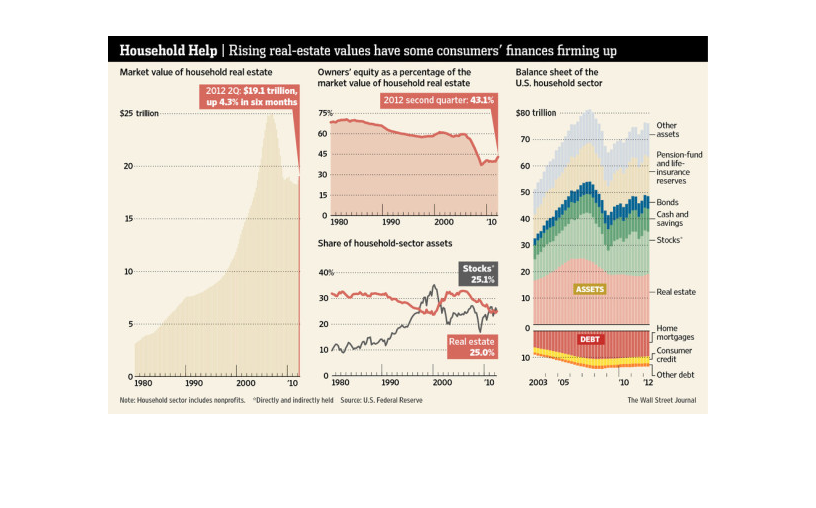

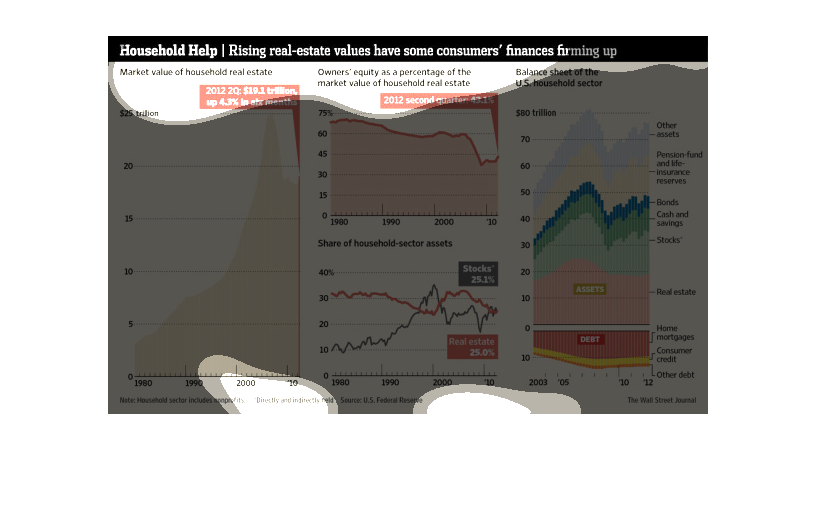

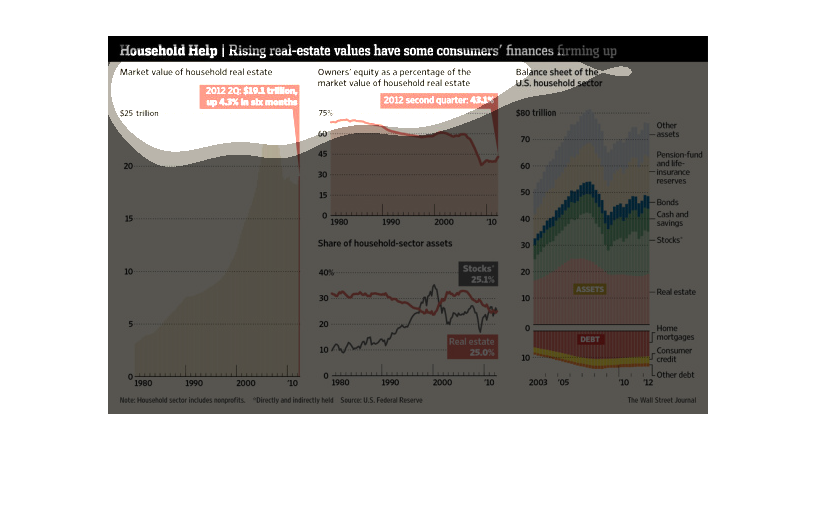

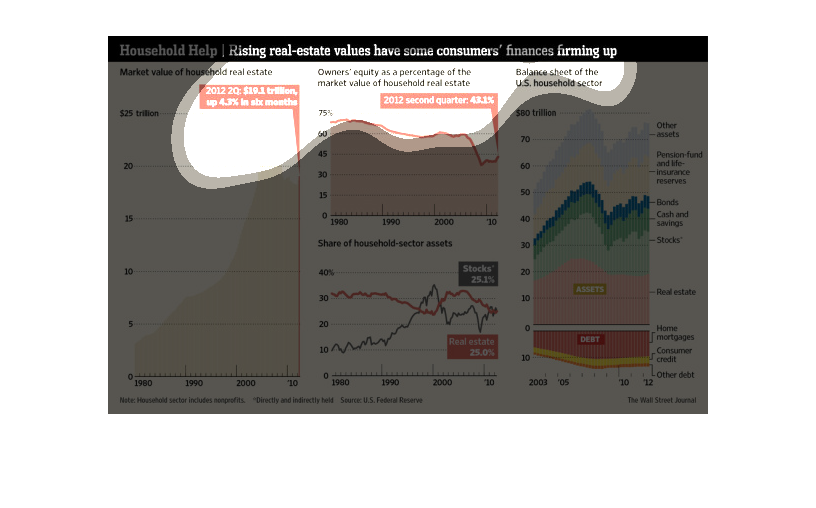

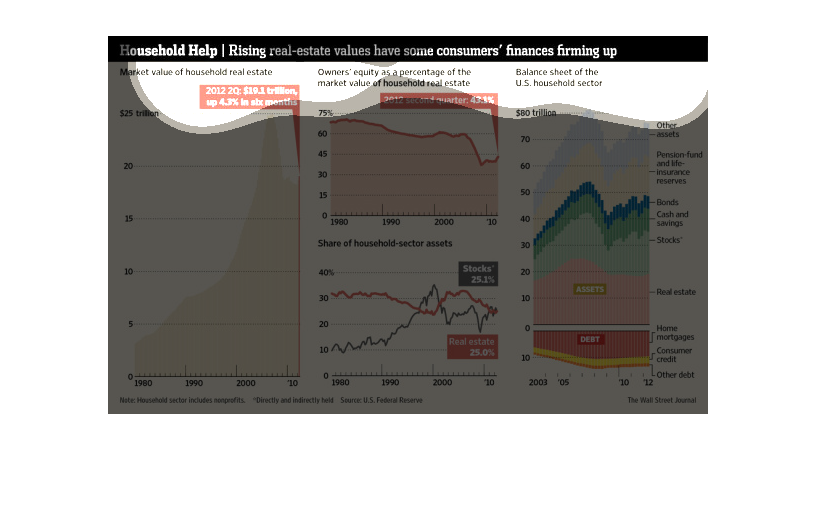

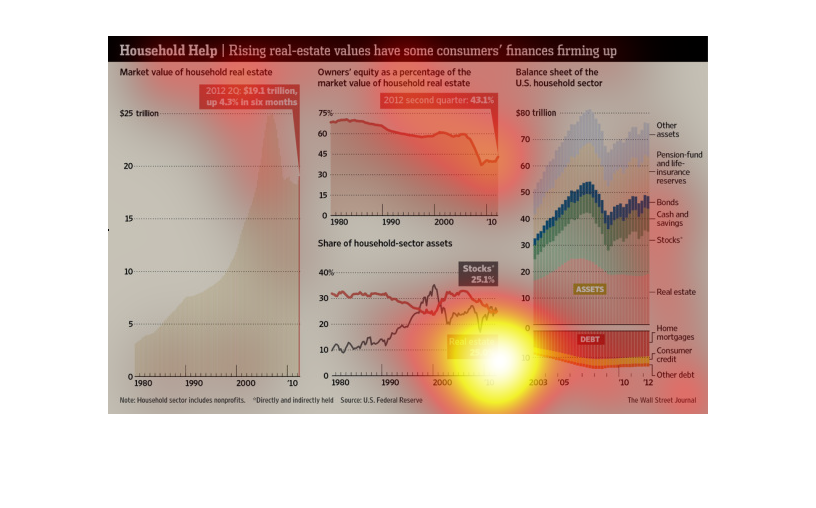

