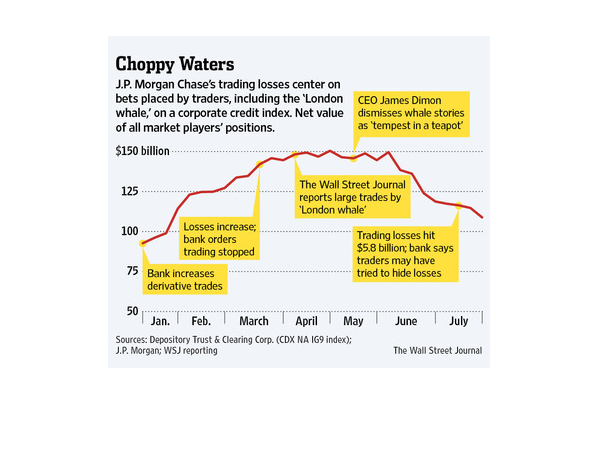

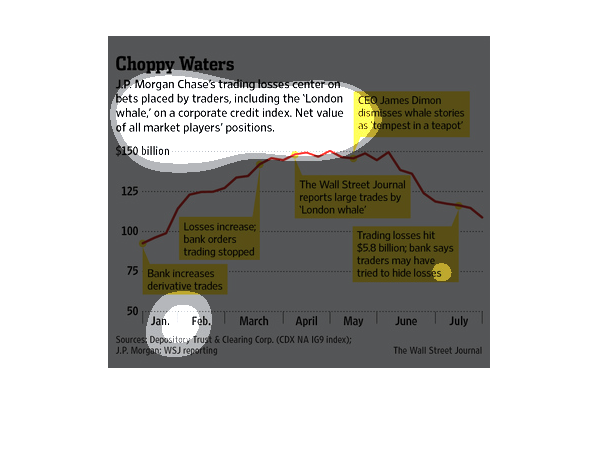

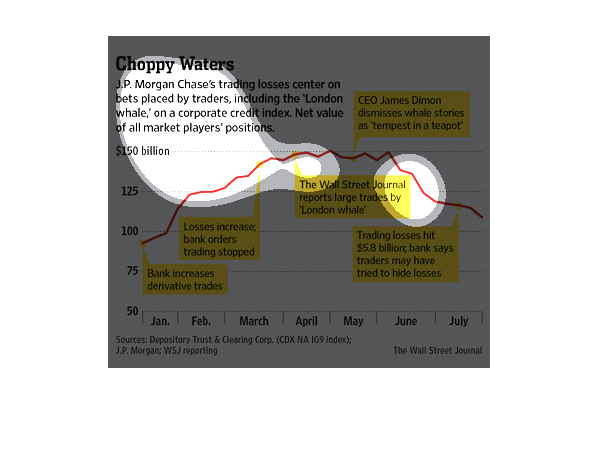

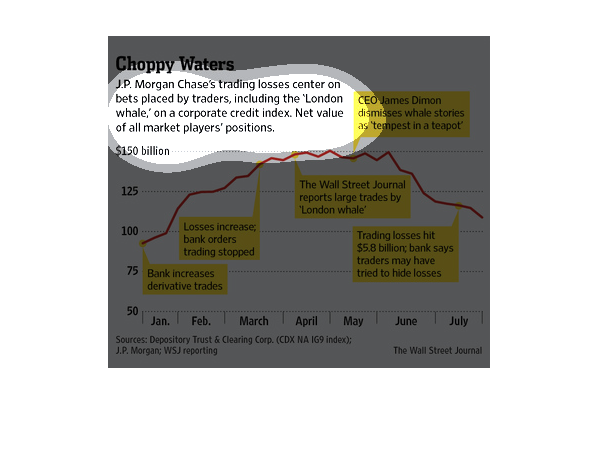

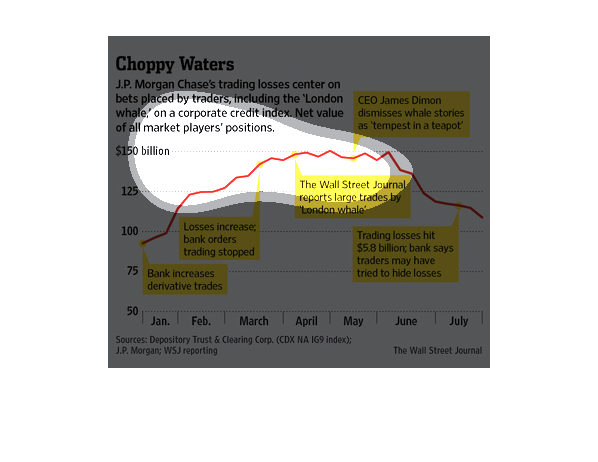

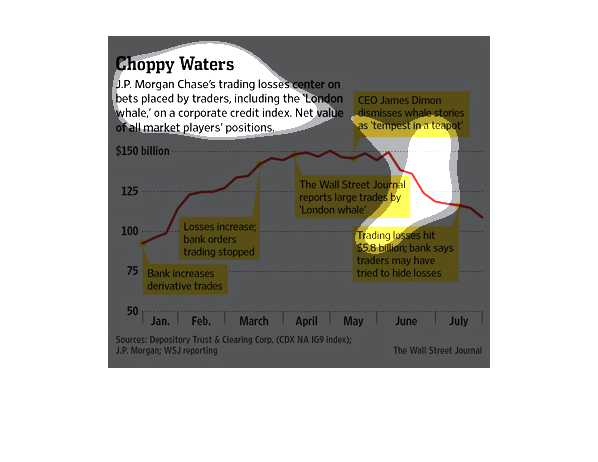

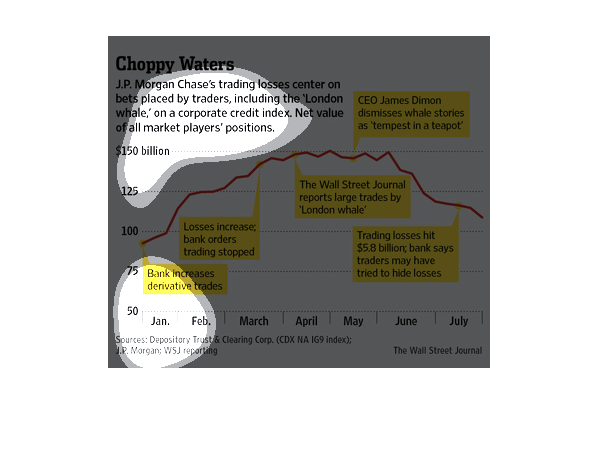

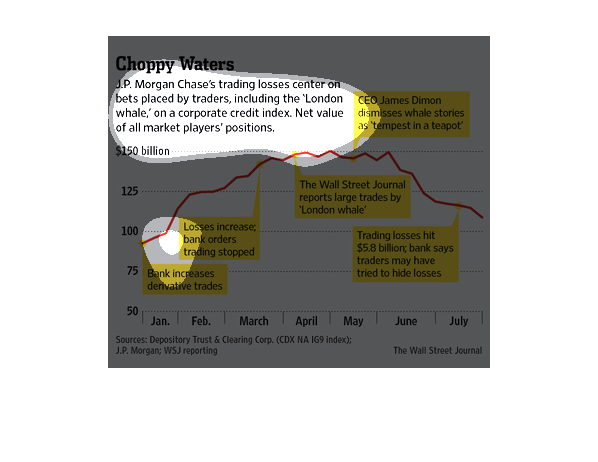

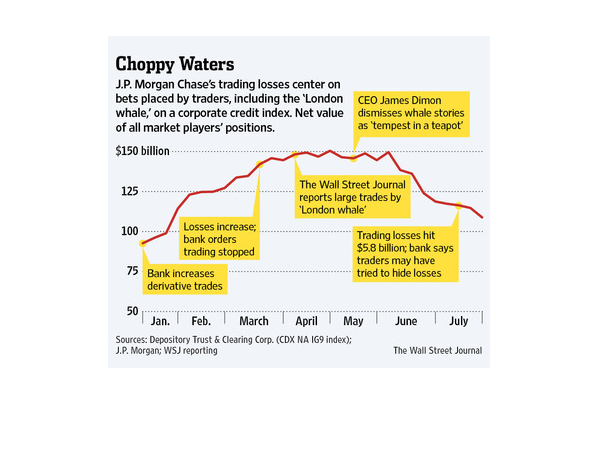

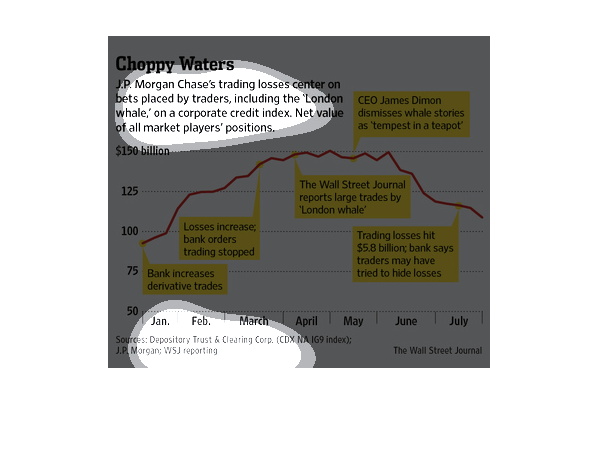

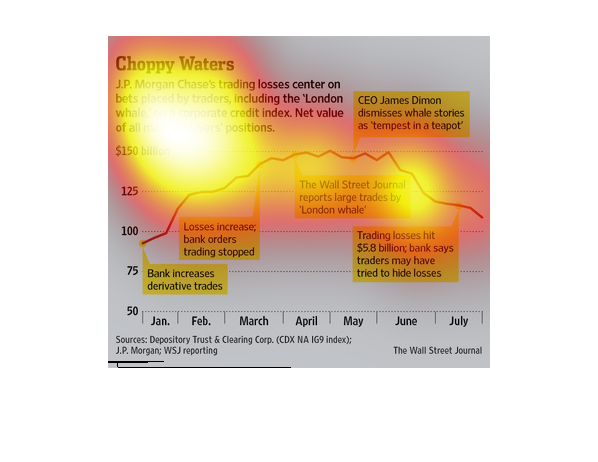

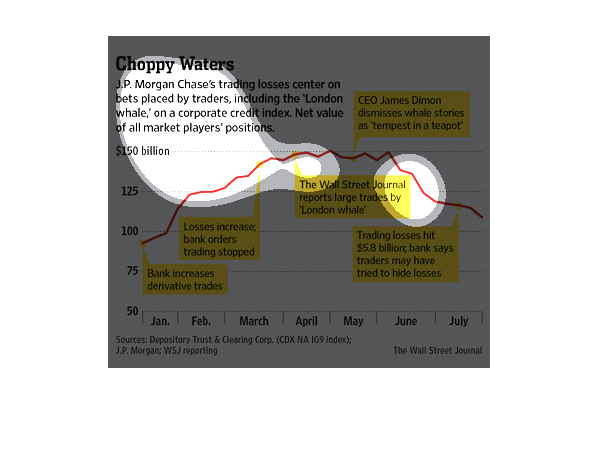

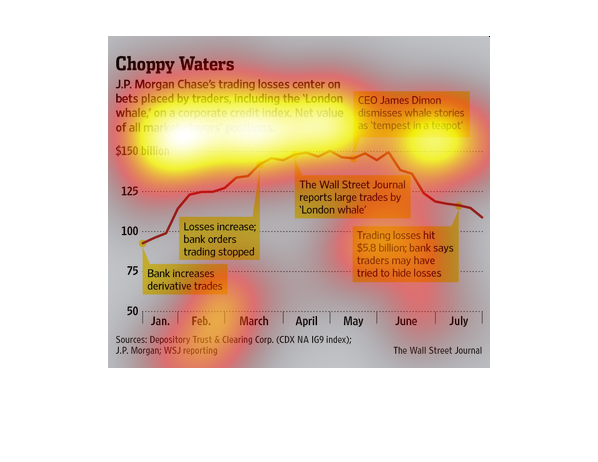

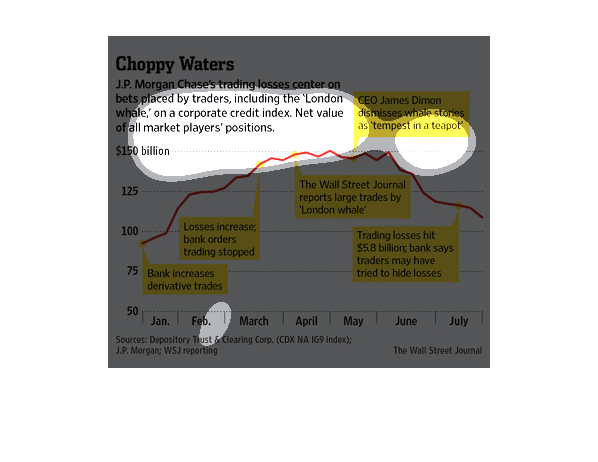

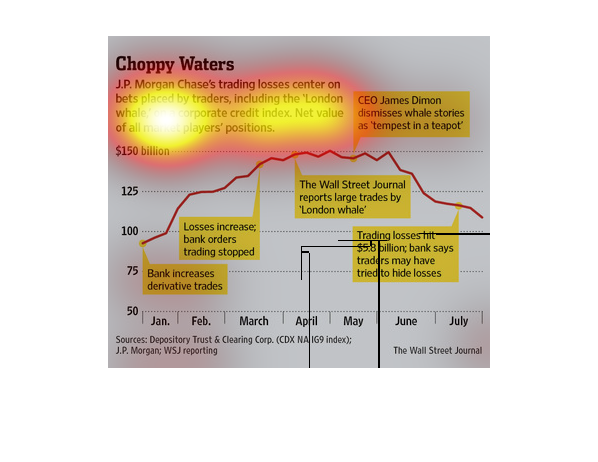

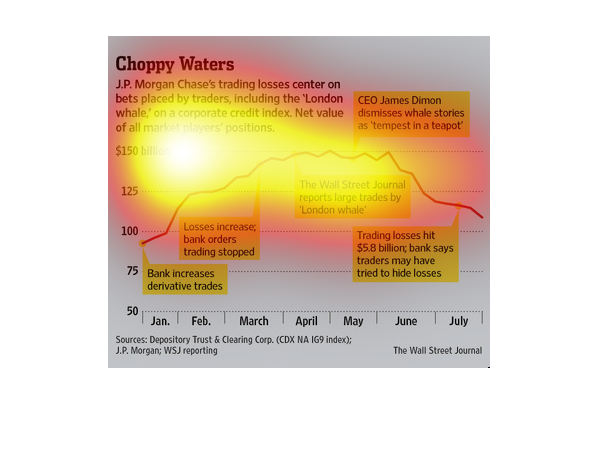

