Warning: Image is too big to fit on screen; displaying at 50%

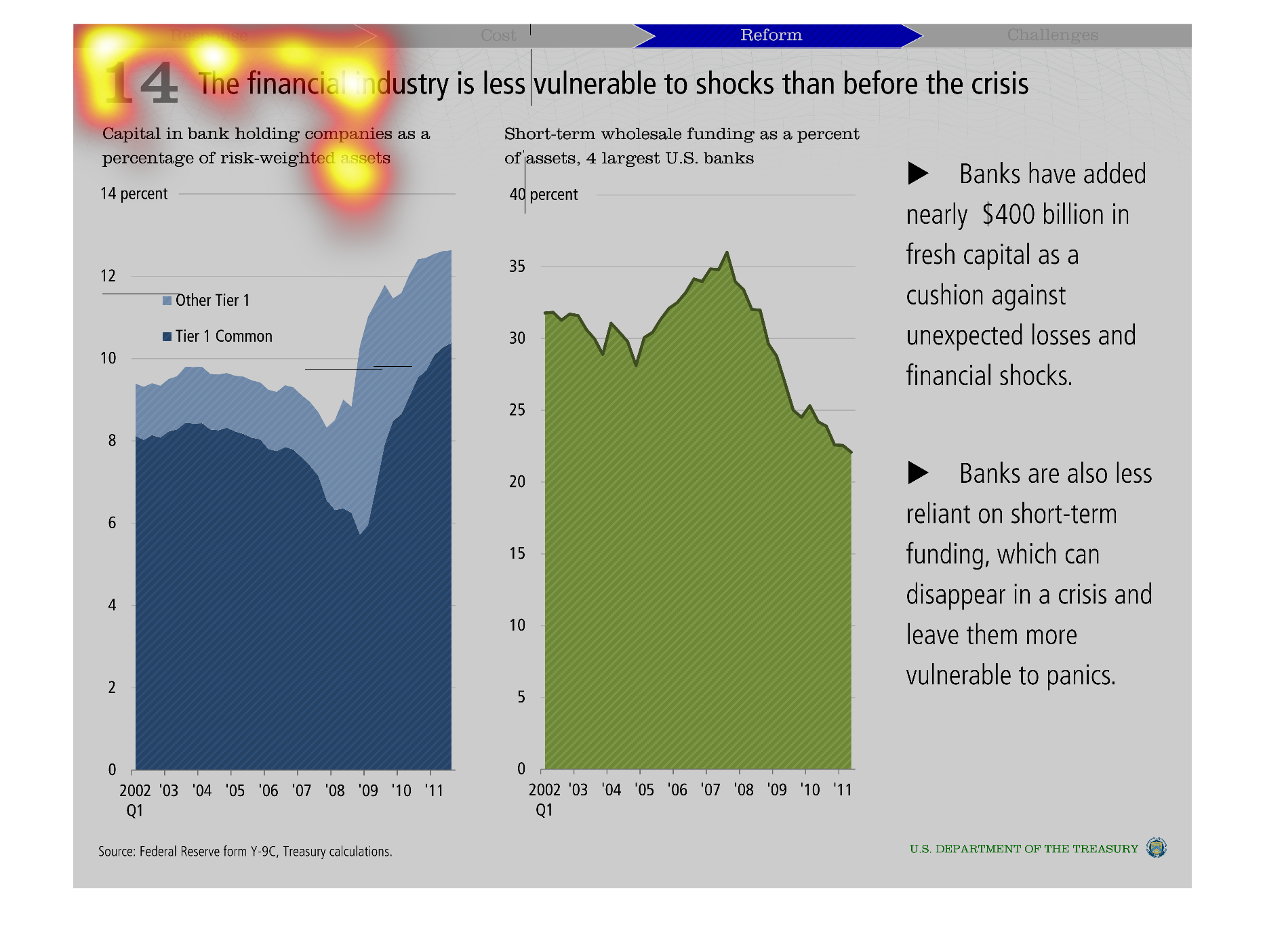

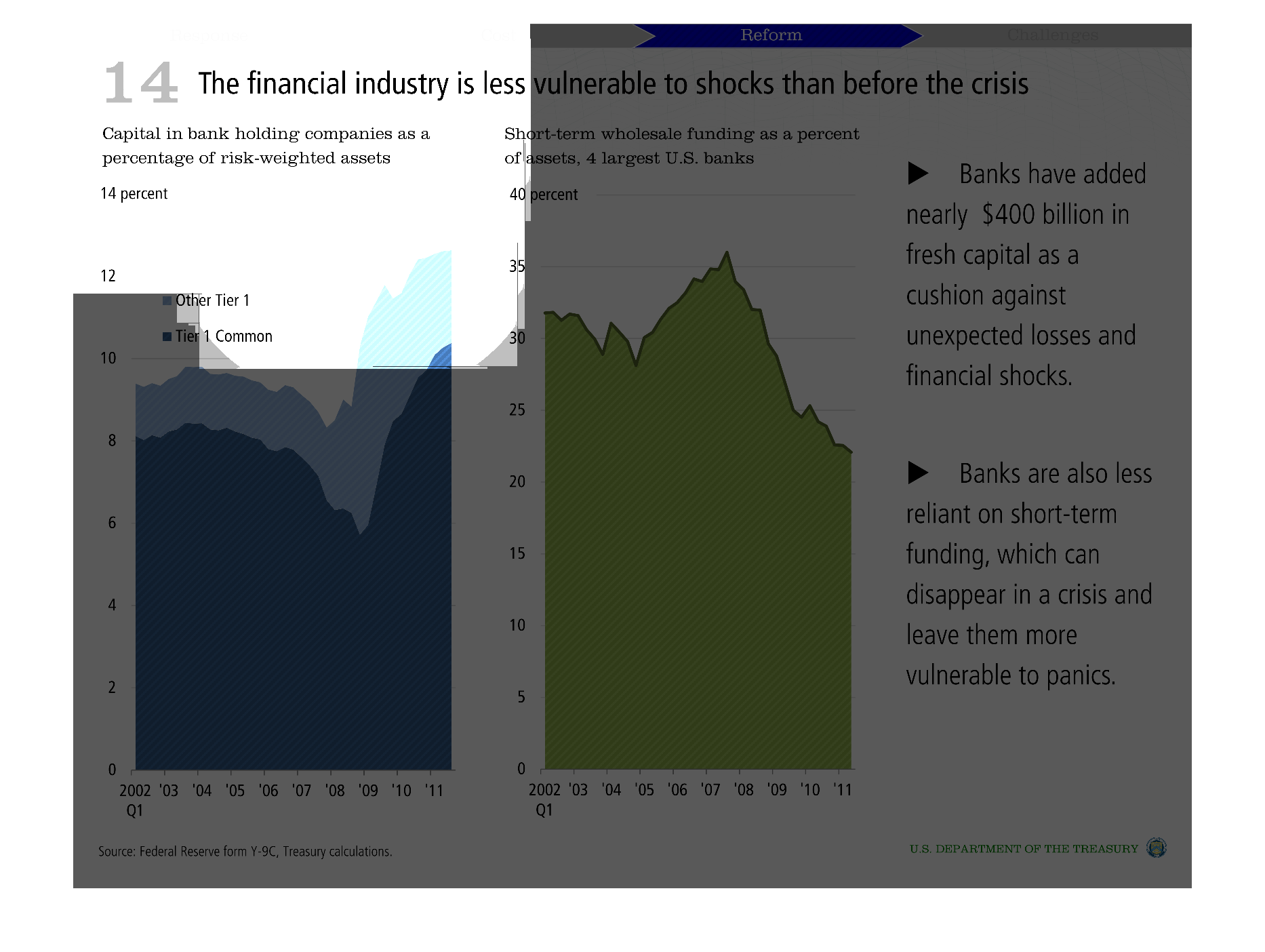

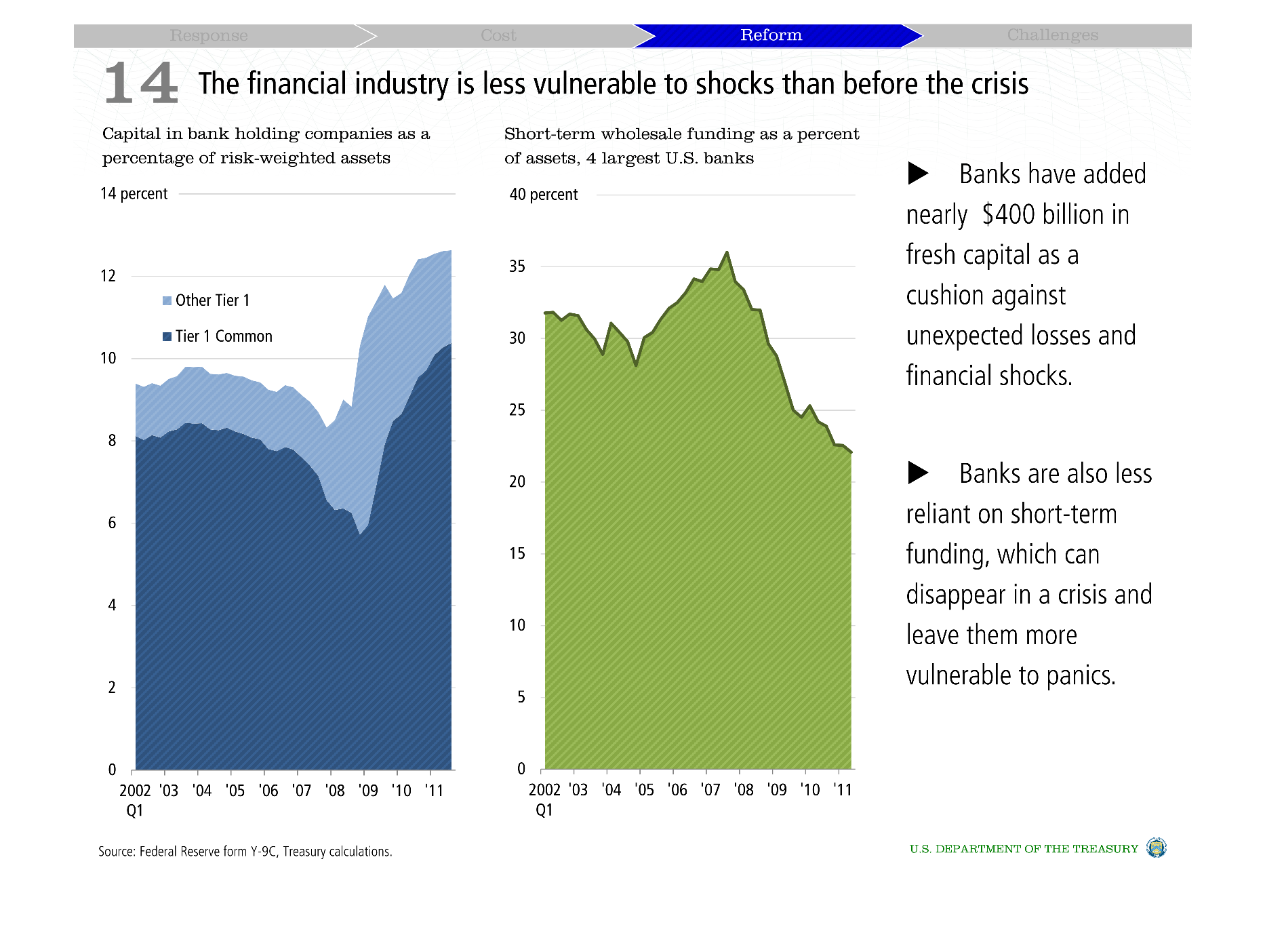

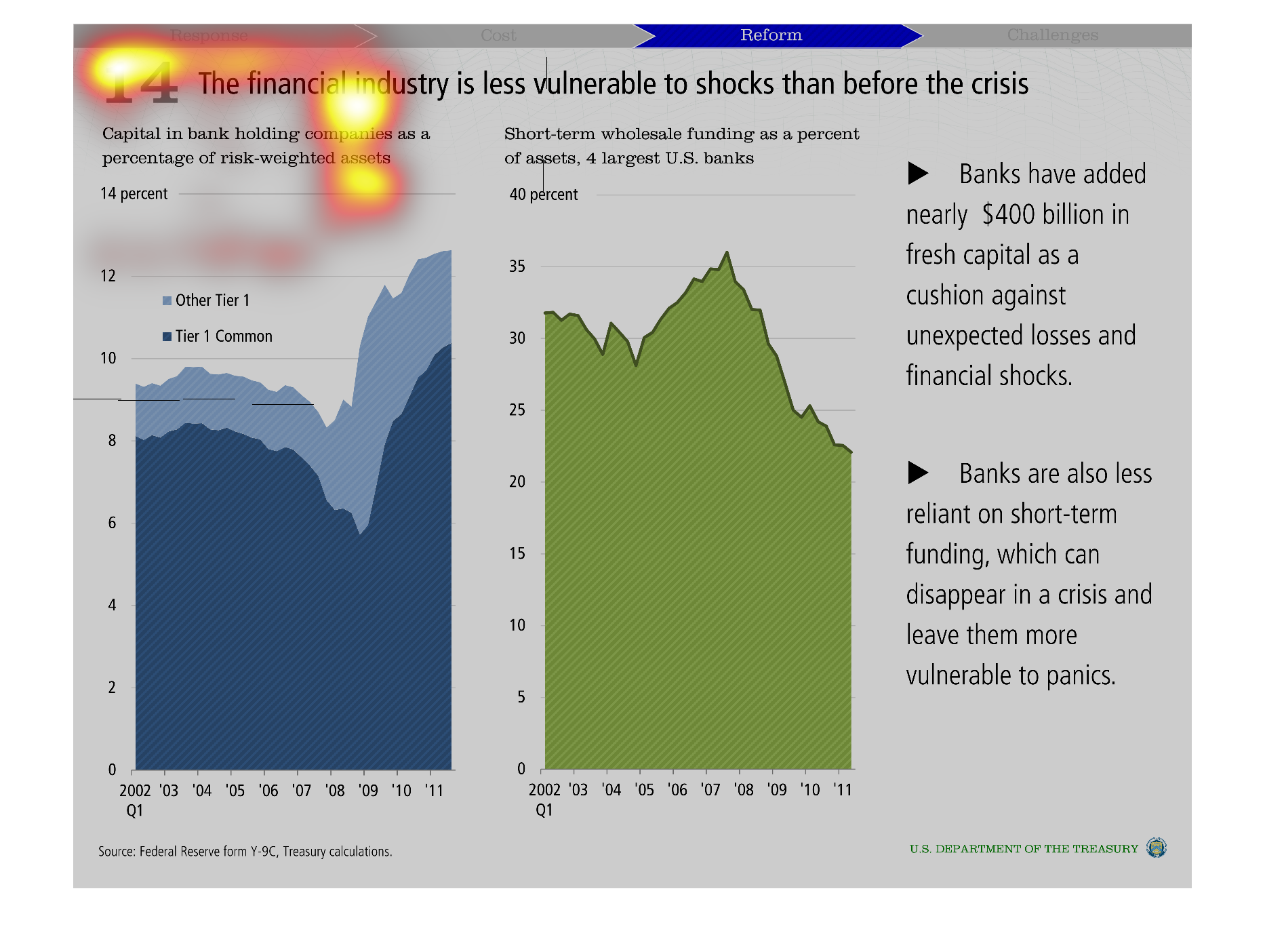

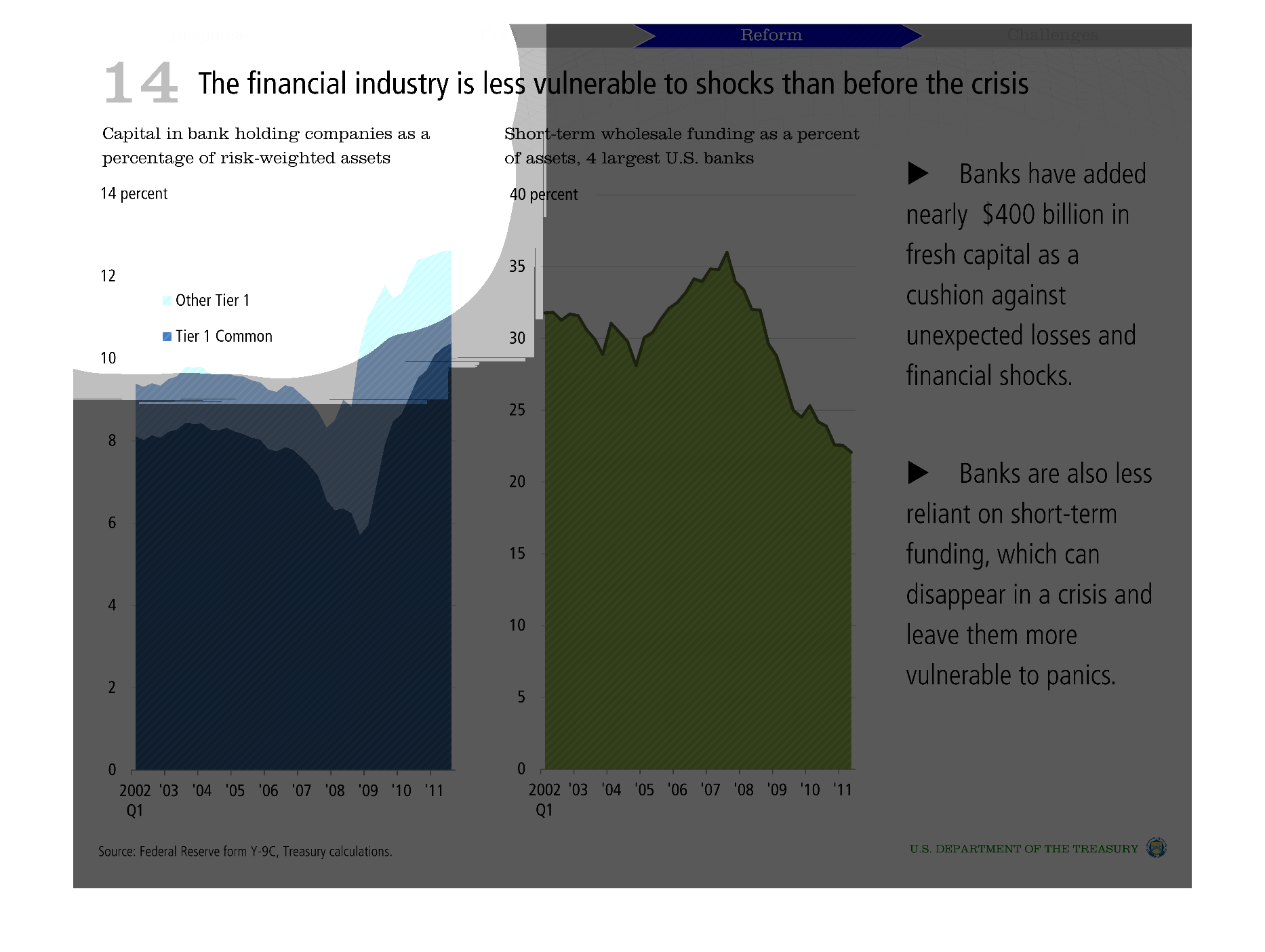

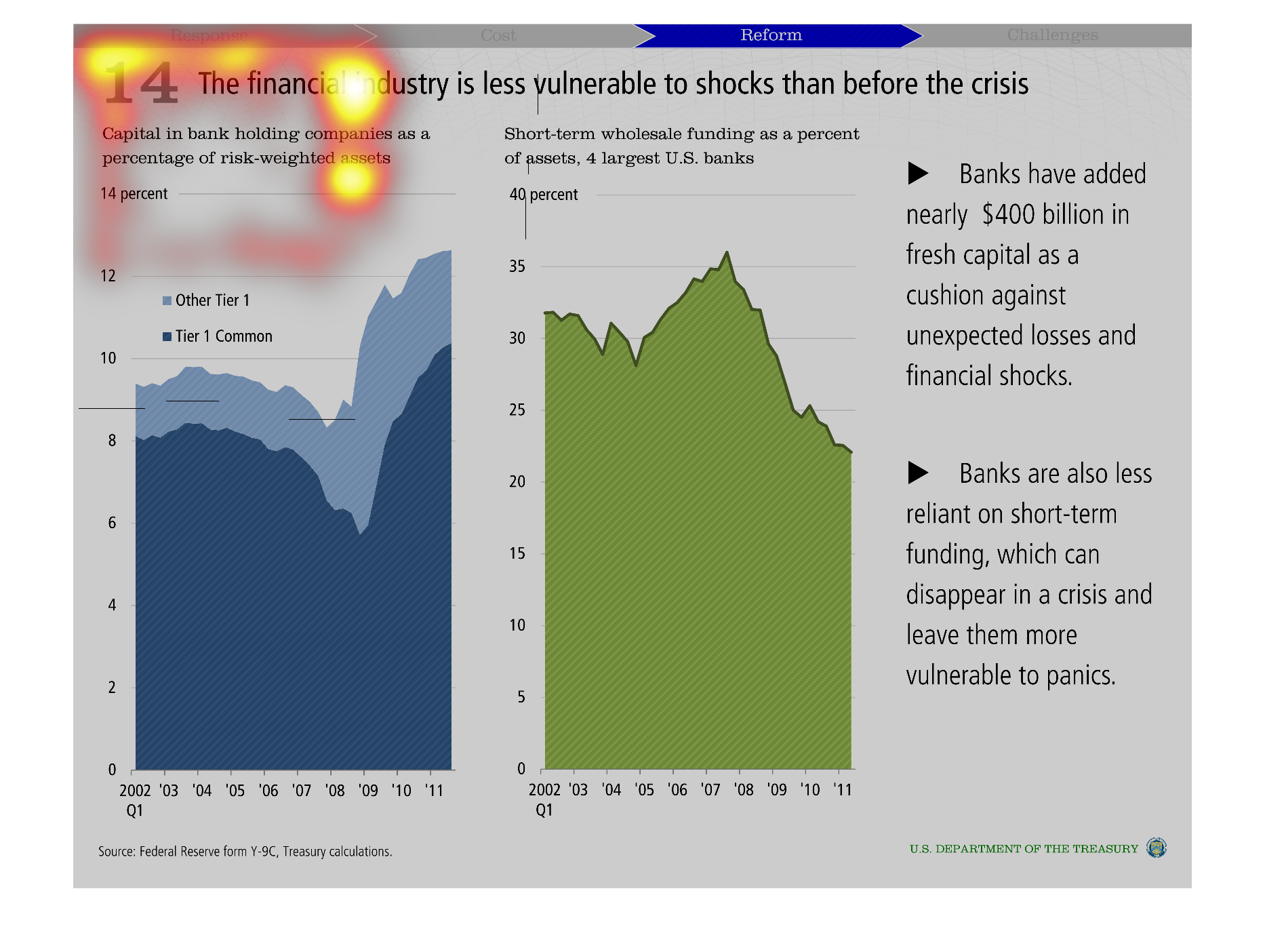

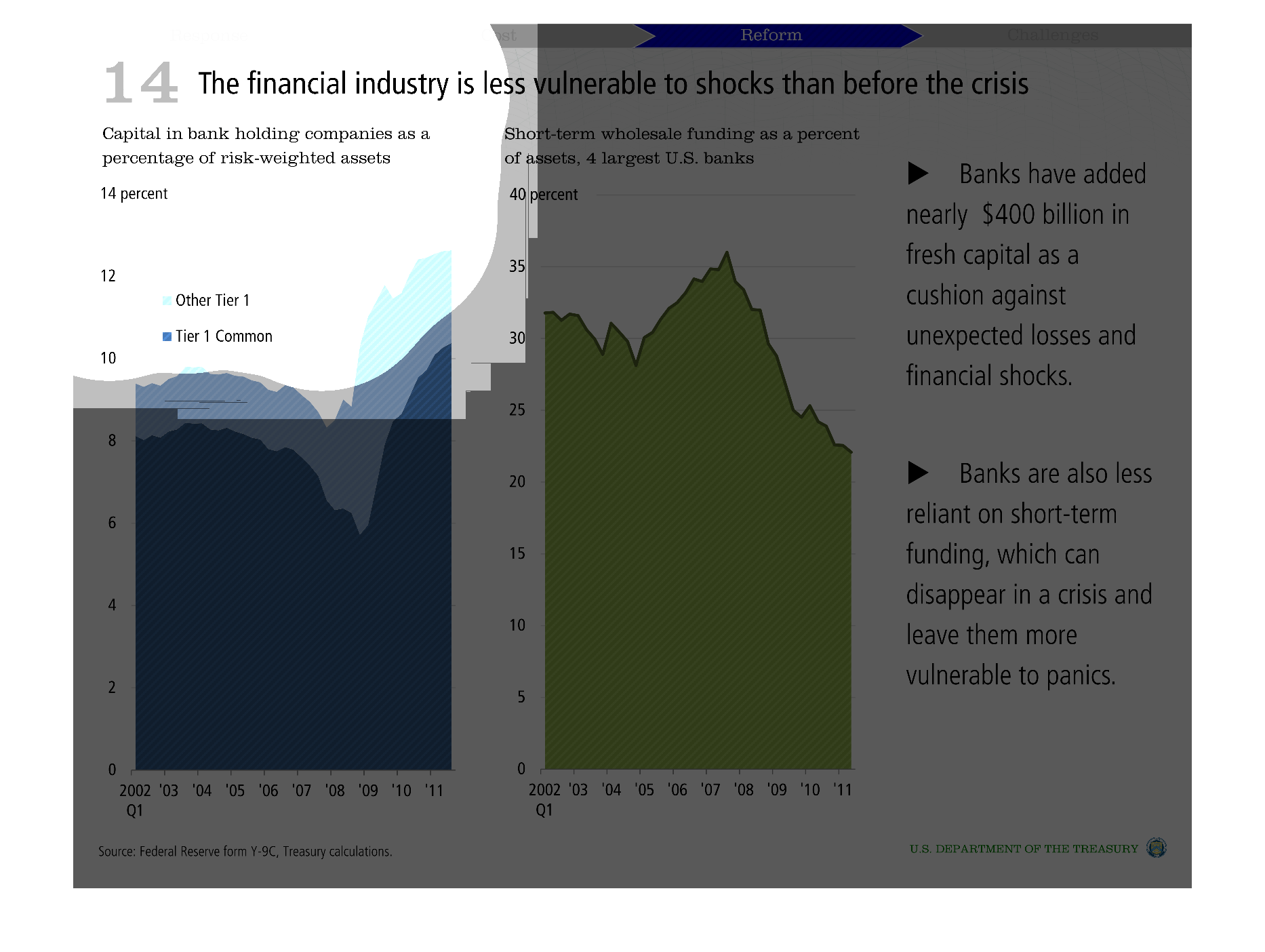

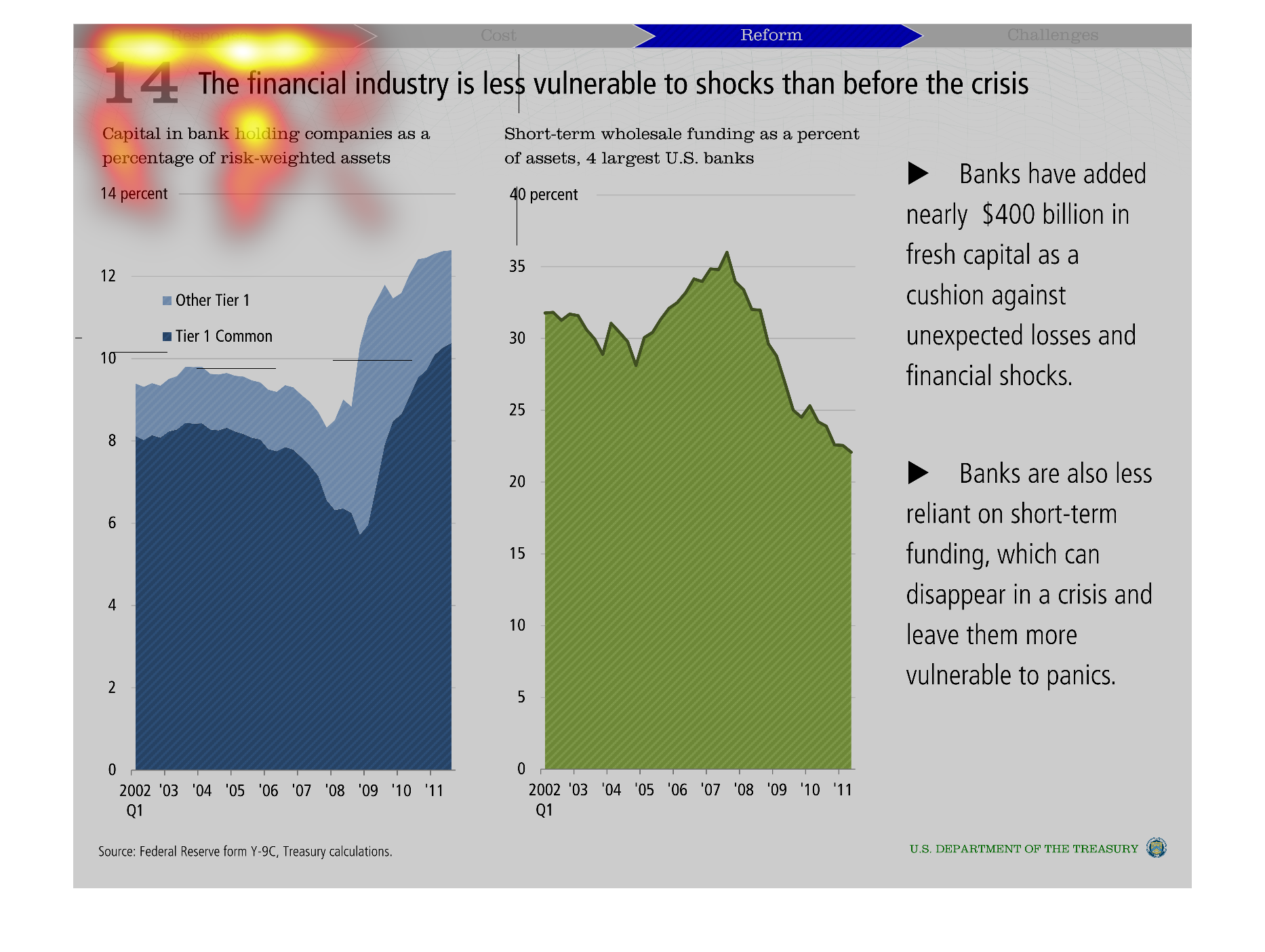

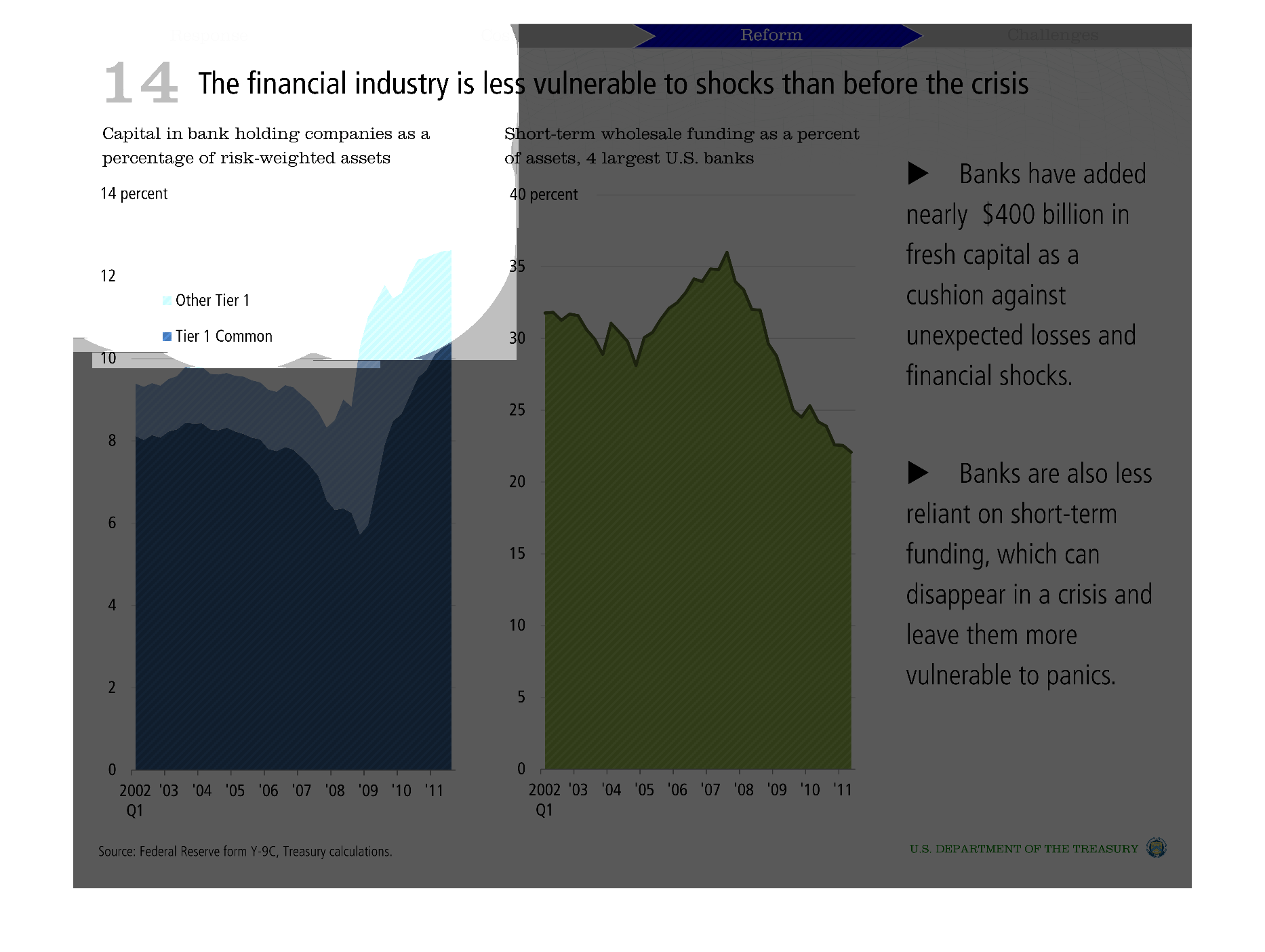

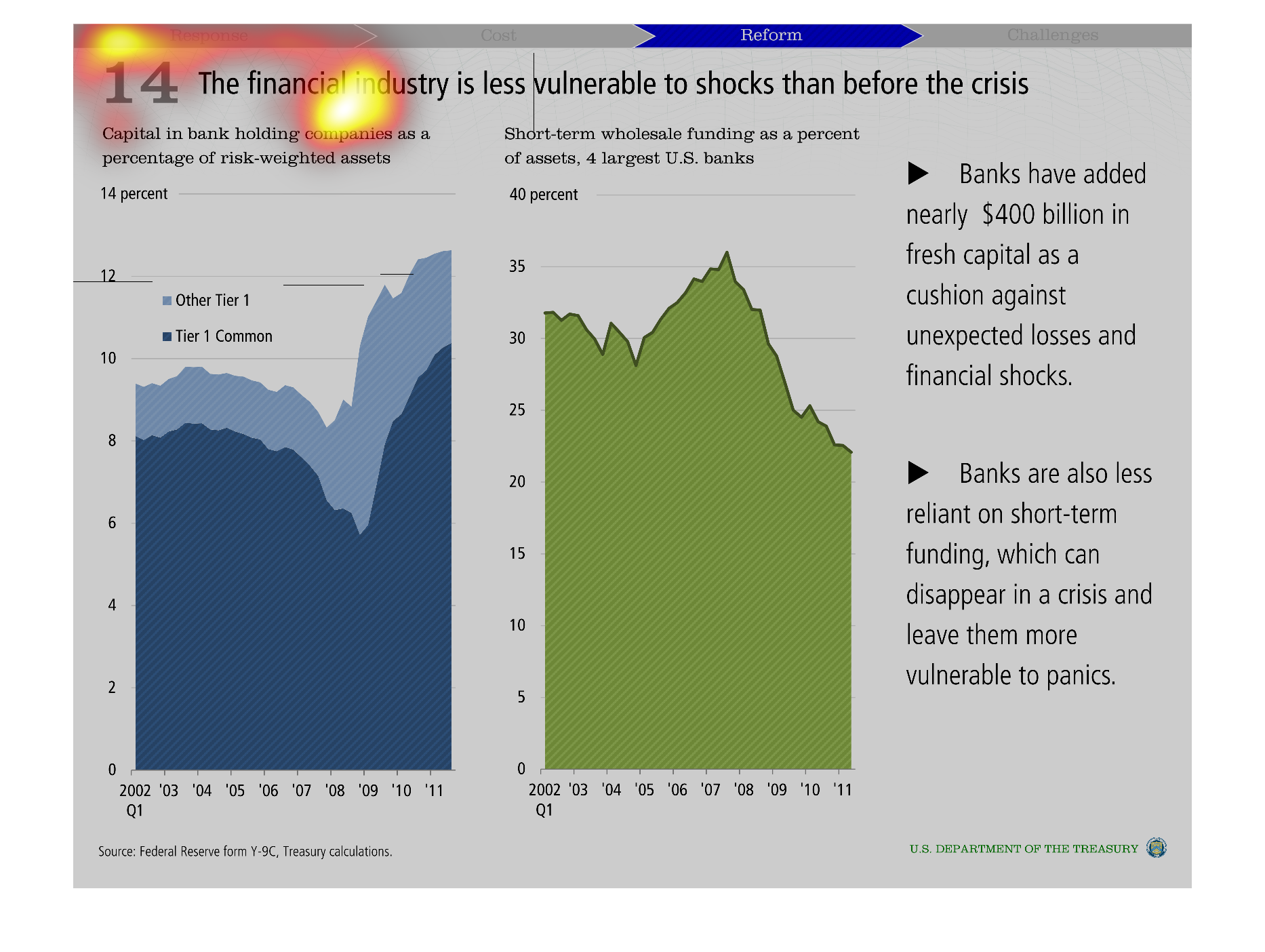

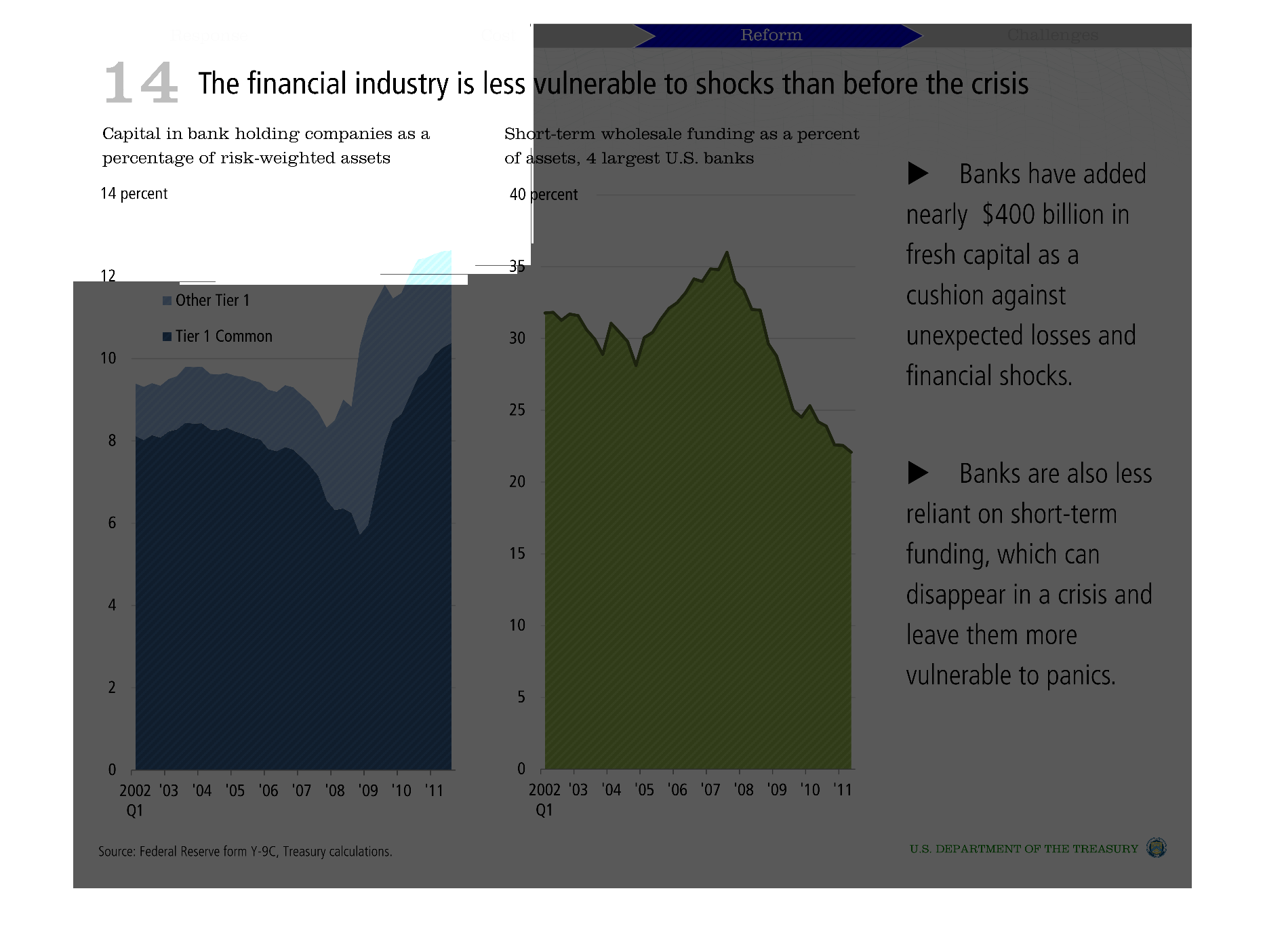

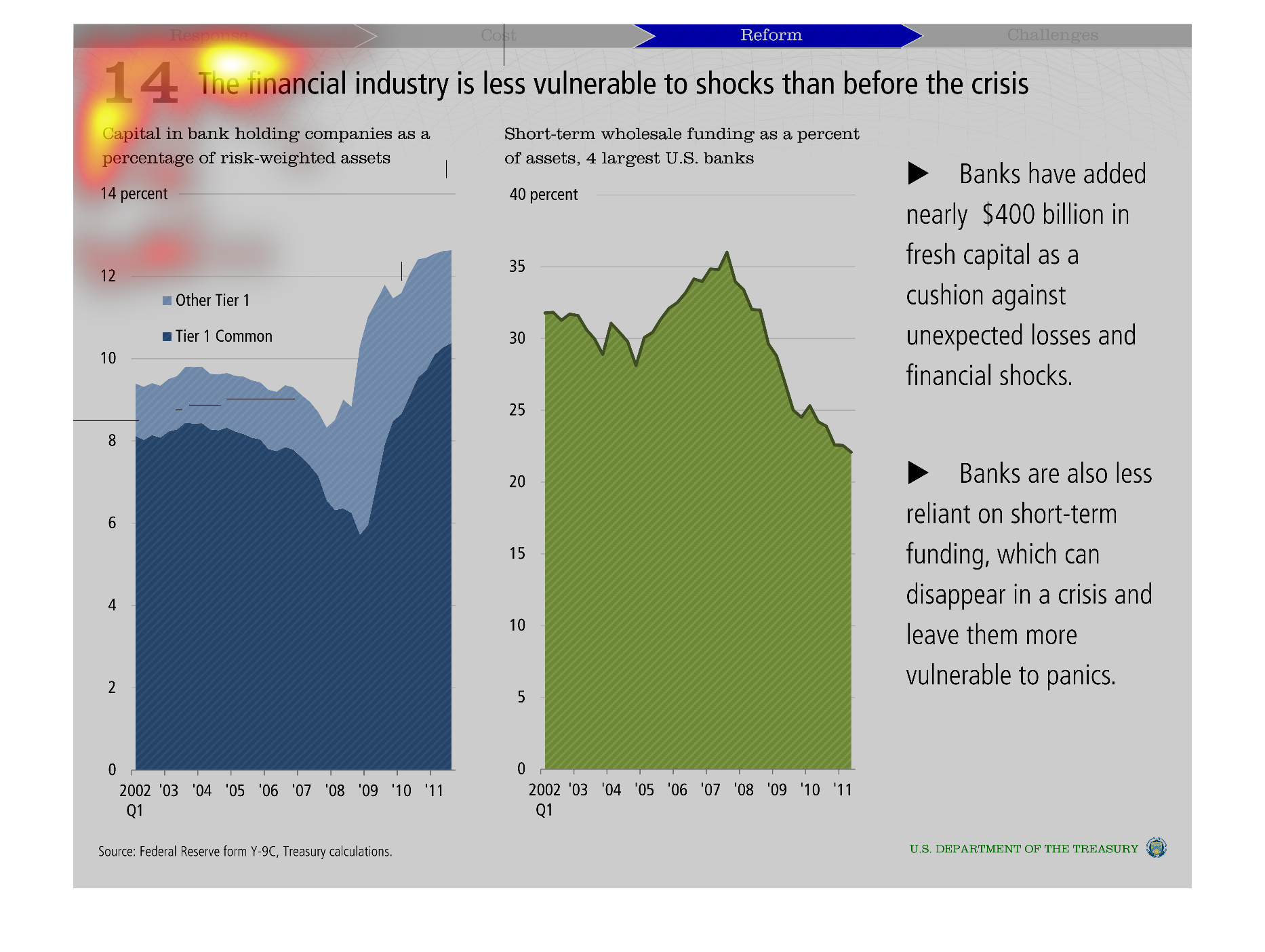

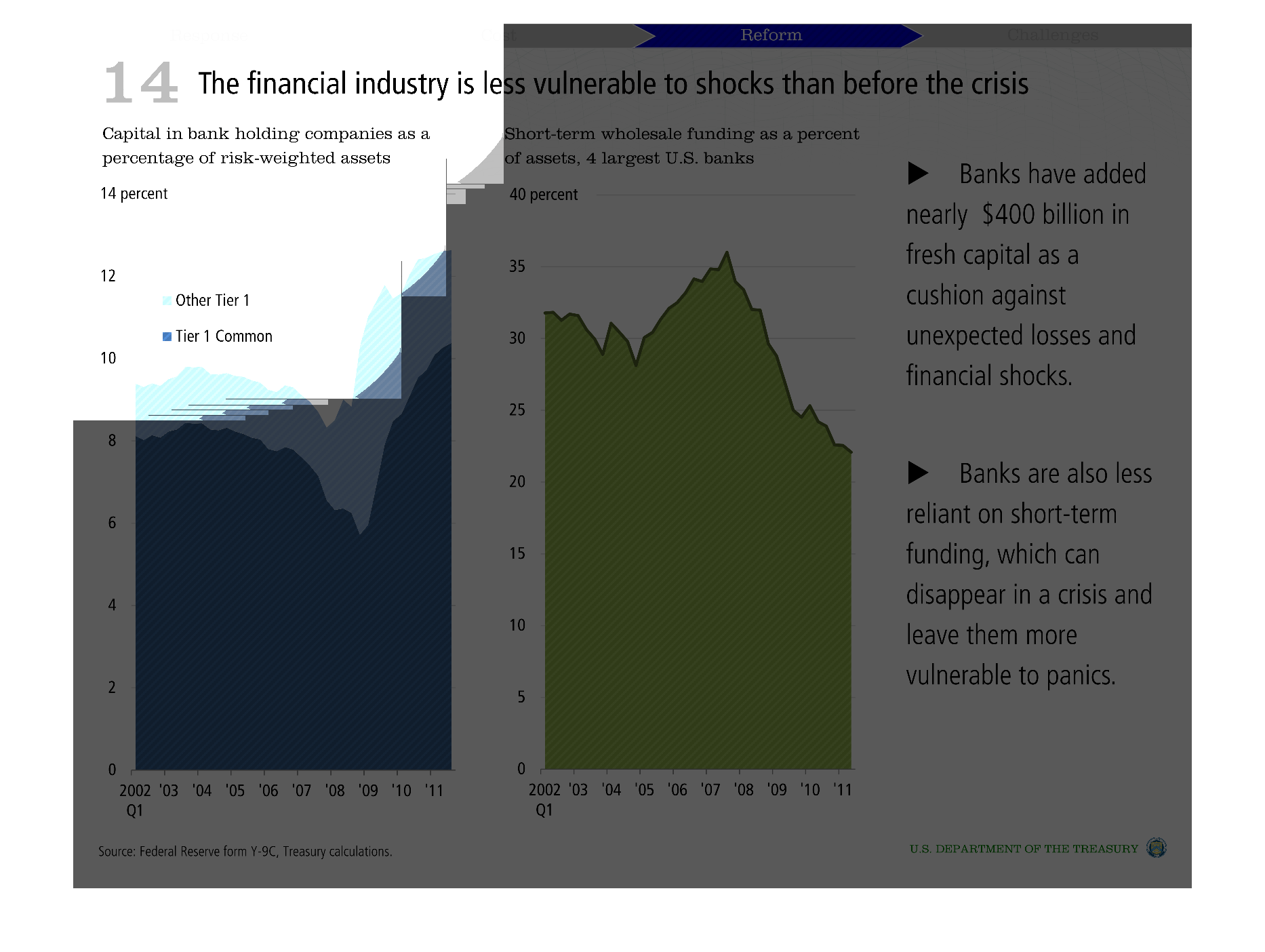

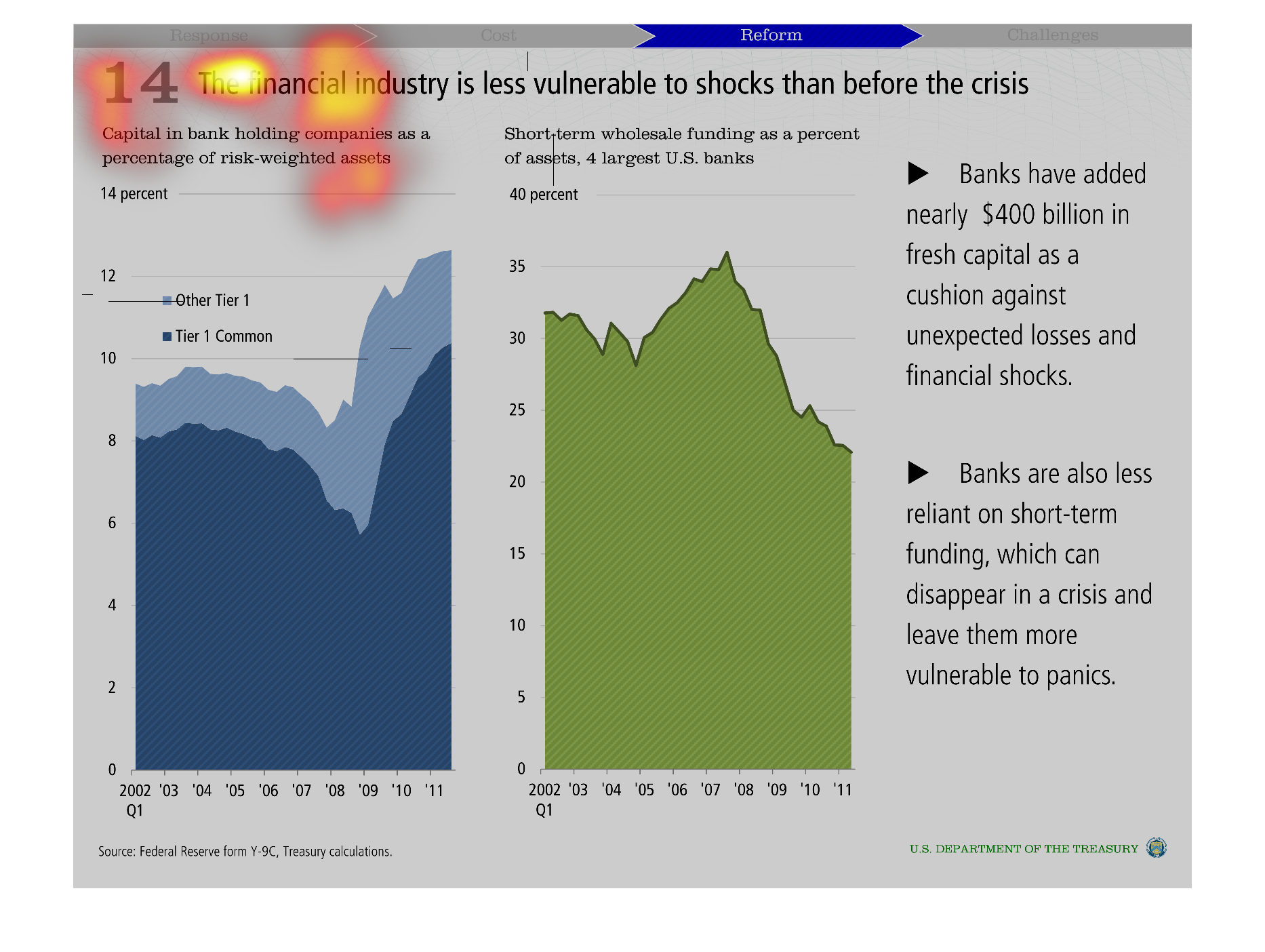

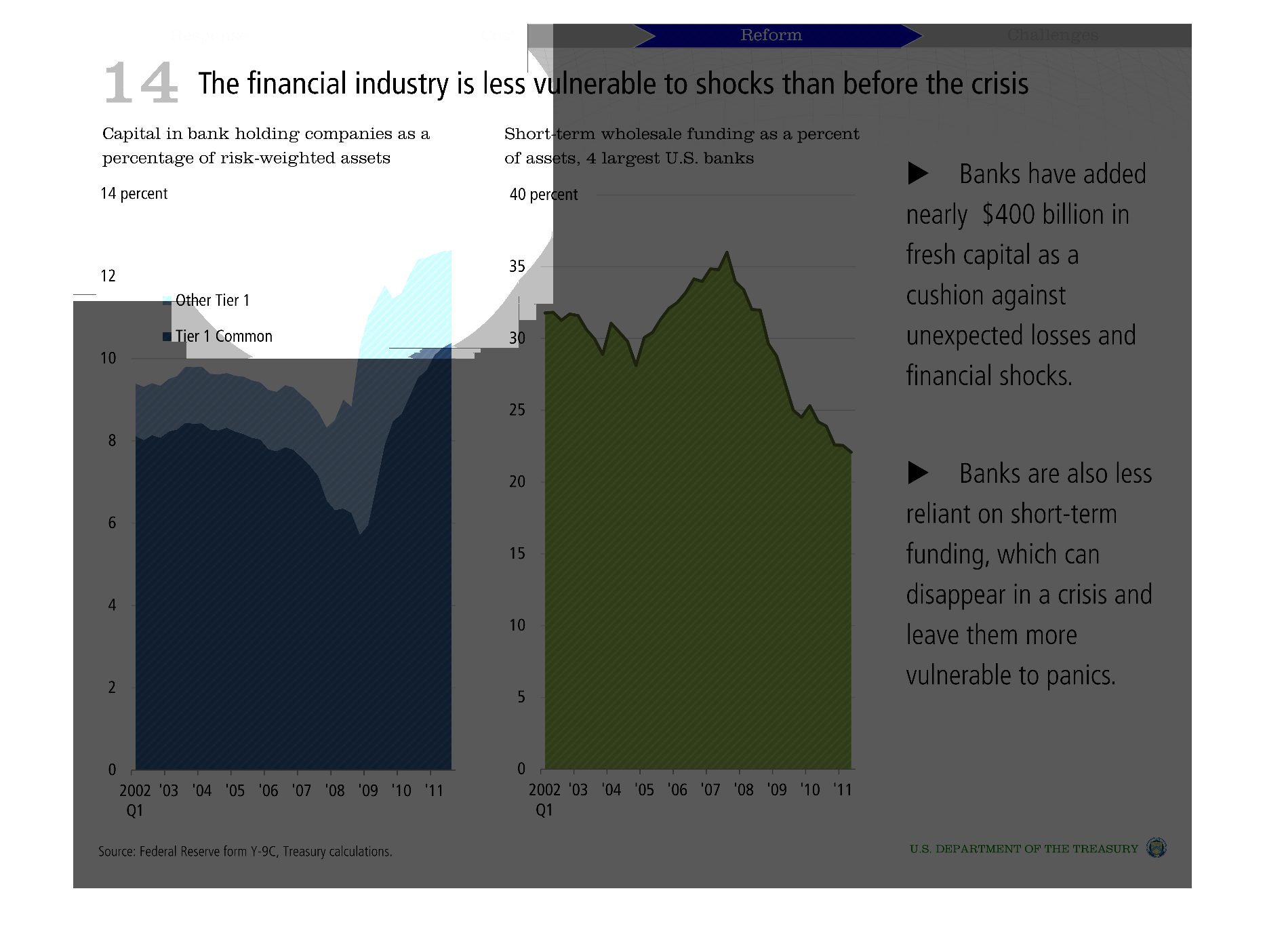

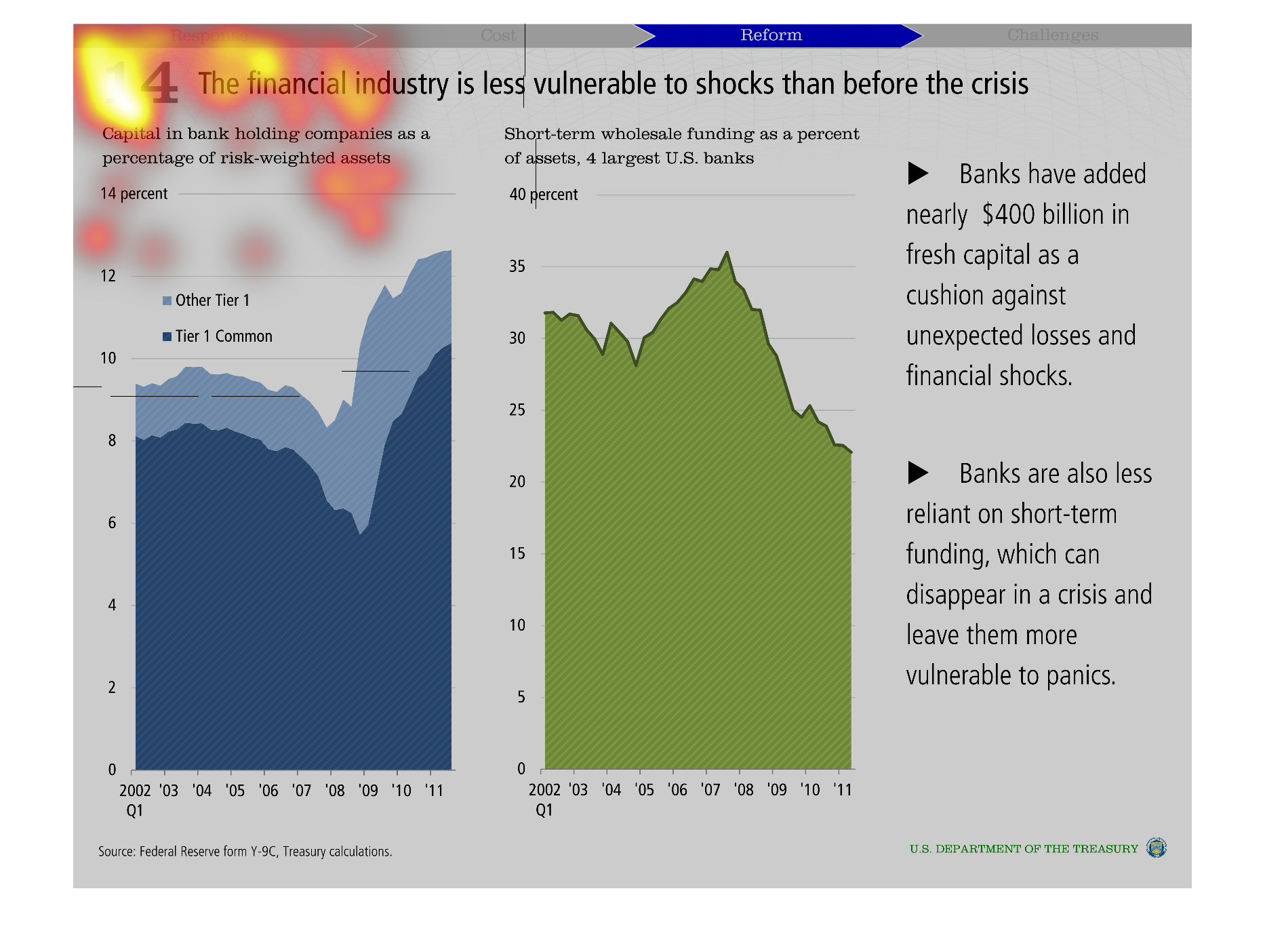

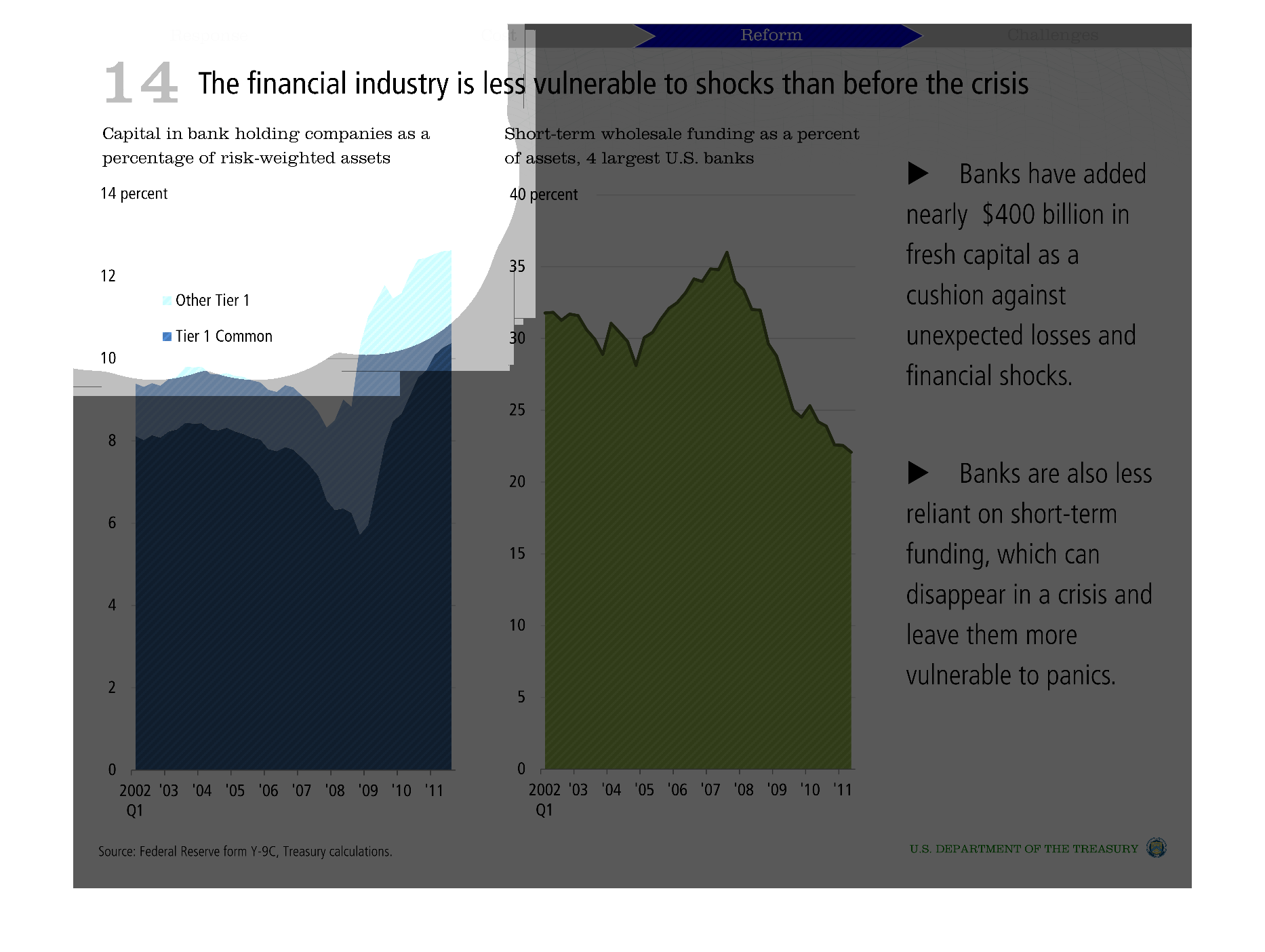

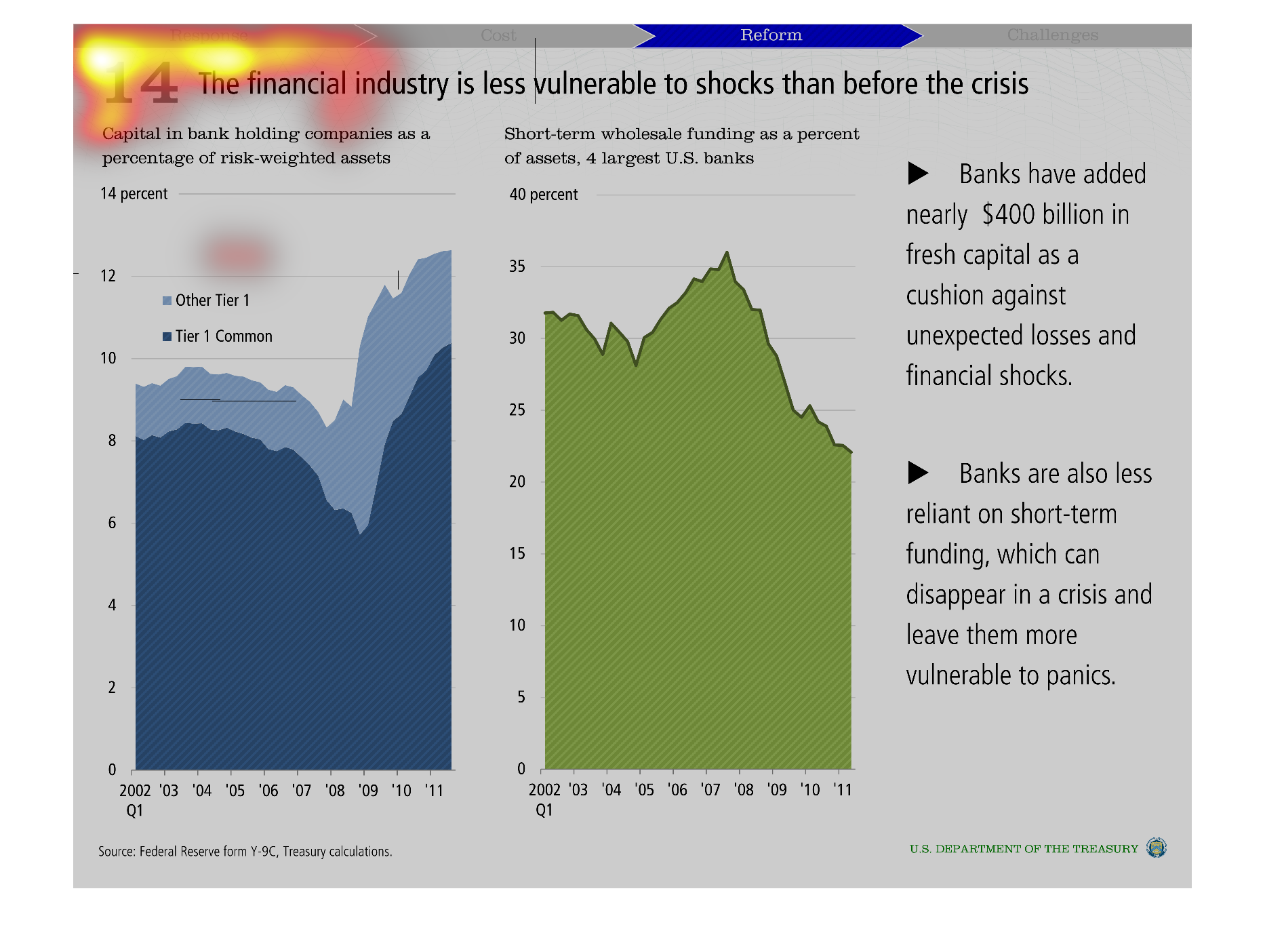

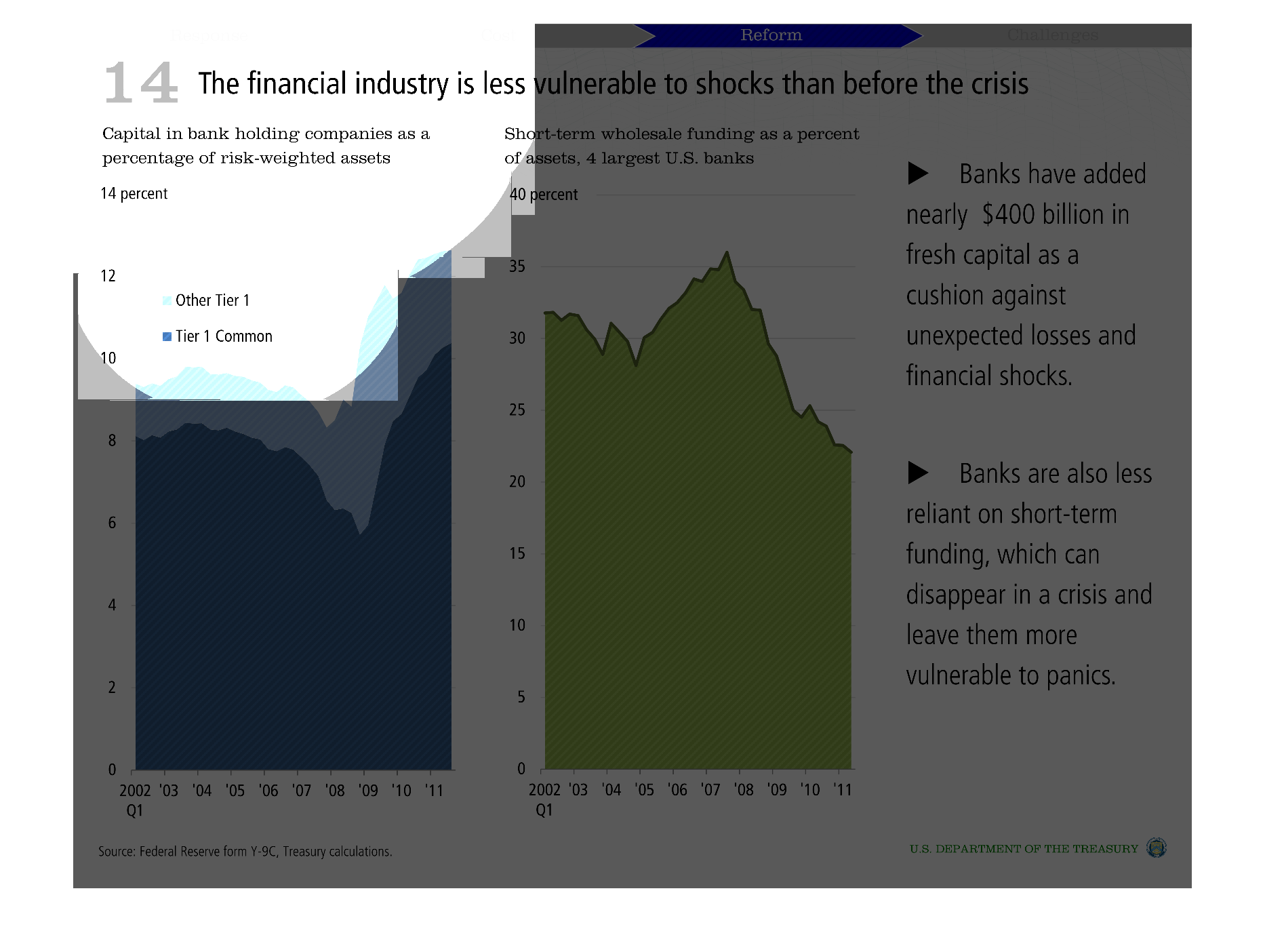

