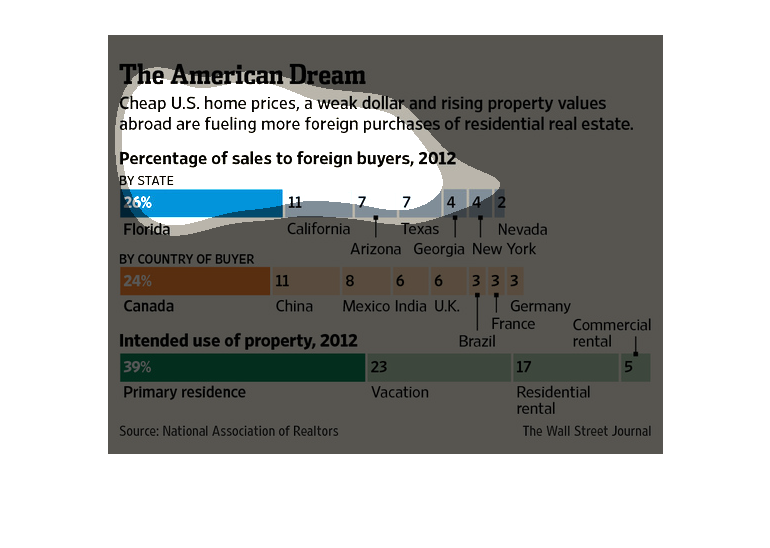

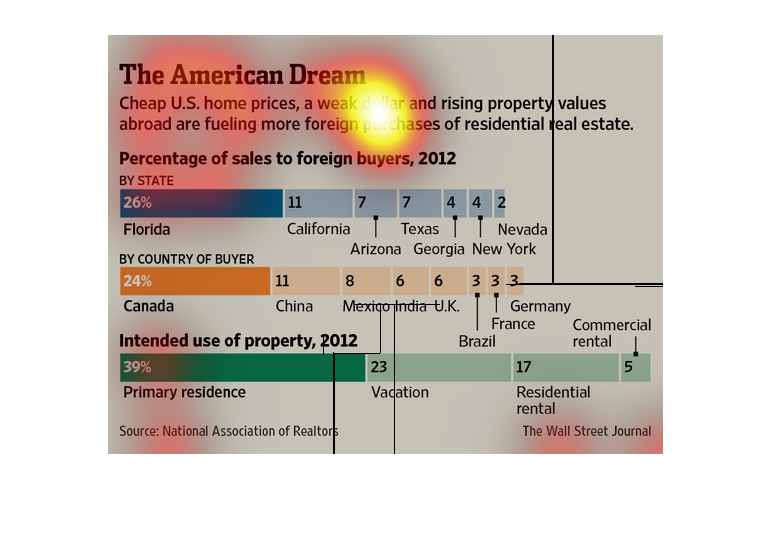

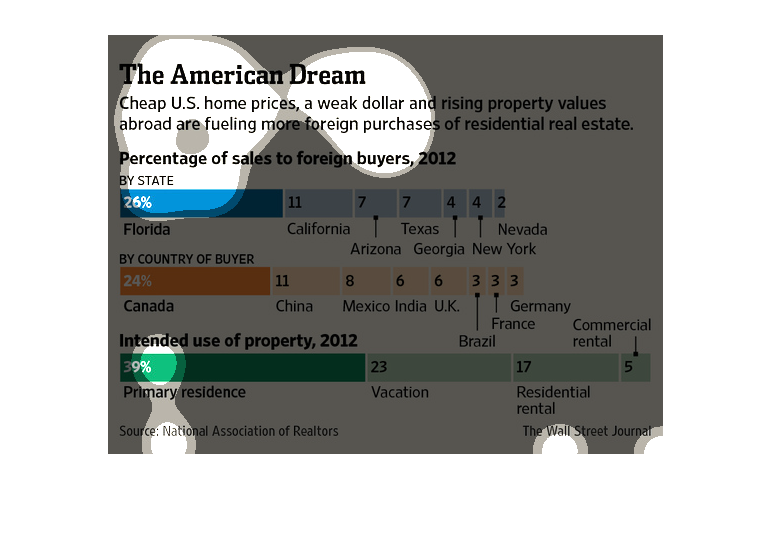

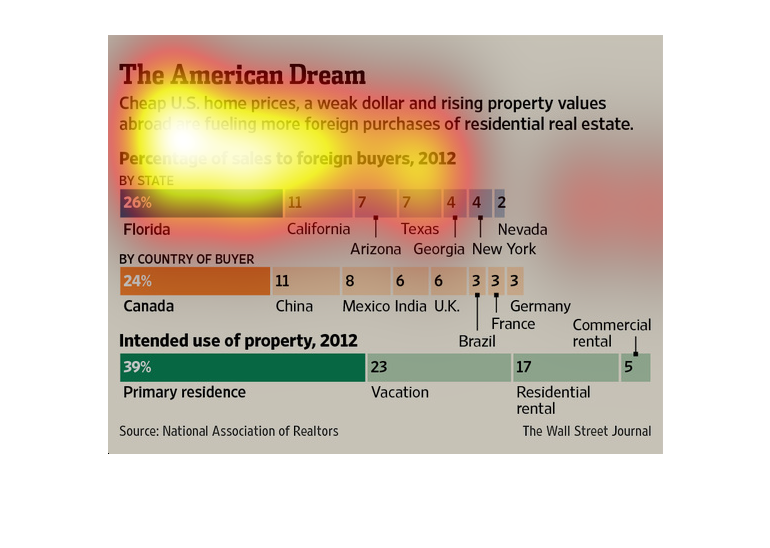

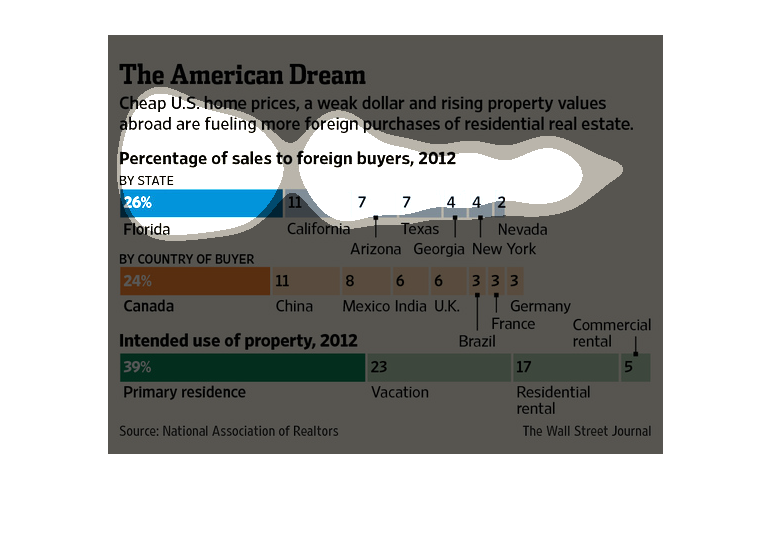

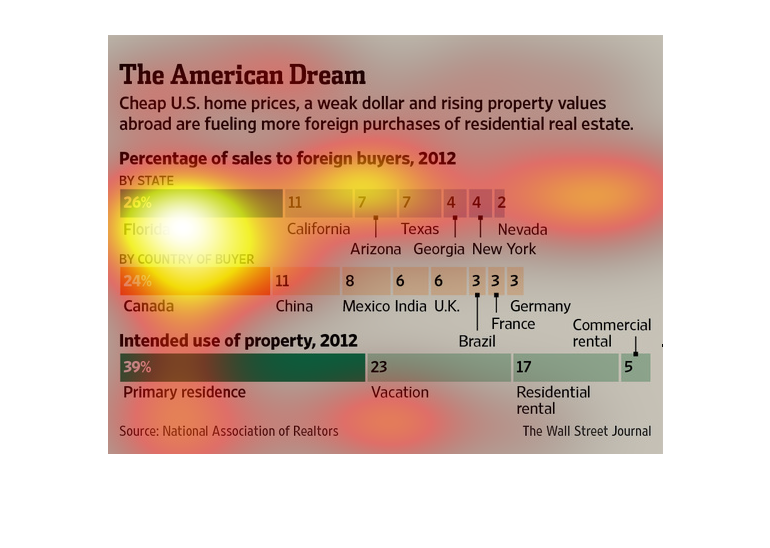

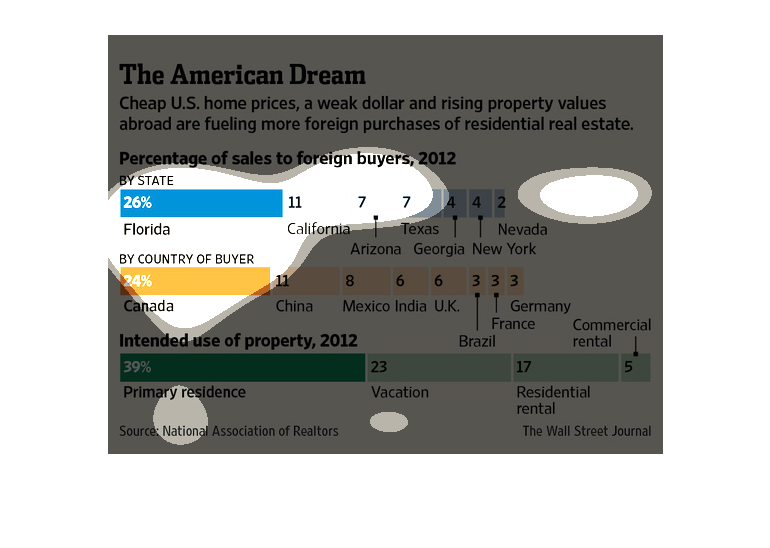

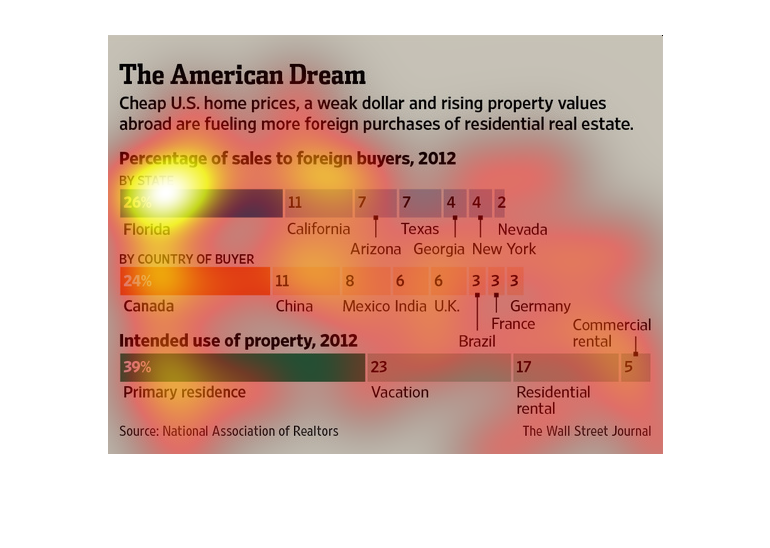

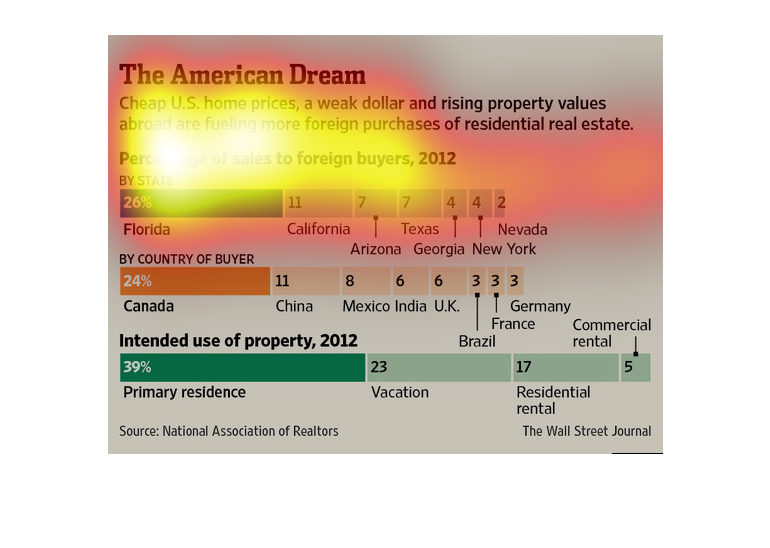

