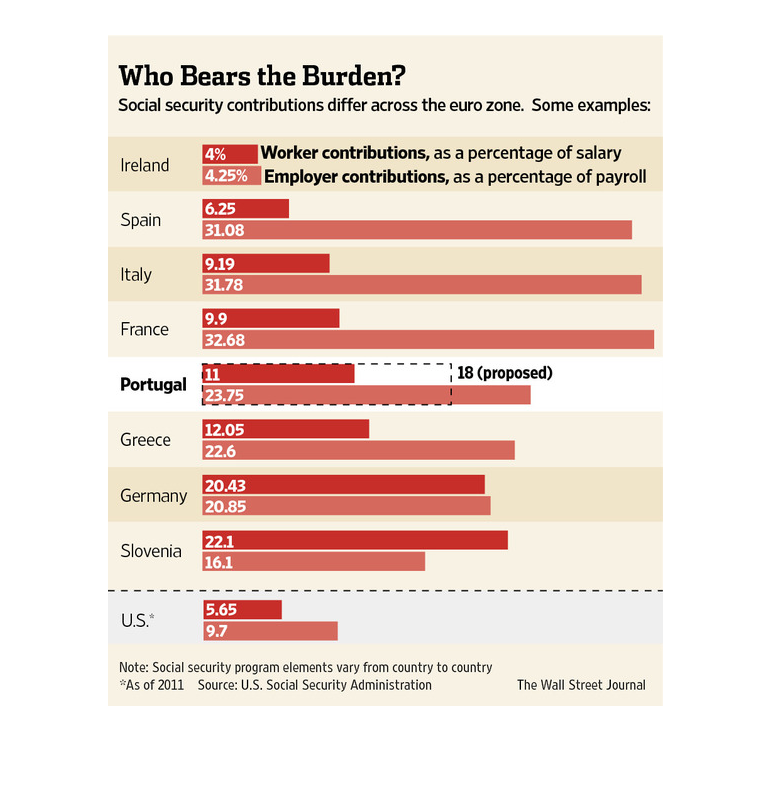

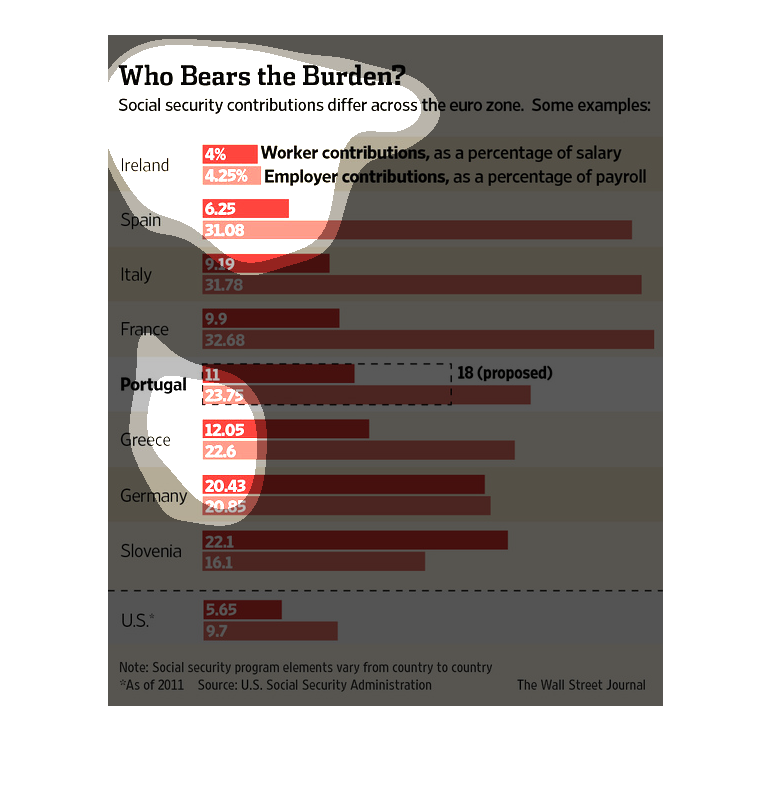

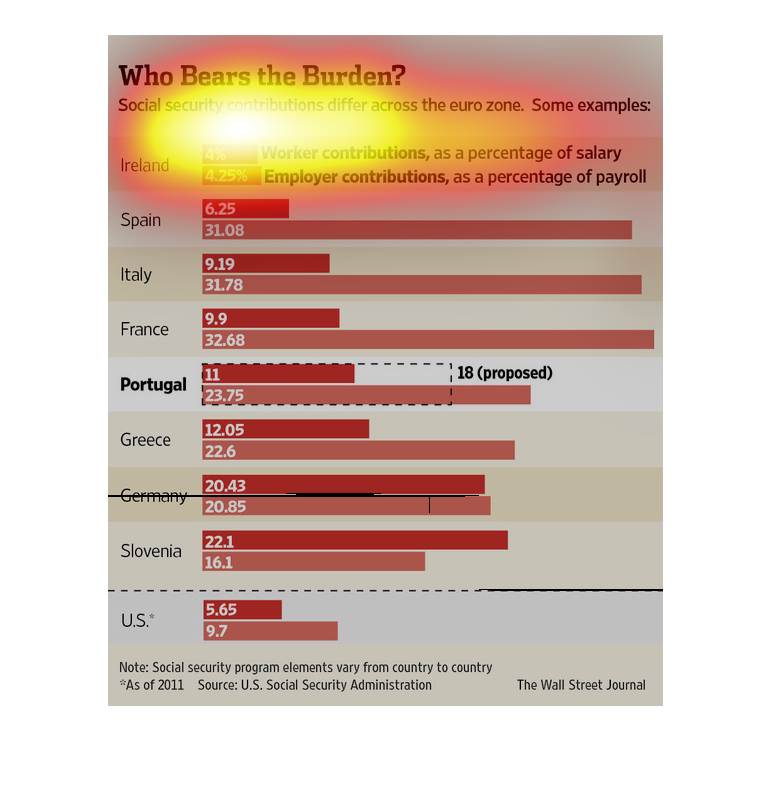

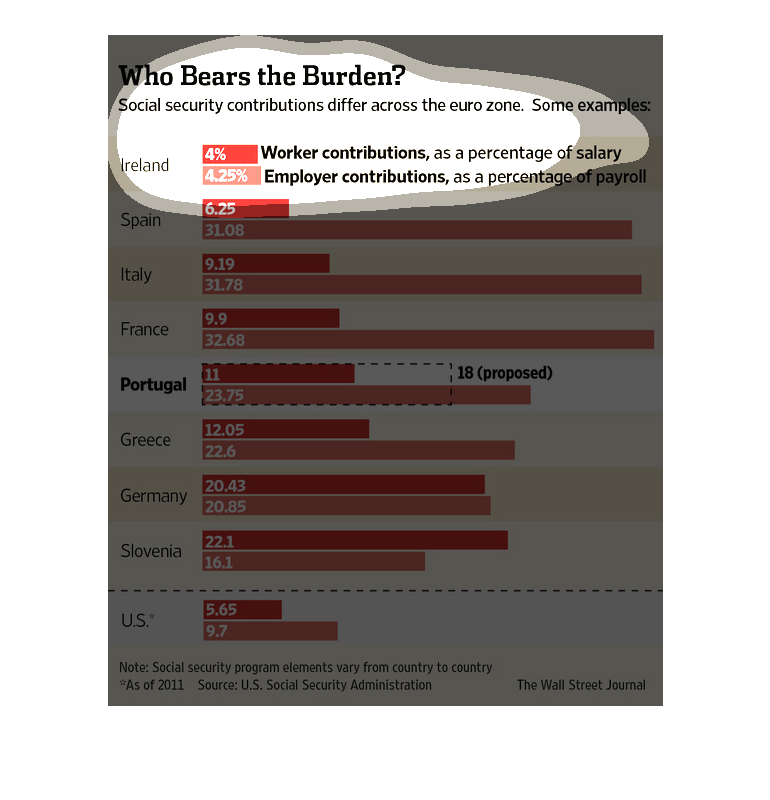

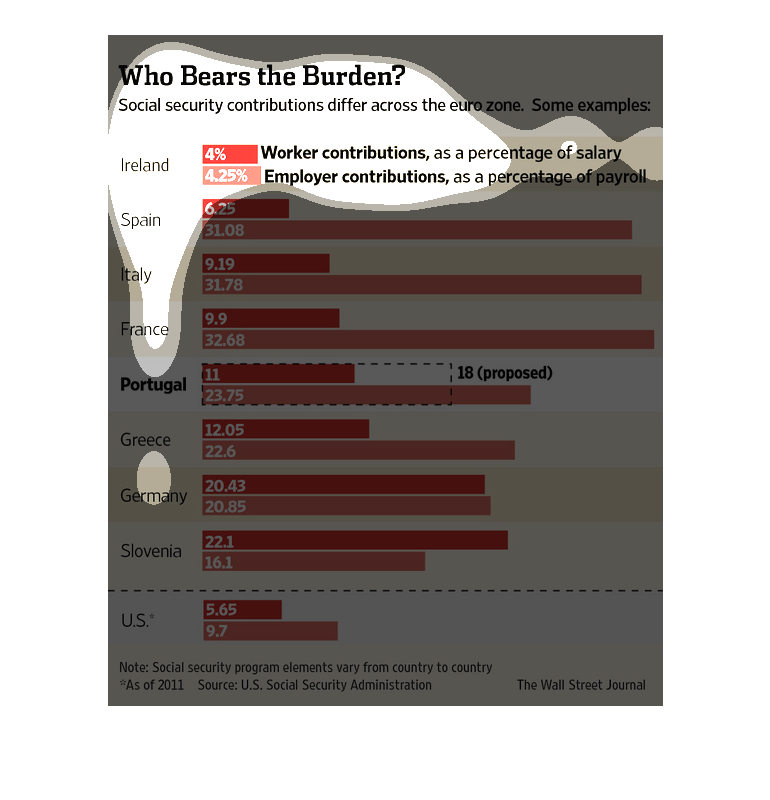

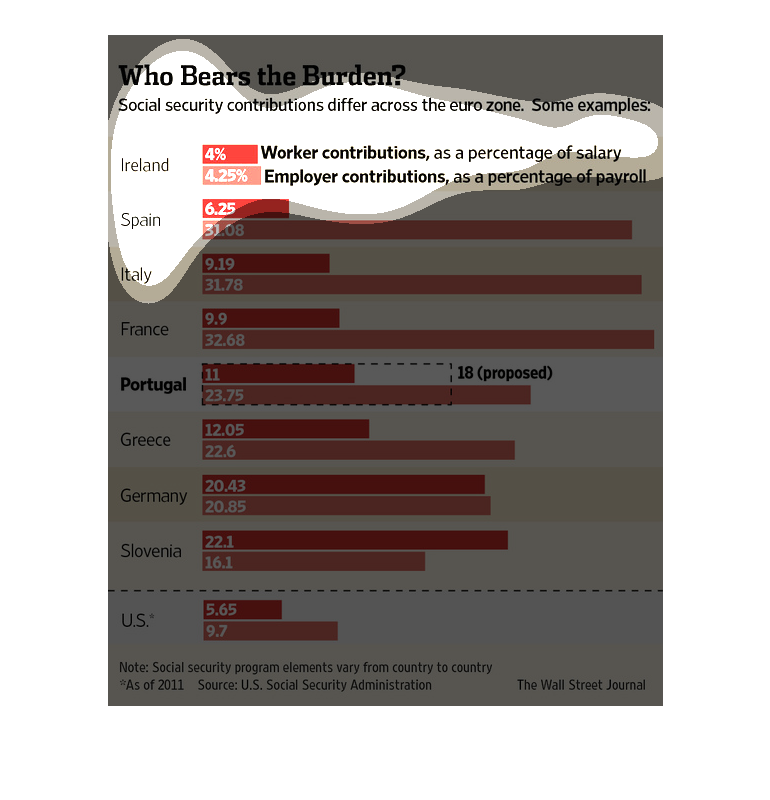

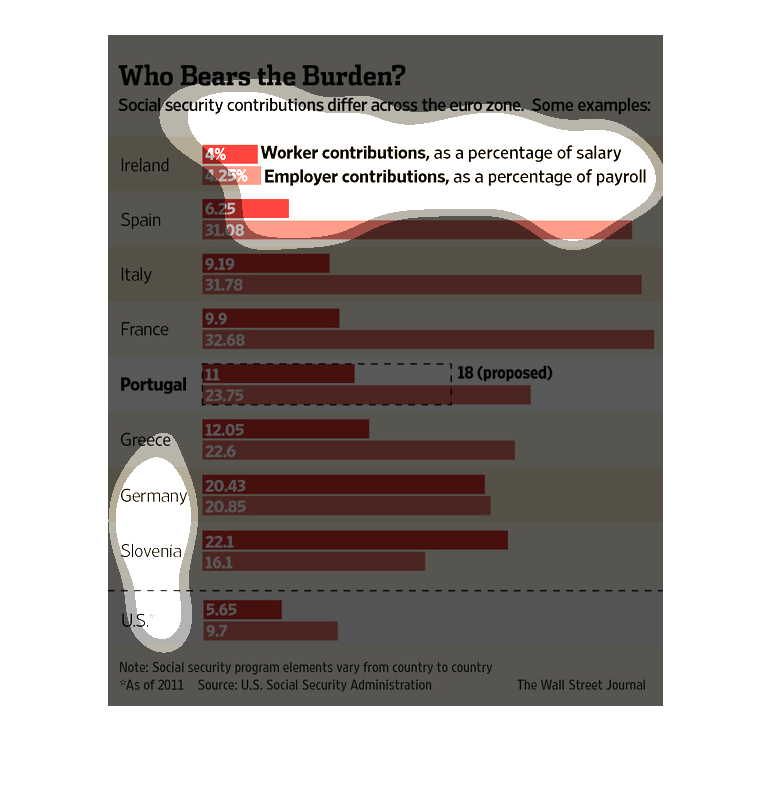

