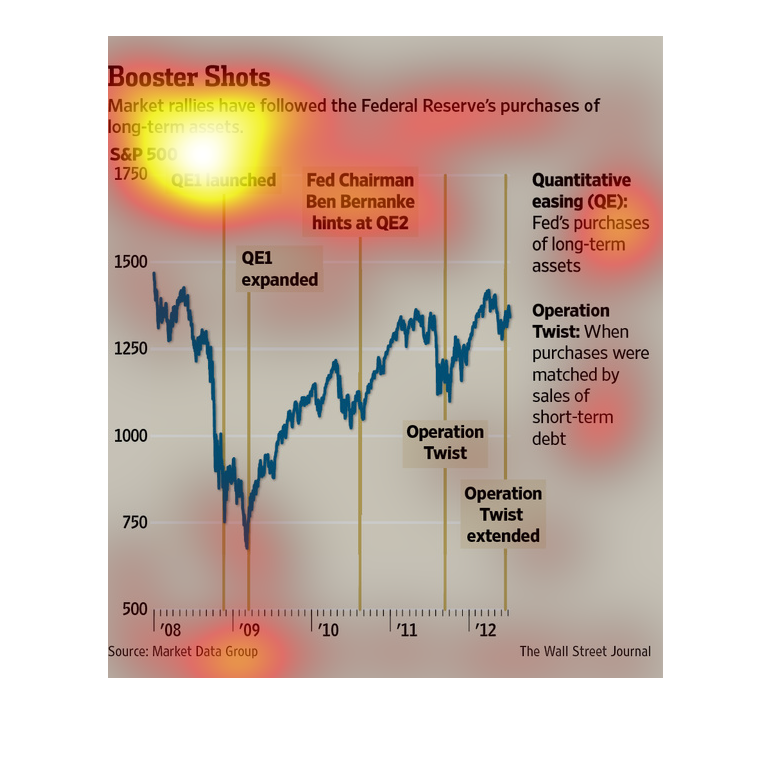

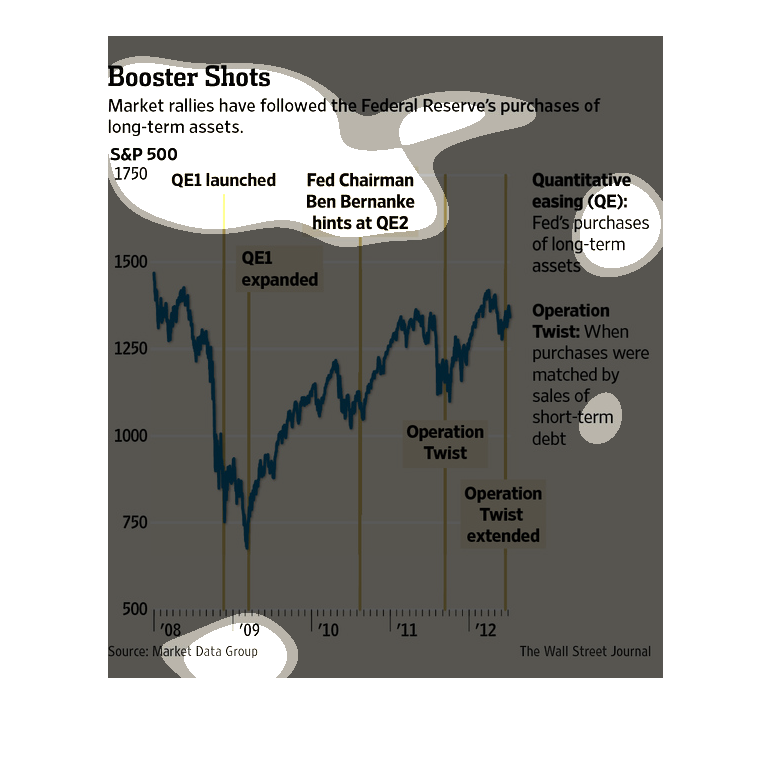

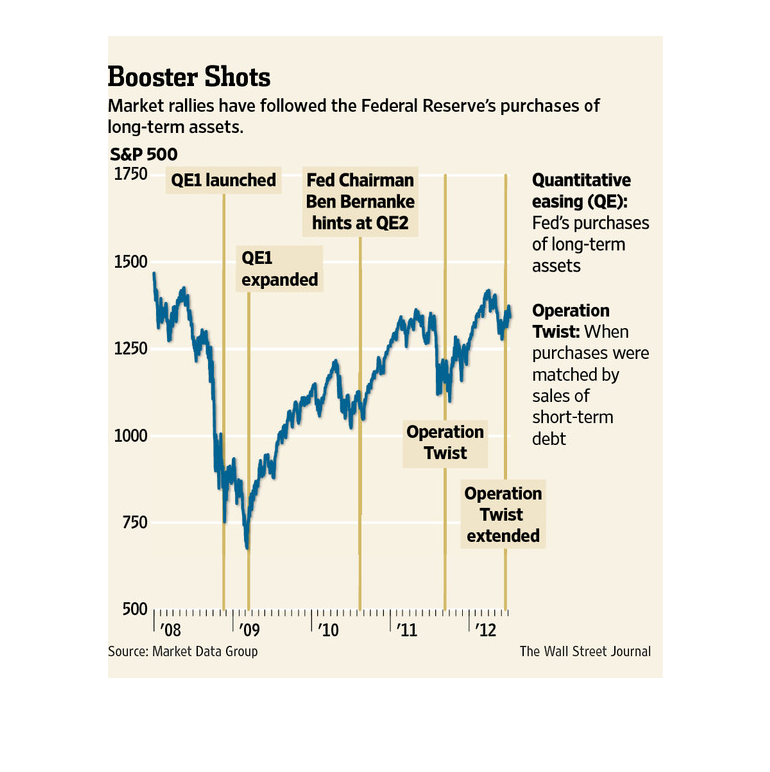

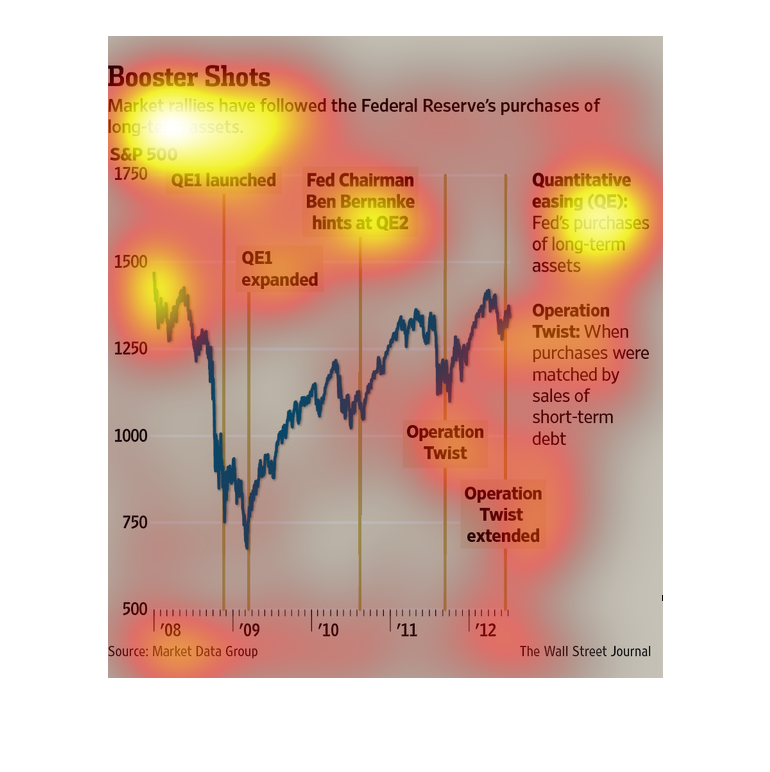

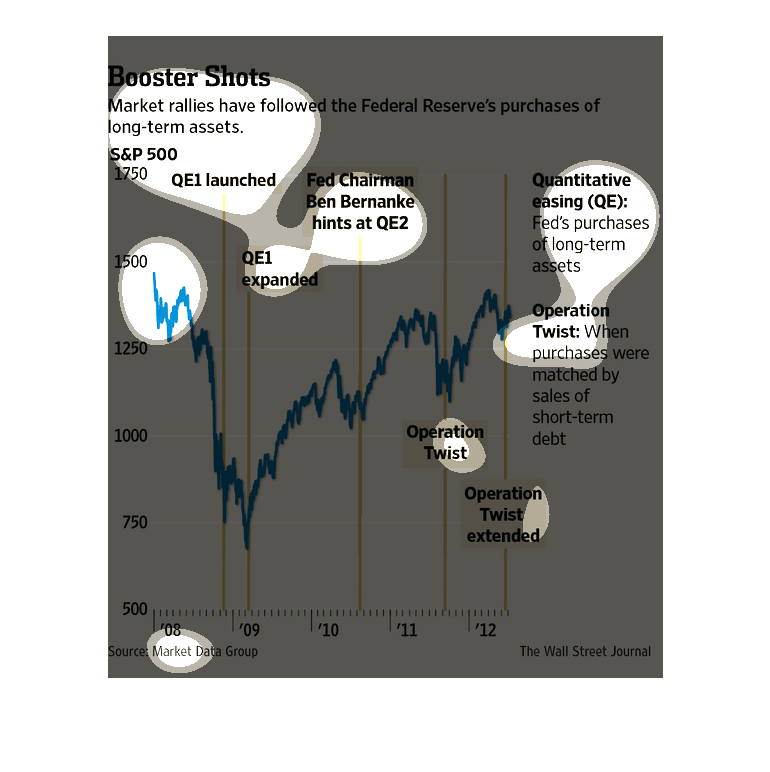

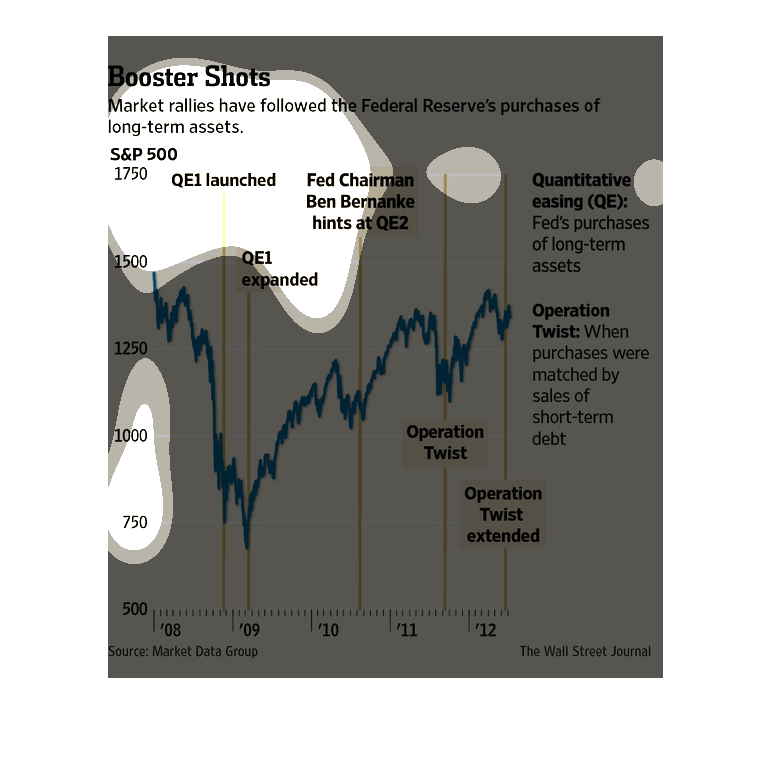

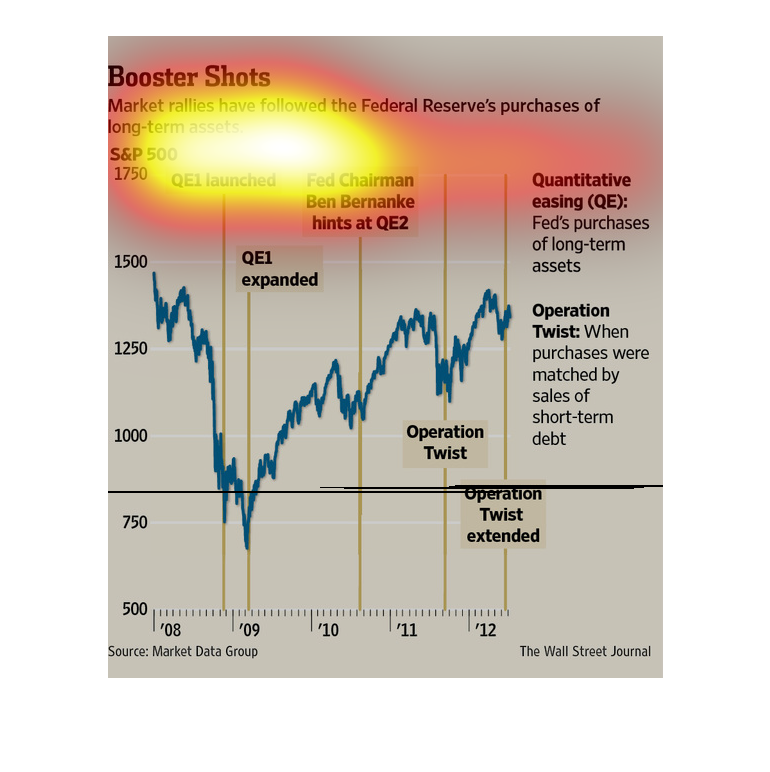

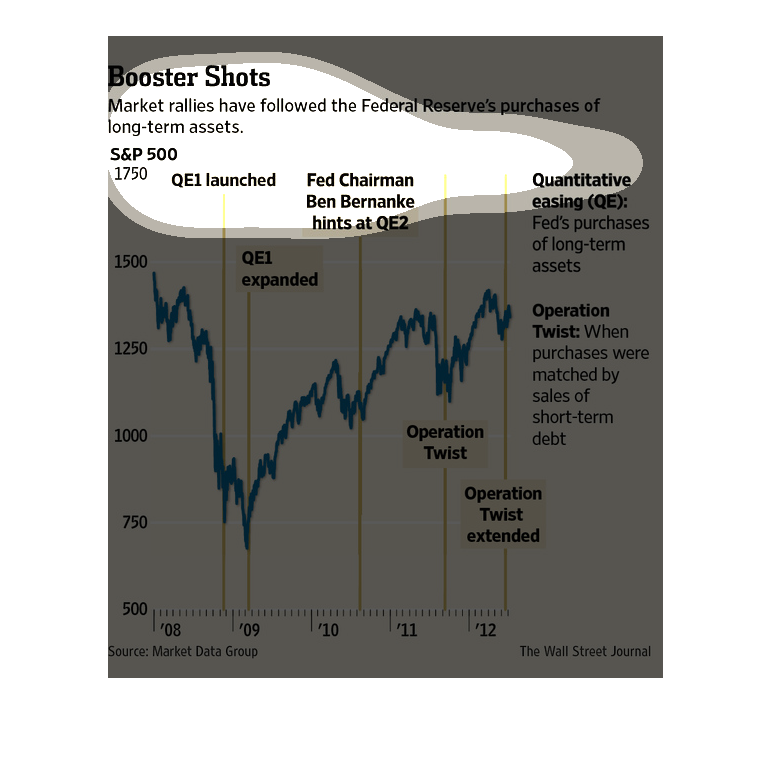

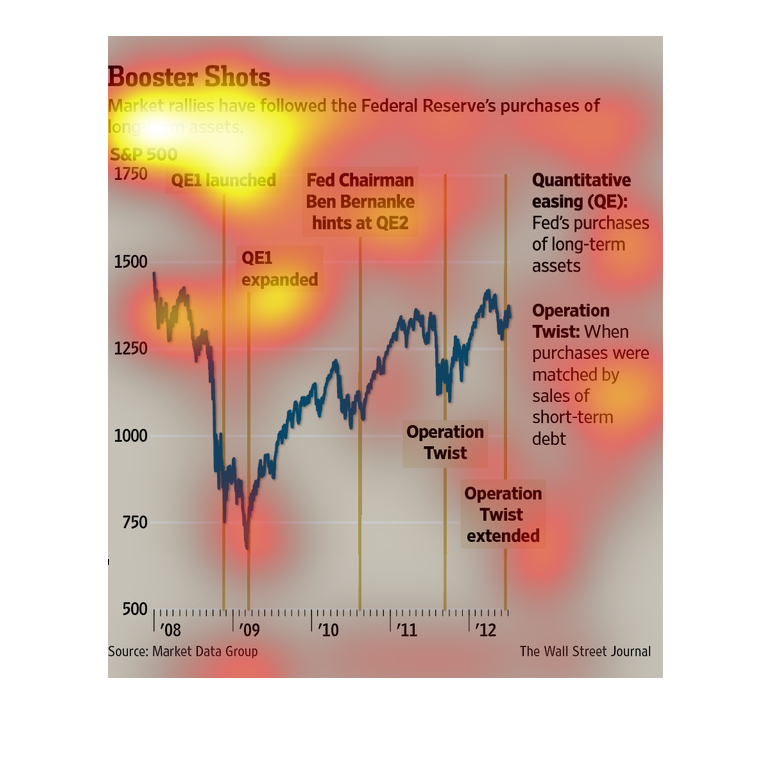

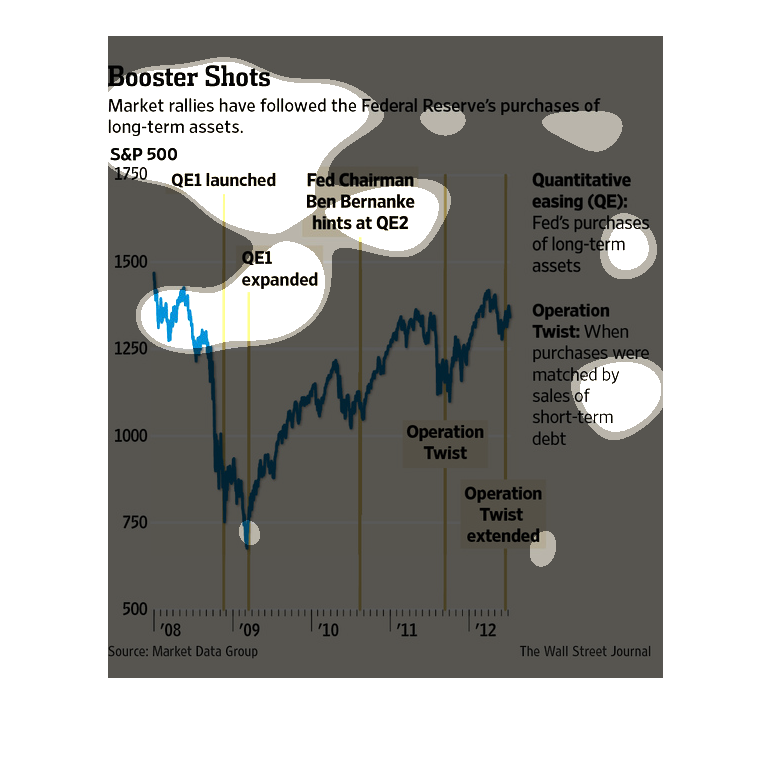

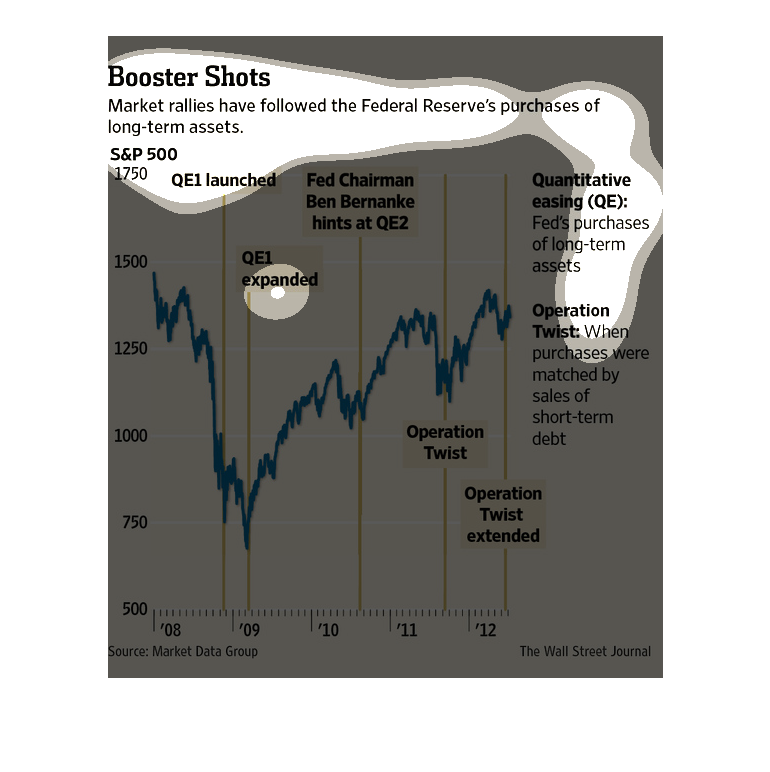

