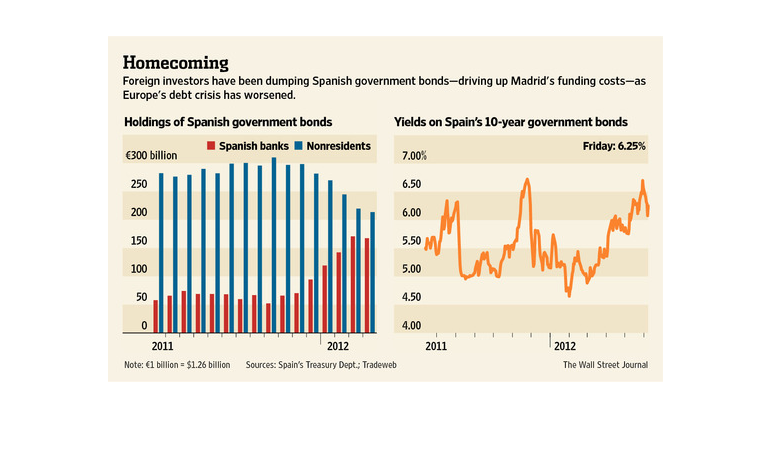

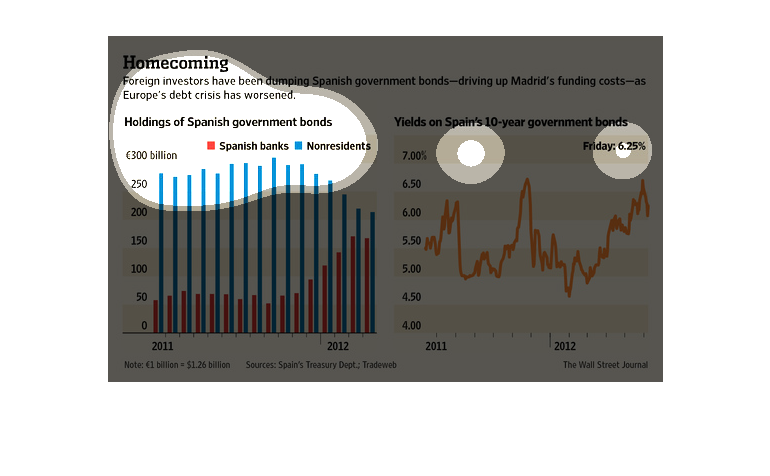

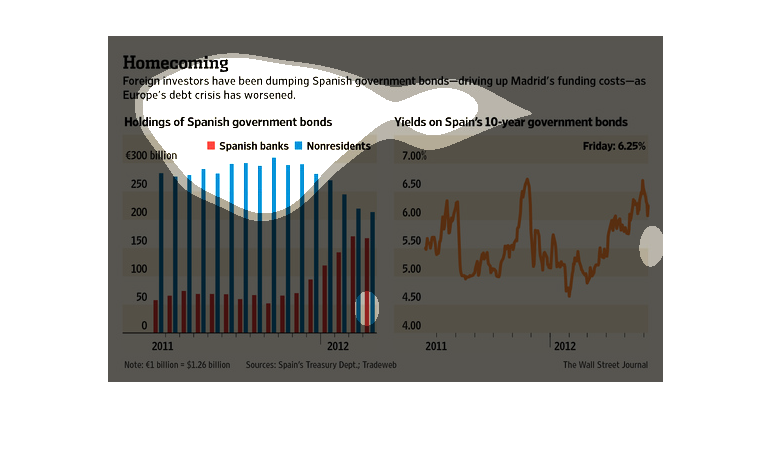

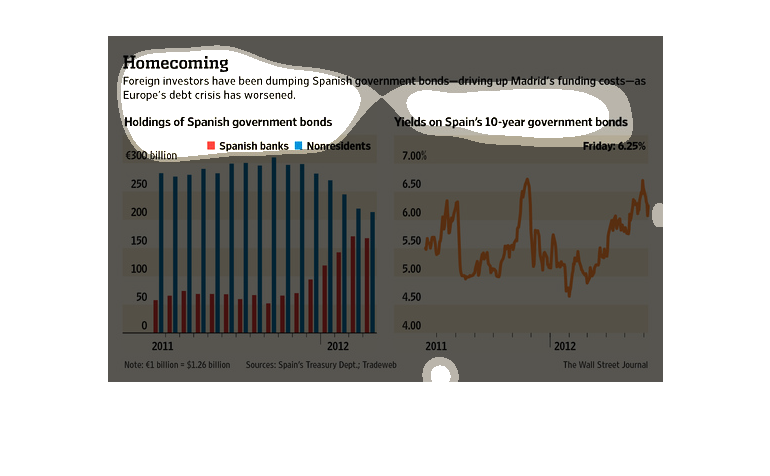

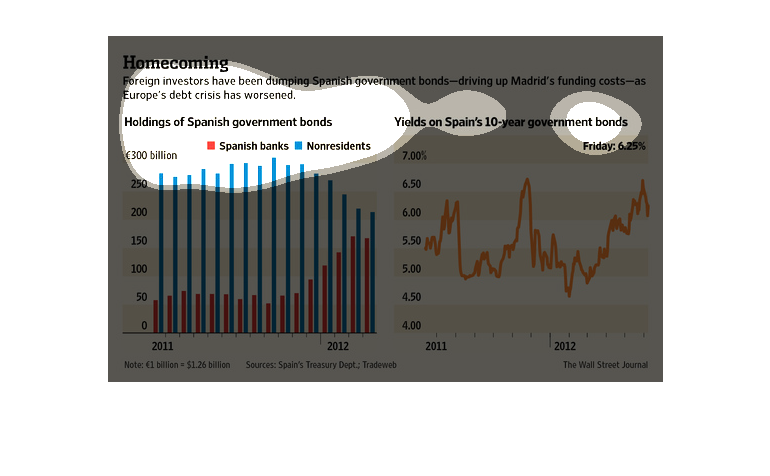

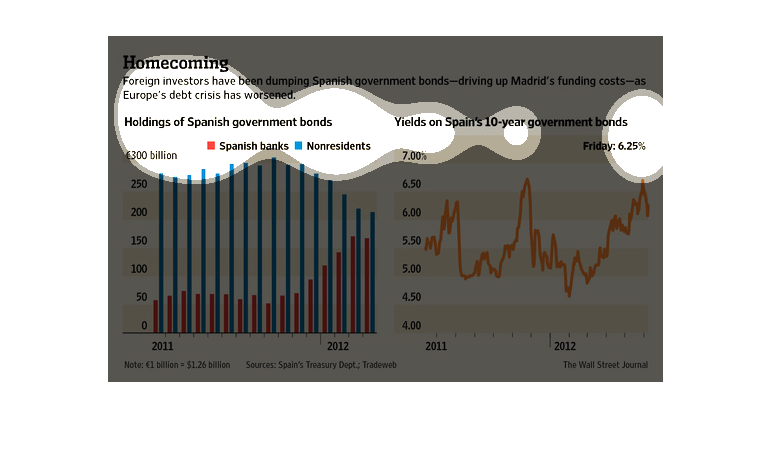

