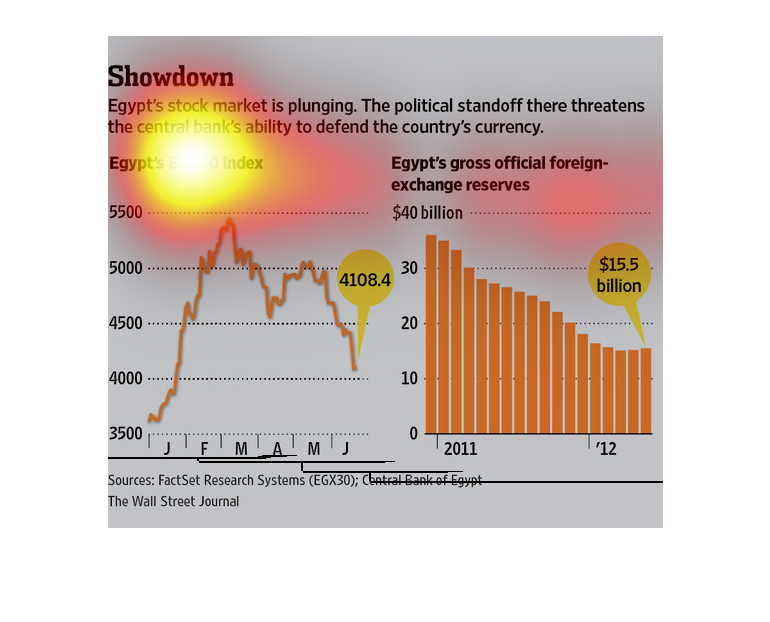

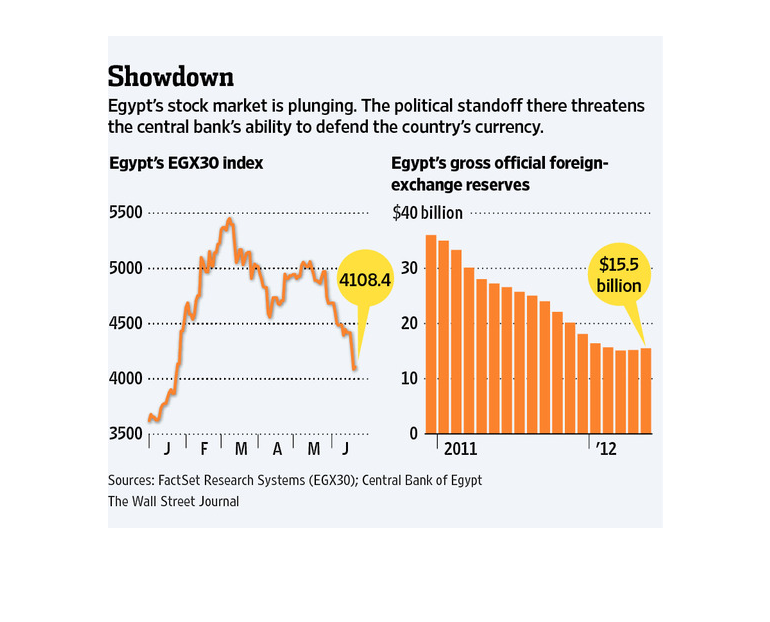

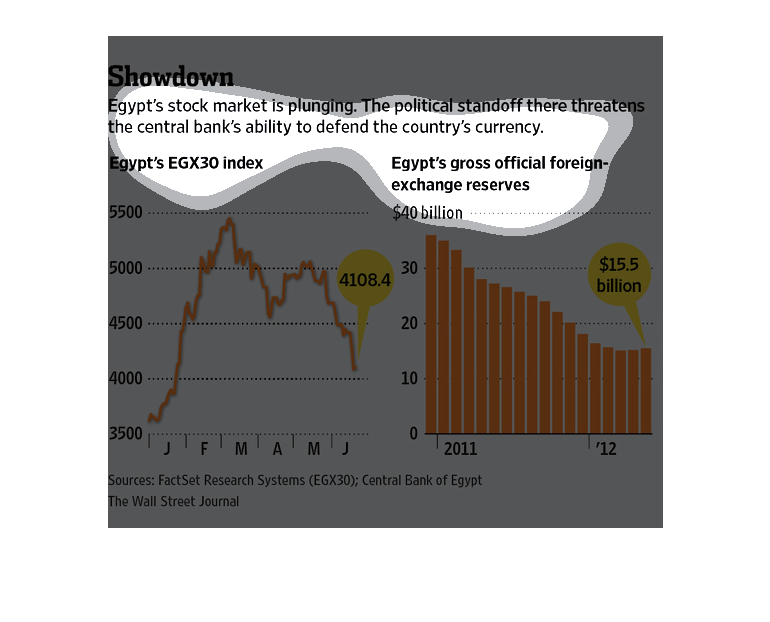

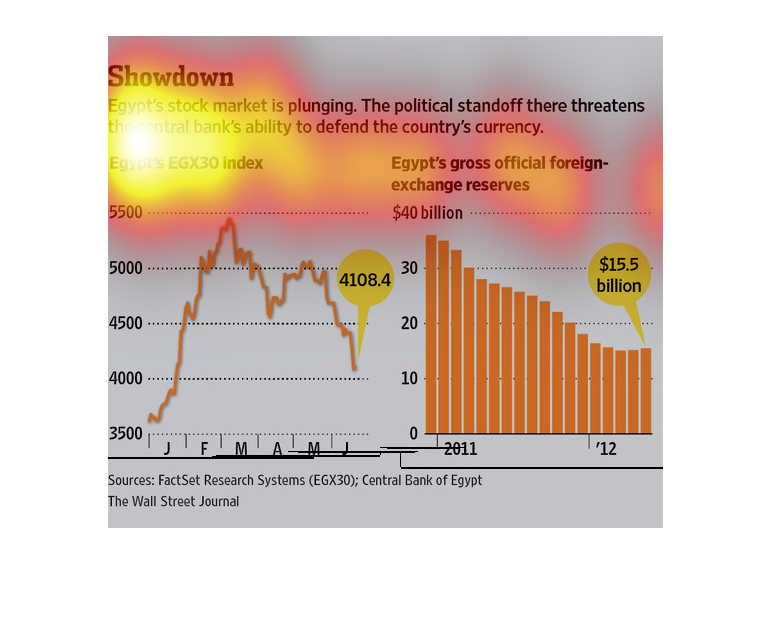

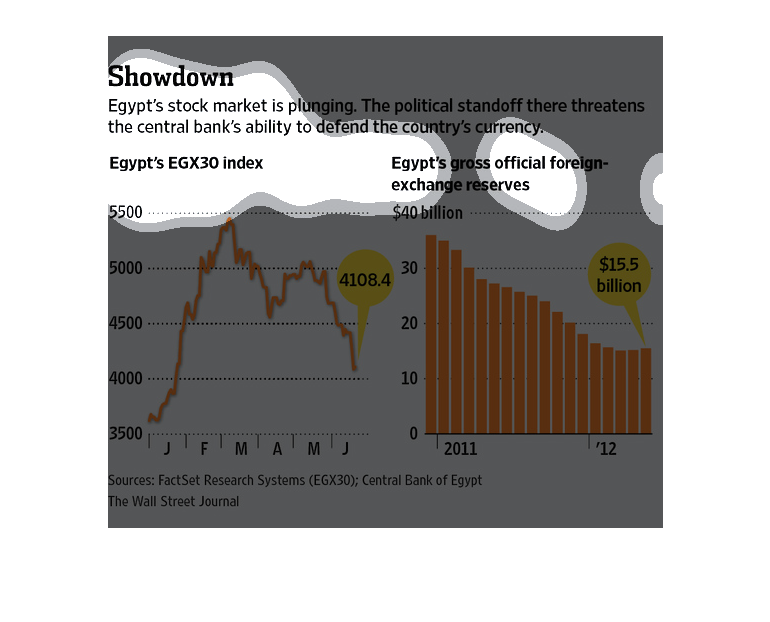

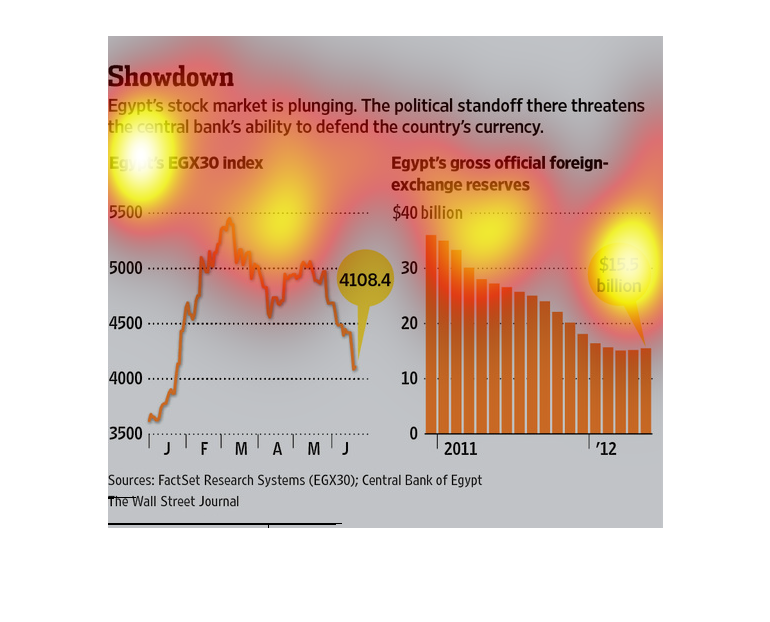

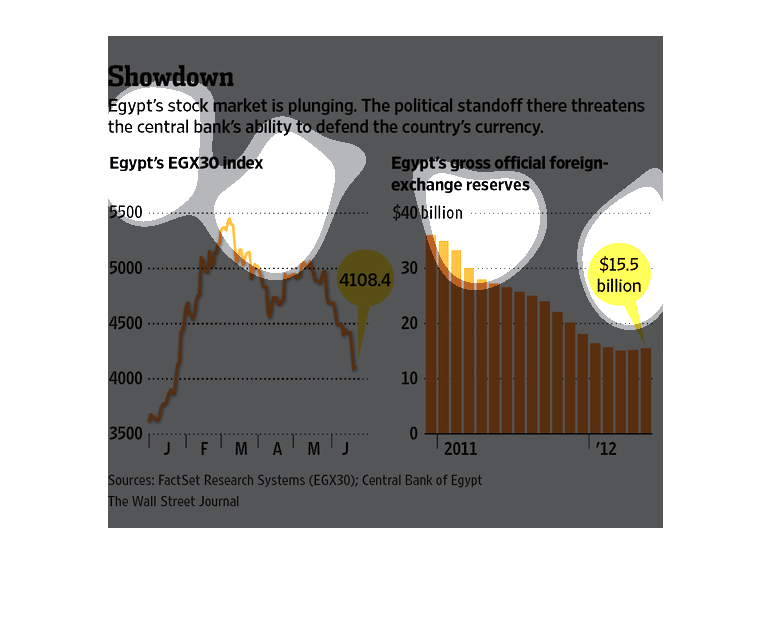

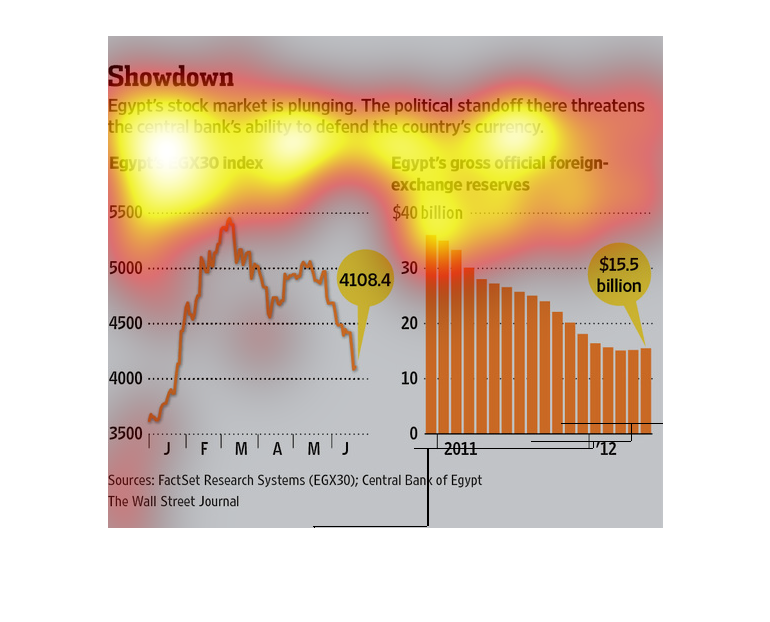

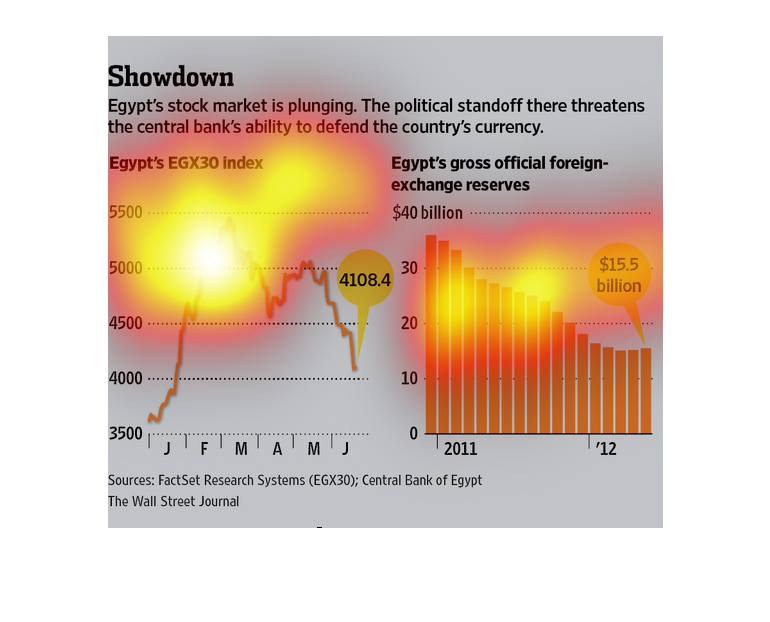

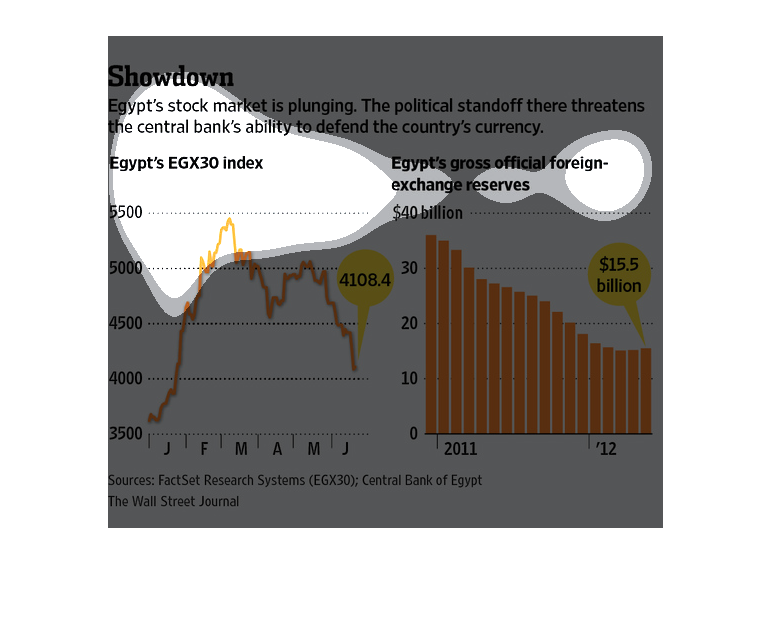

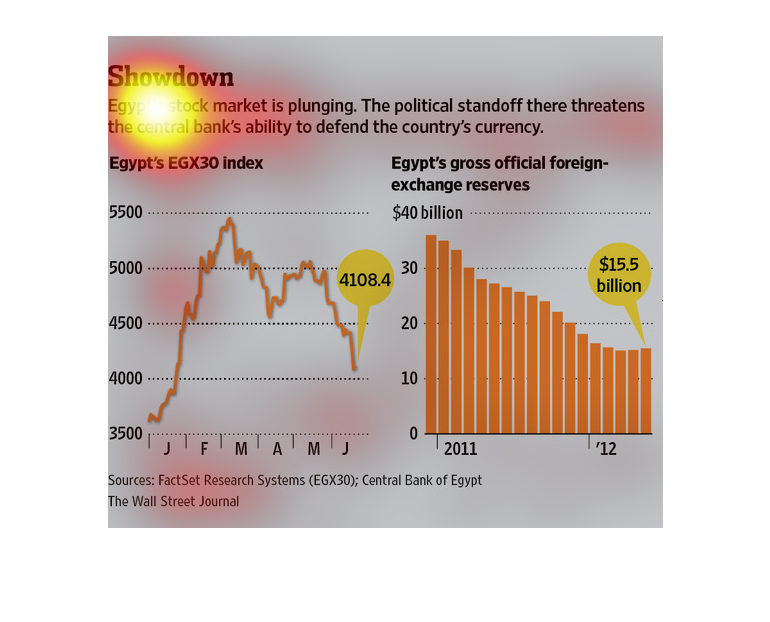

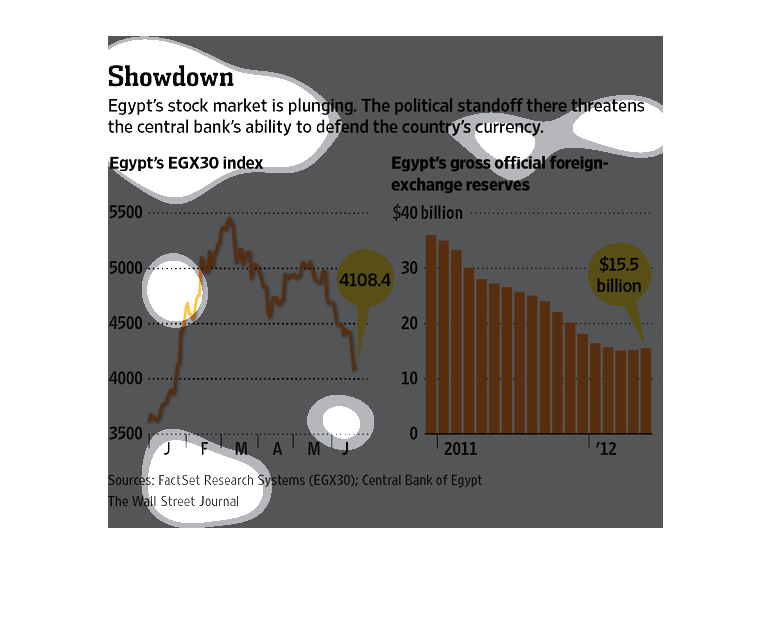

