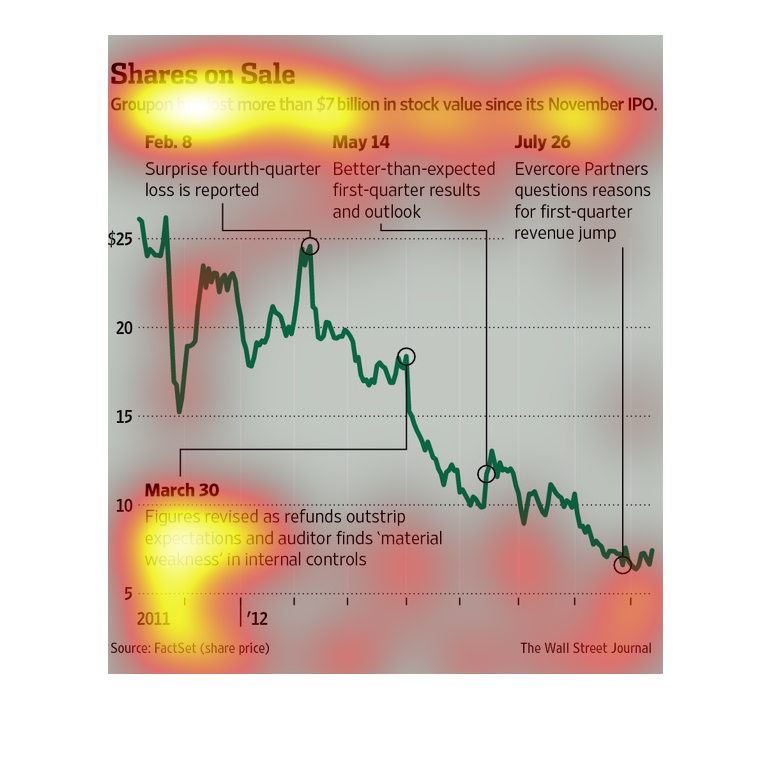

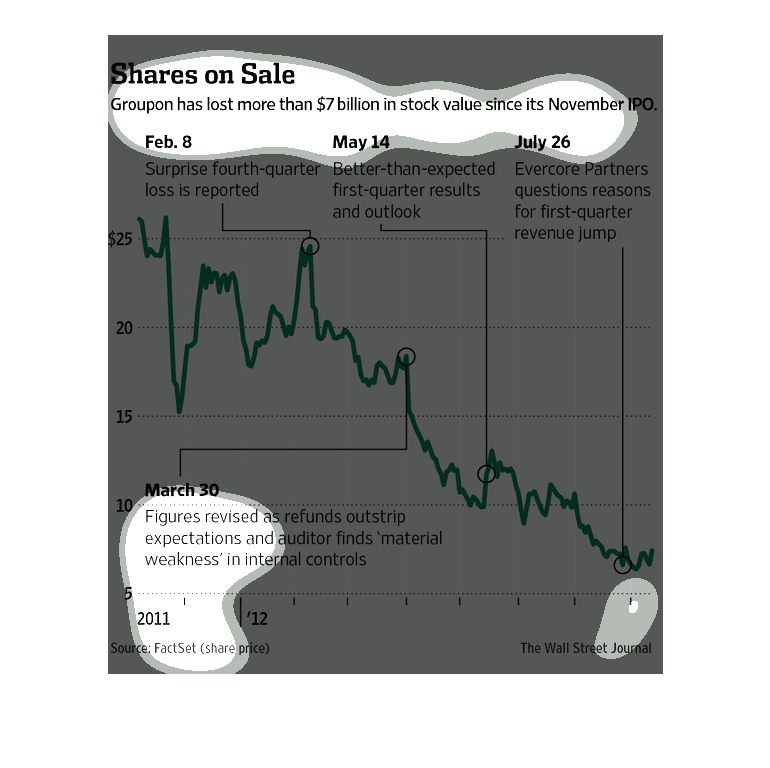

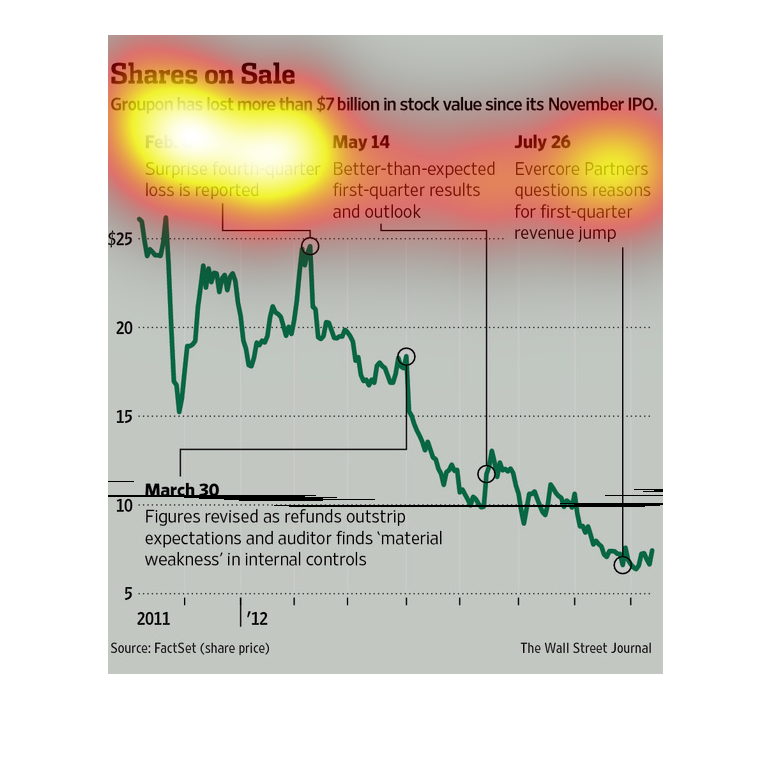

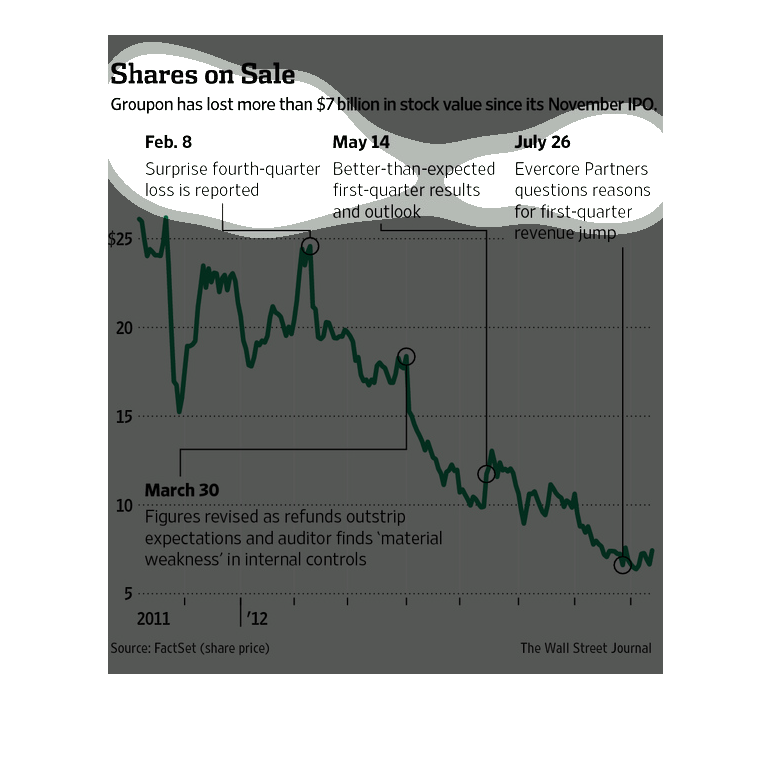

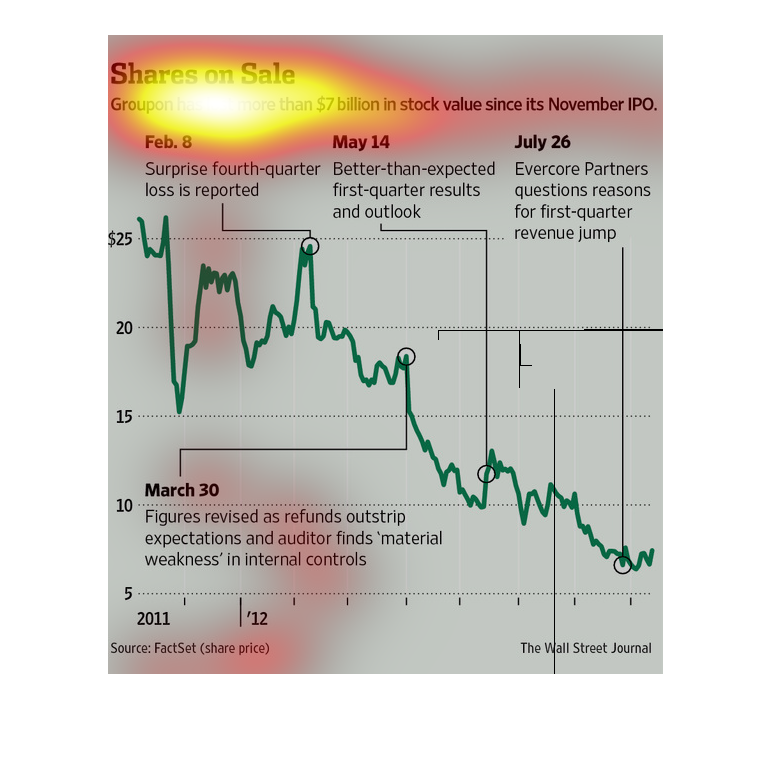

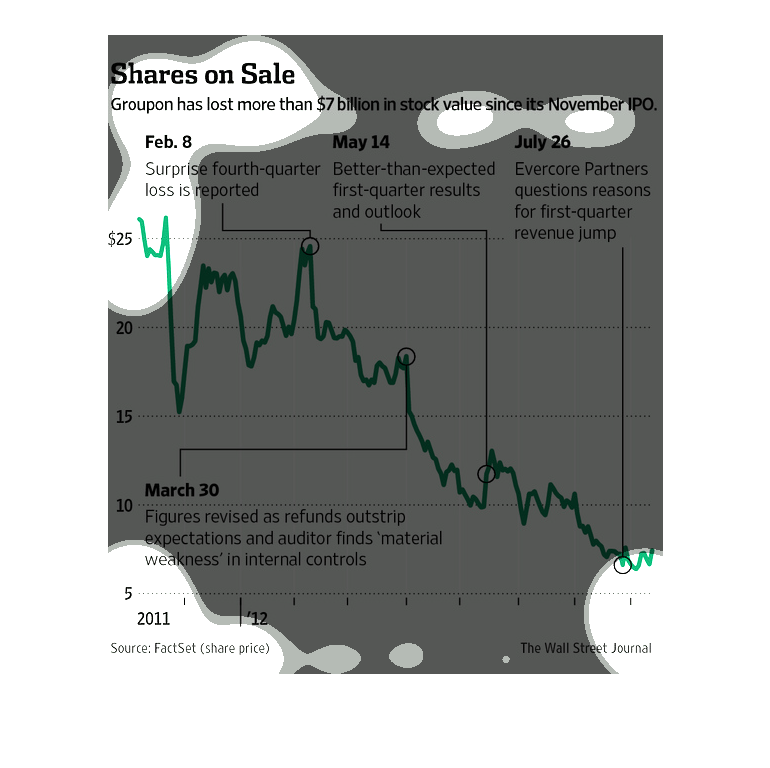