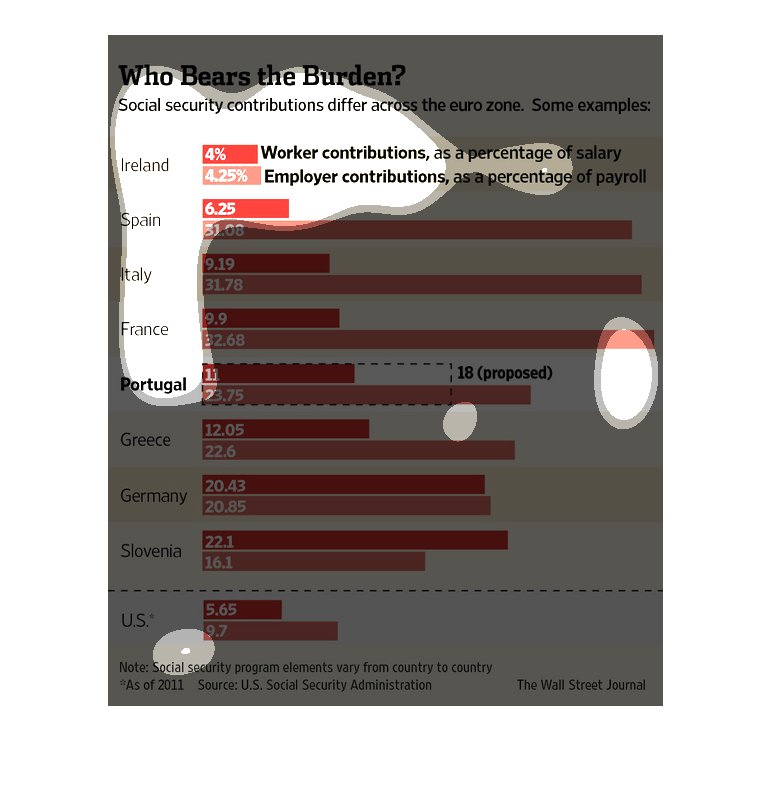

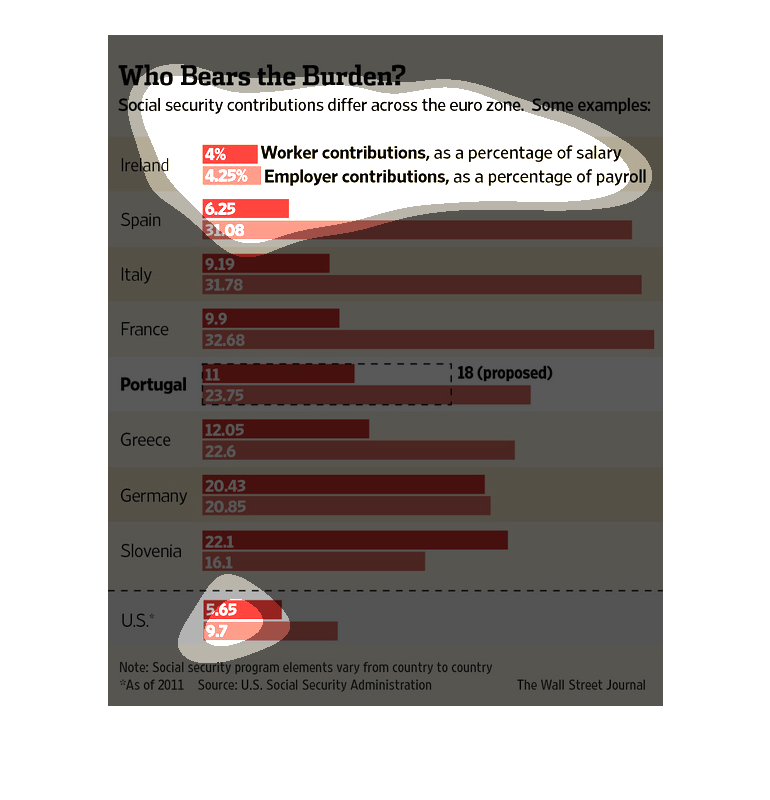

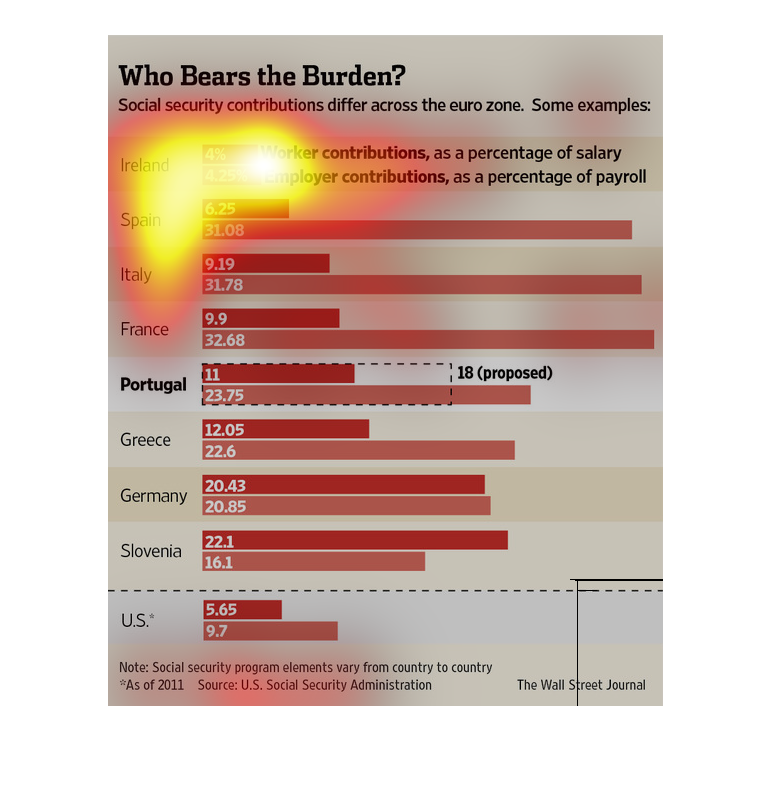

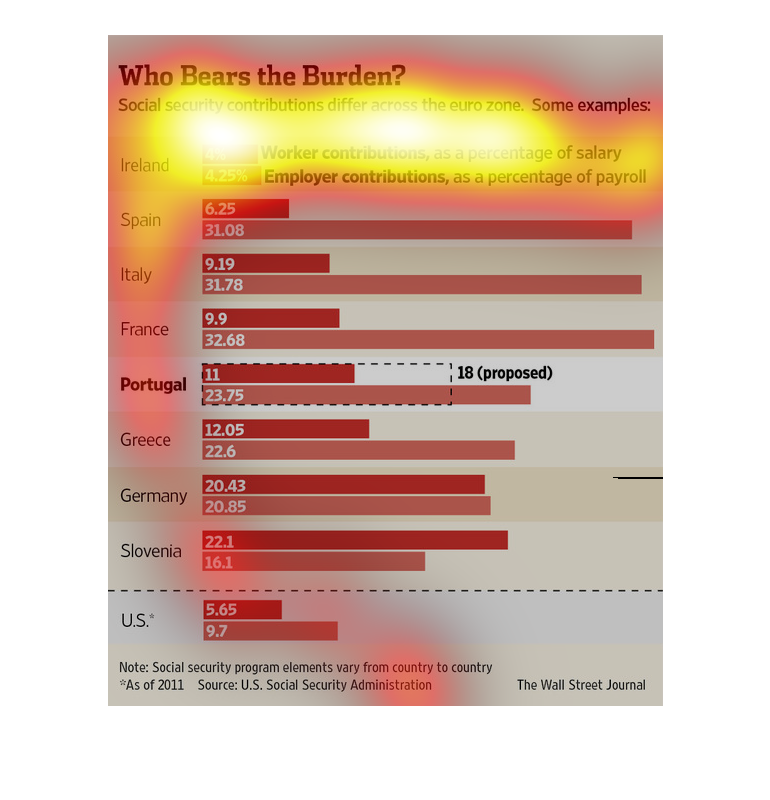

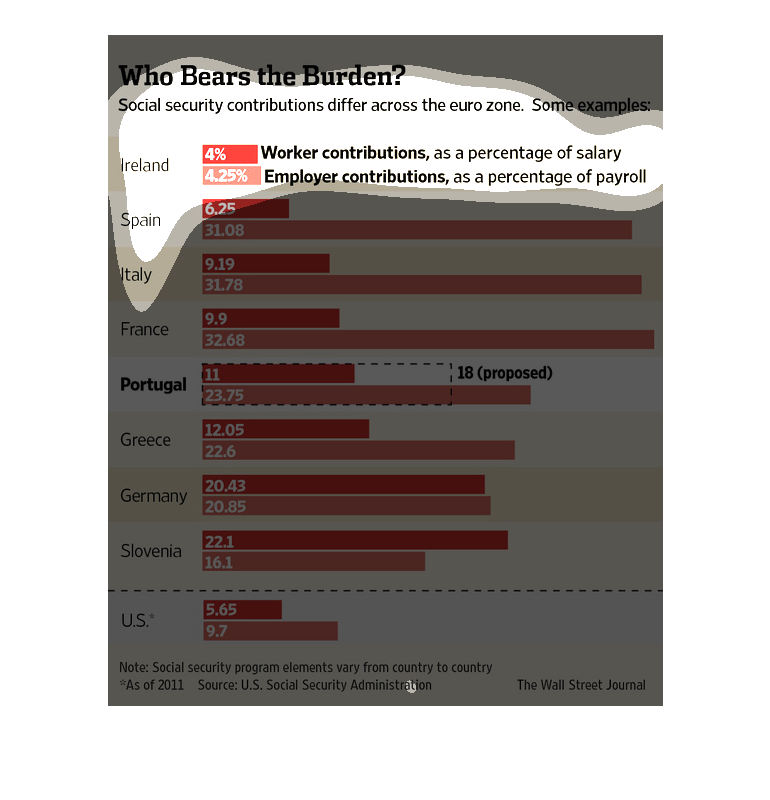

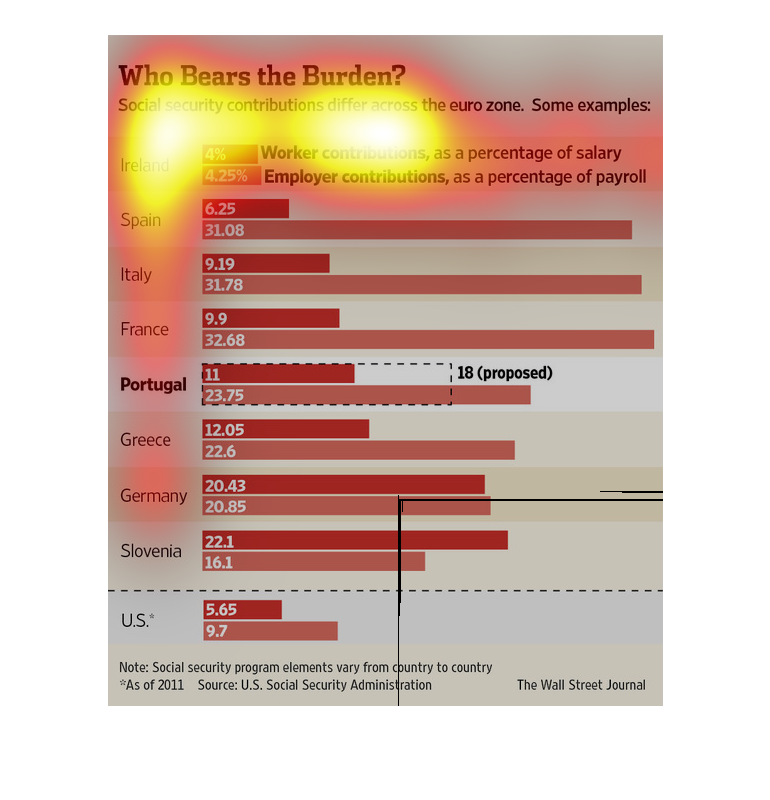

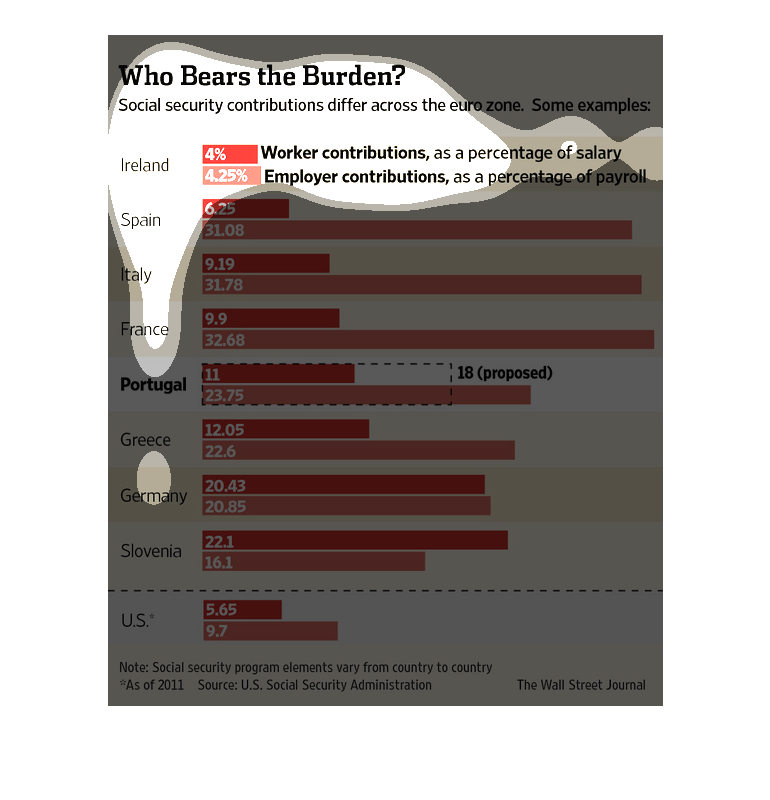