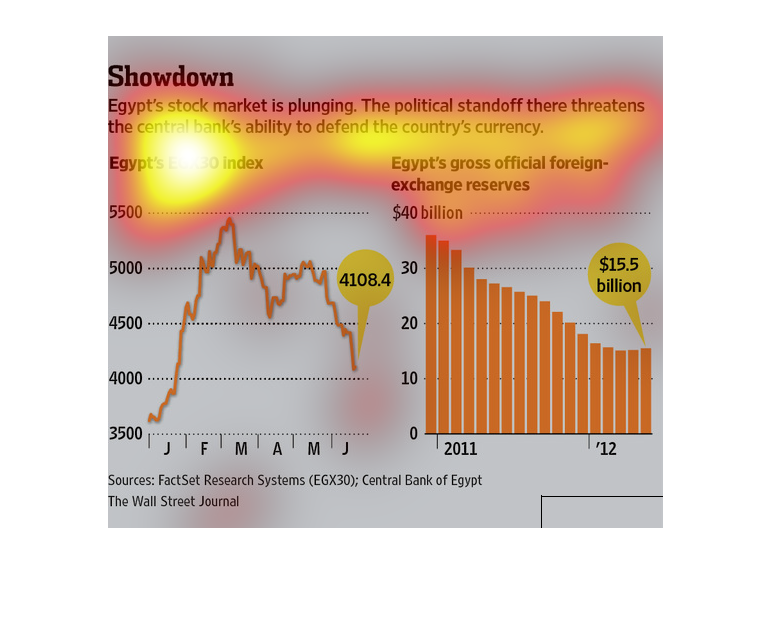

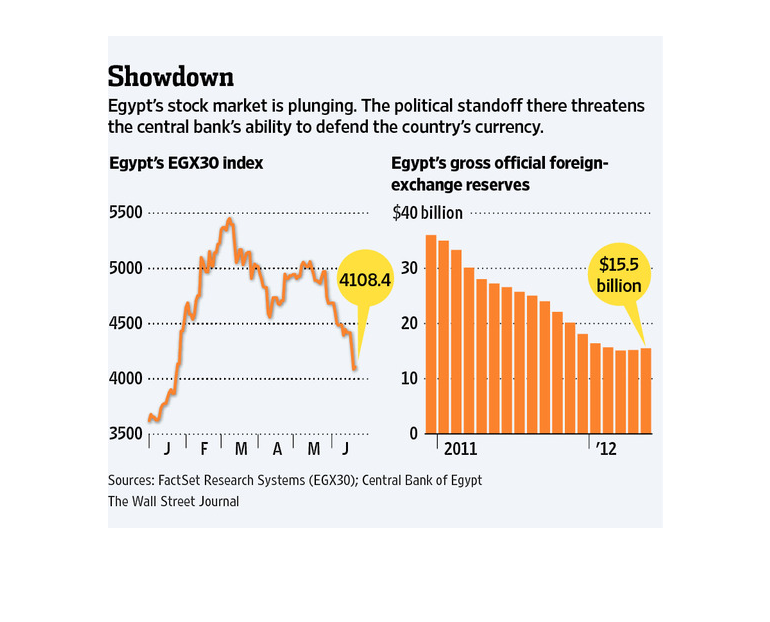

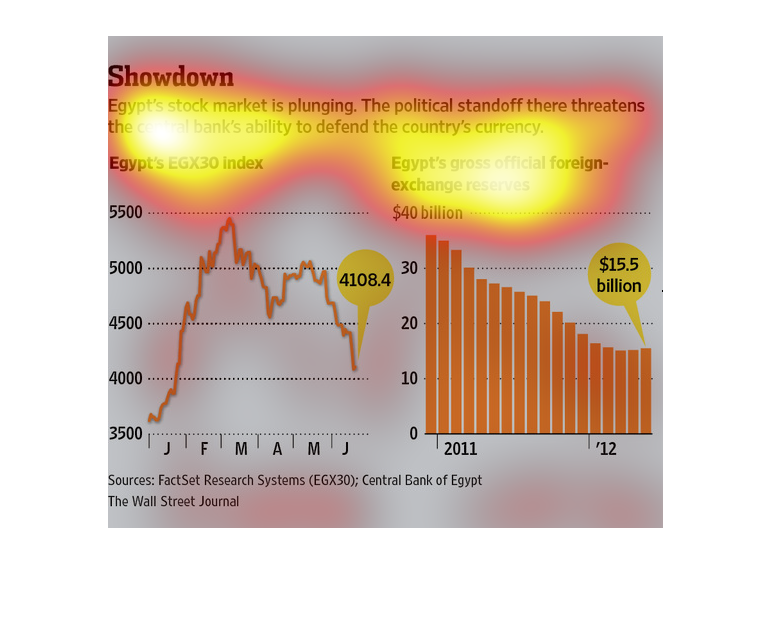

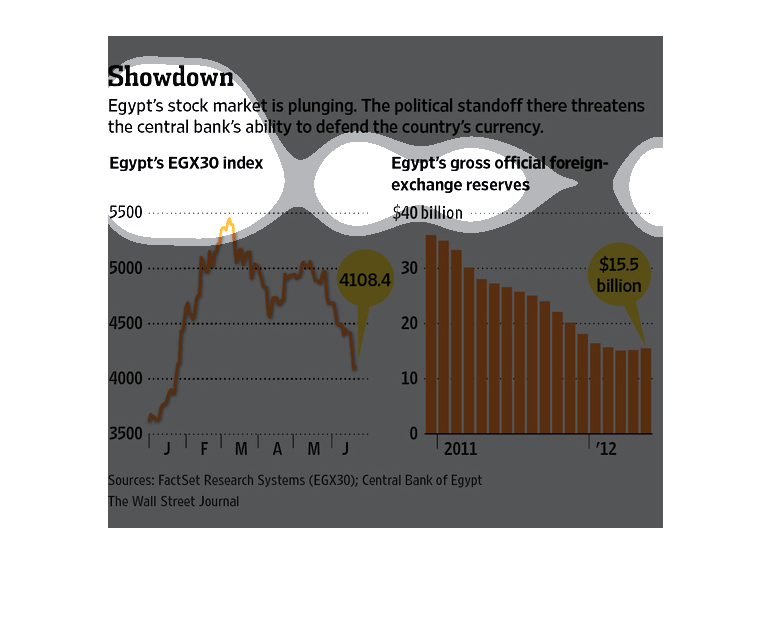

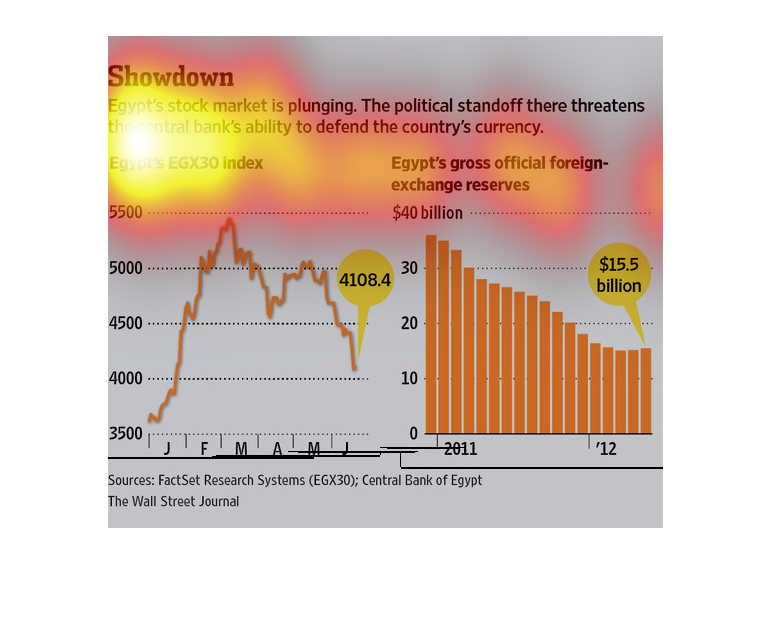

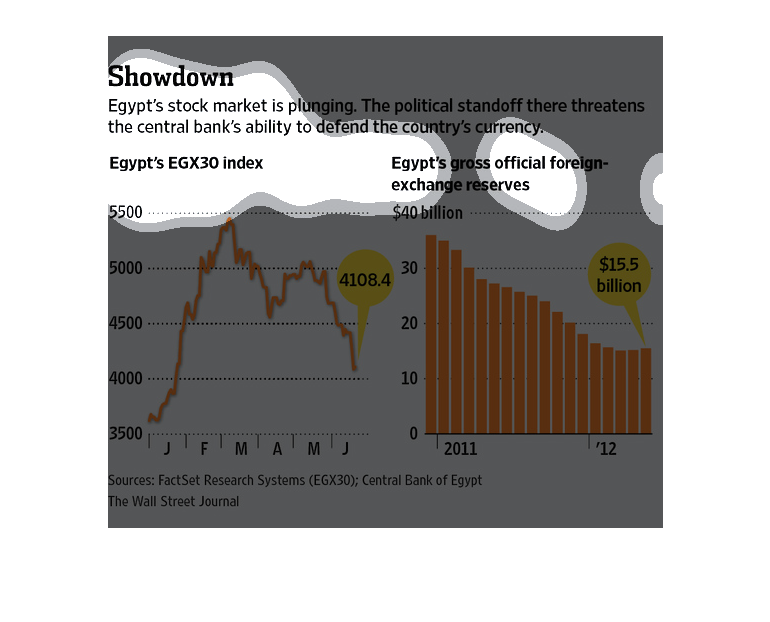

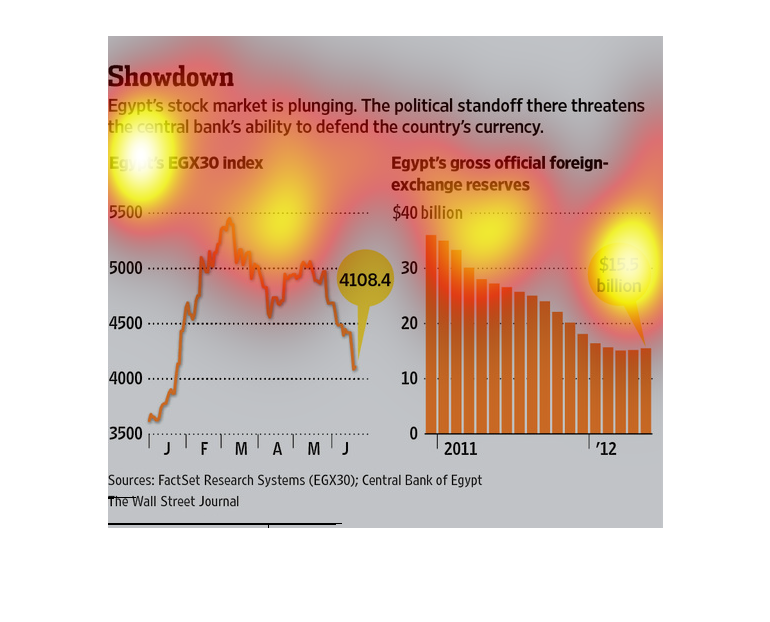

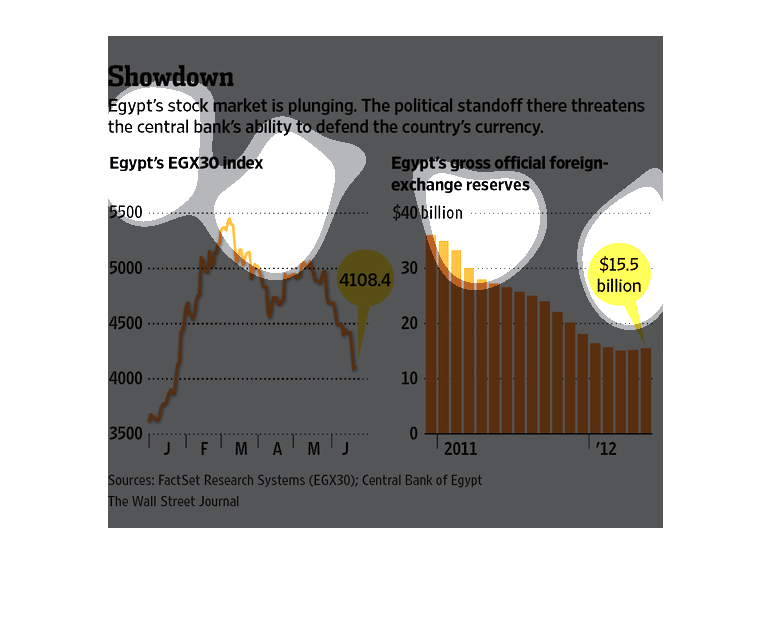

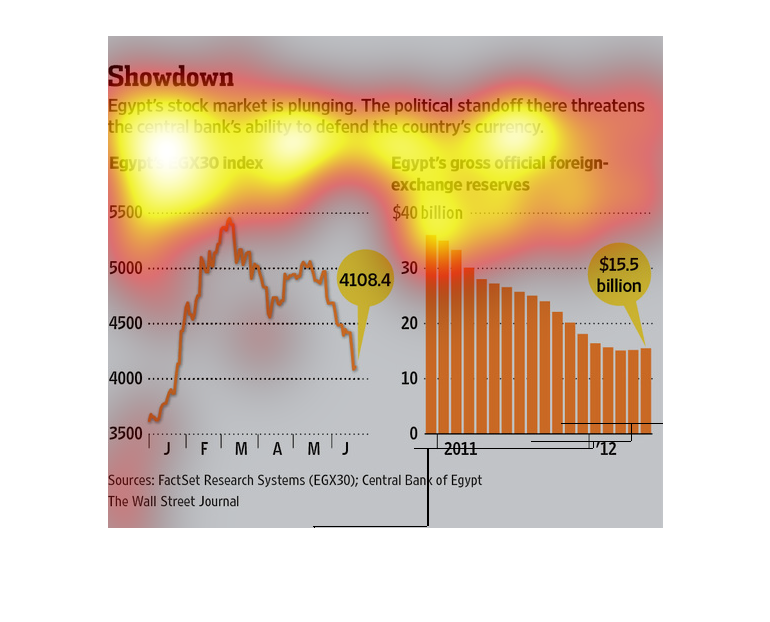

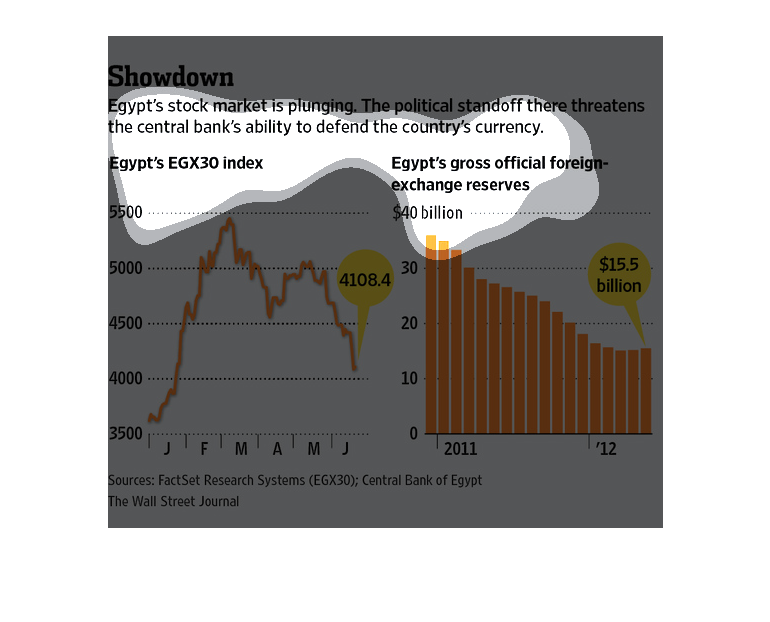

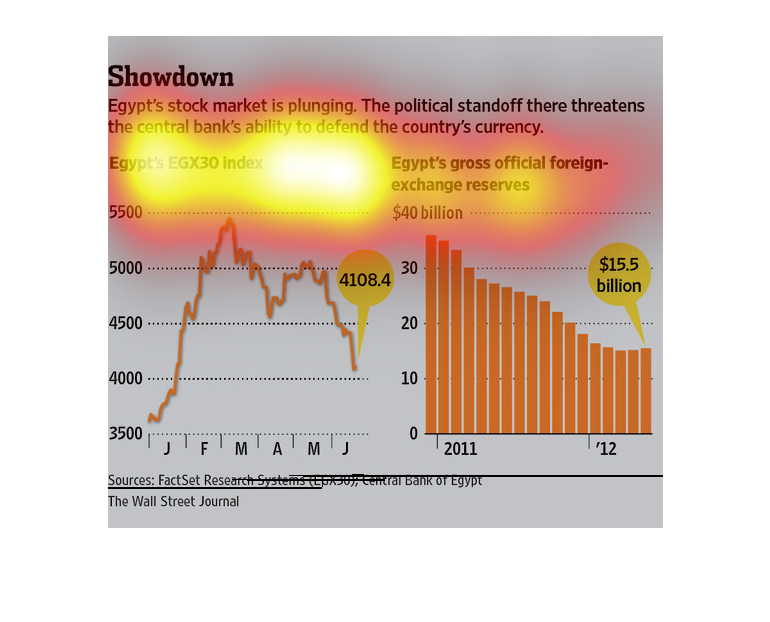

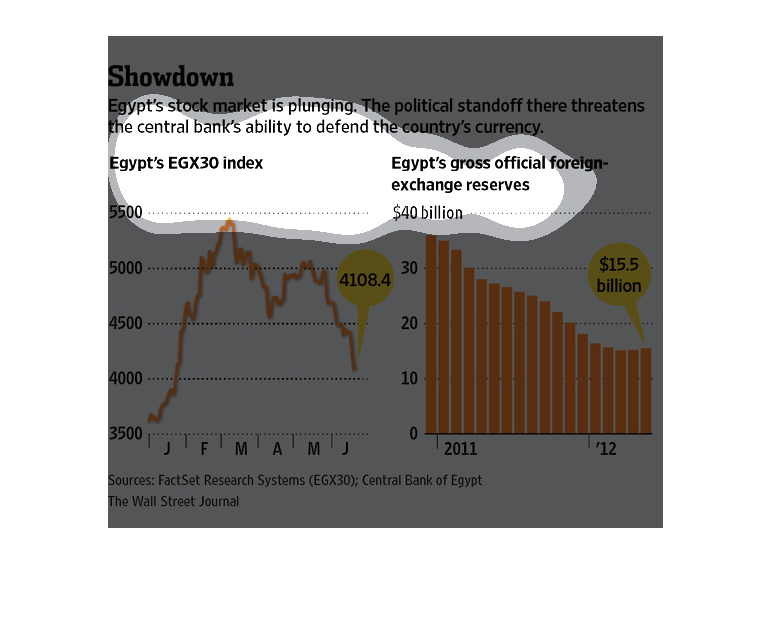

