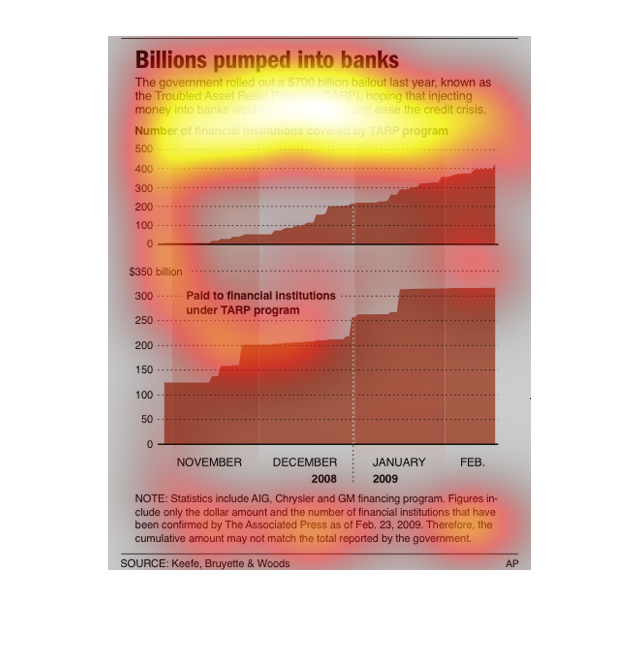

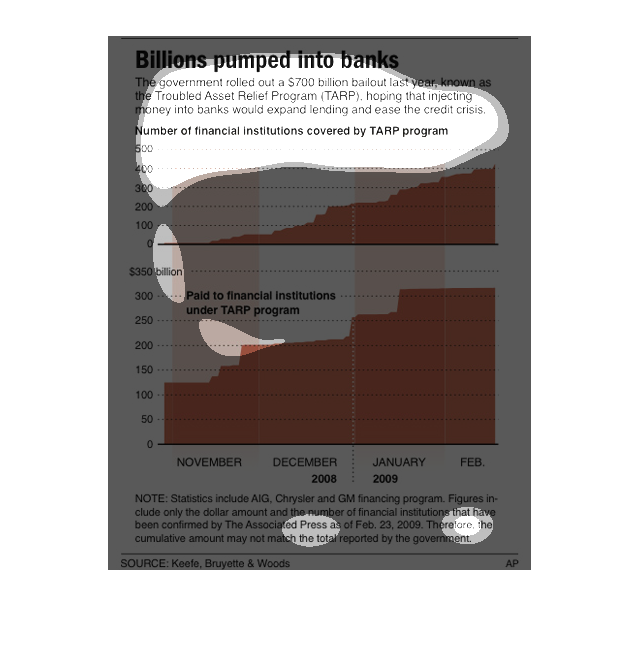

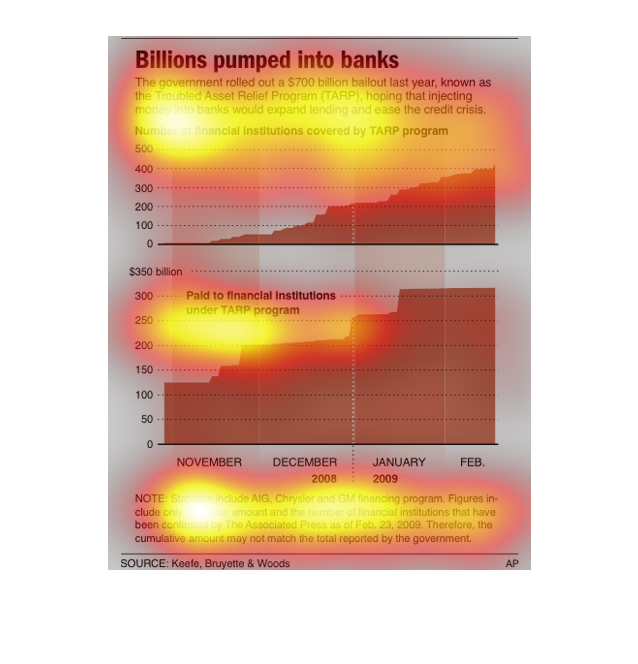

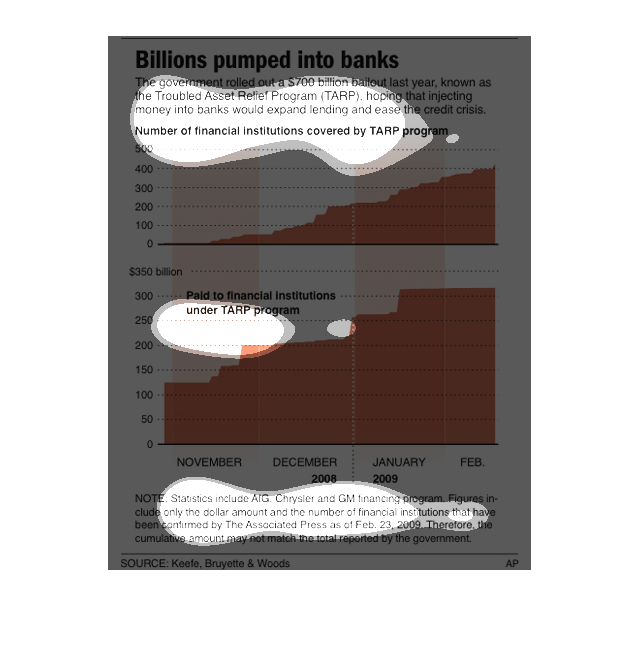

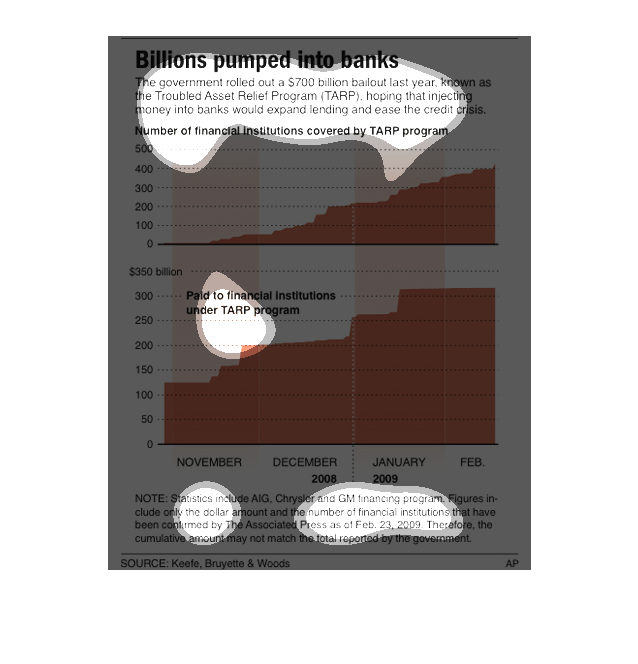

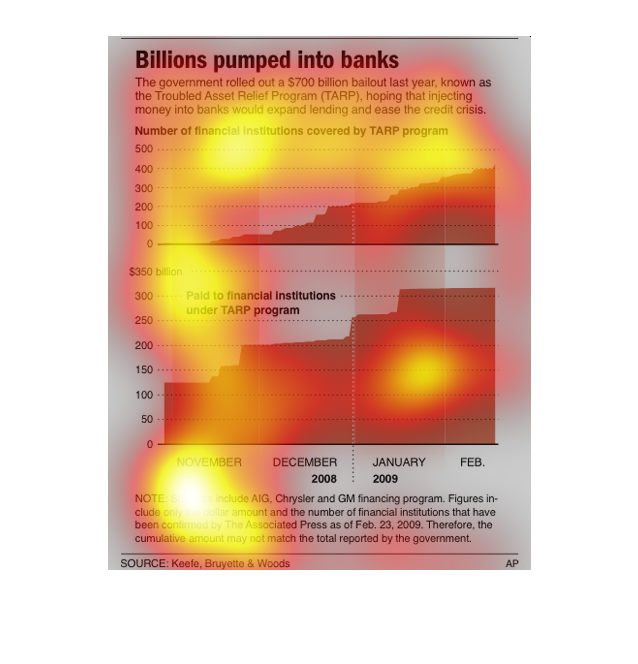

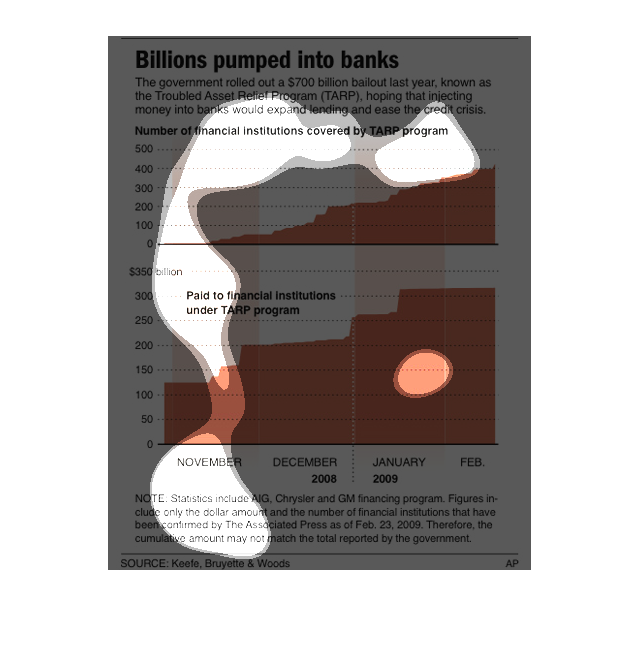

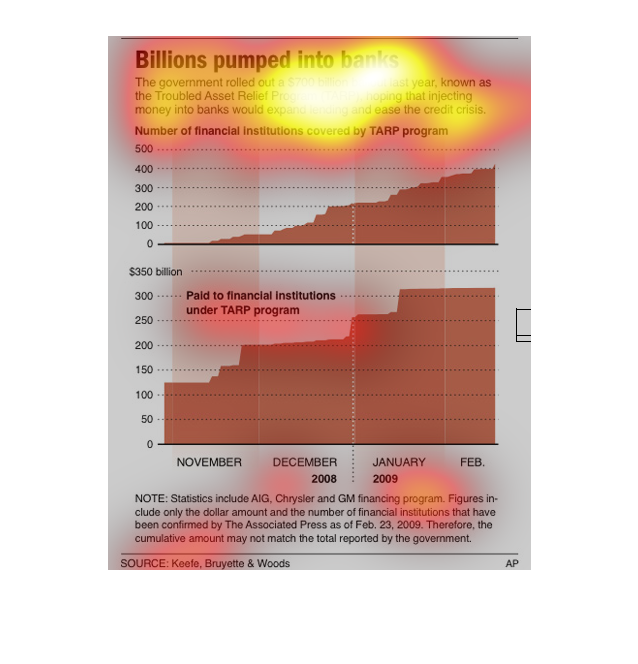

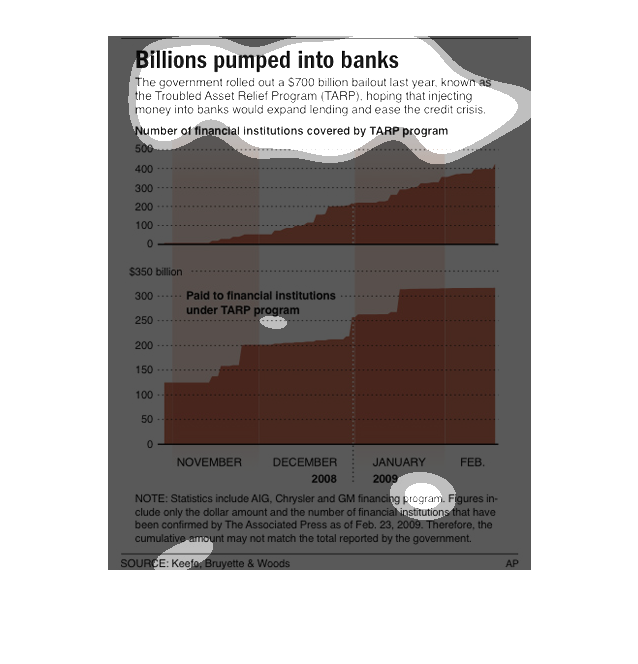

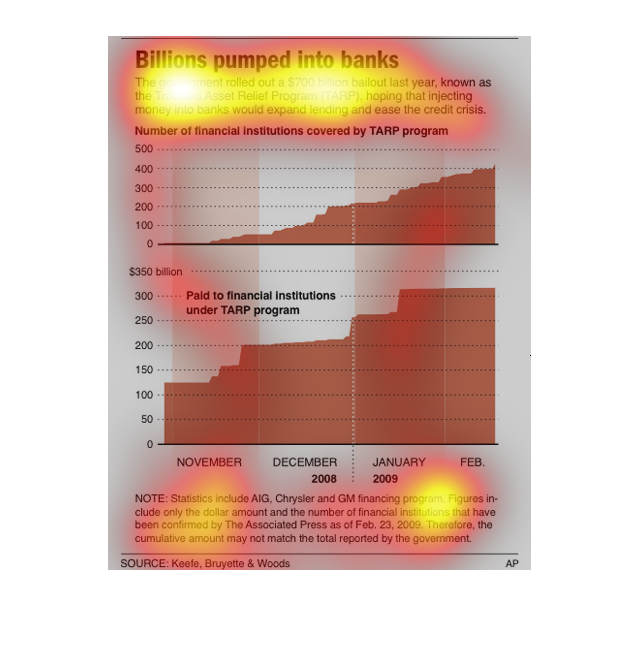

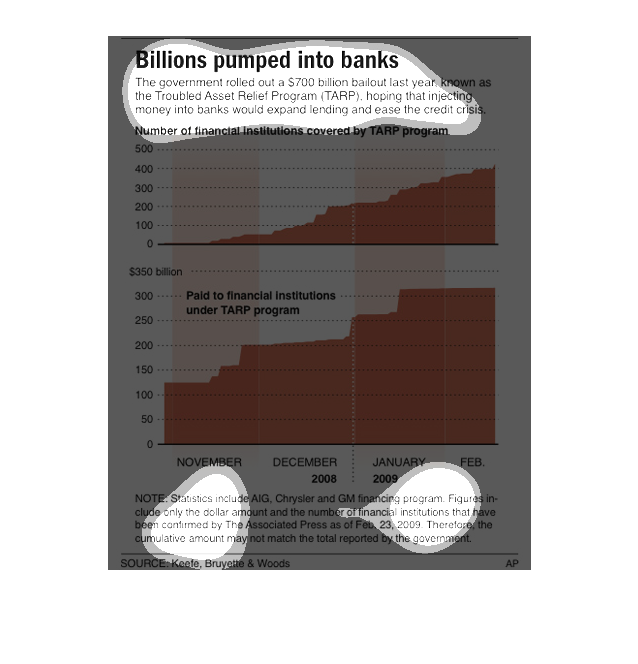

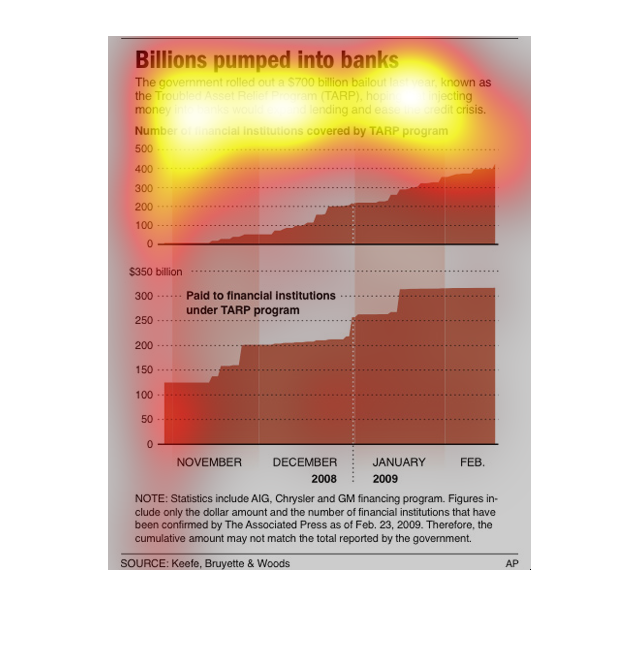

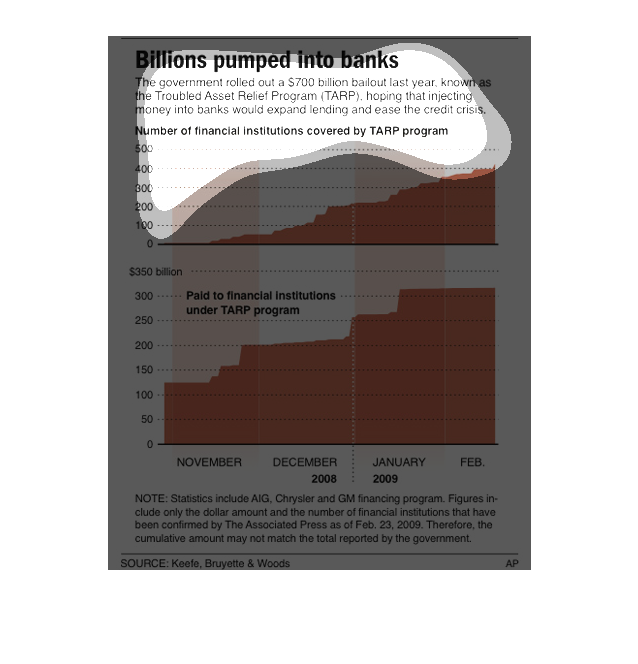

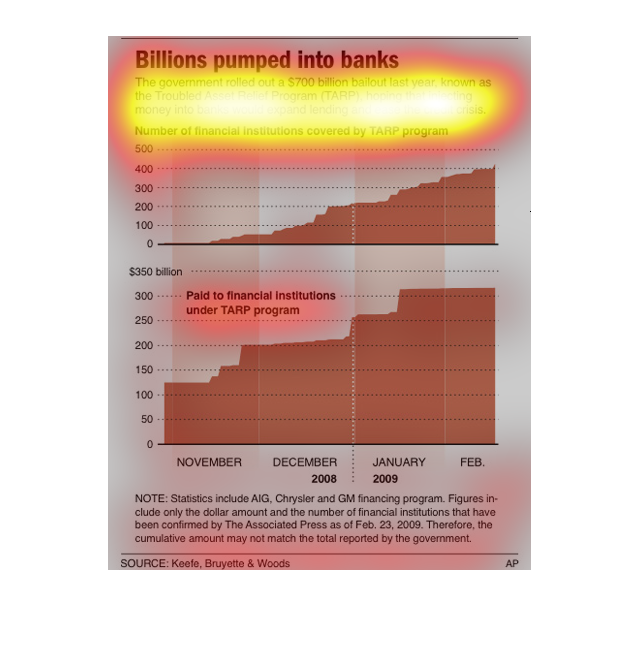