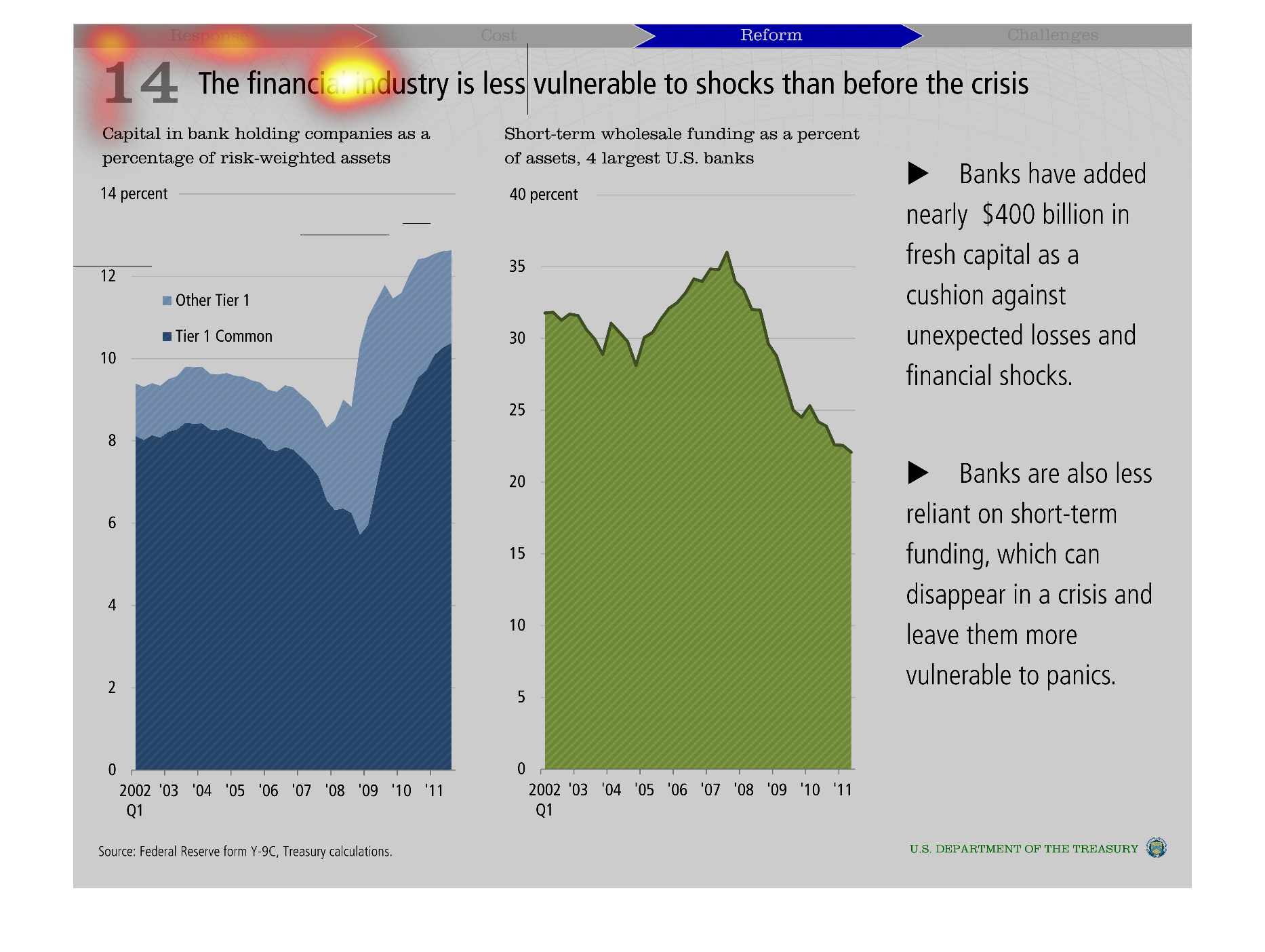

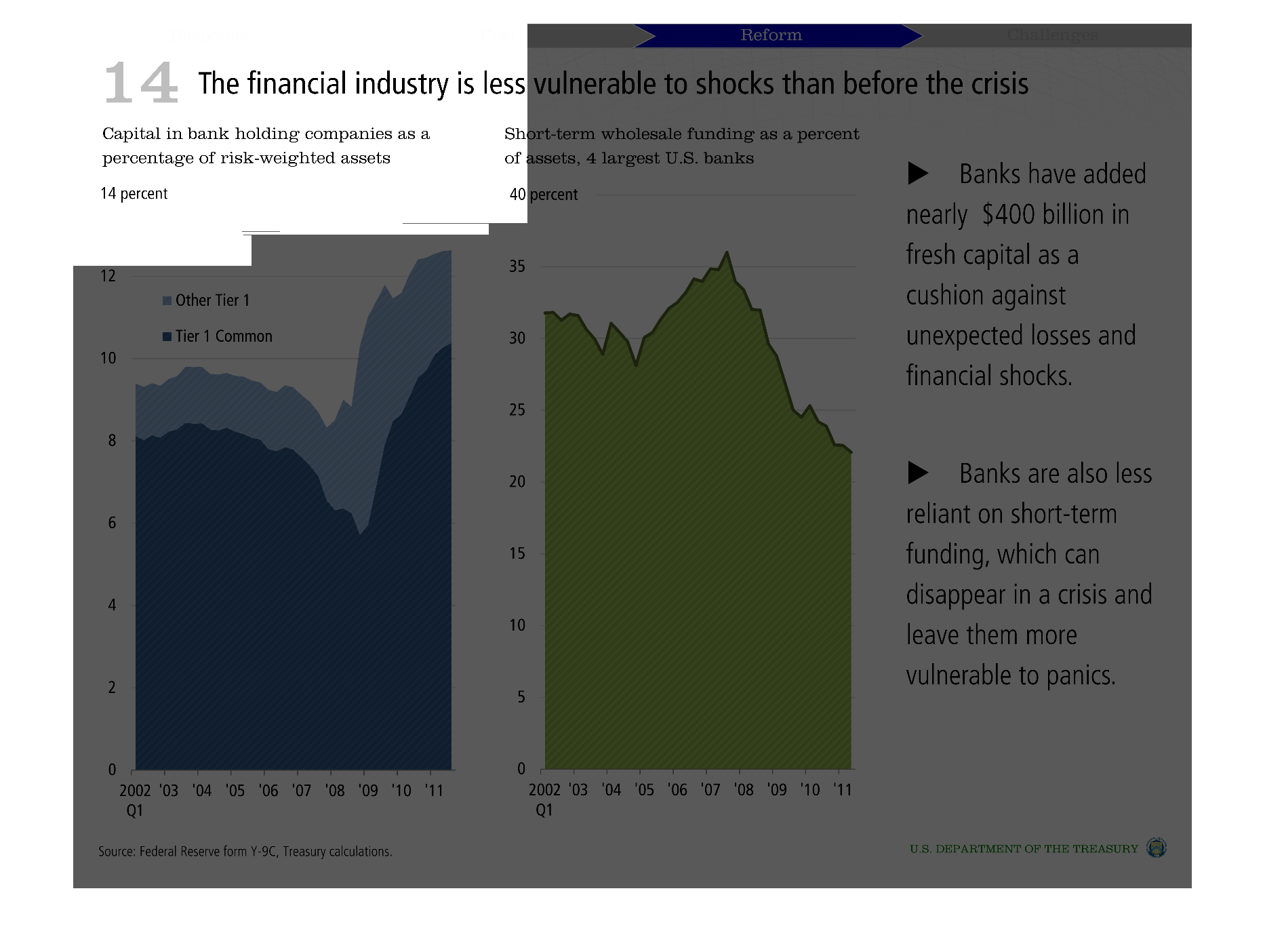

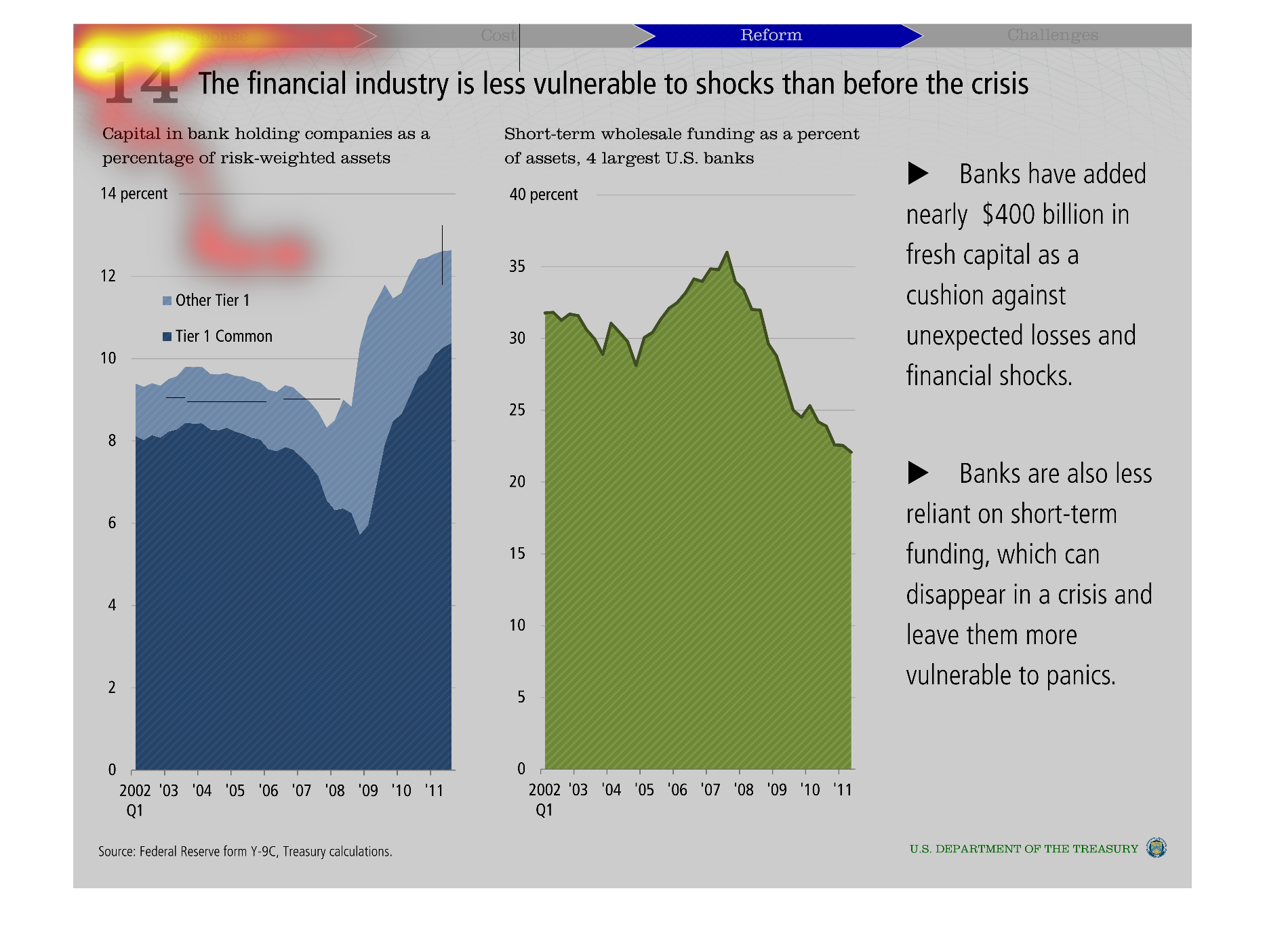

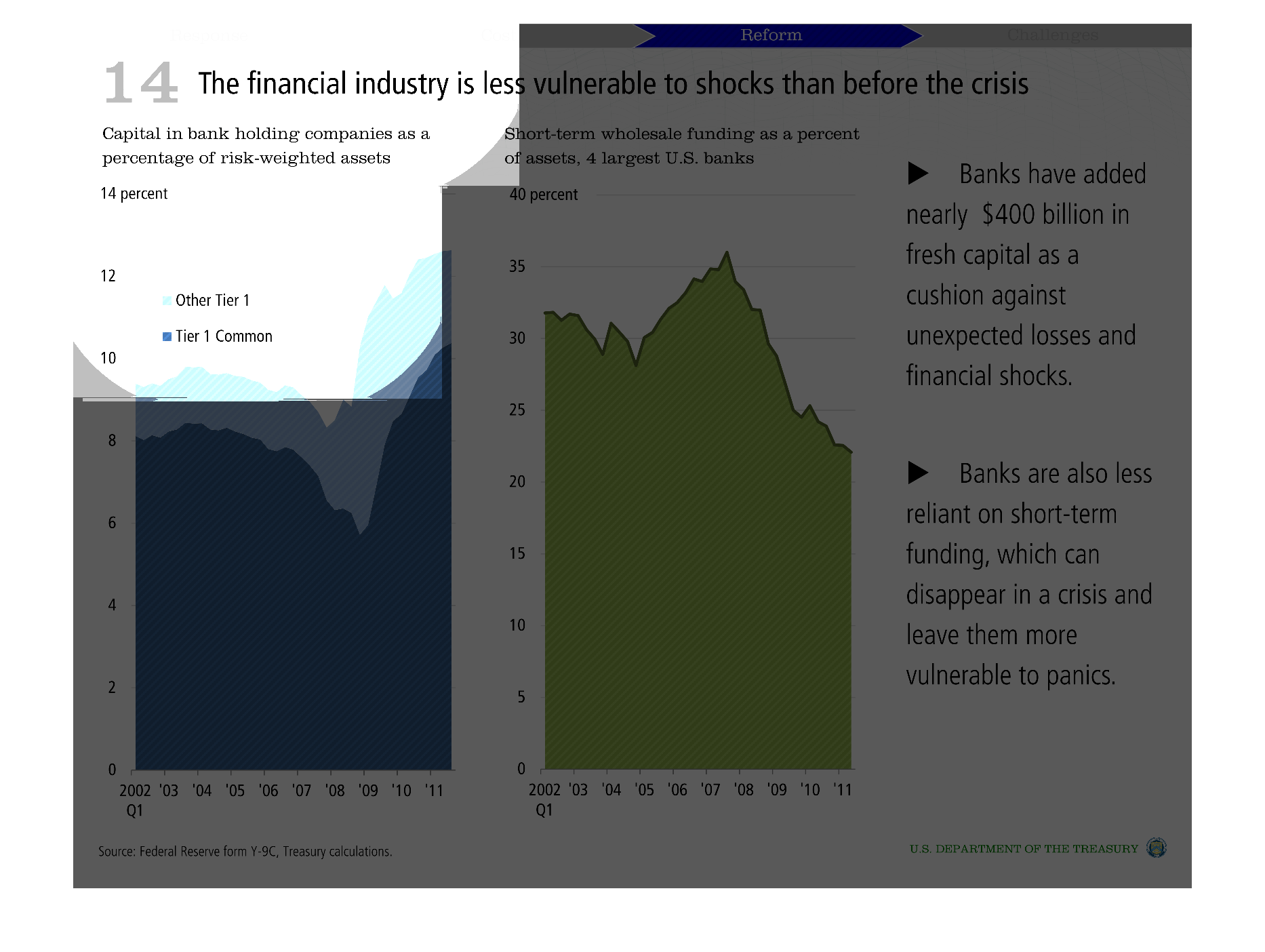

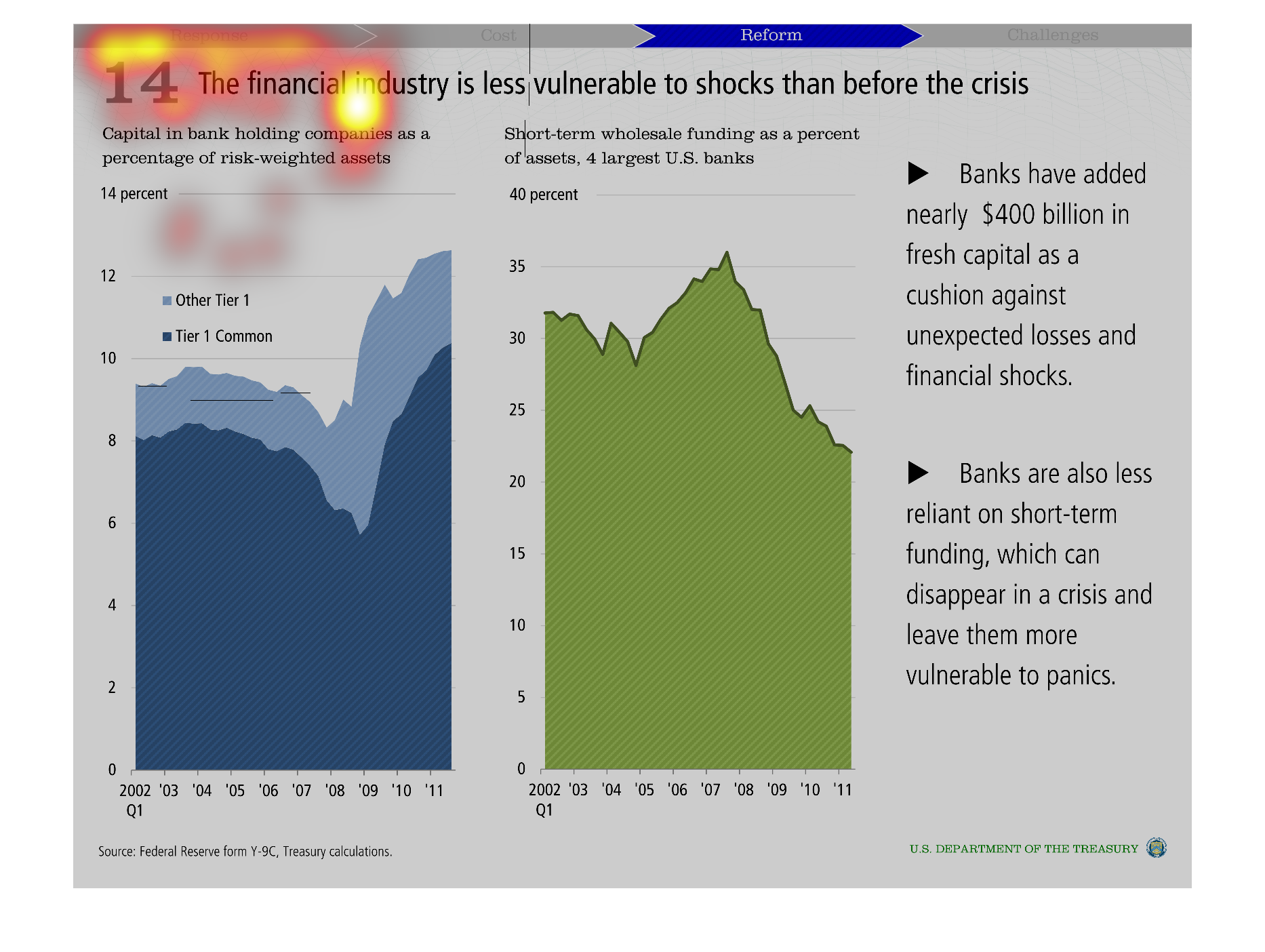

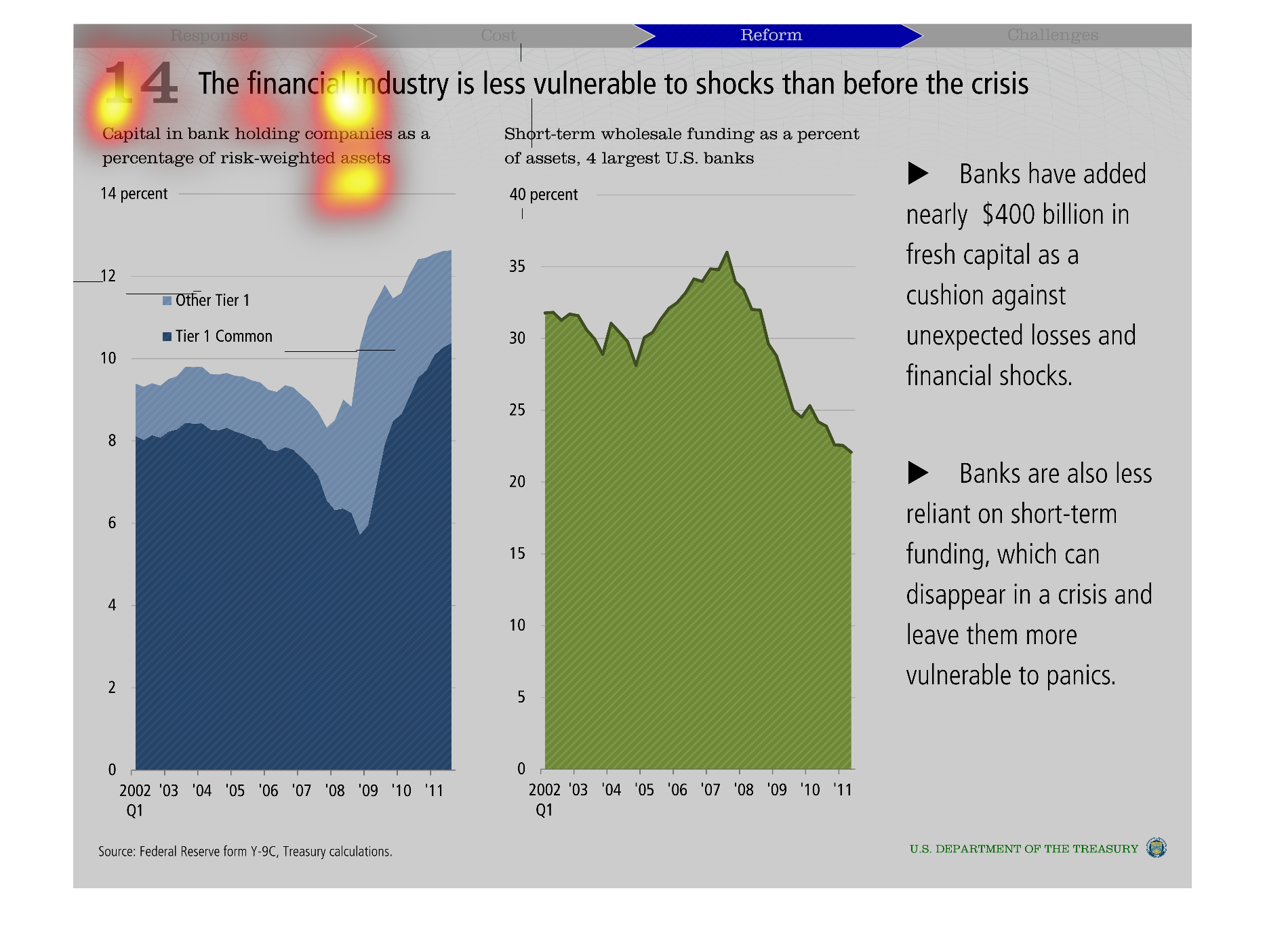

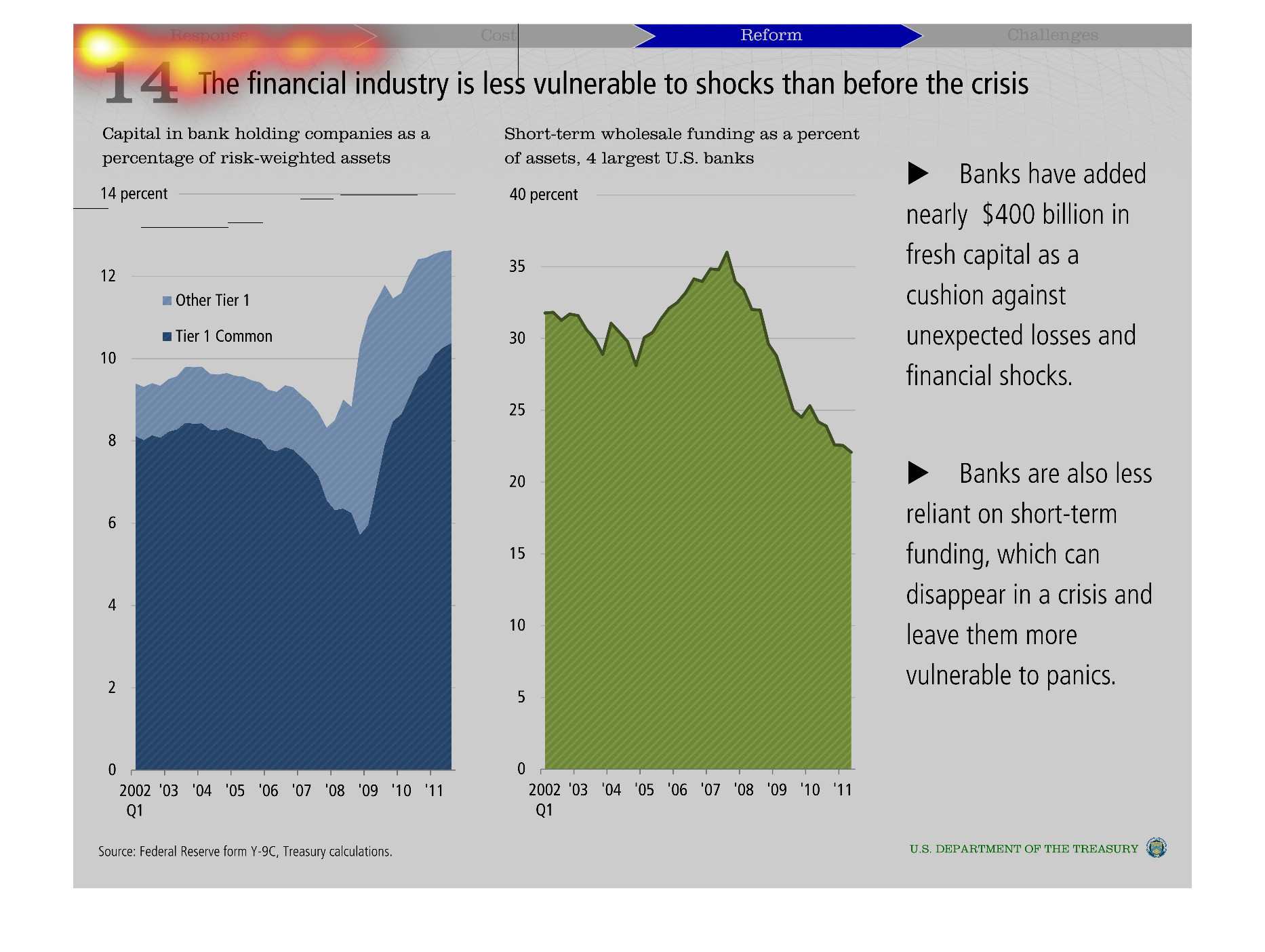

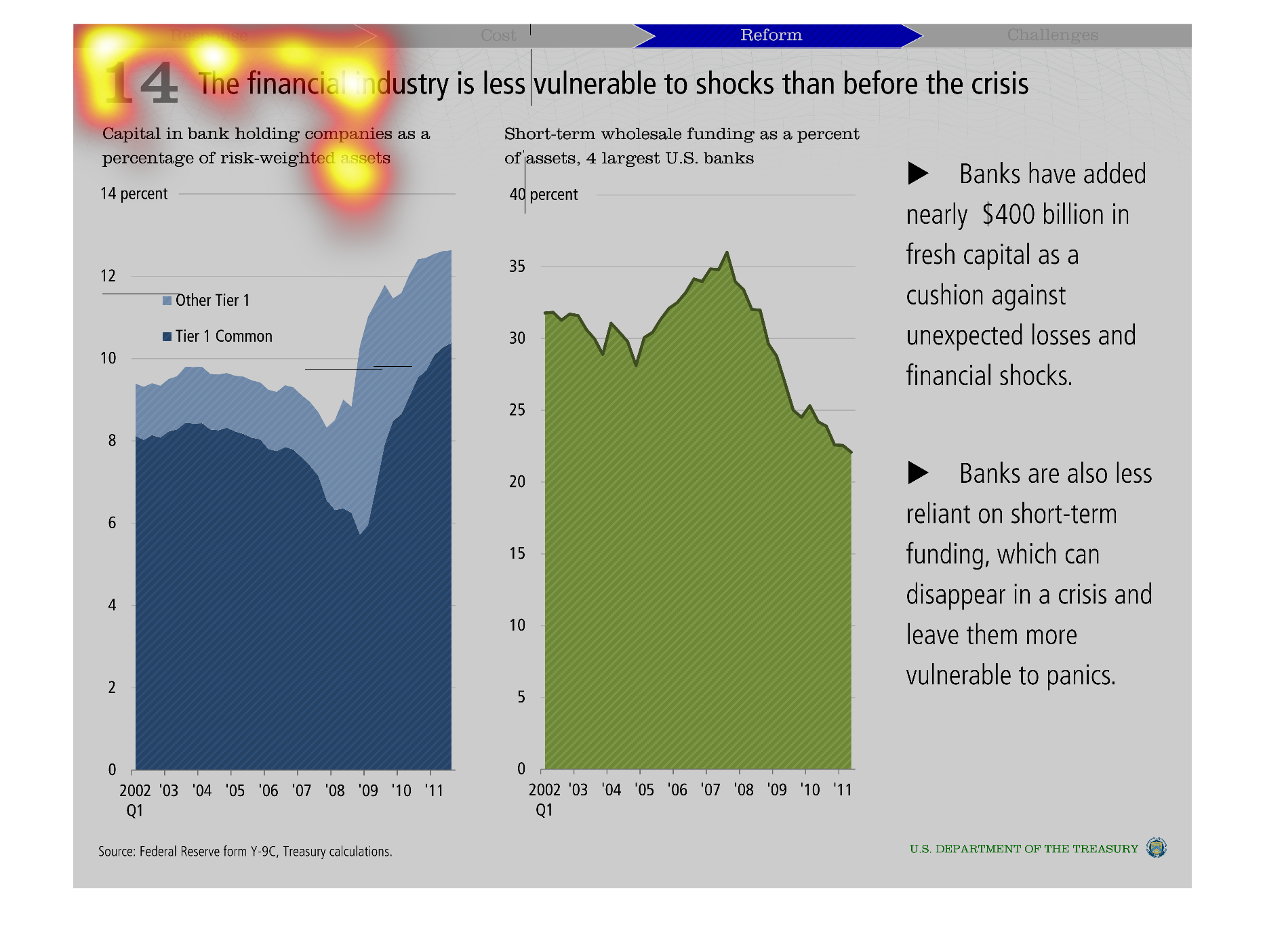

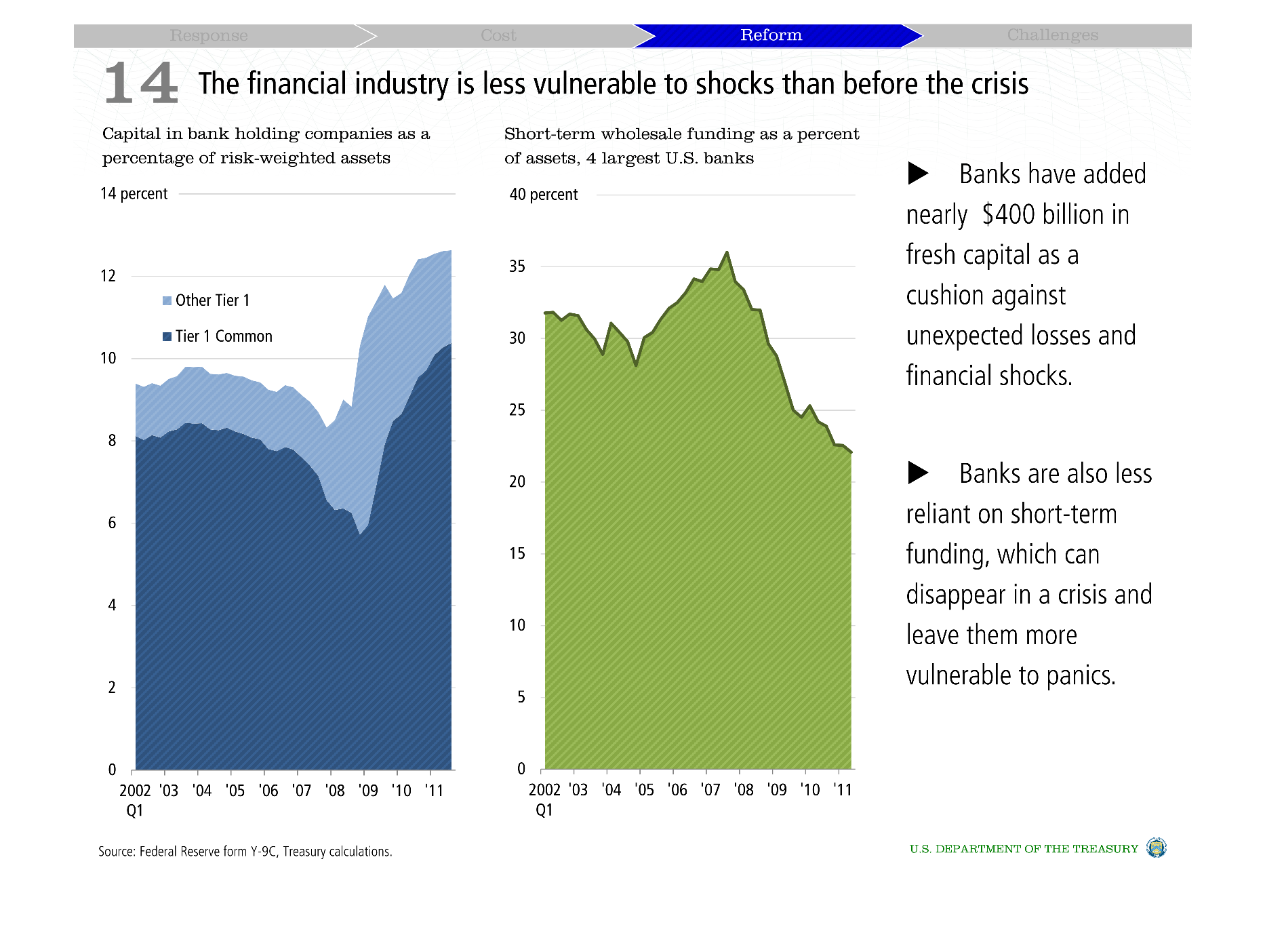

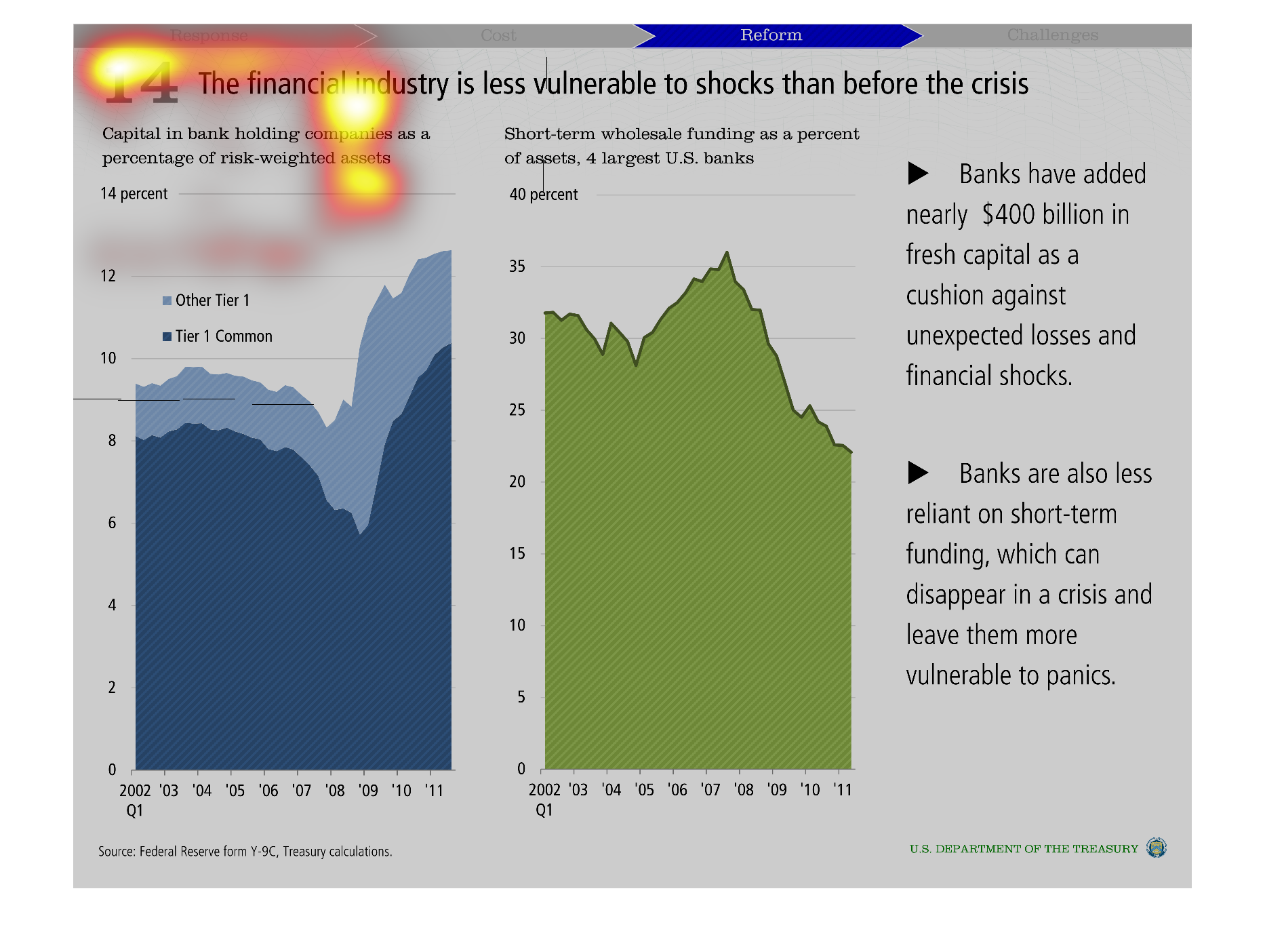

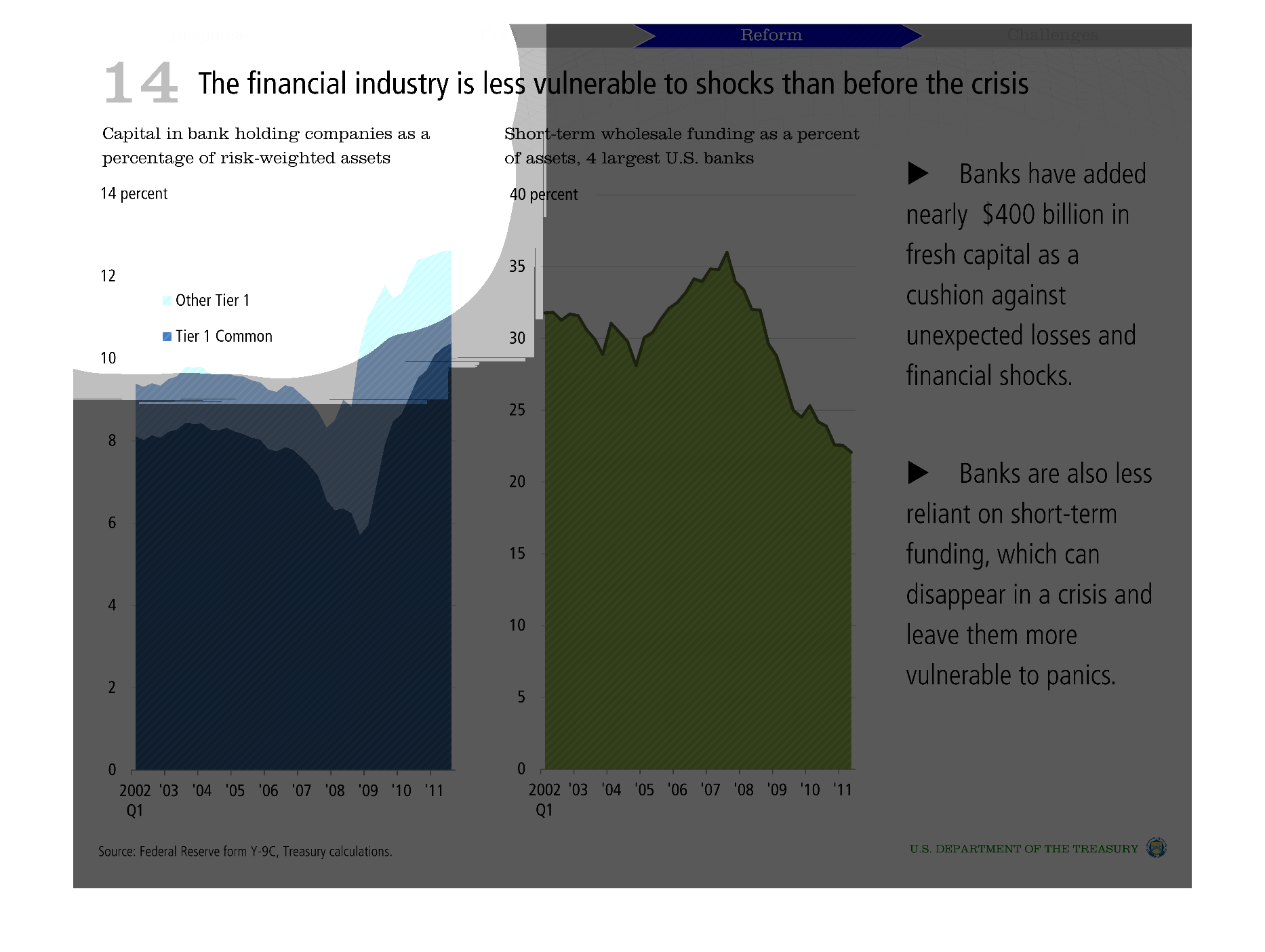

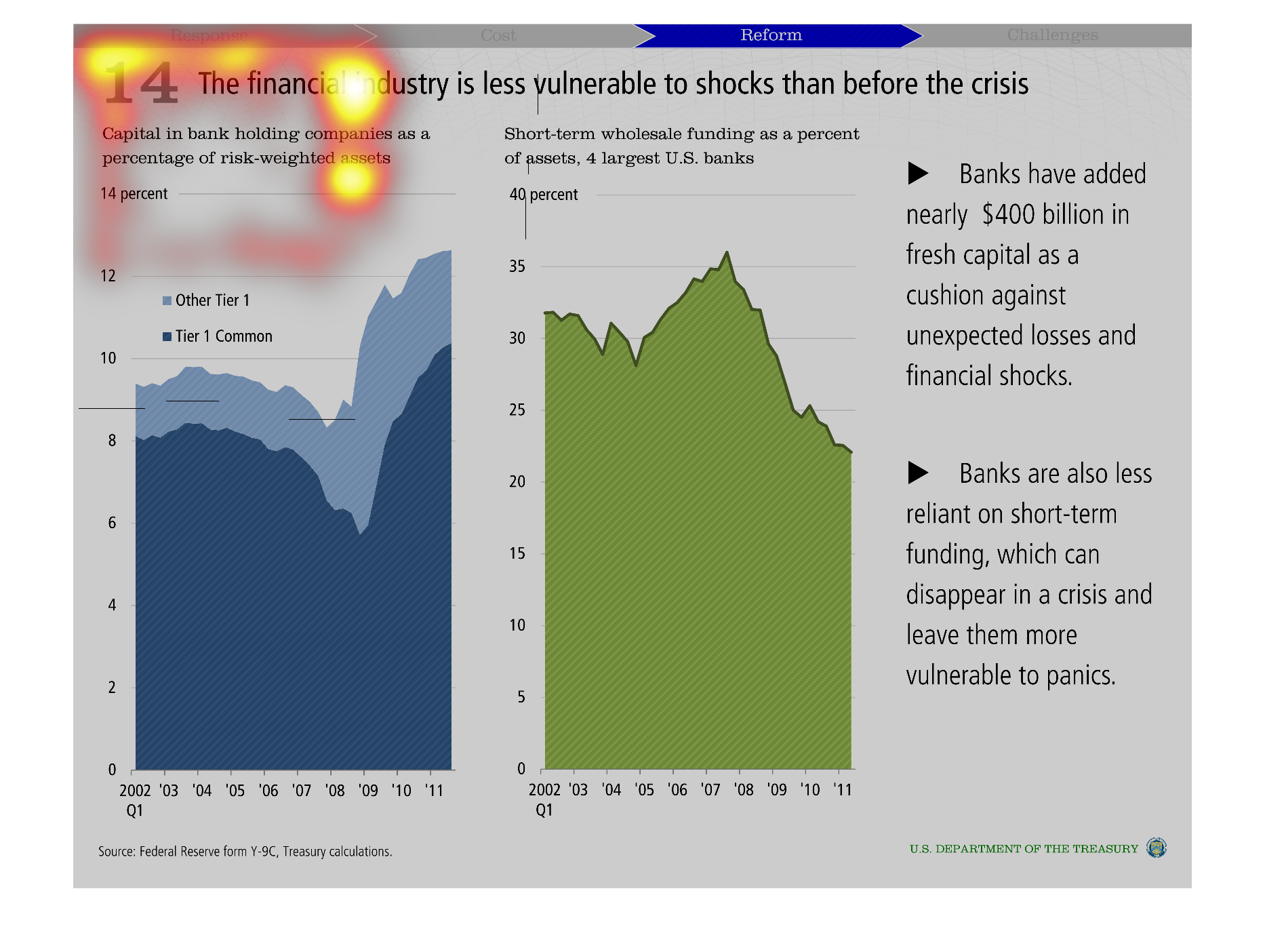

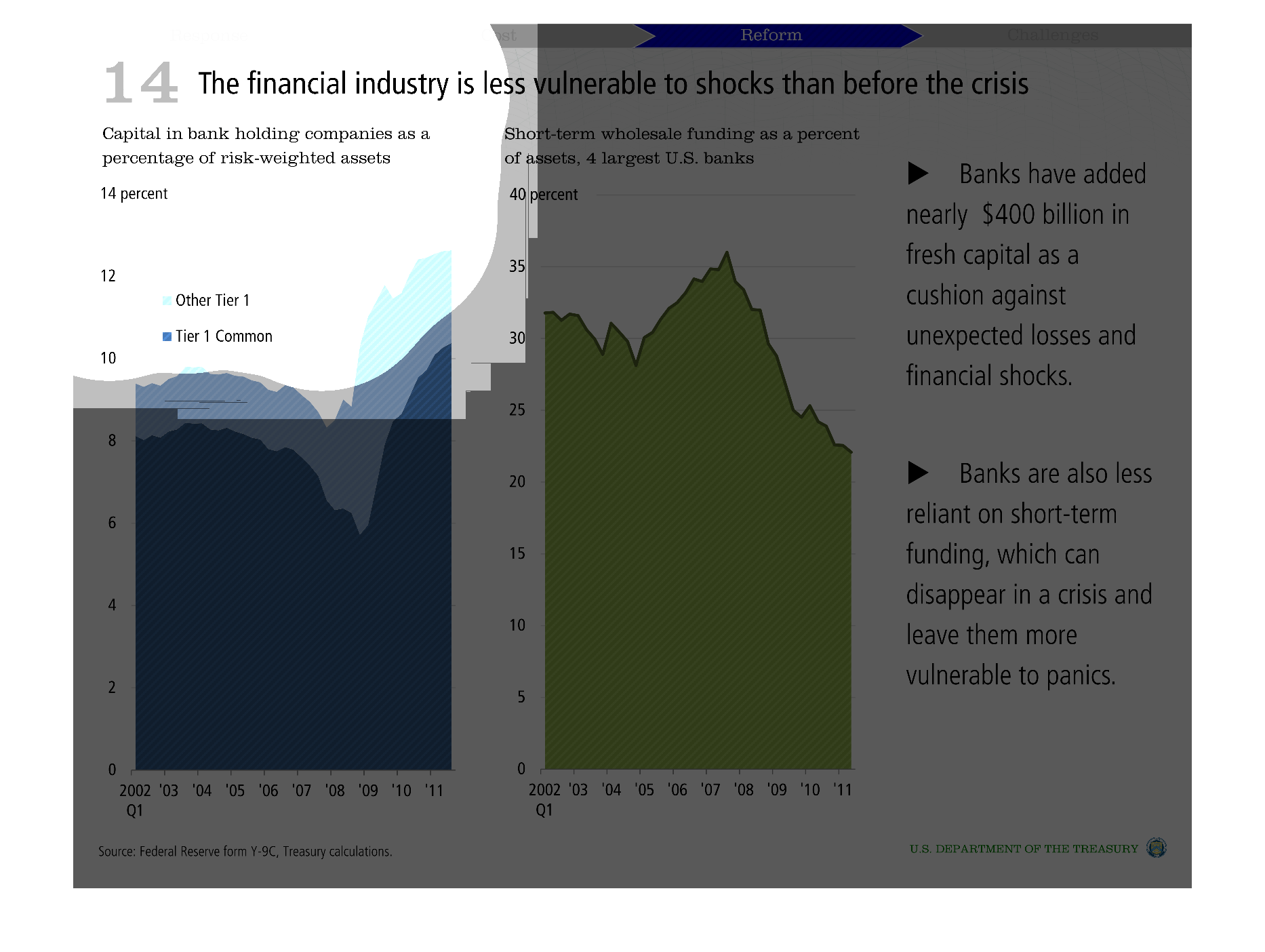

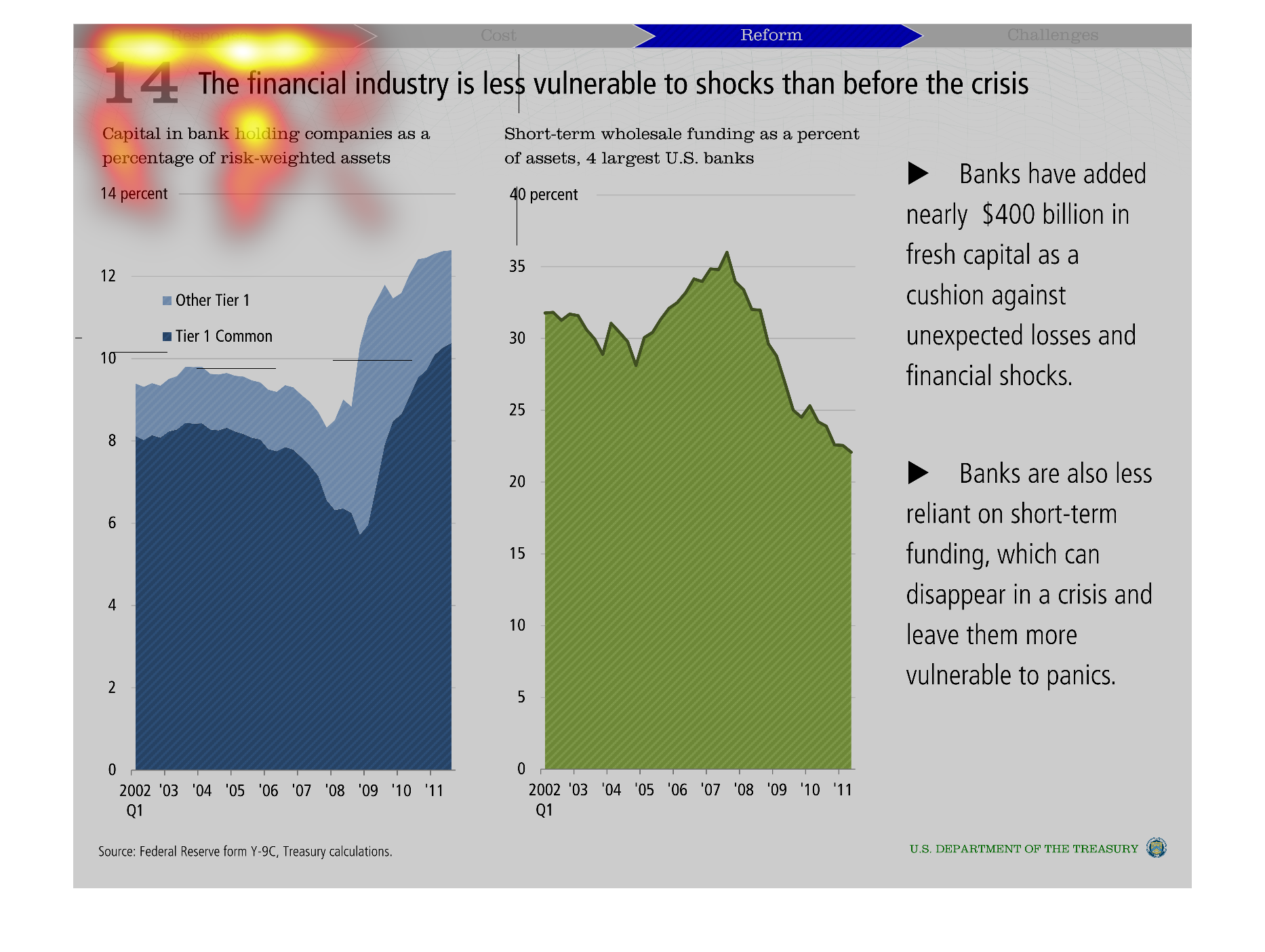

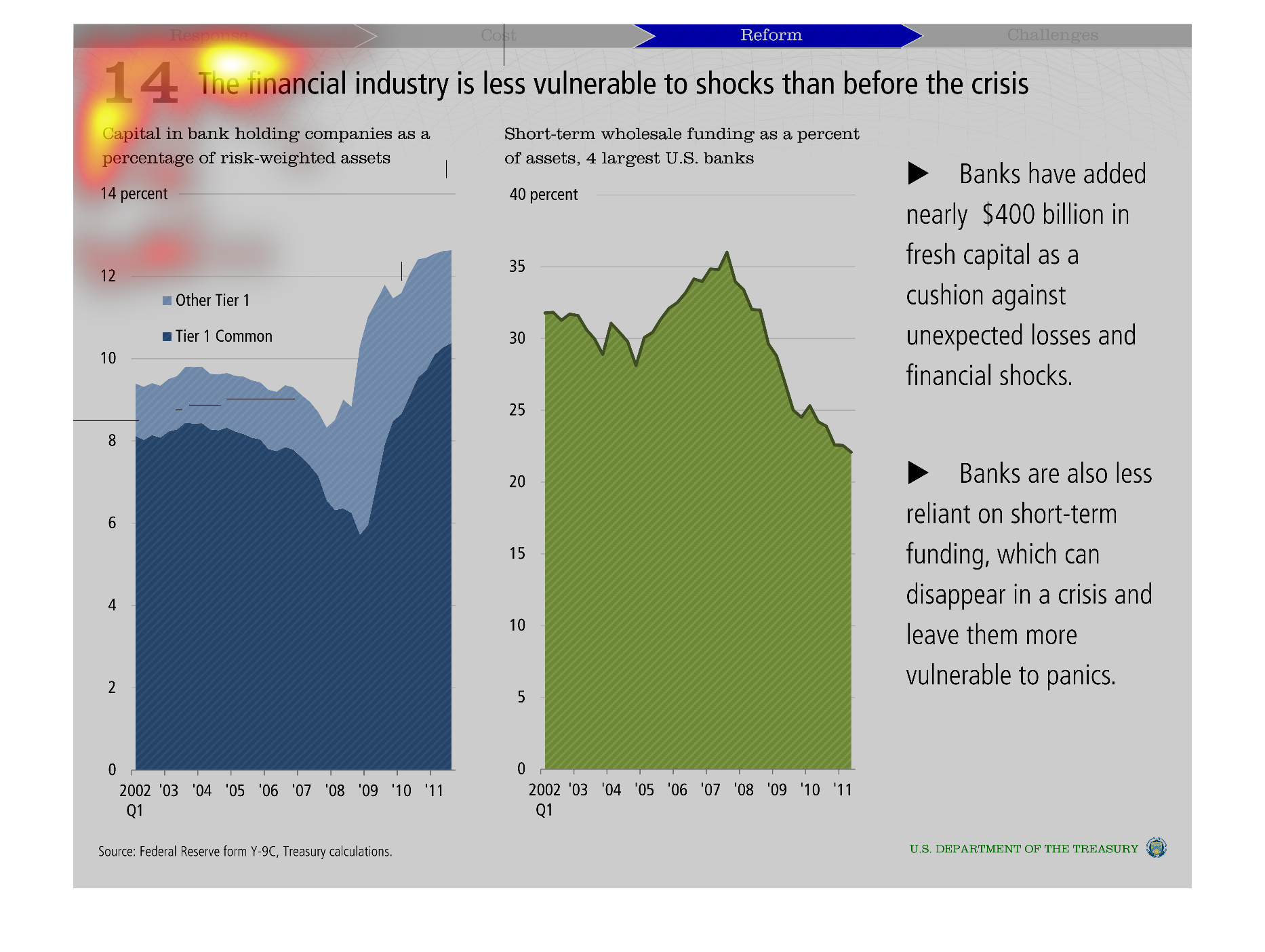

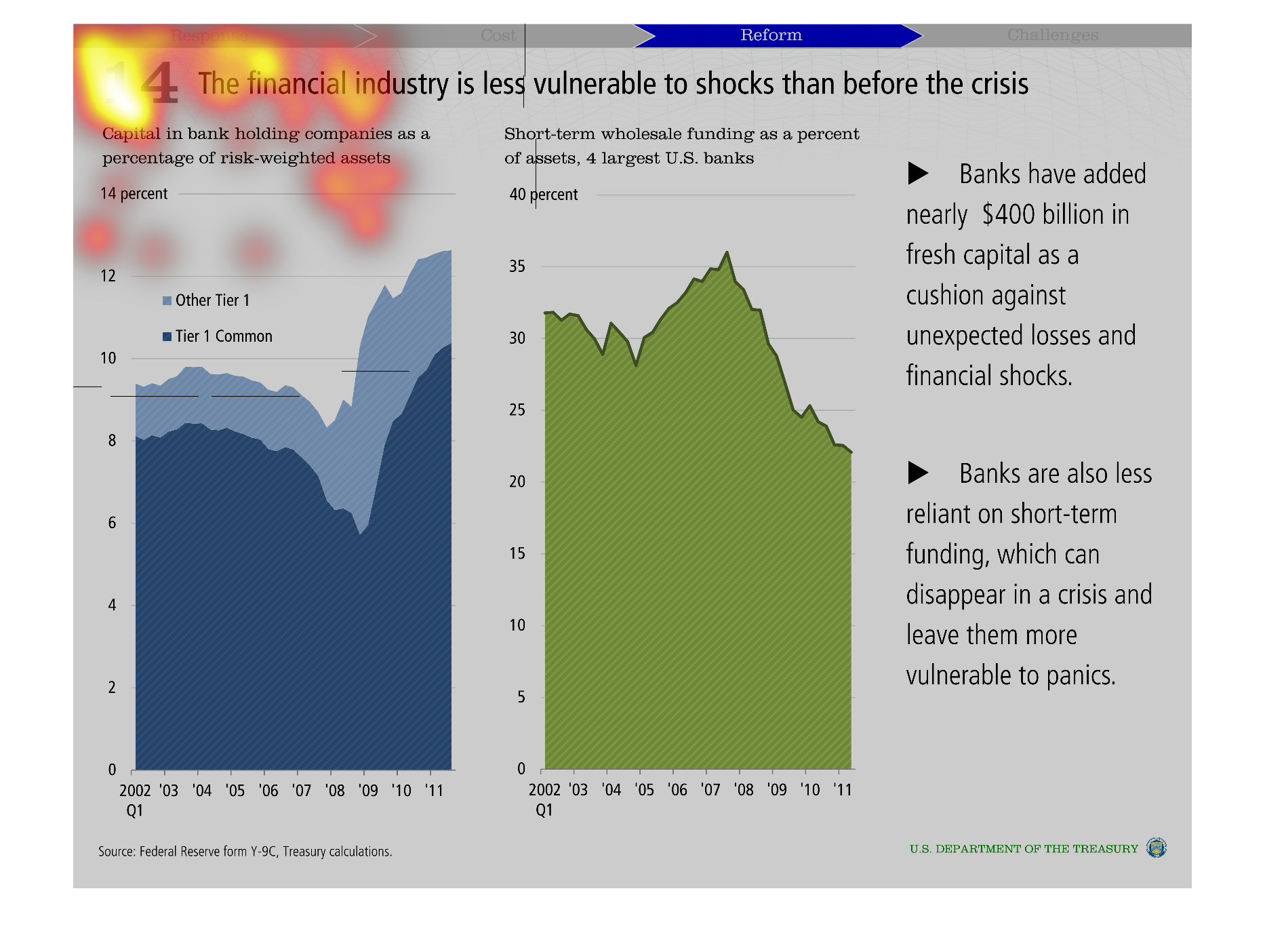

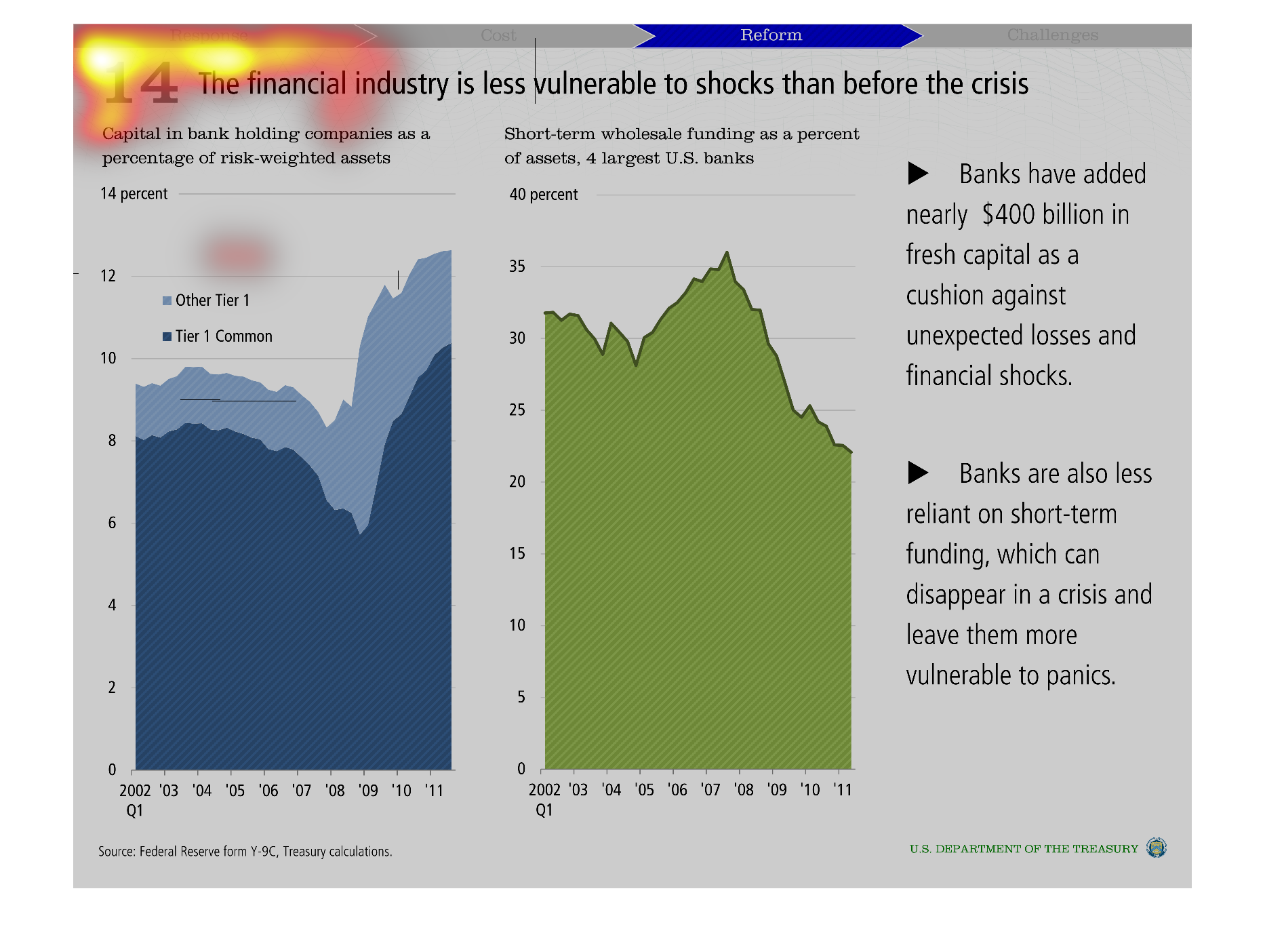

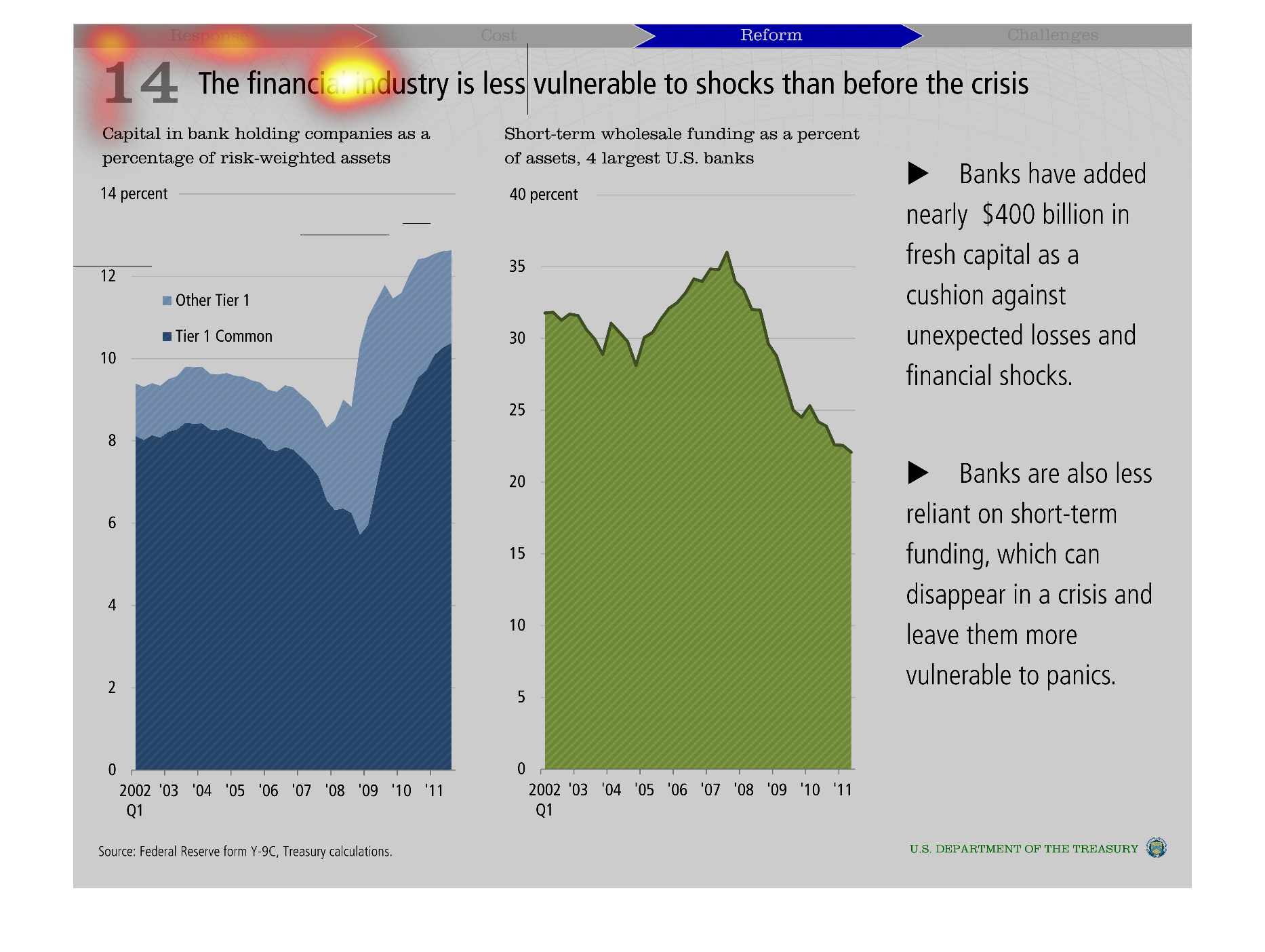

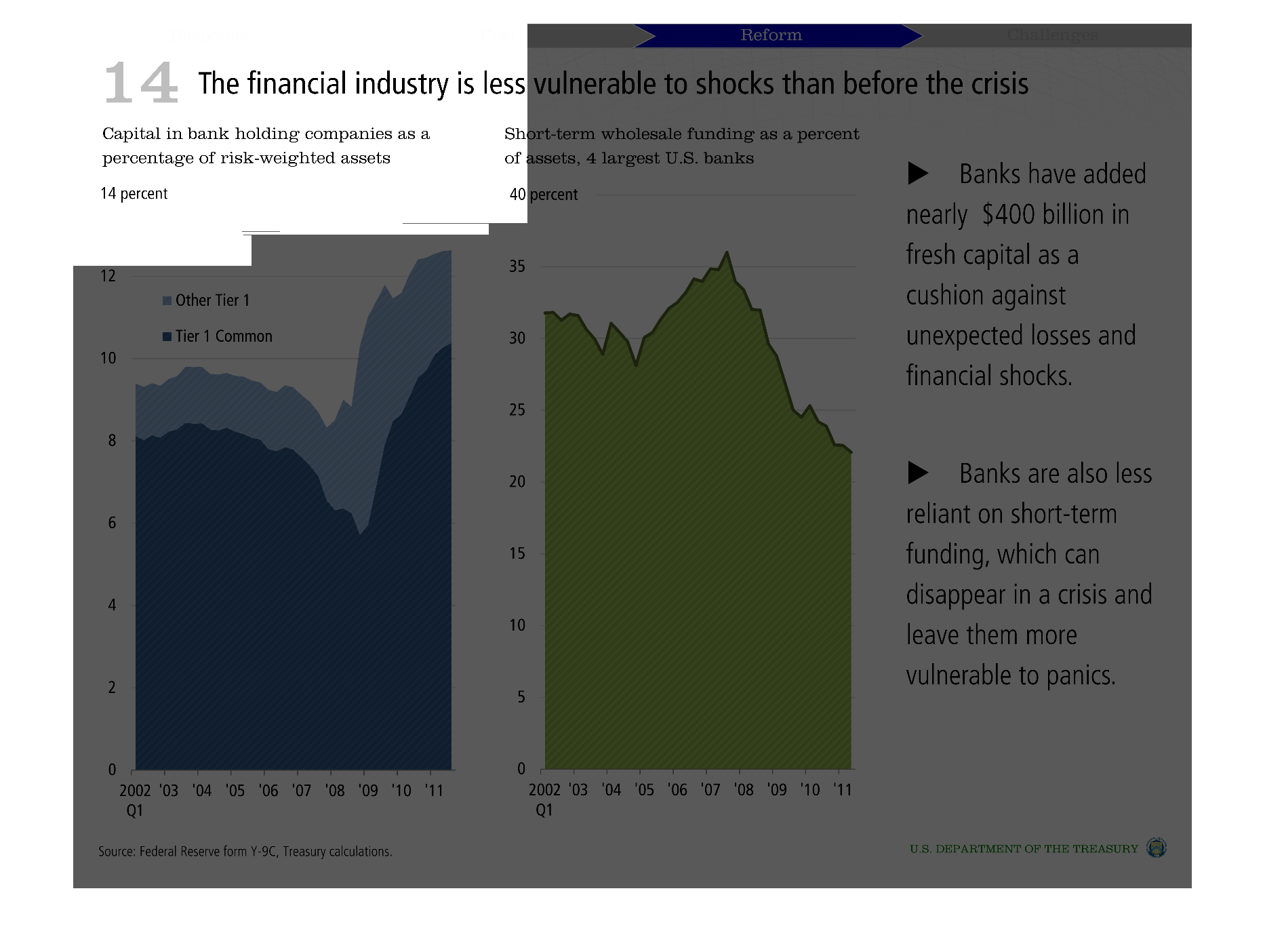

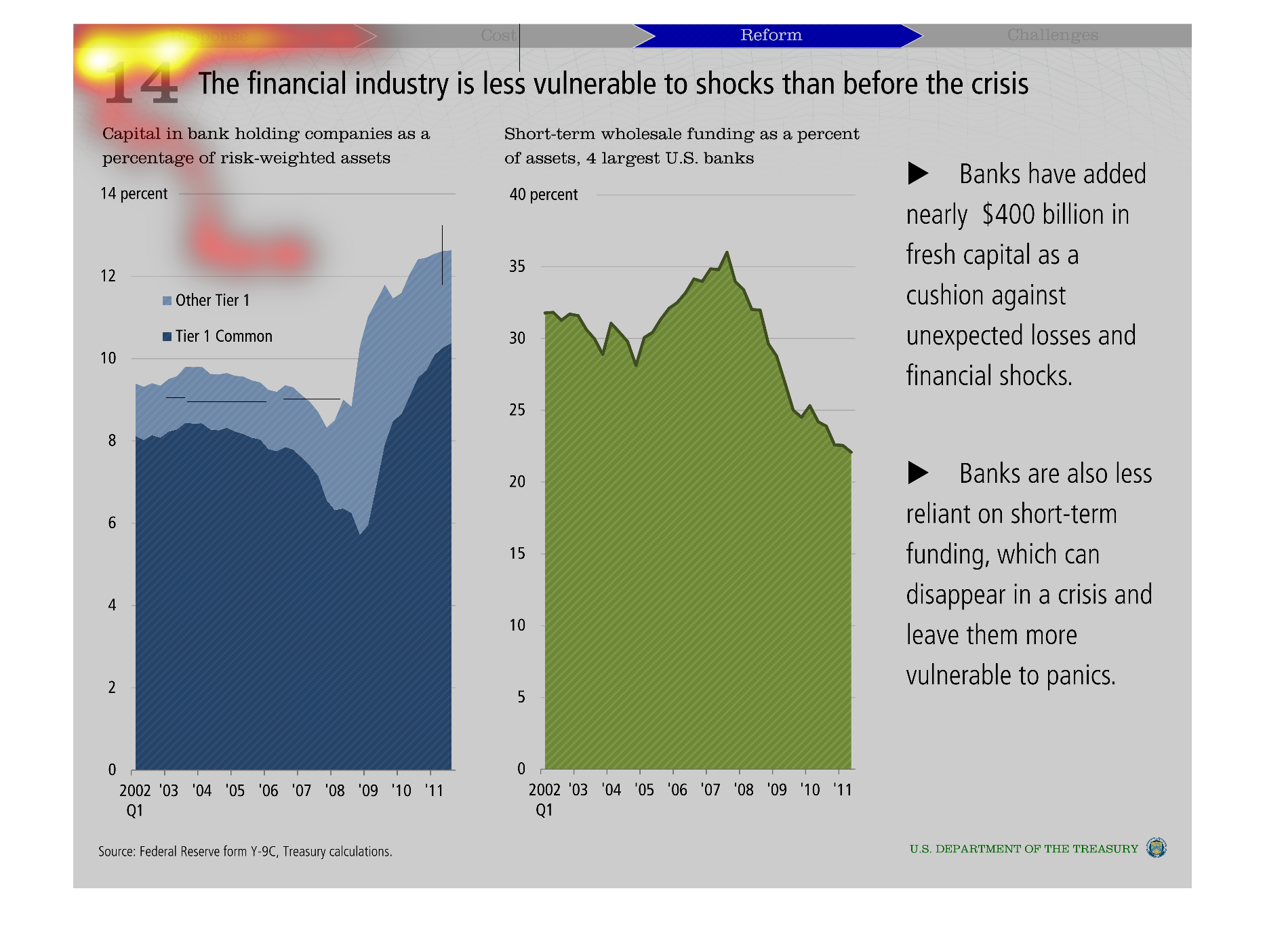

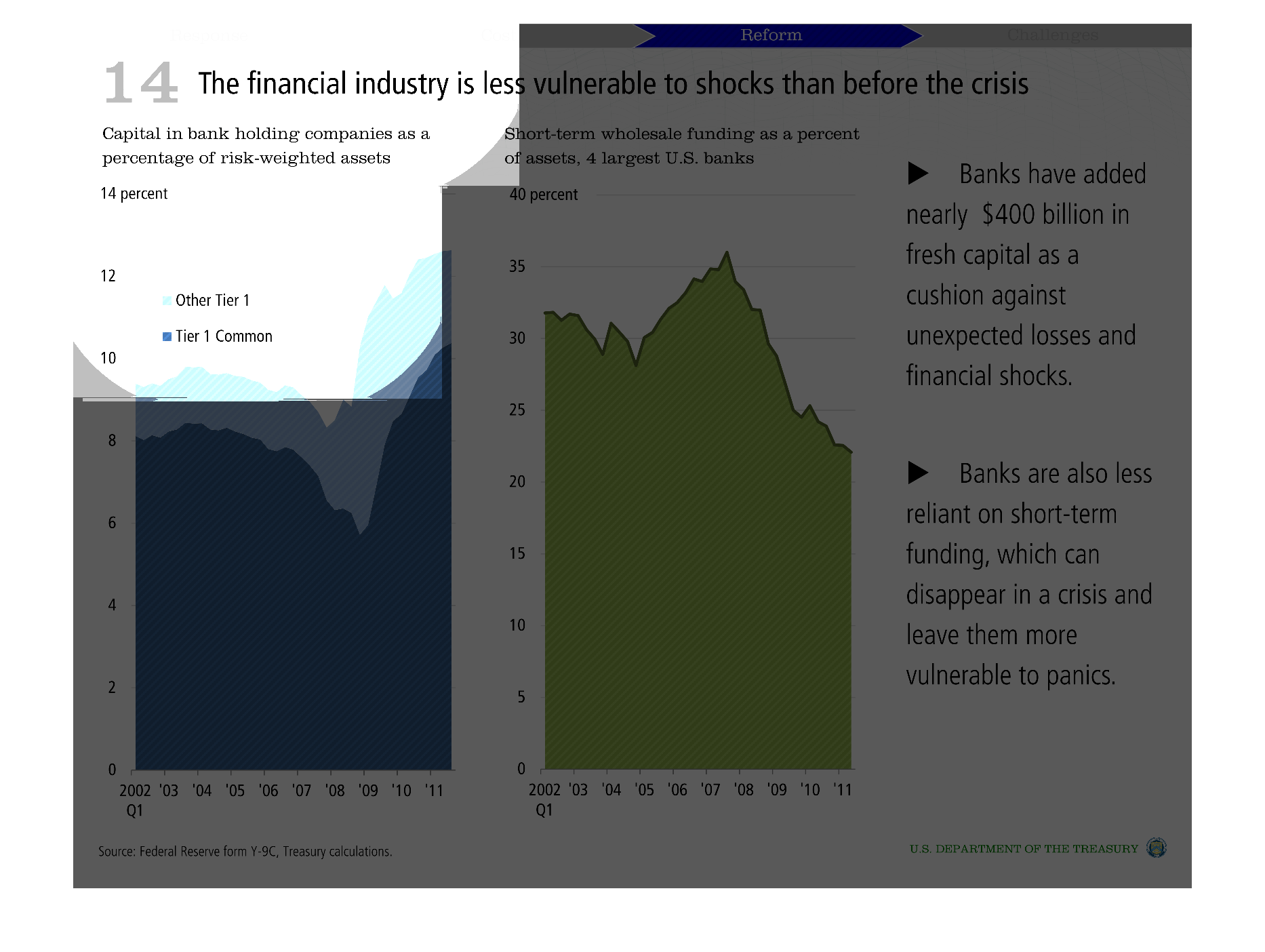

