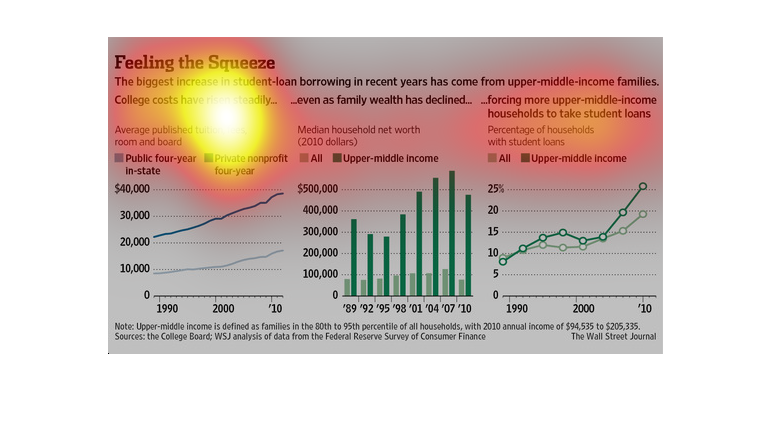

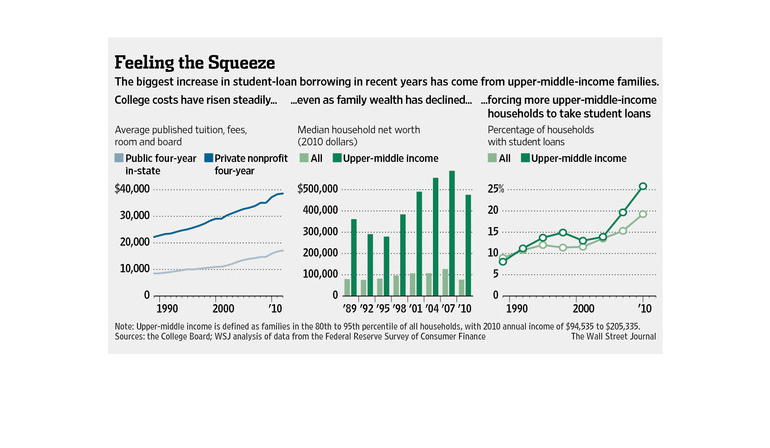

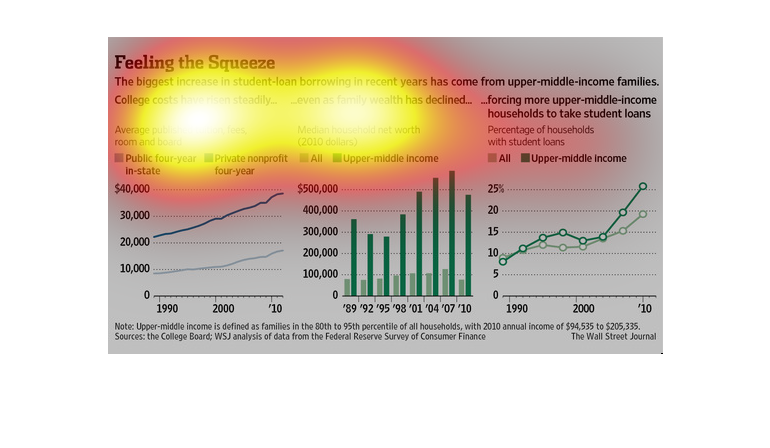

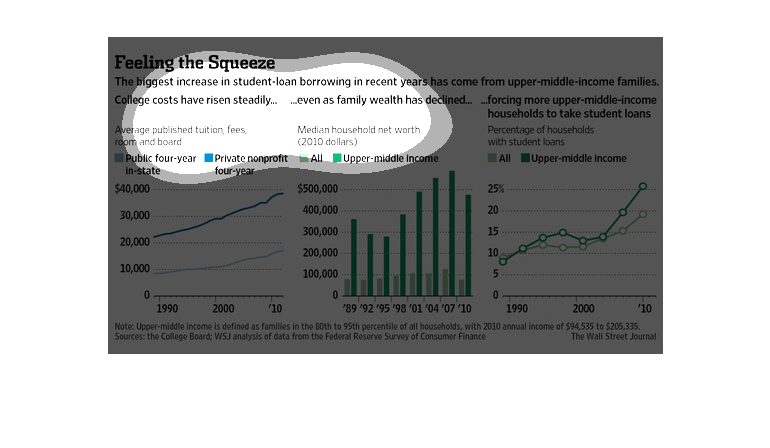

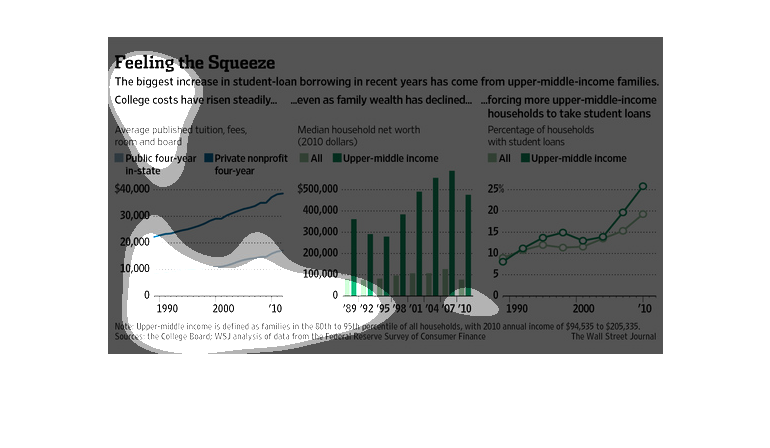

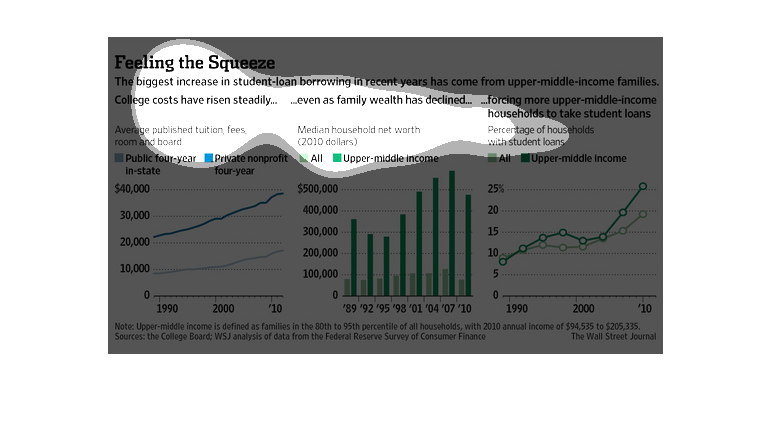

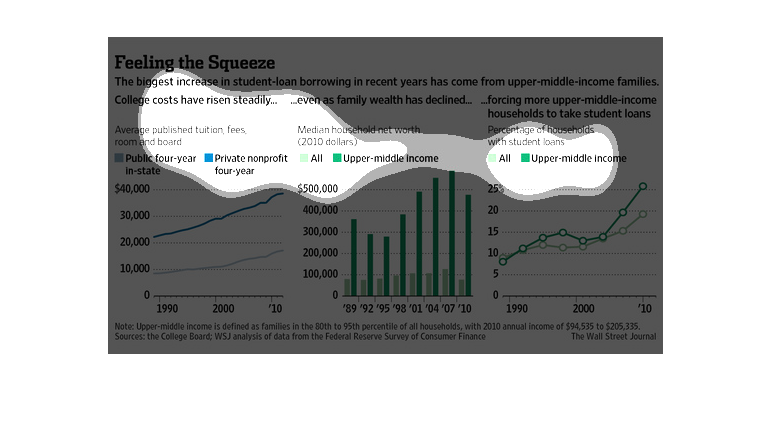

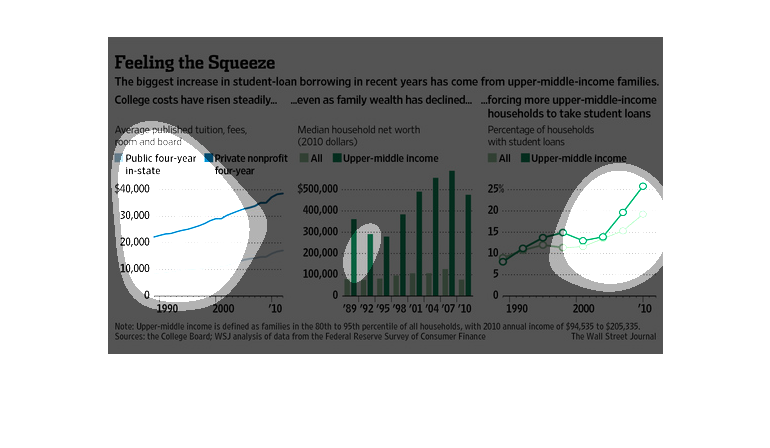

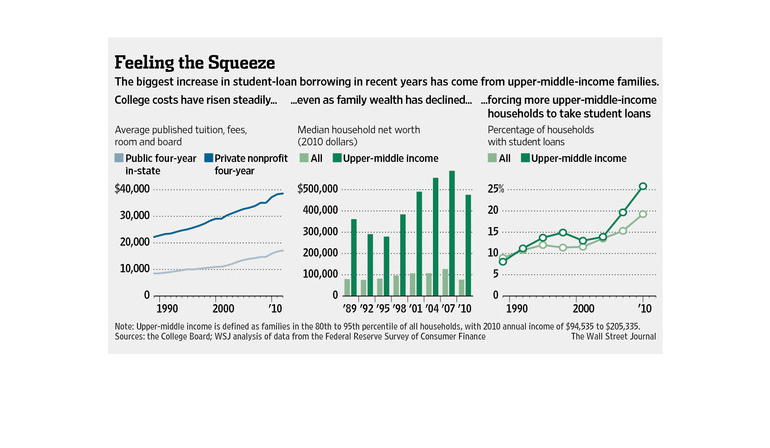

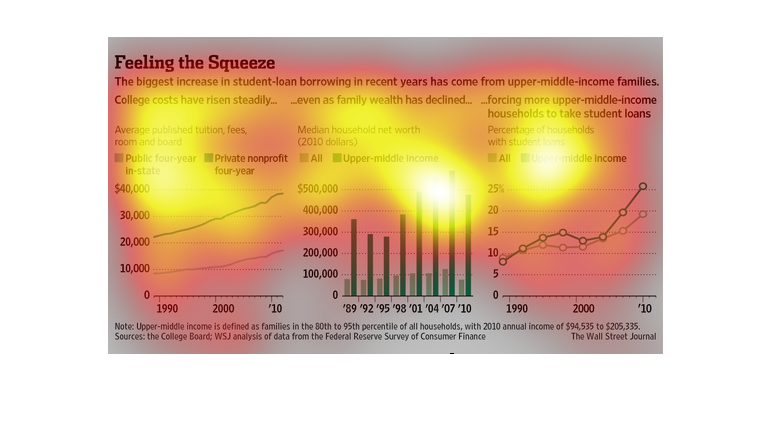

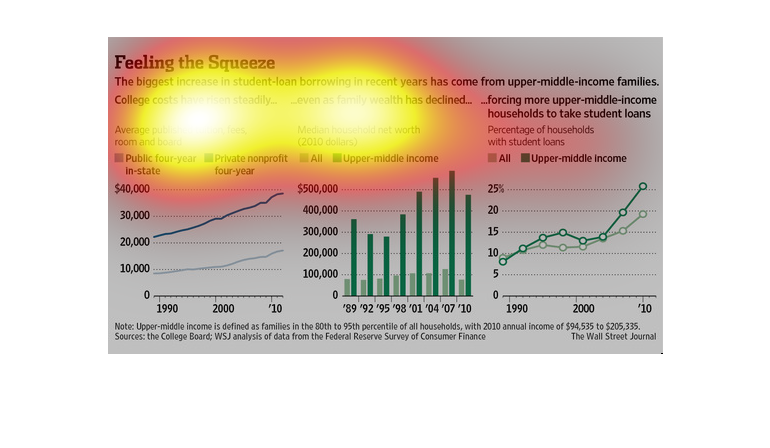

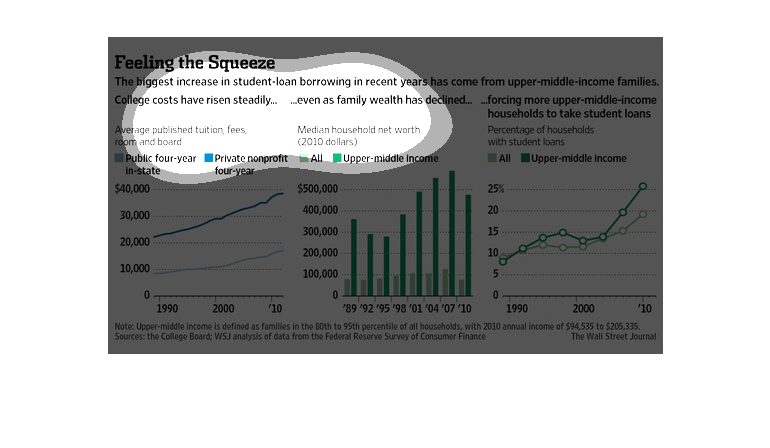

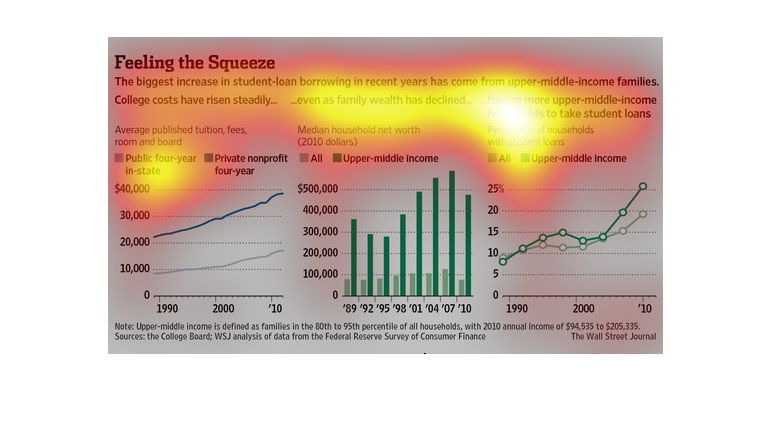

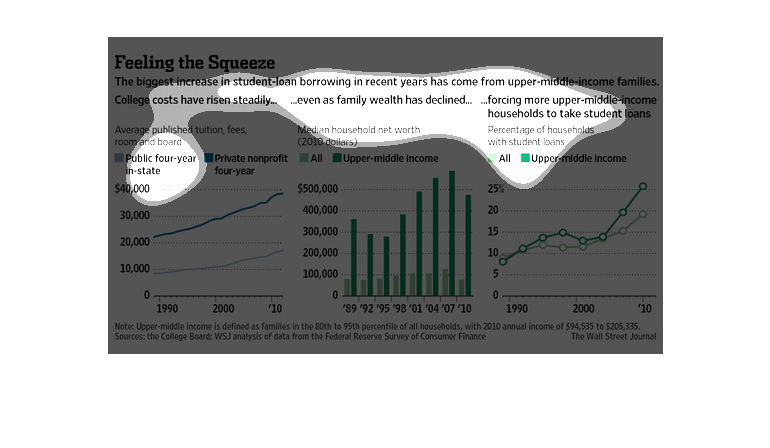

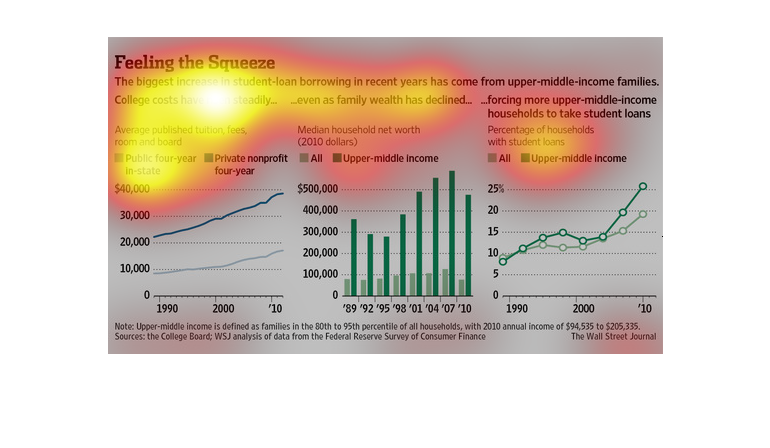