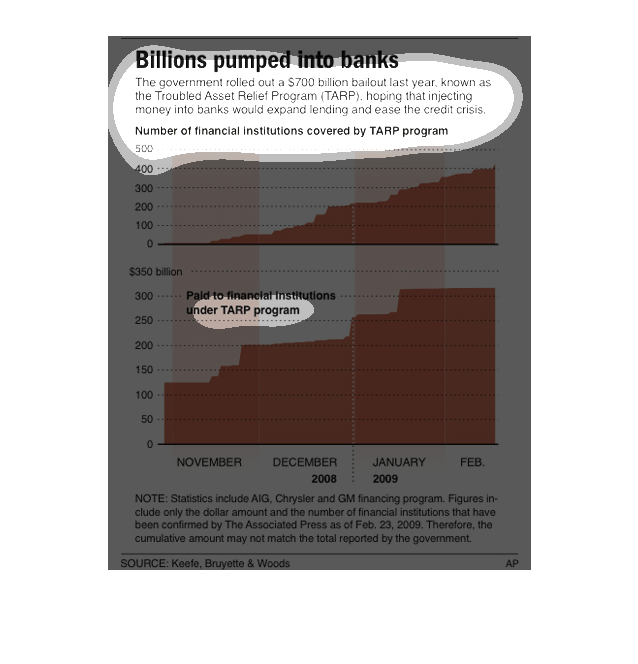

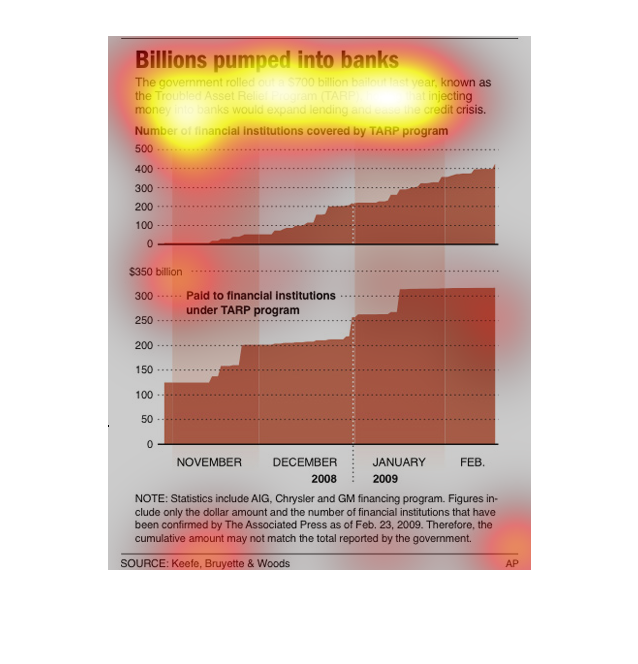

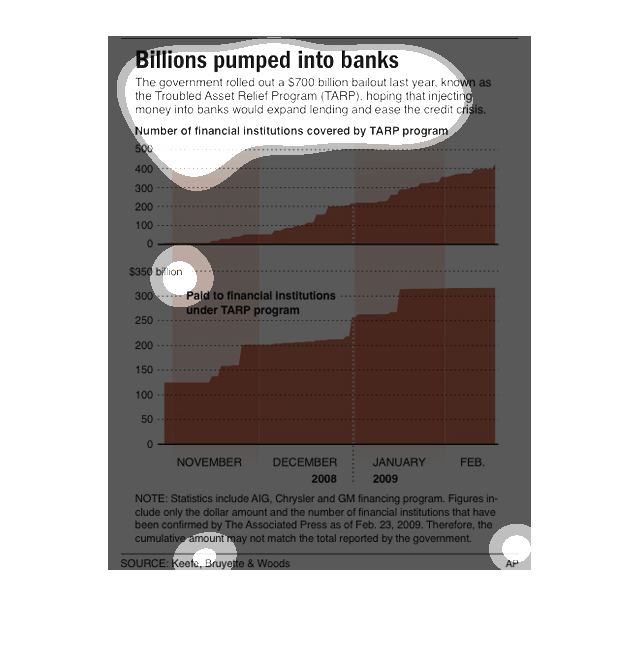

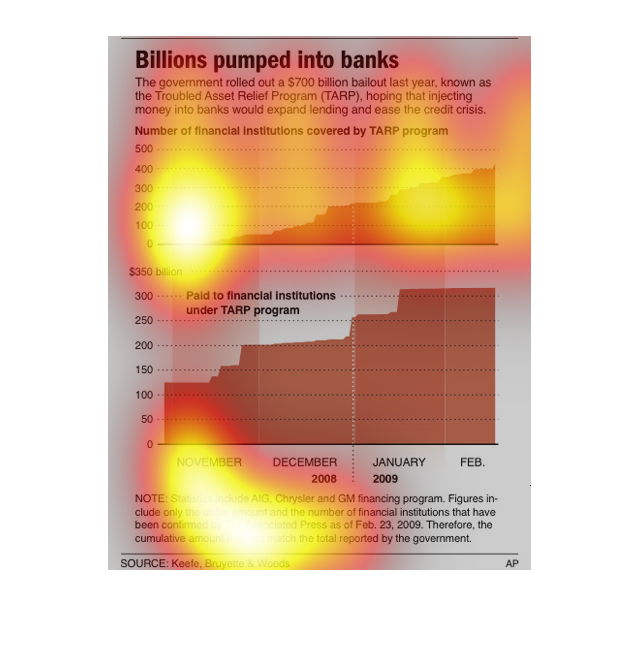

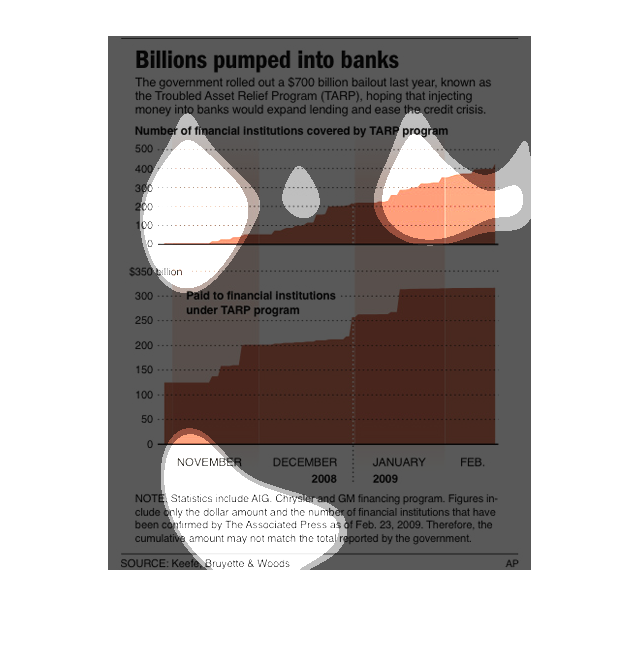

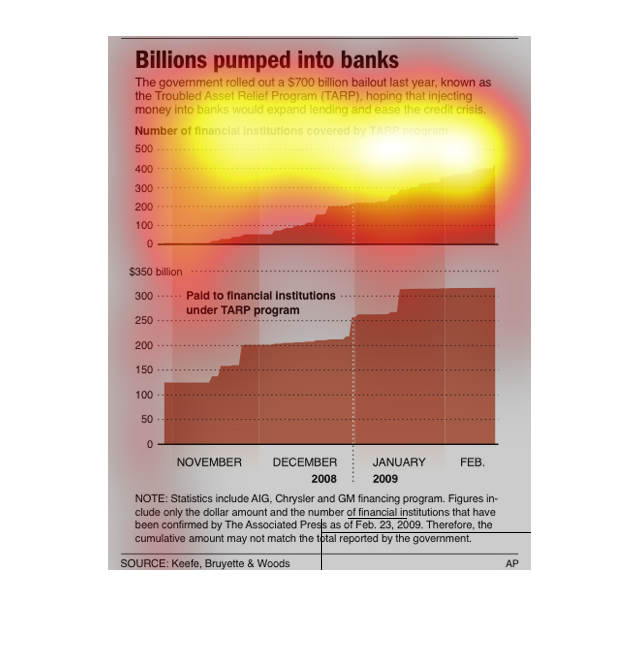

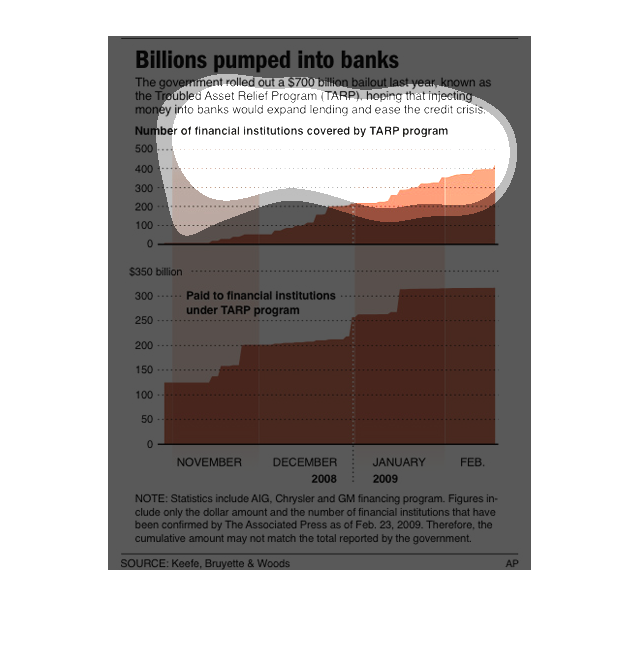

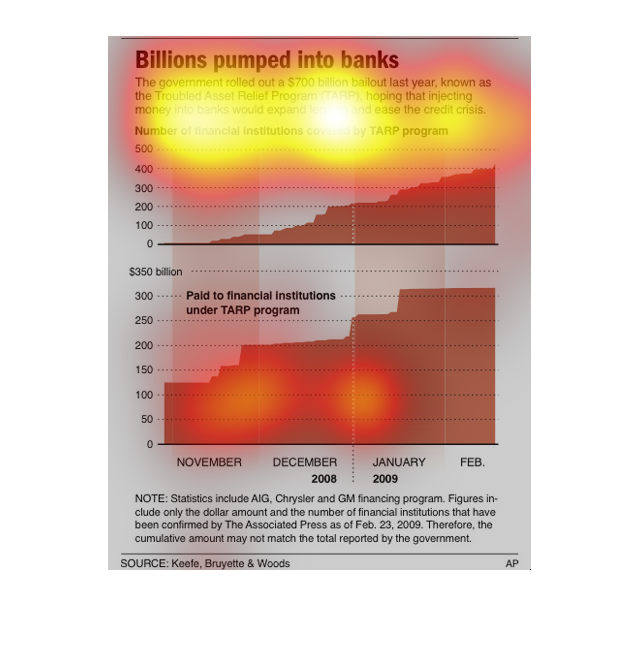

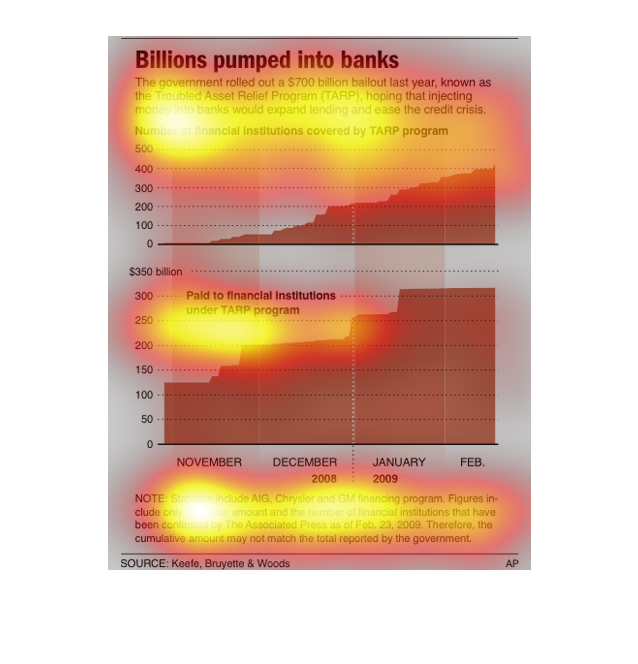

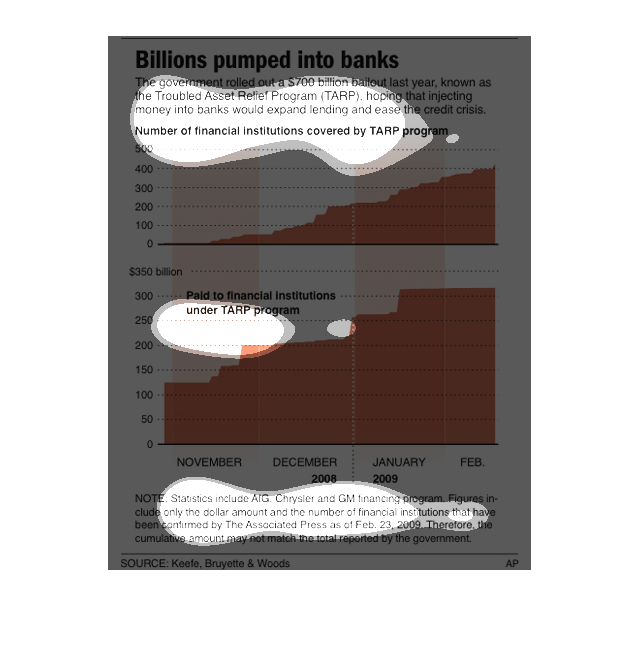

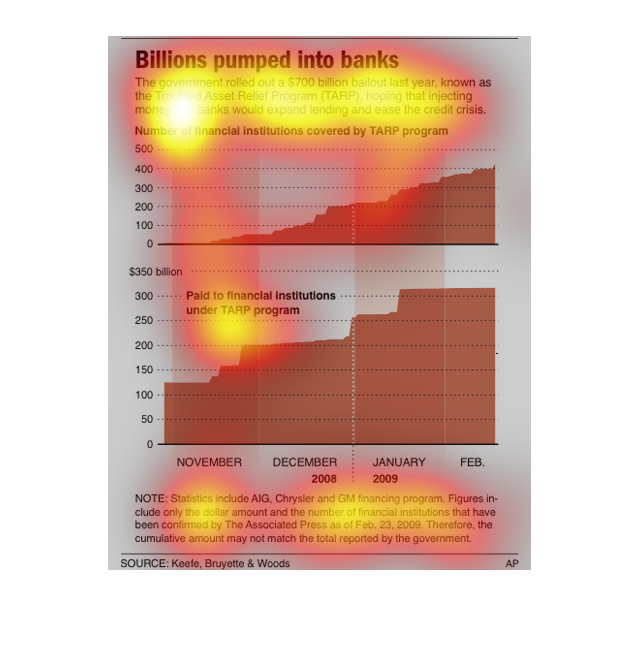

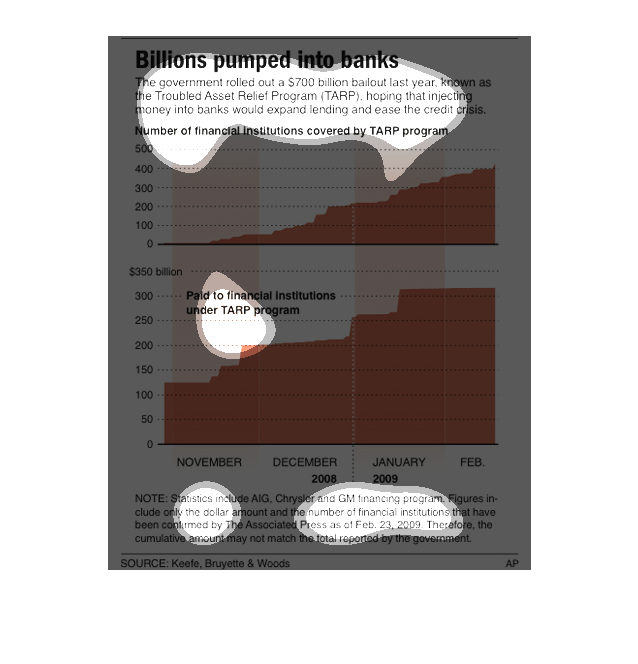

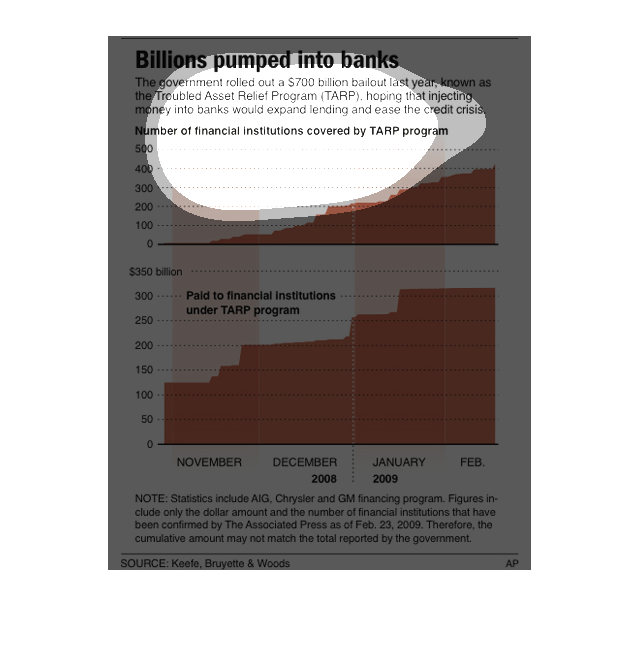

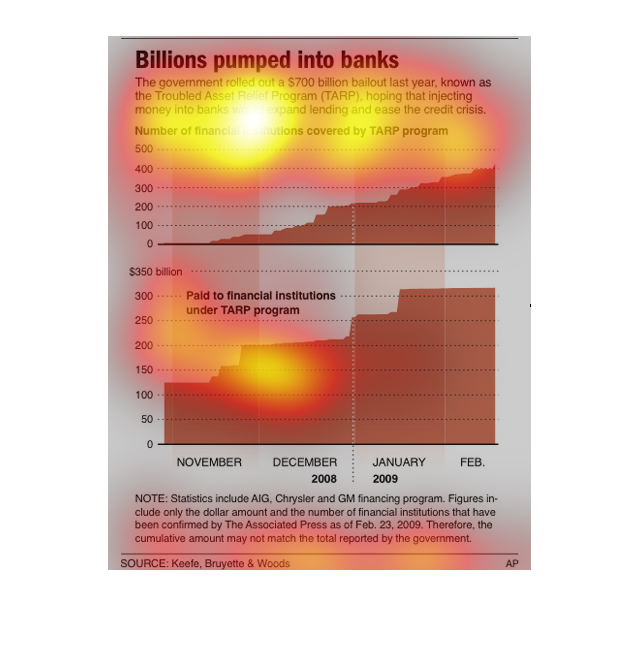

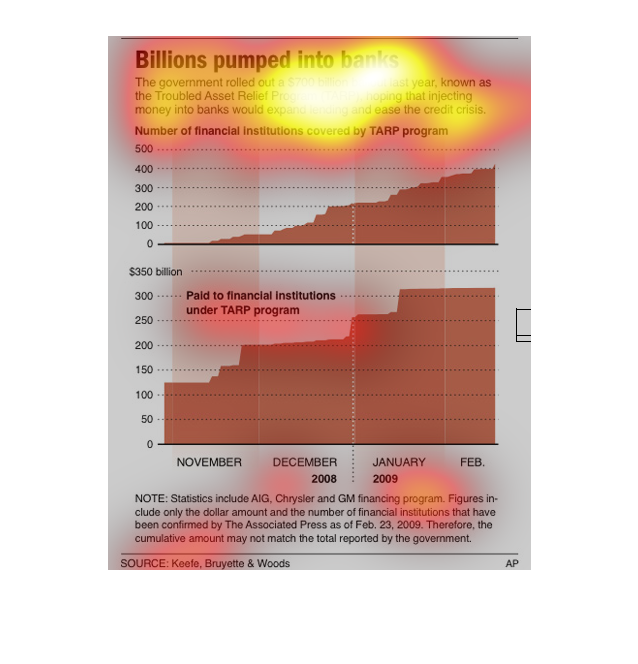

