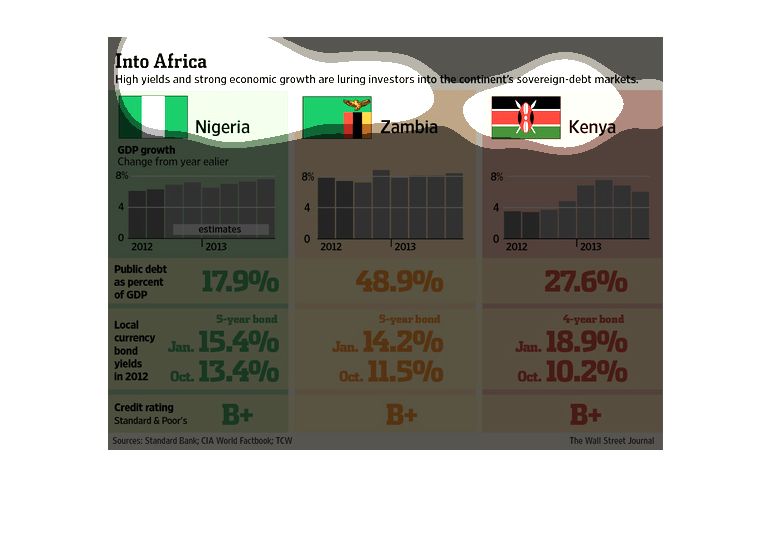

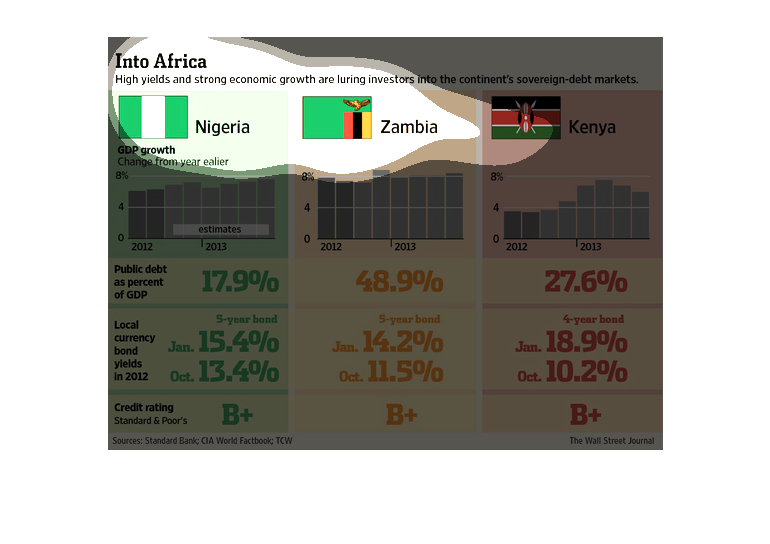

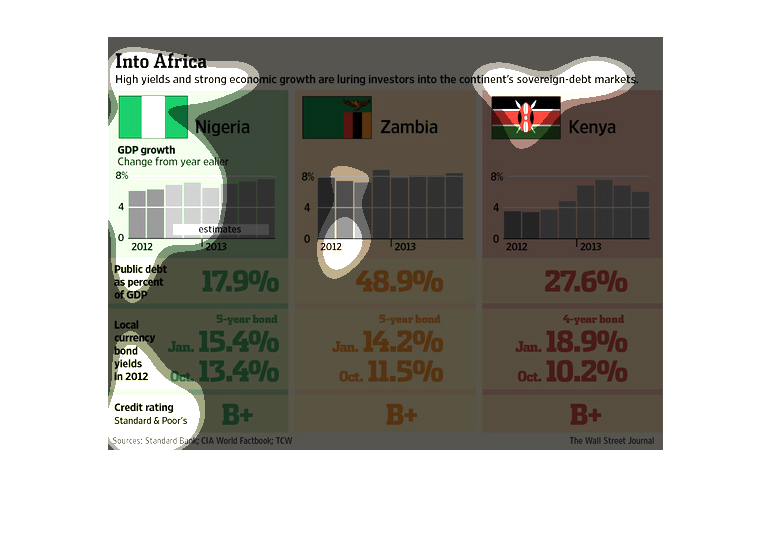

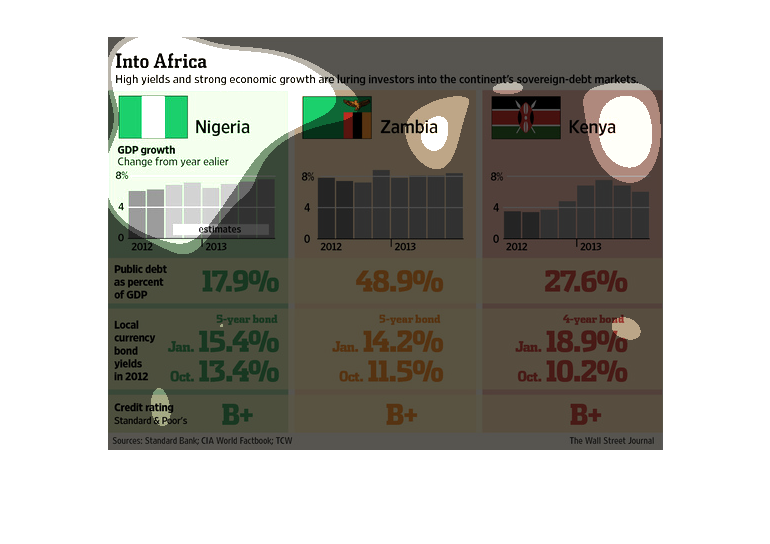

