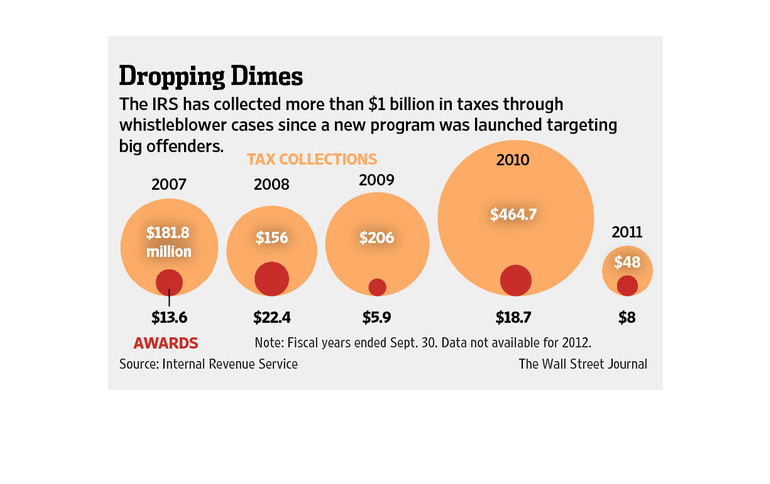

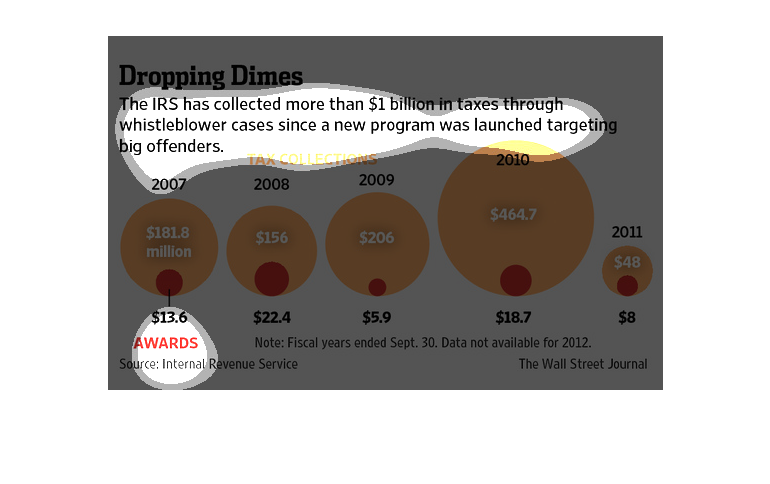

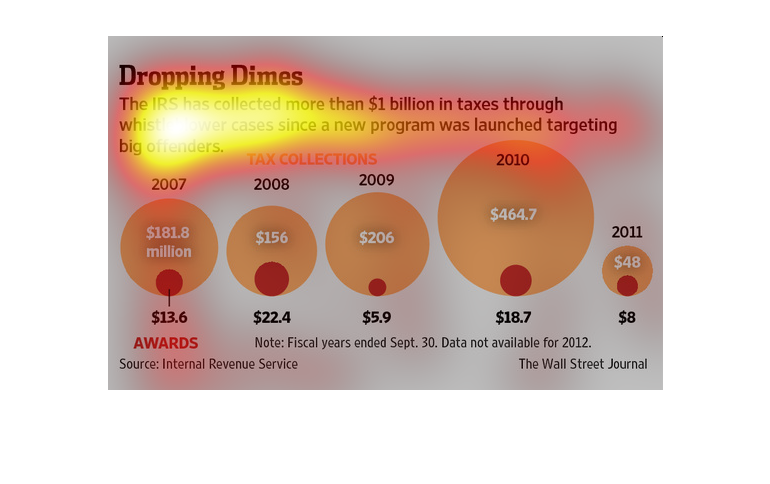

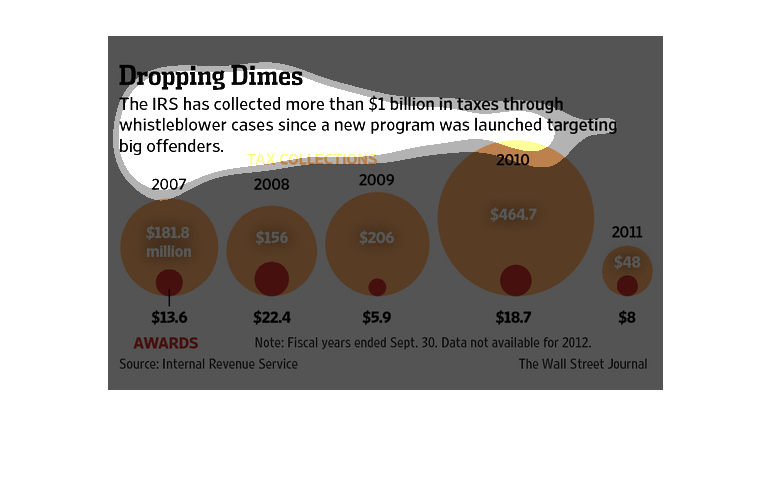

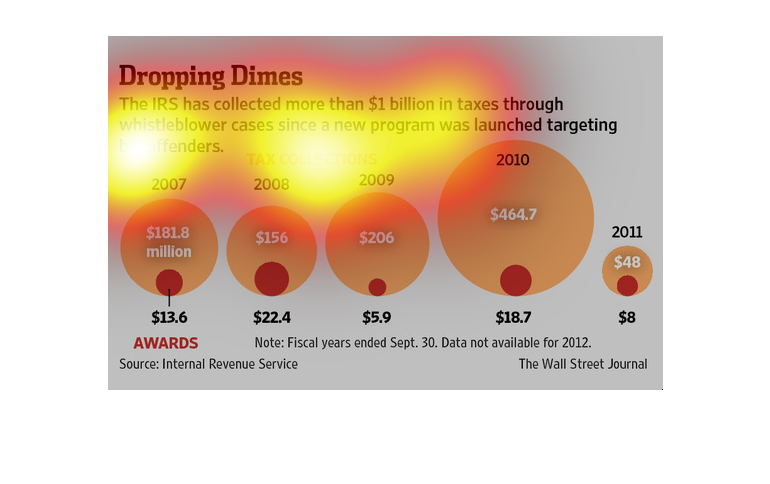

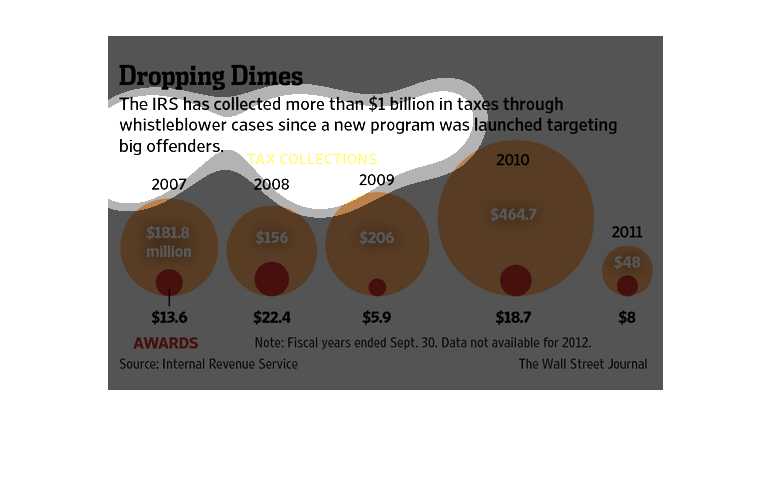

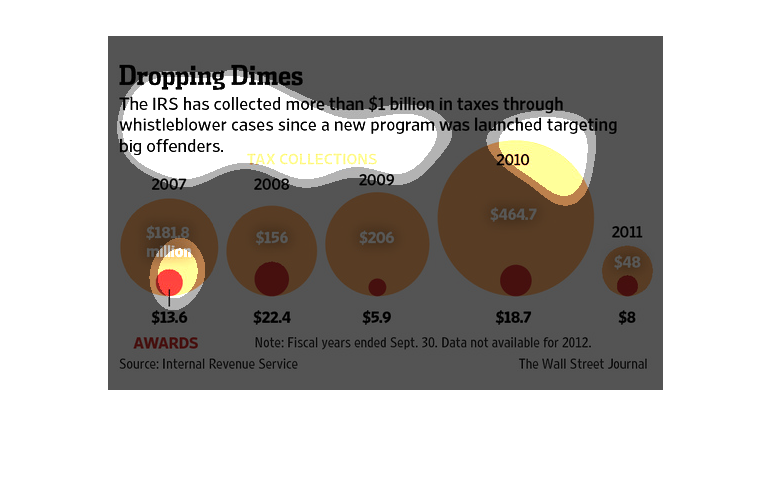

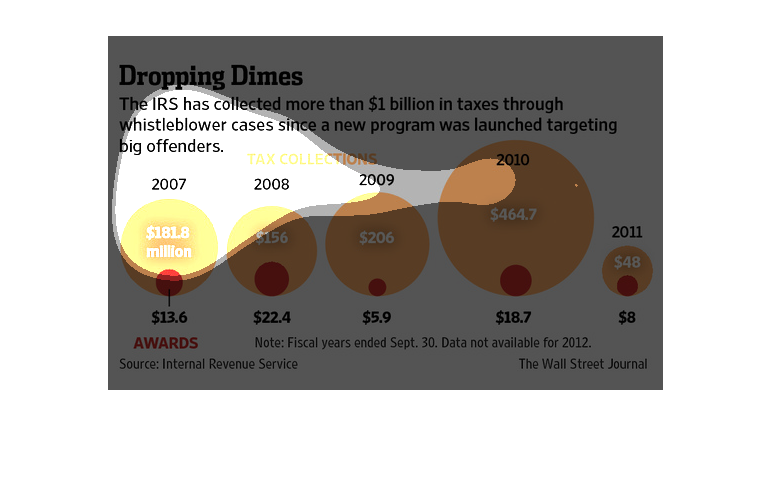

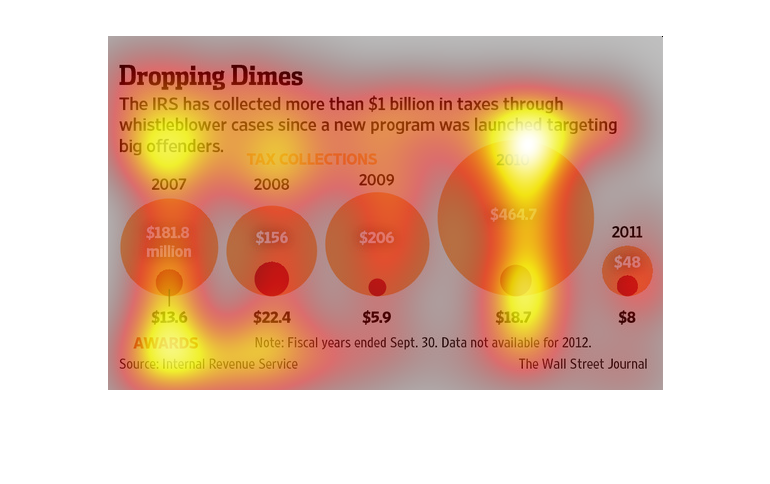

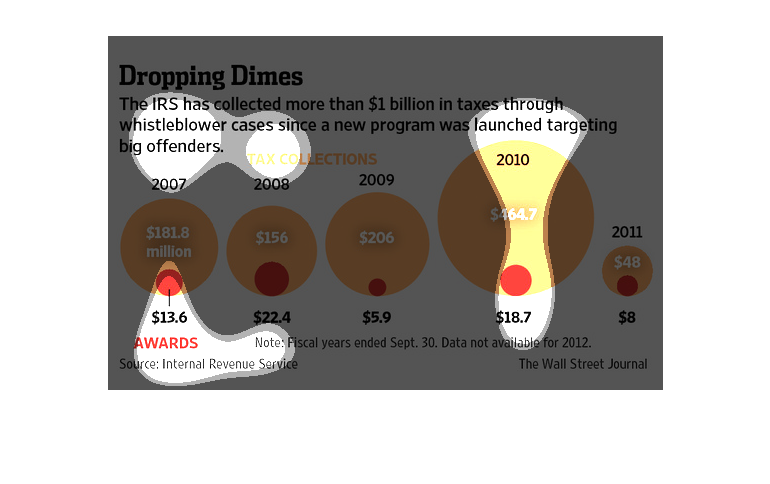

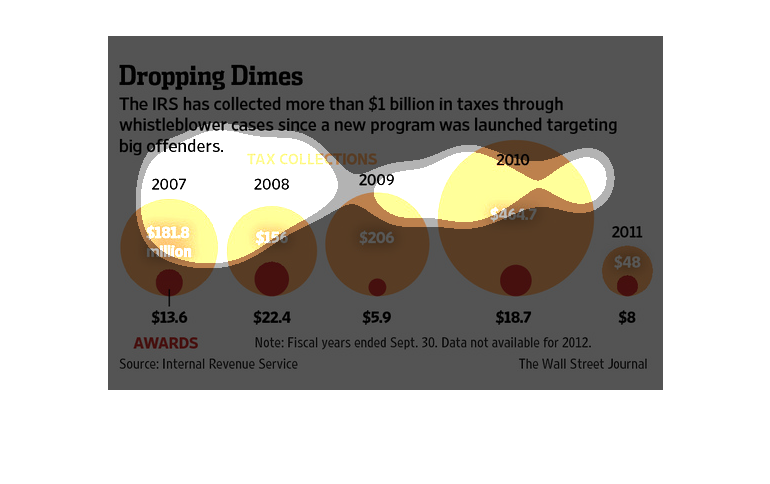

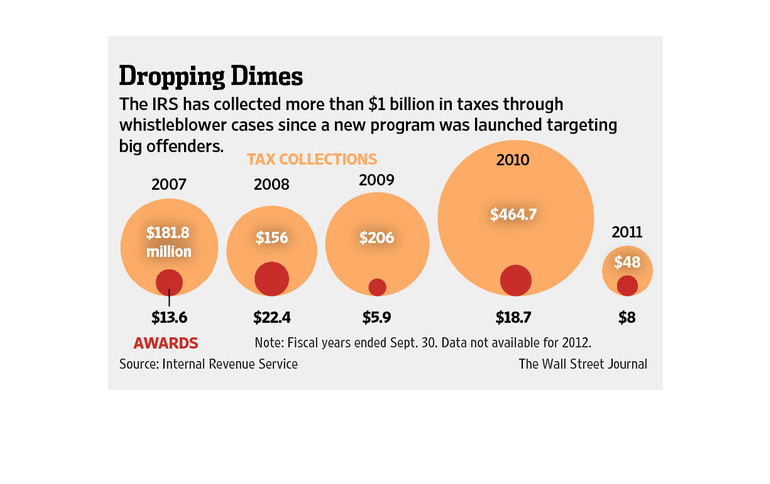