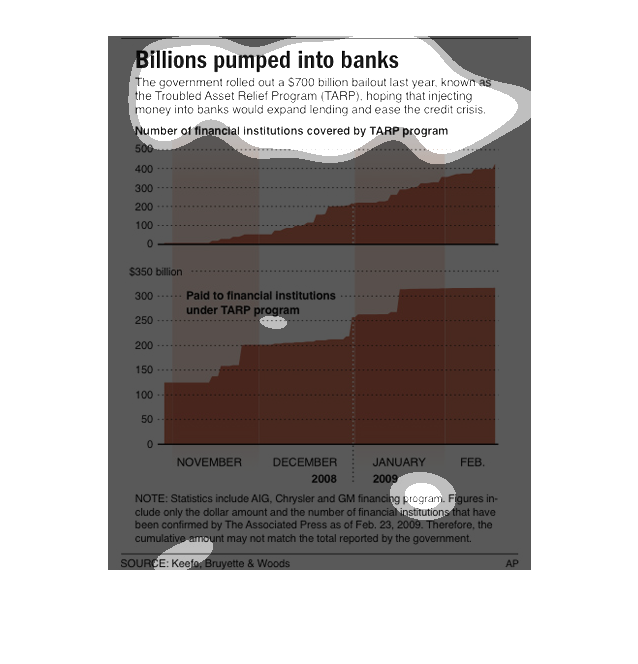

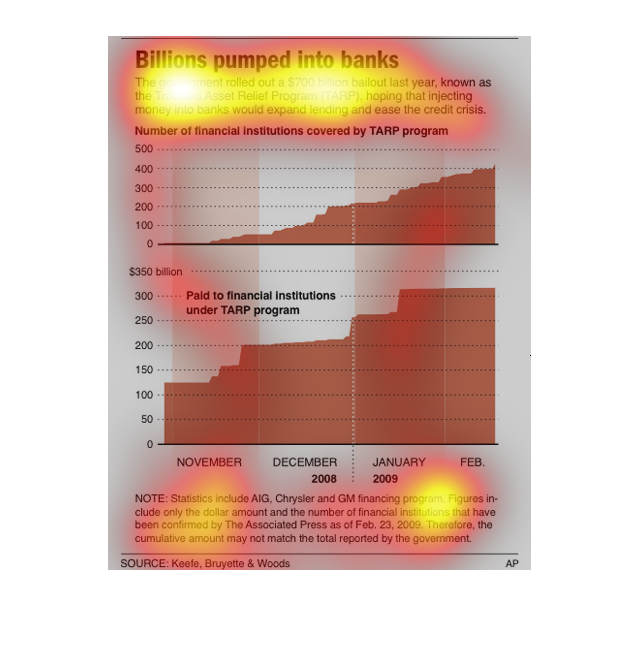

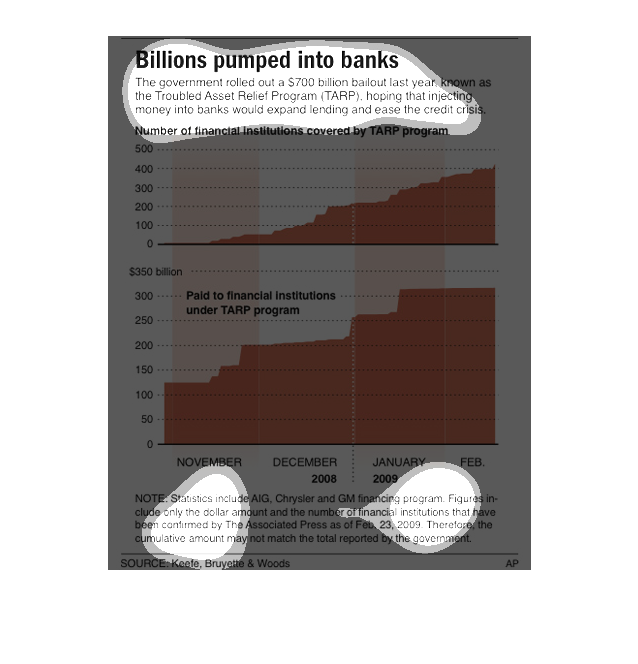

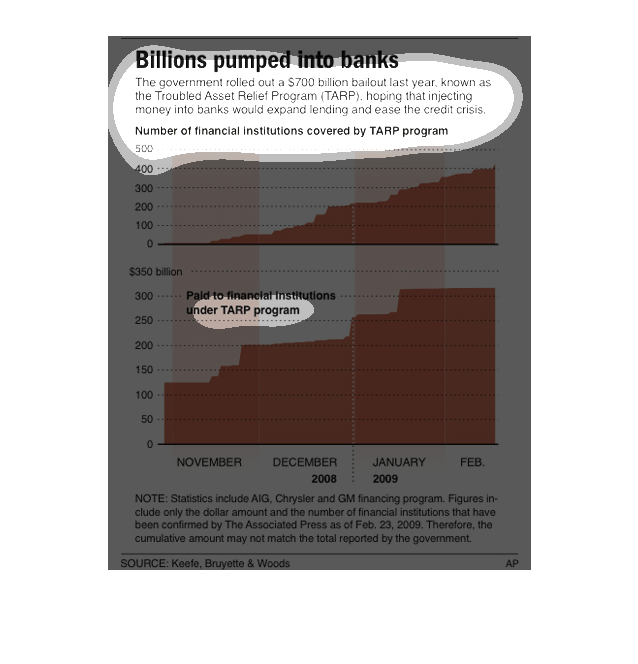

The graph shows the number of banks included in the $700B TARP program rolled out by the Federal

Government and the amount paid to these financial institutions over time between Nov 2008

and Feb 2009. About 400 institutions received money totaling just over $300 B.

The title ofthis graph is, "Billions pumped into banks". The information charted within this

graph displays information from back in 2008-2009, when the United States federal government