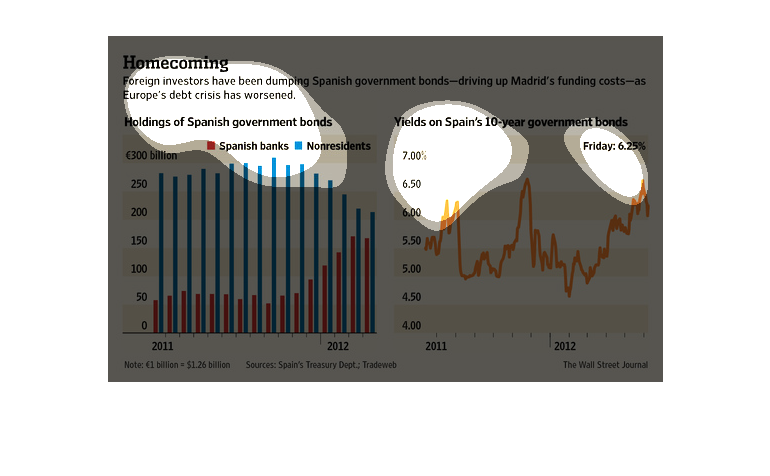

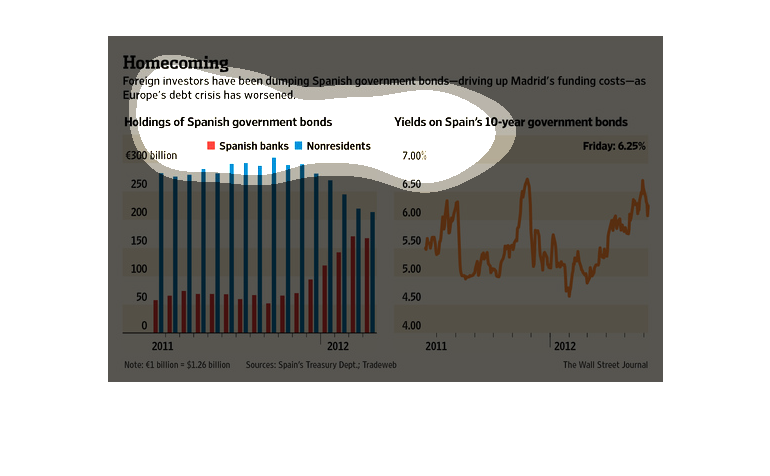

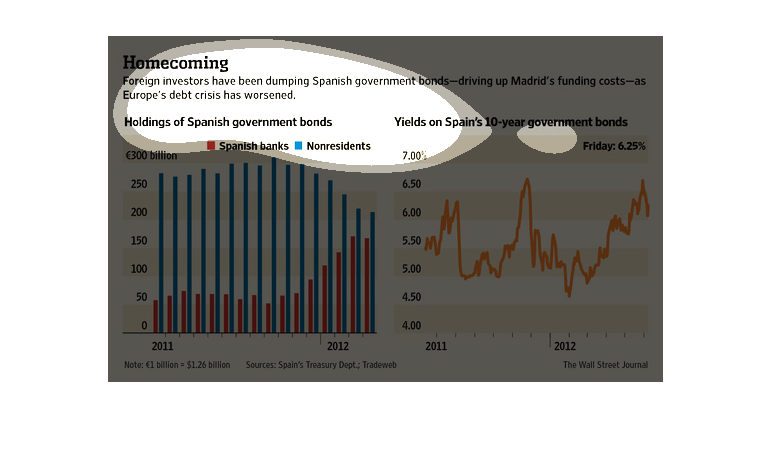

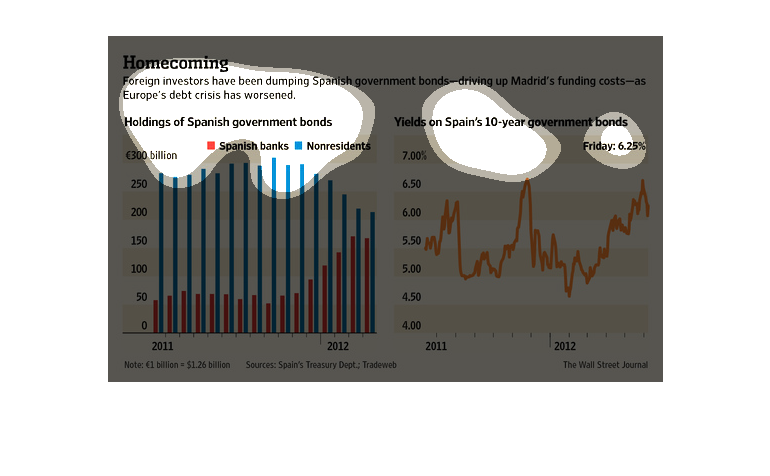

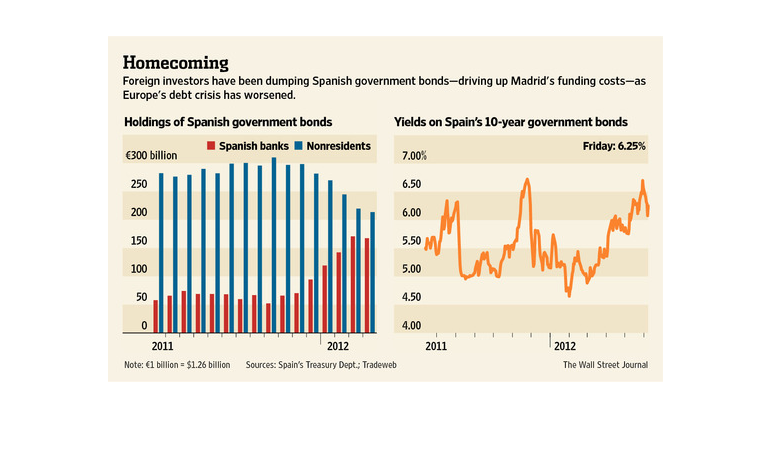

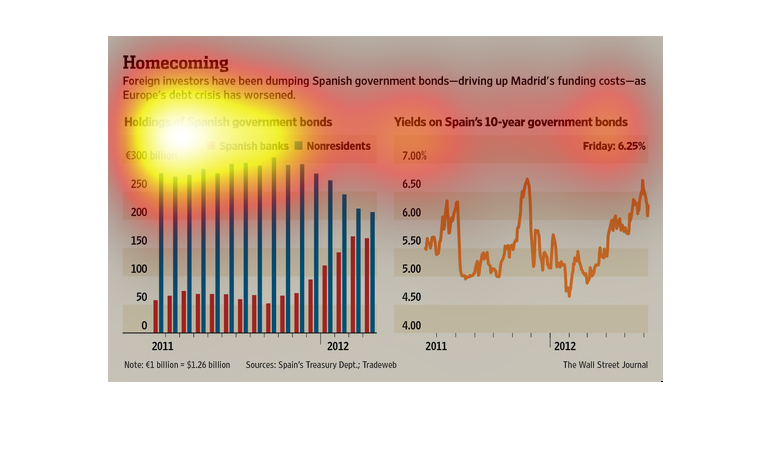

