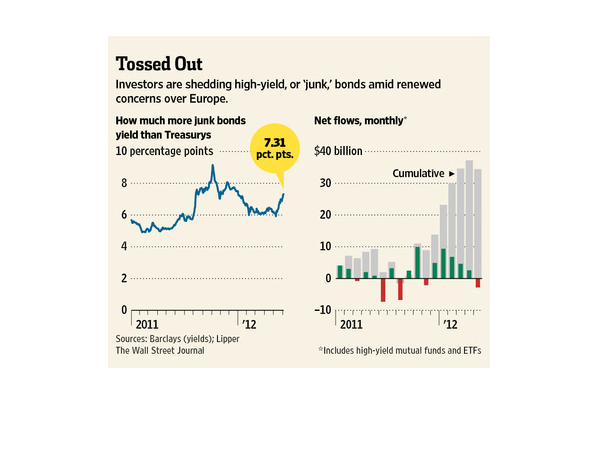

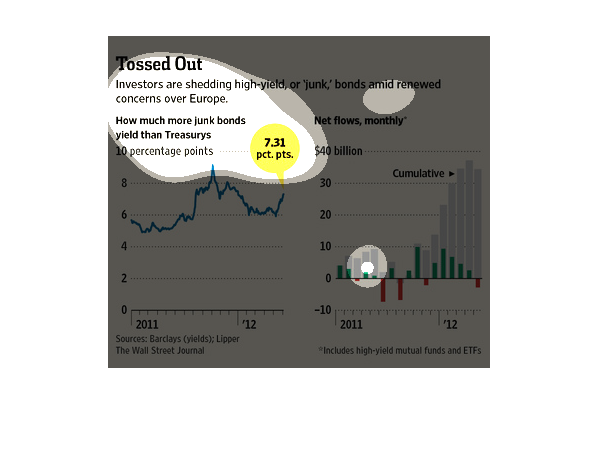

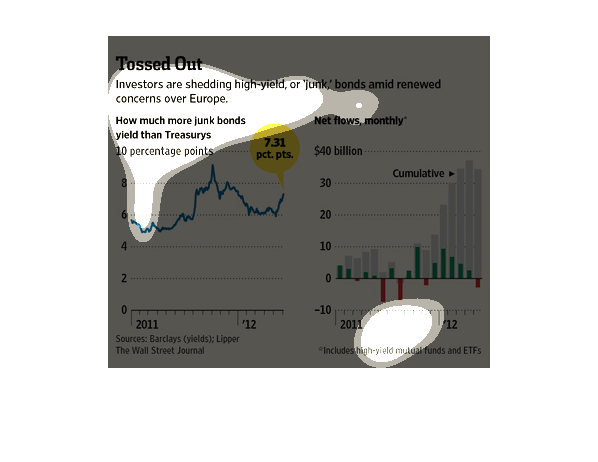

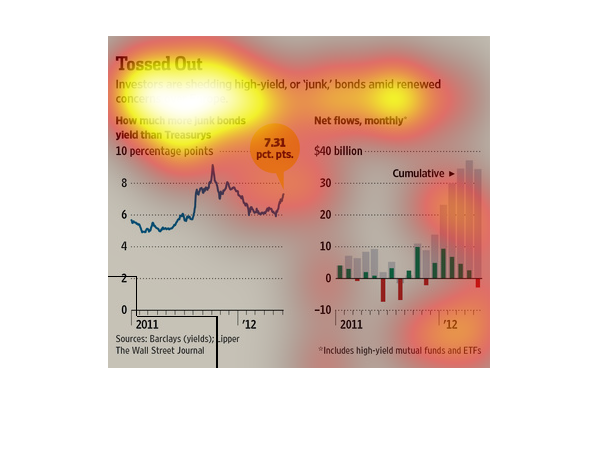

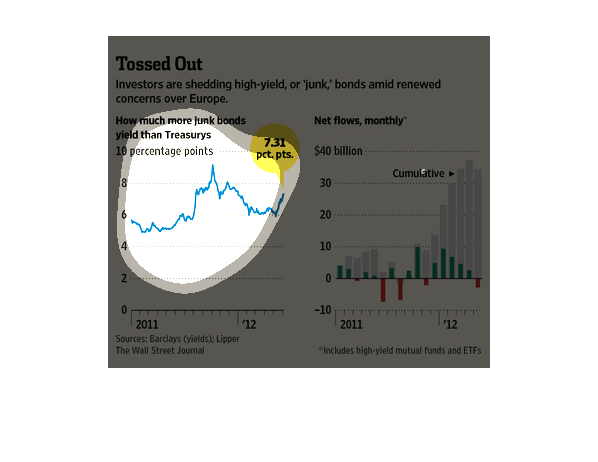

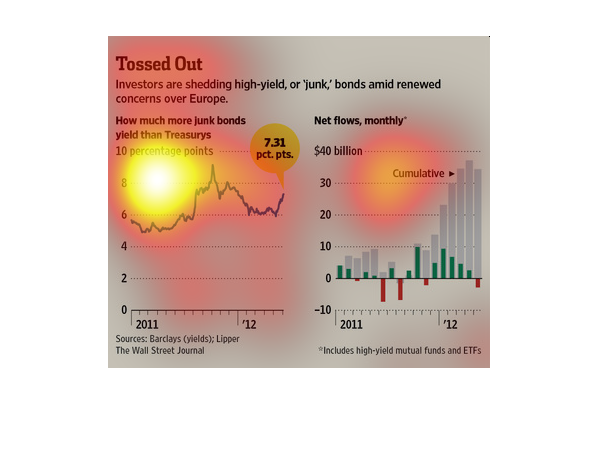

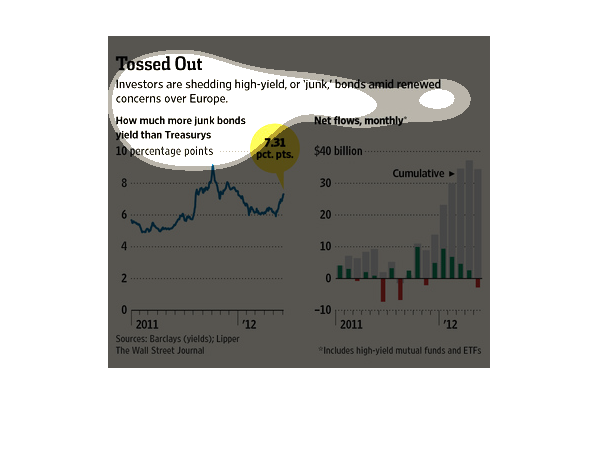

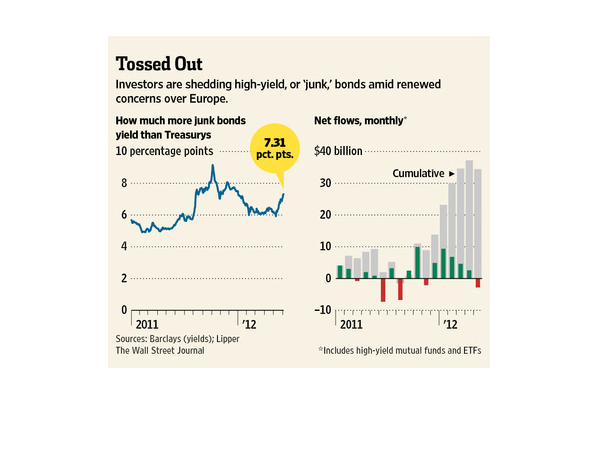

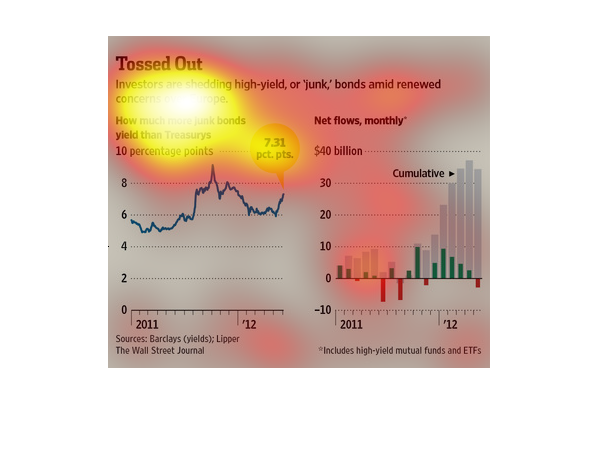

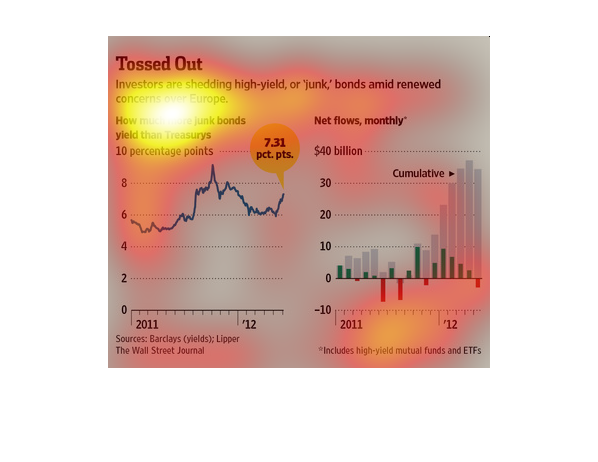

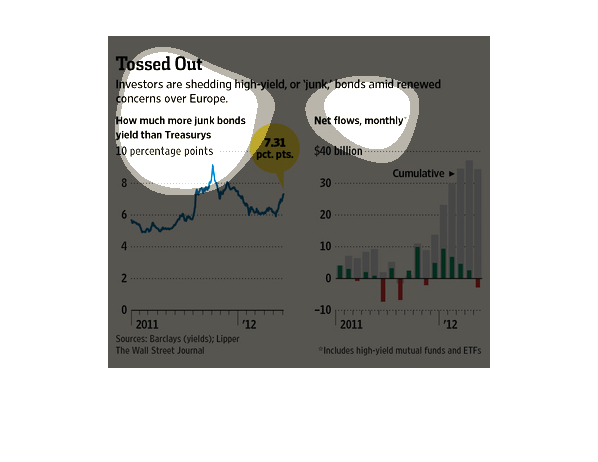

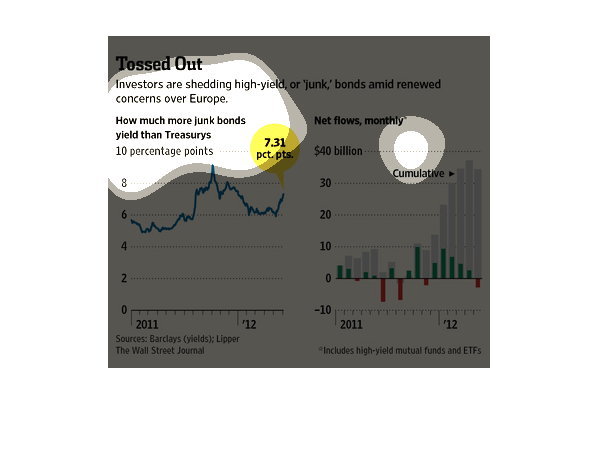

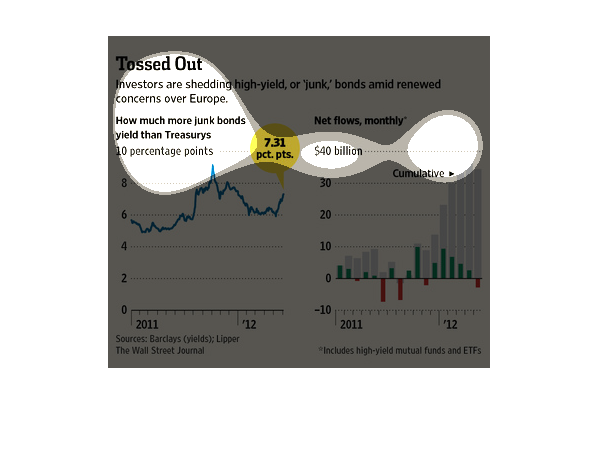

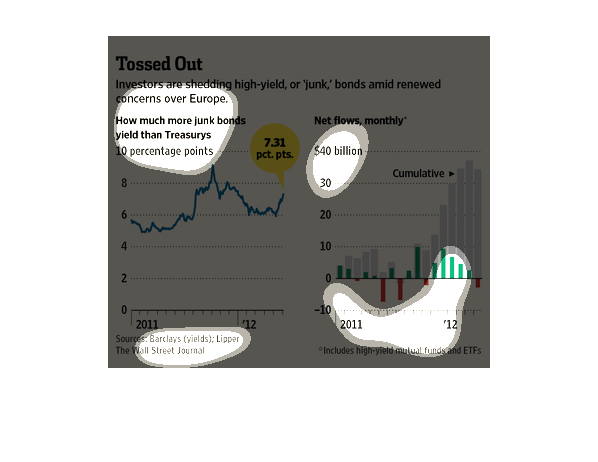

