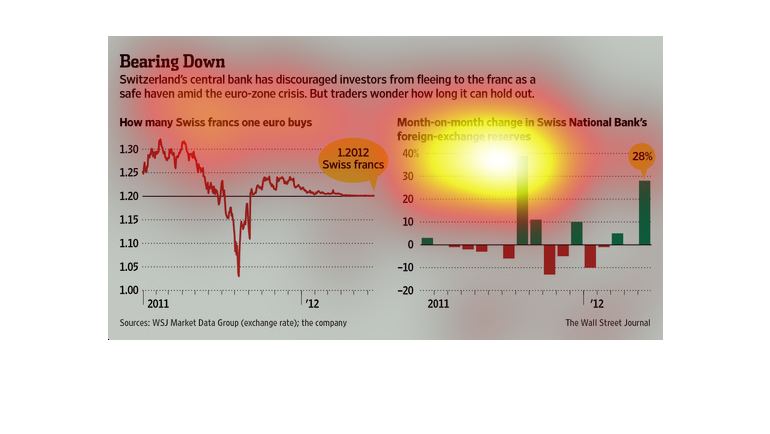

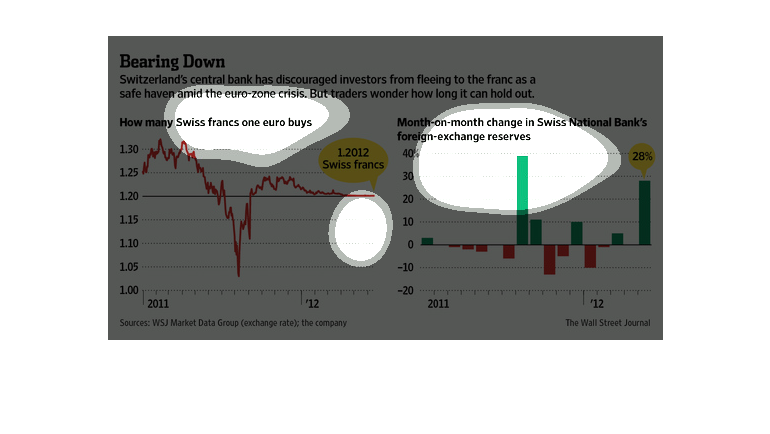

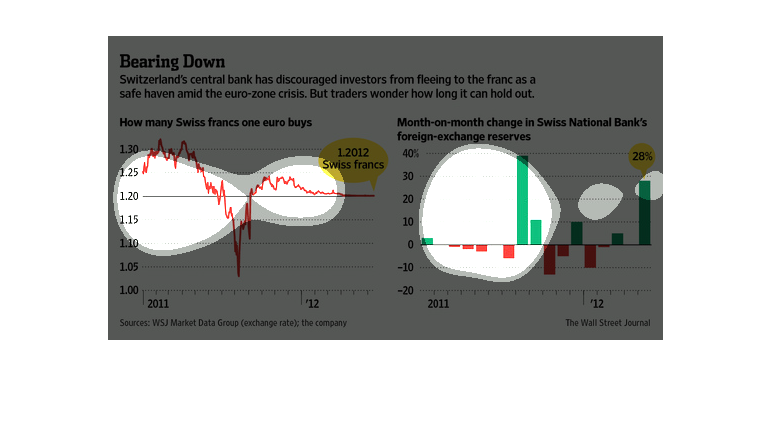

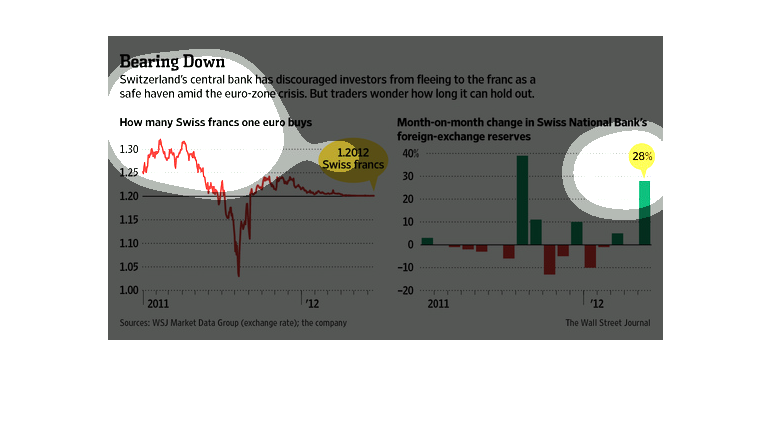

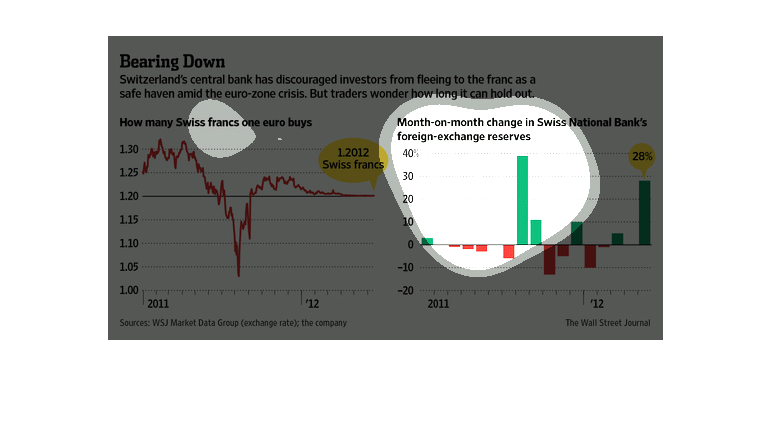

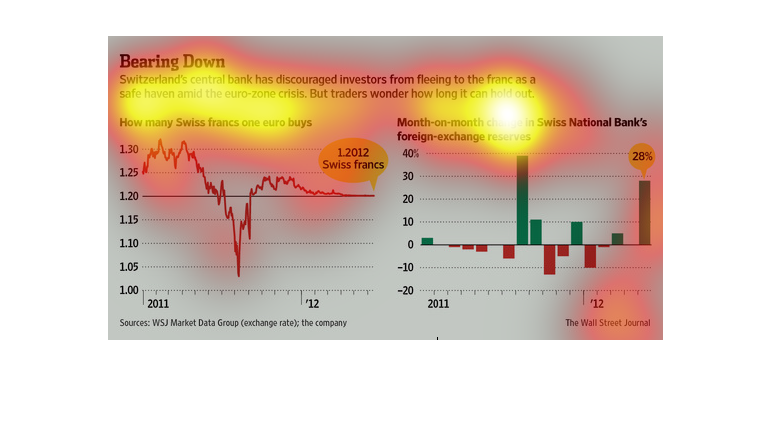