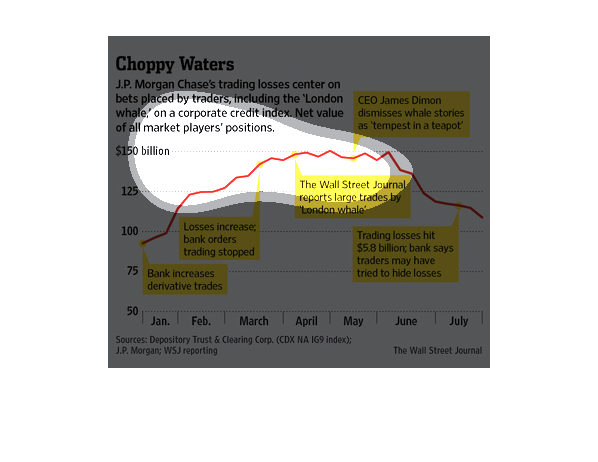

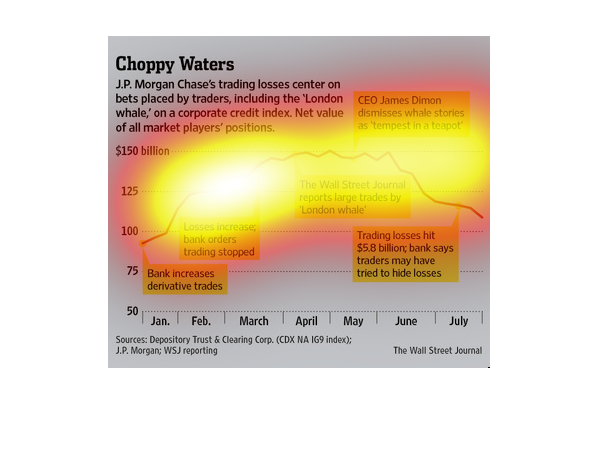

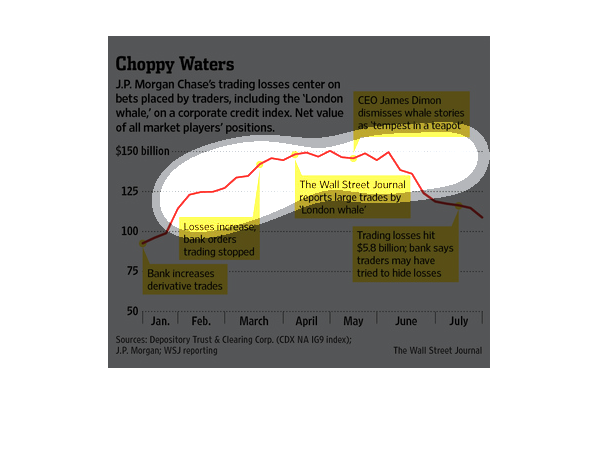

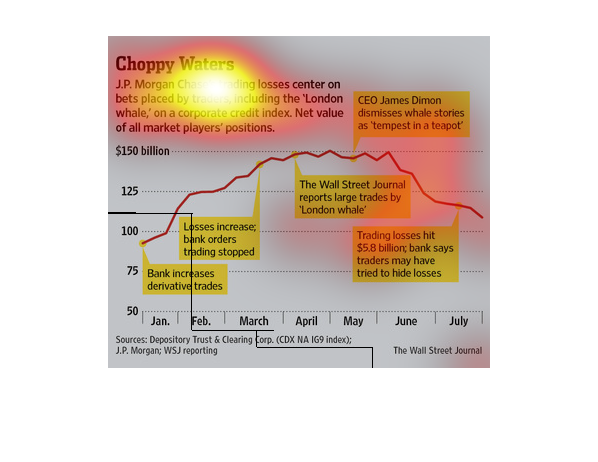

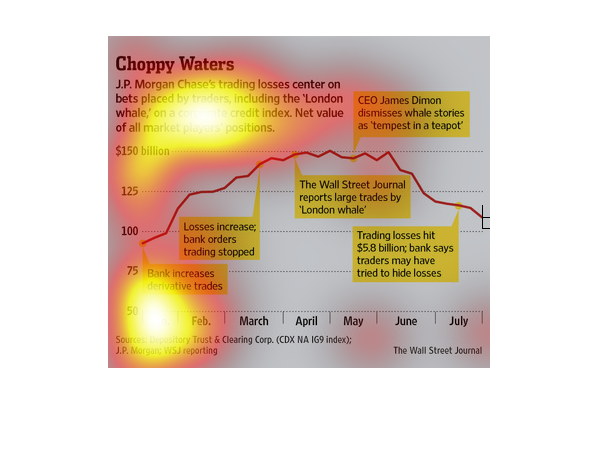

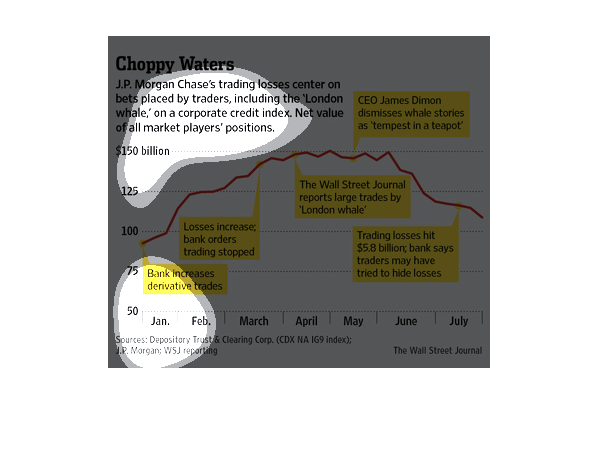

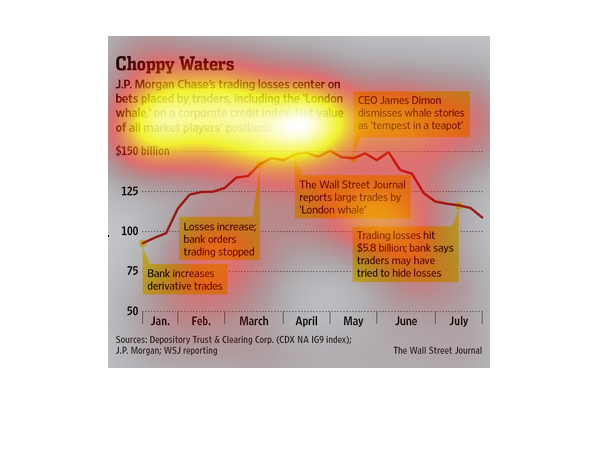

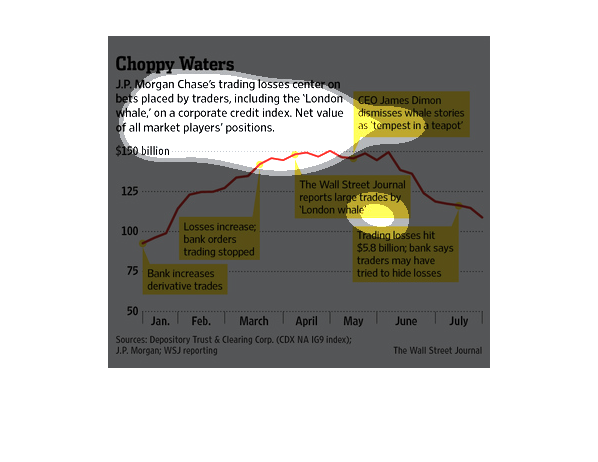

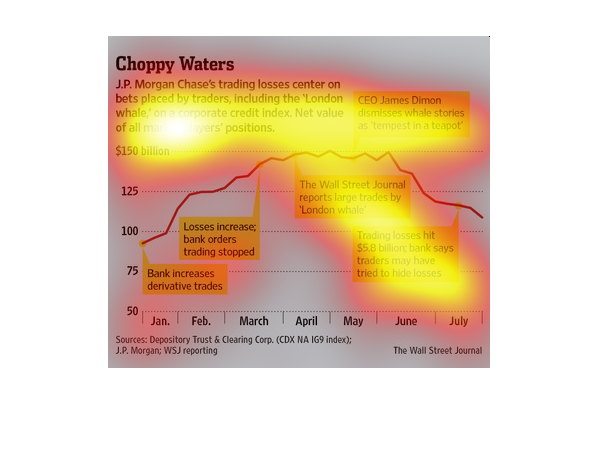

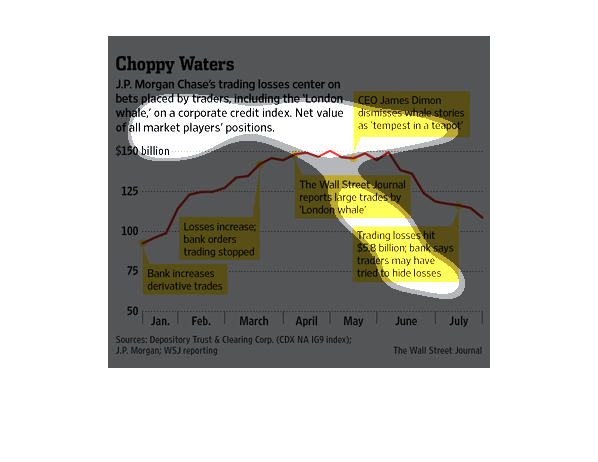

This infographic seems to be about the "London Whale," which seems to be a supposed insider

trading deal between banks. It is denied, but this infographic shows the relationship between

