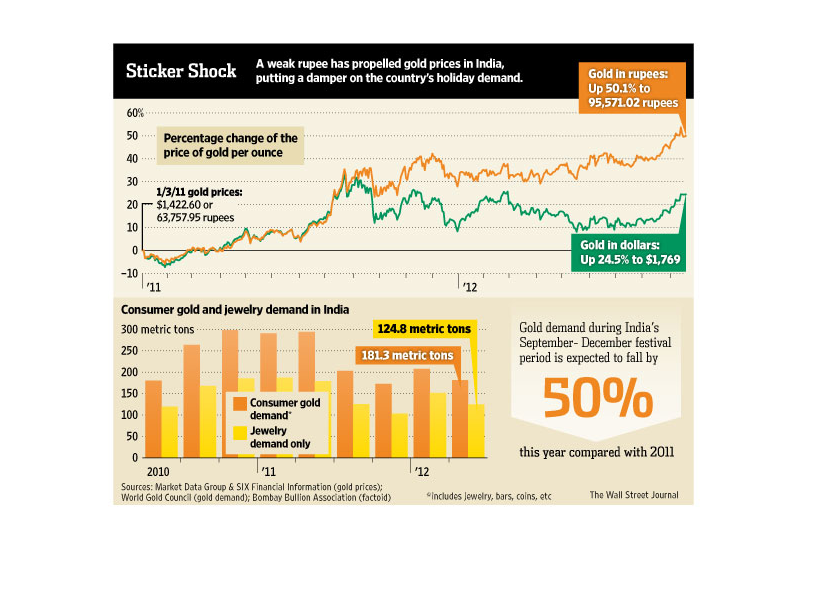

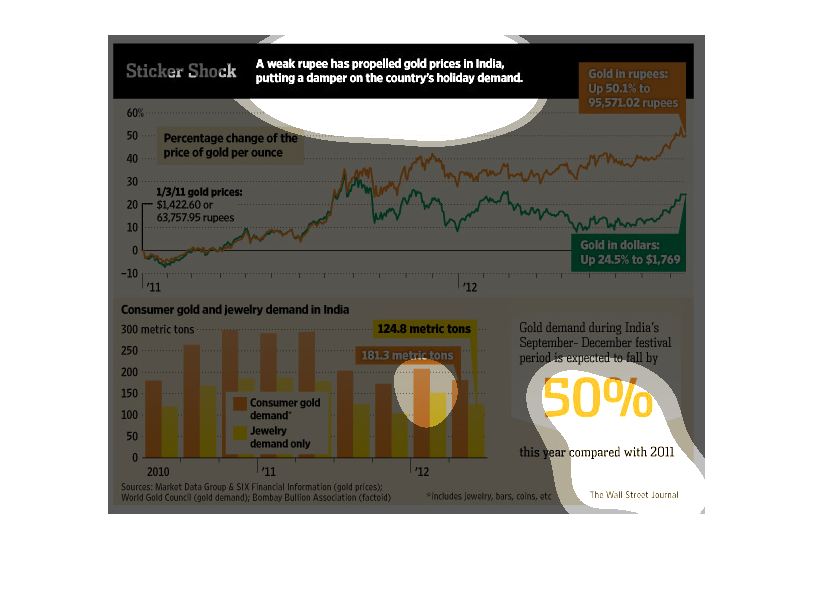

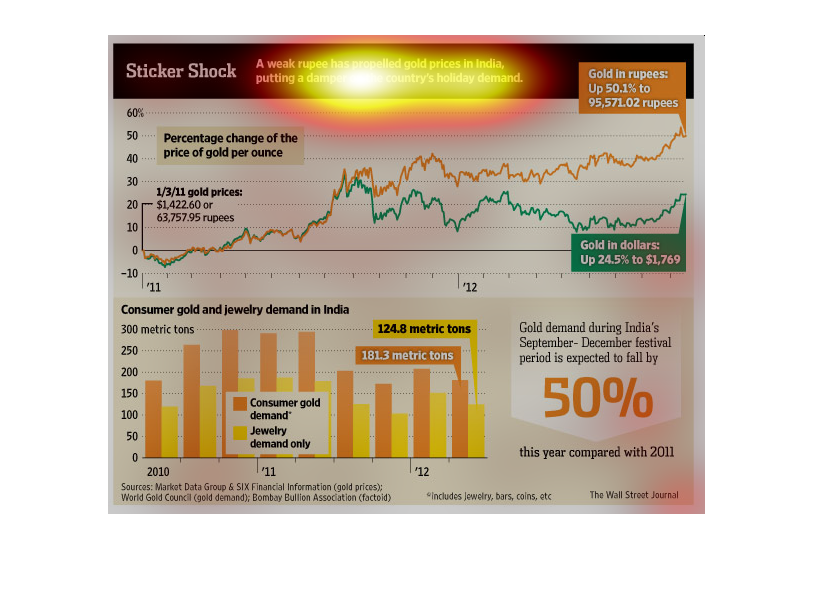

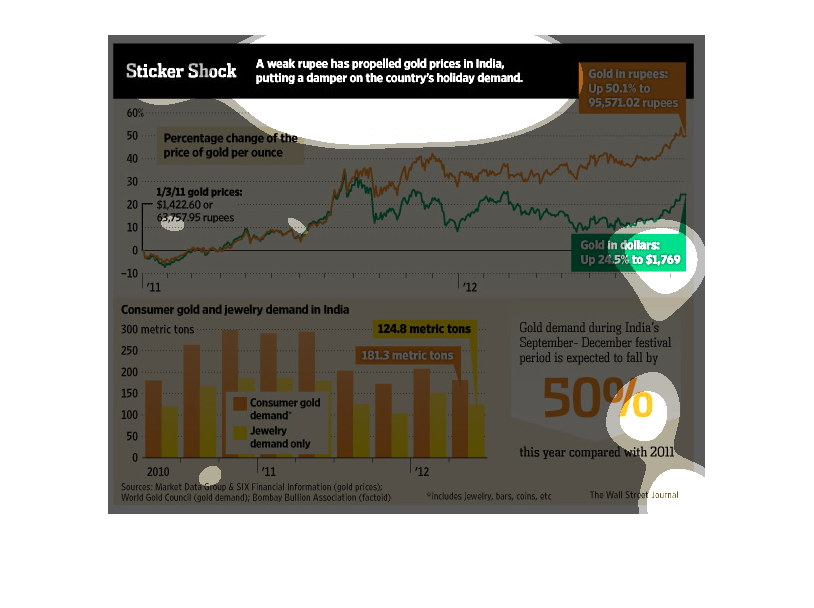

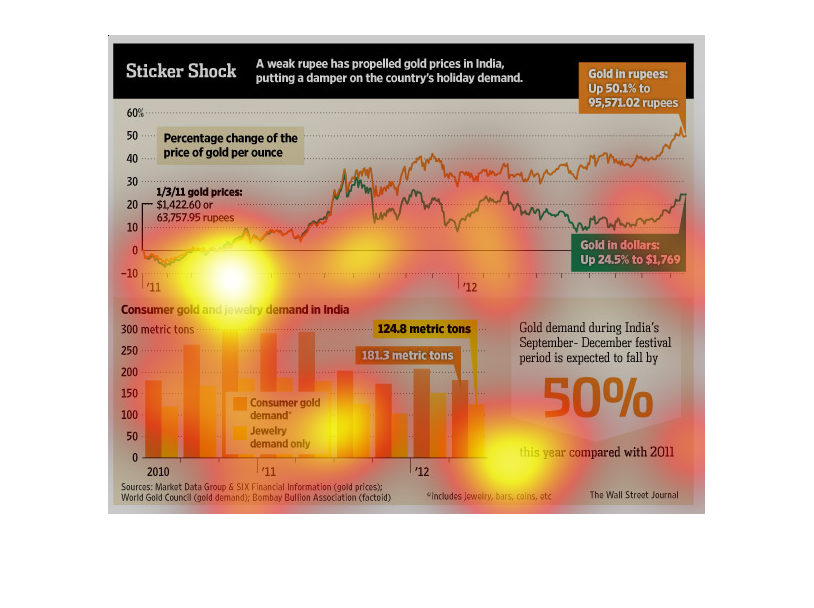