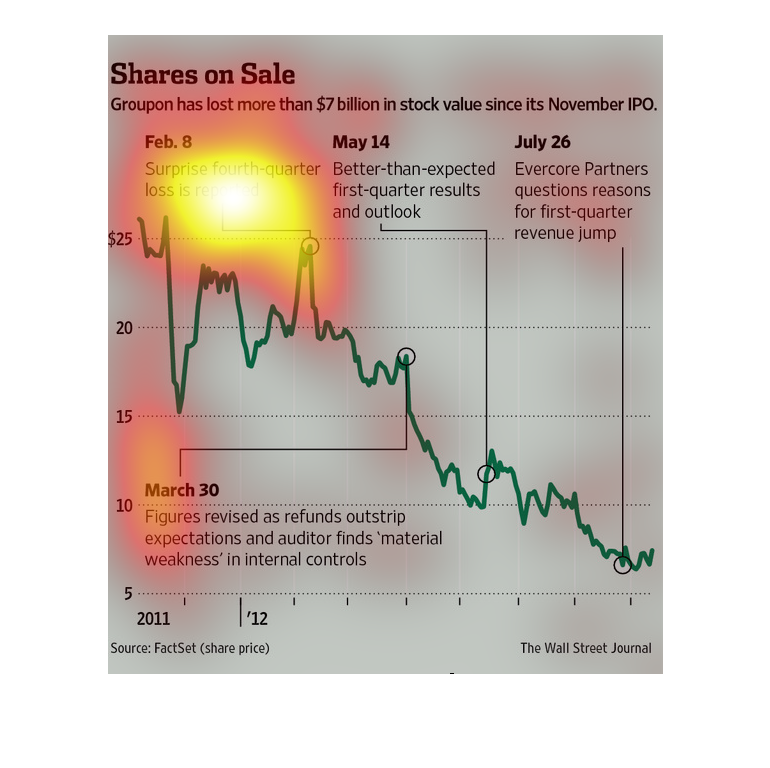

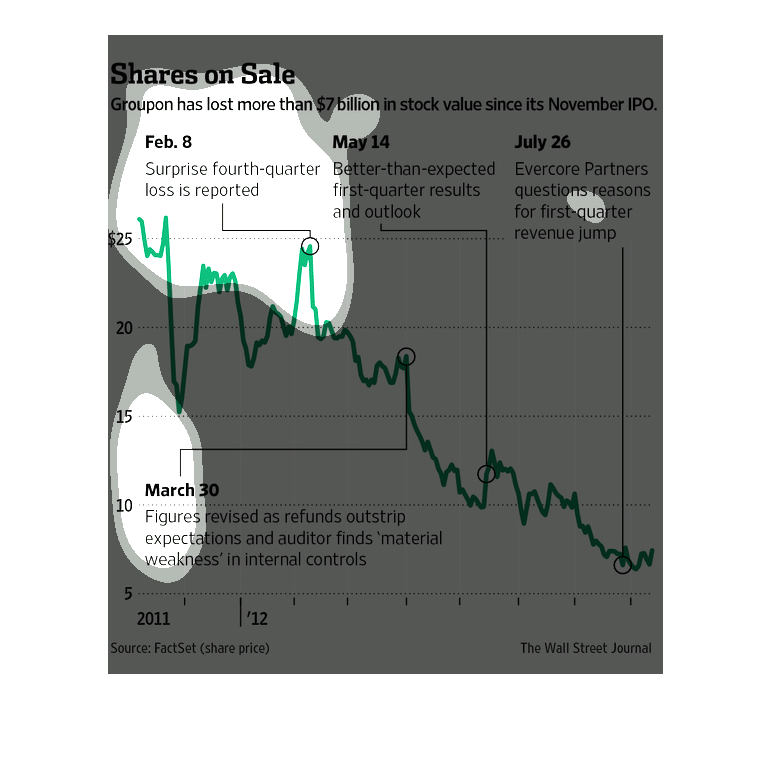

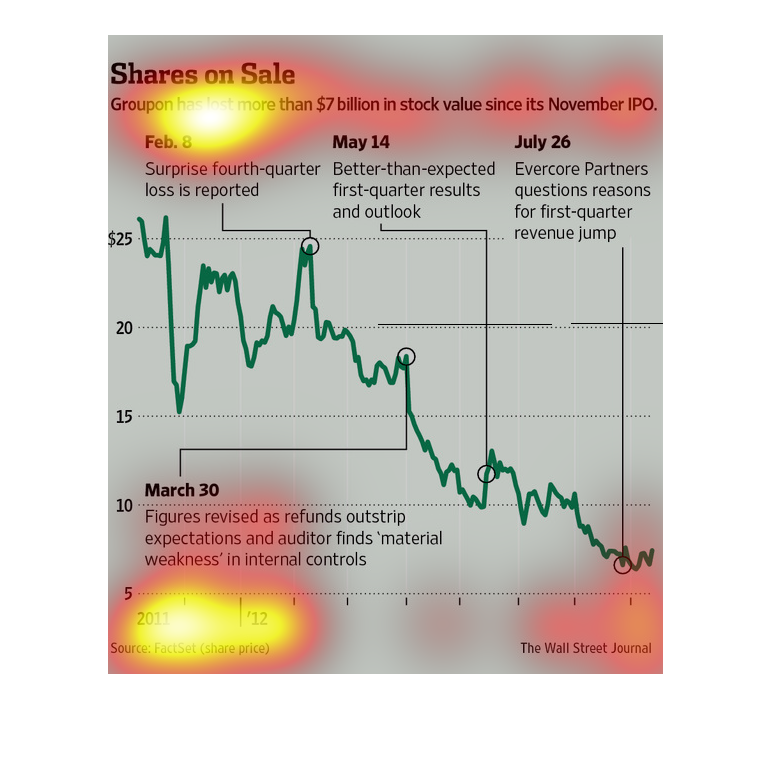

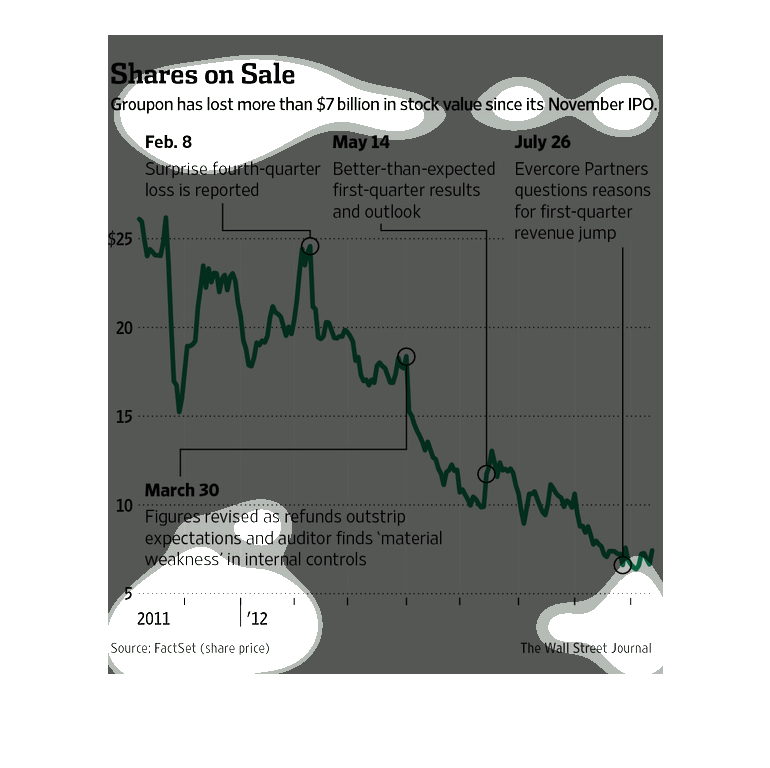

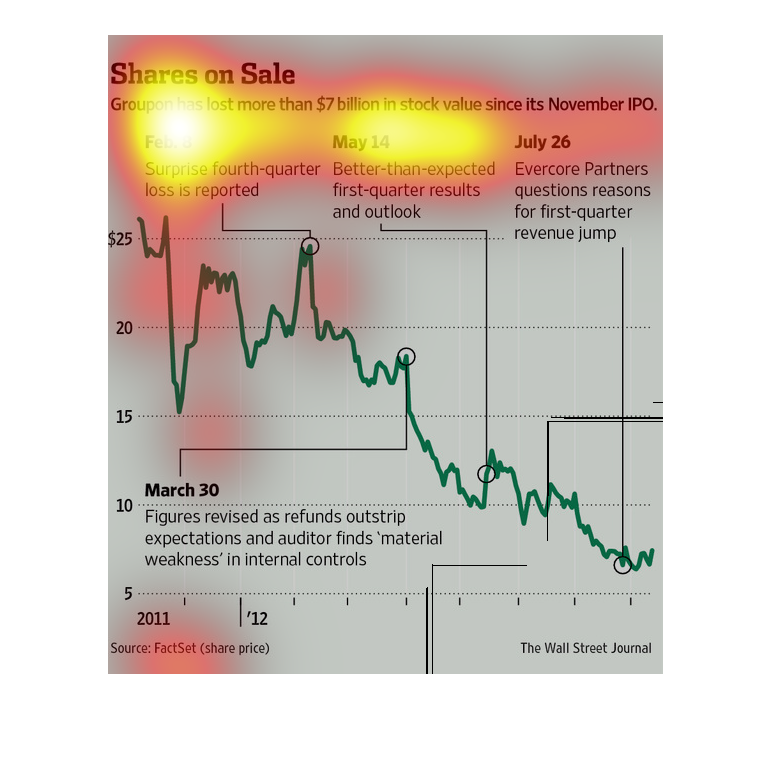

