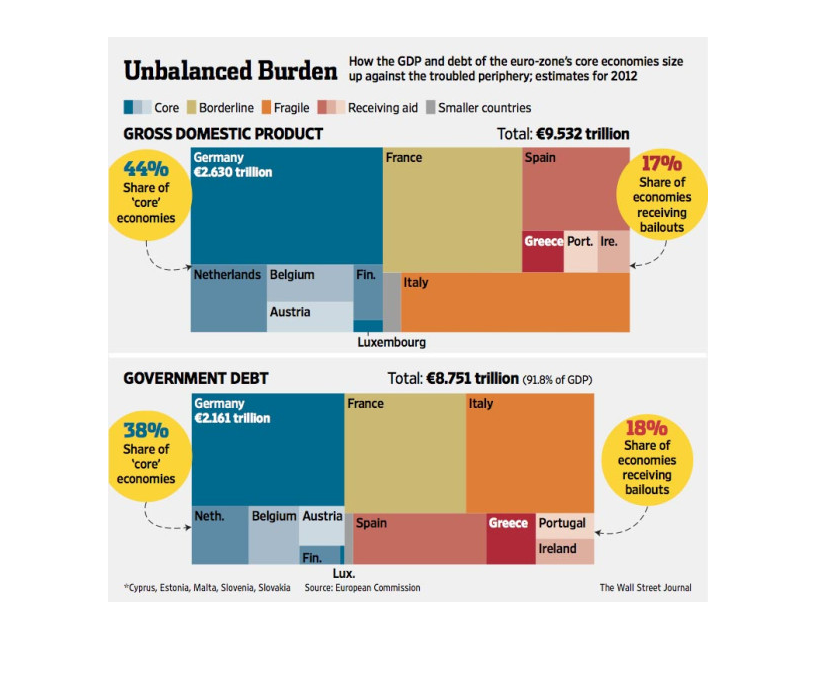

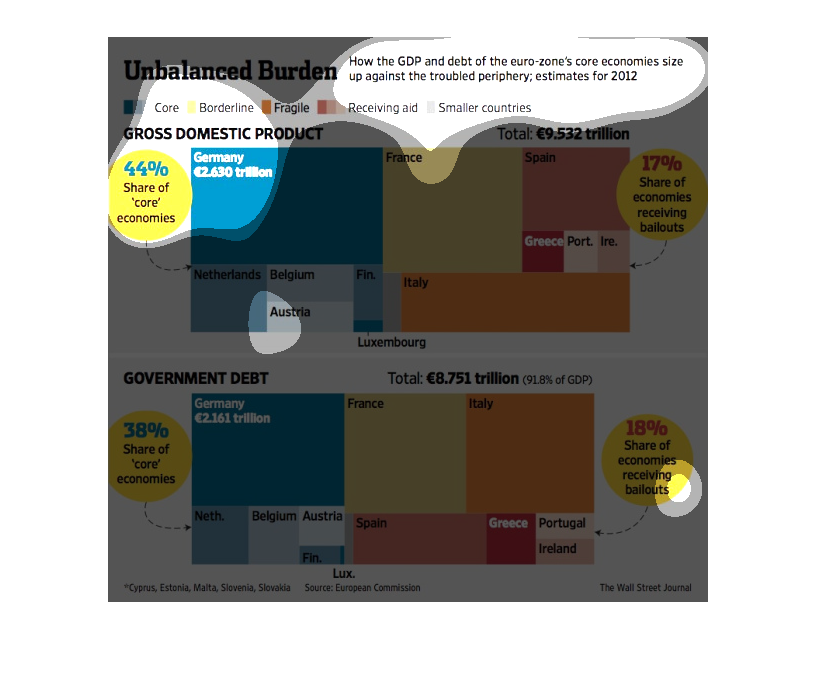

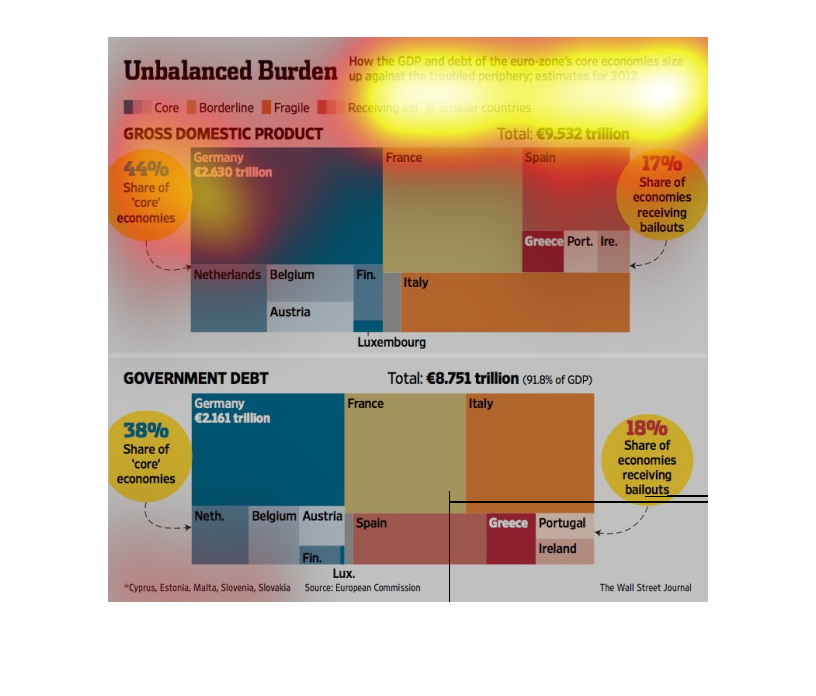

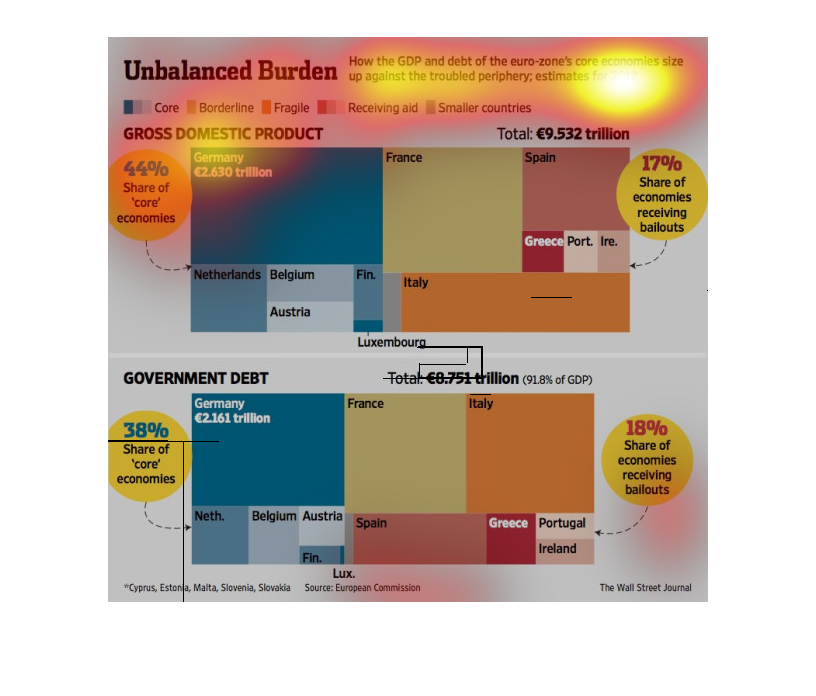

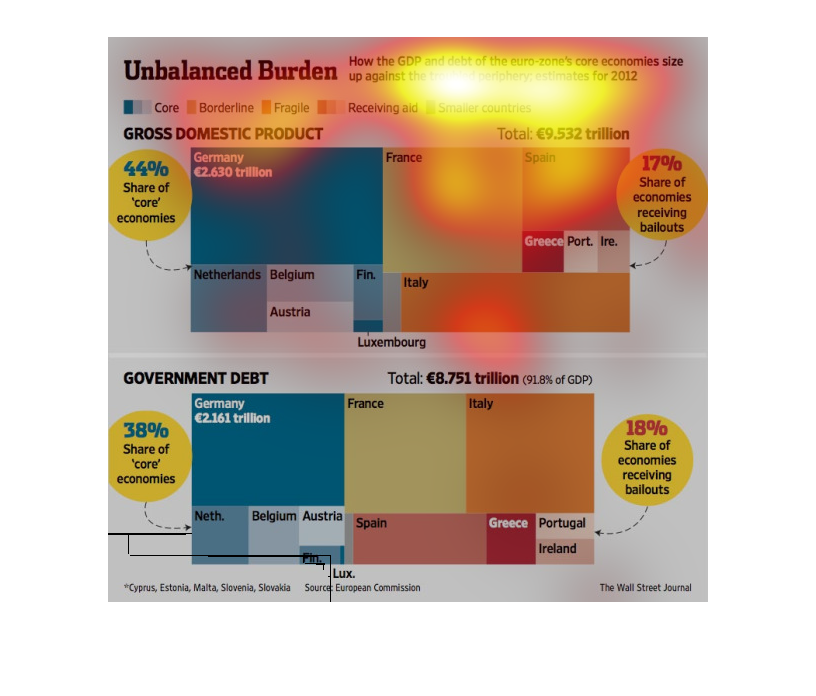

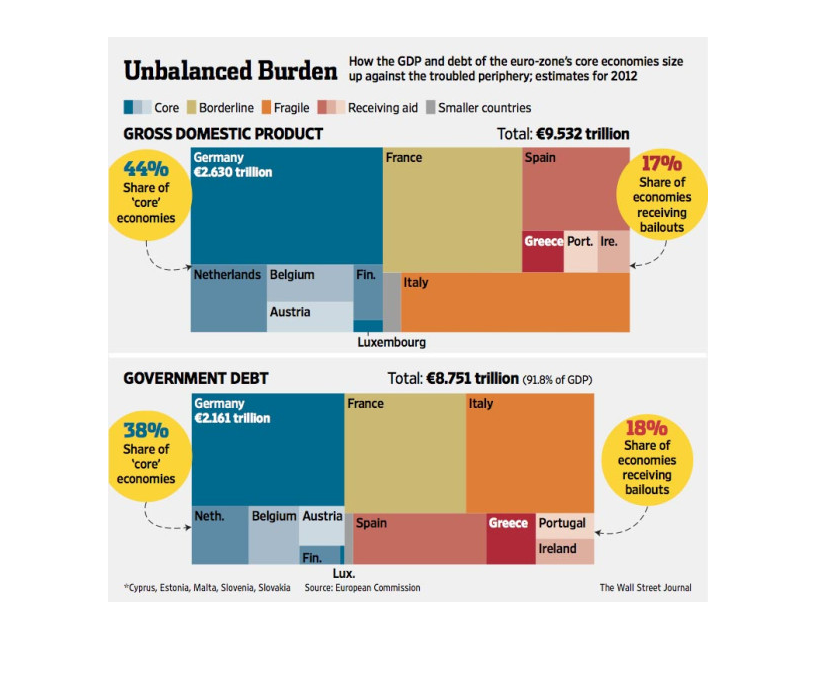

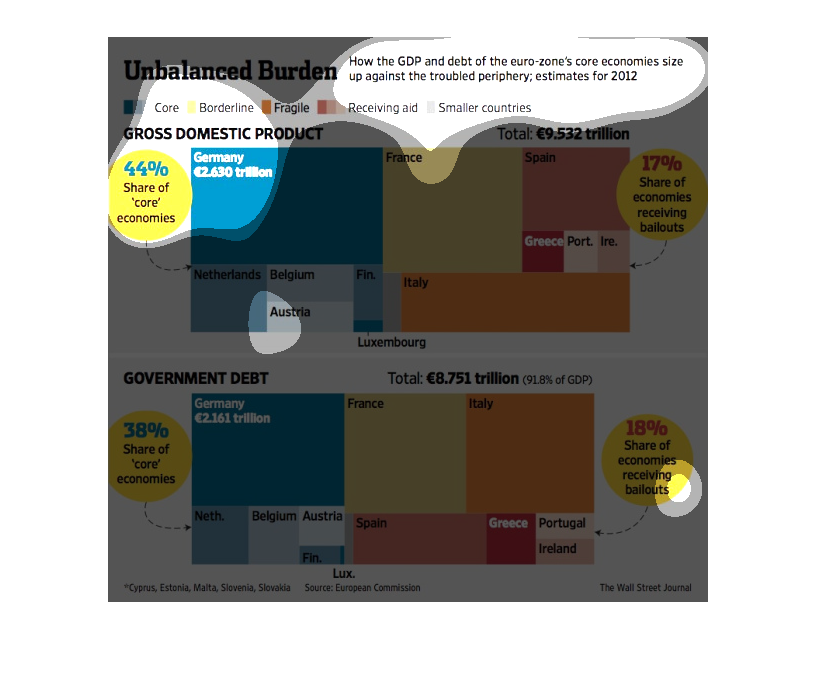