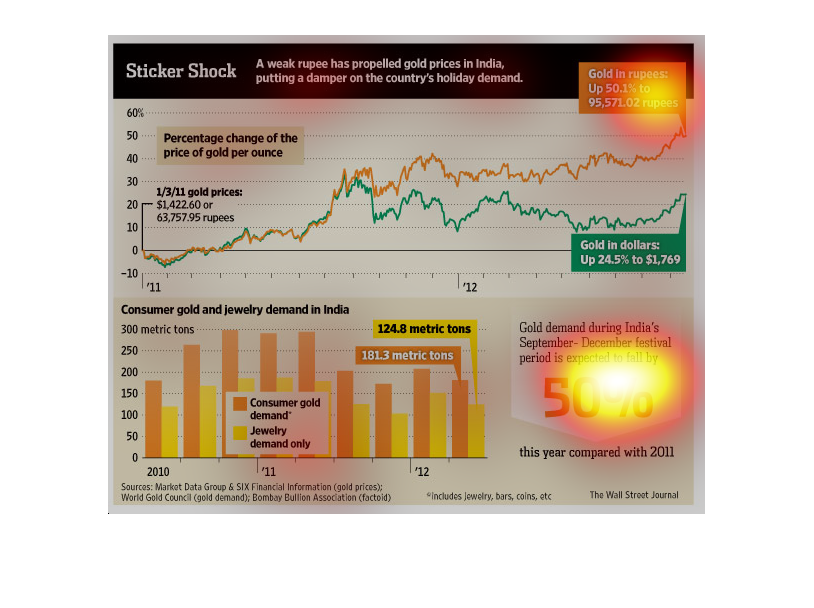

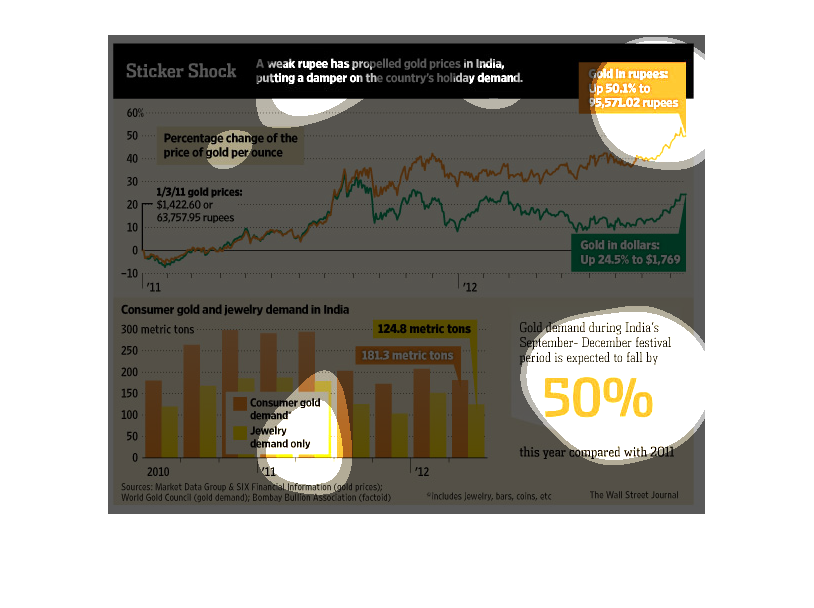

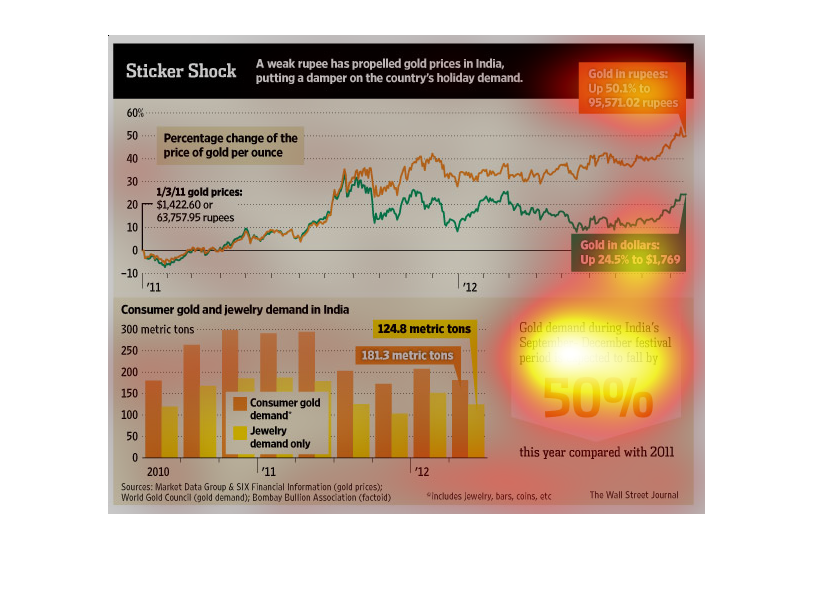

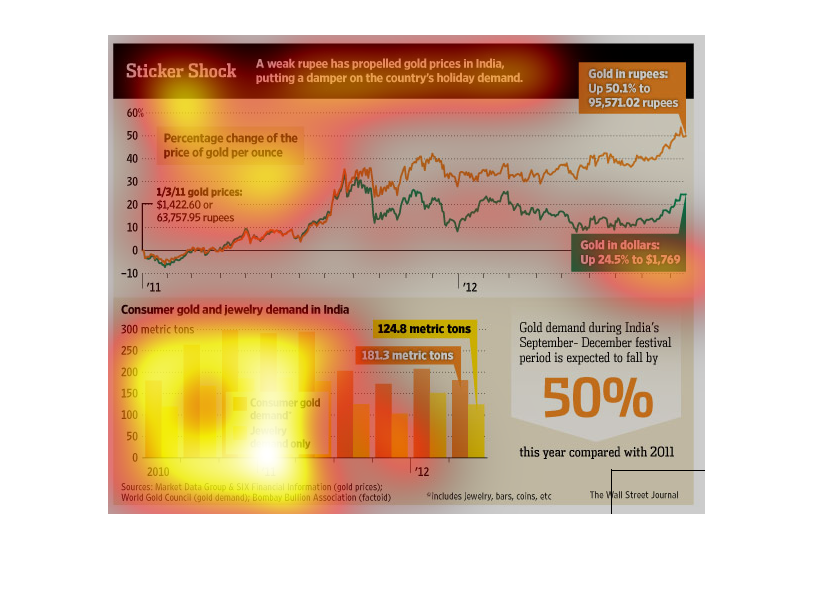

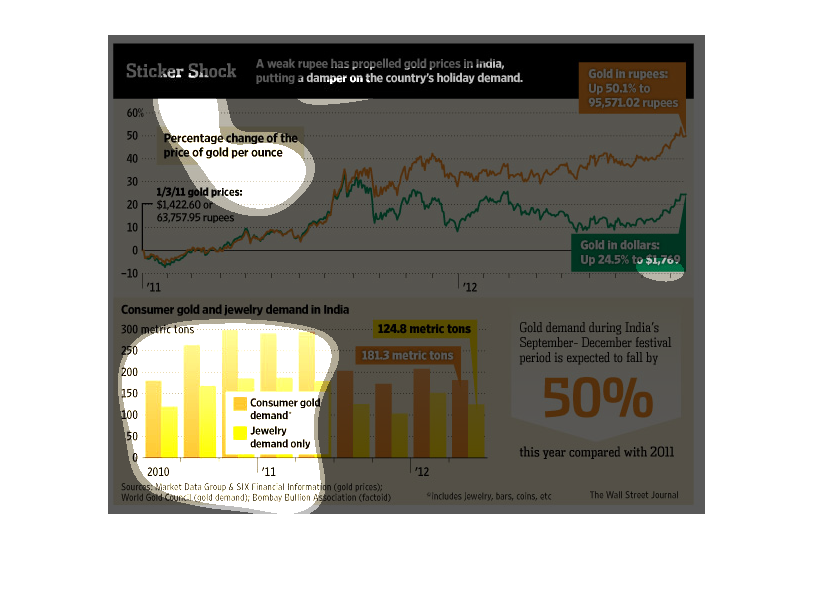