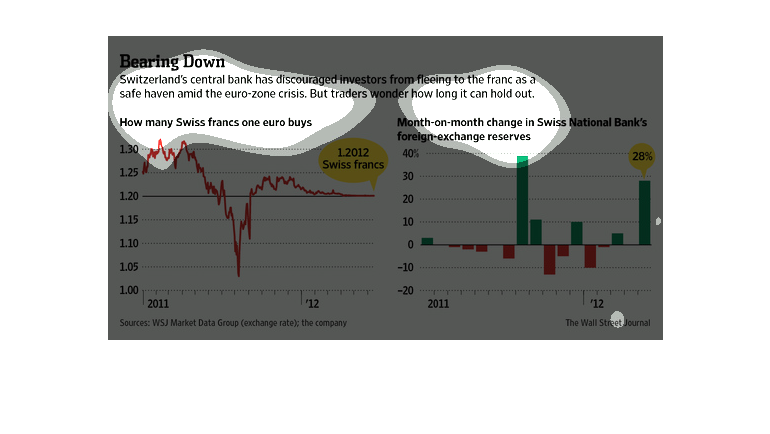

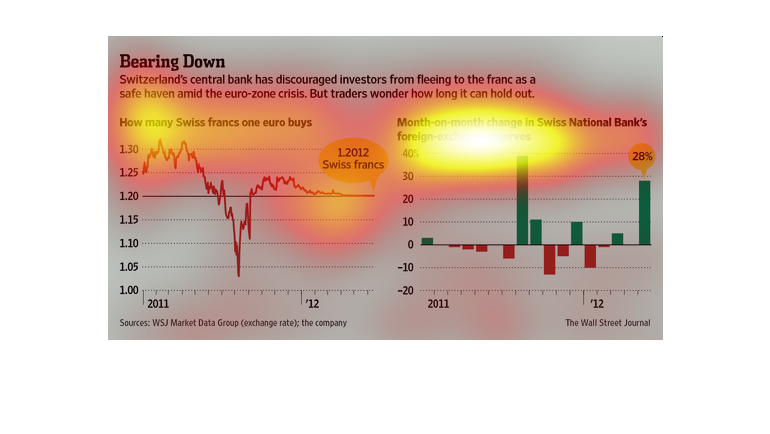

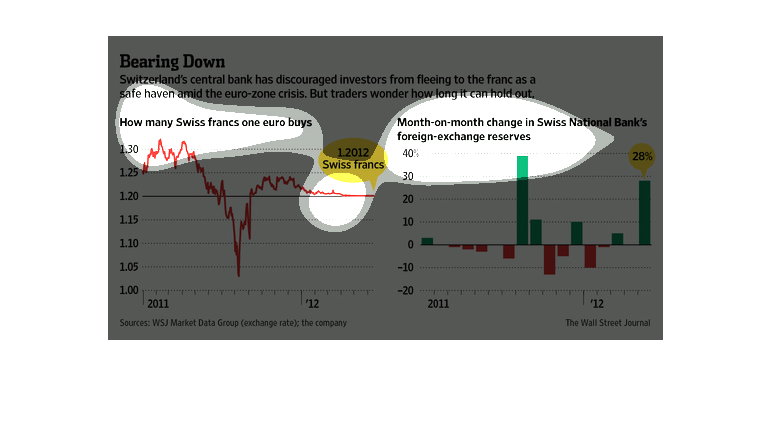

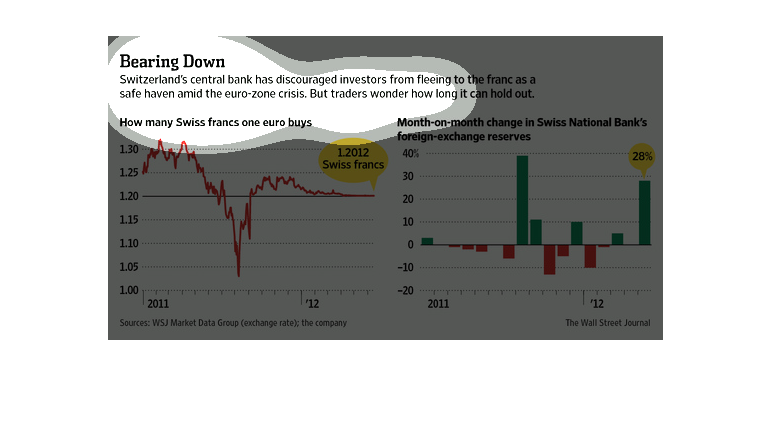

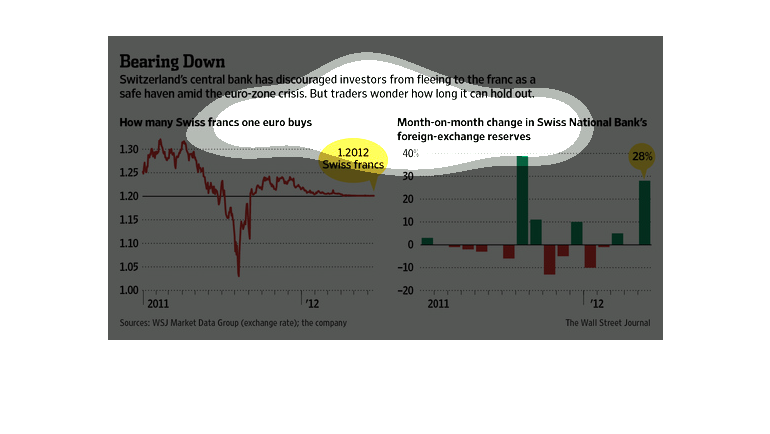

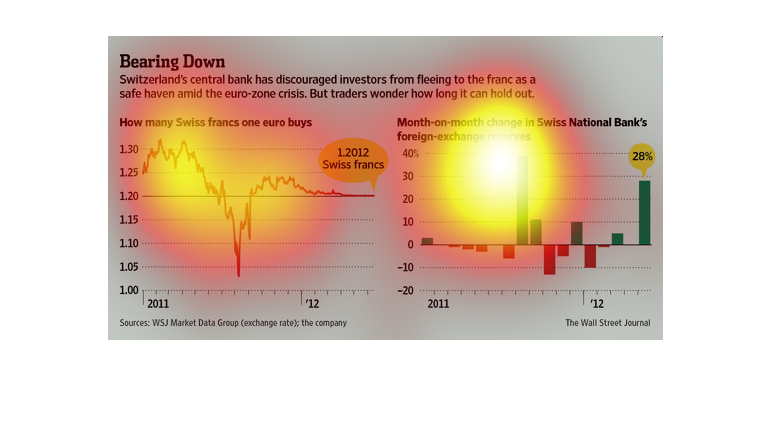