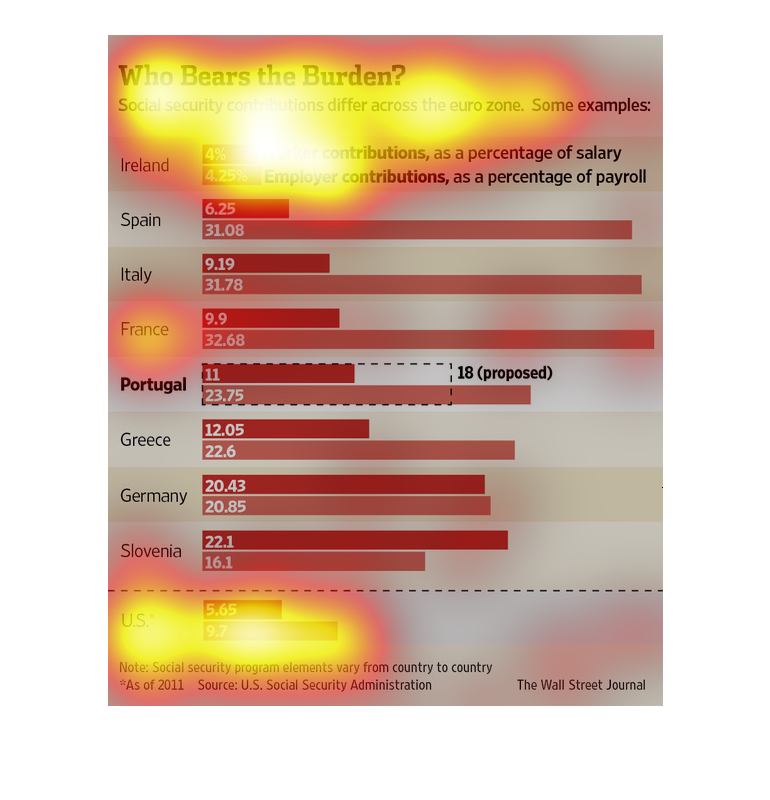

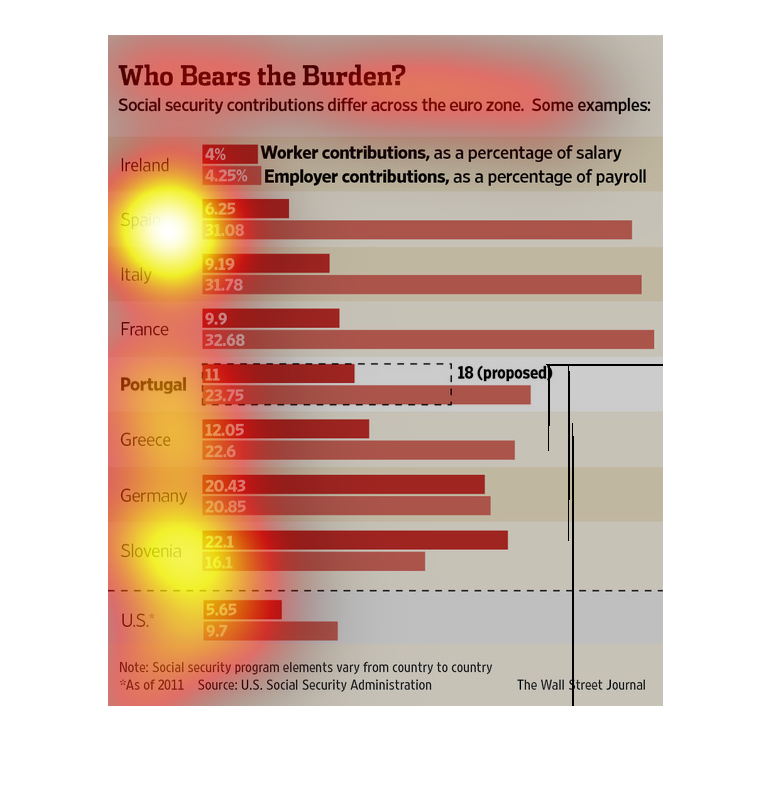

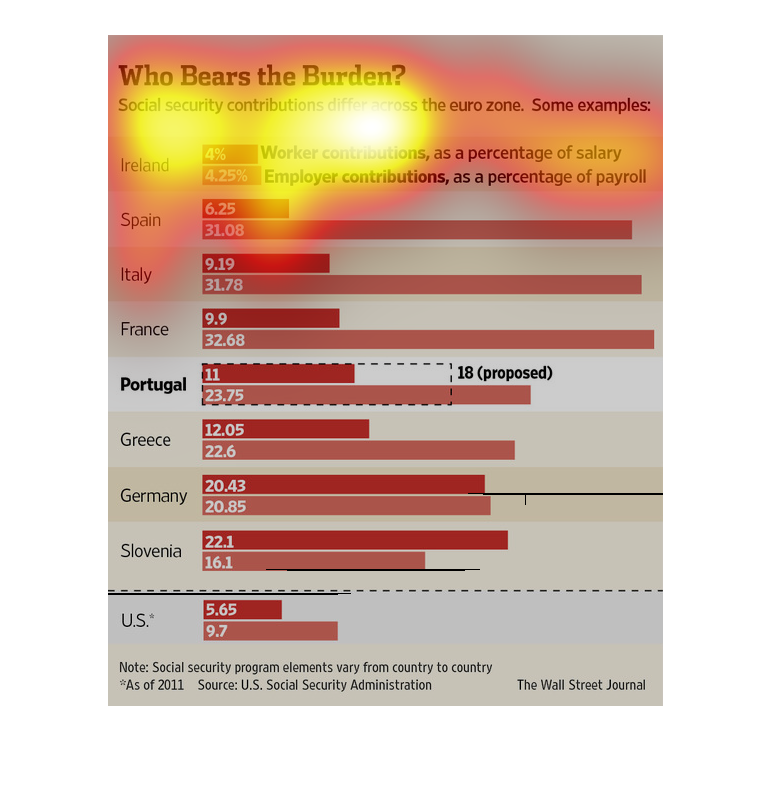

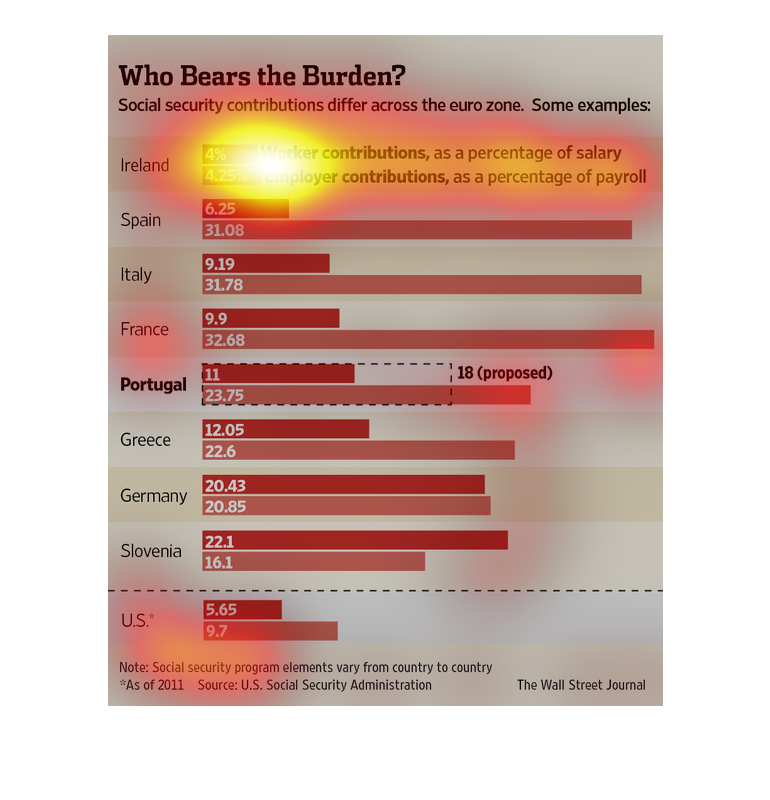

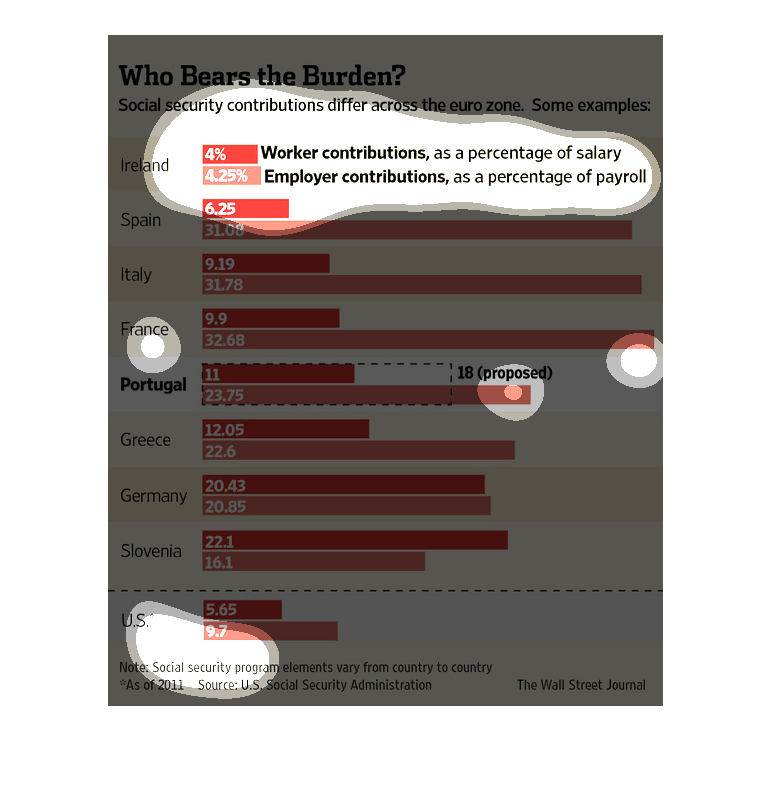

This image is detailing the burden of Social Security, or who is mostly responsible, workers,

or employers, for the financial compensation received after retirement. It includes 8 European

countries and the United States. Most countries show that the employer bears the majority

of the burden, but two countries, Ireland and Germany are very much equal.