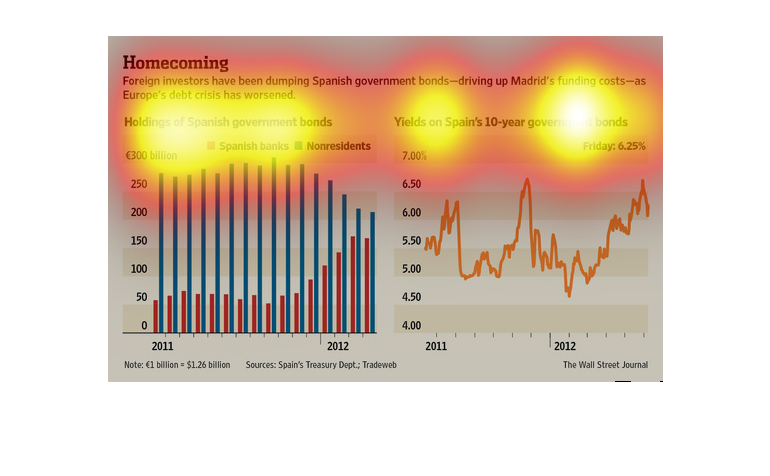

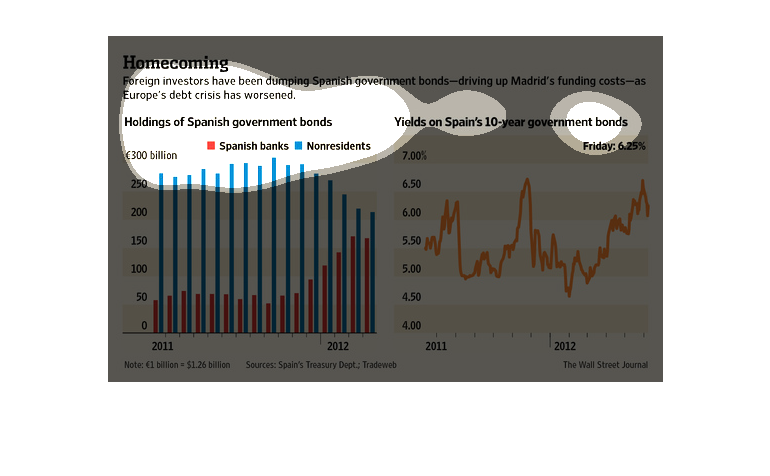

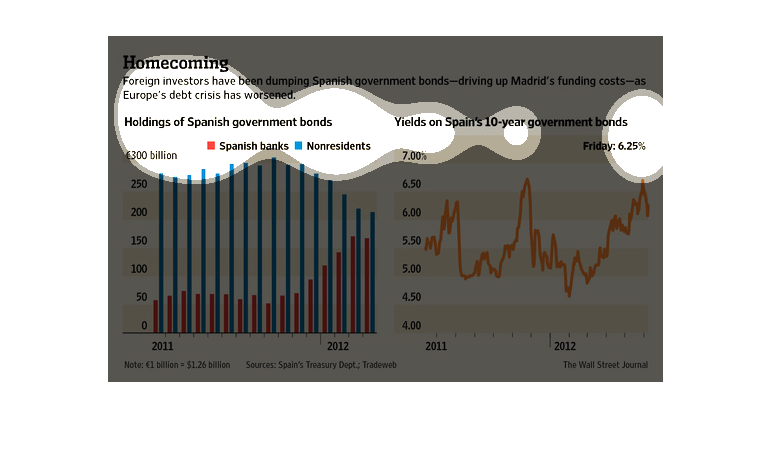

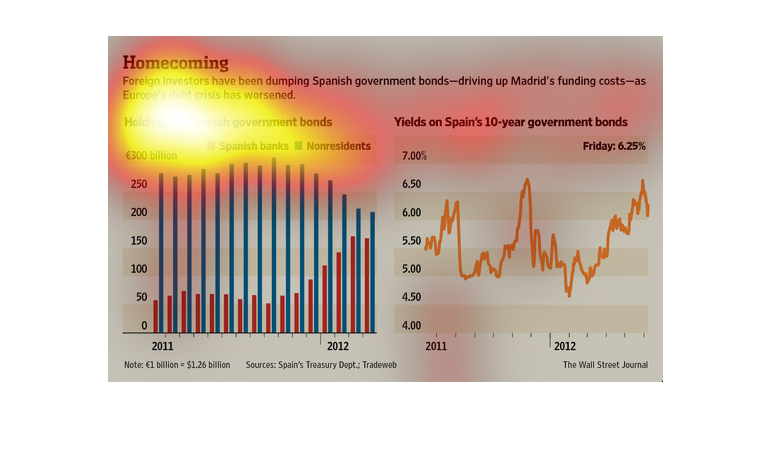

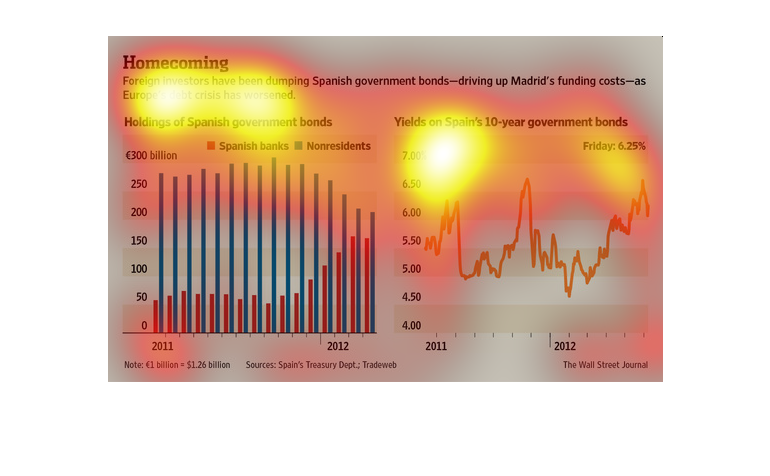

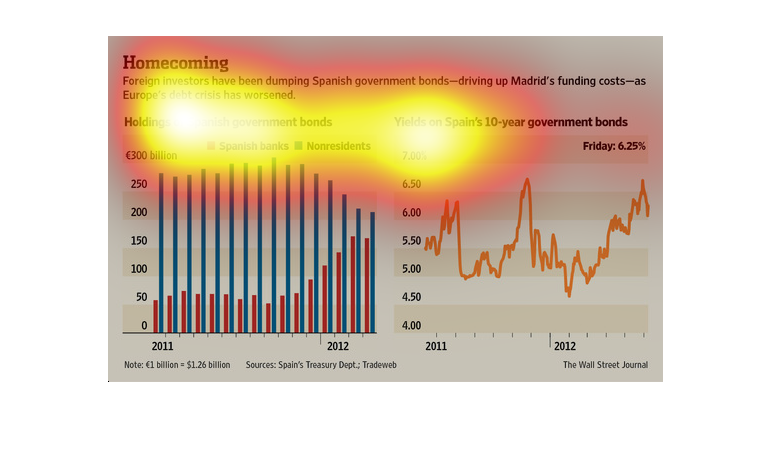