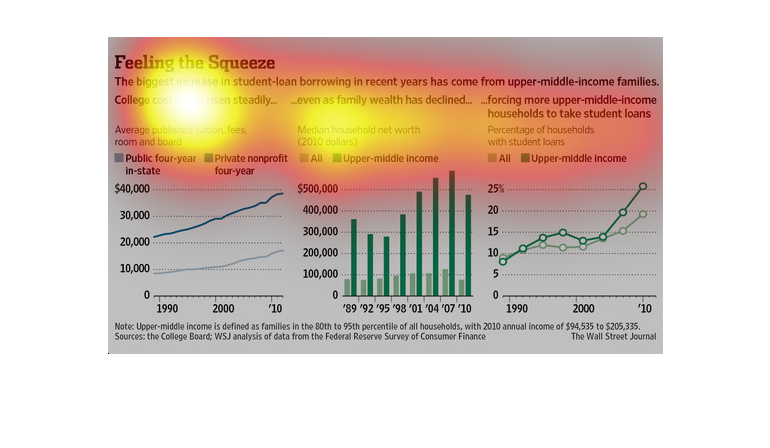

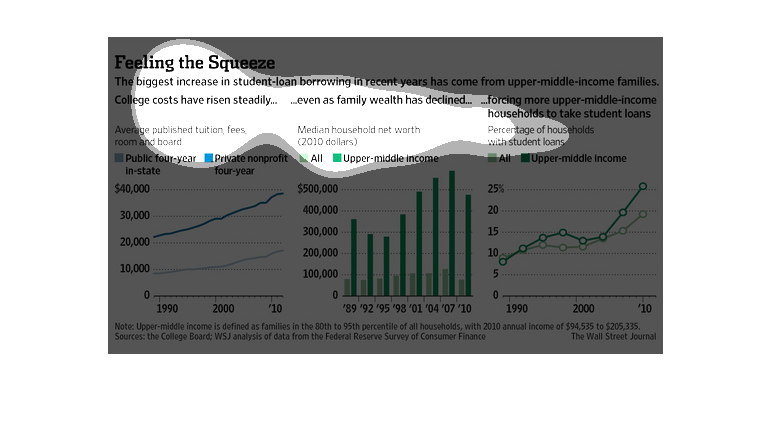

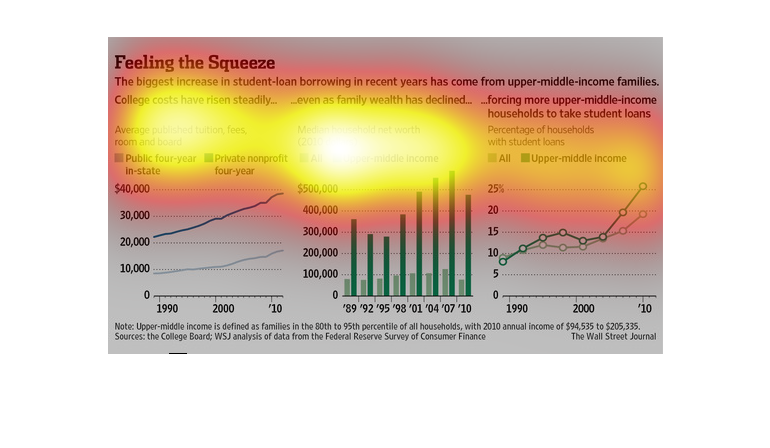

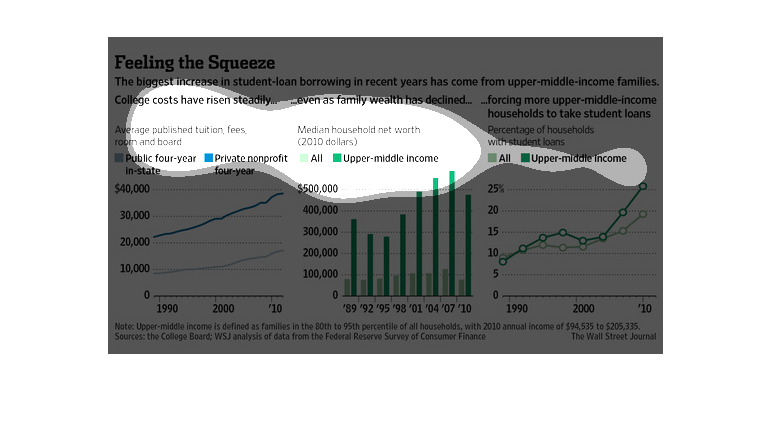

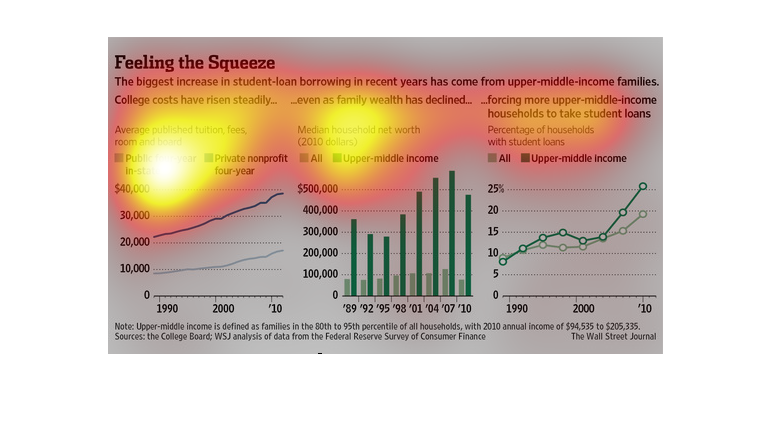

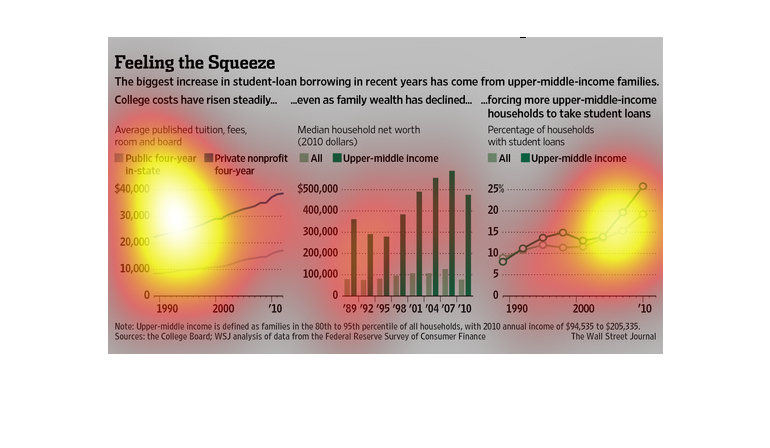

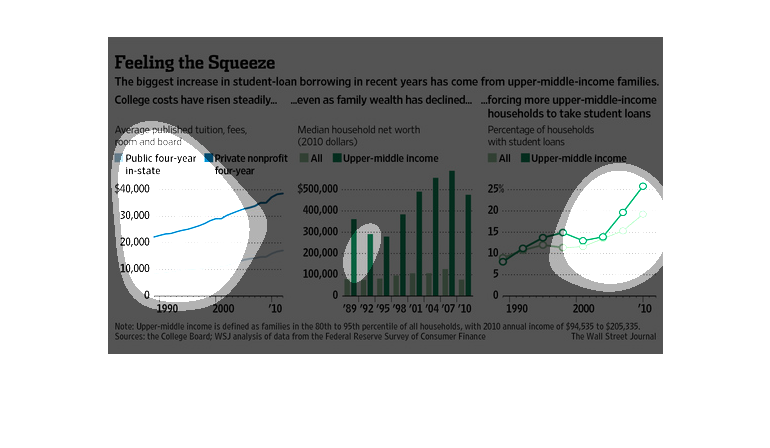

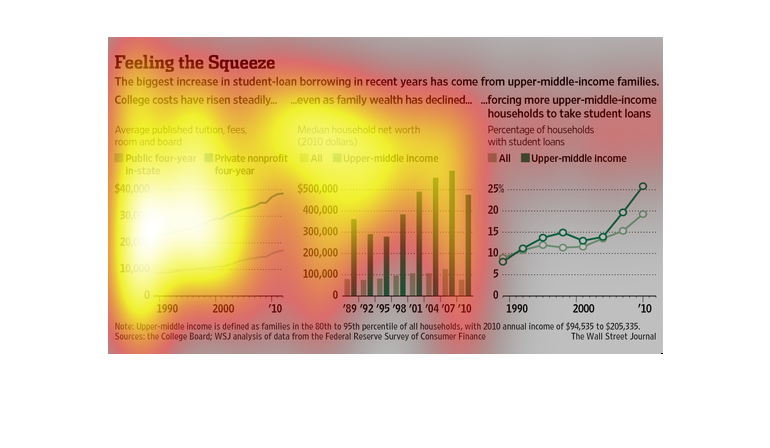

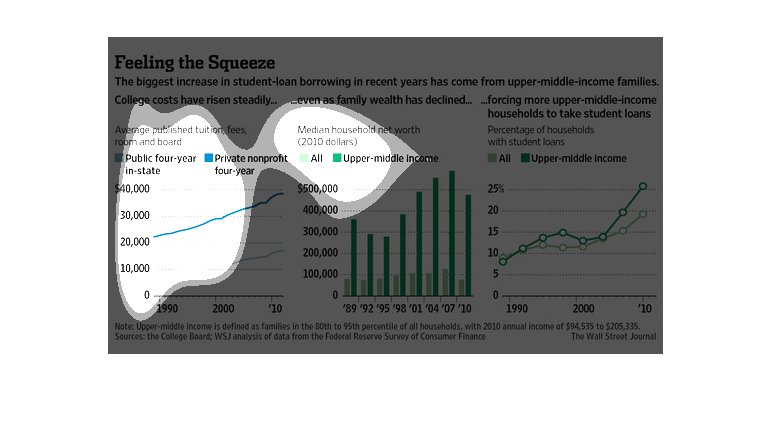

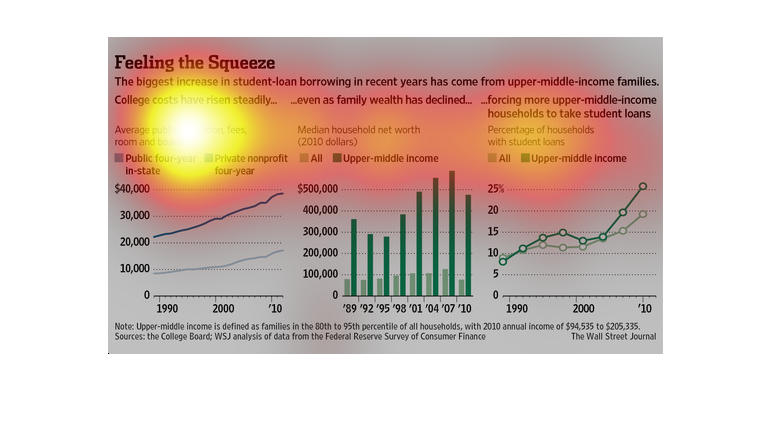

This graph shows the rate of increase of college debt among upper-middle class families. Four

year private and public school tuition has increased steadily since 1990. Even though upper-middle

class household wealth increased, the amount borrowed for college has also increased more