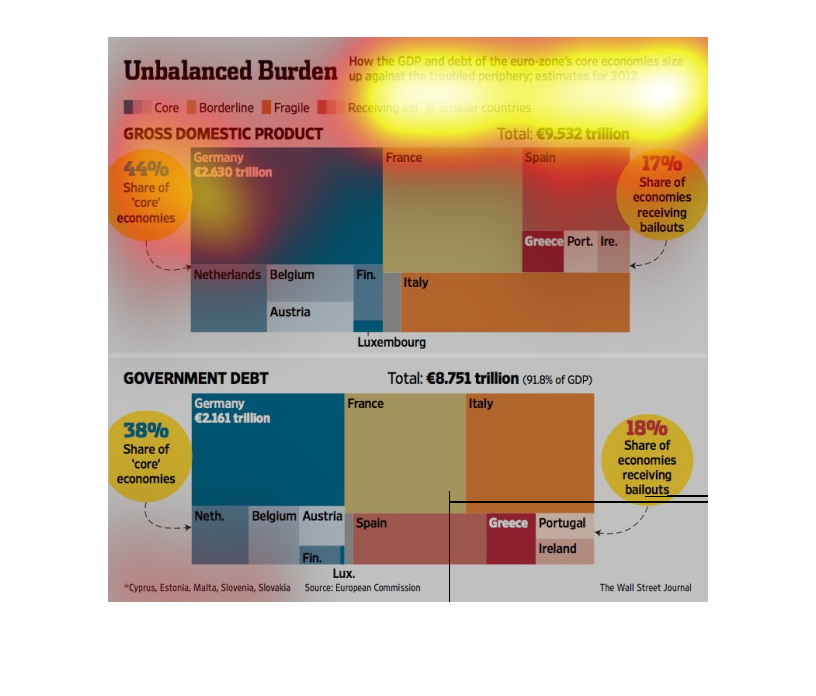

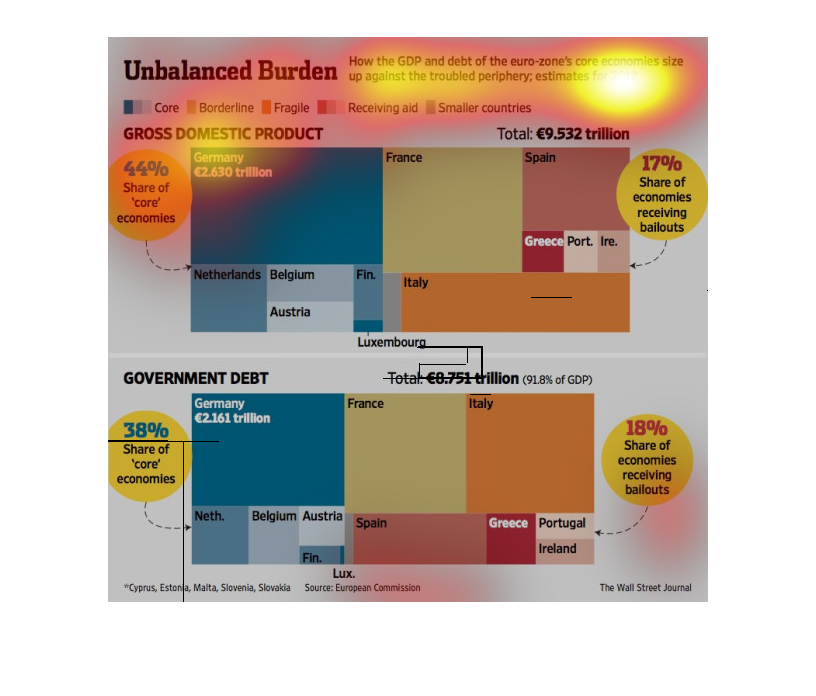

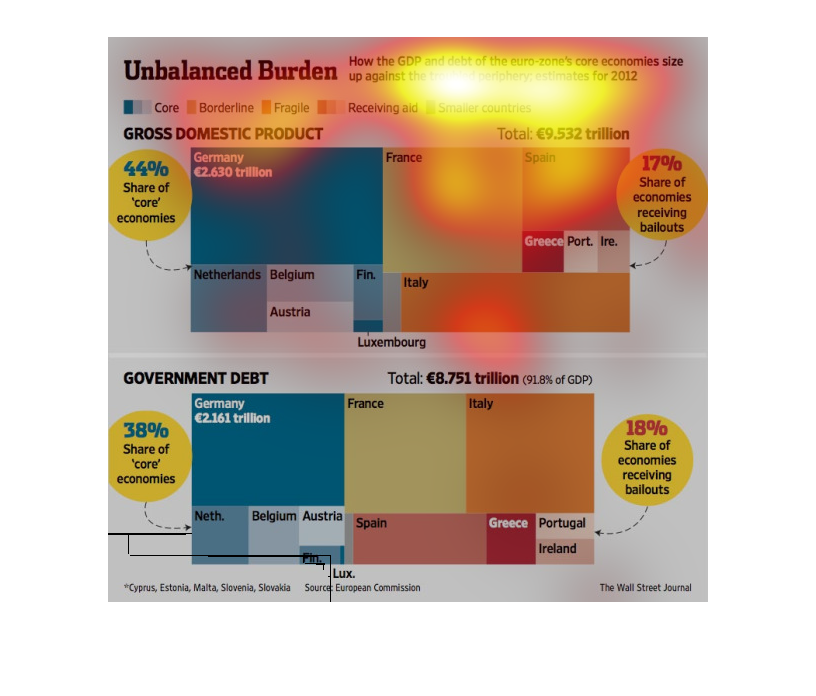

This image is meant to show the fact that the GDP and debt of many different European countries

compare to one another. For example, Germany's GDP is about 2.63 Trillion Euros, whereas its

government debt is equal to about 2.161 Trillion Euros.

The figure presented is titled Unbalanced Burden. The figure is a representation of the statistical

data for the debt with the GDP and the euro zone show signs of trouble.

The image depicts how the GDP and the debt of the eurozone's core economies compare to the

troubled periphery. The data shows the core economies having to prop up the periphery economies,

which are dragging down the entirety of the EU.

This image is entitled "Unbalanced Burden." It shows how the GDP and debt of the euro-zone's

core economies size up against the troubled periphery. Estimates are for 2012. Countries

represented are: Germany, Netherlands, Belgium, Austria; France, Spain, Greece, Italy. Comparisons

are made between GDP and government debt. The source is European Commission. This image

appeared in The Wall Street Journal.