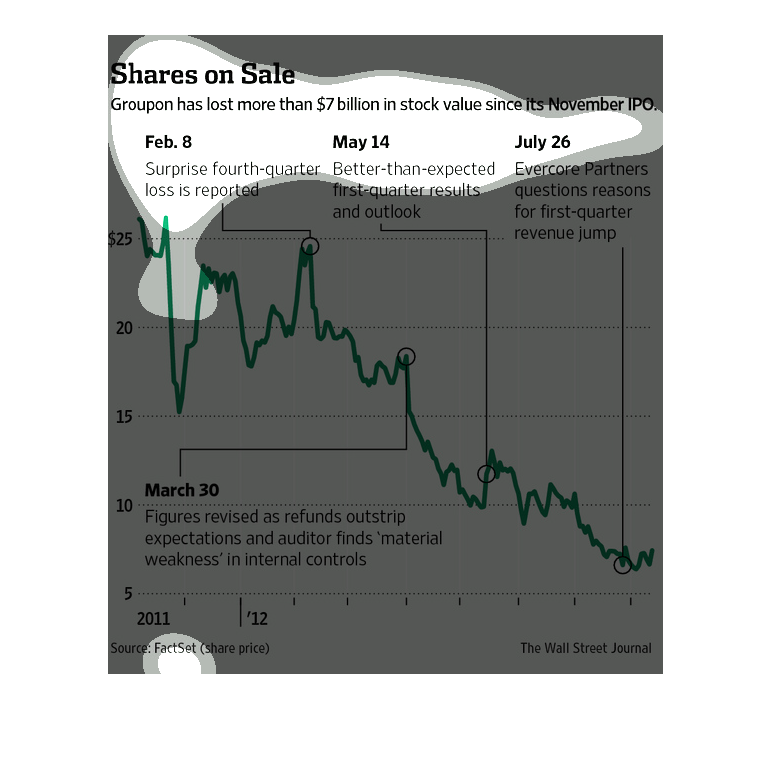

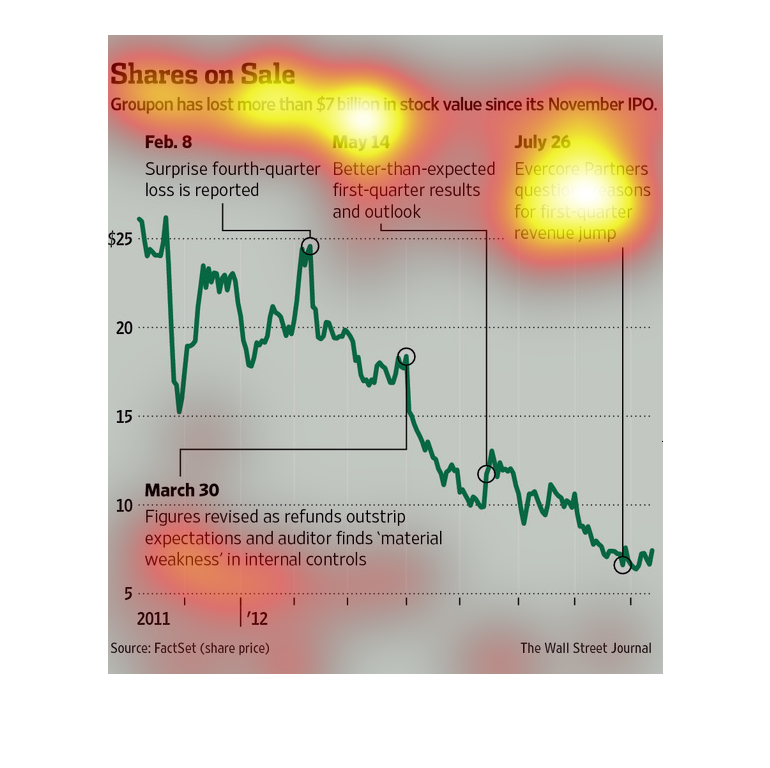

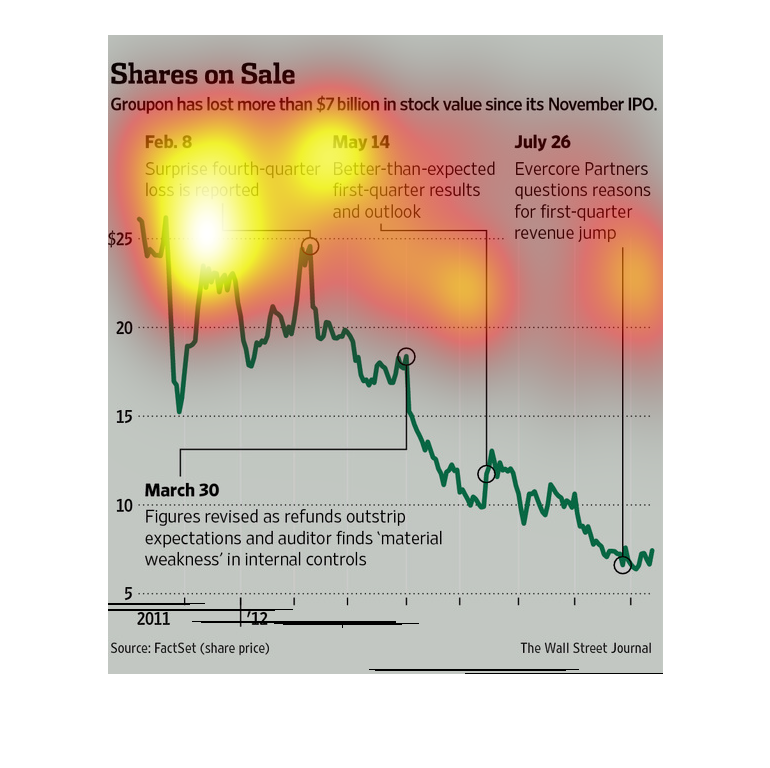

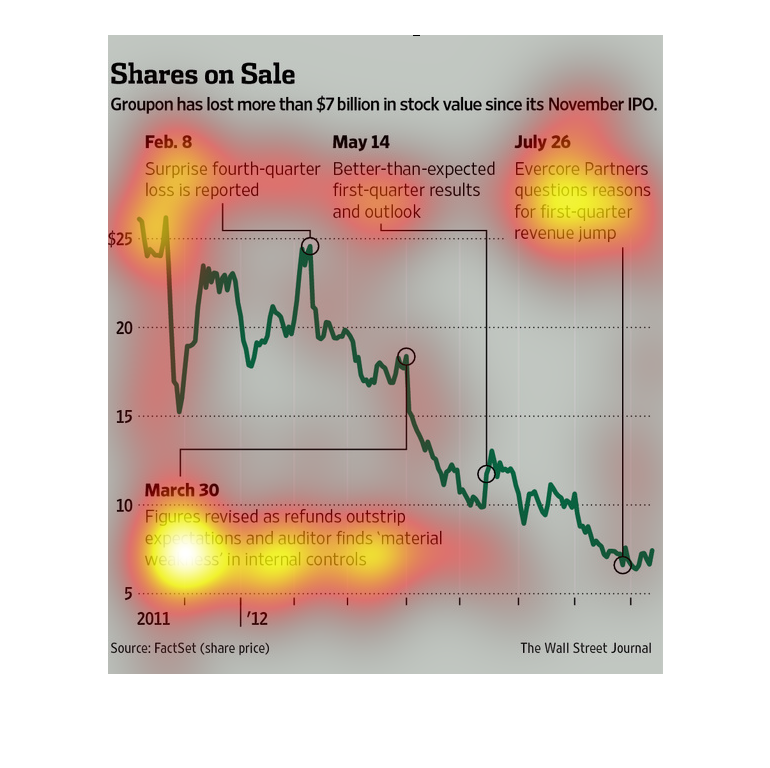

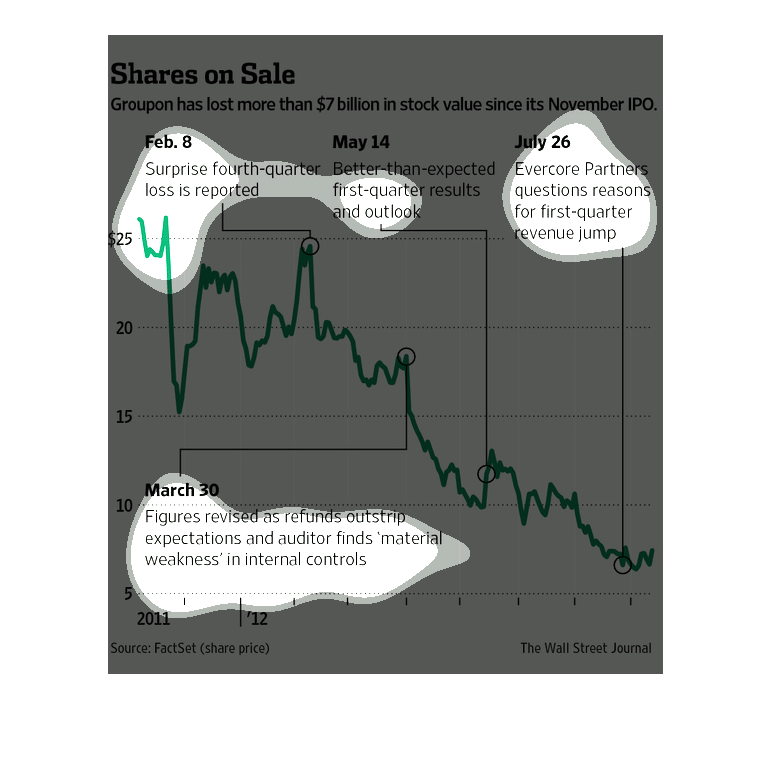

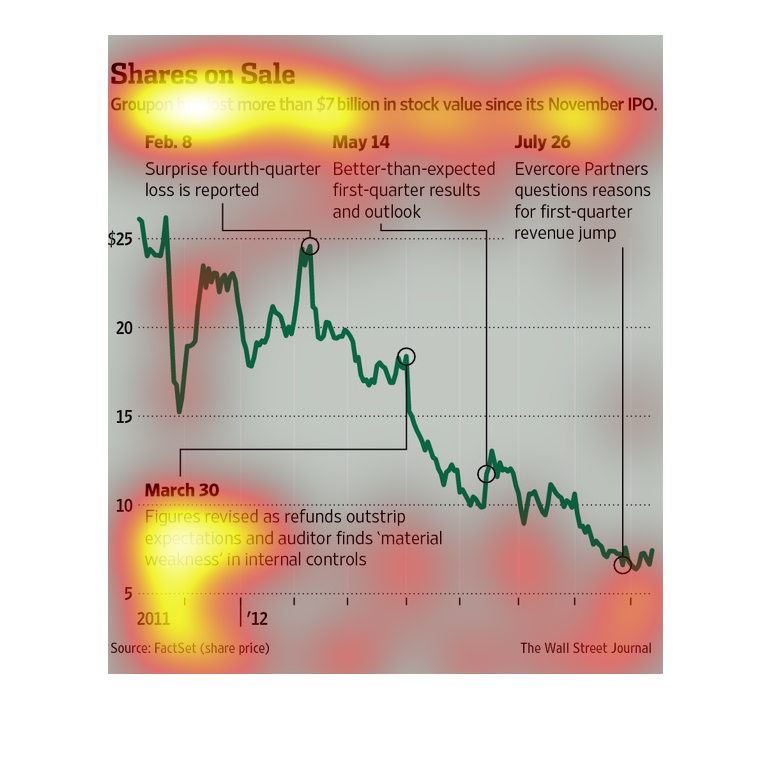