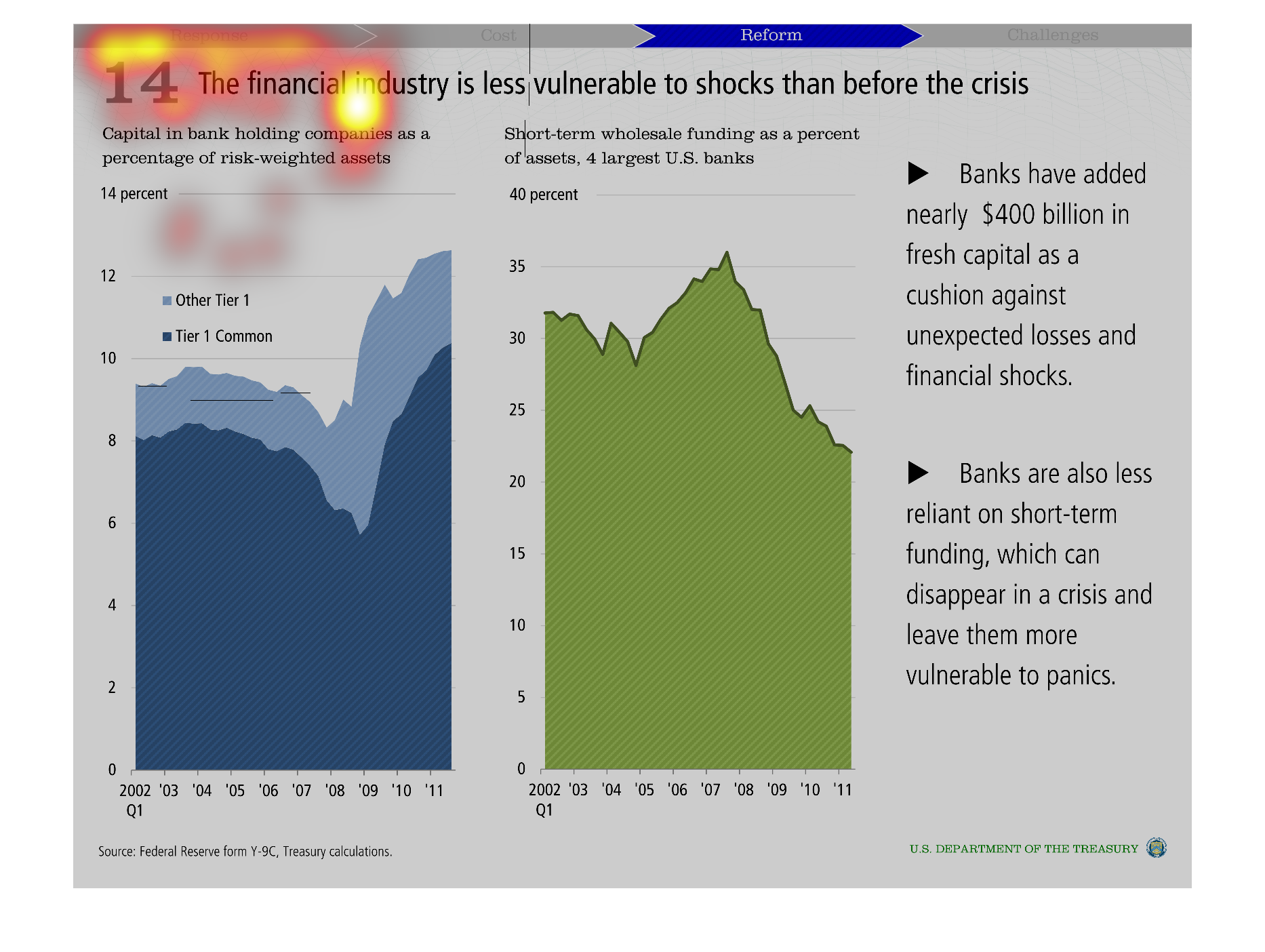

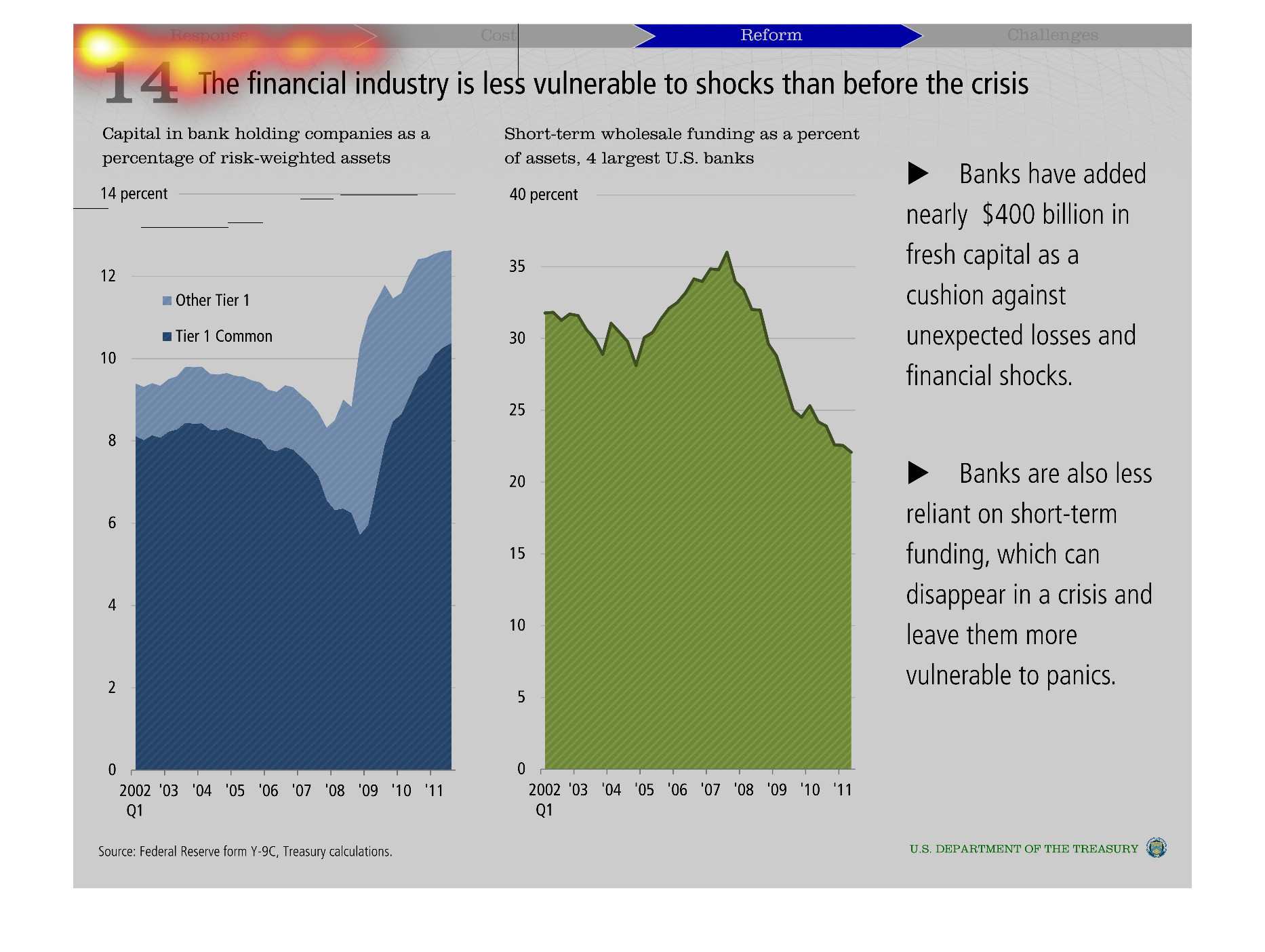

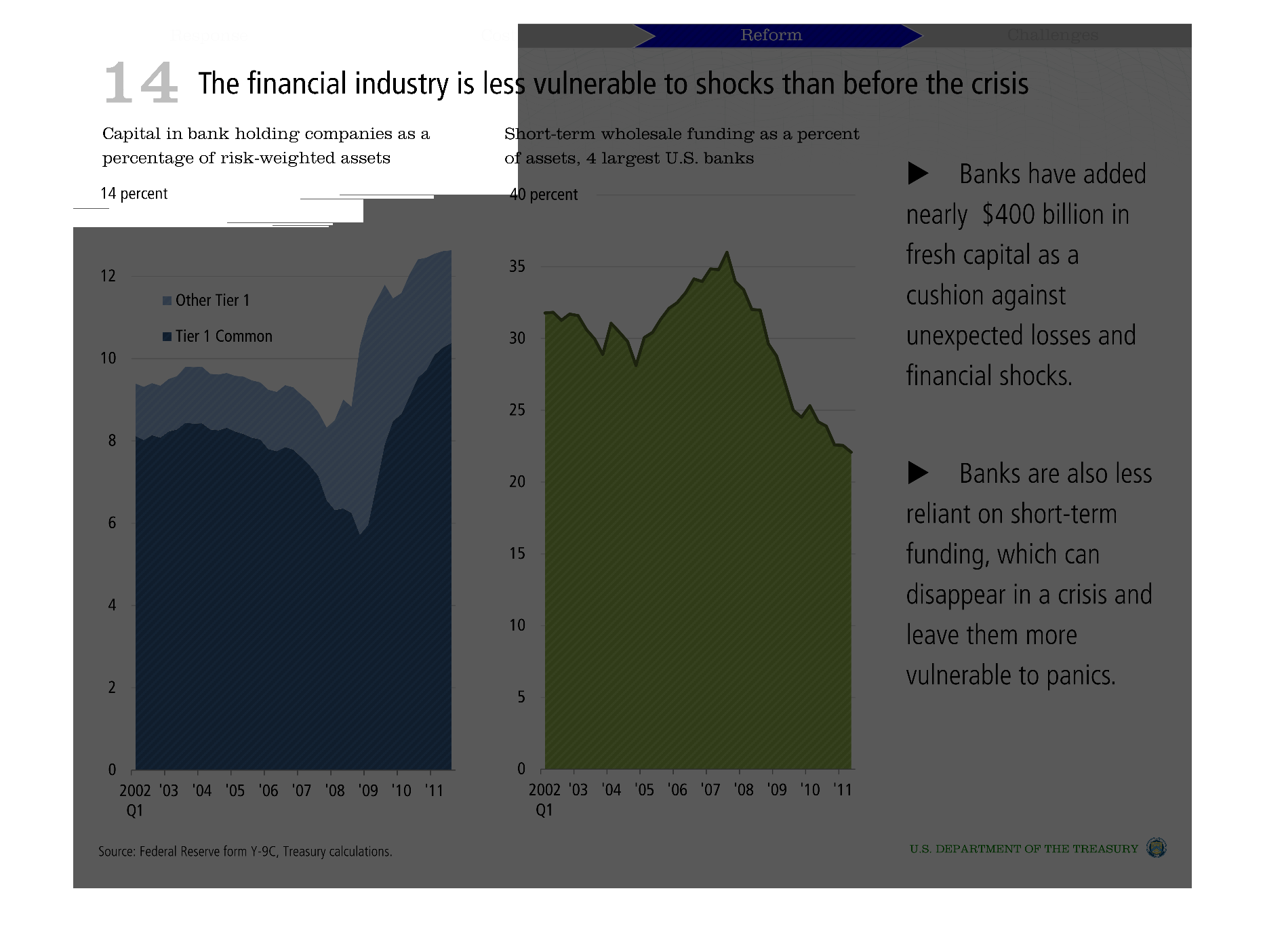

The data in graph suggests that the finical industry may be less vulnerable to shocks post-crisis',

by comparing data from 2002-2011. This stability may be due to banks depending less on ephemeral

funding sources and due to the increase in fresh-capitol added, which can act a cushion during

times of financial crisis.

Warning: Image is too big to fit on screen; displaying at 50%

Warning: Image is too big to fit on screen; displaying at 50%

The charts are about how the financial industry is less susceptible to shocks after the recent

crisis. It explains that banks have added monetary cushions against losses and are less reliant

on short-term funding.

Warning: Image is too big to fit on screen; displaying at 50%