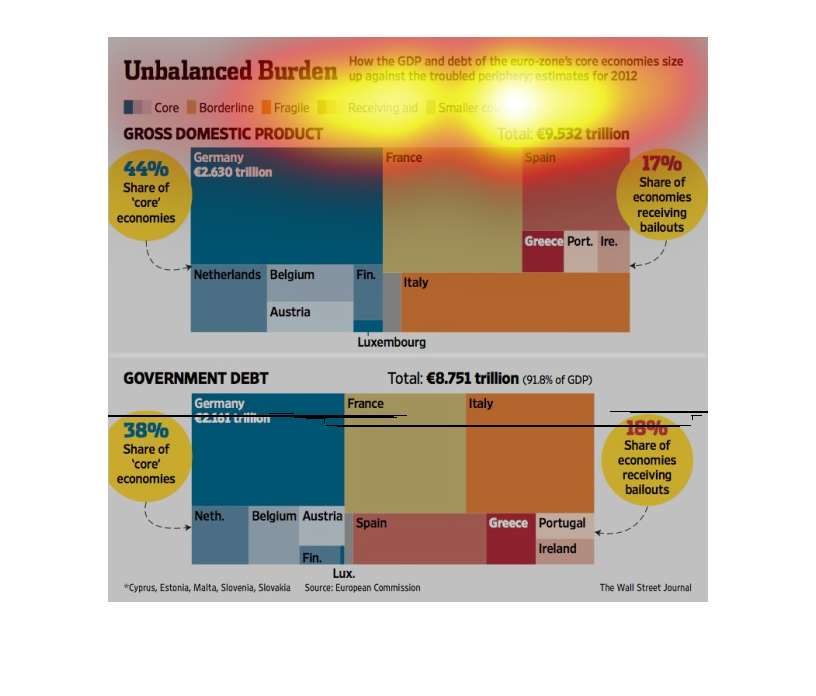

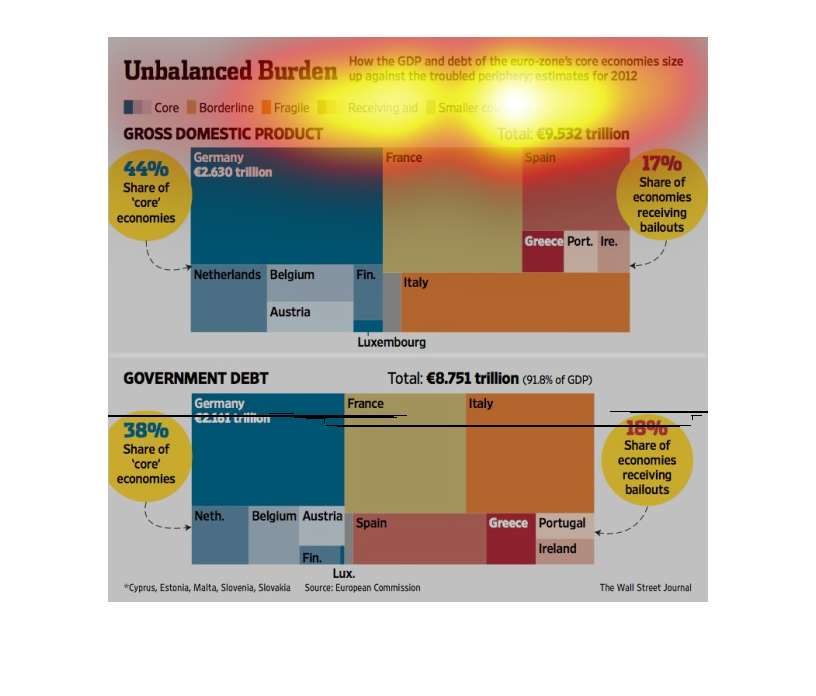

This chart shows economic outlook of the Euro zone including gross domestic product and government

debt in the categories of core, borderline, fragile, and receiving aid.

This image looks at how the Gross Domestic Product and debt of the Eurozone's core economies

stack up against the troubled periphery (ie, the debt-laden countries in the immediate vicinity).

Two separate graphics back this claim visually with colors for each different country, and

textually and numerically. One graphic is for GDP, the other is Government debt.