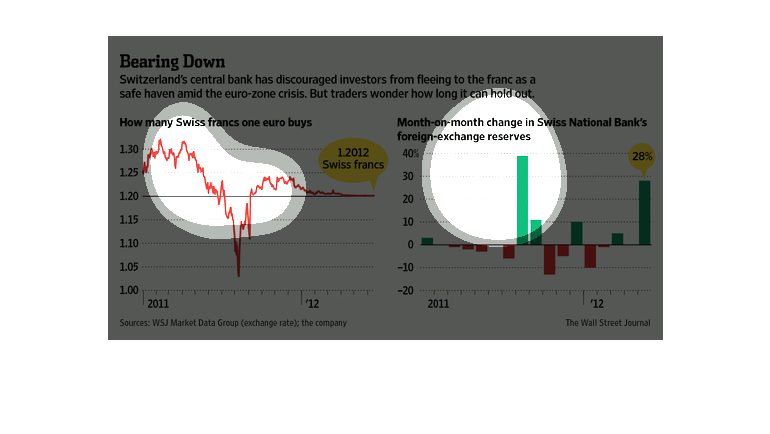

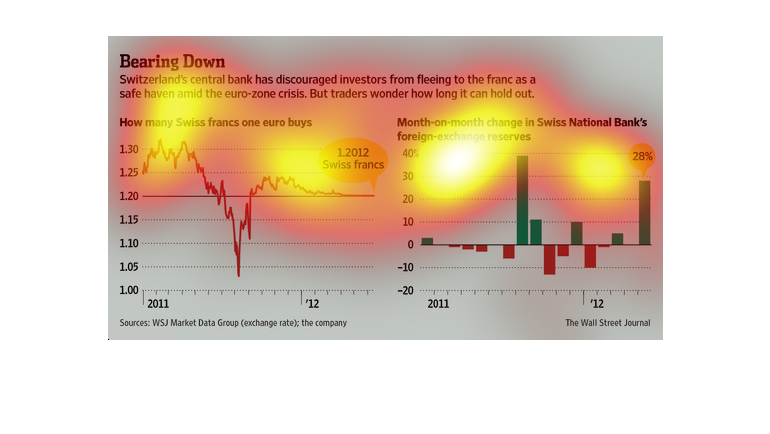

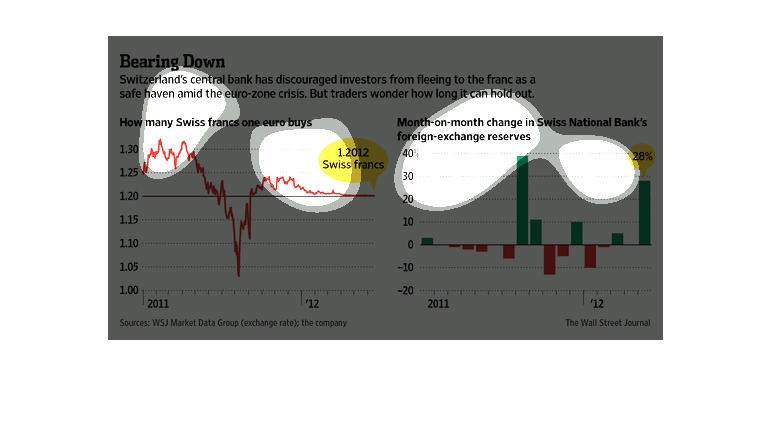

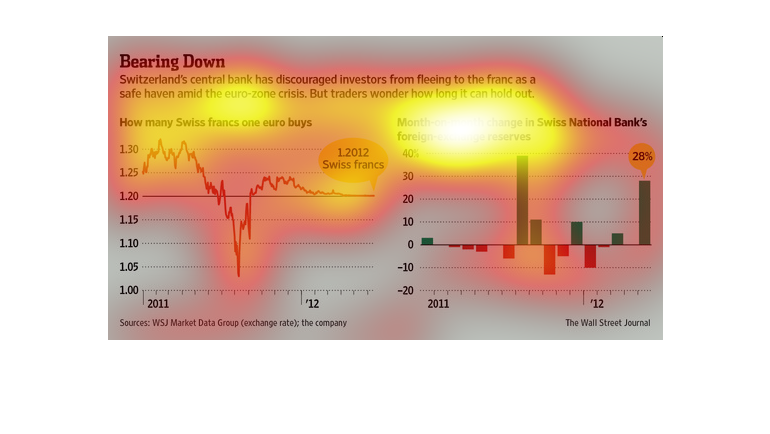

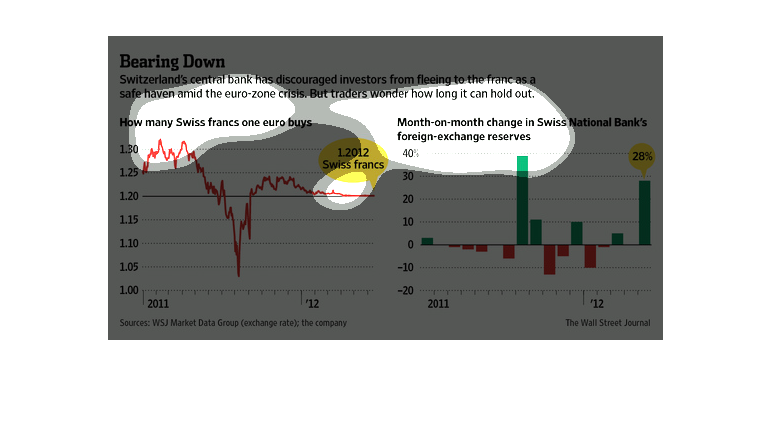

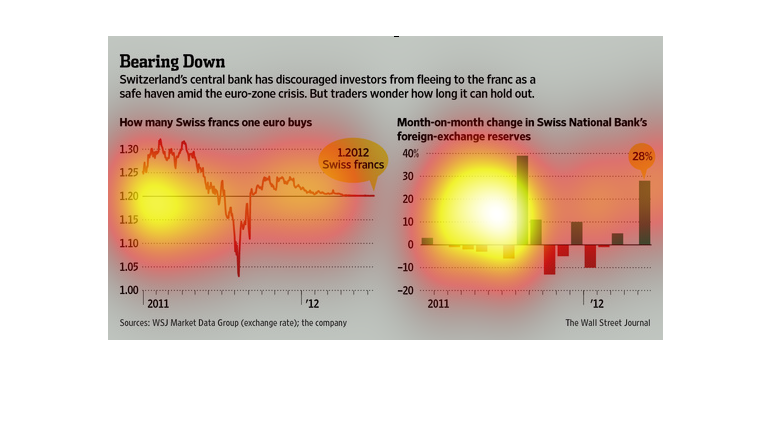

