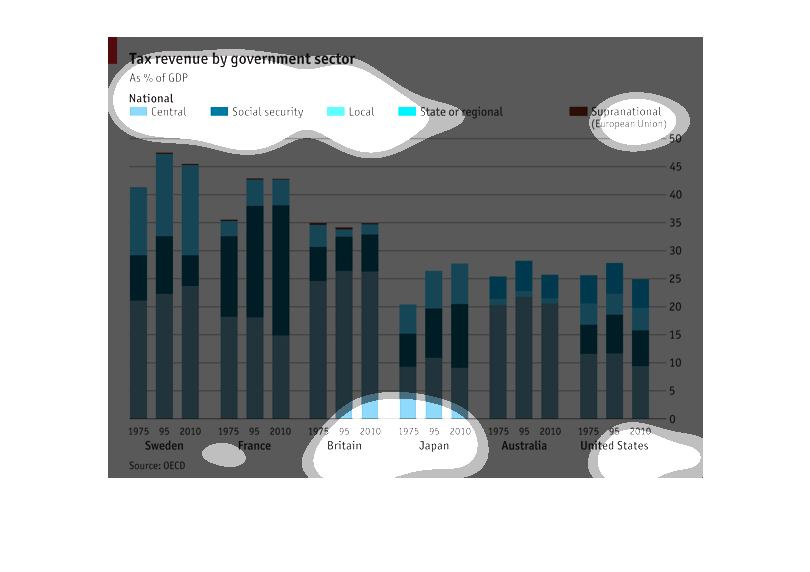

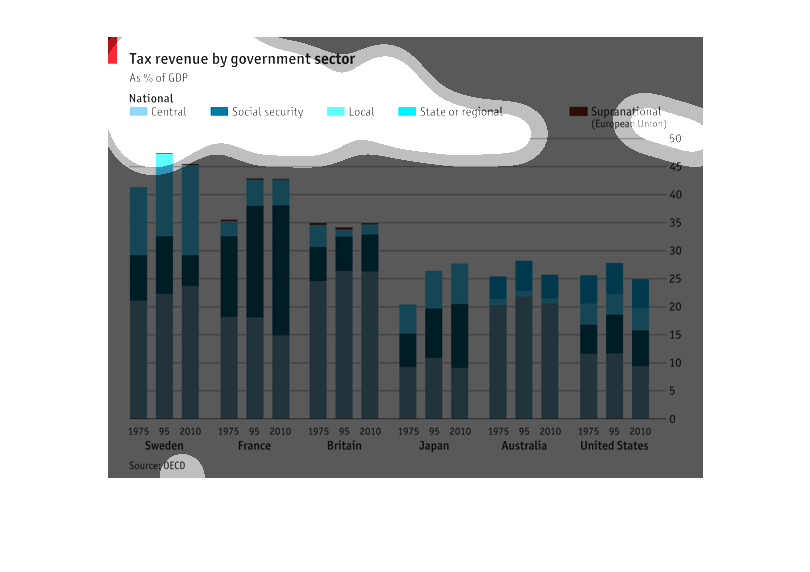

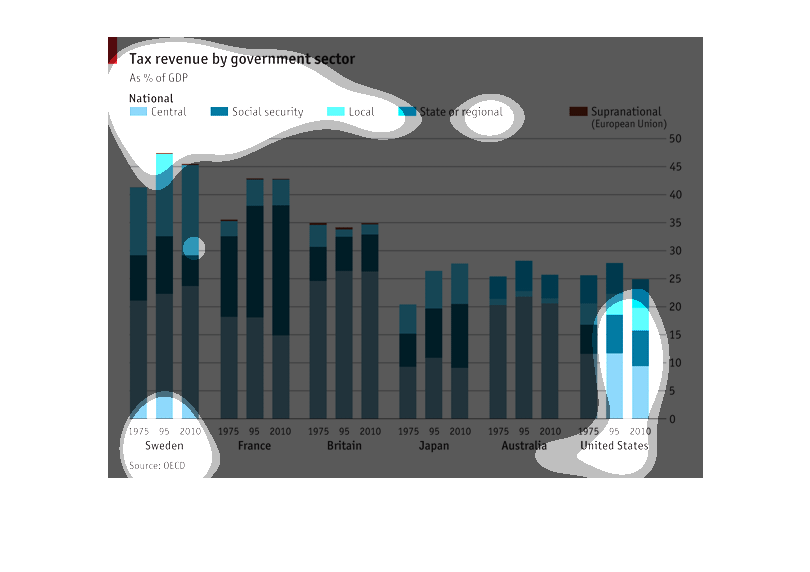

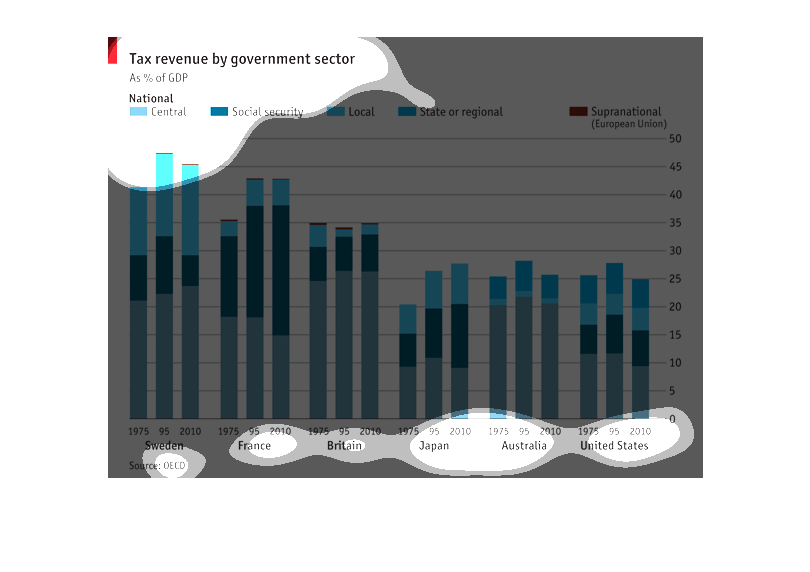