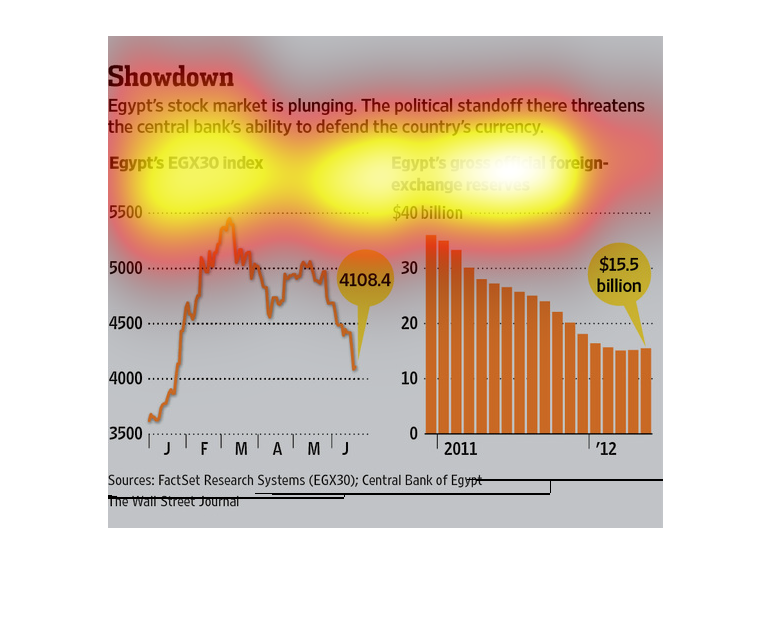

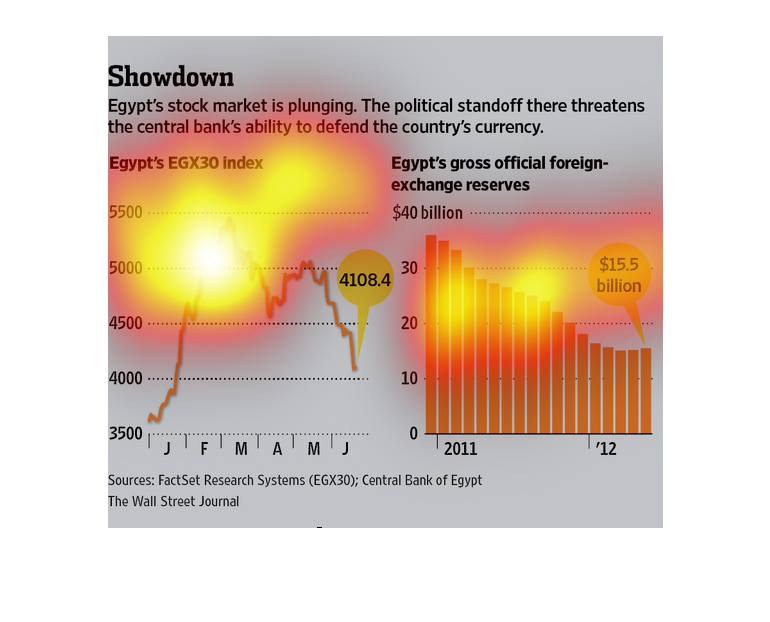

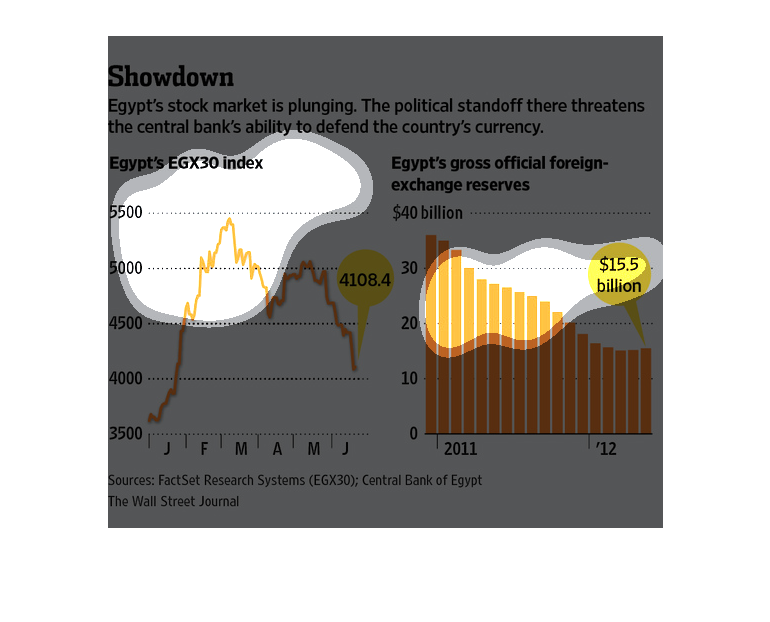

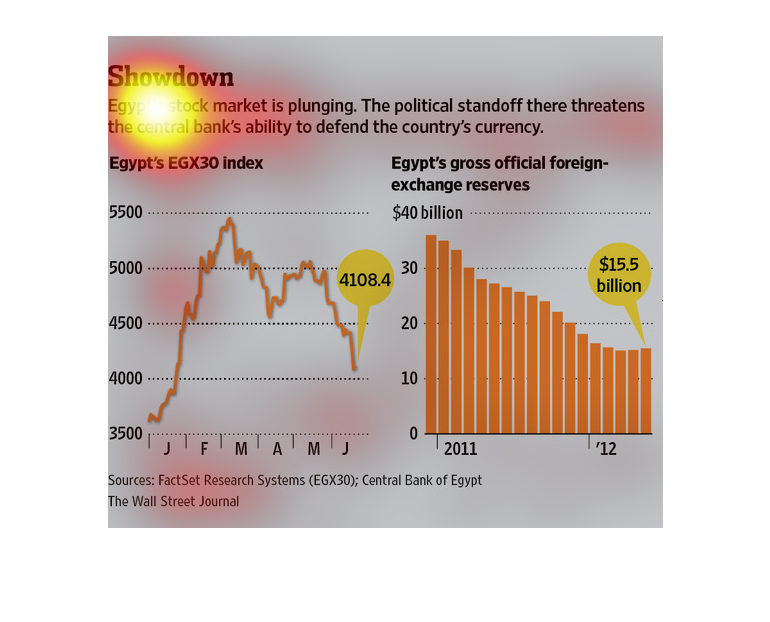

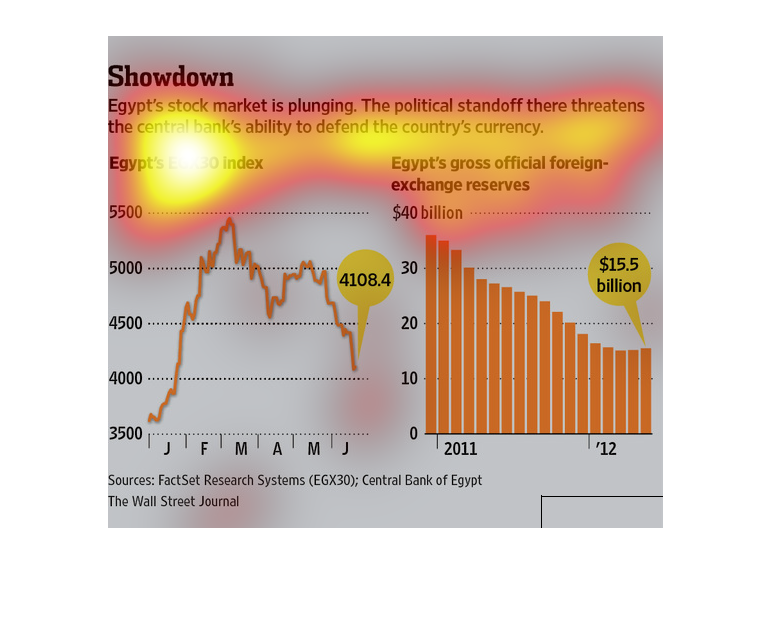

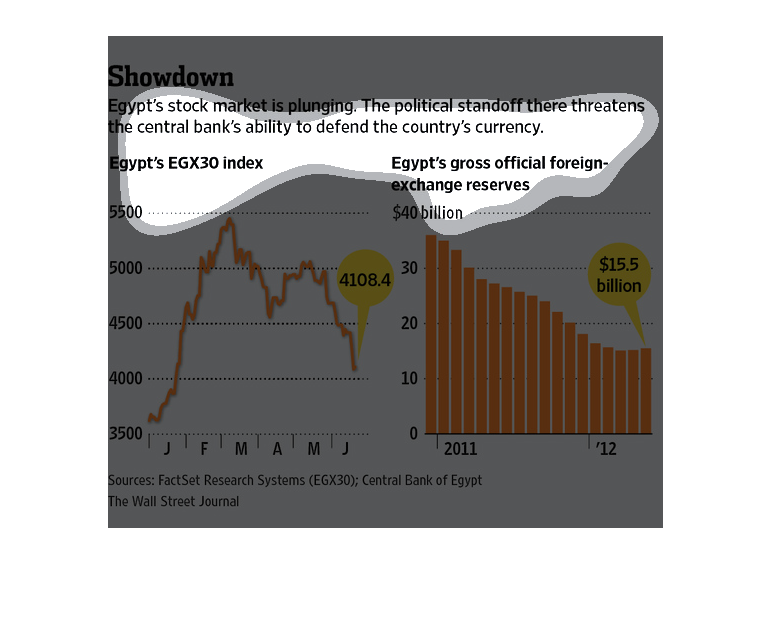

This article is about how Egypt's stock market is plunging. People are saying that Egypt's

central bank will not be able to defend the country's currency. Both graphs shows that over

time that both the Egypt stock market, and gross official foreign-exchange reserves are both