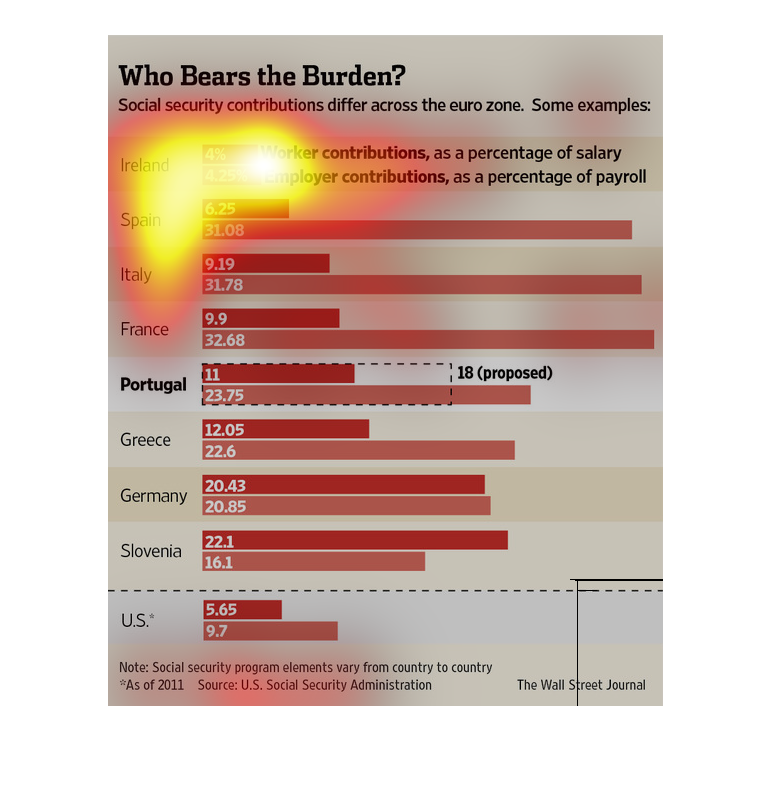

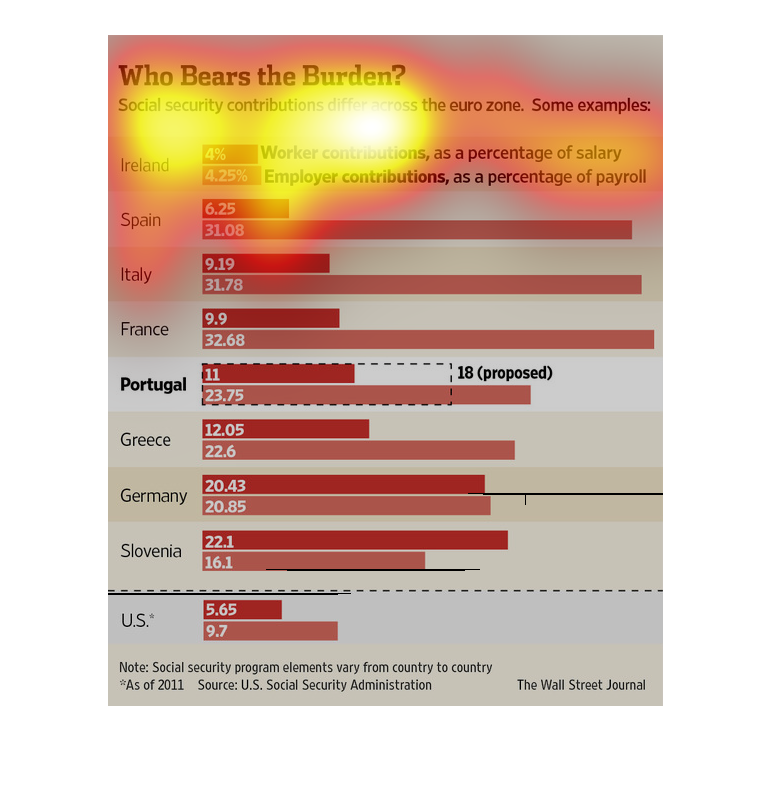

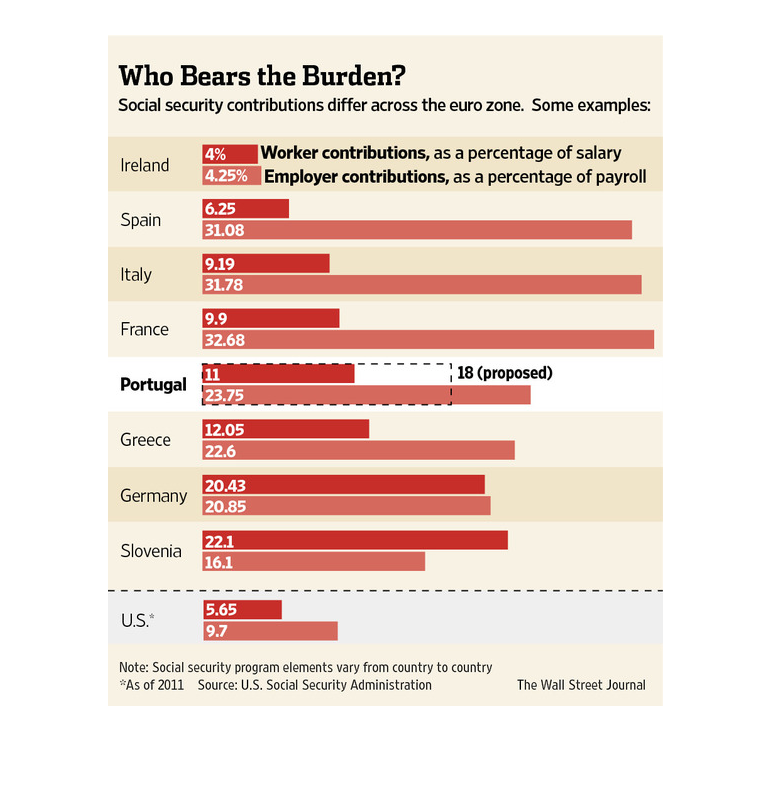

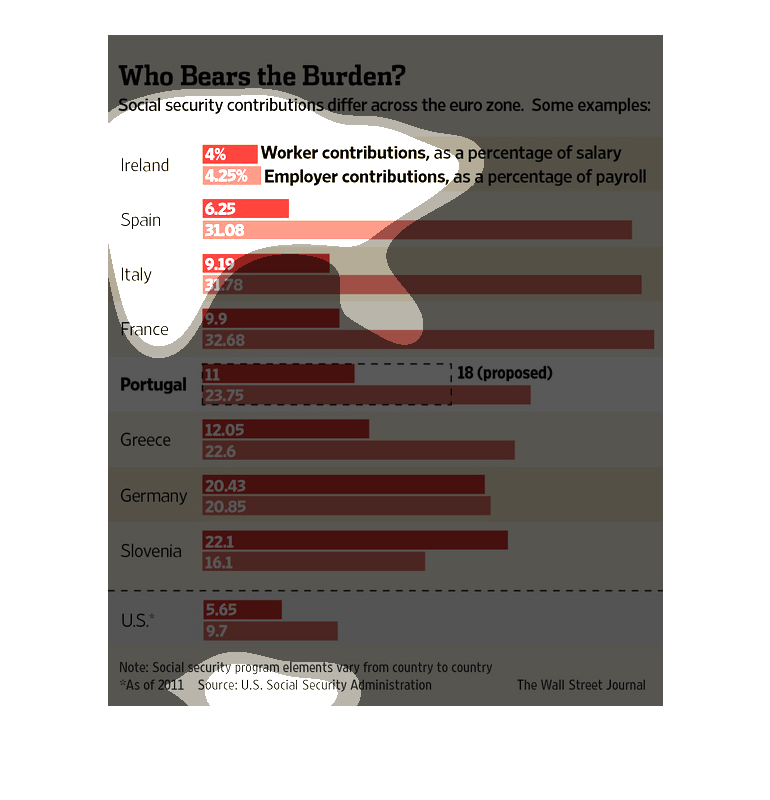

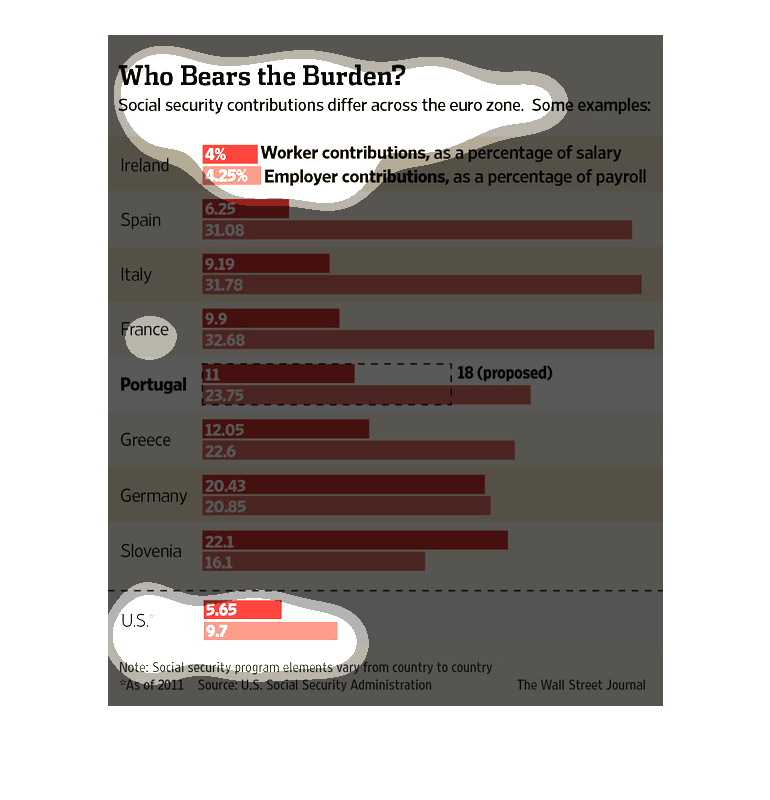

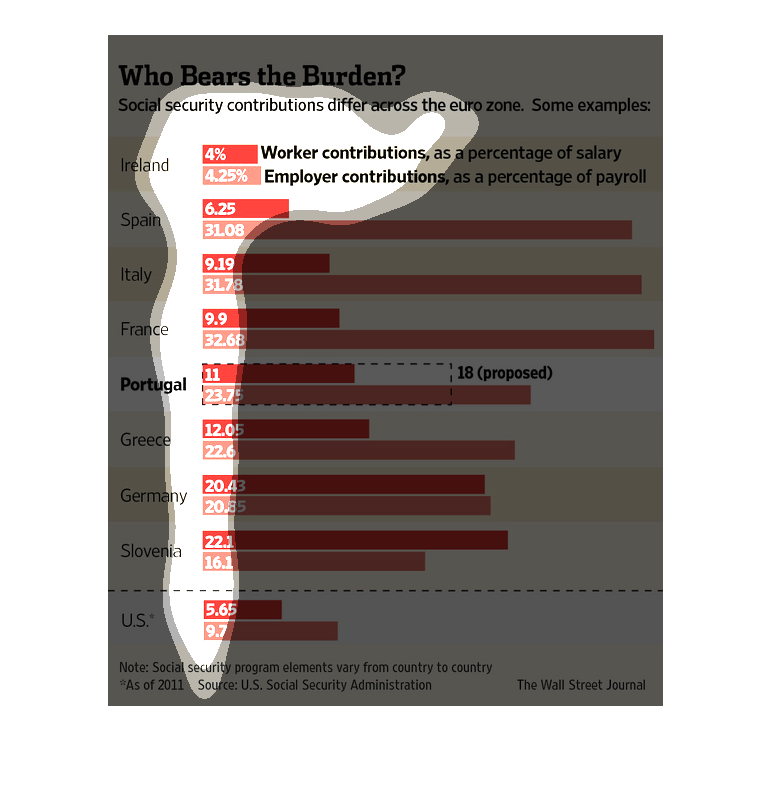

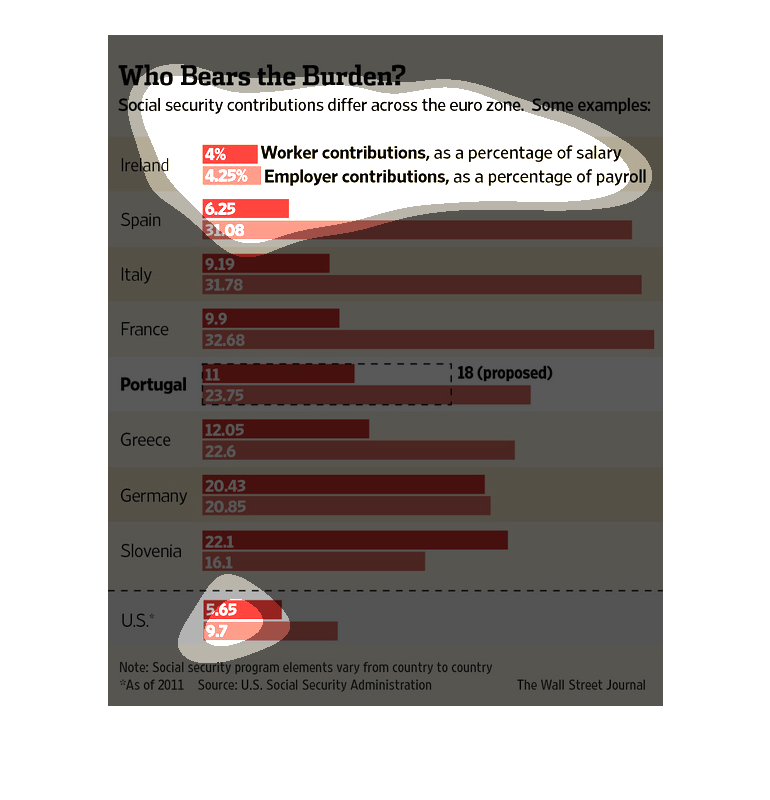

This chart breaks down the amount of Social Security contributions given by employees versus