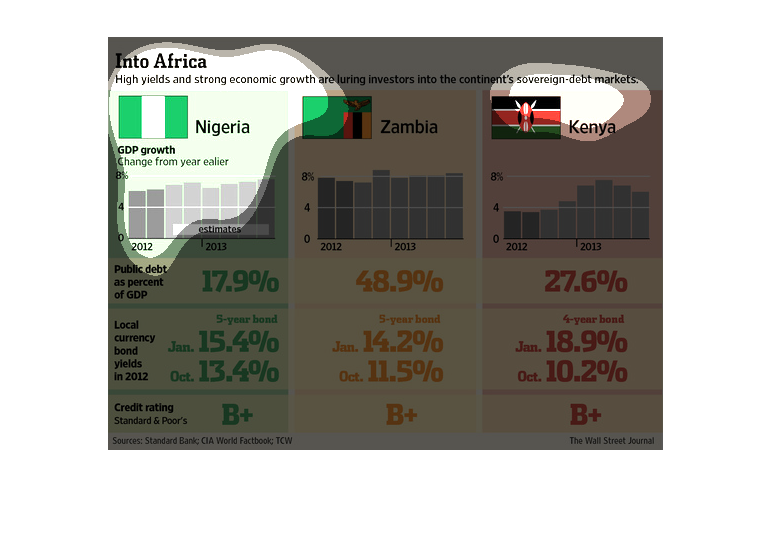

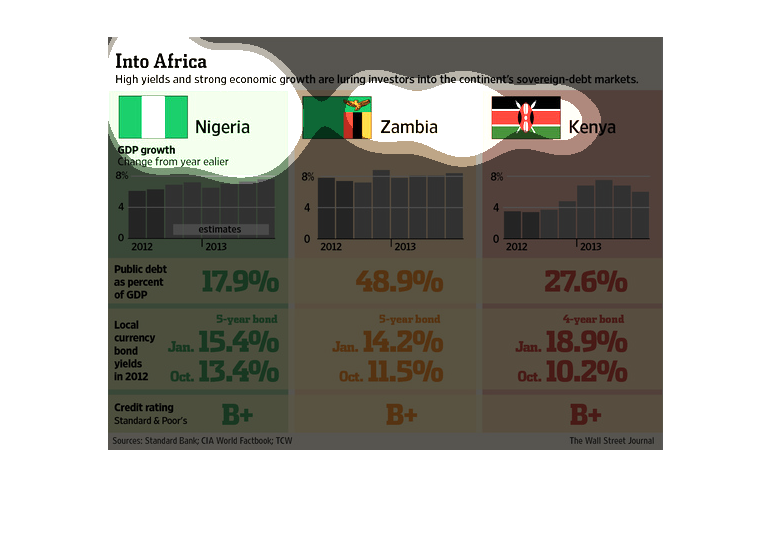

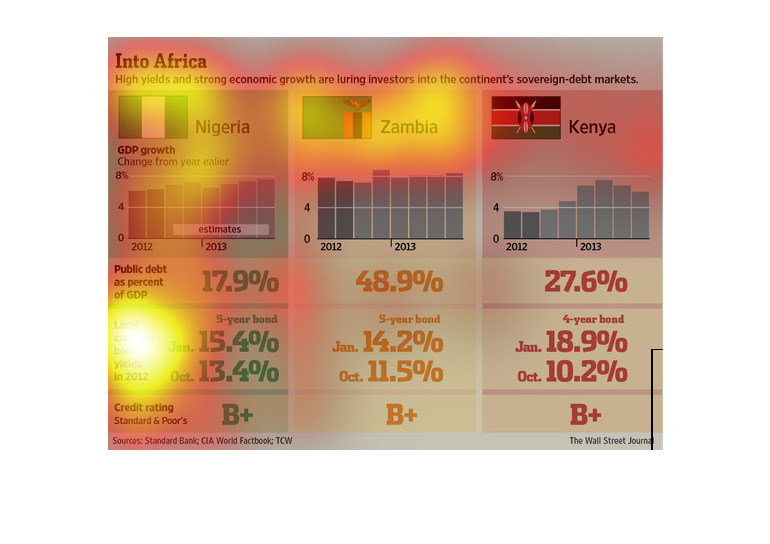

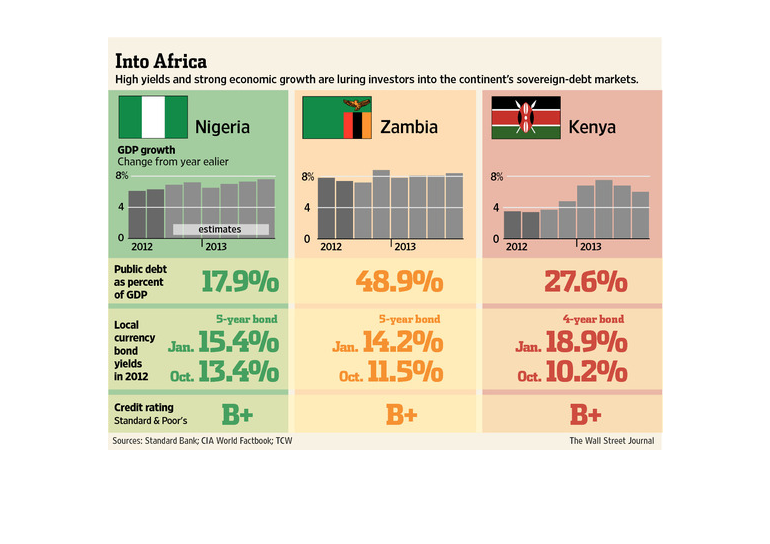