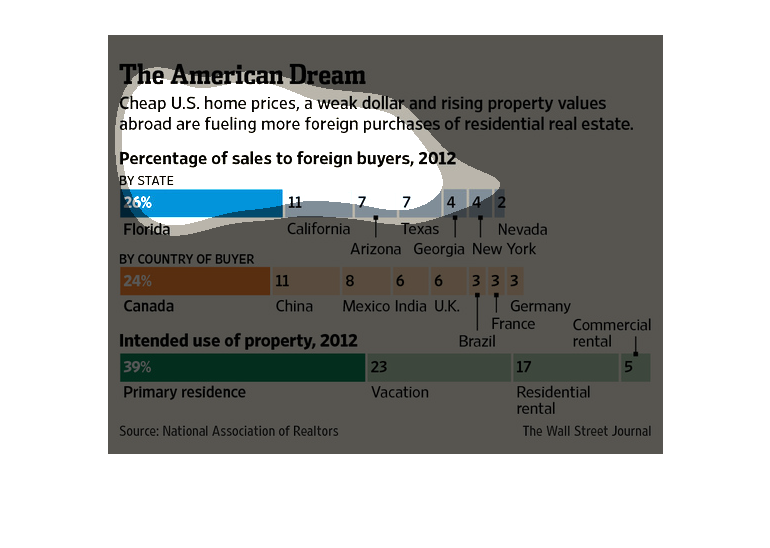

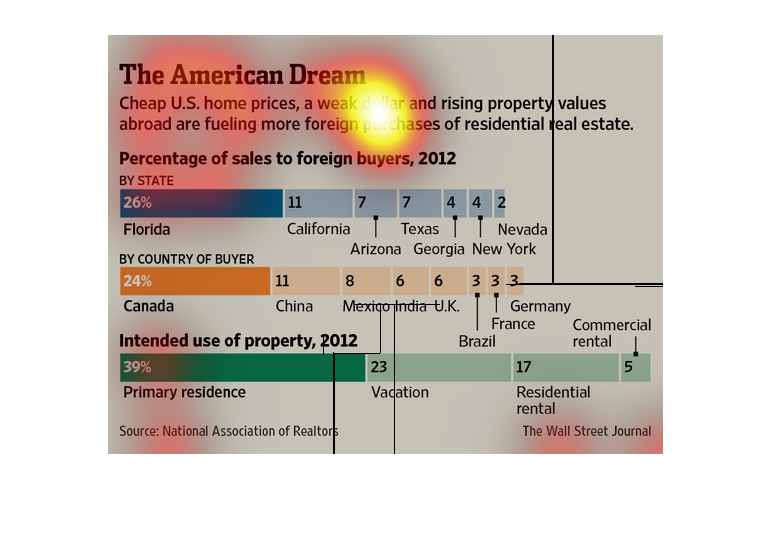

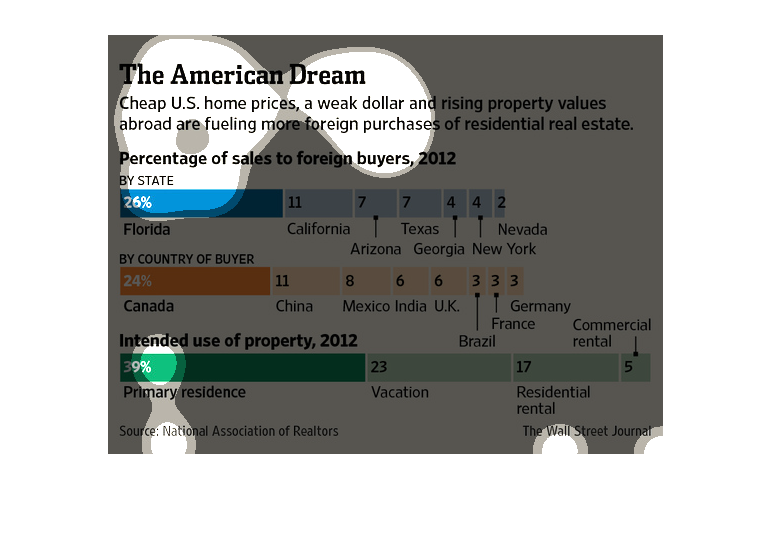

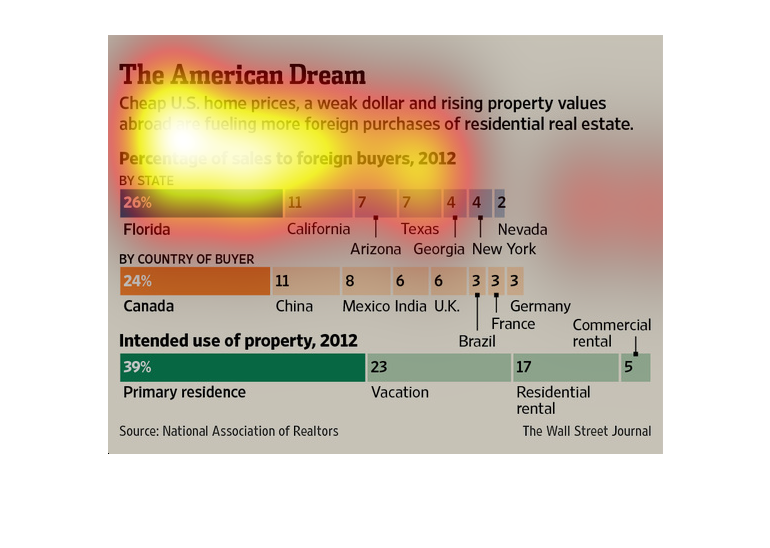

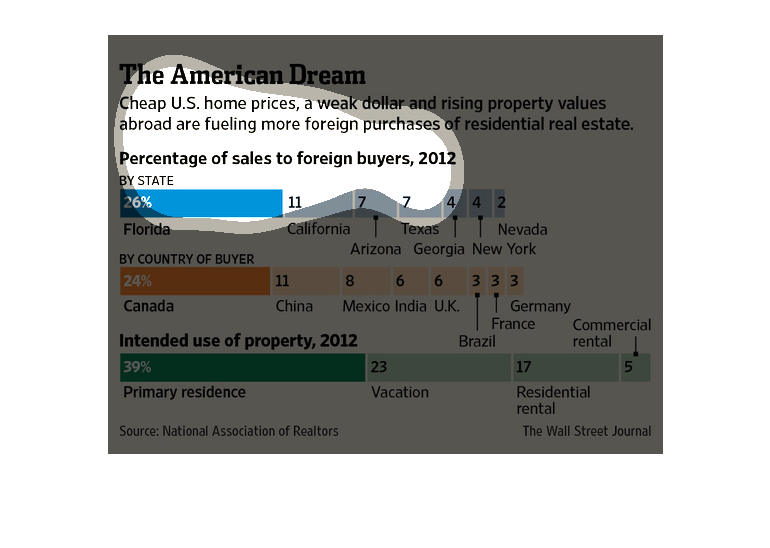

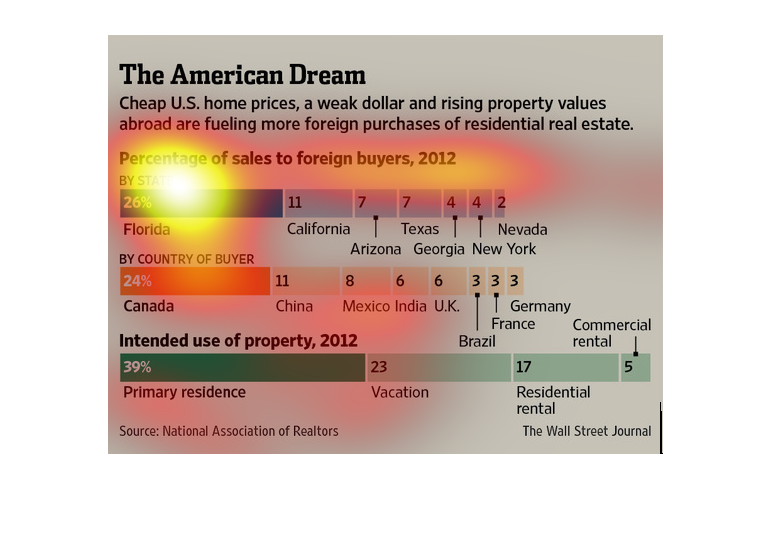

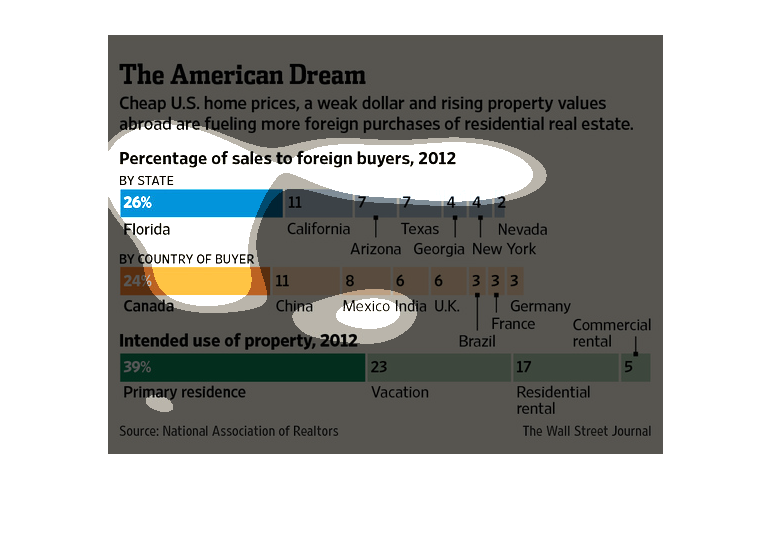

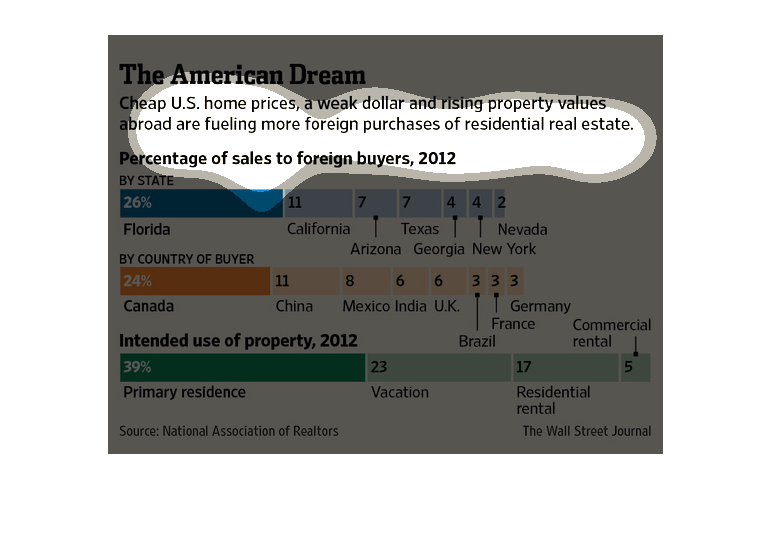

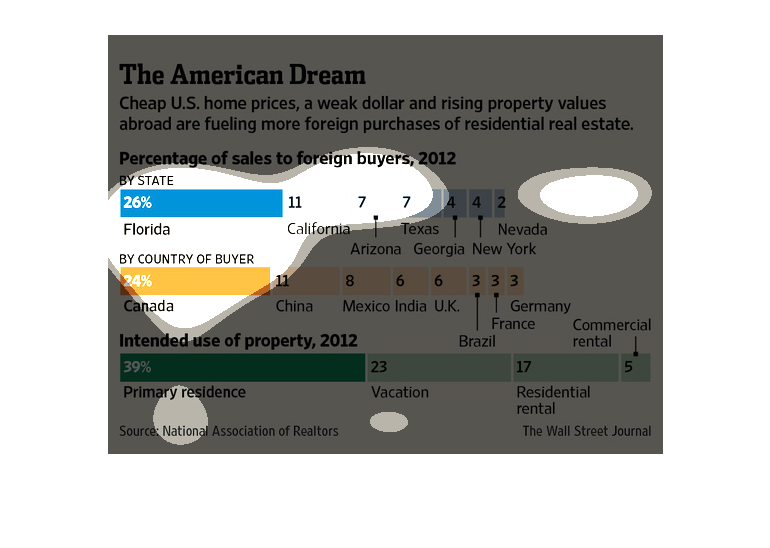