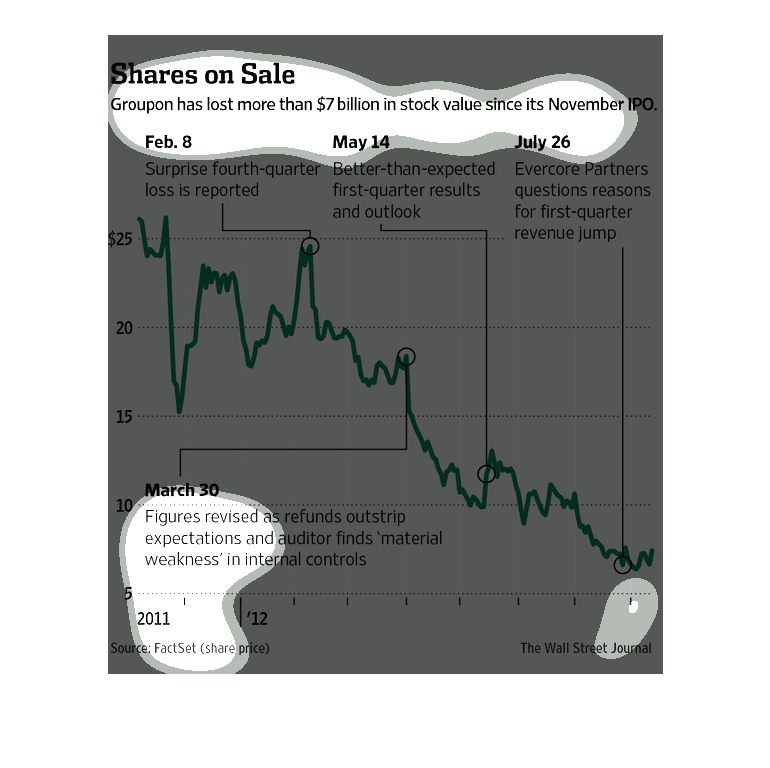

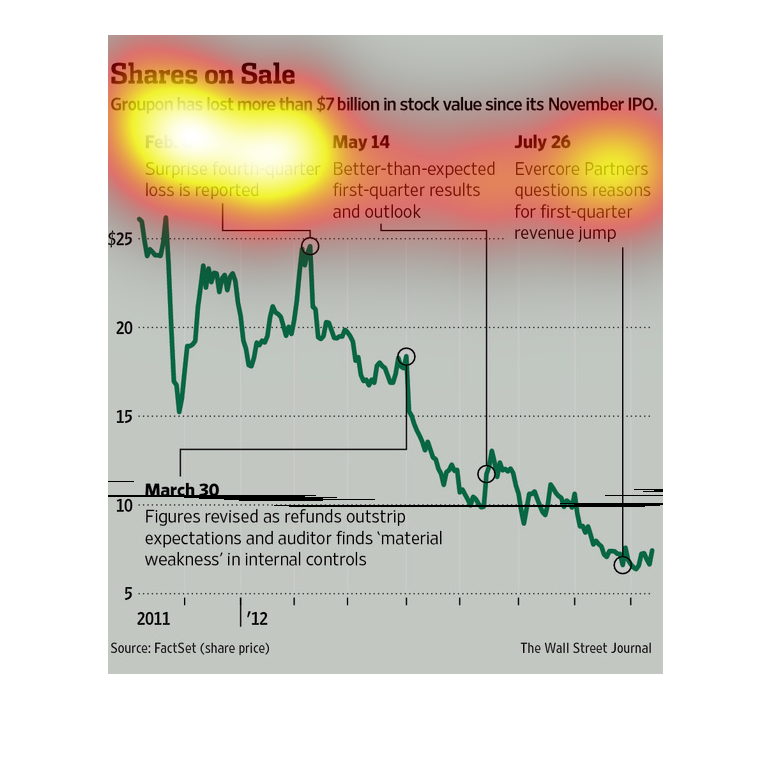

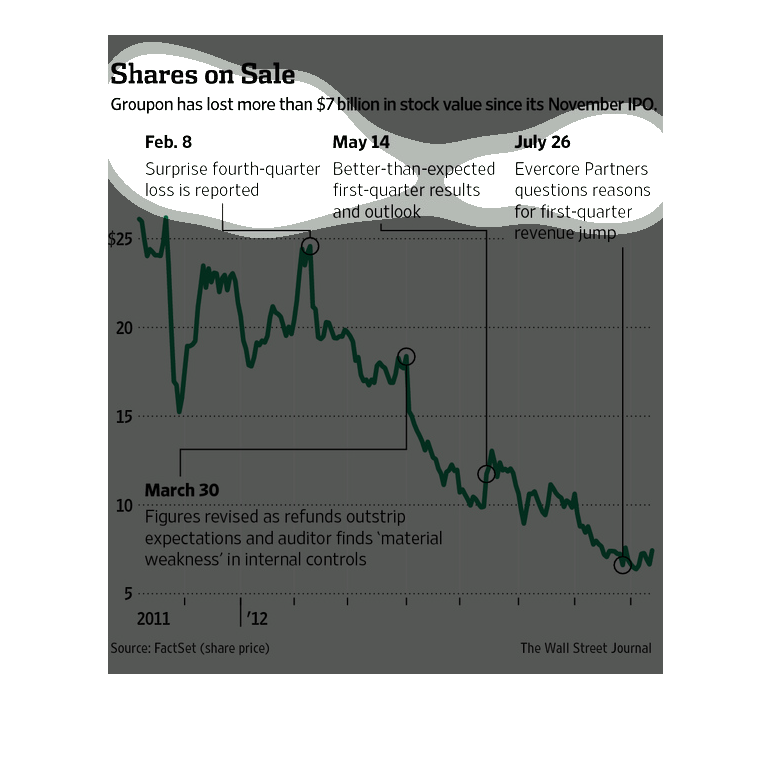

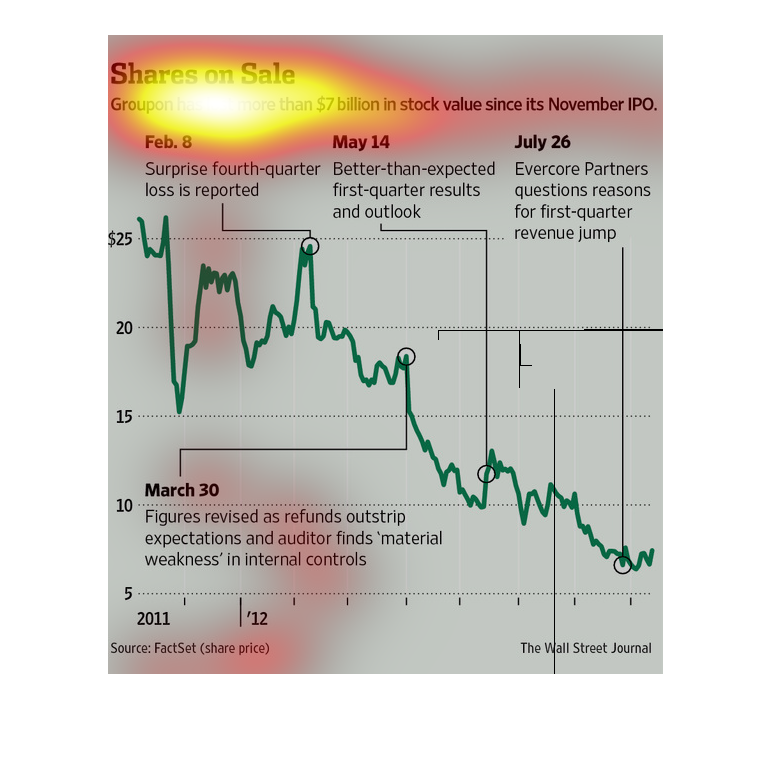

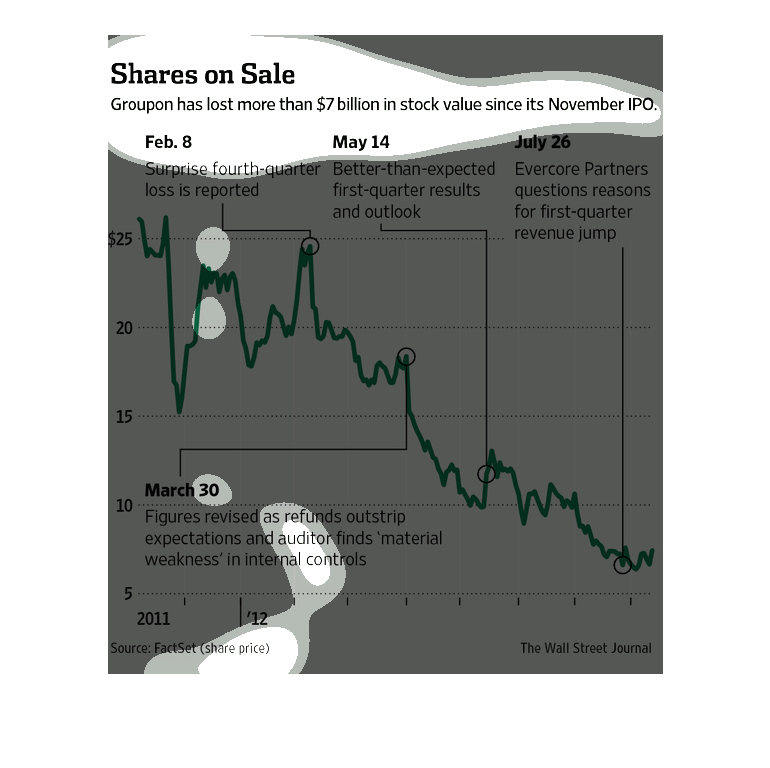