rapidly than other classes.

In recent years the college loans have been borrowed mostly by upper middle income families.

The image contains 3 graphs. Graph1:The money loaned is around 40,000 in 2010 compared to

10,000 in 1990. Graph2:The percentage of upper middle income families have raised from 1990

to 2010 from below 10% in 1990 to around 30% in 2010. Graph3:The median household income in

2010 who got loans are 500,000$.

This chart from the Wall Street Journal shows how the student loan crisis is growing and more

students are taking out loans and more than ever.

This image is titled "Feeling the Squeeze." It states that the biggest increase in student

loan borrowing recently is from upper-middle-income families even as family wealth has declined.

The cost of public and private four-year colleges is listed at the left. The center graph

show the median household incomes. The right graph shows the increase in loan percentages

from 1990 - 2010. The source cited for this information is The Wall Street Journal.

In this 1989 to 2010 study conducted by the Wall Street Journal from various sources, we see

that times are rough, and that money is tight. The fact that it affects college students most

is not surprising.

This image is entitled "Feeling the Squeeze." It shows the biggest increase in student-loan

borrowing has come from upper-middle class income families. College costs have risen steadily

as family wealth has declined. The image on the left shows the comparison between public

four-year colleges (light blue) and private colleges (dark blue). The center image shows

all income (light green) and upper-middle income (dark green). The image on the left shows

the percentage of households with student loans. All households are in light green and upper-middle

households are in dark green. Data was obtained from The Wall Street Journal.