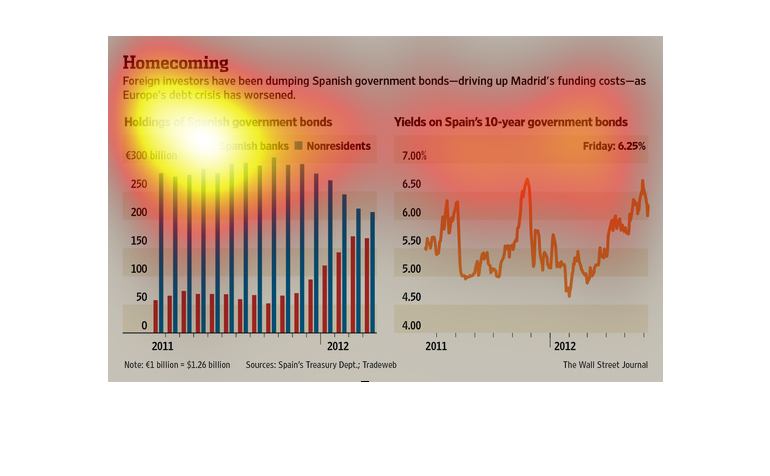

This chart from the Wall Street Journal shows how spanish government bonds were seeing higher

yields due to investors dumping the bonds, putting strain on the country

This chart is titled Homecoming stating that Foreign investors have been dumping Spanish government

bonds - Driving up Madrid's funding costs - as Europe's debt crisis has worsened.

The image depicts how foreign investors have been dumping Spanish government bonds, in the

process driving up Madrid's funding costs as Europe's debt crises continues to get worse.

This graph represents the amount foreign investors have been dumping Spanish government bonds

and driving up Madrid's fundraising costs. This has negatively impacted the European nation's

ongoing debt crisis.