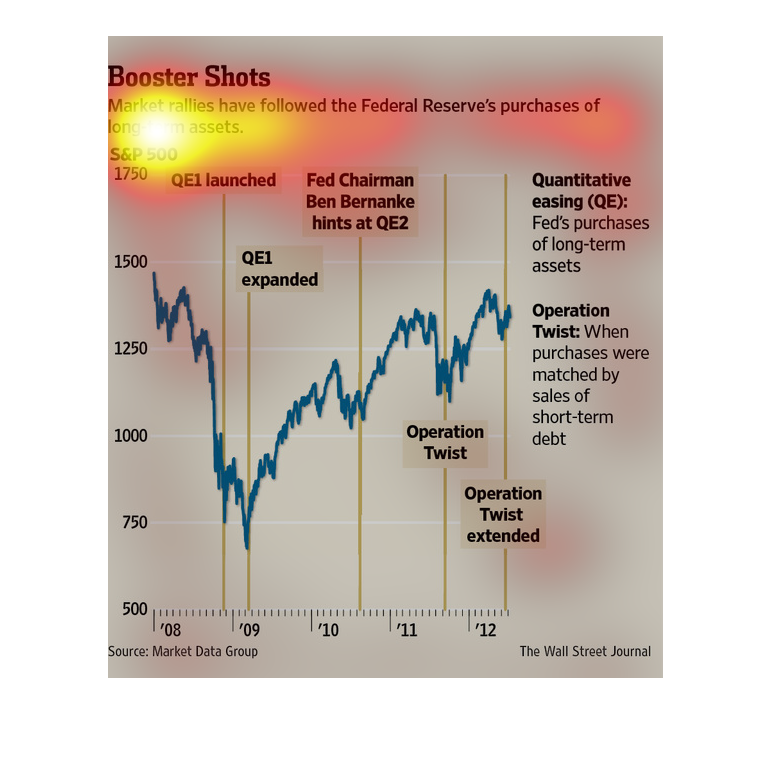

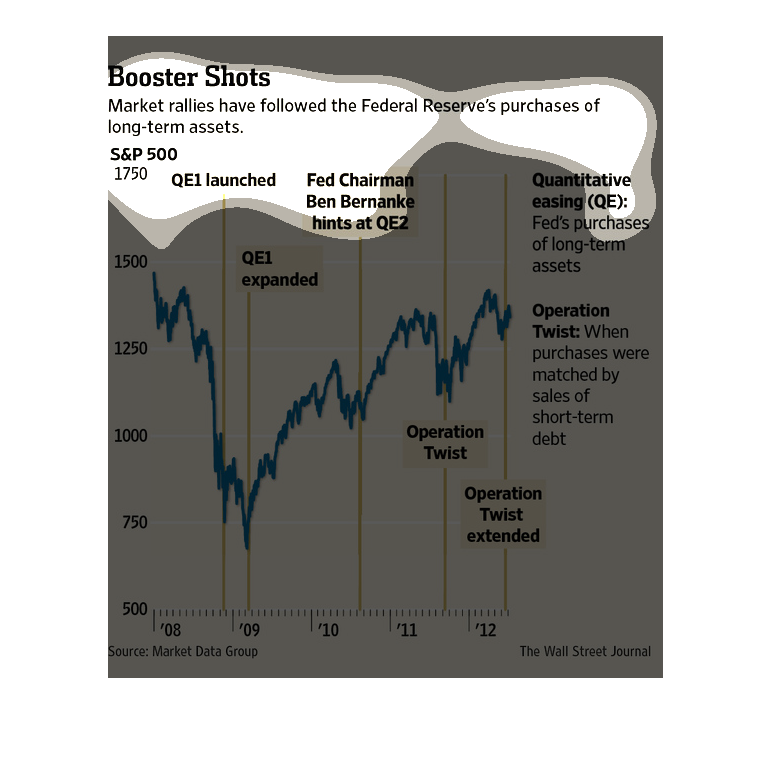

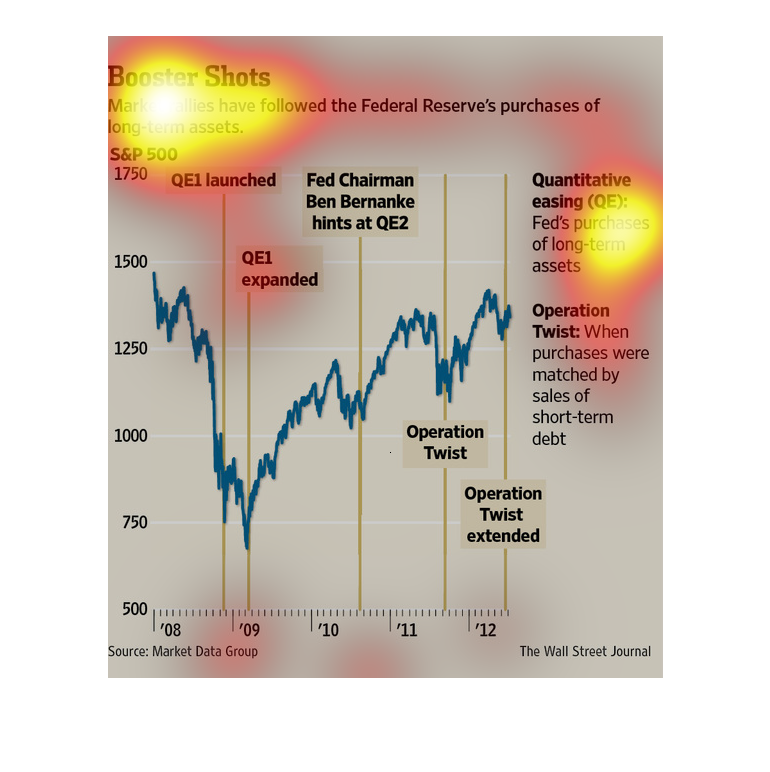

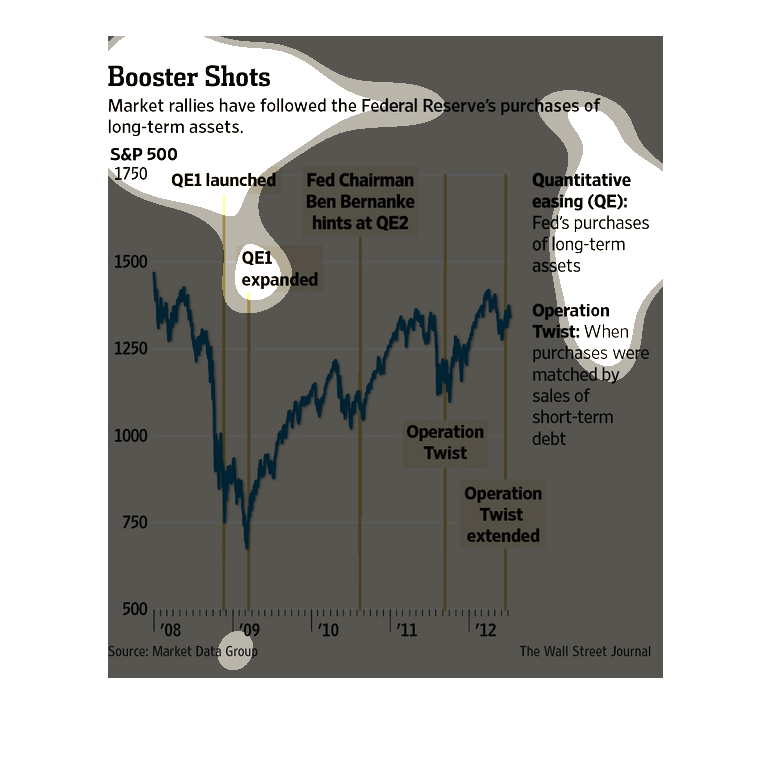

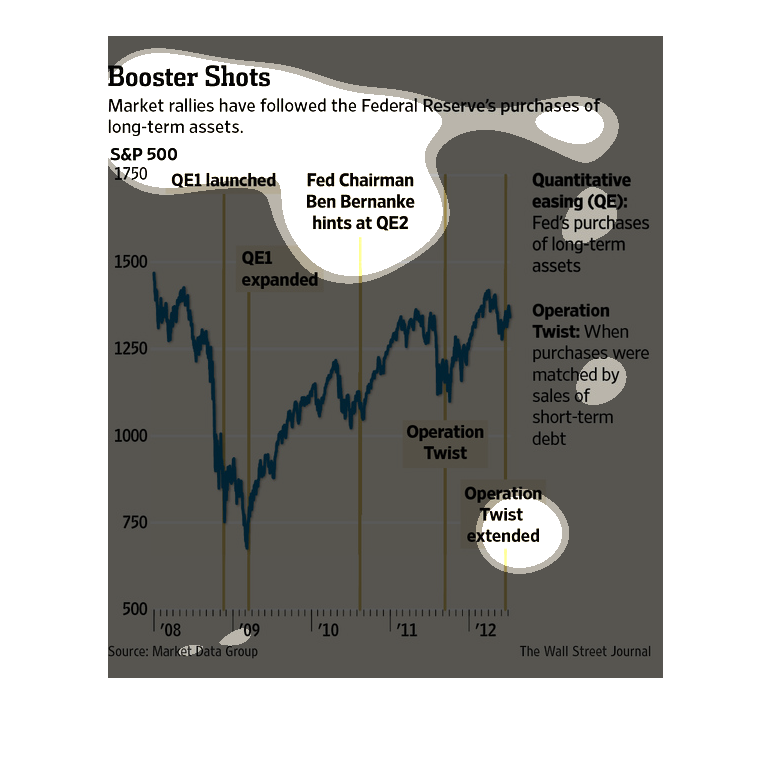

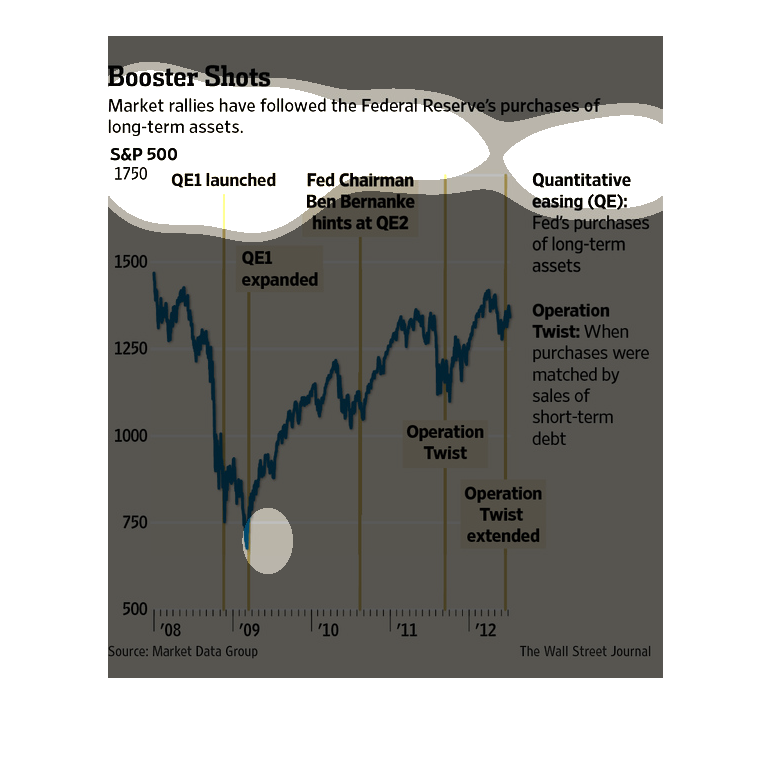

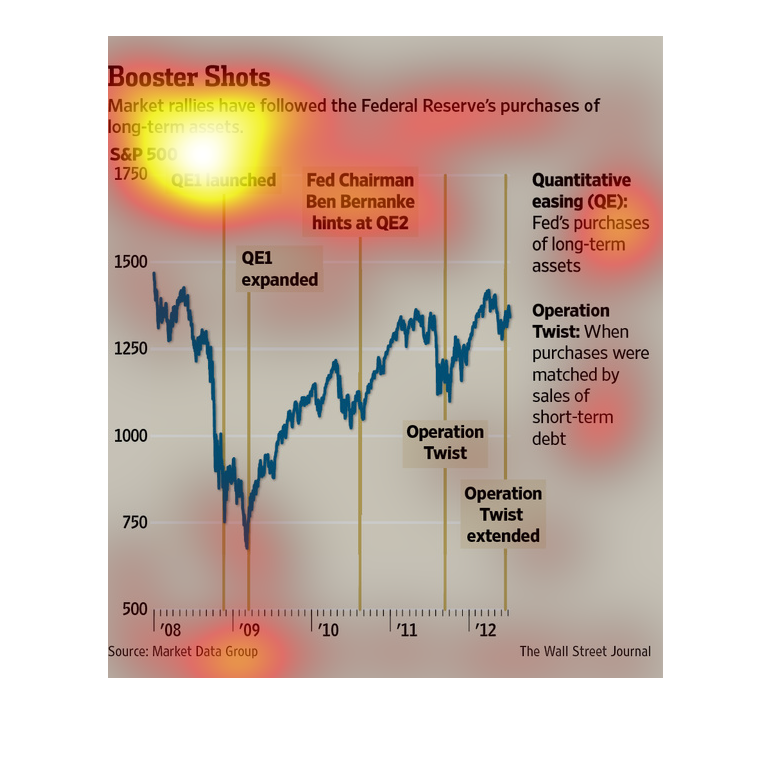

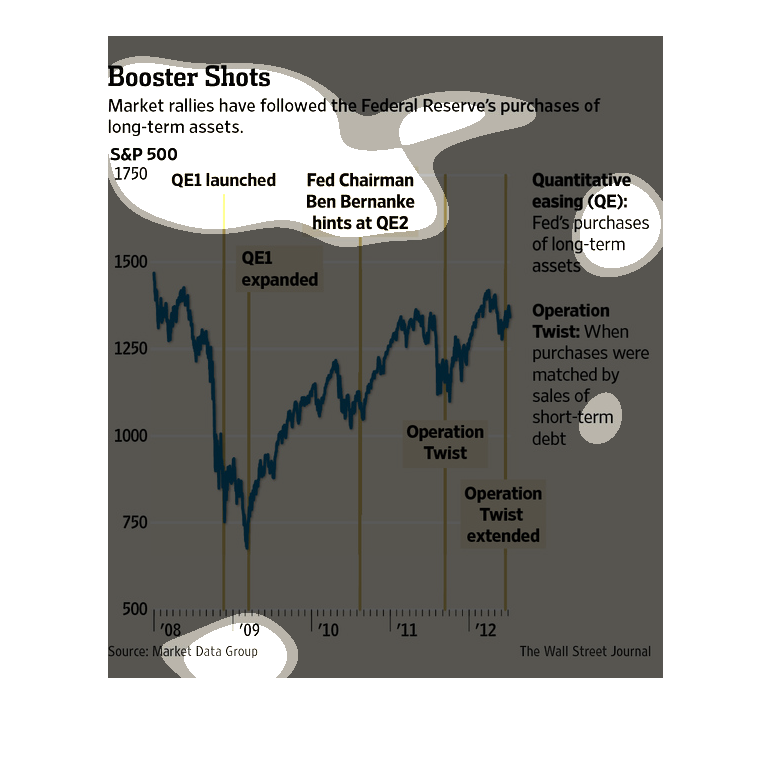

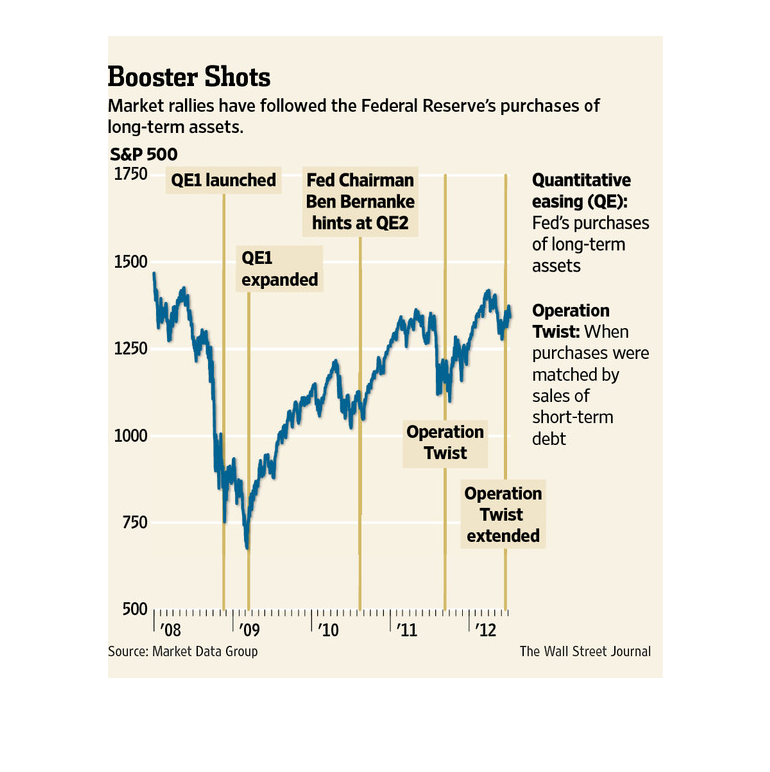

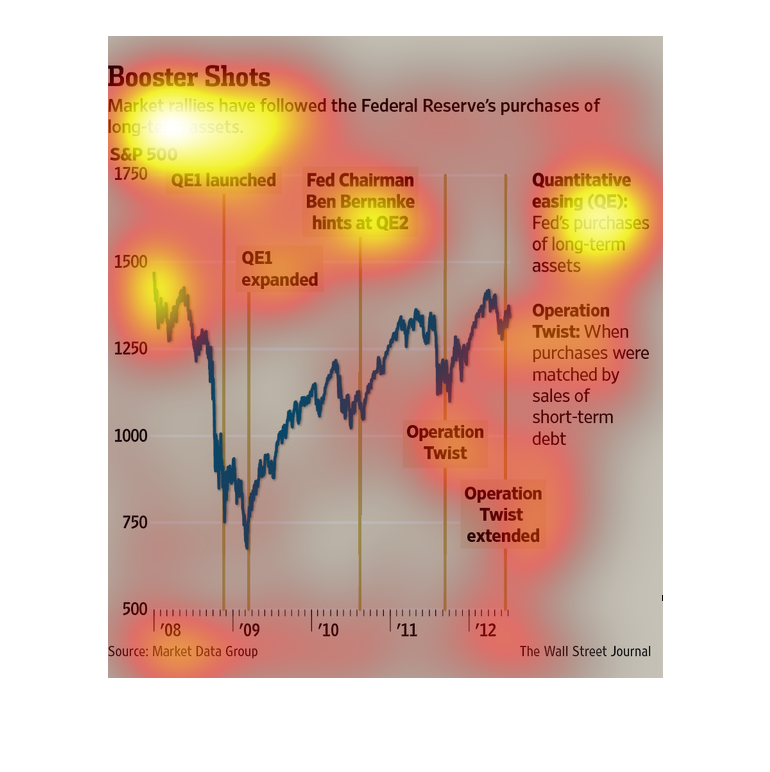

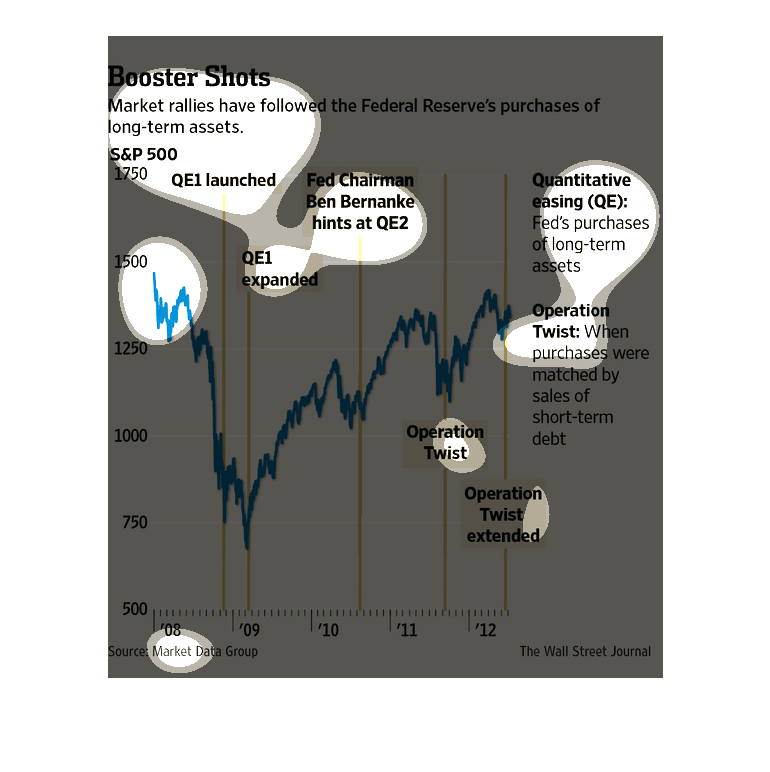

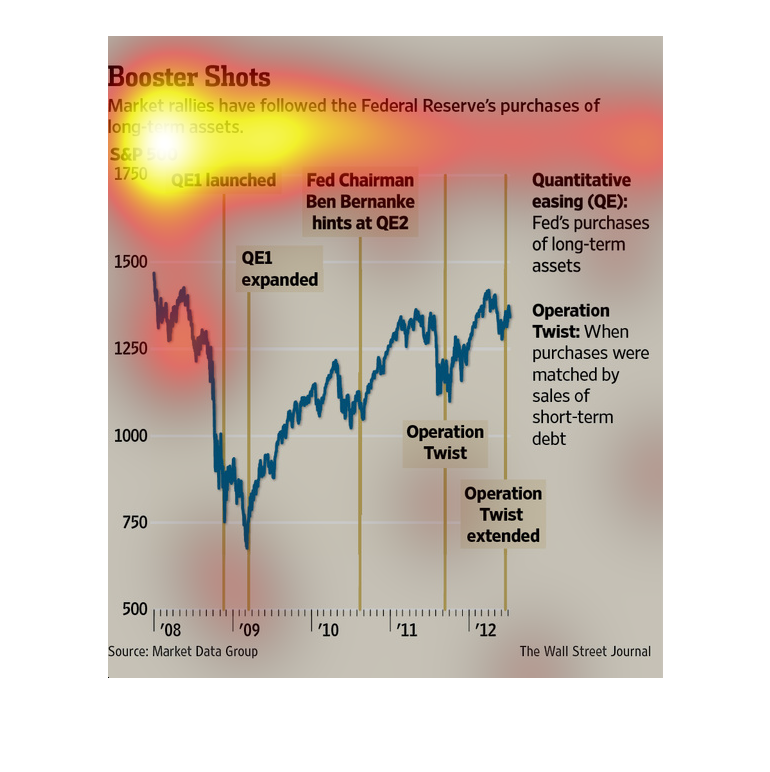