Warning: Image is too big to fit on screen; displaying at 50%

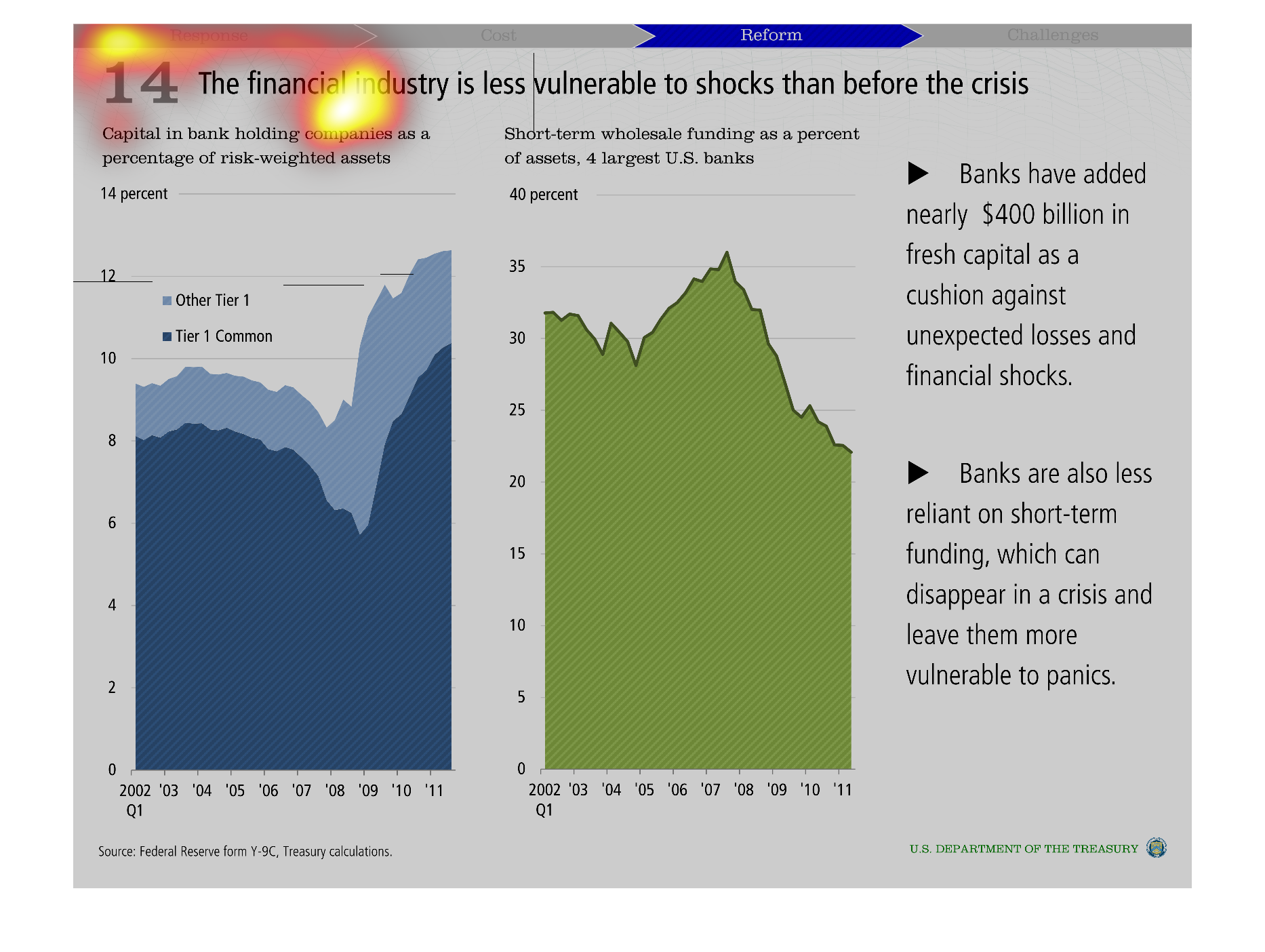

This image shows or depicts in statistical formats the relationship of how the financial industry

is less vulnerable to shocks than before the crisis.

Warning: Image is too big to fit on screen; displaying at 50%

Warning: Image is too big to fit on screen; displaying at 50%

This graphic shows the financial industry is less vulnerable to shocks than before the crisis,

explaining that banks have billions of dollars in cushion to against unexpected losses.

Warning: Image is too big to fit on screen; displaying at 50%

Warning: Image is too big to fit on screen; displaying at 50%

There are two graphs that depict how banks in the US are more able to withstand a turbulent

economy than they were previously. Tier 1 capital ratios were approximately 8% until they