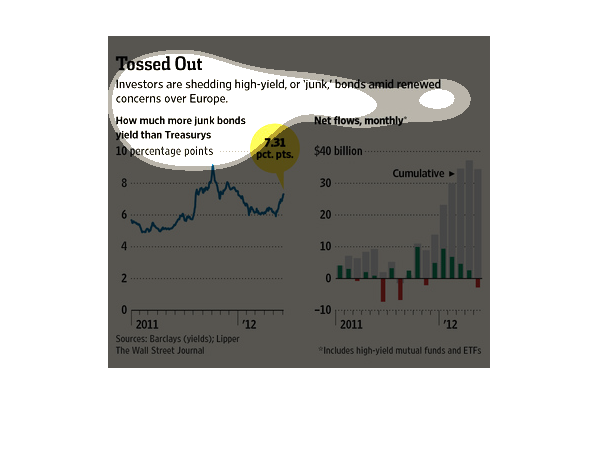

This graph depicts how much Europe is spending on junk bonds or high yeild in a time of economic

turmoil/unrest in 2011-2012. It shows the dollar amount to how much is going into these types

of bonds.

In this study conducted by the Wall Street Journal- from various different sources- we see

that investors are trying to dump bad stock left and right in the Euro zone.

NIce graphics, clearly cited sources, vibrant blue line graphs, and color coded bar graph.

Shows how investors are shying away from "junk" bonds amid concerns over Europe.

These graphs show how unstable "high yield" or "junk" bonds are in comparison to surety bonds.

This apparently has to do with concerns over Europe. Junk bods seem to yield more but not

at a cost.

This article is about different bonds concerns in Europe. They compare "junk" bonds and Treasurys.

Then there is two graphs on the bottom, which shows the percent yields and net flow monthly.

This chart talks about junk bonds, which are a type of investment tool. This specifically

talks about junk bonds in Europe and how they have invested in junk bonds.