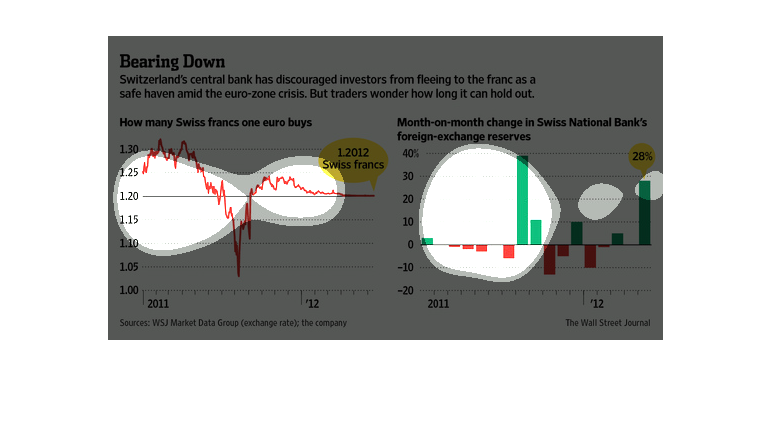

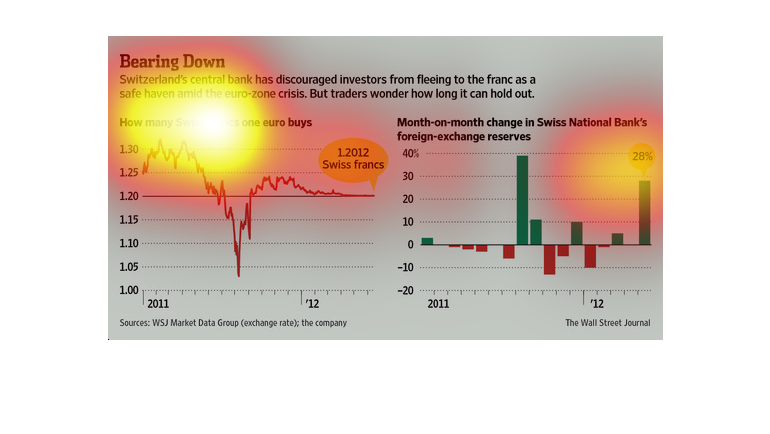

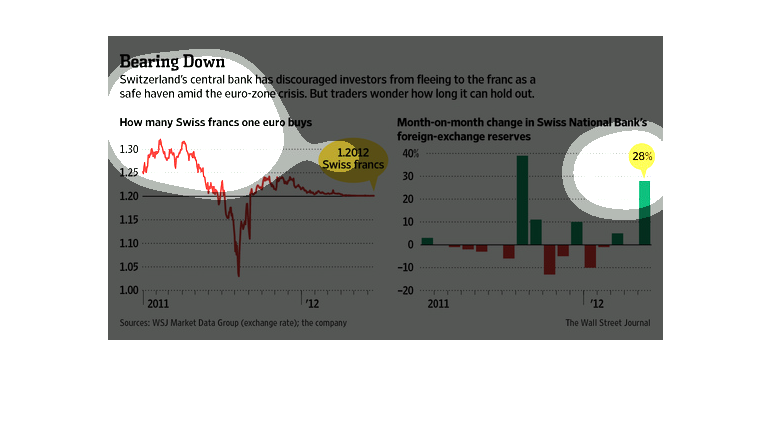

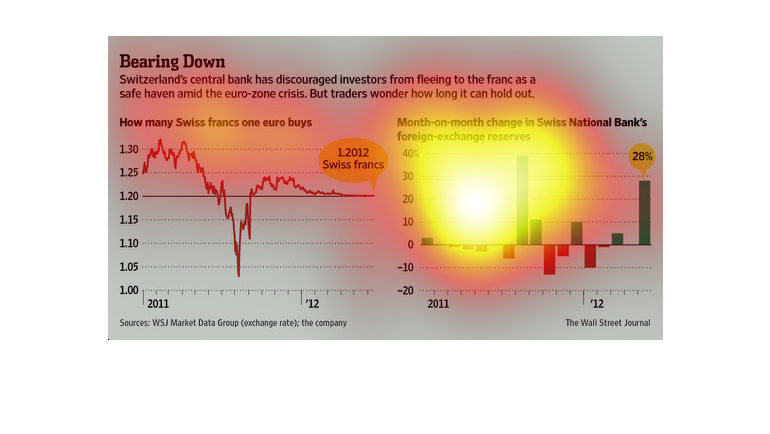

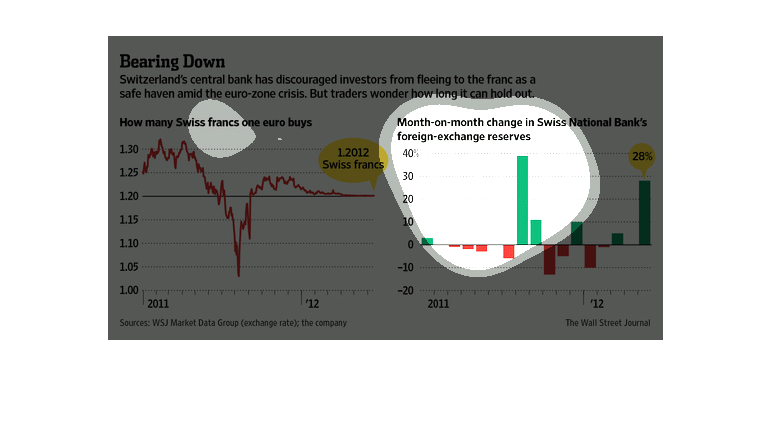