reached a low with the financial crisis in 2008, and are now at new highs. Short-term wholesale

funding is also down as a percentage of total deposits and total assets. There is a better

reliance on core deposits now.

Warning: Image is too big to fit on screen; displaying at 50%

Warning: Image is too big to fit on screen; displaying at 50%

This chart shows how capital influences banks an d the economy. It shows how the bailout influenced

the bank . It appears that the banks tend to do better with more capital

Warning: Image is too big to fit on screen; displaying at 50%

Warning: Image is too big to fit on screen; displaying at 50%

the finiancial industry is less vulnerable than before the crisis Banks have added 400 mil

in capital banks less reliant on short term funding graphs showing supporting data

Warning: Image is too big to fit on screen; displaying at 50%

Warning: Image is too big to fit on screen; displaying at 50%

Given changes in capital structure the chart postulates that the financial industry is less

vulnerable to shocks than before the financial crisis in the mid 2000s. Two different charts

are shown - one for Tier 1 capital, the other for short term funding. The bullets on the

side further support the charts with detail.

Warning: Image is too big to fit on screen; displaying at 50%

Warning: Image is too big to fit on screen; displaying at 50%

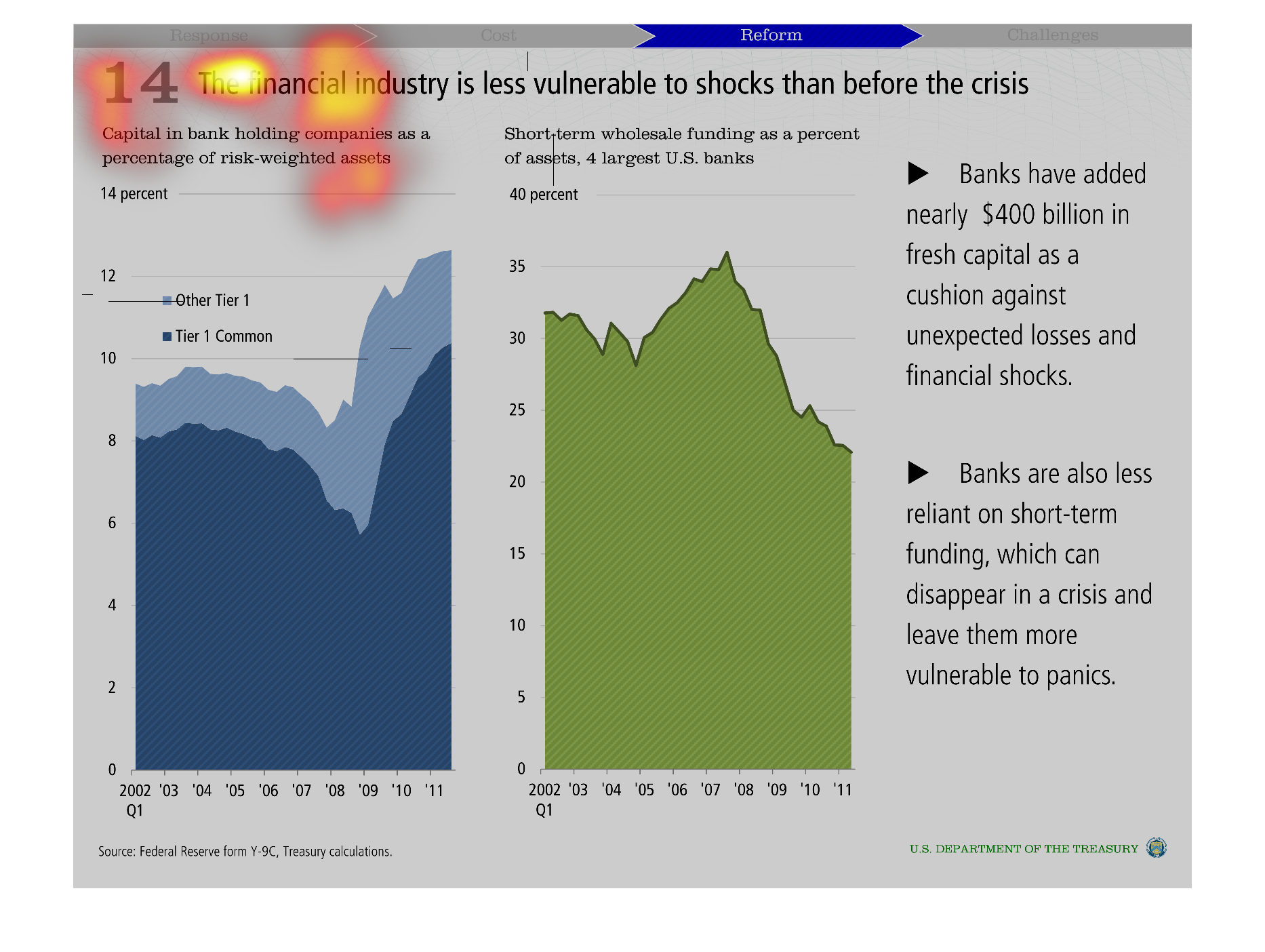

This chart describes the financial industry is less vulnerable to shocks than before the crisis.

The chart states that banks have added nearly $400 billion in fresh capital.

Warning: Image is too big to fit on screen; displaying at 50%