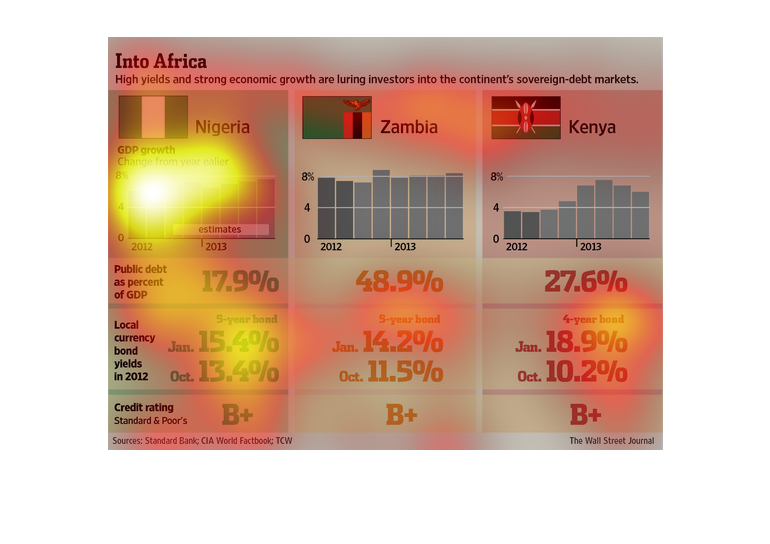

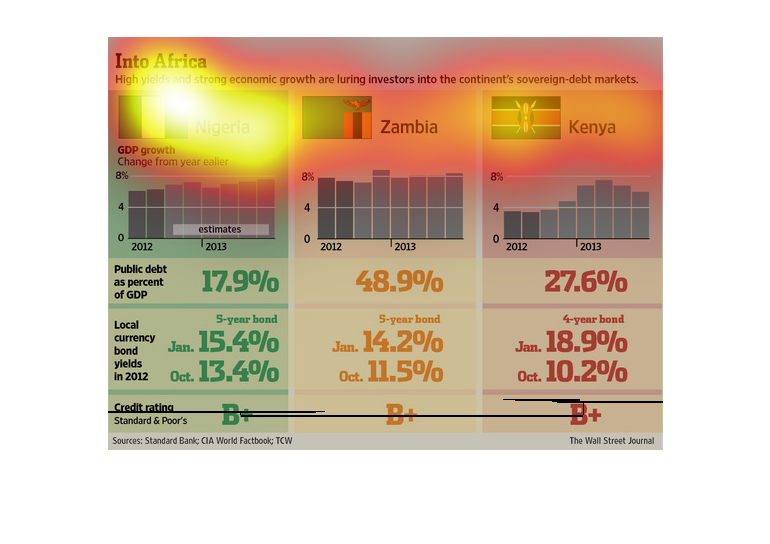

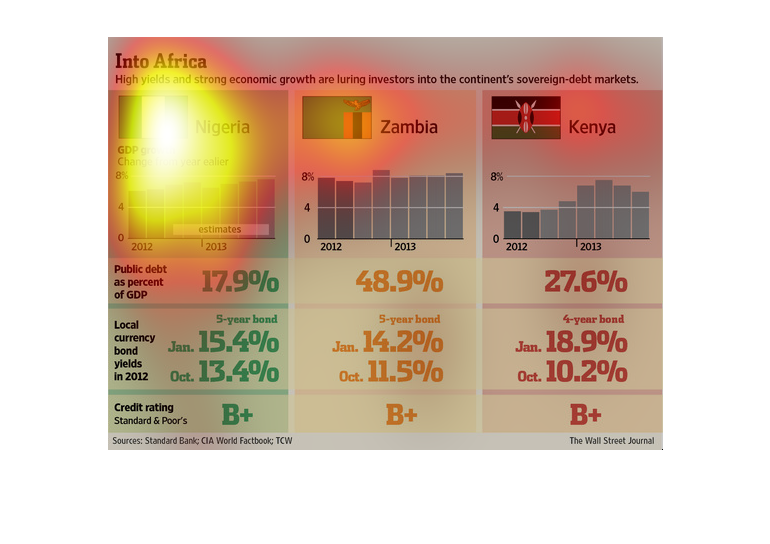

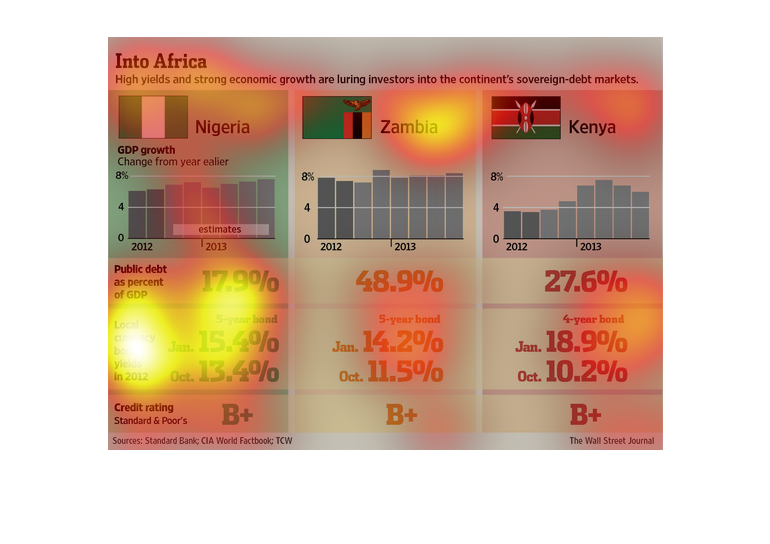