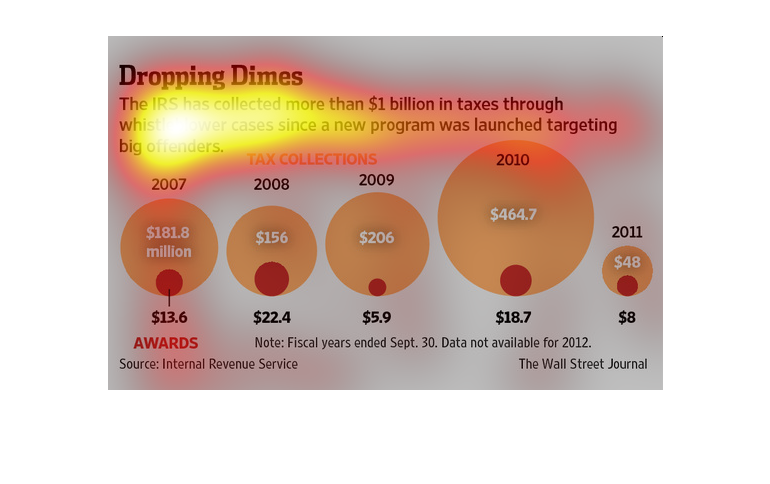

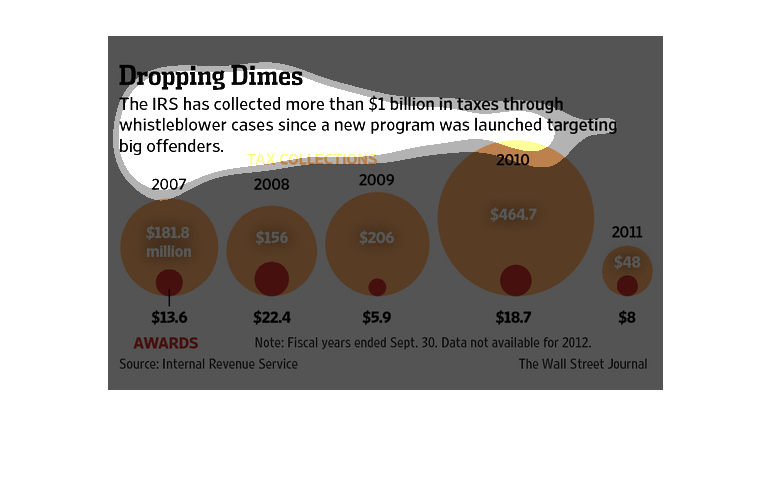

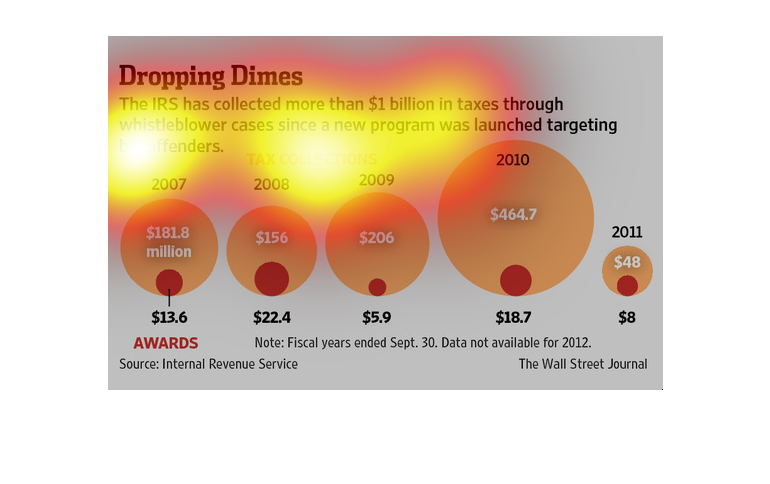

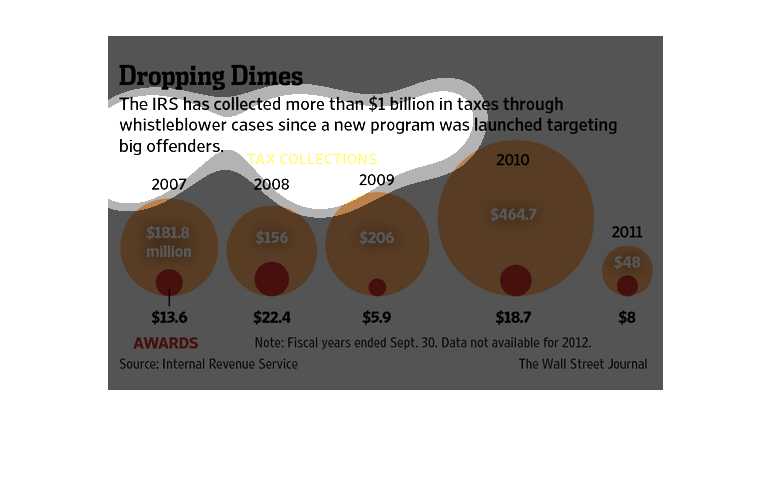

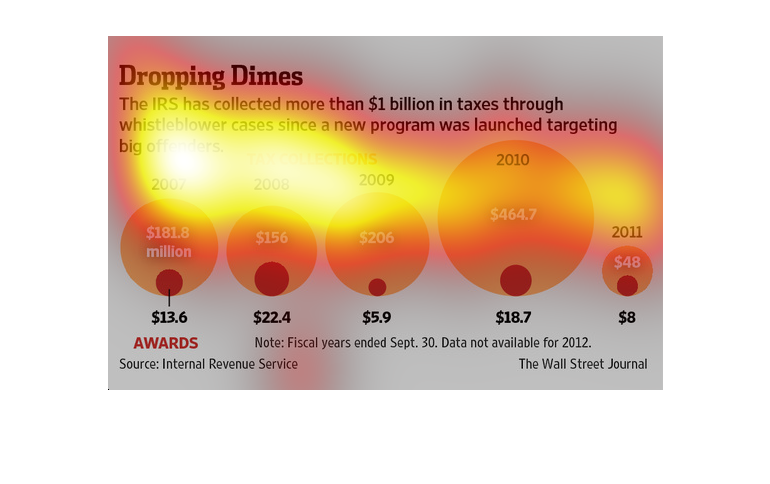

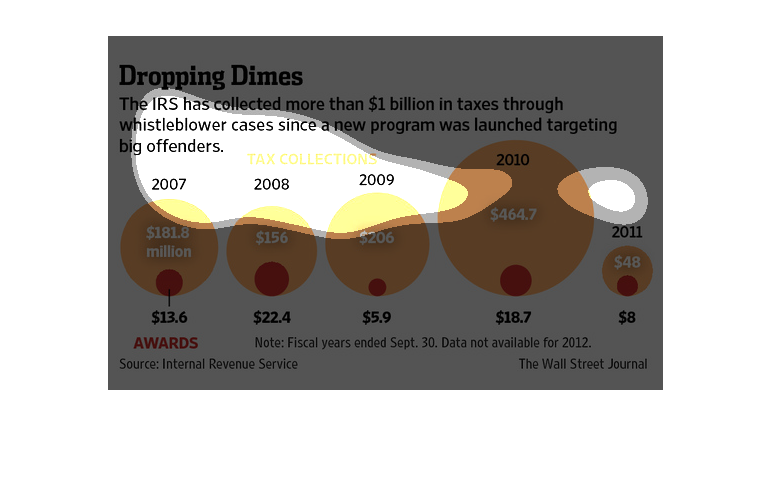

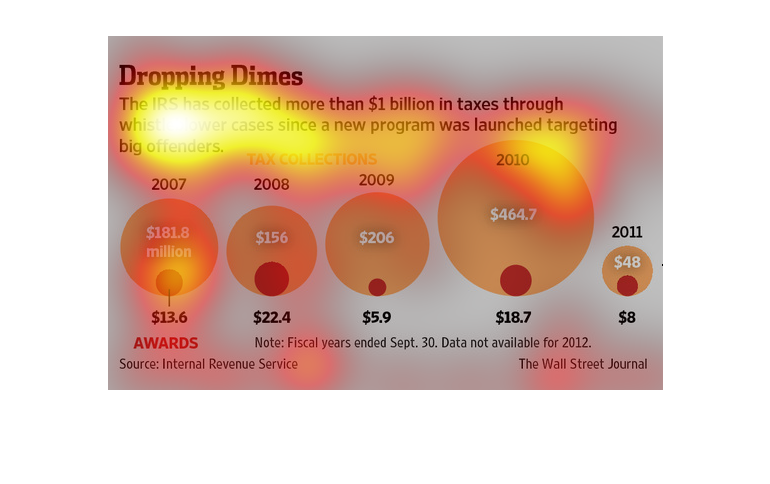

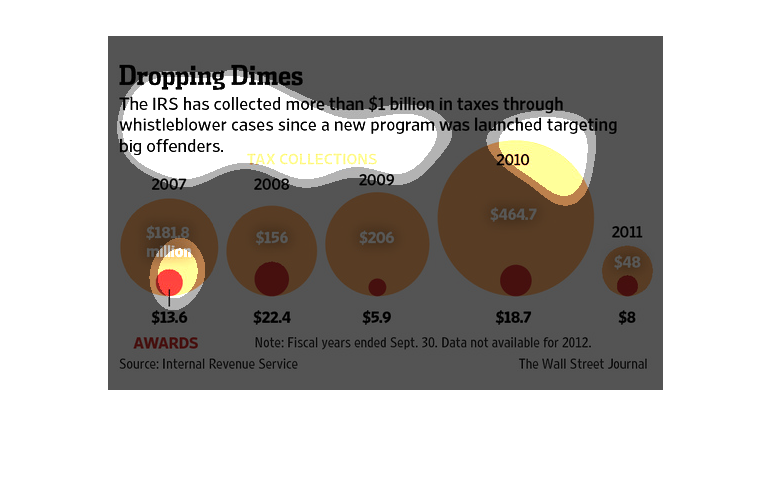

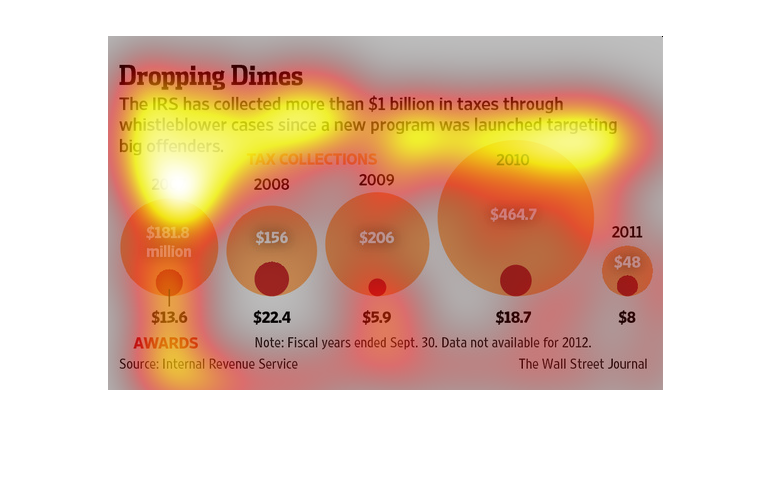

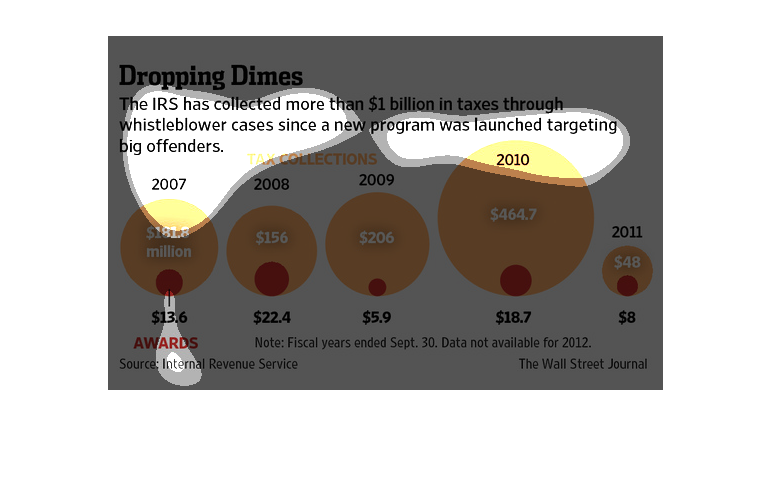

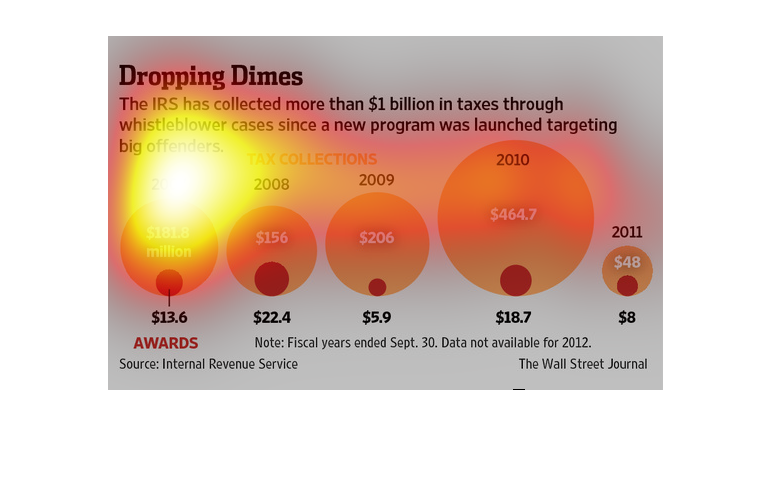

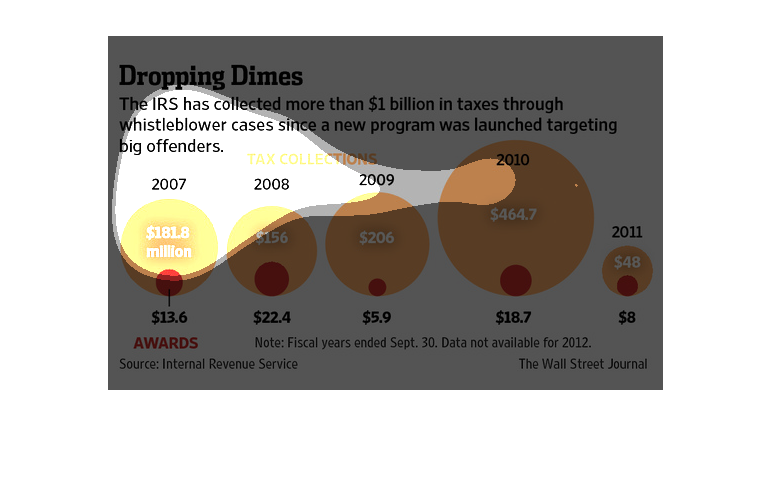