This image discusses textually and with bar chart and graph the debt crisis in Europe, particularly

with Spain and the holdings on Spanish government bonds. The yield on these bonds have fluctuated

alot over 2011-12, and look to be on their way down again.

These two graphs depict how foreign investors have been dumping government bonds in Spain

- driving up Madrid's funding costs as Europe's debt crisis.

This chart from the Wall Street Journal shows how spanish debt is seeing higher yields because

investors are dumping spanish bonds due to their budget crisis

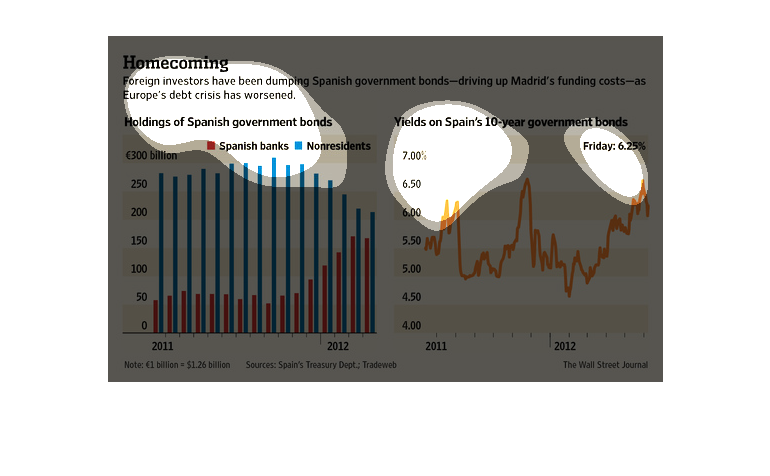

Homecoming Foreign investors have dumped Spanish government bonds and it leads to Europe's

debt crisis. The bar graph shows that nonresidents hold more Spanish government bonds.

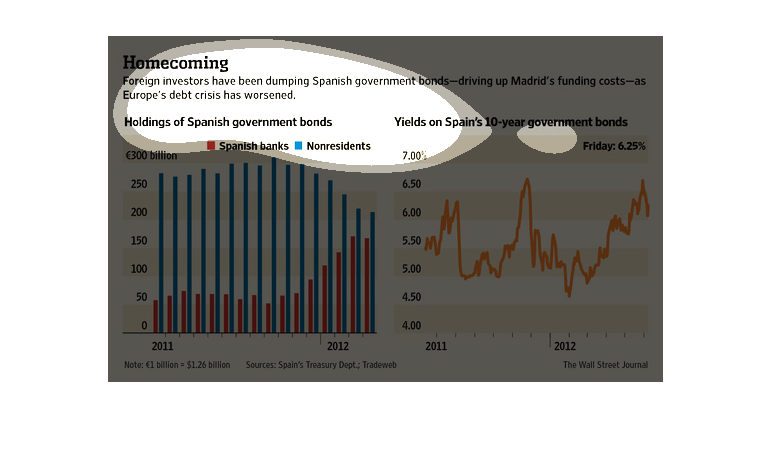

This chart on the left shows non-resident holding Spanish bonds, then dumping them from 2000

to 2012 which was worsening the European debt crisis. It also shows that yields on 10- year

government bonds was up to 6.25% by the end of 2012.

This graph is illustrating the amount of money that foreign investors have been dumping out

of Spanish government bonds. The graph also shows what this means in terms of cost to the

Spanish government.

The figure presented to the left is titled Homecoming. The figure is a representation of

the statistical data for Foreign investors clumping Spanish government.

This talks about how foreign investors have been dumping Spanish government bonds, and driving

up Madrid's funding costs. As Europe's debt crisis has worsened. Then there is 2 graphs about

how the Spanish bonds.