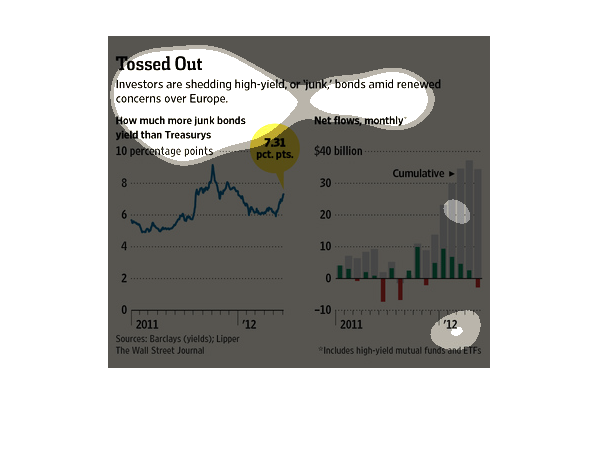

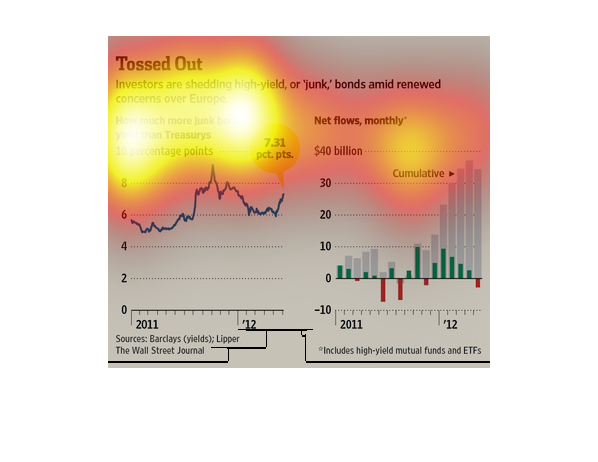

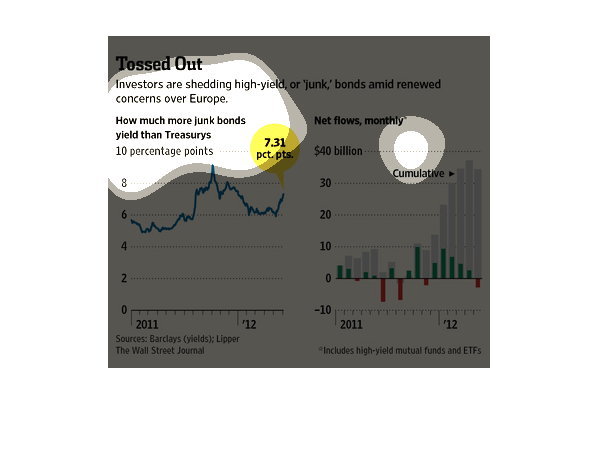

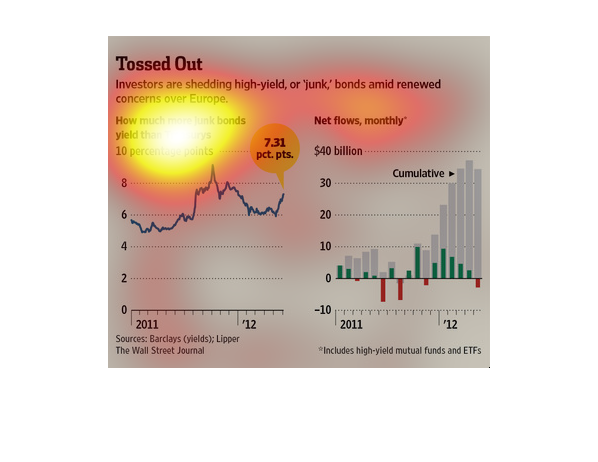

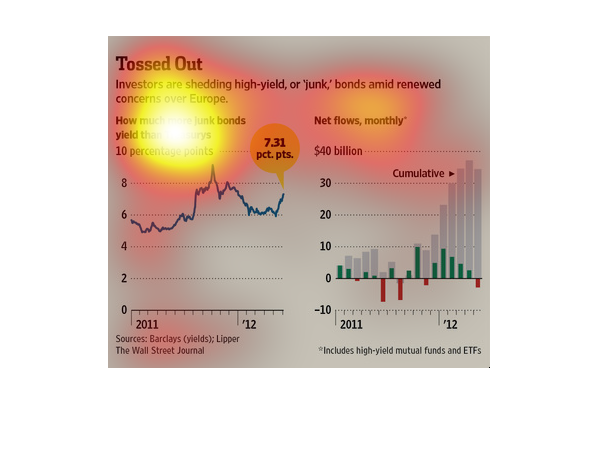

The figure presented is titled Tossed Out. The figure is a representation of the statistical

data for Investors shedding high-yield or junk bonds amid concern.

Investors are shedding high yield or junk bonds amid renewed concerned over Europe.The chart

shows the relationship between the costs of junk bonds over Treasuries.

This chart from the Wall Street Journal shows how institutional investors are shunning high

yield or junk bonds in Europe because of the debt crisis

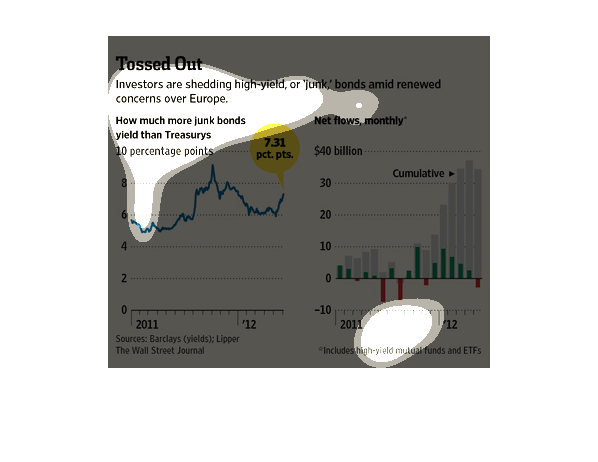

A line graph and a bar graph under the title of "Tossed Out". The line graph is blue and for

how much more junk bonds yield than treasury. The bar graph uses red and green (red being

the negatives) for Net Flows.

The graphs show the expected rate of return on "junk" bonds in an effort to express that investors

are dumping these bonds due to growing concerns about Europe.

This is a small graph telling that investors are starting to shed junk bonds also known as

high yielding bonds. this is happening based on concerns about Europe.

This chart from the Wall Street Journal shows how investors are starting to shun buying high

yield or junk bonds in Europe because of growth concerns