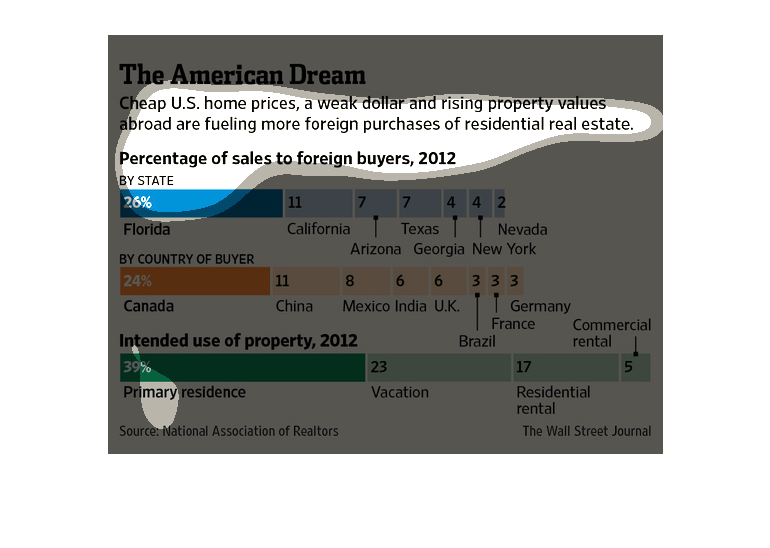

This chart from the Wall Street Journal shows how foreign investors are bidding on us real

estate because of low home prices, a weak US dollar, and rising prices

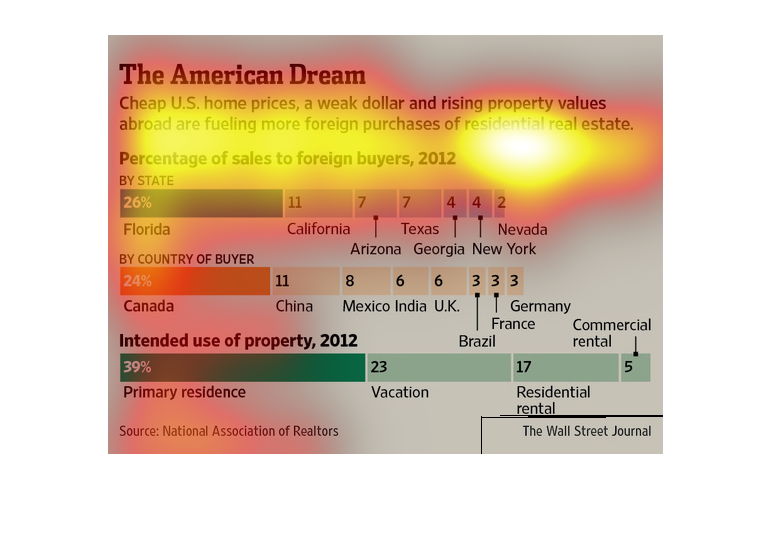

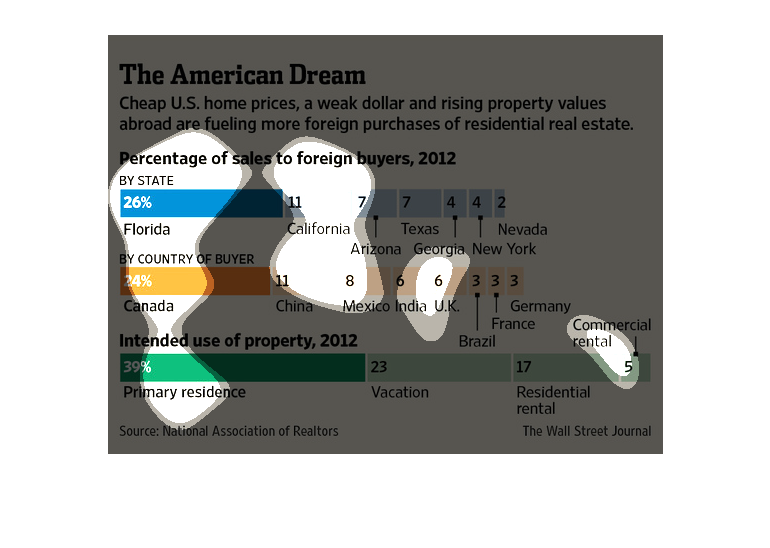

This is a graph that describes what states foreigners are purchasing property in America by

state. It also describes where the foreigners are coming from and what they intend to do with

the property. This trend is because of the weak US dollar, the cheap price of homes in the

US and the rising property values.

This chart from the Wall Street Journal shows how foreign investors are driving real estate

investments in the US because of low prices, a weak dollar, and growth expectations

This chart shows sales of goods to foreign countries by state country and region it breaks

all of the numbers down by the percentage of each area and amount

This image shows or depicts in statistical bar graph format information concerning the American

Dream. Cheap U.S. home prices, a weak dollar and rising property values are causing more foreign

purchases or real estate in the U.S.

This chart shows how more foreign investors are purchasing American real estate. This real

estate is broken down by type and in which state. This is caused by cheap home prices and

a weaker dollar.

This is a graphic that is meant to illustrate that the current low prices of US homes, a weak

dollar and rising property values abroad are fueling foreign purchases of residential real

estate.

