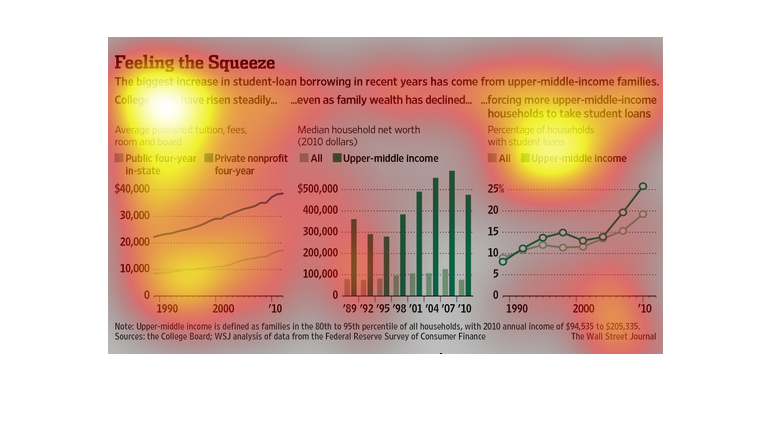

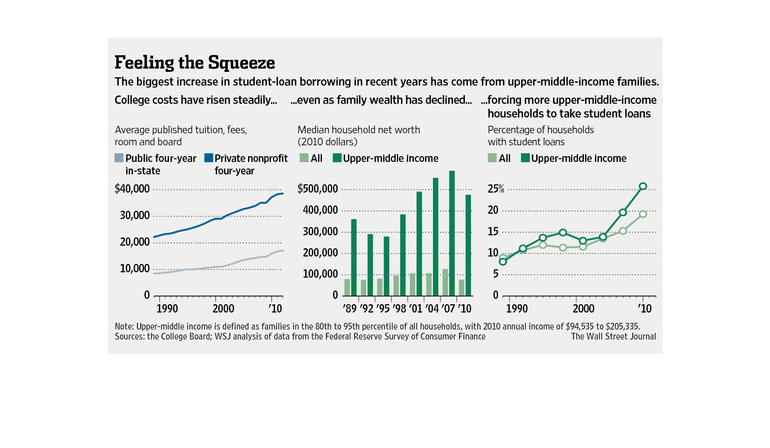

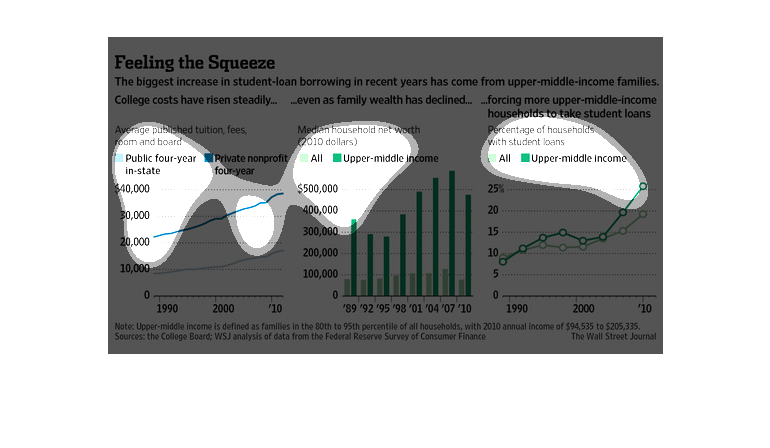

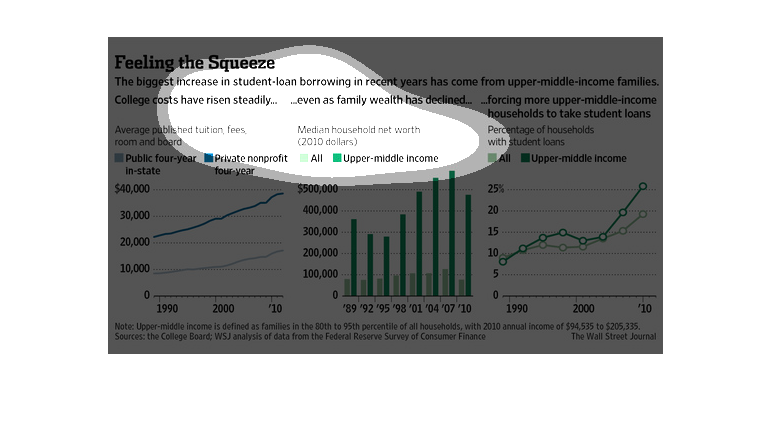

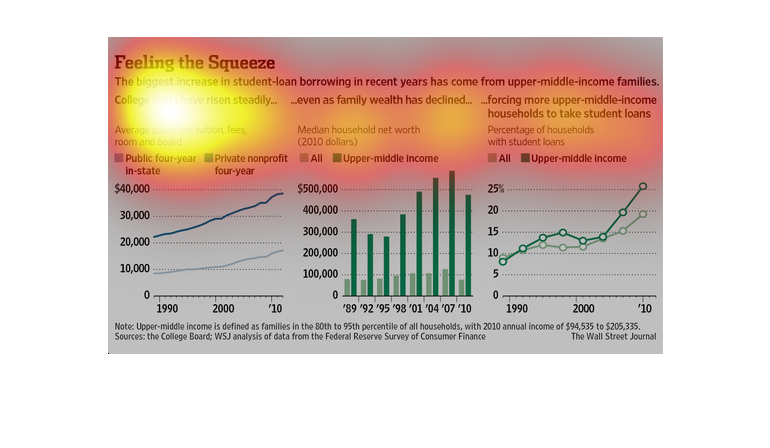

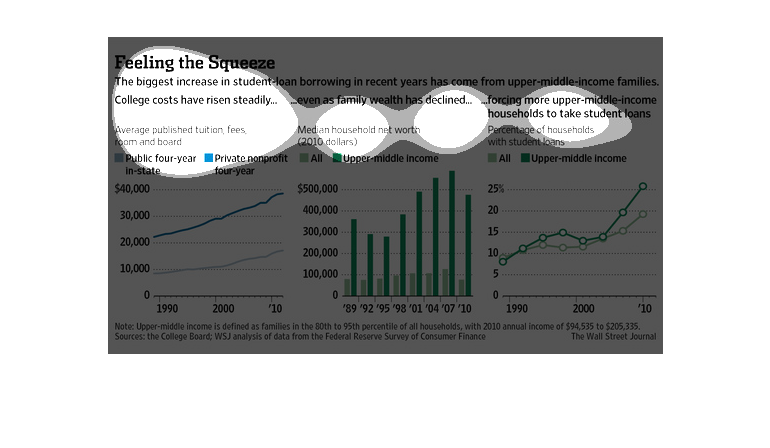

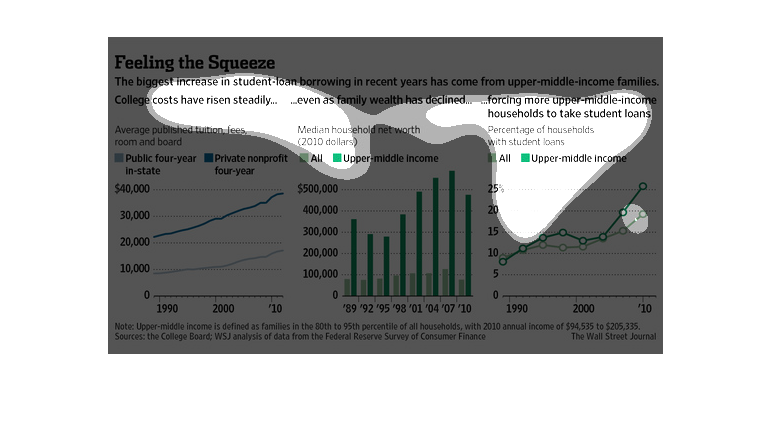

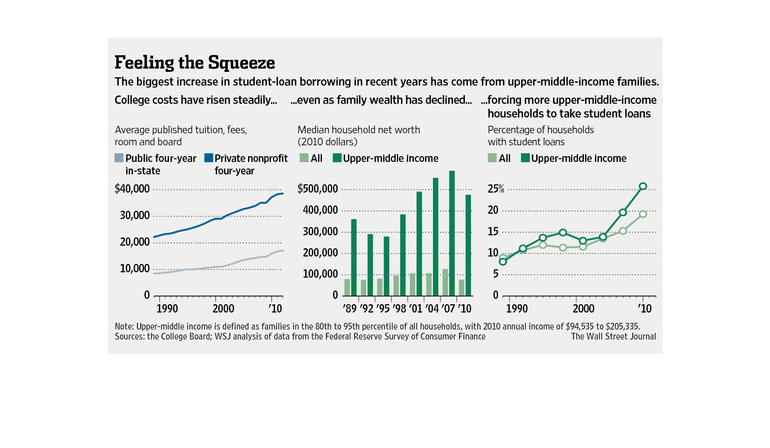

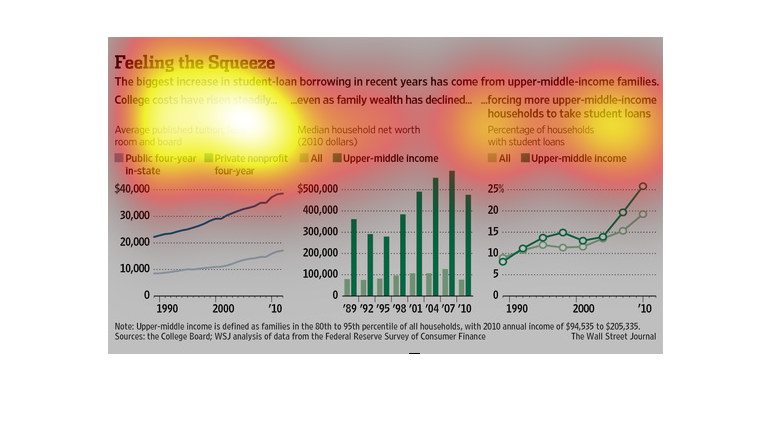

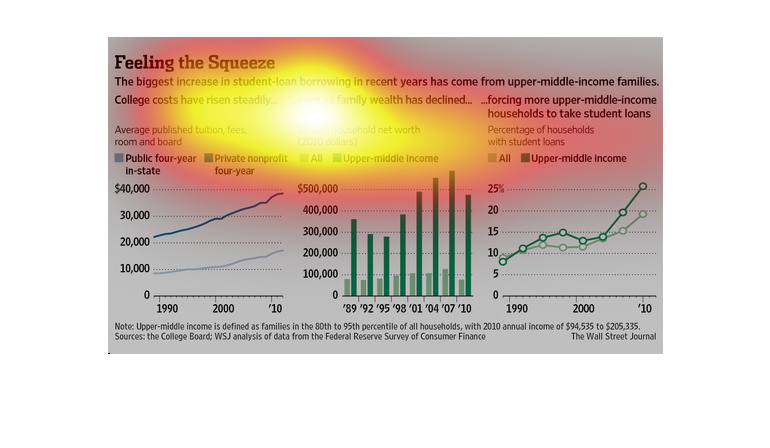

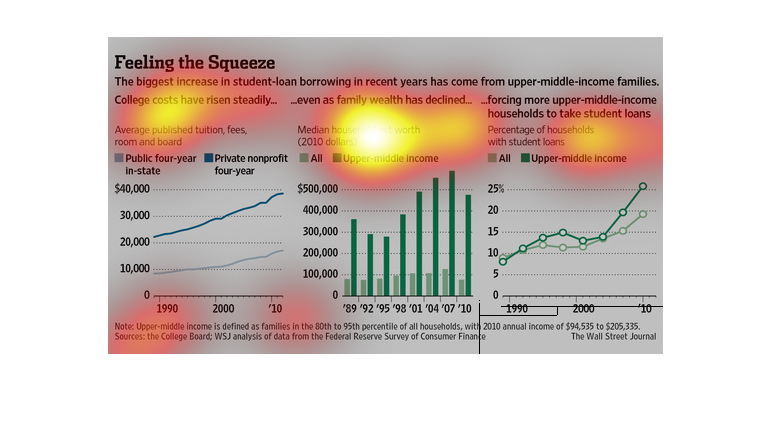

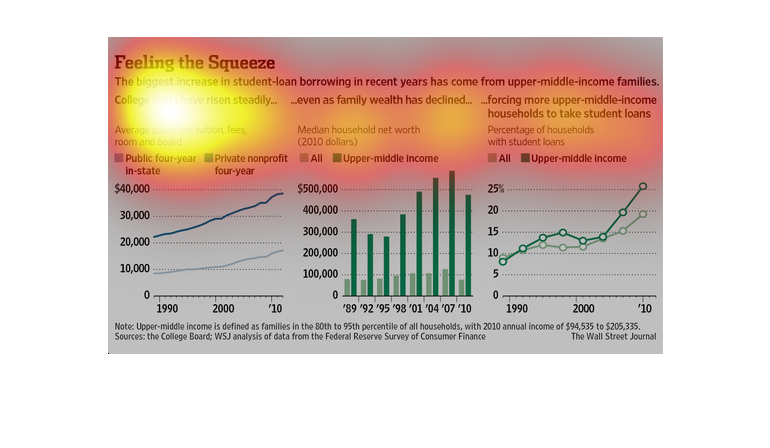

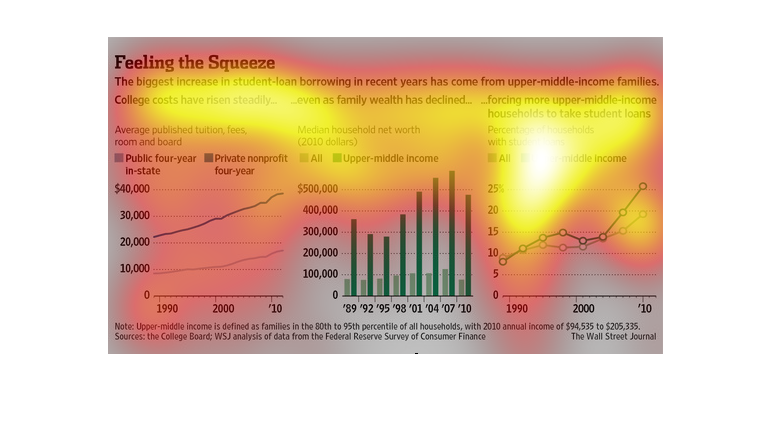

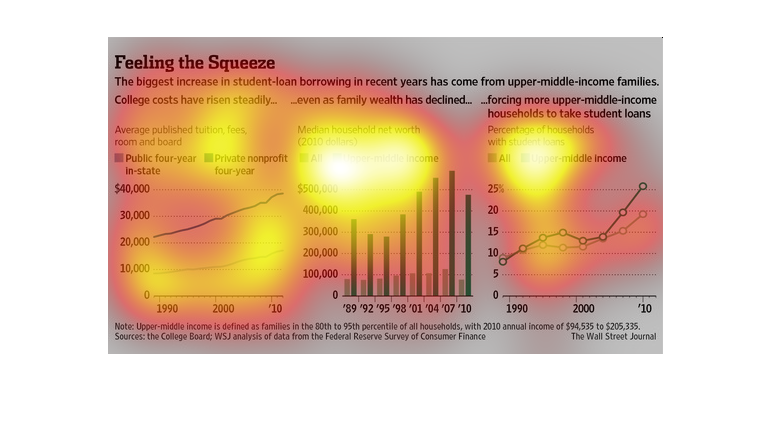

For 1990 2010 the two decade saw Student loans in middle income families have increased while

the income levels of declined. In both private and public institutions tuition increases were

seen over the same timeframe. Household media income Doubling in public institutions form

$10,00 to $20,000 and from $20,00 to $40,000 in private institutions. Median household net

worth for all households hovered right at $90,000 for that same period of increase tuition