Warning: Image is too big to fit on screen; displaying at 50%

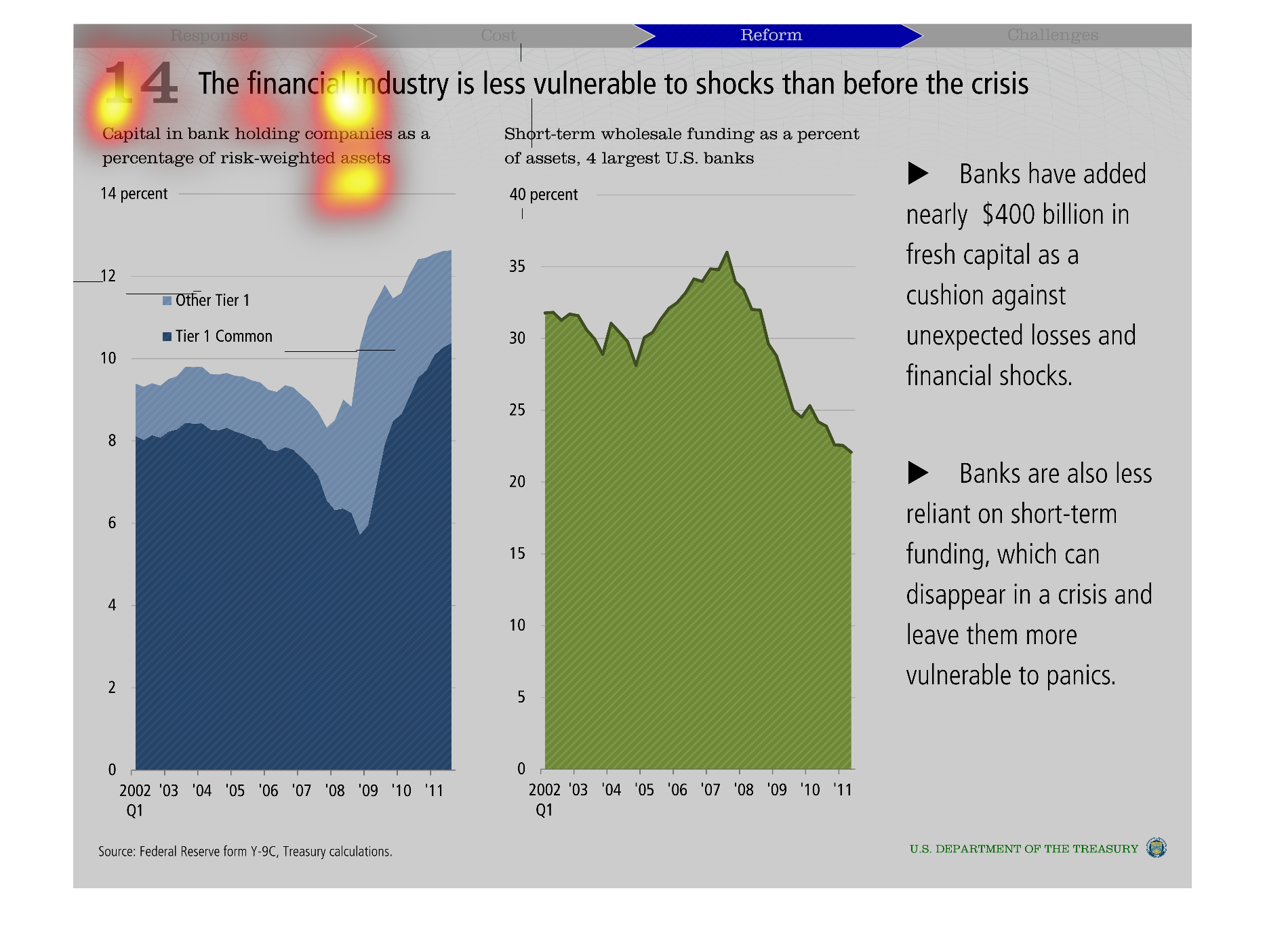

This graph is intended to show the shock absorption capability of banks, both before and after

the financial crisis. The author's determination is that this capability was better before

the crisis.

Warning: Image is too big to fit on screen; displaying at 50%

Warning: Image is too big to fit on screen; displaying at 50%

This chart shows the "Financial industry is less vulnerable to shock than before the crisis".

It states banks now have a cushion of $400 billion against shock.

Warning: Image is too big to fit on screen; displaying at 50%

Warning: Image is too big to fit on screen; displaying at 50%

Banks are using more long term capital to protect against financial issues, instead of relying

on short term capital. The banking industry is now more prepared for financial issues than

it was previously because it changed it's funding arrangement.

Warning: Image is too big to fit on screen; displaying at 50%

Warning: Image is too big to fit on screen; displaying at 50%

The graph is trying to illustrate that after the world economic crisis hit, a lot of business

had to make adjustment to their day to day operations that now safeguard them from a future

collapse.

Warning: Image is too big to fit on screen; displaying at 50%

Warning: Image is too big to fit on screen; displaying at 50%

This chart displays the Financial Industry's stability - different tiered banks. Fresh capital

added was marked at $400. Banks are more vulnerable now than before the recent crisis in

2008.

Warning: Image is too big to fit on screen; displaying at 50%

Warning: Image is too big to fit on screen; displaying at 50%