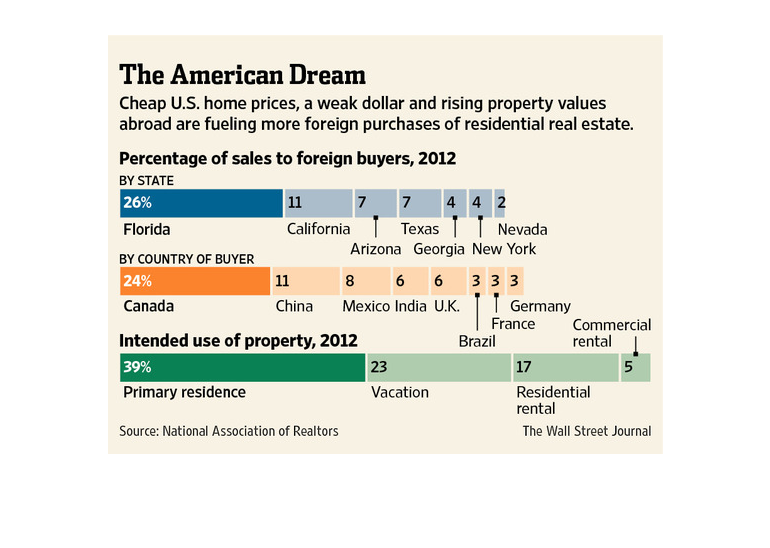

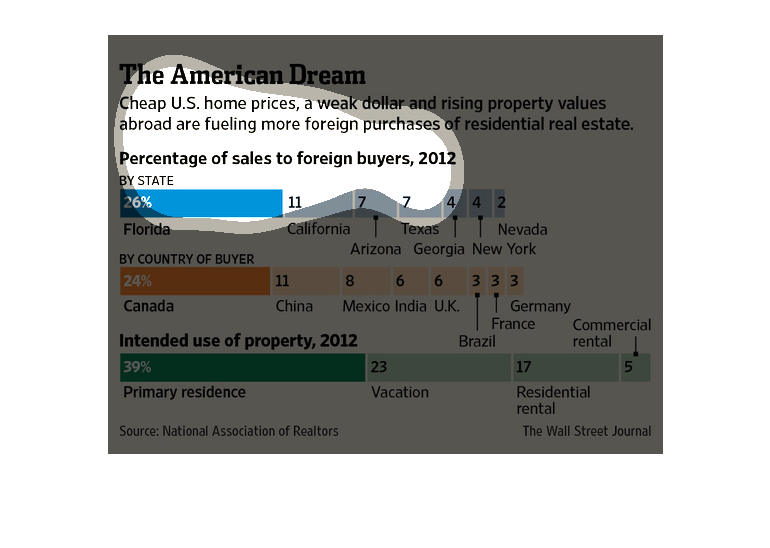

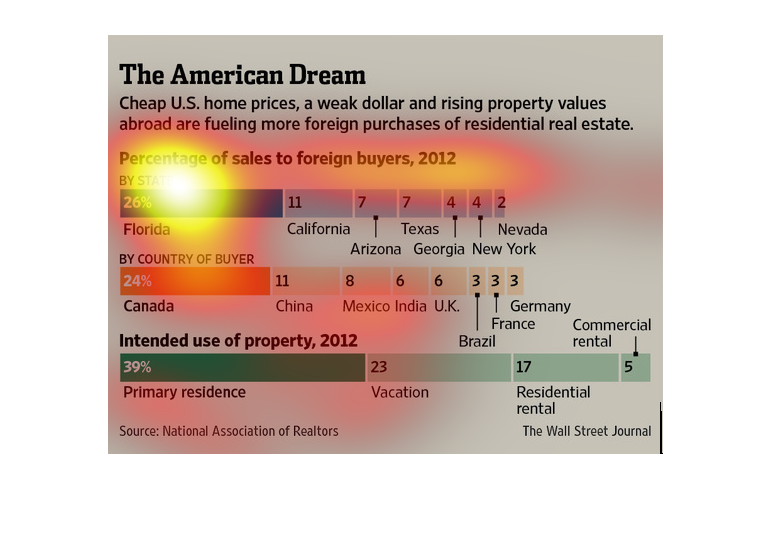

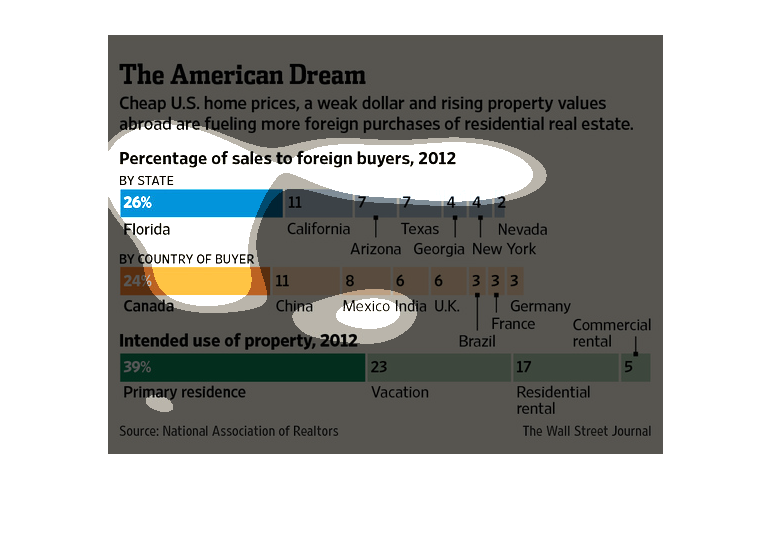

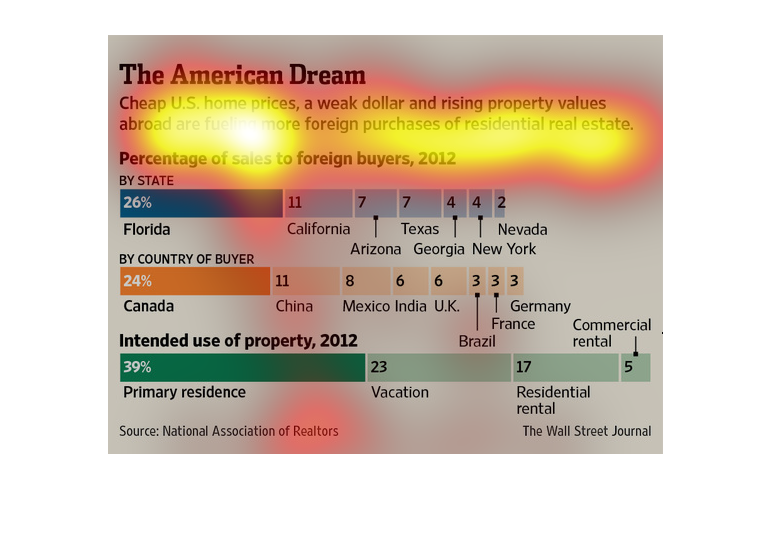

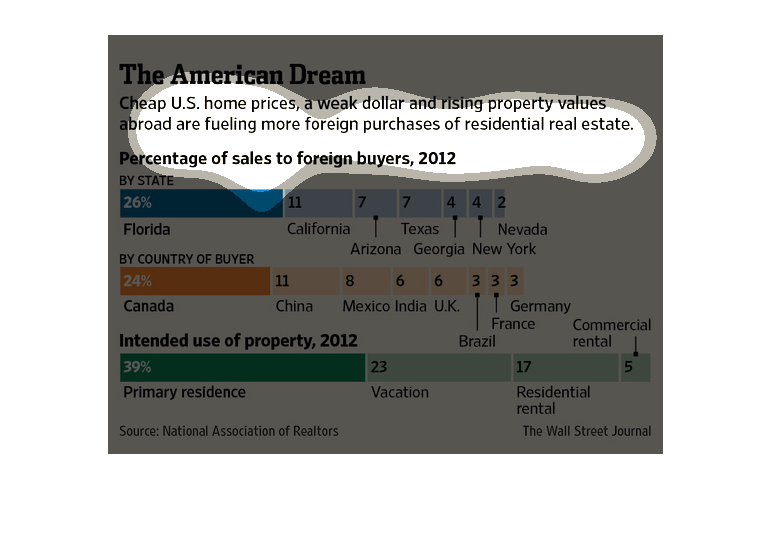

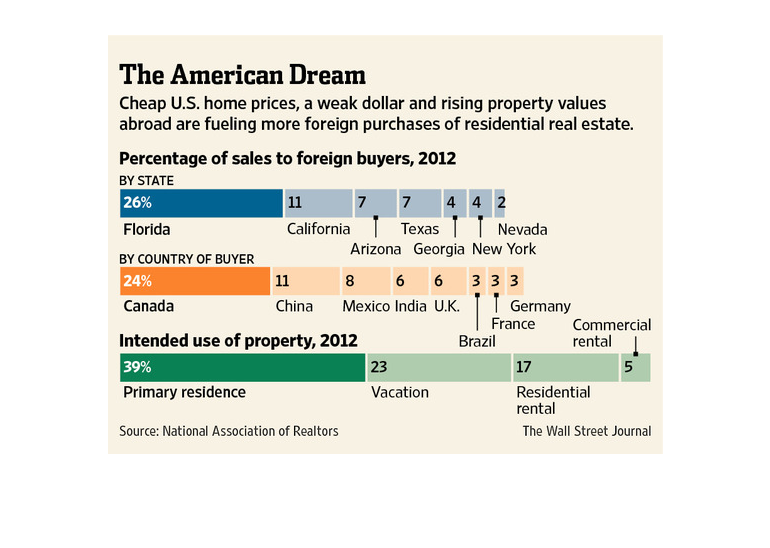

A graph with three different colored bars called "The American Dream". The bars are for Percentage

of Sales to Foreign Buyers in 2012. The blue bars are for states, the orange ones for countries,

and the green ones for intended use of properties.

This chart illustrates the percentage of US homes that re being sold to foreign buyers by

state, by country of buyer, and the intended use of property.

Weak dollar, cheap home prices and rising housing prices abroad have all contributed to foreign

purchases of residential real estate in the US. This fact is backed up by graphic that illustrated

the percentage of sales to foreign buyers in 2012, broken down by state (Florida is an example),

but country of buyer (like Canada) and intended use of the property.

This graph looks at the percentage of US homes that were sold to foreign buyers in 2012, as

a result of falling costs, a weak dollar, and rising real estate value. The highest percentages

of foreign-bought homes occurred in Florida, followed by California, Arizona, and Texas.

The greatest number of buyers were citizens of Canada, followed by China and Mexico. The

intended use was most often as a primary residence, followed by use as a vacation home.

The image depicts how cheap US home prices, a weak dollar and rising property values abroad

are causing more foreign purchases of residential real estate. Florida, California, Arizona

and Texas are the leading markets.