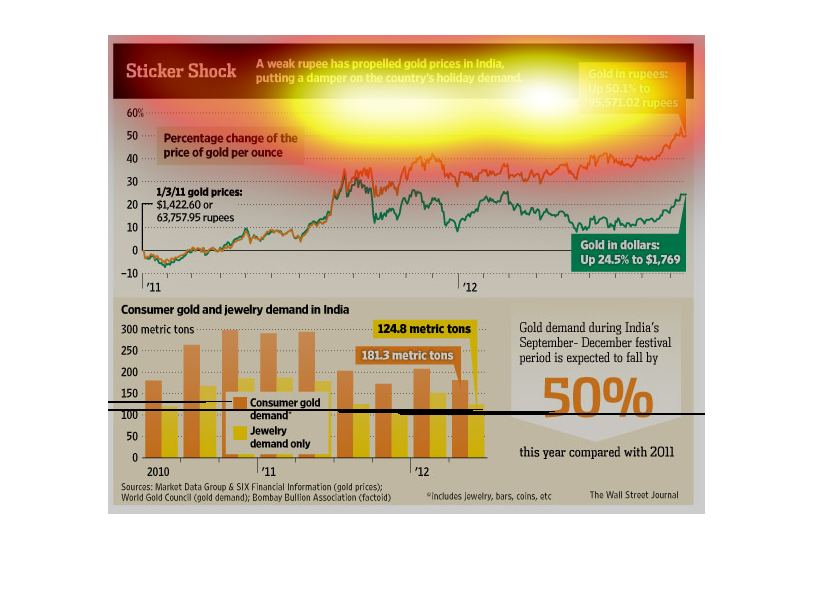

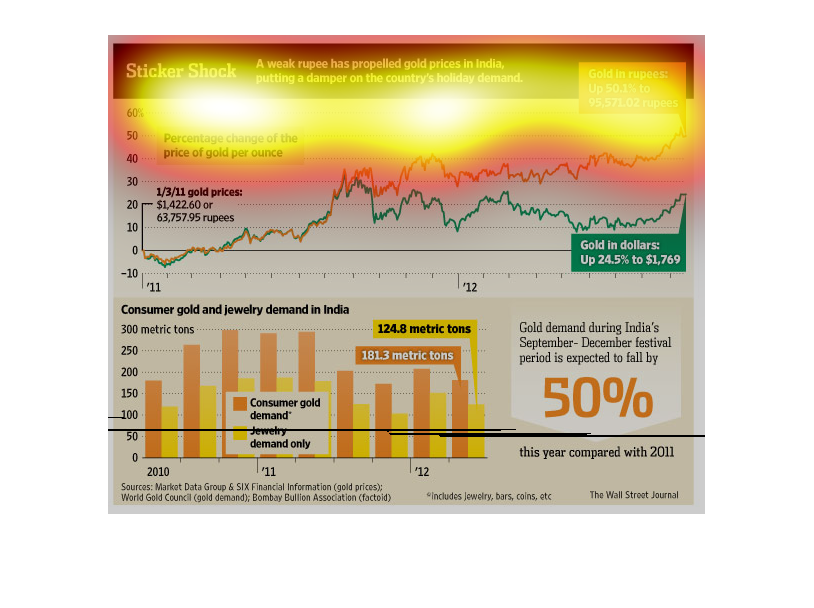

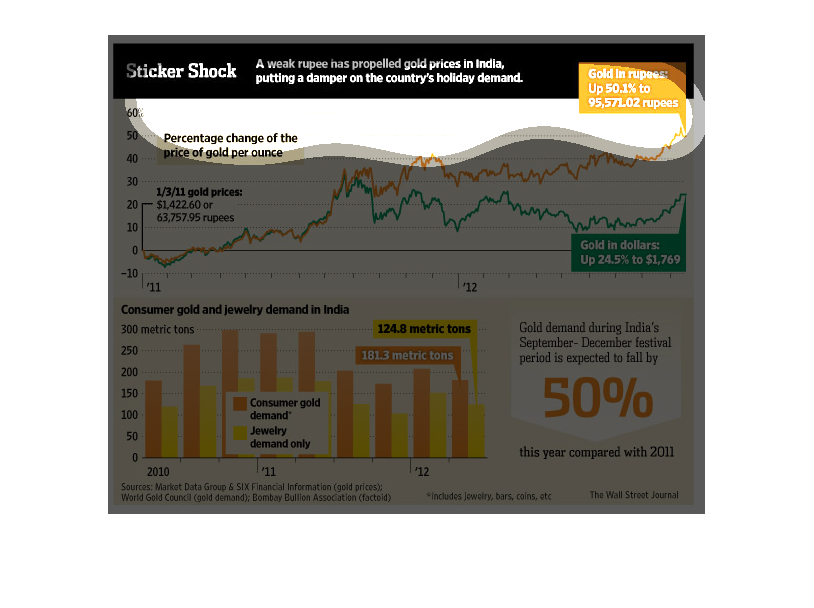

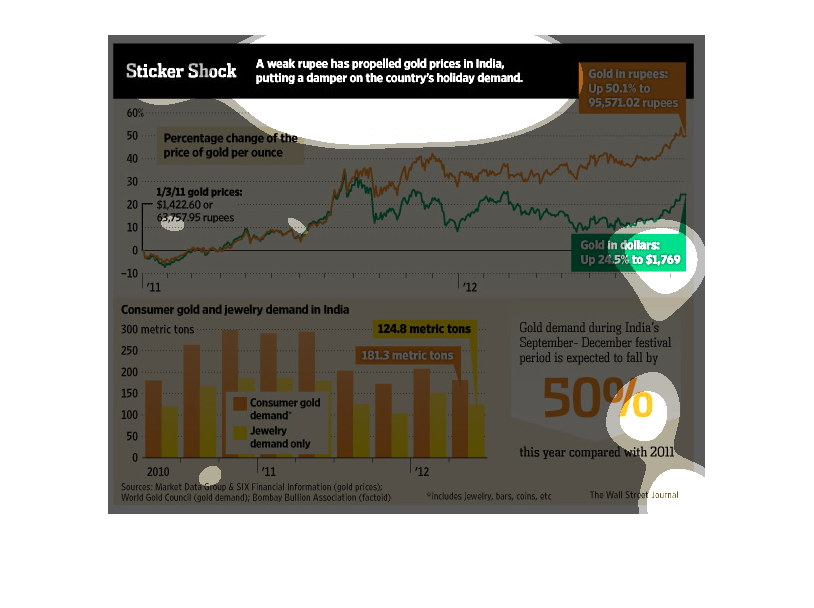

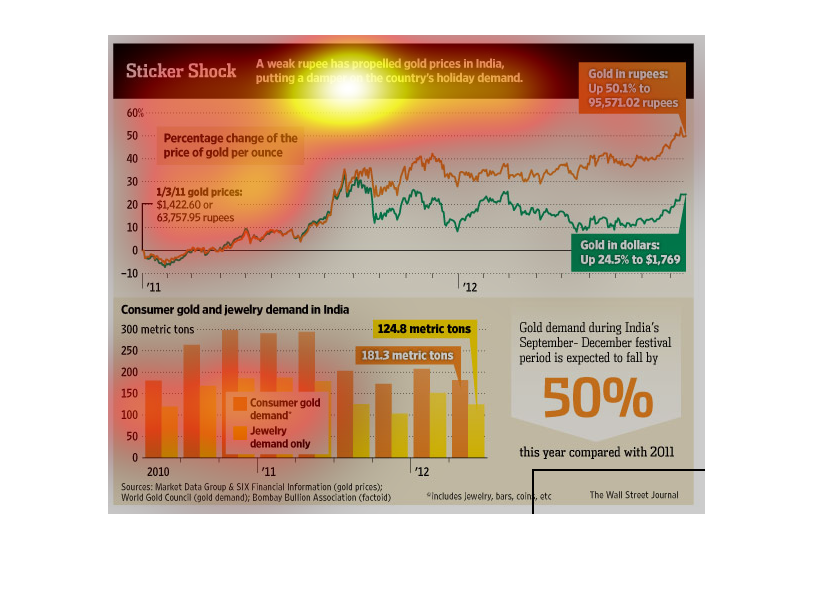