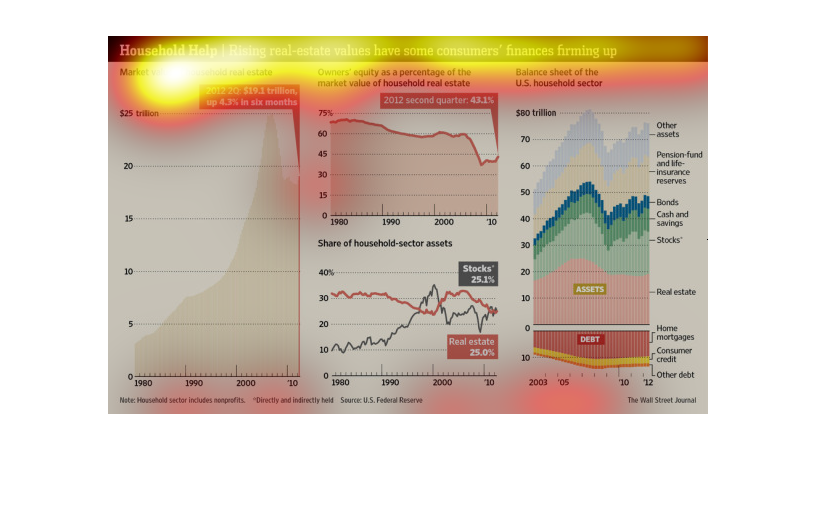

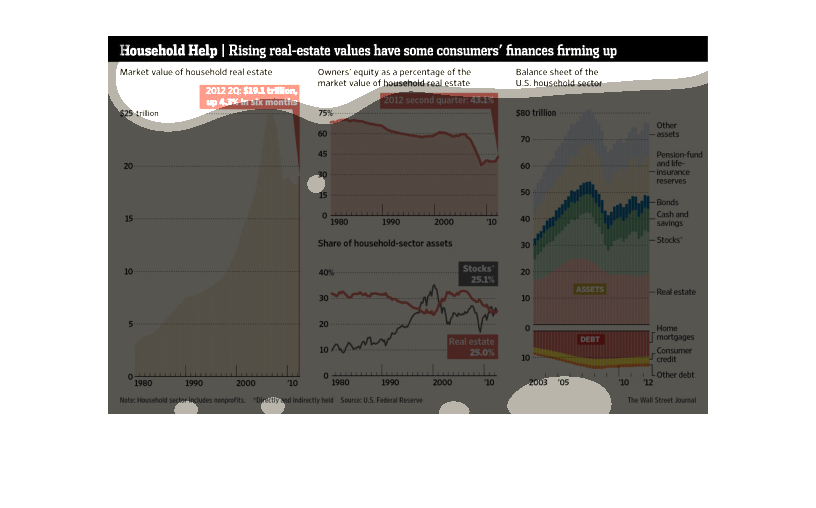

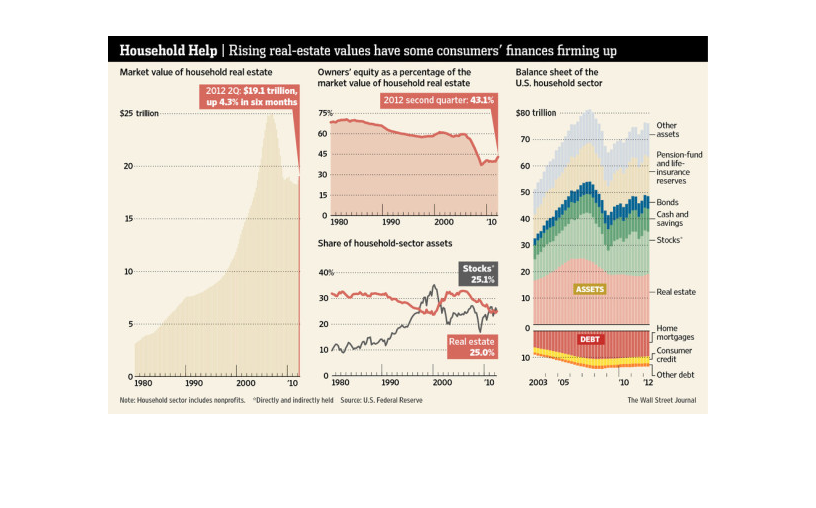

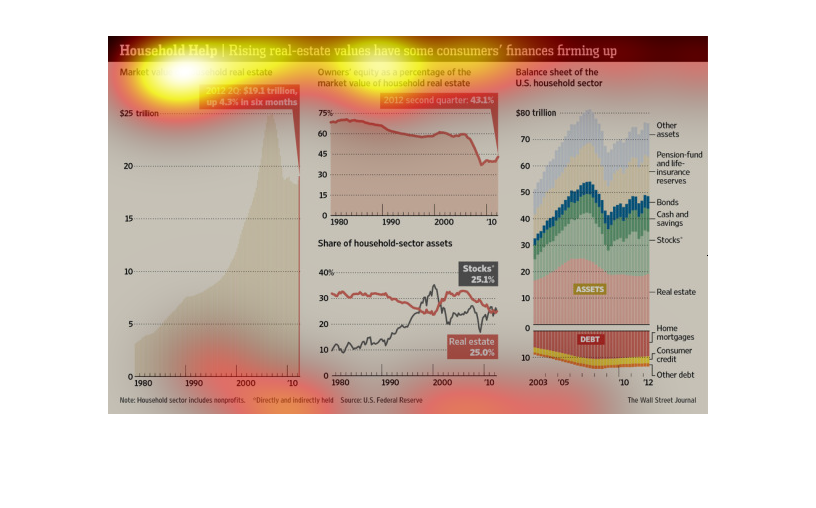

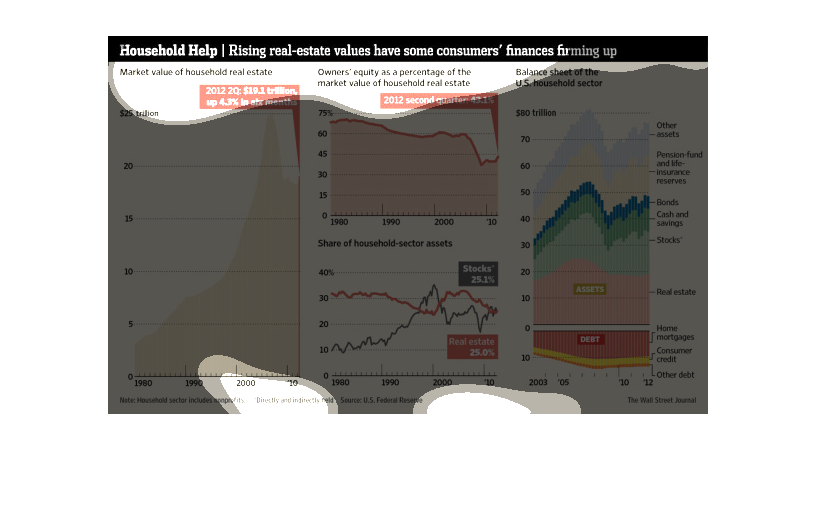

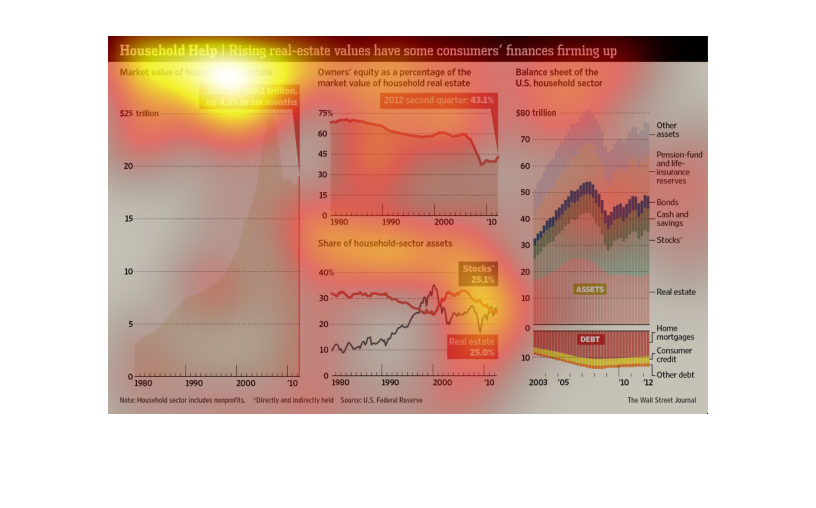

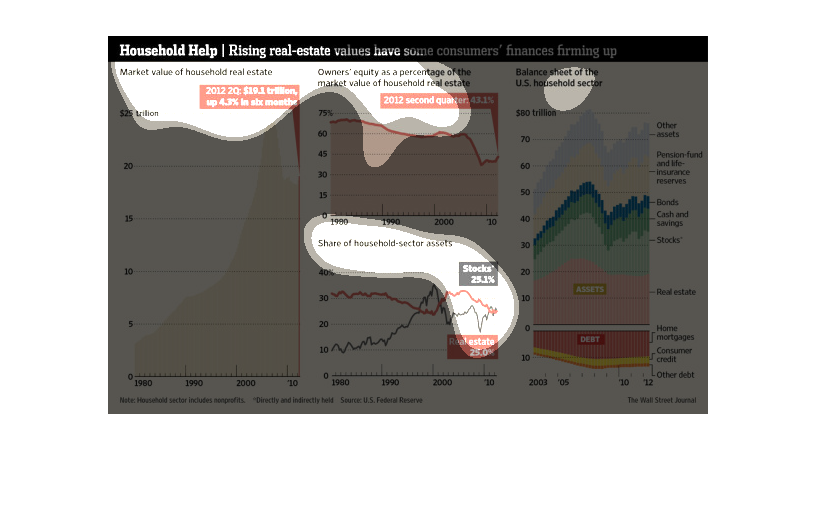