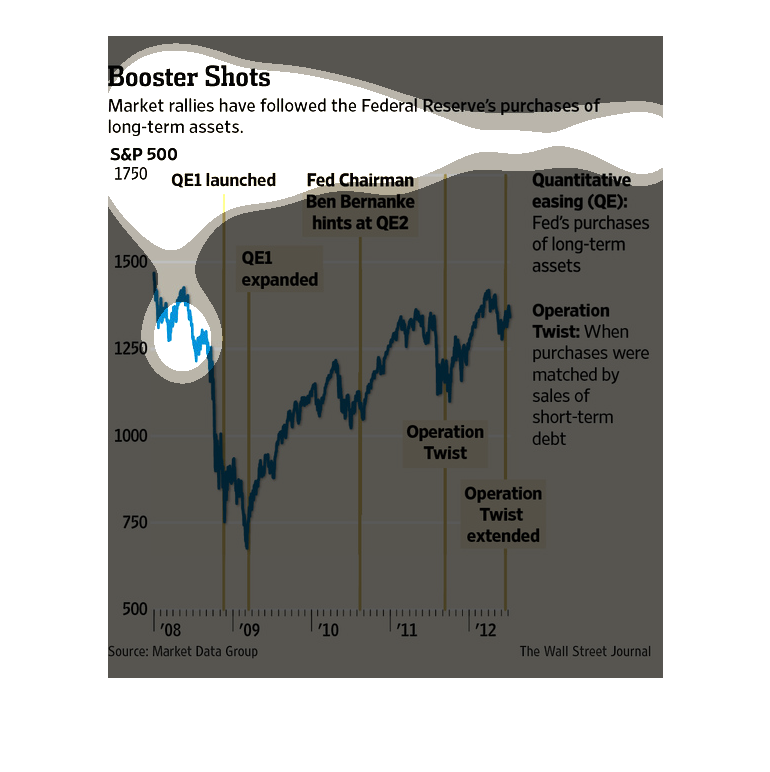

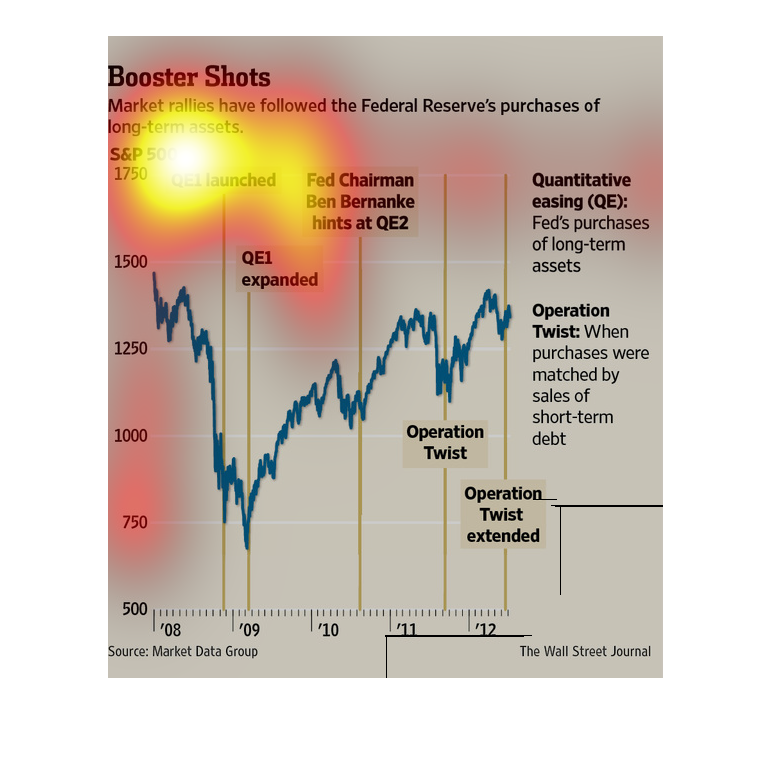

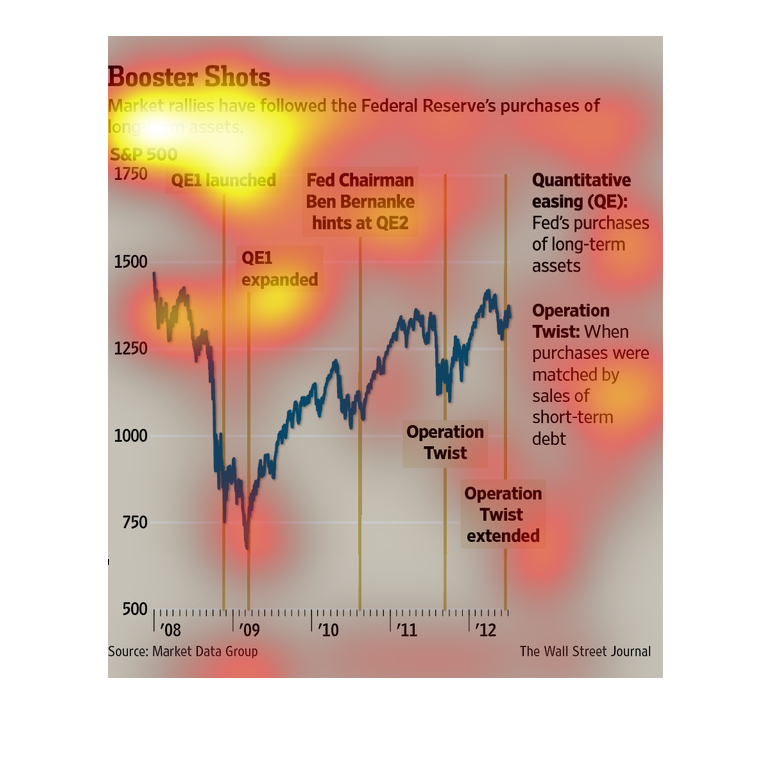

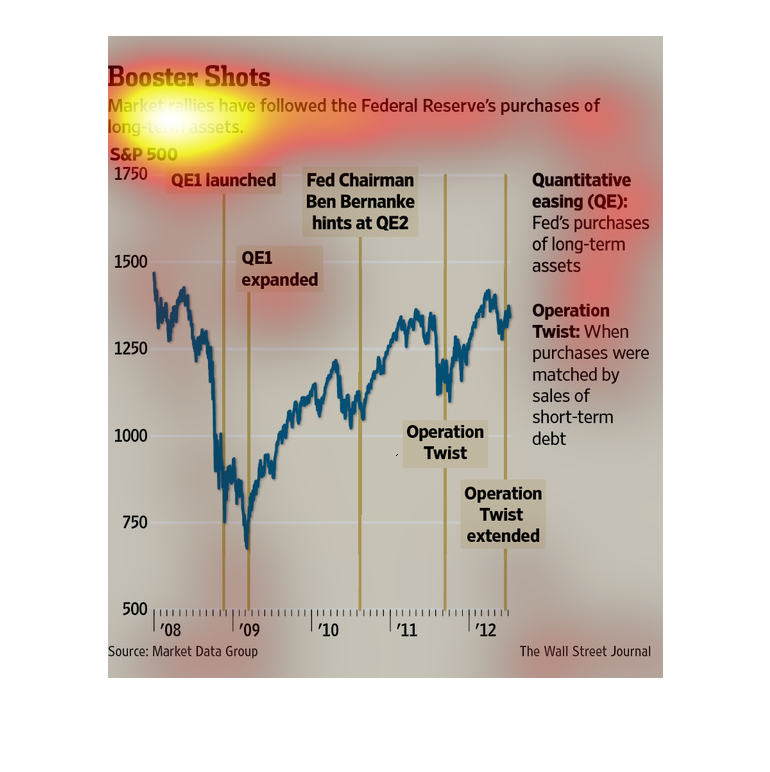

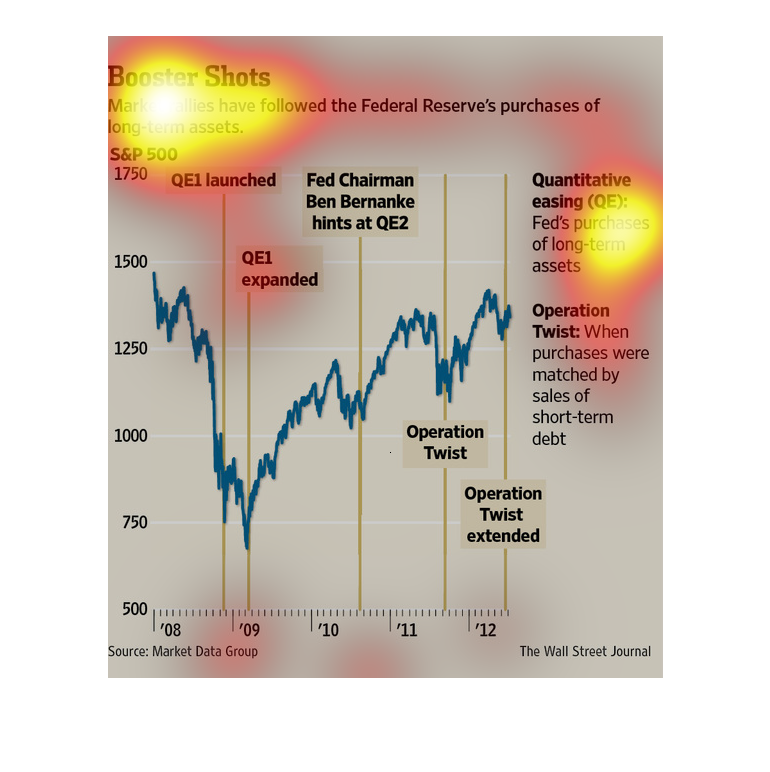

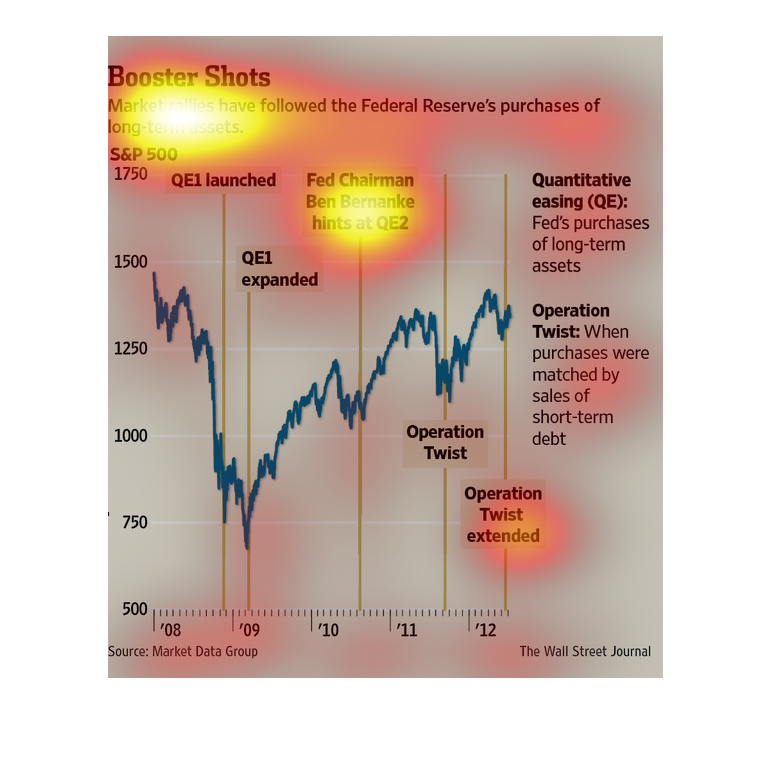

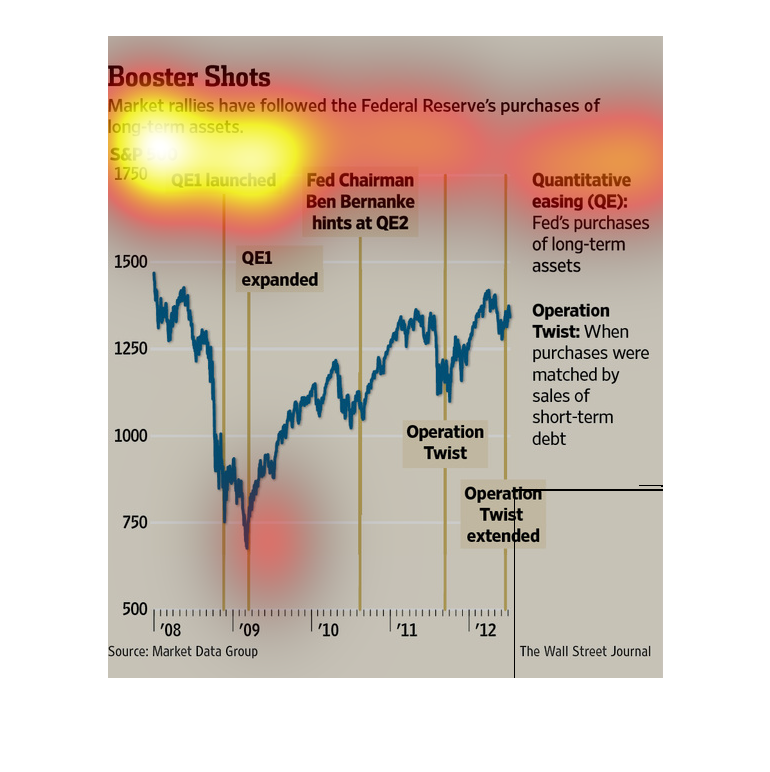

The caption for this poster is, "Booster Shot, Market rallies have followed the Federal Reserve's

purchases of long term assets". This poster features one graph that follows trending data