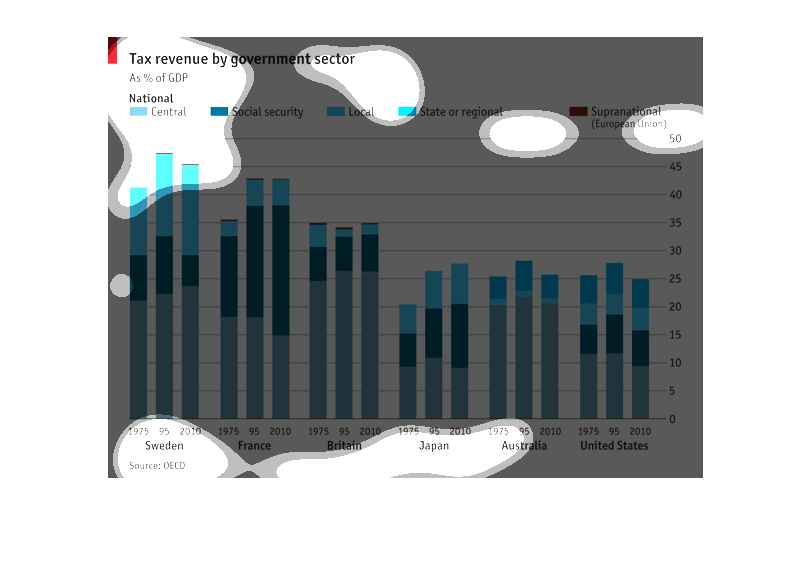

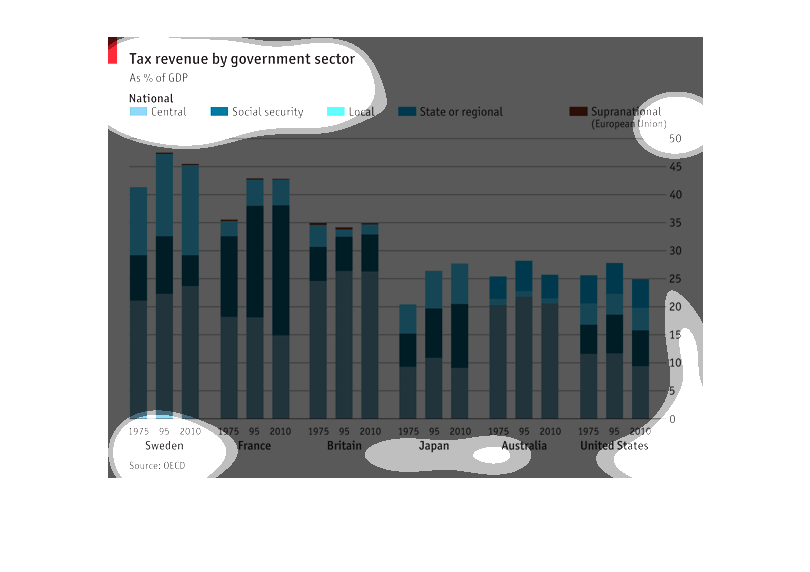

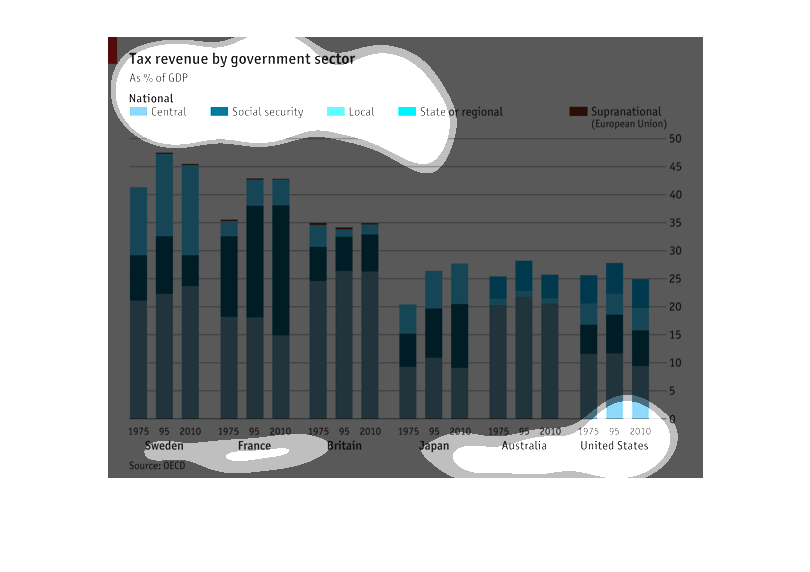

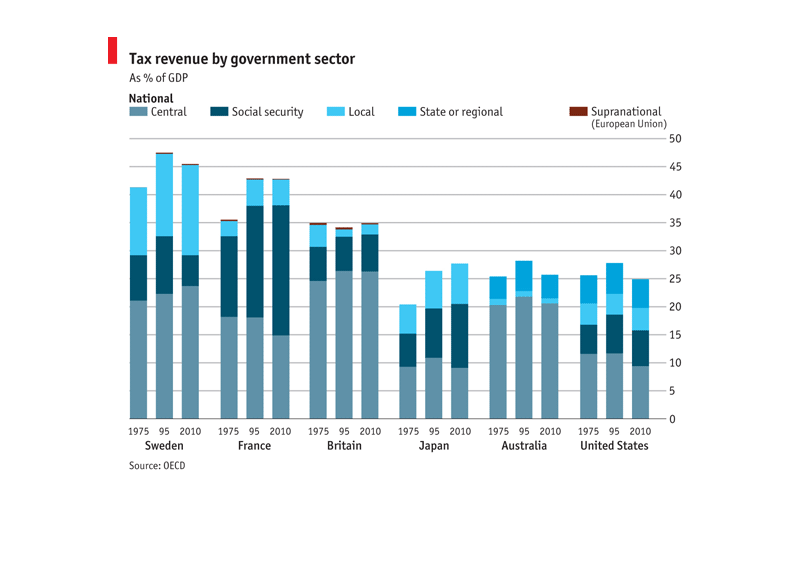