defied the basic tenants of capitalism and bailed out private institutions with TARP's and

other programs.

This graph depicts the amount of money pumped into banks during the Financial Crisis, as a

function of time. Statistics also include loans to the auto industry.

This chart describes billions pumped into banks. It states that the government rolled out

a $700 billion bailout last year in a troubled asset relief program.

Billions pumped into bank, 700 billion dollar bailout, number of financial institutions covered

by TARP the acronym for the bailout. november 2008 to january 2009

This image shows two graphs displaying the number of banks that participated in the TARP program

and the amount of money funded to TARP from November 2007 to February 2008. The graphs show

that few institutions used TARP right when it was first funded, however more and more joined

steadily over the next few months. The amount of money used by TARP grew in spurts with large

increases in November and January but plateauing in December and February.

These charts describe how much money was given to certain banks to aide in relief efforts

to help with the credit crisis. The bottom chart shoes how each month there has been an increase

in billions given.

The following chart shows the total amount of money pumped into the United States Financial

System during the TARP Bailouts. From November 2008 until FEB 2009.

This image depicts or shows in 2 different bar graph statistical formats of the billions of

dollars pumped into banks. The government rolled out a $700 billion bailout during the year

before.

This graph shows the billions of dollars that the government injected into the banking business

to help them expand lending and ease the credit crisis in a program called (TARP) The graph

shows the number of institutions as well as the dollar amount the government has put out in

a 3-month period.

An infographic showing the billions of dollars pumped into the banking system over a several

month period as bailouts. A graph of funds for the TARP bill

This graph illustrates the billions that have been pushed into the banks for the economic

bailouts. The top is the number of financial instituions covered by TARP programs. The bottom

shows money paid to financial instituions by the TARP programs.

This chart shows the different financial institutes that are covered by the new government

program called TARP. The money being put into these banks should help the credit issue and

help relieve financial troubles.

The graphs depict the bail out of banks in the TARP program. They show the difference pouring

the money into the banks made and how many more banks were covered by the TARP program over

time.

This is a chart showing the outcome of the $700 billion pumped into banks to ease the credit

crunch from November of 2008 to February of 2009. The chart shows there were 500 financial

institutions covered by tarp.