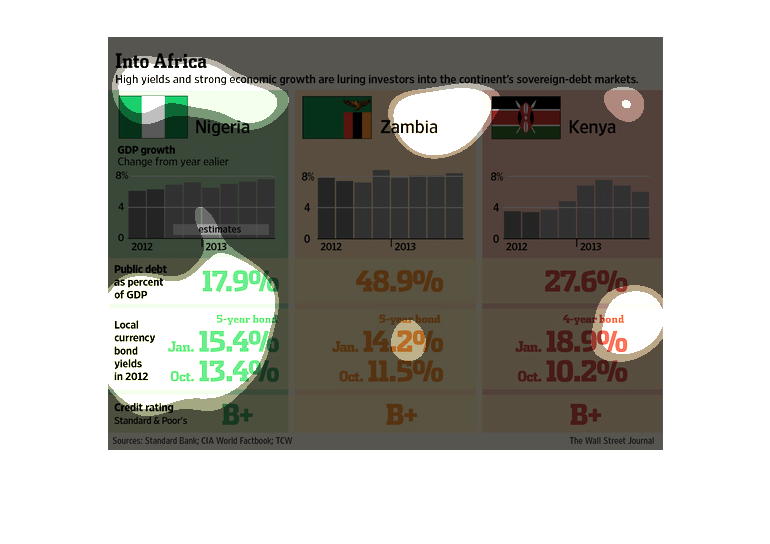

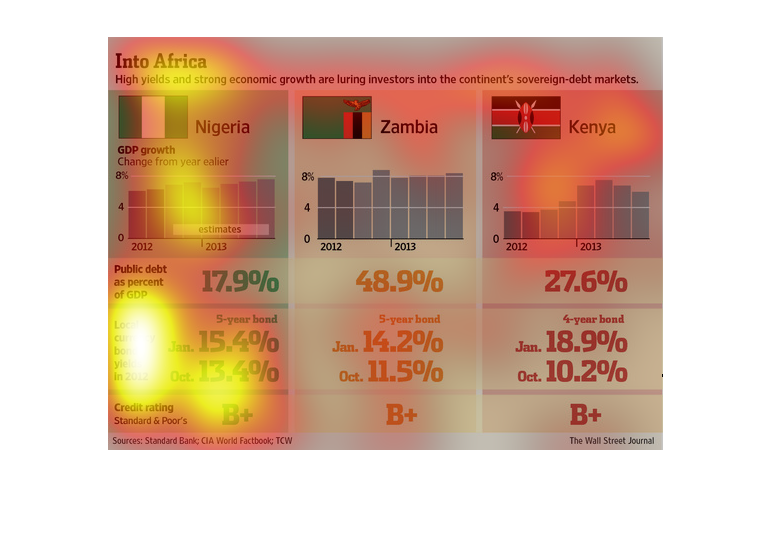

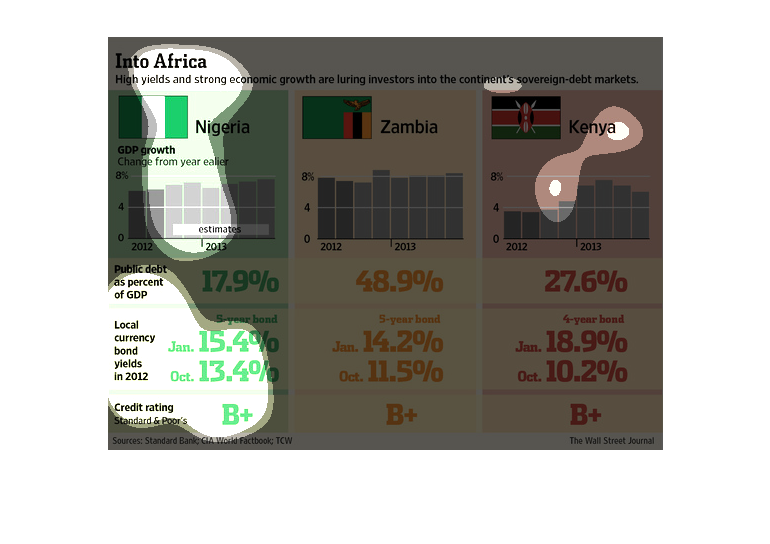

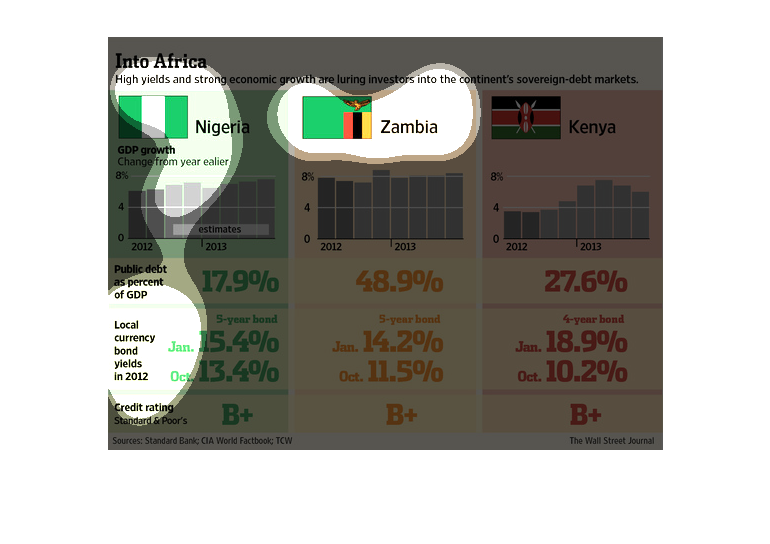

This is a chart that shows how the high yields and very strong economic determinants are actually

luring large amounts of investments into Africa and it shows the key countries concerned.