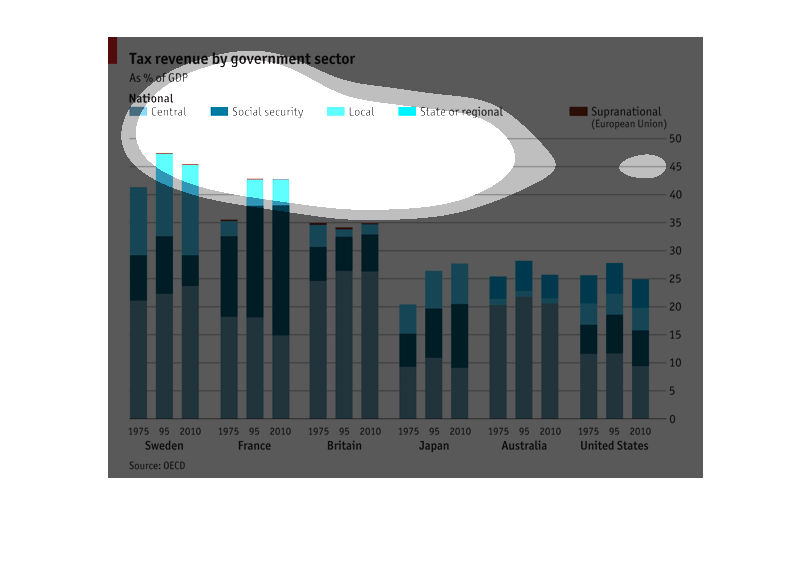

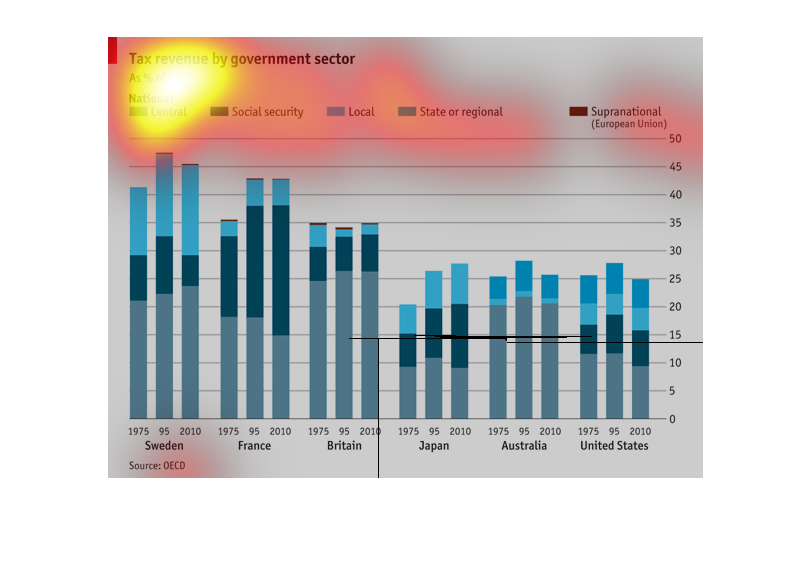

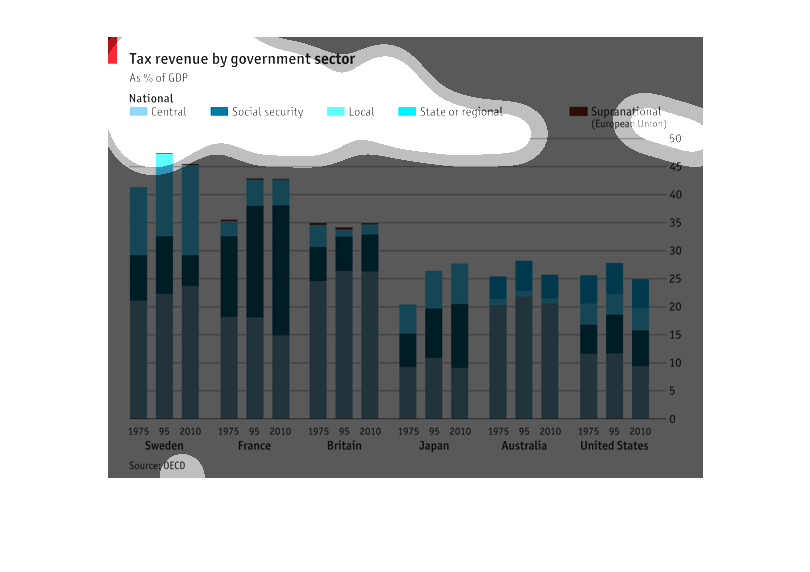

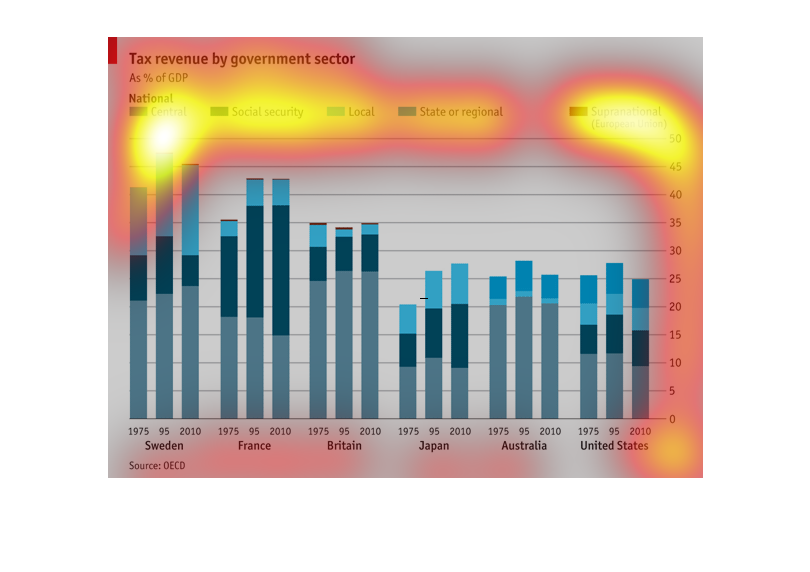

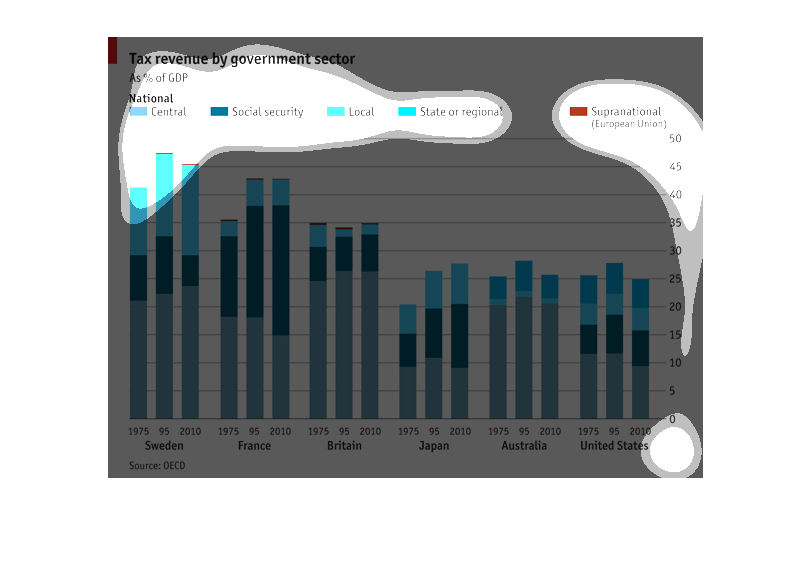