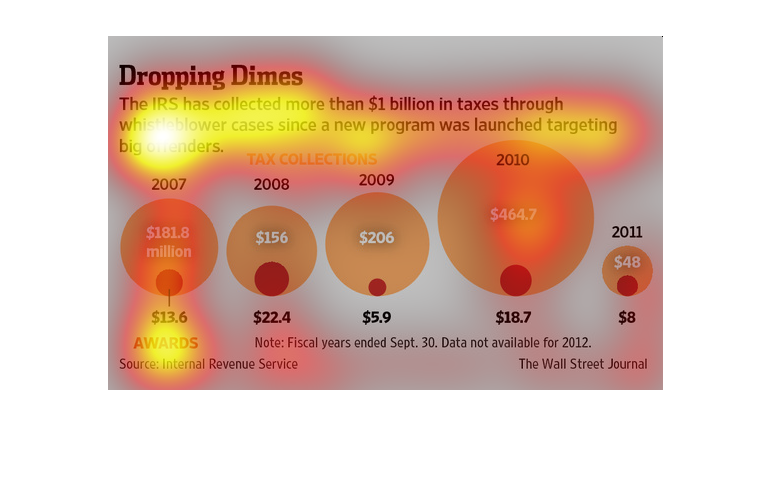

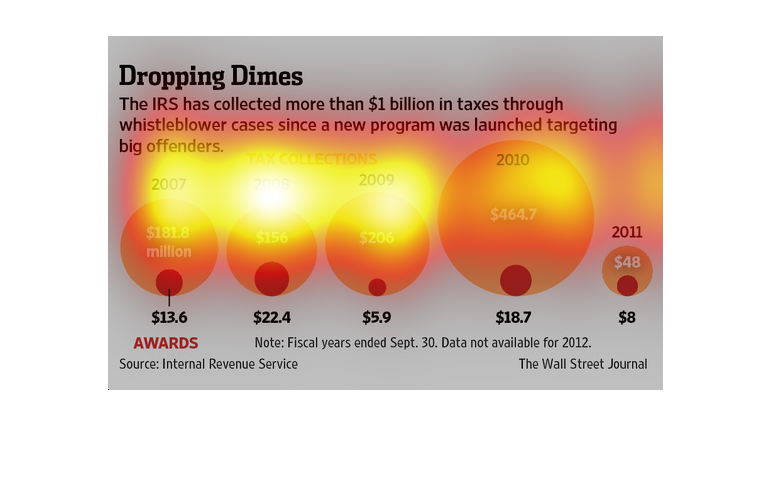

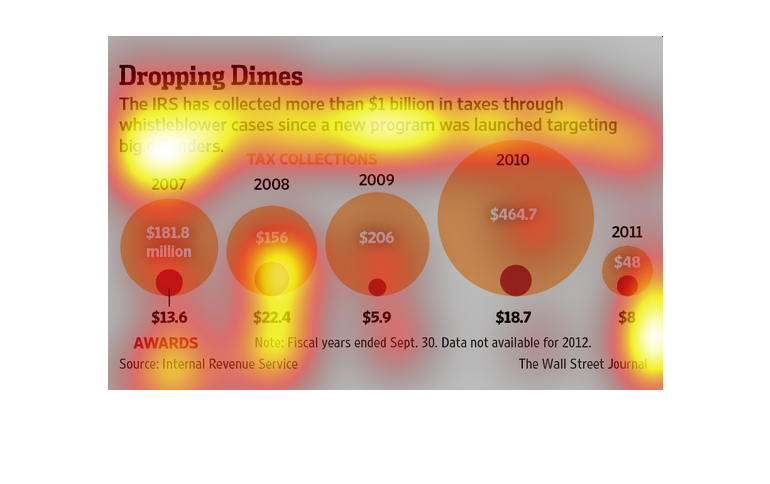

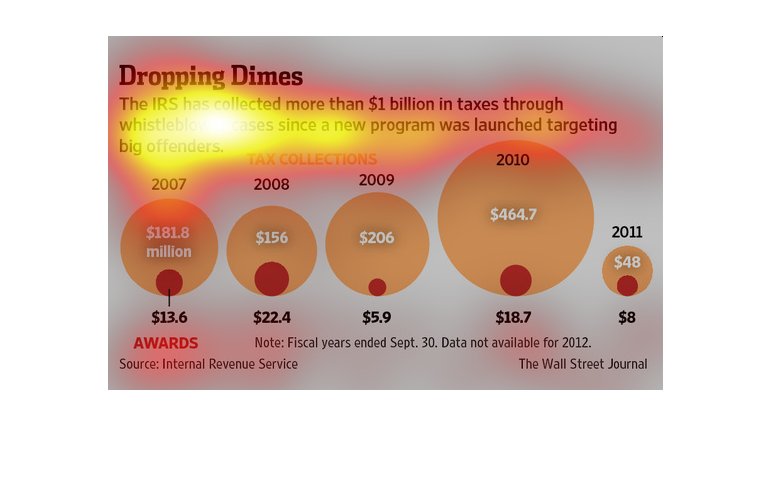

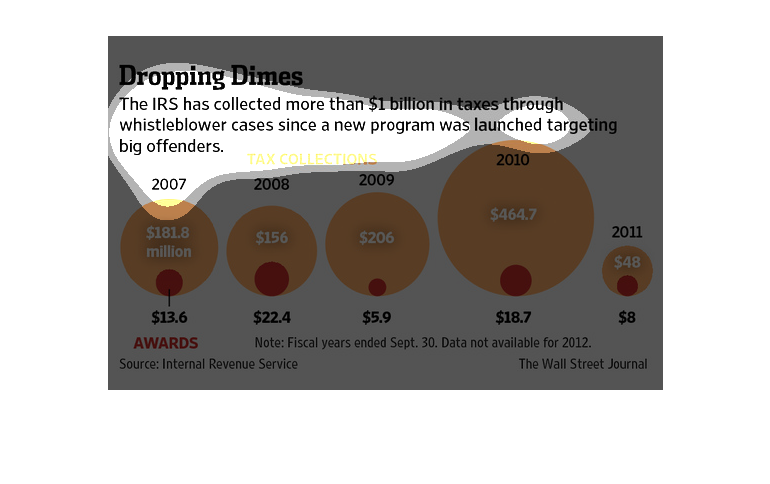

The illustration describes how the IRS has gotten lot of money from tax offenders, with its

reporting system. Its fund increased from $13.6 in 2007 to $18.7 through 2010. But, in 2011

there is a decline to $8.

The following chart shows how the United States collected over 1 Billion dollars in Taxes