trading losses over time and also time stamps certain events that happened along the plotline.

You win some, you lose some; that is the way things go. In this study conducted by the Wall

Street Journal, from information obtained by the Depository Trust and Clearing Corp, J,P Morgan

has a big of a back luck run recently.

This chart from the Wall Street Journal shows how the trading income at JP Morgan have decreased

significantly in recent times due to the fixed income divisions

The image depicts J.P Morgan's trading losses center on the bets made by traders, specifically

pertaining to a massive loss in London referred to as the 'London Whale'.

This chart shows how JP Morgan Chases' trading losses center on bets placed in trading dollars

including the 'London whale' on a corporate credit index.

JPMC's trading losses center on bets placed by traders, including 'London whale' on a corporate

credit index. Net value of all market players positions.

This chart describes choppy waters. Specifically, J.P. Morgan Chase's trading loses center

on bets placed by traders, including the London Whale, on a corporate credit index.

This chart details how India's trading losses centered around bets placed by traders including

what is referred to as the 'London Whale' on a credit corporate index.

This chart from the Wall Street Journal shows how JP MOrgan's trading income over time has

dipped and how this is putting a strain on JP morgan's profits.

This chart shows the amount of losses and gains on stocks that are related to banks. It also

shows other events in the news and how that effected the outcome

Choppy Waters: J. P. Morgan Chase's trading losses center on bets placed by traders, including

the 'London whale,' on a corporate credit index. Amounts indicate net value of all market

player's positions. In January, the value is approx $80 Billion. By May, it is $150 Billion.

The following Chart Highlights the events around JP Morgan Chase Bank and the losses that

occurred over the London Whale mishap. It displays to the total index of all market players

positions.

Chase's trading loses center on bets placed by traders, including the "London Whale" on a

corporate credit index. The graph shows an increase in the debt loses and topping at 150 billion

in May when the CEO of Chase ignored the large trades by "London Whale". Chase then acknowledged

in June that it traders had hid their losses.

This chart shows the net value of all market players in a corporate credit index from January

to July. In January the value was below $100 billion, it rose to $150 billion in April and

dropped to just above $100 billion in July.