This chart from the Wall Street Journal shows how the core economies in the Euro zone fare

with regards to deficits and overall national debt in the trillions of euros

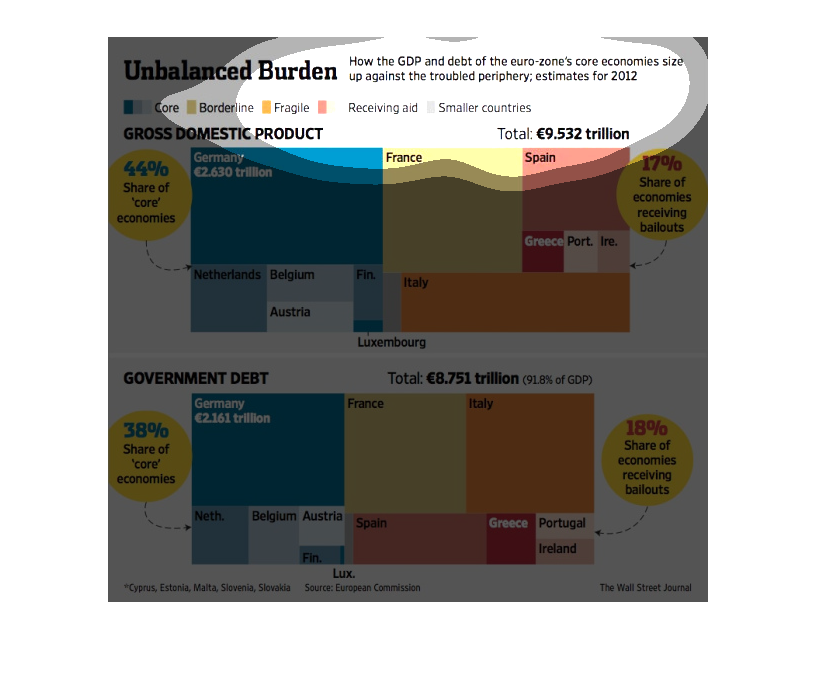

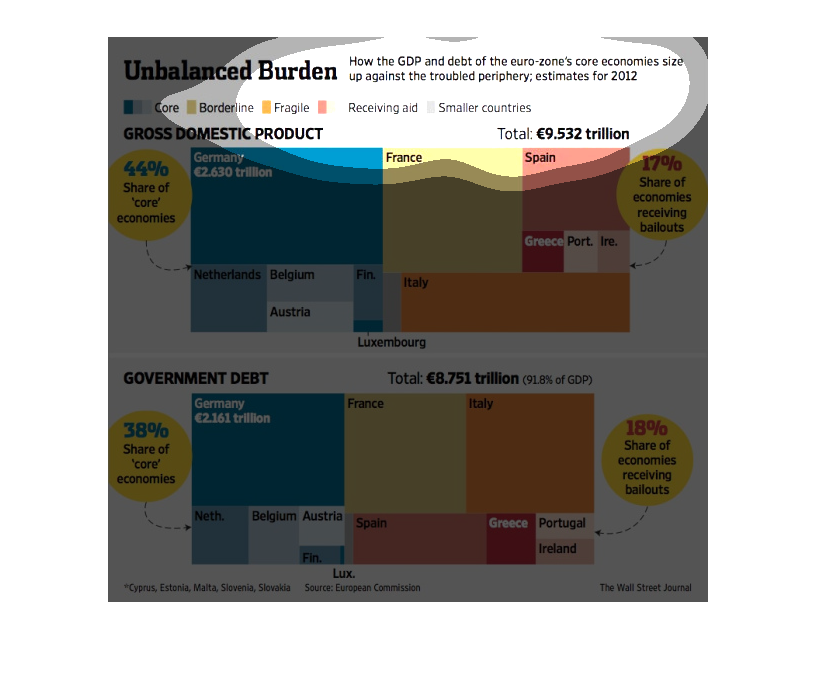

This chart estimates how the gdp will perform in 2012. It compares several countries on their

economic performance. Some countries received bailouts as well.

This image compares the GDP growth and levels of debt between the euro zone, France, Spain,

and Italy. Included are measures of core economies and percentages of economies receiving

bailouts.