costs. The percentage of all household student loans rose from 9 to 20%.

This chart describes feeling the squeeze. Specifically, the biggest increase in student loan

borrowing in recent years has come from upper middle income families.

This chart from the Wall Street Journal shows how the increases in student loan borrowing

in the United States have increased dramatically recently.

This is a chart showing that college costs have kept rising steadily and it shows that people

are taking out more loans and bigger loans. mostly middle income families.

The left graph shows how college costs have risen from 1990 to 2010. During the same period

the middle graph shows how median household income has decreased. Consequently, the right

graph shows the increase in student loans.

This graph shows the changes in student loan borrowing and tuition costs. It shows the relationship

using a bar graph and a line graph. It displays a positve correlation between the two.

This chart from the Wall Street Journal shows how student loan debt is increasing rapidly

but amongst middle to upper middle income borrowers because of increasing costs

This chart describes feeling the squeeze. Specifically, the biggest increase in student loan

borrowing. The highest spike on the chart comes in the year 2007.

Student loans are increasing in recent years for middle-income families. College costs are

increasing even as income is decreasing so there has been a steady incline of student loans

for both private and public institutions. The number of households with student loans has

increased by about 10% since the 90s.

The caption for this image is, "Feeling the Squeeze, The biggest increase in student loan

borrowing in recent years has come from upper middle income families". There are a total

of three graphs here. One graph depicts tuition costs for public four year in-state colleges

versus private non-profit four year schools. The second graph displays median household net

worth, general population versus the upper middle class. The last graph charts the percentage

of households with student loans.

Three graphs illustrate the relationship between average tuition costs, median net worth of

households, and the percentage of households with student loans over a 20 year period. Tuition

costs have been steadily increasing, more so at private universities than public. Upper-middle

income median net worth has increased similarly to the tuition costs, but overall median net

worth has not increased nearly as significantly. The percentage of households with student

loans has increased steadily as well, much more so in the upper-middle class than overall

as well.

This graph depicts the increase of student loan borrowing from upper middle-income families

in relation to the rise in costs of tuition. Private insitutions have been rising quicker

than public institutions while the borrowing of money have come dramatically largely from

upper-middle income families over all. The amount of student loans from upper middle income

on average has increased dramatically over all from 2000 to 2010.