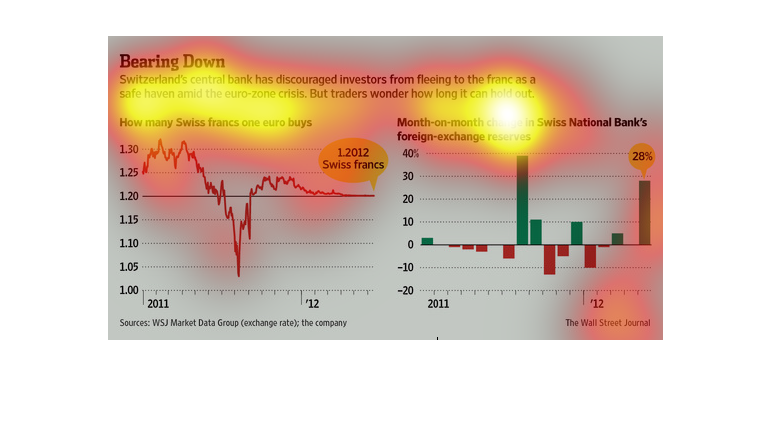

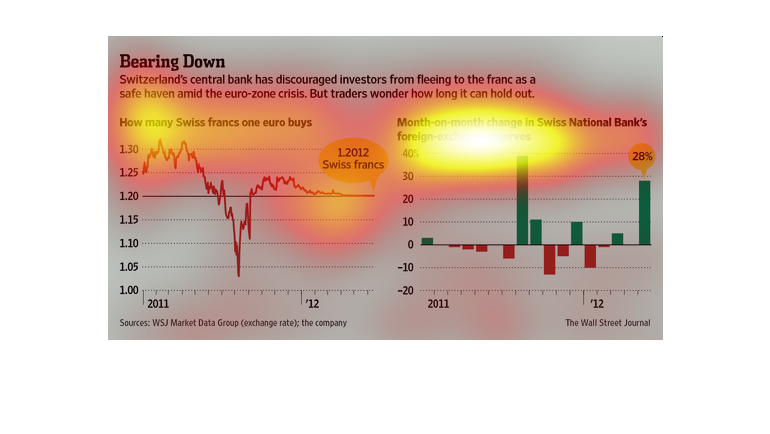

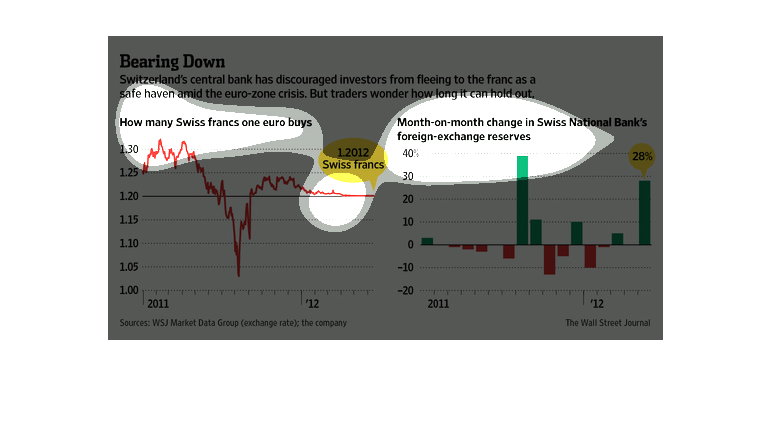

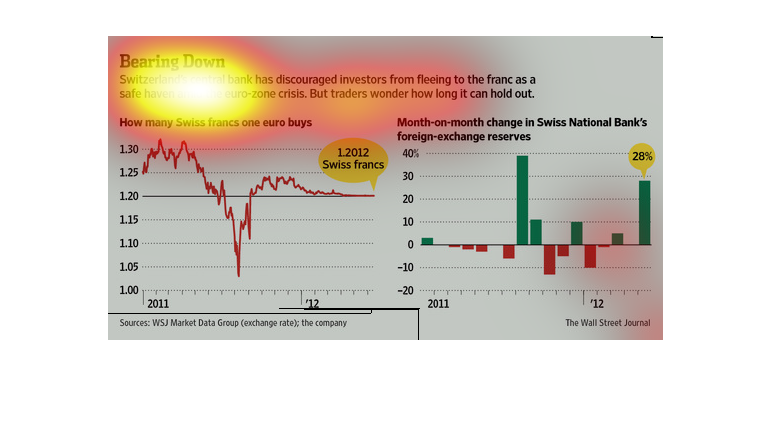

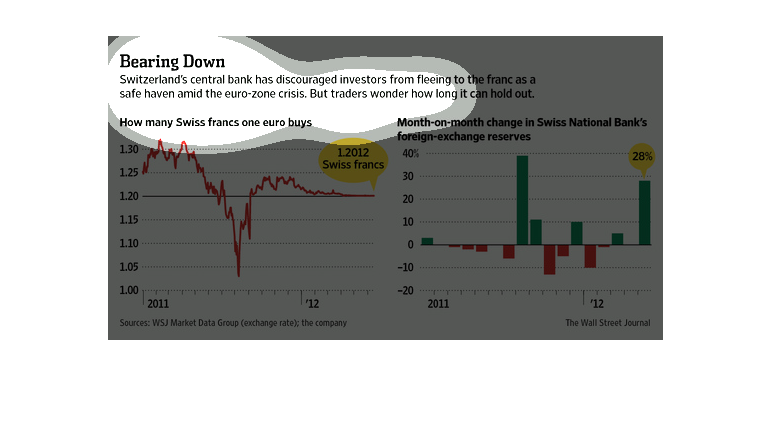

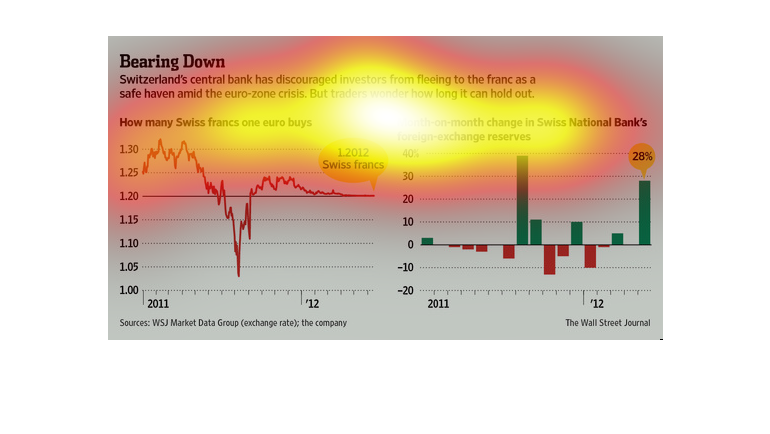