the amount of contributions given by employers. It's broken down by country

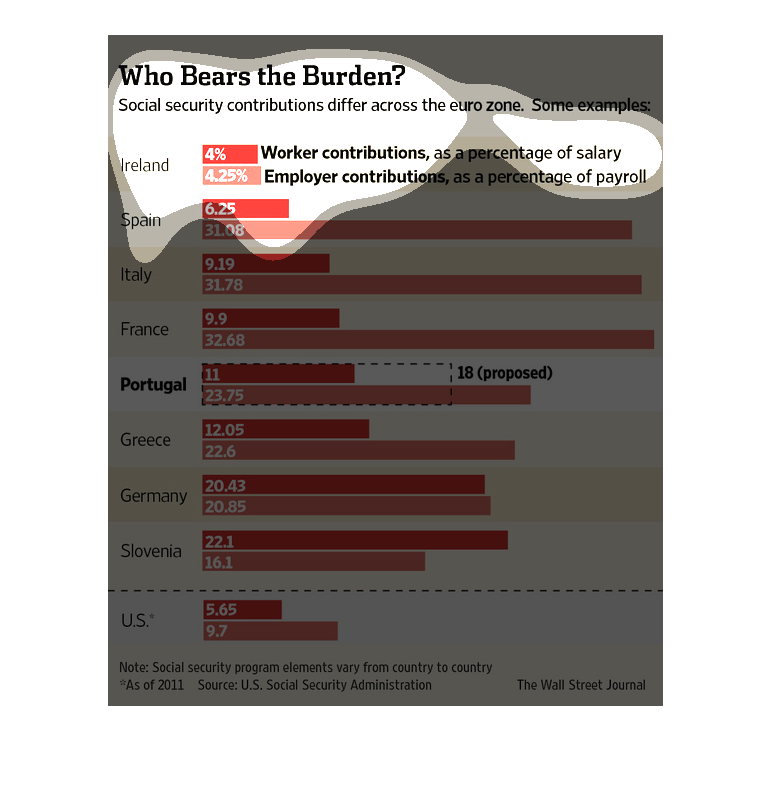

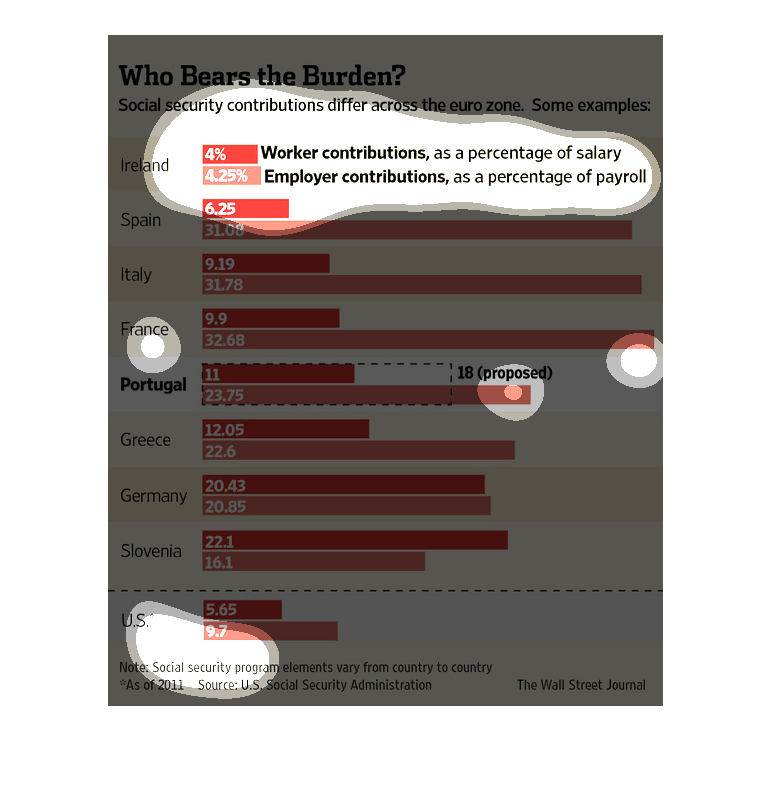

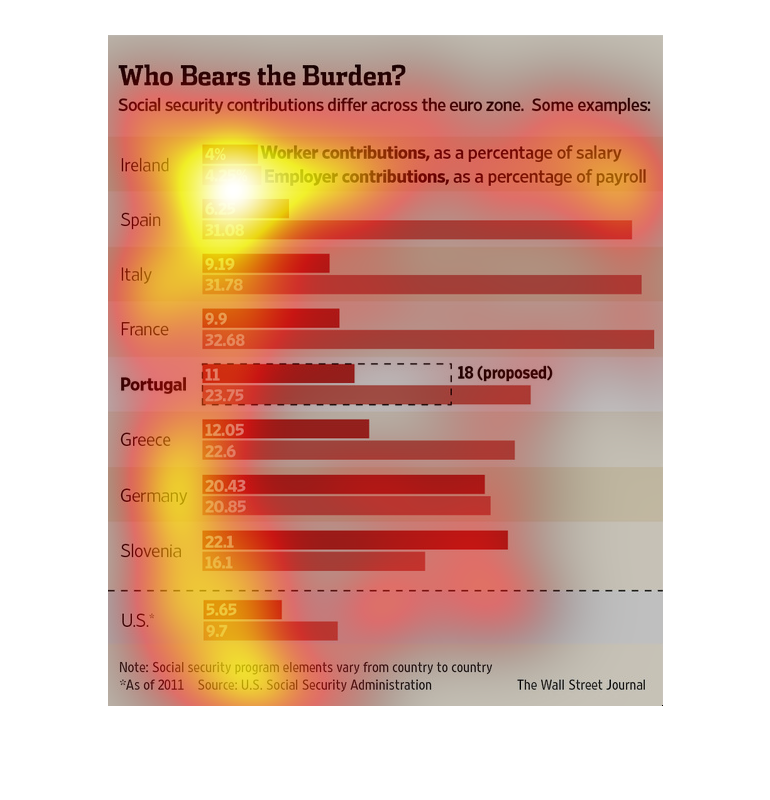

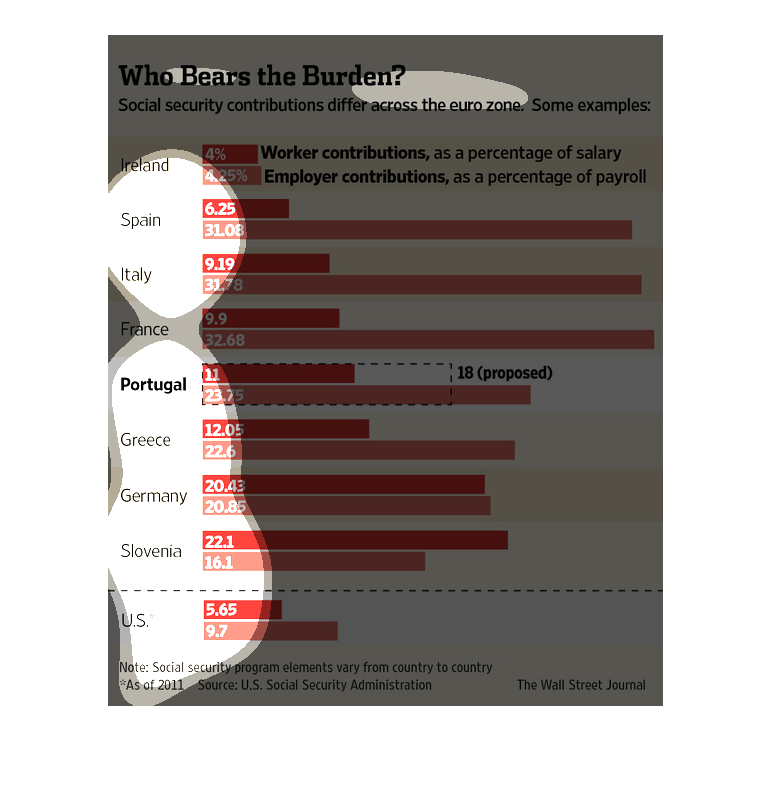

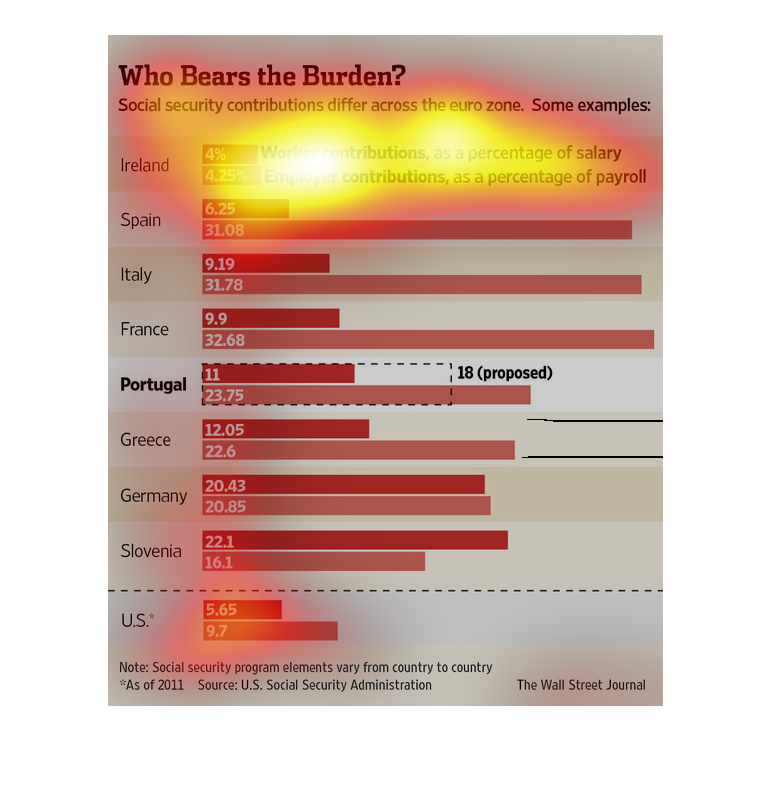

The following chart is titles who bears the burden. It shows the different. It shows what

countries provide the most social security contributions across the Euro Zone.