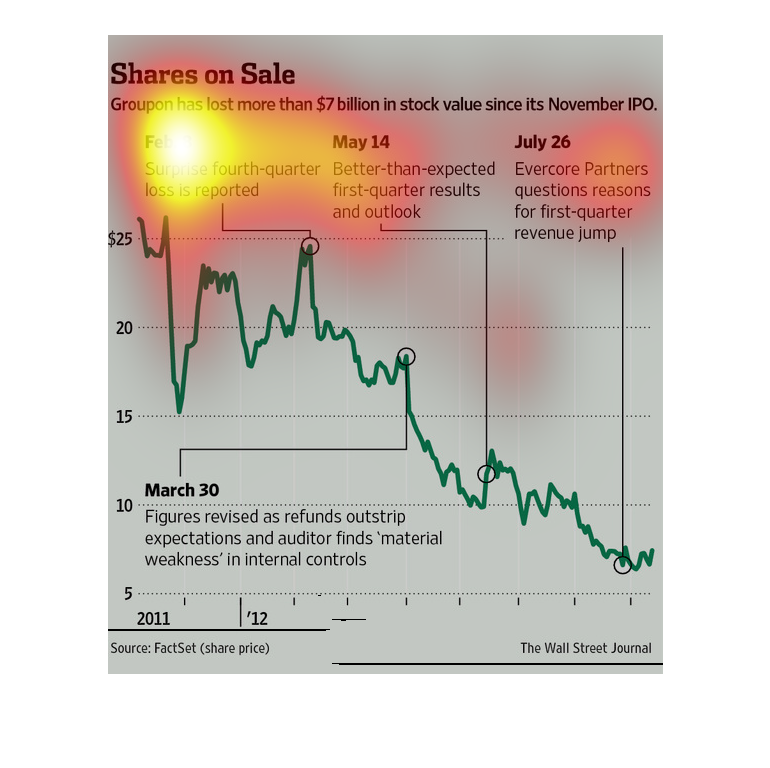

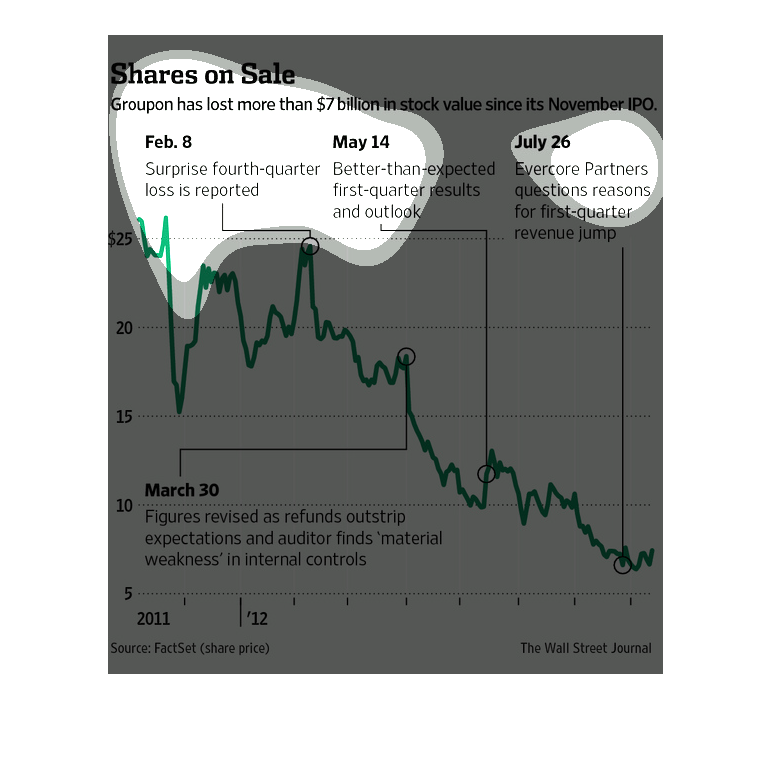

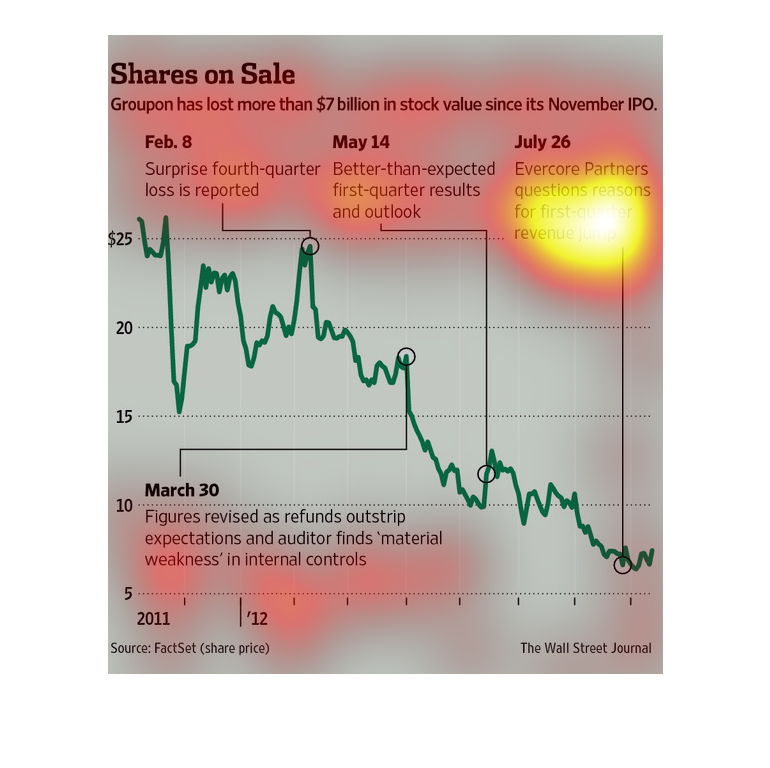

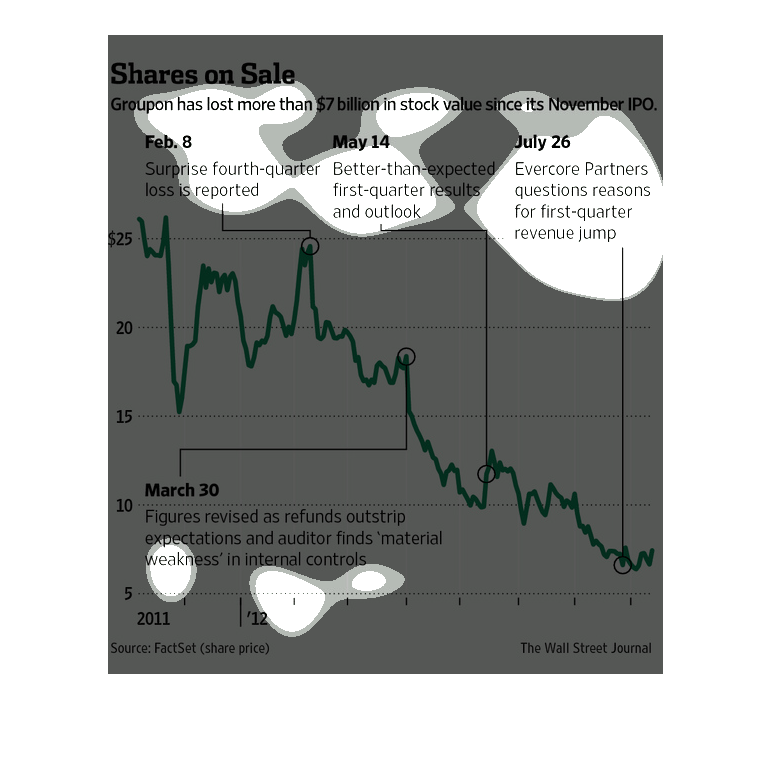

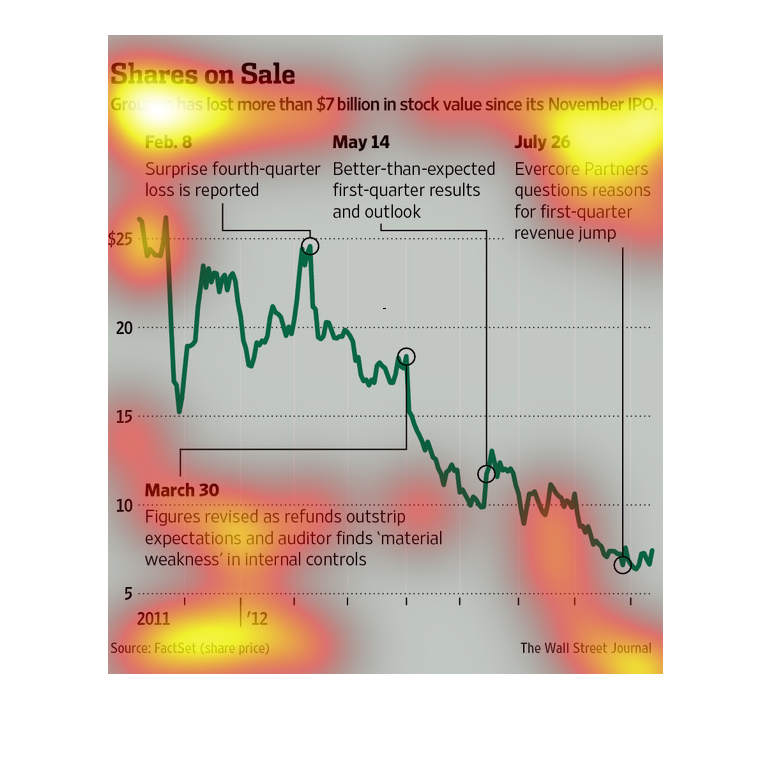

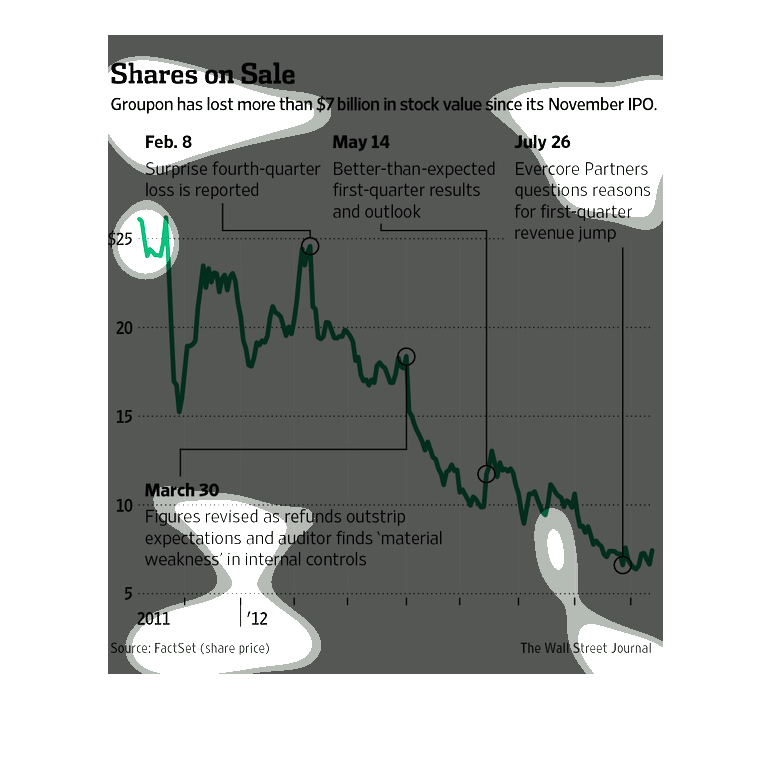