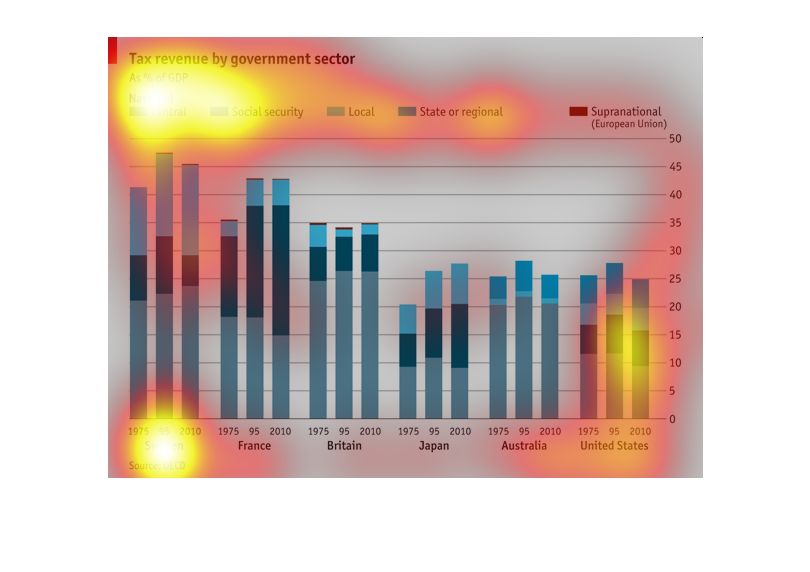

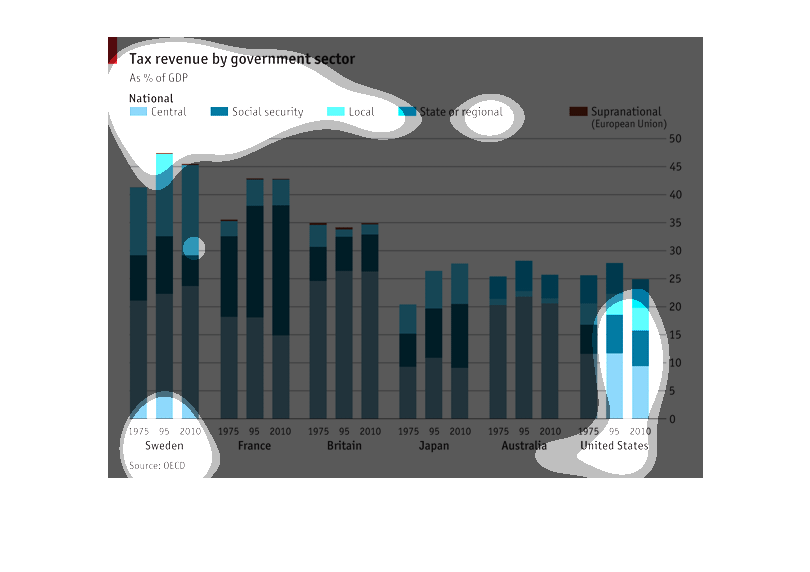

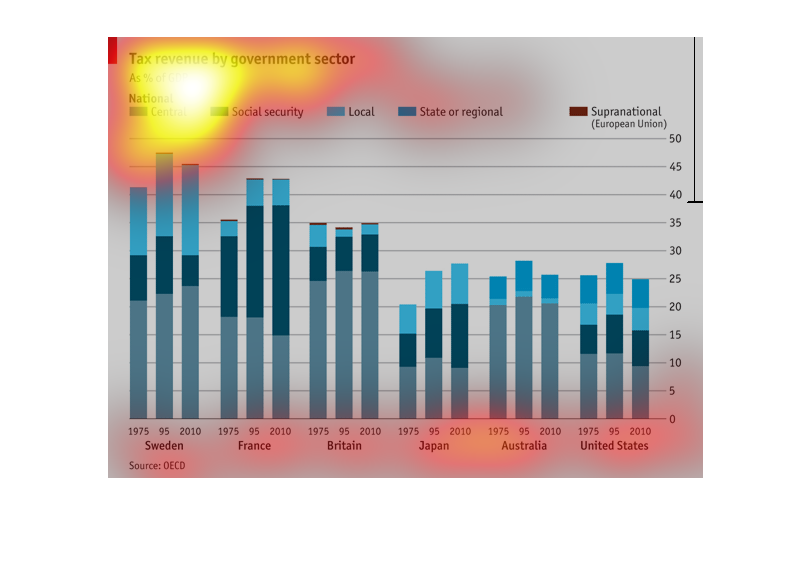

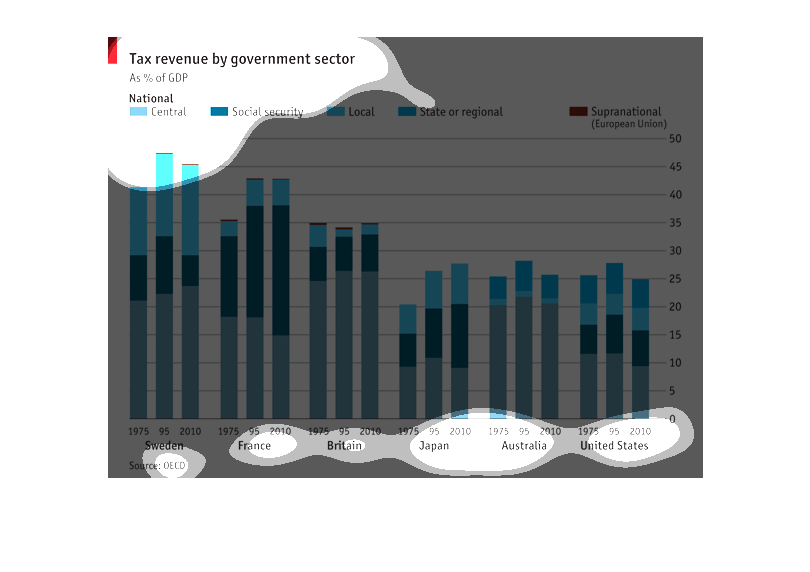