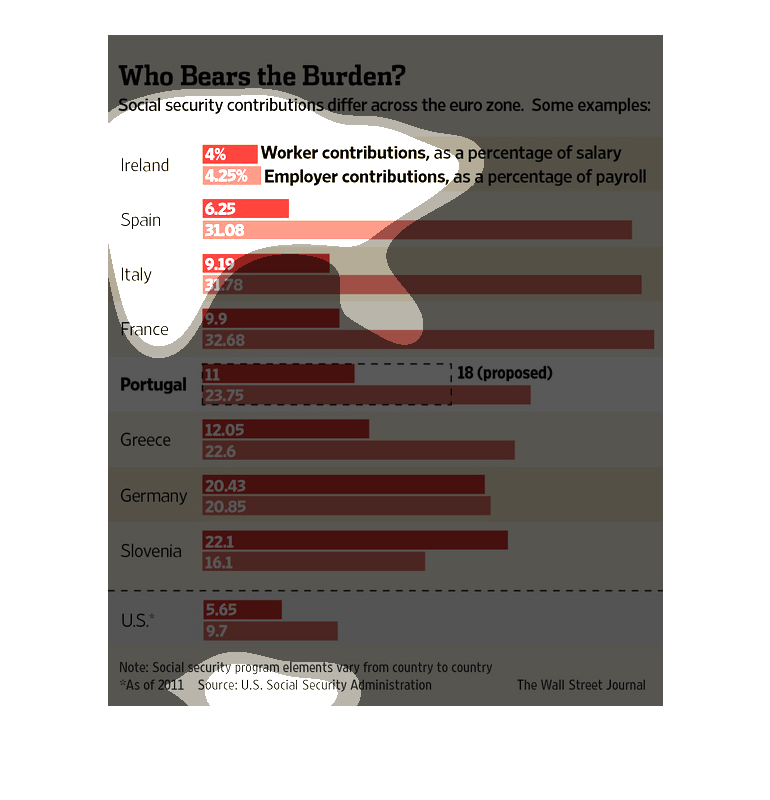

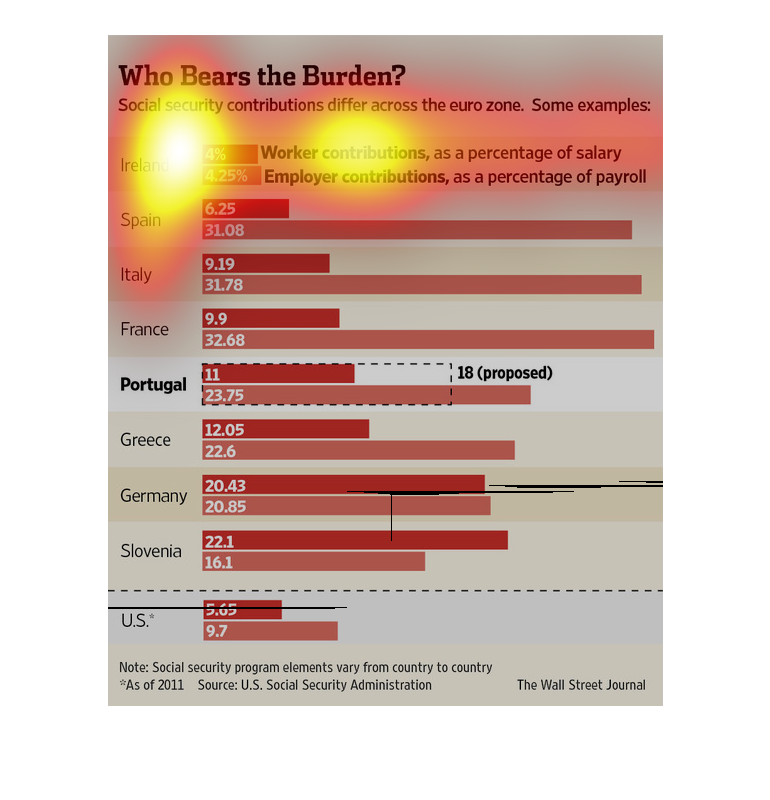

This shows the contrbution to the social security system in the euro zone. The contributions

from different nations in the euro zone are shown and compared in bar graph form.

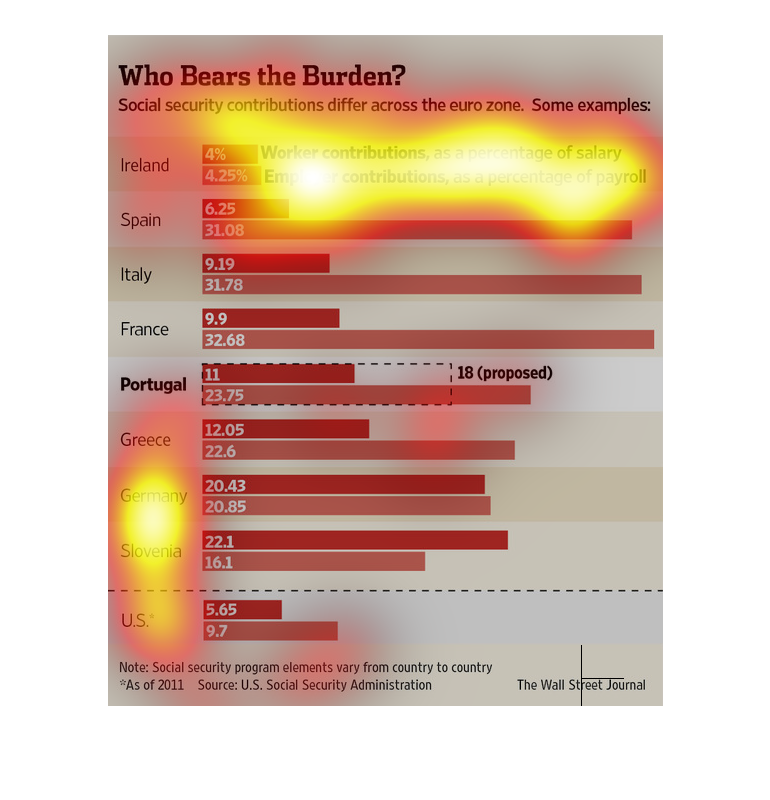

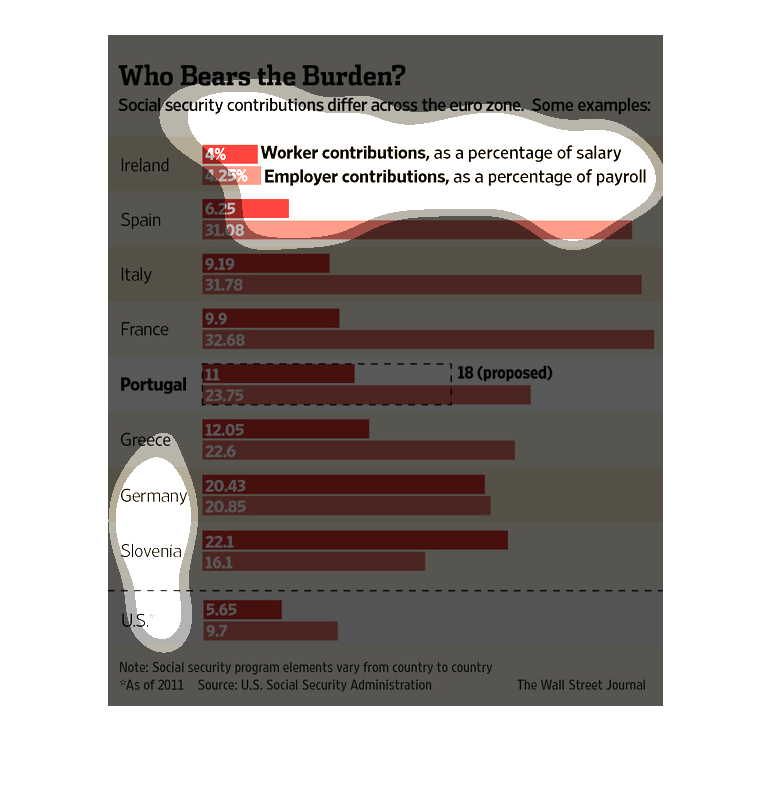

This is a series of charts and related statistics depicting that social security contributions

differ across the euro zone and provides data from several selected countries.

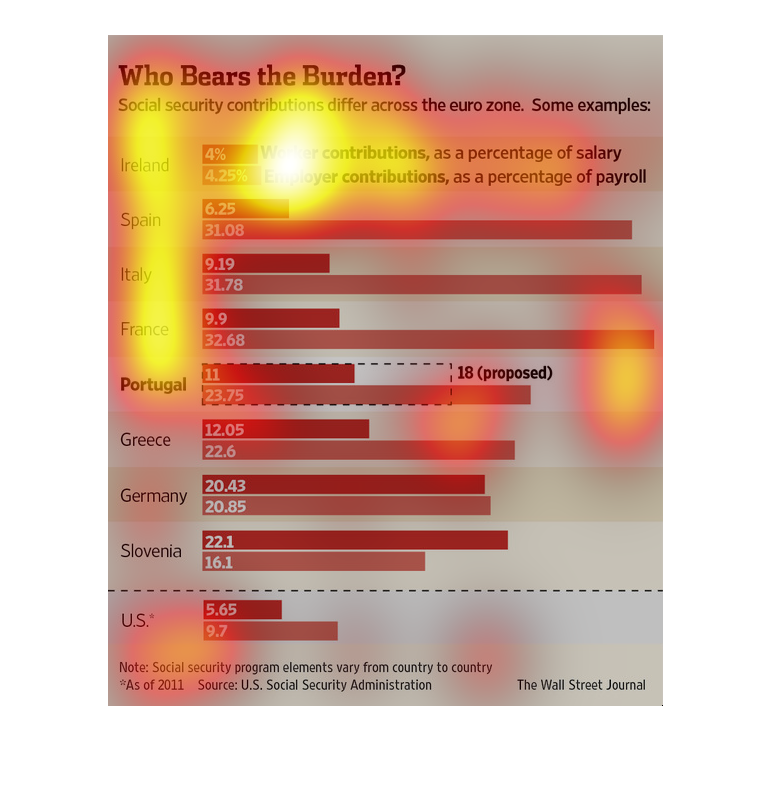

This chart compares who pays into social security, employers or employees across different

countries. France has the biggest employer contribution while Slovania relies more on the

individual employee than the company contribution.