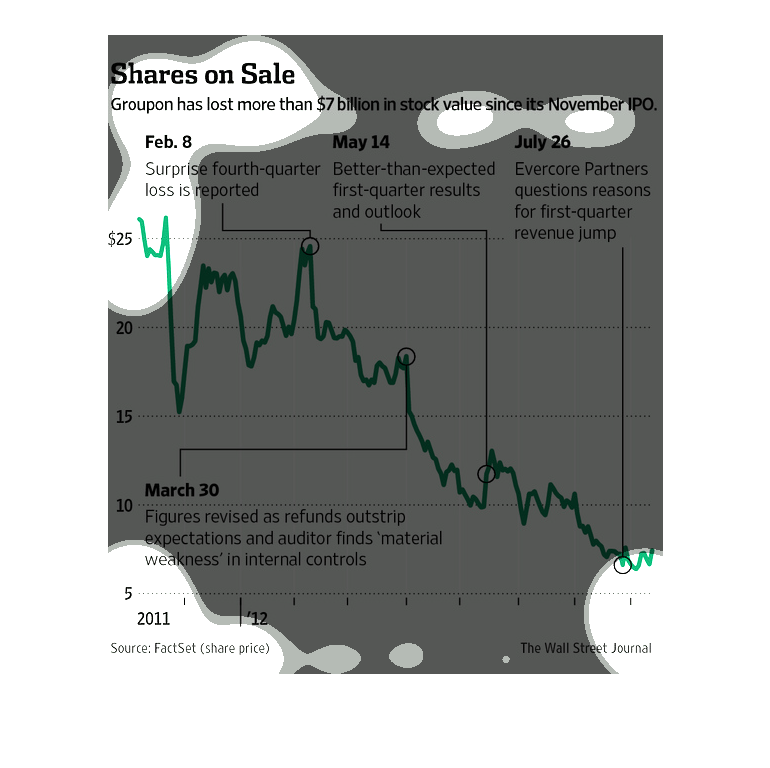

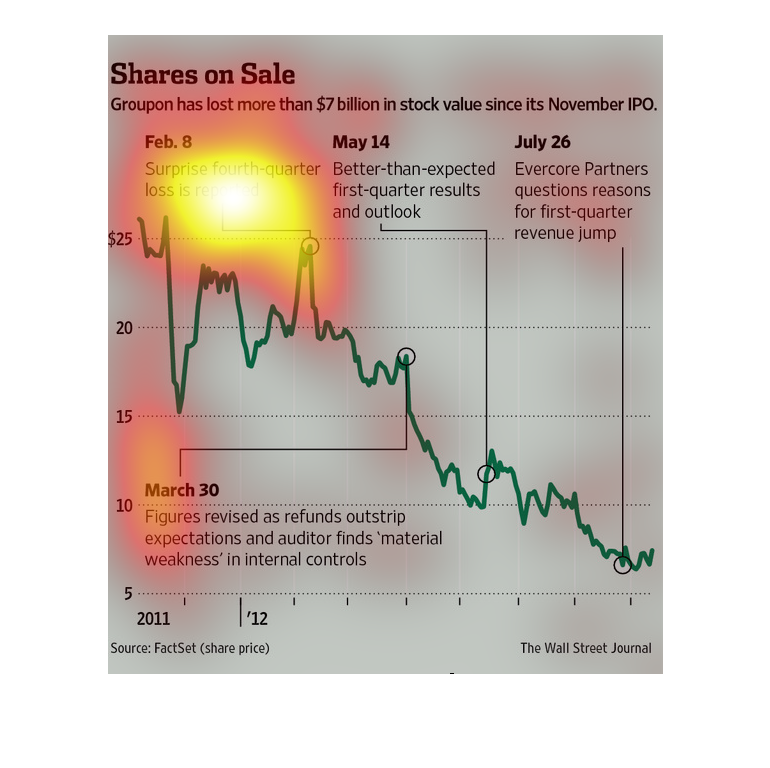

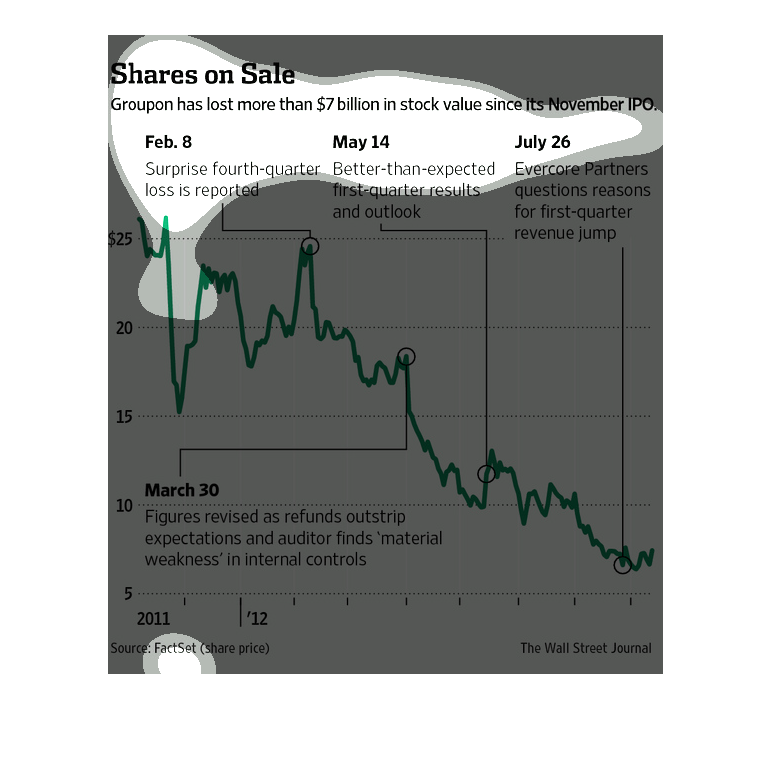

This chart shows the stock value of a particular company and its losses and gains over a certain