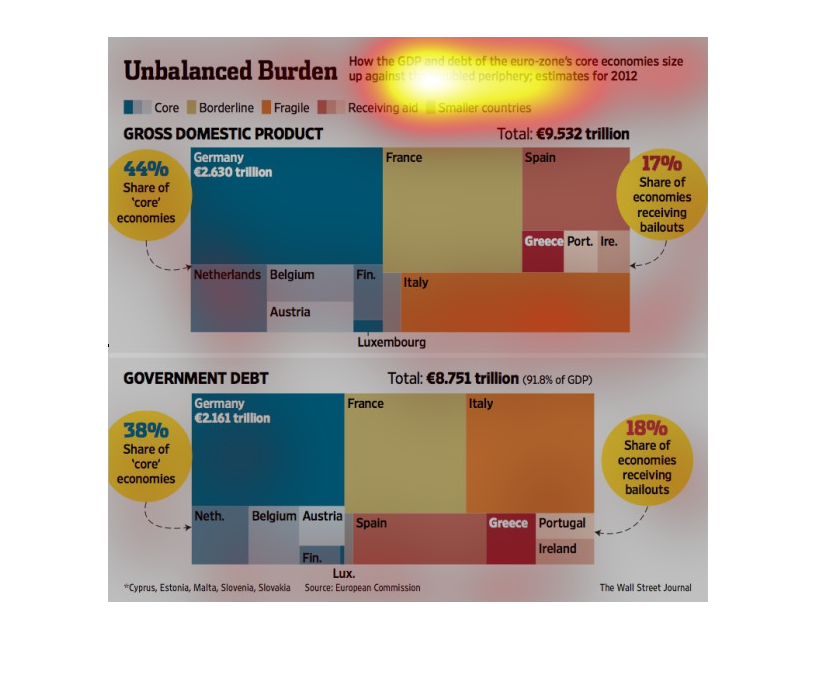

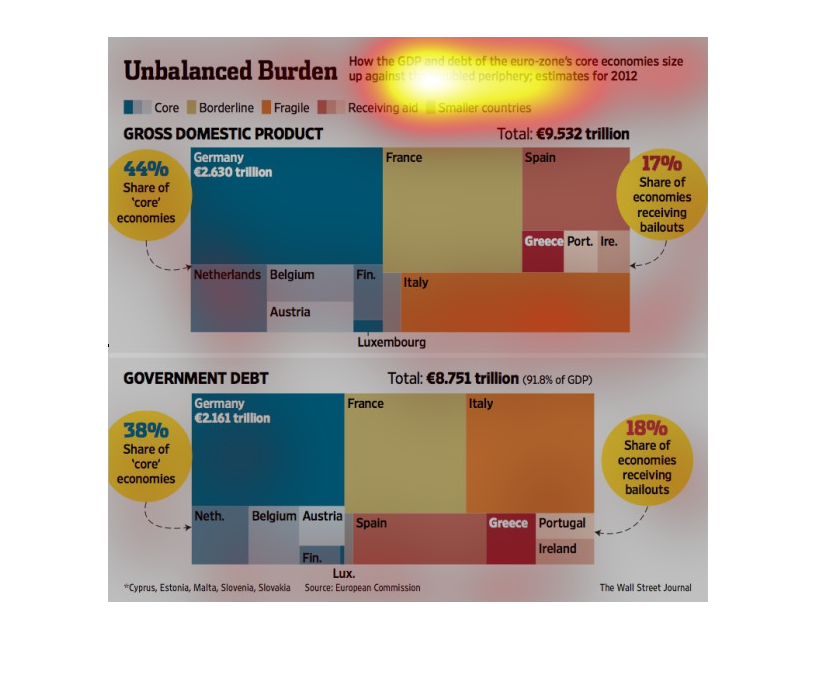

The image depicts how the GDP and debt of the eurozone core economies compares to the under-preforming

periphery. The data shows that core eurozone economies are having to hold up the troubled

eurozone economies, with Germany doing most of the work while Spain, Italy and Greece crumble.

This chart from the Wall Street Journal shows how the debt burdens in the euro zone is not

evenly distributed and some countries have much higher debt to GDP ratios

This is a graphic showing the balance of economies in the Euro Zone. In particular, the graphic

is drawing a comparison between Gross National Product and Debt as a proportion of the domestic

economies of various Euro Zone nations. Some nations do better than others.