since the establishment of their whistle Blowing Program which began in 2007.

The graph on my left is titled "Dropping Dimes." And how the IRS has been taking out money

that was owed or wasn't owed by the tax payers and other people

This chart describes dropping dimes. Specifically, the IRS has collected more than a billion

in taxes through whistle blower cases a new program was launched.

This pictorial graph shows that the IRS has collected more than $1 billion in taxes through

whistleblower cases since a new program was launched targeting offenders around 2007. In 2007

the IRS collected 181.8 million, 206 million in 2009 and 464.7 million in 2010.

The chart shows revenue collected by the IRS due to whistle blowers catching large tax evaders.

From 2007 through 2010 the revenue collected increased steadily but dropped in 2011.

This chart describes dropping dimes. Specifically, the IRS has collected more than one billion

in taxes through whistle-blower cases since a new program was launched targeting big offenders.

This is describing how the IRS is collecting more money in taxes since a new program was launched

that targets big offenders. In 2007 $181.8 million was collected in taxes, and increased to

$464.7 million by 2010.

This chart illustrates how the IR Shas collected over a billion dollars from whistleblower

calls by implementing new programs launched to target big offenders.

This is a series of color coded charts depicting that the IRS has collected more the one billion

dollars in taxes through whistleblower cases since a new program was launched.

More than a billion dollars in back taxes has been collected by the IRS since launch of a

whistleblower program in 2007. The whistleblowers receive about 10% of the taxes recovered

as a reward.

The image depicts how the IRS has collected more than 1 billion dollars in taxes through whistleblower

cases by way of a new program which targets big offenders. The program appears to be a success

for the government.

This chart/graph shows that the IRS are getting a lot of money off people. It states nearly

1 billion had been collected by the IRS from whistleblower cases.

IRS has collected more than one billion dollar in taxes thorugh wistleblower cases since they

start targeting big cases. the graph shows the increase in tax collection

This is a graphic depicting how IRS tax collections have changed over time, since they implemented

a program targeting big tax offenders. It appears that collections have increased and then

decreased.