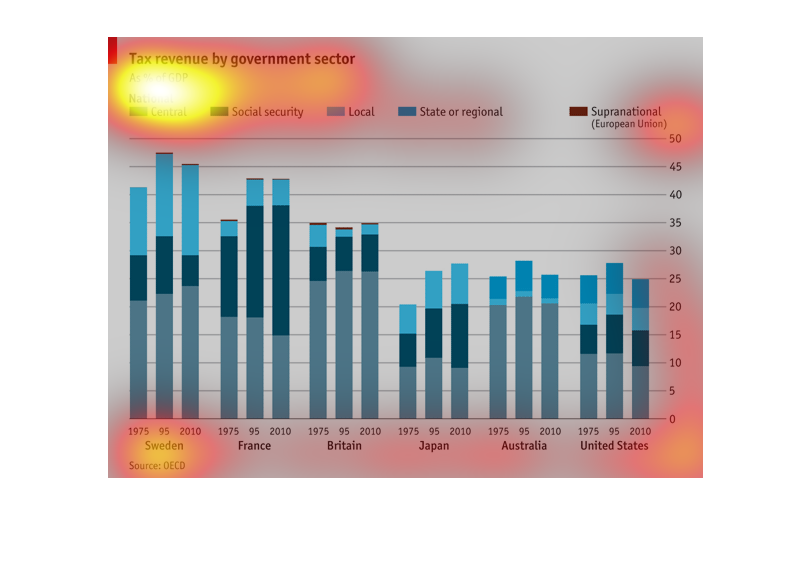

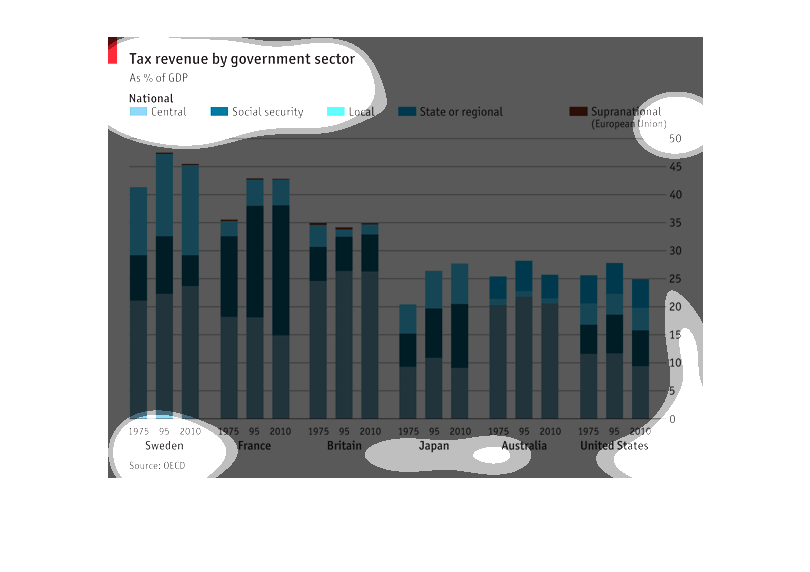

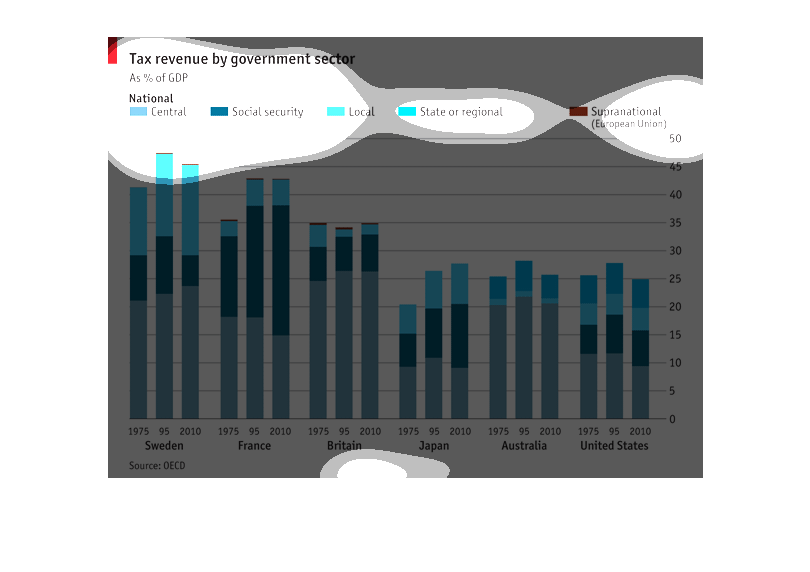

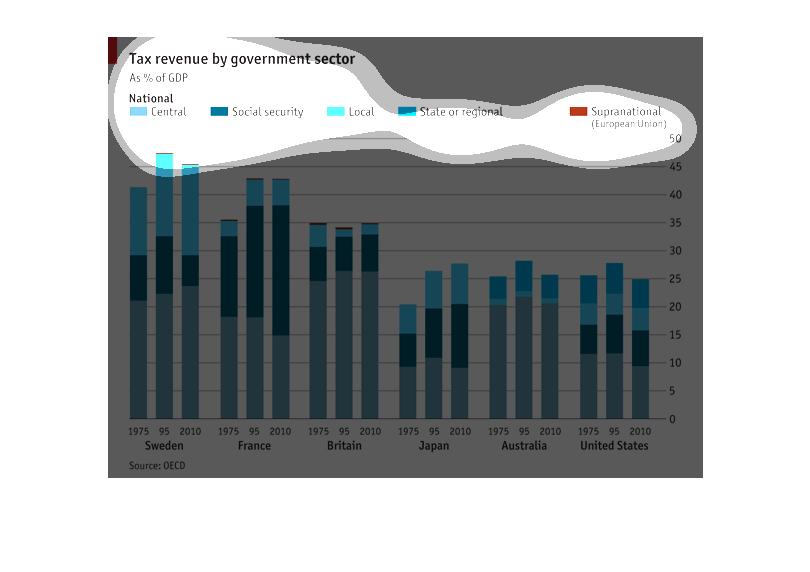

This is a graph about Tax revenue by sector. It analyzes several different countries. It goes

by different areas such as local, national, international, etc. It lists the results from