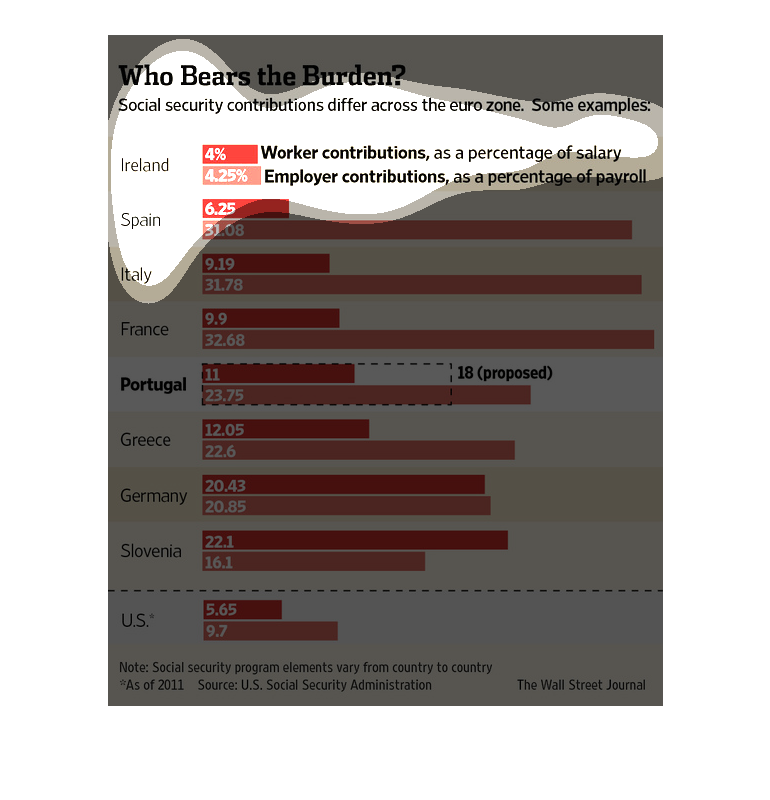

This is a series of color coded bar graphs depicting that social security contributions differ

across the Euro Zone and give a selected group of countries as examples.

This chart describes who bears the burden. Countries on the chart include Ireland, Spain,

Italy, France, Portugal, Greece, Germany, Slovenia, and the U.S.

This is a bar chart that shows who pays the burden for social security in the euro zone. There

are various countries listed and the output is the worker and employer contribution as a percentage

of salary and payroll. It s then compared to the US.

This chart describes who bears the burden. Specifically, social security contributions differ

across the euro zone. Countries on the chart include Ireland and Spain.

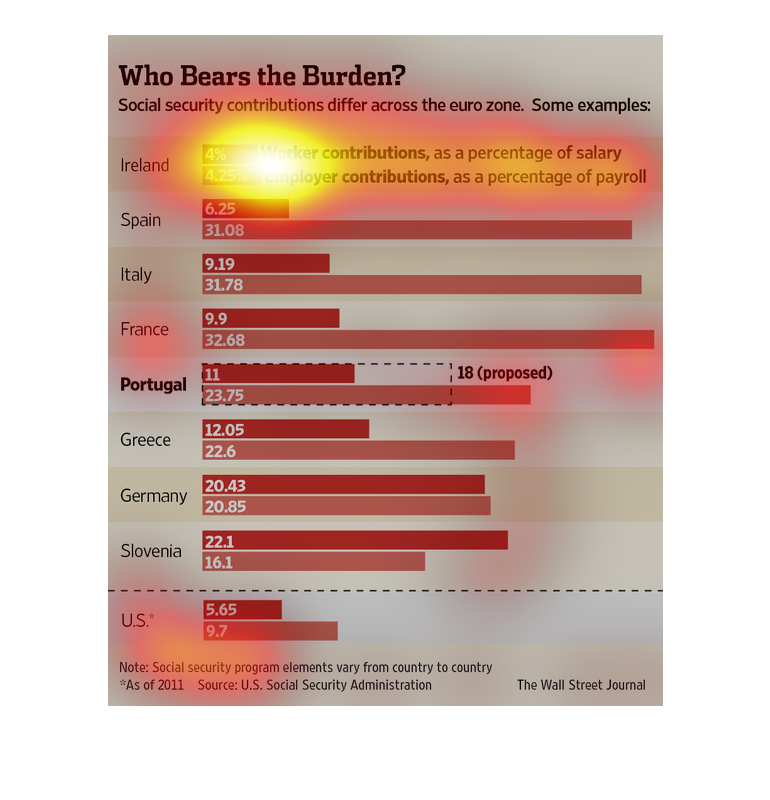

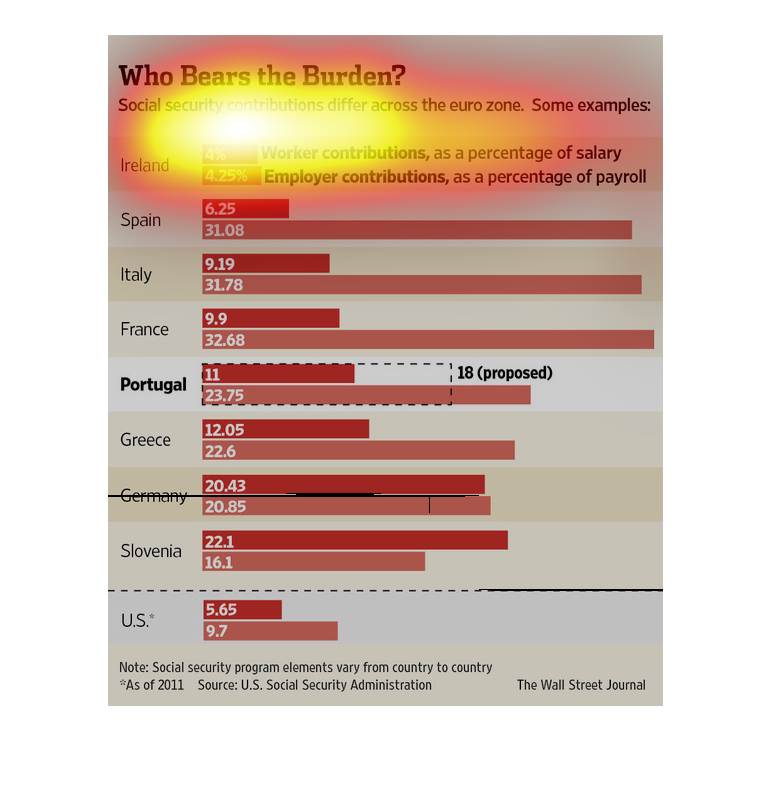

This graph compares social security contributions across the Eurozone. Workers in Ireland

contribute 4% of their paychecks. Workers in Slovenia contribute 22% of their paycheck. In

France, Italy, and Spain, employers contribute significantly more that the workers.

This graph shows the different Social Security contributions across the Euro zone. France

has the highest employer contributions while Ireland has the lowest. Slovenia has the highest

worker contributions while Ireland has the lowest again.

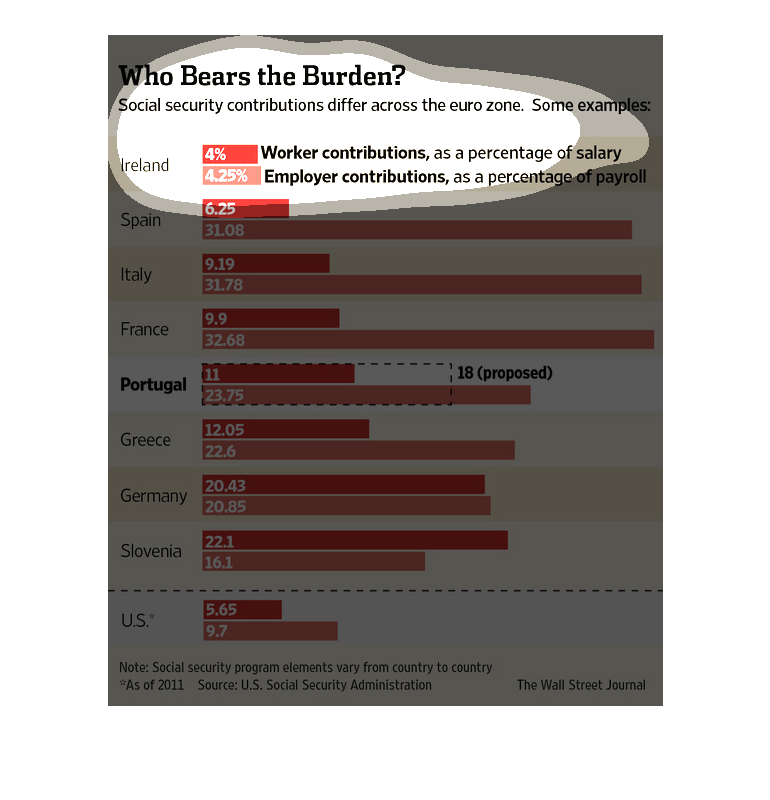

This is a Wall Street Journal article reporting how social security contributions differ across

the Euro Zone. The graph indicates a worker's contribution as a percentage of his/her salary

and a company's contribution as a percentage of its payroll. There are big differences between

the countries.

The image depicts social security contributions differing across the Eurozone. Ireland appears

to be contributing the least to social security within the EU, while France appears to be

contributing the most.

Across Europe, there are large discrepancies as to who pays social security costs: the employee

or the employer. In Ireland and Germany it's fairly equally distributed. In Slovenia, the

employee pays more. In Spain, Italy Greece and Portugal, similar to the United States, the

employer picks up most of the tab for social security.