time period. It shows that this company has lost revenue over the last quarter

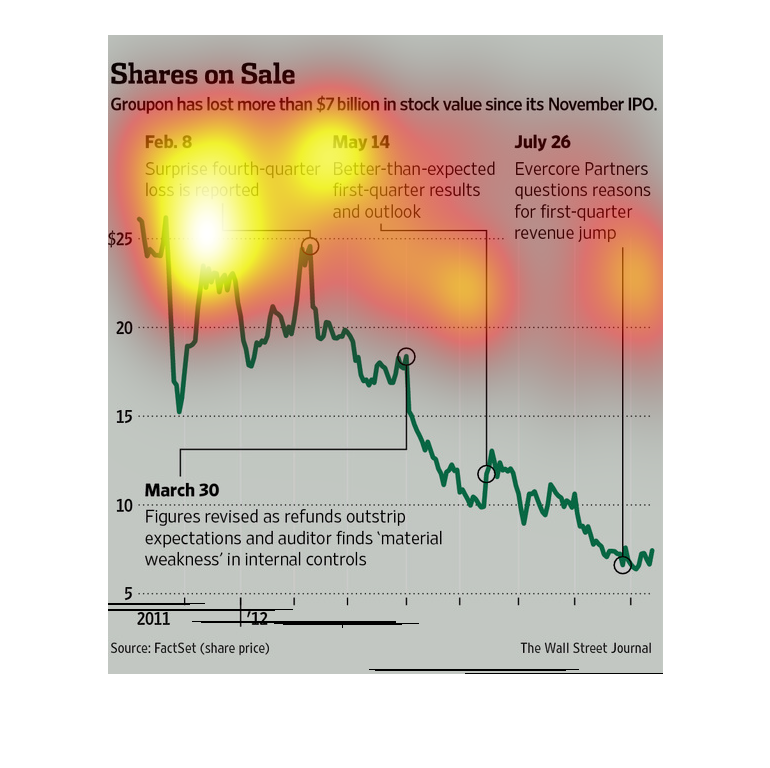

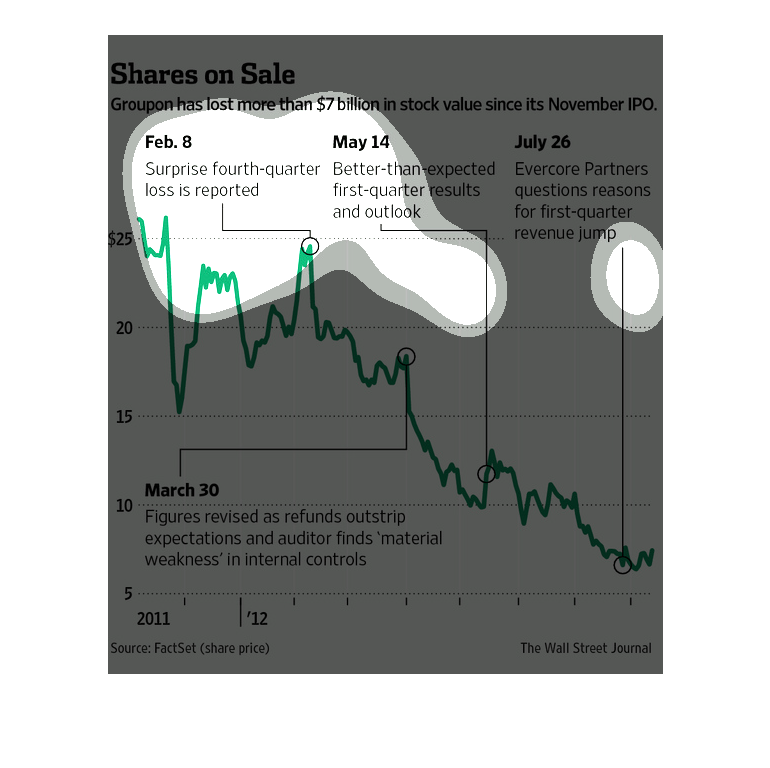

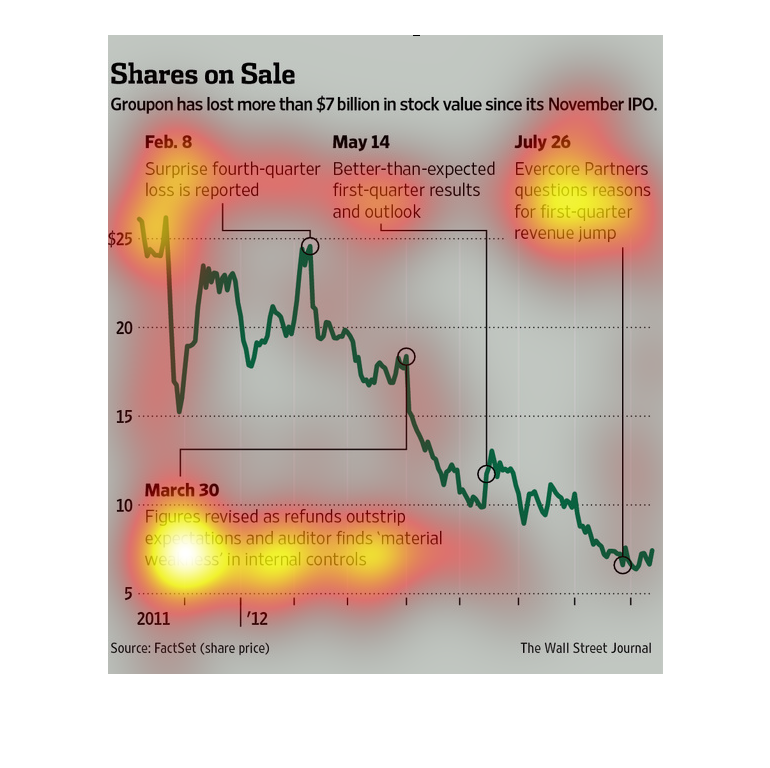

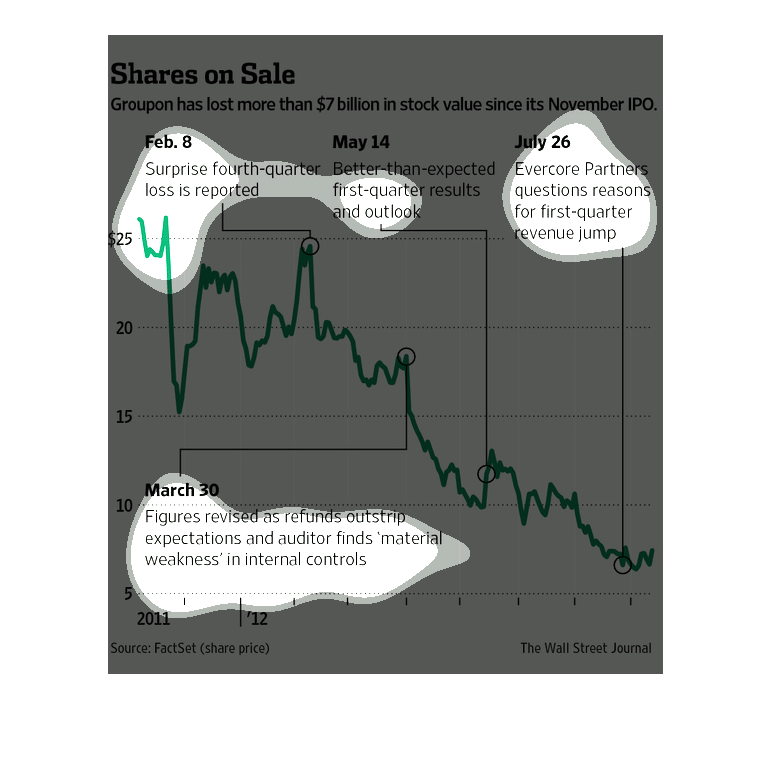

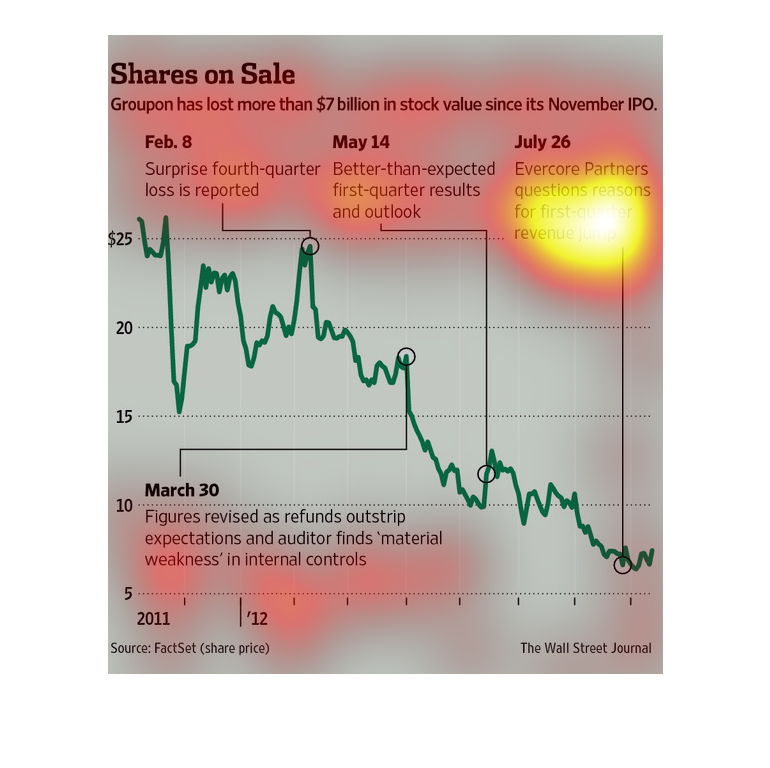

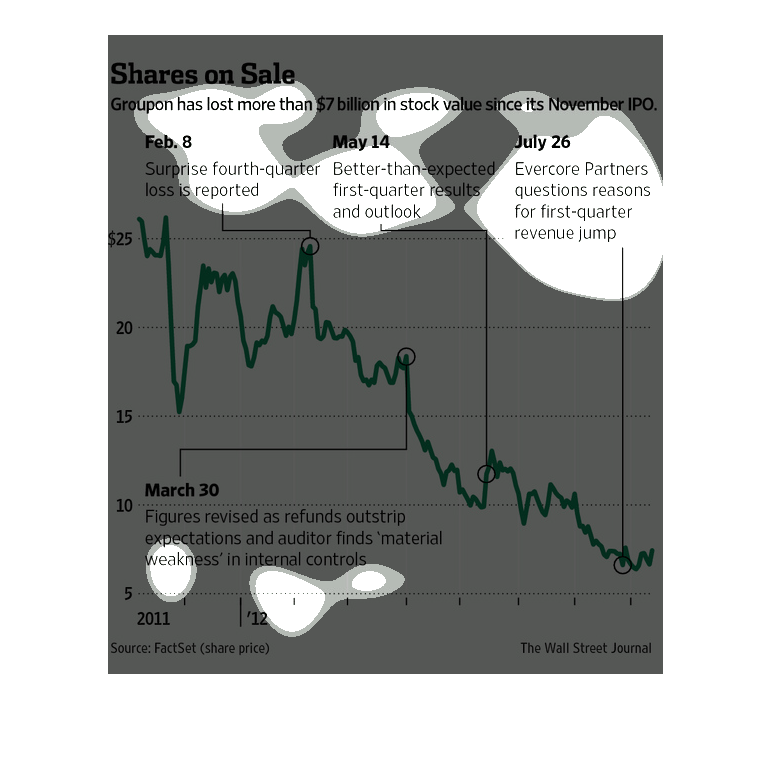

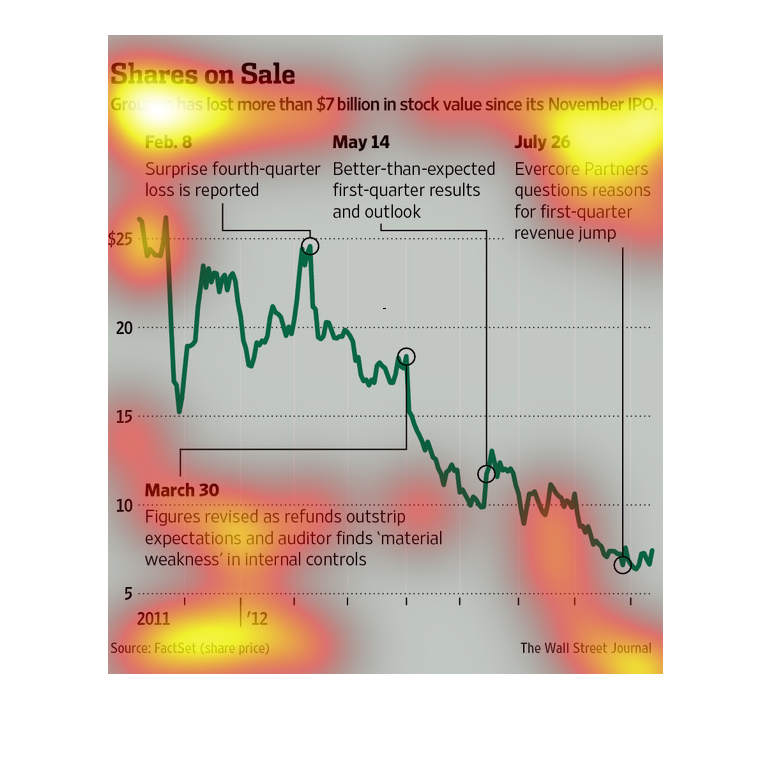

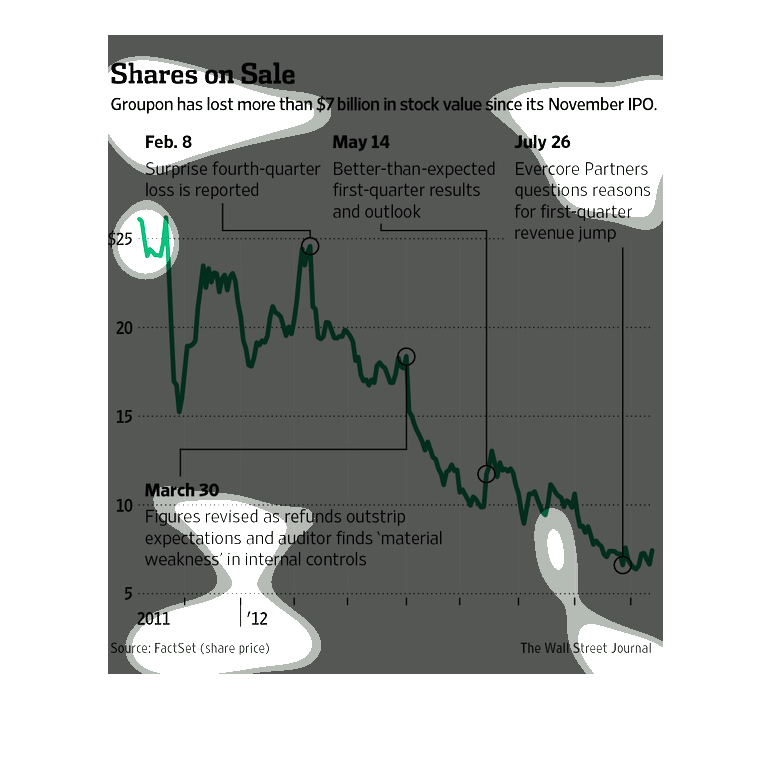

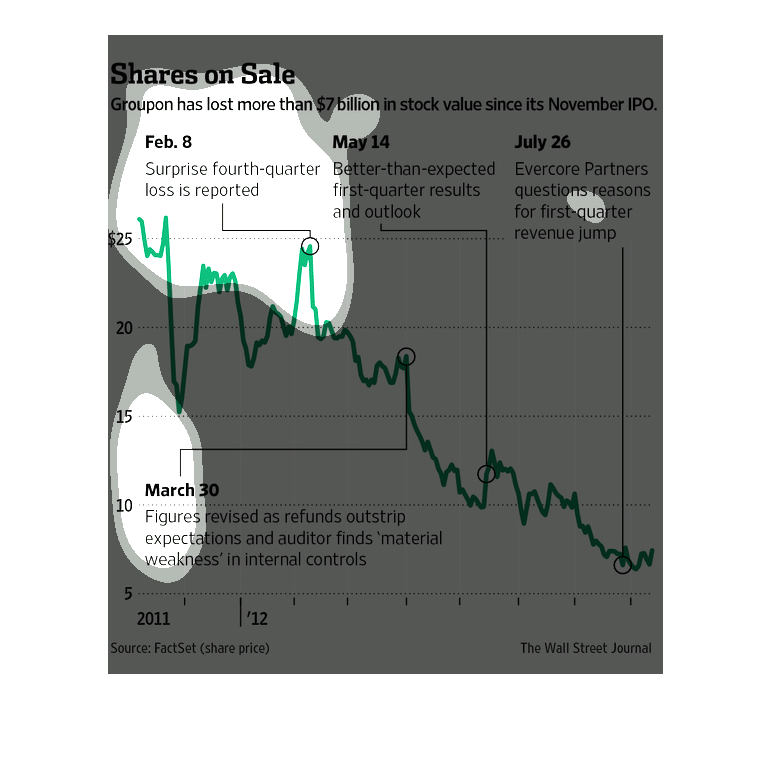

The following chart is titled shares on sale. Groupon has More than 7 Billion Dollars in its

share price since its November IPOL date. The IPO was in November 20011.

This shows the price trend of the Groupon stock over time. It is shows as a line graph and

it shows the trend of the price over time. It shows the price has dropeed significantly since

the IPO.

This chart describes shares on sale. Specifically, Groupon has lost more than $7 billion in

stock value since its November IPO. The highest spike comes in the year 2012.

This is a graph of groupon's stock prices. The data shows that groupon has lost more than

seven billion in stock since its November IPO, which is a dramatic decrease.

This chart describes groupon's 7 billion dollar loss in stock value since November. in quarter

one there was a big jump and then it plummeted again. They are trying to figure out why the

first quarter spiked.

This is a chart depicting that Groupon had lost than seven billion dollars in stock value

since it's IPO as of data available in 2012. It's decline is shown to be steadily down.

The image depicts how Groupon has lost more than 7 billion dollars of stock value since it's

November IPO. Stock prices decreased from around $25 per share, to around $6 per share.

Group on has lost more then 7 million dollars in stock sales since it's November IPO. It had

a steady decline per the chart with a boost in the loss in the fourth quarter of February.

This is a graph that has charted the stock price of Groupon over the last many years. The

trend of the graphs is a definite negative as time goes on. The years mentioned are 2011 and

2012.

This chart describes shares on sale. Specifically, Groupon has lost more than seven billion

in stock value since its November IPO. The highest spike on the chart comes in at the $25

mark.

This chart displays the stock fall of Groupon, which has lost more than 7 billion in stock

value since the November IPO. Its partner Evercore is perplexed as to why Groupon saw a jump

in July, though.

The image depicts how Groupon has lost more than 7 billion dollars in stock value since it's

November IPO. The stock has fallen from around $25 to $5. Bad news for Groupon.

Groupon has lost nearly $7 billion in stock value since November. There was a shocking 4th

quarter loss reported on February 8th. On May 14 there was a better than expected results

for the first quarter. Evercore Partners questions the increase in the first quarter.