The title of the graphic is feeling the squeeze. It says that biggest increase in student

loan borrowing in recent years has come from upper-middle class families.

According to the chart, the biggest increase in student loan borrowing in recent years has

come from upper-middle-income families. College costs have risen even though family wealth

has declined.

This image details the problem of decreasing family earnings over time in conjugation with

increasing costs of college, requiring more families to take out more student loans/

The caption for this graph reads, "Feeling the Squeeze, The biggest increase in student loan

borrowing in recent years has come from upper middle income families..." Three graphs display

data on tuition fees, general and upper-middle class incomes, and lastly the rates in which

upper-middle class income people are taking out loans to pay for school versus the general

population.

The left hand graph shows average published tuition, fees, room and board for colleges. The

middle shows median household net worth. The right shows percentage of student loans.

TITLE: Feeling the Squeeze The biggest increase in student-loan borrowing in recent years

has come from upper middle income families. There are three graphs and bar charts that give

data on the following facts: College costs have risen steadily. Graph of public four year

college tuition is currently around 40,000 dollars. Another: Family wealth has been declining,

as measured by median household net worth (500,000 dollars).

Feeling the squeeze, the biggest increase by student loan borrowing in recent years has been

from upper middle income families, college costs have risen steadily even as family wealth

has declined. This data is displayed in three separate graphs.

This chart from the Wall Street Journal shows how families in the upper middle income bracket

in the united states are taking on more student loans to pay for education