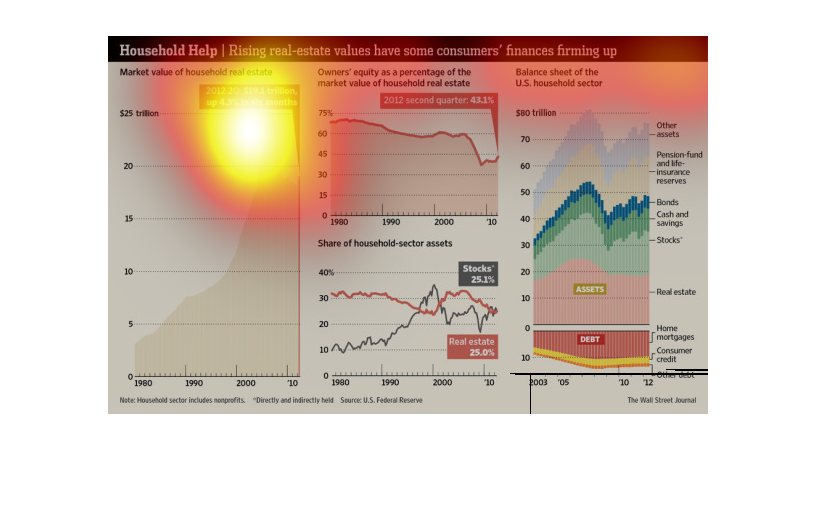

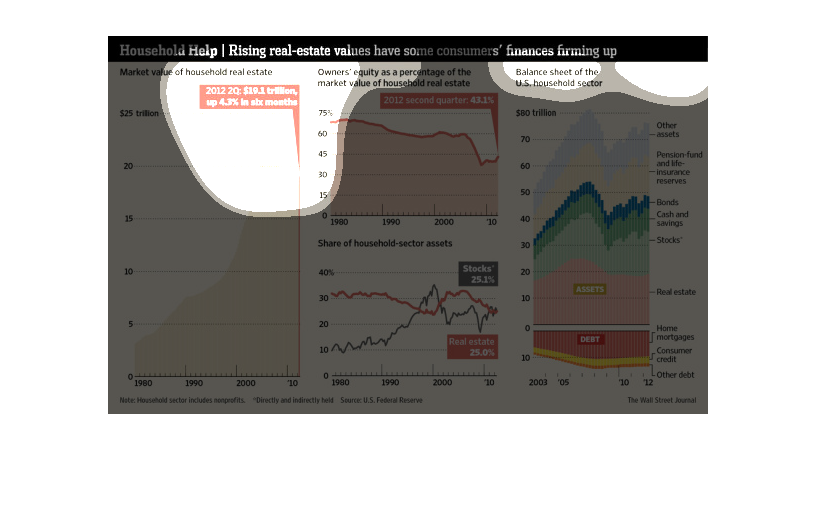

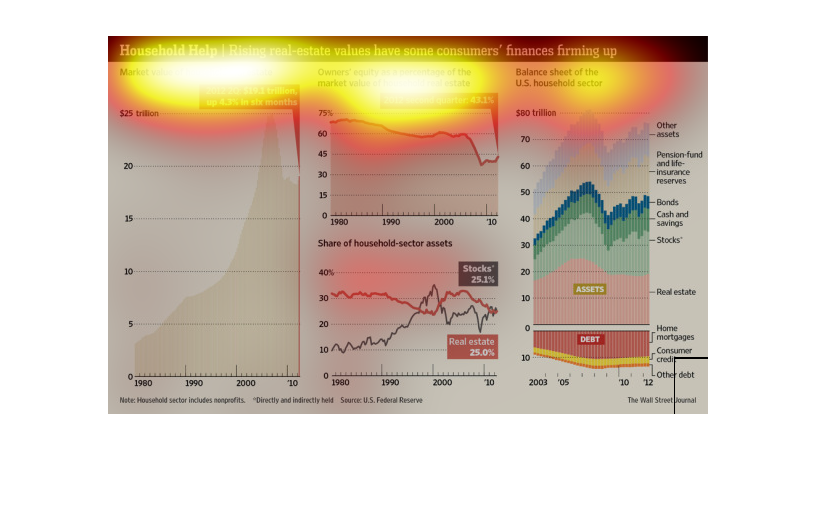

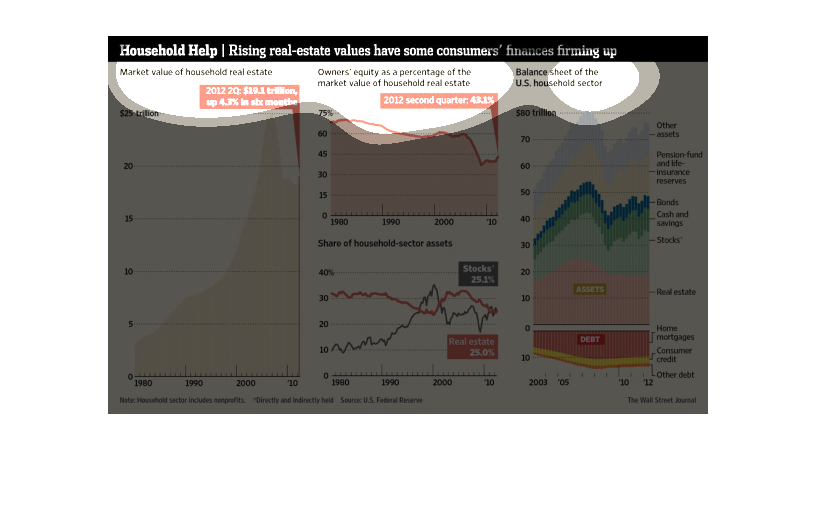

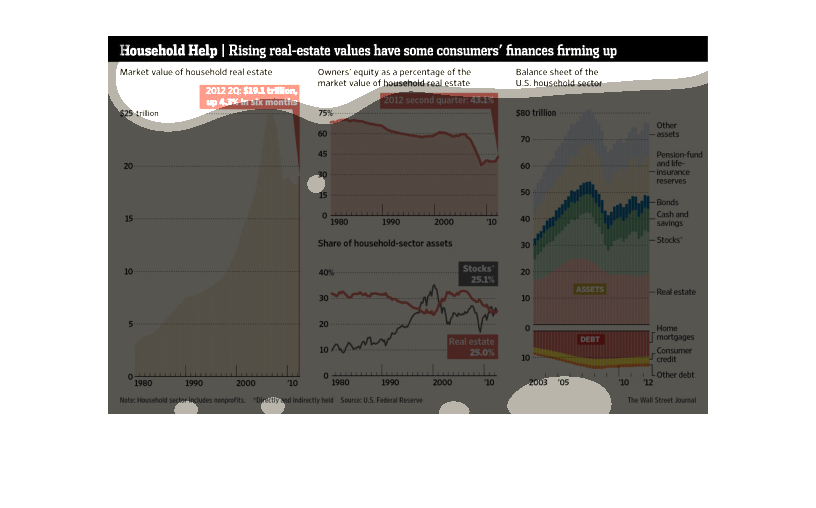

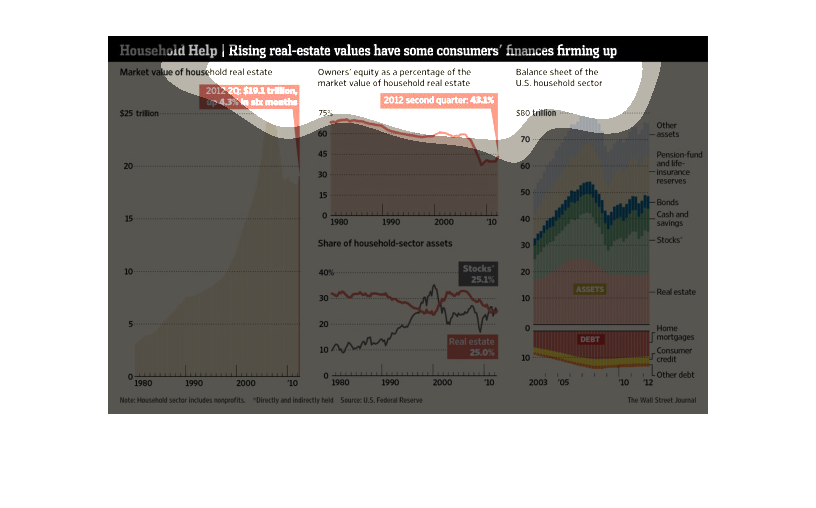

This is a series of charts and graphs with related statistics depicting that rising real-estate

values have some consumers finances firming up through the year 2010.

These images attempt to provide evidence that homeowner assets are improving due to rising

real estate value as well as returns for other investments such as stocks.

Home equity is a tricky thing that goes up and down; it is highly volatile and unpredictable.

In this study we see the turbulence of this housing situation take place.

The following chart talks about the financial status of Americans since the housing bubble

market crises. It shows that housing values gone up along with the overall stock market and

that Americans are financially starting to be more stable. This data appears to come from