declining.

This image shows two charts. One chart depicts Egypt's EGX 30 index for its stock market and

how it has decreased over time. A second chart is compared to the side of the first chart

showing decreasing foreign-exchange reserves.

This chart from the Wall Street Journal shows how the egyptian stock market is in a free fall

because of the political instability in the country.

The figure presented to the left is titled Showdown. The figure is a representation of the

statistical data for the critical plunging of Egypt's stock market.

The image is showing the decrease in Egypt's stock market due to their political standoff

and the banks inabilities to protect the currency of the country. The stock has nearly dropped

from 40 billion in 2011 to about 16 billion in 2012.

This chart is your typical graph chart that sets up one or a number of categories, illustrated

by either a map, a graph, an illustration, or photograph.

Two charts showing how Egypt's stock market has plunged due to a political standoff which

also threatens the central bank's ability to defend the country's currency. The first chart

shows the plunge in Egypt's EGX30 index and the second Egypt's gross foreign exchange reserves.

This is a set of graphs that are meant to illustrate that Egypt's stock market is plunging.

It explains that the political conflict threatens the central bank's ability to defend the

currency.

This graph is illustrating how Egypt's stock market is plummeting. The graph shows these numbers,

which corresponds to the country's ability to defend it's own currency.

This chart shows how Egypt's stock market is plunging and has Egypt's EGX30 index on the left

hand side and the gross official foreign exchange reserve on the right hand side.

the image is about showdown of egypts stock market and the political standoff their threatens

the central bank ability to defend the countries currency

In this study conducted by the Wall Street Journal we see that the deficit since the 2009

recession have had a massive affect on how people do business, and we see it clearly here.

The image depicts Egypt's stock market plunging. The political standoff is threatening the

countries ability to defend it's currency on the market. Foreign exchange reserves have fallen

as well as index value.

This chart from the Wall Street Journal shows how the egyptian stock market is taking a nose

dive because of political instability in the country.