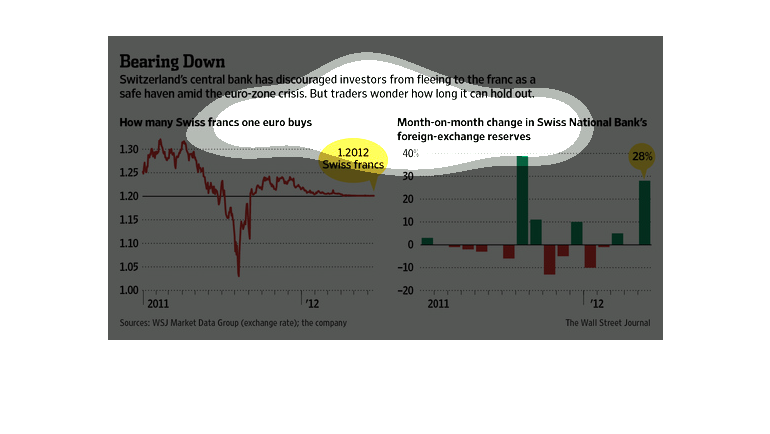

The image depicts how Switzerland's central bank has discouraged investors from fleeing to

France as a safe haven during the eurozone crisis. Traders are skeptical. The foreign exchange

rate is hovering at 28%.