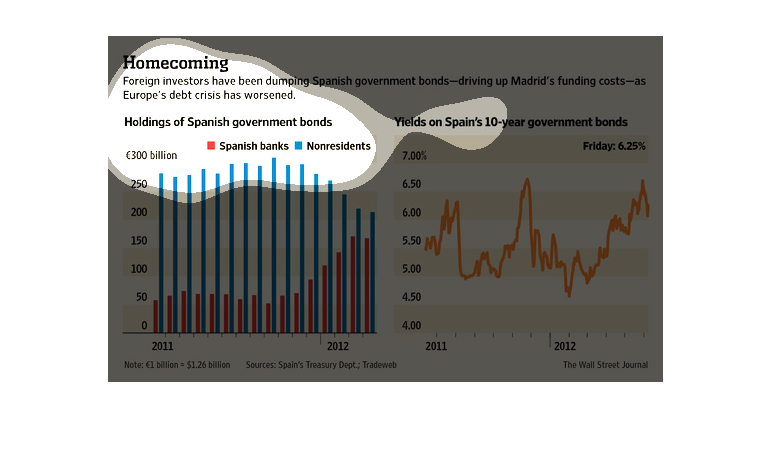

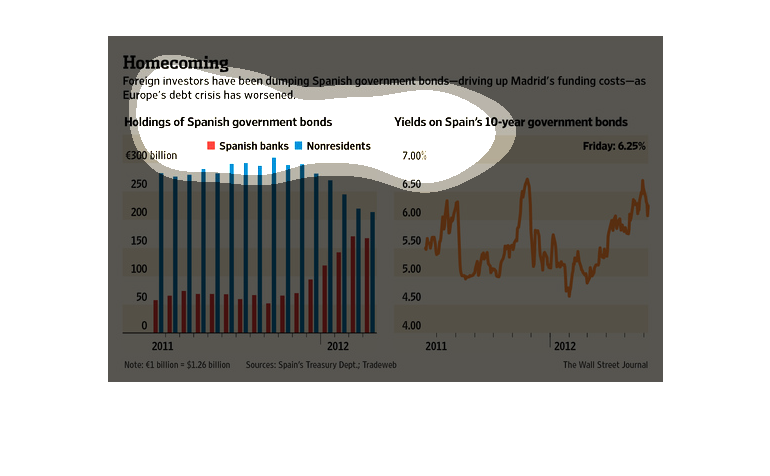

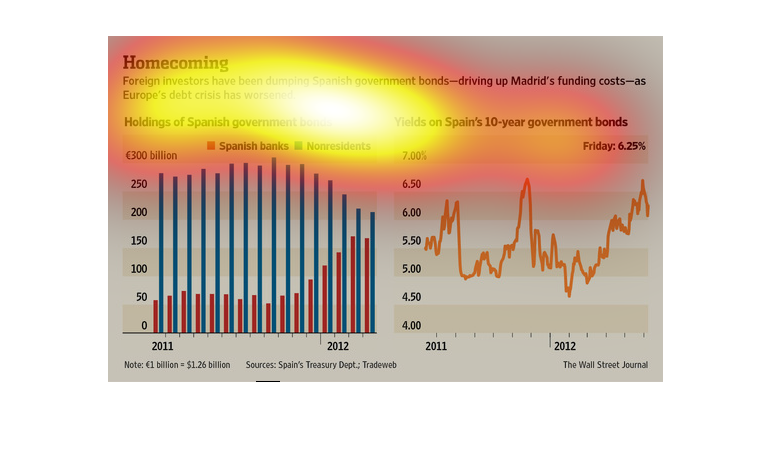

These graphs detail the effects of foreign investors manipulating Spanish government bonds,

causing Europe's debt crisis to worsen. The first graph shows the stark contrast between the

number of bonds held by Spanish banks versus the amount held by nonresidents, driving home

the point that the actions of foreign investors are truly having an adverse effect upon the

economy. To support this argument, the second graph shows the 10 year yields of these bonds,

demonstrating all the money that is not going to Spanish banks (and thus the Spanish economy)

but instead flowing to foreign economies.