1975 up to 2010

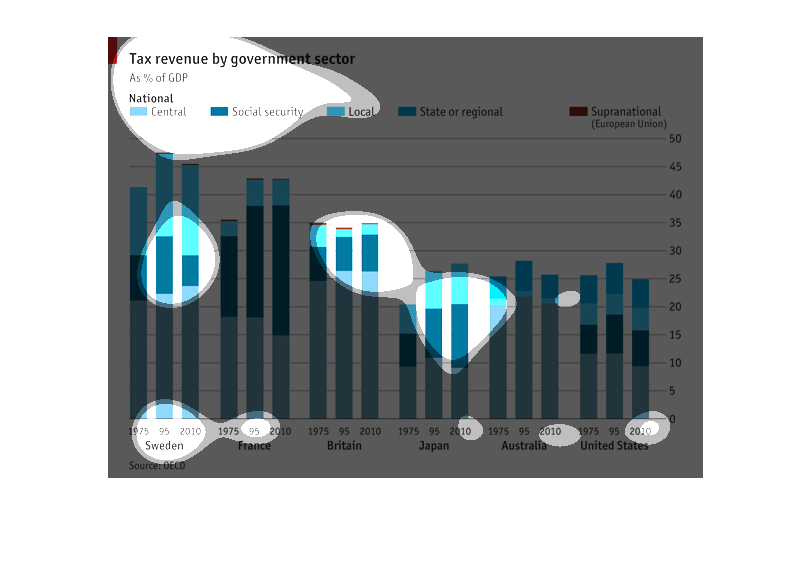

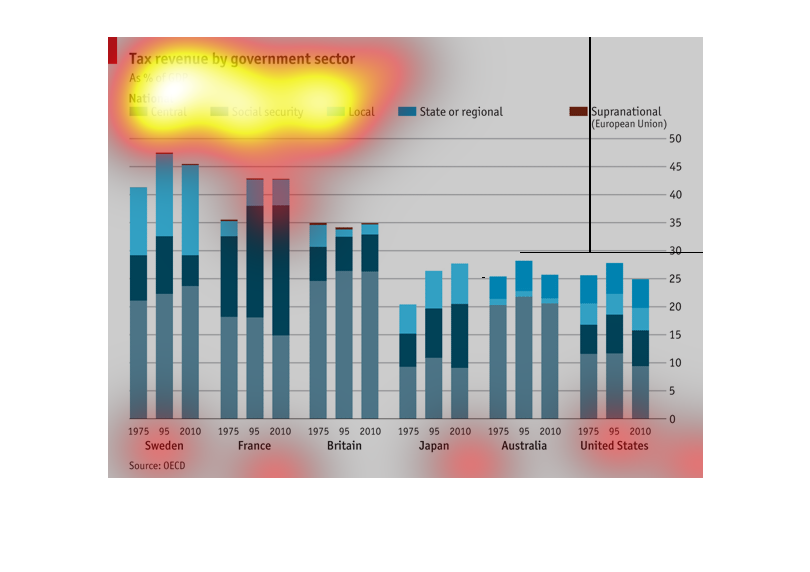

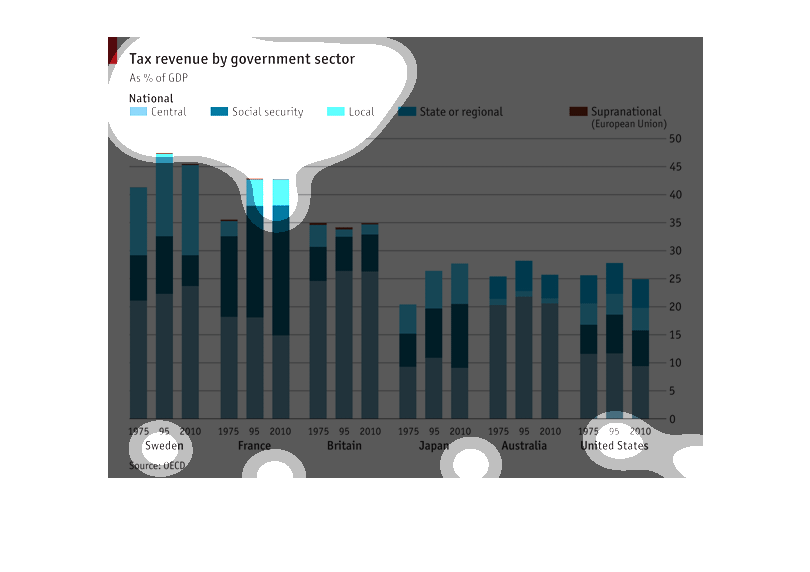

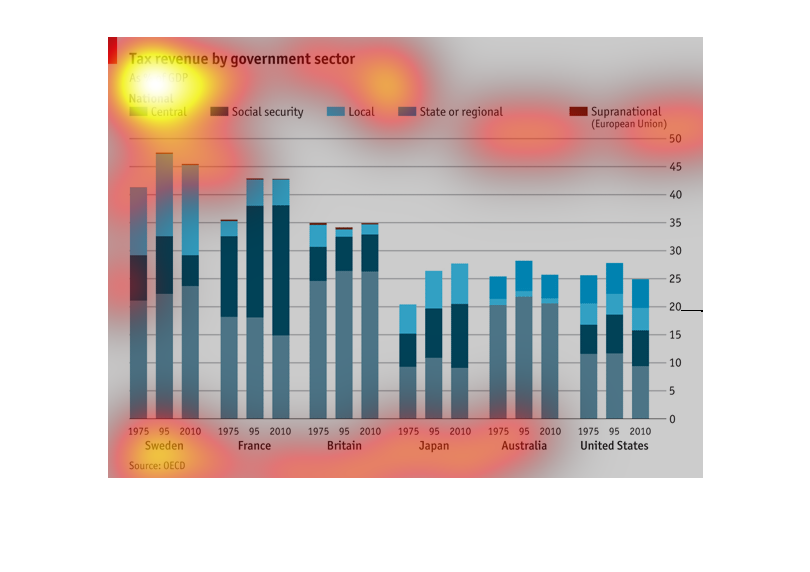

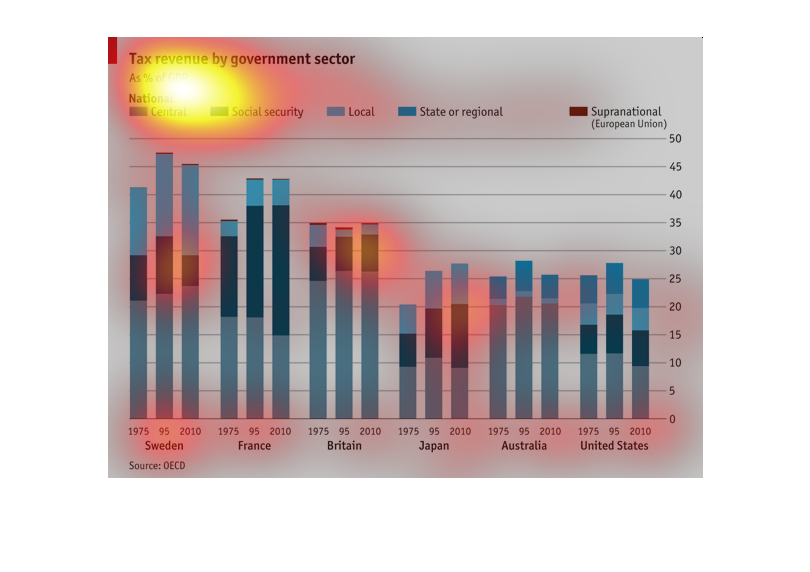

This chart describes tax revenue by government sector as a percentage of GDP. Categorires

on the chart include social security, local, state or region.

This graph shows tax revenue by government sector as a percent of GDP for central, social

security, local, state or regional and supernational. Sweden has the highest figures for all

years displayed.

Tax revenue by government sector. It is a bar graph showing the composition of tax revenue

by country and time. It compares France, Sweden, Britain, Japan, Australia, and the United

States for 1975, 1995, and 2010. It compares sources like central, local, social security,

state or regional, and supernational.

This chart shows tax revenue by government sector as a % of GDP. The categories included are

Central, Social Security, Local, Sate or Regional, and Supernational. From the years 1975-2010,

Sweden had the greatest % of the total GDP coming from these sources while France was close

in second the majority from each coming from Central. The United States and Australia had

the lowest percentages with a much smaller portion coming from social security.

The following chart gives the taz revenue of a state or region as a percentage of the overall

GDP. The countries that data is presented for in this study include the following: Sweeden,

France, Britain, Japan, Australia and the United States.

This graph displays the national tax revenue of different government sectors as a % of Gross

Domestic Product. Three different sectors are considered: Central, Social Security, and Local.

Six different first-world countries are under investigation, and for each country data for

three different years are displayed: 1975, 1995, and 2010. Overall, the graph allows you

to visualized how tax revenue (as % of GDP) in three basic government sectors has changed

over time in six first-world countries. Sweden has the highest tax revenue as %GDP and the