The Indian currency, the Rupee, had decreased in value. The graph shows the relationship

between the decreased value and shopping for things like jewelry.

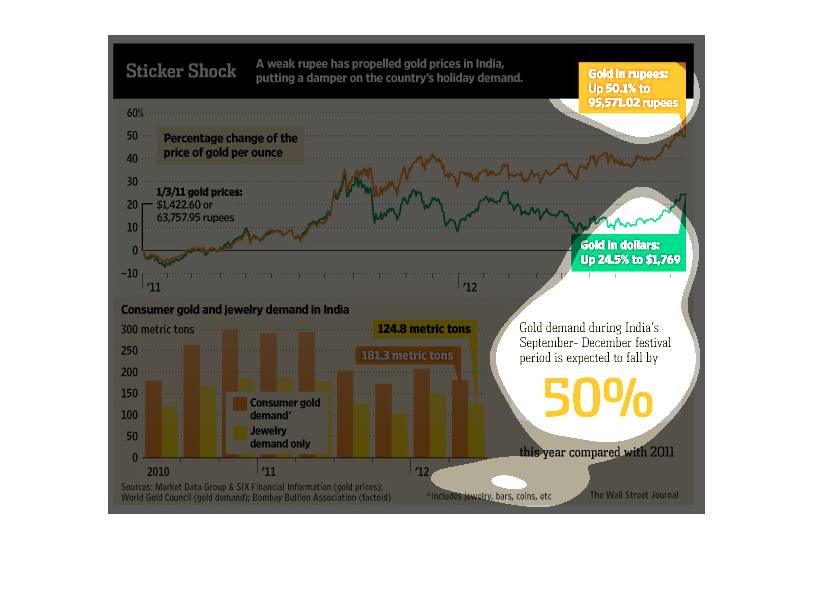

This chart describes sticker shock. Specifically, a weak rupee has propelled gold prices in

the country of India, putting a damper on the country's holiday demand.

This chart describes sticker shock. Specifically, a weak rupee has propelled gold prices in

India, which is putting a damper on the country's holiday demand.

An infographic showing the price of gold relative to the Indian Rupee. The weakness of the

currency has caused surge in gold prices which has reduced holiday demand.