A comparison of Nigeria, Kenya and Zambia. It indicates that Zambia has the highest percentage

of debt, followed by Kenya and Nigeria respectively. All countries have a B+ credit rating.

This chart describes into Africa. Specifically that high yields and strong economic growth

are luring investors into the continent's sovereign-debt markets.

This chart describes info Africa. Specifically, high yields and strong economic growth are

luring investors into the continent's sovereign debt markets.

This is a chart about investments in Africa. It shows GDP growth, public debt as a percentage

of growth, local currency bond yields from 2012, and credit rating for 3 African nations.

The fact that Africa has so many nations, should probably make these countries cooperate more,

but that is not the case. In this information provided we can safely say there is much strife

in Africa.

into Africa. High yields and strong economic growth are luring investors into the continent's

sovereign debt markets. Three columns/countries are represented, nigeria, zambia, and kenya.

Basically showing promising economic growth with positive predictions of continued growth.

These graphs shows investors into Africa due to high yield and strong economic growth into

the countries sovereign debt market. It shows GDP growth in Nigeria

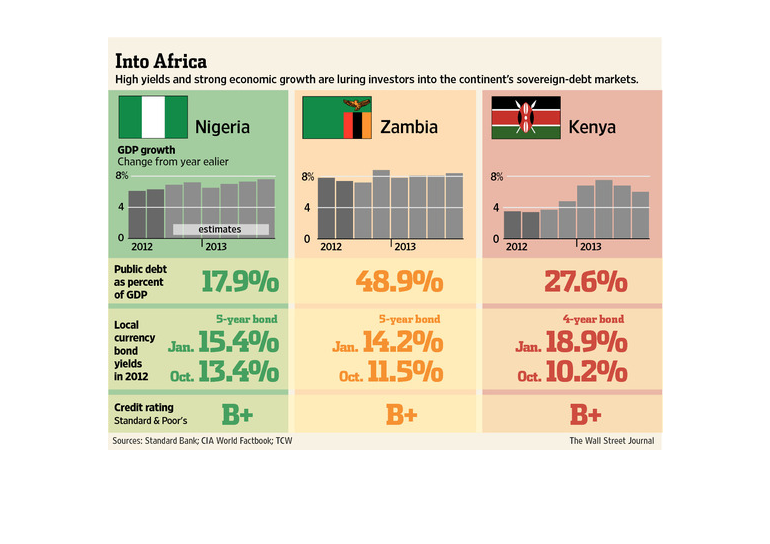

This chart takes three separate countries in the African continent, Nigeria, Zambia, and Kenya

and shows their GDP growth from the year 2012 to 2013 in relation to the sovereign debt markets

and the rise in economic growth that has brought growing interest to investors.

Strong economic growth is luring investors to explore business opportunities in Nigeria, Zambia,

and Kenya. This chart also compares the GDP and its' correlation to public debt. This also

shows the credit rating per country according to the Wall Street Journal.

The figure presented is titled Into Africa high yields and strong economic growth are luring

investors into the continent's sovereign-debt. The figure is presented with multiple charts.

Investments into Africa are talked about in the graphic, specifically, Nigeria, Kenya, and

Zambia. All three have a credit rating of B+. Zambia has the highest amount of debt to GDP

ratio, while Nigeria has the lowest.

This info graphic shows that high yields and strong economic growth lure investors into the

continents sovereign-debt market in Africa. Nigeria, Zambia, and Kenya have all had a steady

increase in GDP between 2012 and 2013. They also have all achieved B+ credit ratings and improved

bond yields.

This graph depicts the increase in investment into the economies of Nigeria, Zambia and Kenya.

For each country, the year over year GDP growth is reported, and is the percentage of public

debt with respect to GDP.

Investors are looking into Africa, specifically Nigeria, Kenya and Zambia. Their credit ratings

are a B+ and their GDP has been consistent since 2012. Their bond yields are over 10%