patterns of the Federal Reserve between 2008-2012 and their acquiring of long term assets.

This image shows or depicts in line graph statistical format information concerning booster

shots. Market rallies have followed the Federal Reserve's purchases of long-term assets.

This graph shows how the market reacts after the Ferderal Reserve buy bonds in an effort to

stimulate the economy. It is a simply line graph that shows the s&P 500 index over time.

This chart from the Wall Street Journal shows how the federal reserve's changes in interest

rates have boosted growth in the stock market, which may be a bubble

This is a chart of Booster Shots describing the market state following actions by the Fed

over multiple years. There was an initial plunge and then Federal Reserve strategies took

the market back up.

This chart from the Wall Street Journal shows how the market, specifically the S&P 500, have

changed or grown after the Federal Reserve has altered its bond buying

This graph from 2008 to 2012 shows the markets uptick as the federal reserve purchases assets.

Specific purchases are denoted along the timeline as the years progress.

This is a large graph of the federal reserves purchasing of certain assets. It shows the amount

and that is put up against the amount of time that has passed.

The title of the graphic is boosted shots. It says that market rallies have followed the federal

reserve's purchases of long-term assets. It shows the feds purchases of long term assets.

This chart describes boosted shots. Specifically, market rallies have followed the federal

reserve's purchases. Categories include quantitative easing.

This graph is about Market rallies that have followed the Federal Reserve's purchase of long-term

assets from 2008-2012. It shows that they were at their lowest during 2009.

This chart describes booster shots. Specifically, markets rallies have followed the federal

reserve's purchases of long term assets. Categories on the chart include QE1 Expanded.

This is a color coded chart with related statistics depicting that market rallies had followed

the Federal Reserve's purchases of long term assets at the time.

This line graph describes what the Federal Reserve has been buying as long term assets over

the years 2008 to 2012. The lowest point is in 2009, at 750.