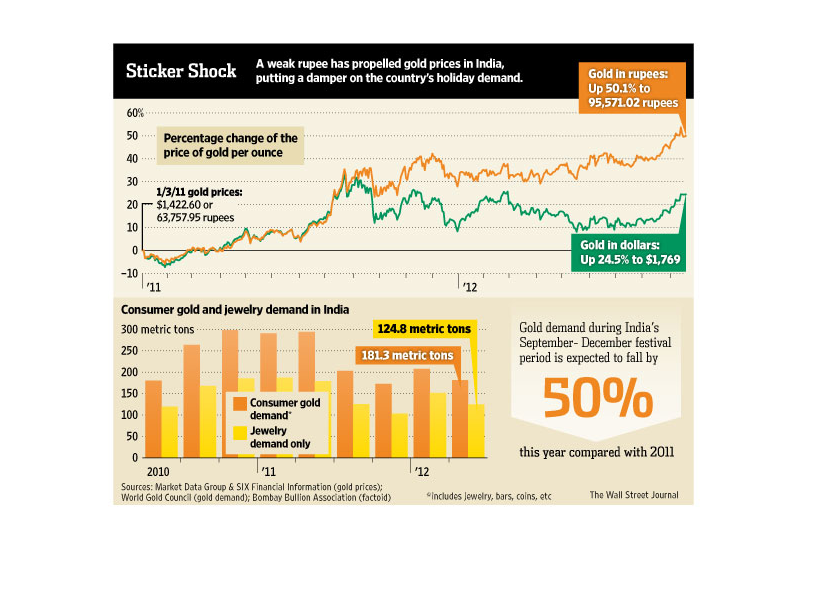

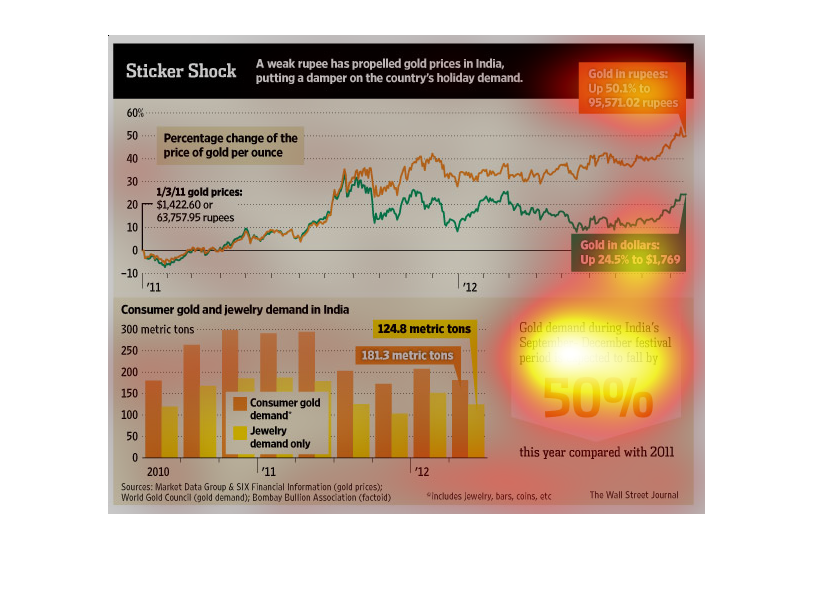

In this study conducted by the Wall Street Journal we see that the Rupee is weak and because

of it the prices of gold are rocketing sky high. The graph goes into great detail of that

process.