United States the lowest. Sweden shows the most dramatic change in the ratios of different

sectors with a shrink in Social Security from 1995 to 2010.

Describes tax revenue to each government sector between different countries. Sweeden has the

most tax revenue total, while France has the most coming from Social security. Japan, Australia

and United States are about equal.

This describes tax revenue for the US government and correlates the differences among multi

nations and the brackets define the sector from which taxes are milked from.

This is a bar chart of tax revenue by social sectors, as a percentage of the GPD. The different

sectors are color coded, while the bars are in groups denoting different world nations.

This graph shows tax revenue by government sector, comparing different sectors of government

in different locations throughout the world from the years 1975 until 2010.

Titled Tax revenue by government sector. Graphs are as $ of the GDP. Based on Central, Social

Security, local, state or regional and supranational (European Union). The countries and

years are at the bottom of the graphs.

This bar graph compares the percentage of tax revenue by government sector ( Central, Social

Security, Local, State or Regional, and Supranational) comparing different countries for 1975,

1995, 2010. The graph shows the importance and use of collected revenues by different countries

(Sweden, France Britain, Japan, Australia and the United States of America).

The graph shows the percentage of tax money used for different areas of the government in

1975, 1995, and 2010 for Sweden, France, Britain, Japan, Australia, and the United States.

Central, social security, local, state or regional, or supranational. Sweden was fairly consisten

over time, with the majority of money being central. France was consistent from 1975 to 2010,

however with more money now going to social security. Britain has spent low amounts of money

on local and the majority on central. Japan has maintained consistent percentages over the

years, with most money to central and social security. Australia spends the majority of the

money on central, and the US spends more than most on state.