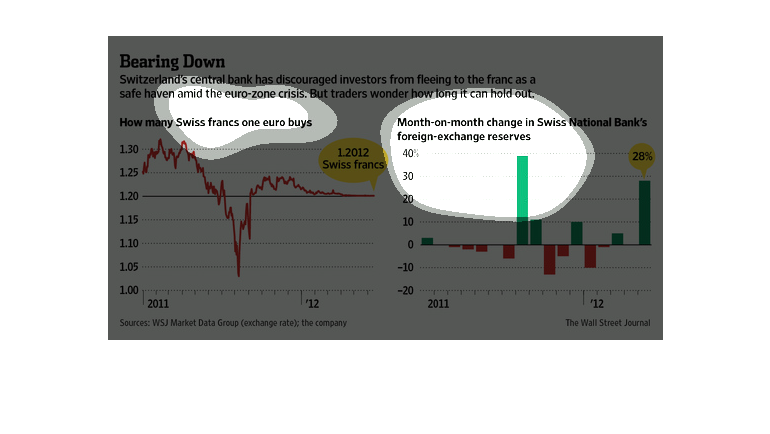

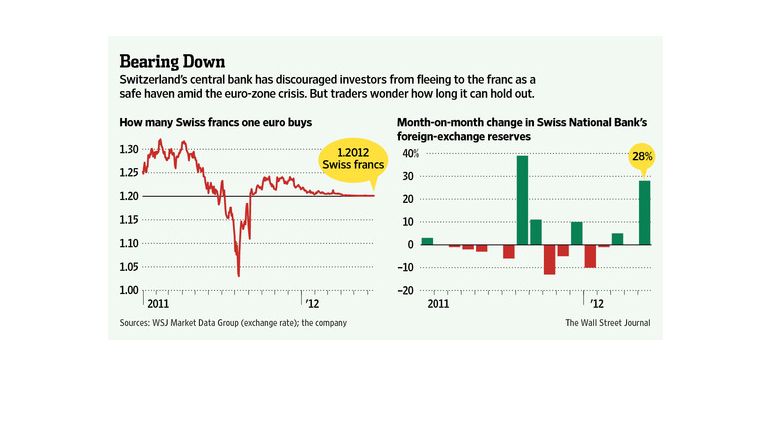

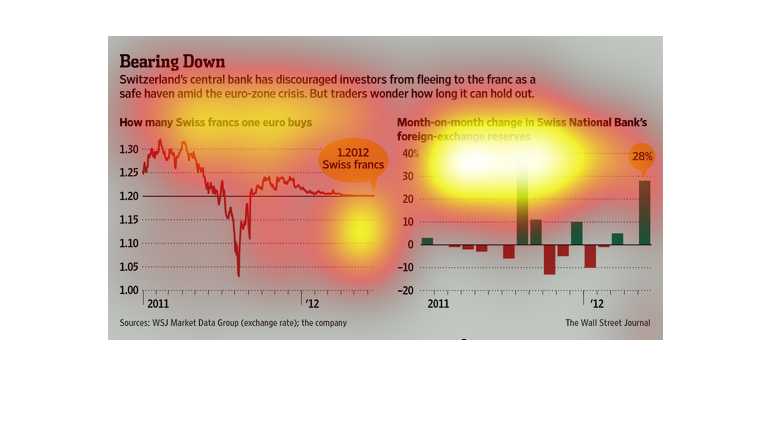

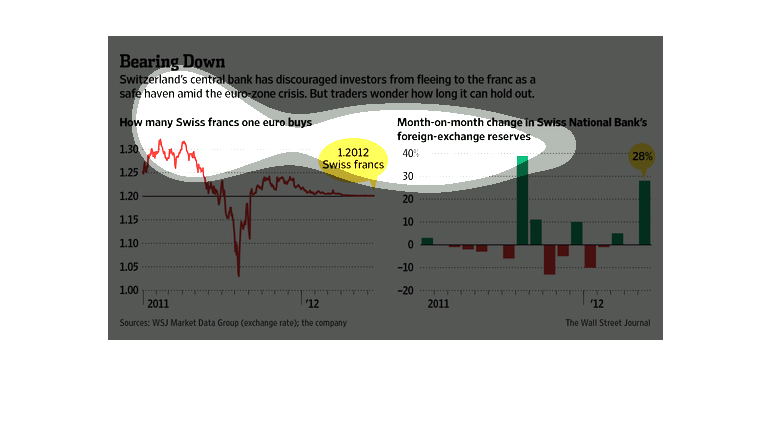

The caption for this image is, "Bearing Down, Switzerland's central bank has discouraged investors

from fleeing to the franc as a safe haven amid the euro-zone crisis. But traders wonder how

long it can hold out." One of the two present graphs displays how many Swiss francs one euro

can buy. The other graph shows month-on-month changes in Swiss National Bank's foreign exchange

reserves.