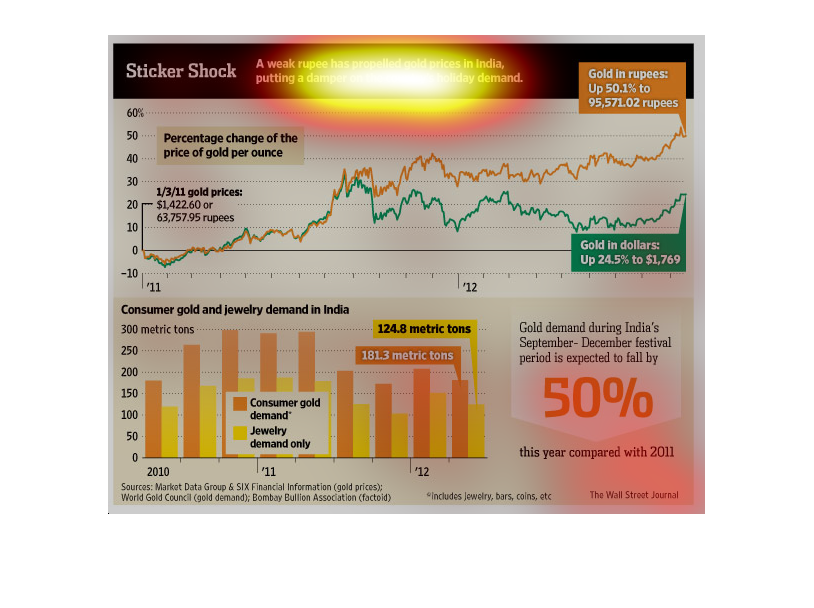

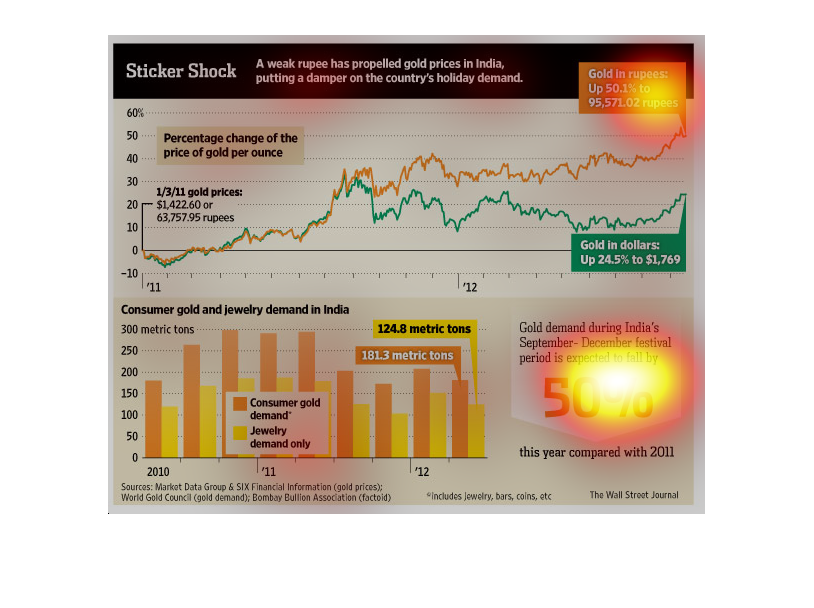

Graph of the Gold futures markets priced in dollars and rupees. Another bar chart describing

the demand for Gold and Jewelry along with the tonnage of weight produced in India.

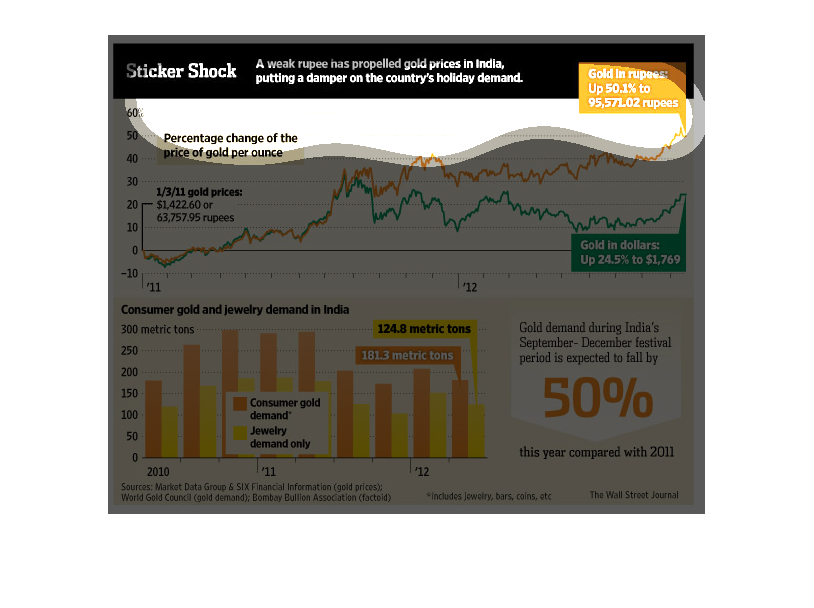

Percentage change of the price of gold per ounce is the title of the first graph. It is a

line graph, with a green line representing gold in dollars, and an orange one that says gold

in rupees. Below it is another graph titled Consumer Gold and Jewelry Demand in India, it's

an orange and gold bar graph with orange being the consumer gold demanded and gold being the

jewelry demand.

The image depicts how a weak rupee has propelled gold in India, putting a damper on the country's

holiday demand. Gold in rupees is up to 50.1%. Gold is expected to fall 50% during India's

September-December festival.

The weak rupee has impacted gold prices in India, which is affecting the consumer gold and

jewelry demand. Based on the charts the price of gold has increased about 20%.

This chart compares rising gold prices in India to demand for gold during the holiday season.

Gold prices have increased 50.1% in Rupees and 24% in US dollars. Demand is expected to drop

by 50%.

This chart describes golds worth in rupees, an Indian currency. The worth was project to go

down by nearly 50%. As the chart shows, there was a drastic decrease in gold worth, in India.

This is a chart about the change in gold price in India. There is a graph depicting the demand

from consumers on a gold and that will have an effect on the price of gold and how much is

available to get.

This chart shows how a weak rupee in India is propelling gold prices, which is sequentially

putting a damper on the countries holiday demand. There is a far higher consumer gold demand

than a jewelry gold demand because of the weak rupee.

With the fall of the price of the rupee, gold prices in India have plummeted. These falling

prices have a direct affect on the upcoming festival during the September to December timeframe.

Consumers will want to buy more, but the funds may not be available to purchase.