the year 2012

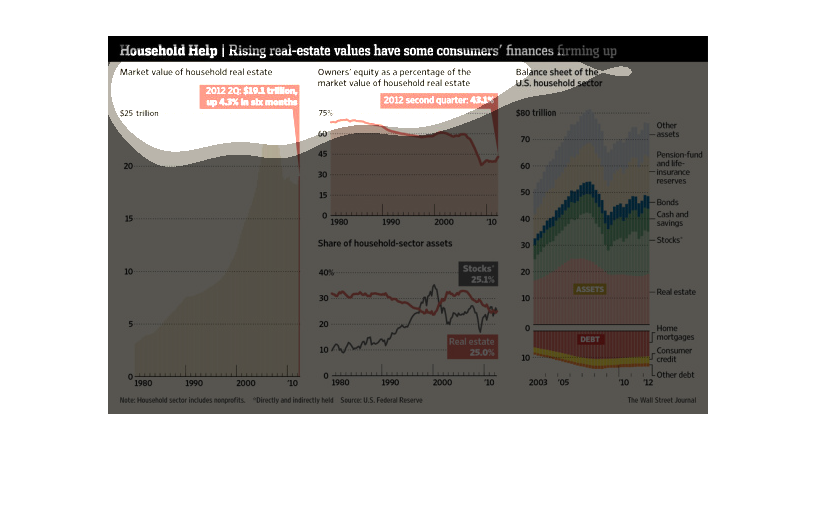

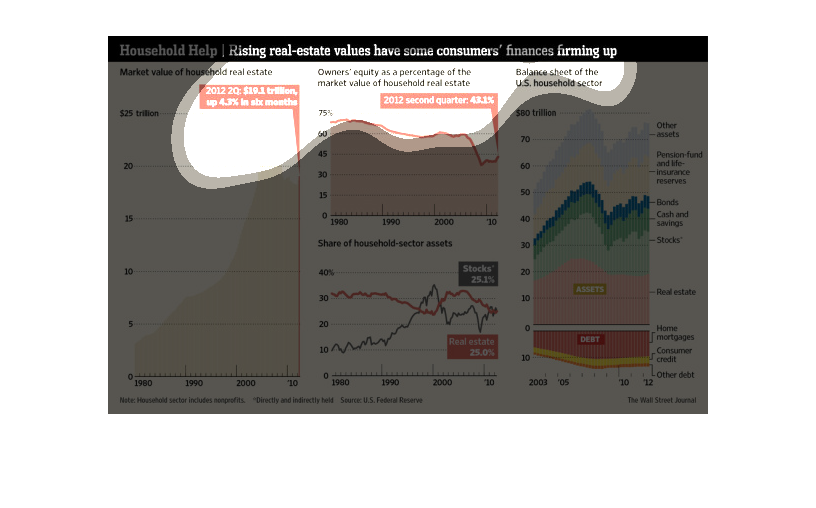

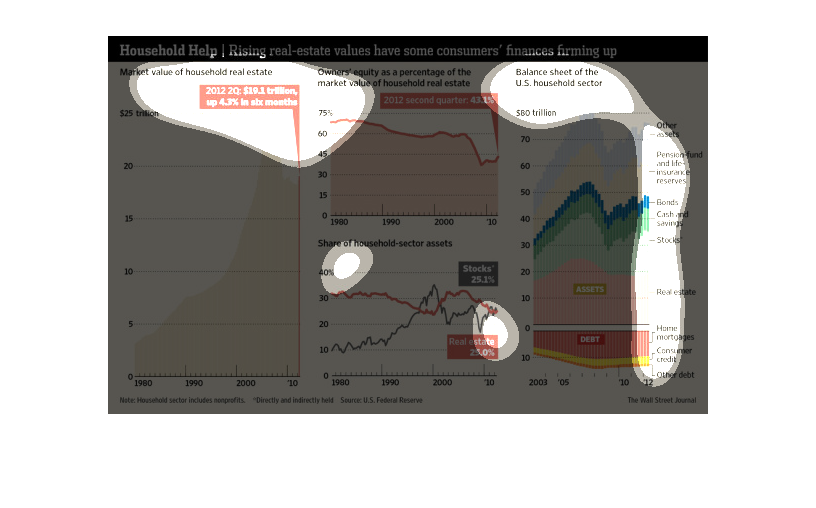

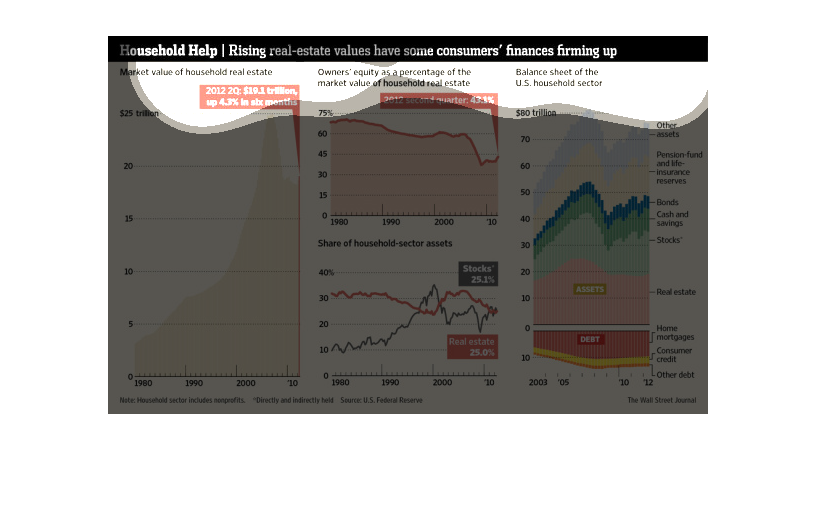

This is a chart showing Household help, rising real-estate values have some consumers' finances

firming up. It shows the values for the second quarter of the year 2012.

The image show 4 different graphs relating to rising real estate values. The first graph shows

the vast increase in market real estate from 1980 to approximately 2012, going from 4 trillion

in 1980 to about 25 trillion in 2007, but then dropping back to about 19 trillion in 2012.

The second graph shows owner equity as a percentage of real estate value, which has decreased

overall since 1980, but has started to rise since 2010. The third graph show the share of

household-section assets versus stocks. Both have fluctuated since 1980, but are within .2%

of each other in 2012. The final graph is a balance sheet of the U.S. household sector, in

which home mortgage and real estate seem to make up much smaller percentages of as opposed

to stocks, pensions and life insurance, and other assets.

This chart describes household help. Specifically, rising real-estate values have some consumers'

finances firming up. Different categories are represented by different colors.

An infographic of market value of household real estate as compared to the owners equity to

the value of their home and a balance sheet of us household sector

This is a series of color coded charts and graphs depicting that rising real-estate values

have some consumers finances firming up as of data available in 2012.

This is a chart showing different aspects of real estate. It shows the market value of houses

in one graph. It shows a graph of owners equity and a balance sheet. There is also an assets

graph.

The image depicts how rising real estate values have some consumer financial firms feeling

more positive. The real estate markets seems to be, at the very least, stabilizing more so

than it has throughout the last few years.

This is a graphic that is illustrates that the rising real estate values have led to some

consumers finances firming up. It shows the years 1980 to 2010.

The image depicts how the rising real-estate values have some consumer financing firms feeling

better about the market. The markets have increased somewhat and show more stability since

the financial implosion around 2008.

This chart shows the value of residential real estate significantly in the period 1980 - 2010

as the owner's equity in these homes plummeted from over 70% to under 45% in the same time

period. The chart also shows personal balance sheet amounts for the period.