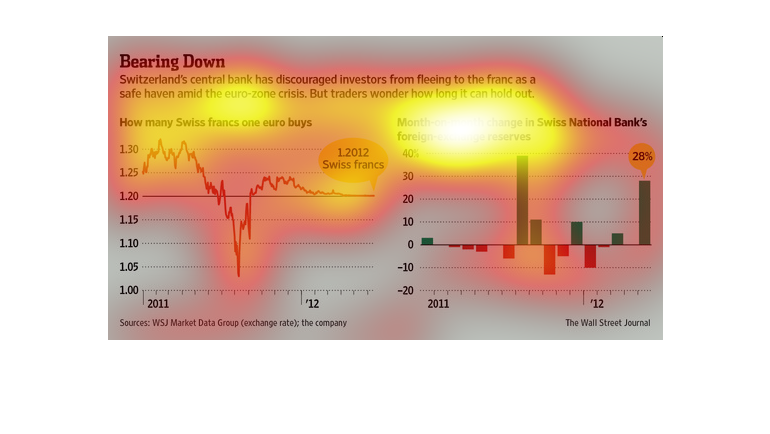

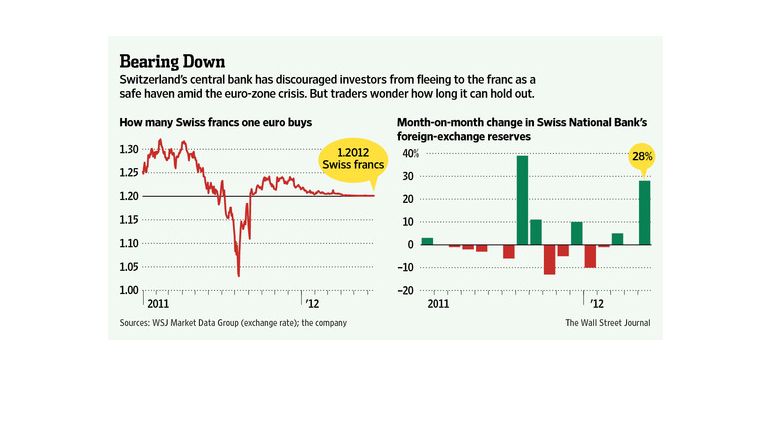

This chart shows two graphs depicting the exchange rate for francs and euros over time. Overall,

the rate has decreased over time. The image also explains how bankers are reacting.

The first chart shows the exchange rate from Swiss Francs to Euro from 2011-2012 with a sharp

decline in the center of the time period and a stagnantion around 1.20. The second chart

shows the corresponding deposits in the swiss national bank.

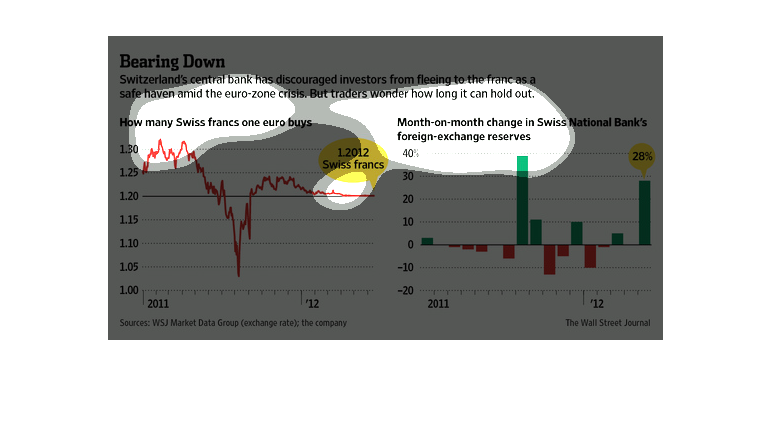

The graph on the left shows how may Swiss francs one Euro buys and the right shows the month

over month change in Swiss National Bank's foreign exchange reserves.

This chart from the Wall Street Journal shows how the Swiss central bank is trying to stem

the capital inflow into the currency to prevent it from getting too strong

This image discusses Switzerland's central bank discouragement of investors in fleeing the

Swiss franc as a safe haven amid the Eurozone crisis. But traders worry that it may not last

long. Two graphs back up this claim. One does this by tracking foreign exchange reserves.

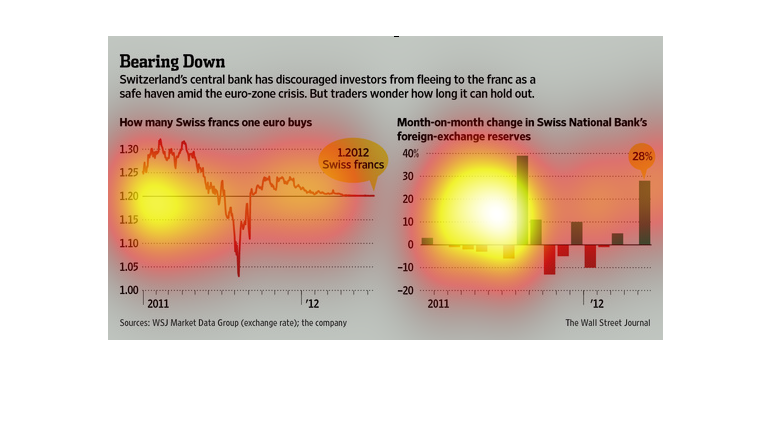

This is a set of graphics evaluating the state of the Swiss economy, particularly the Swiss

franc, in light of crises in the Euro Zone, to which Switzerland is not directly connected

in terms of currency. The graphic shows that Swiss investors are emphasizing the franc.

The first graph shows the relation between the Swiss Franc and the Euro between 2011 and

2012. The second graph details changes in the Swiss National Bank's foreign exchange reserves

in the same year.

This chart describes bearing down. Specifically, Switzerland's central bank has discouraged

investors. Different categories are represented by different colors.

The figure presented is titled Bearing Down. The figure is a representation of the statistical

data for Switzerland's Central bank discouraging investors.

This chart from the Wall Street Journal shows how the Swiss central bank was trying to stem

the flow of money into the franc, which was pegged to the euro

This image shows one chart depicting the change in how many Swiss francs one euro can buy

over time and another showing a monthly change in the Swiss National Bank's foreign exchange

reserves.