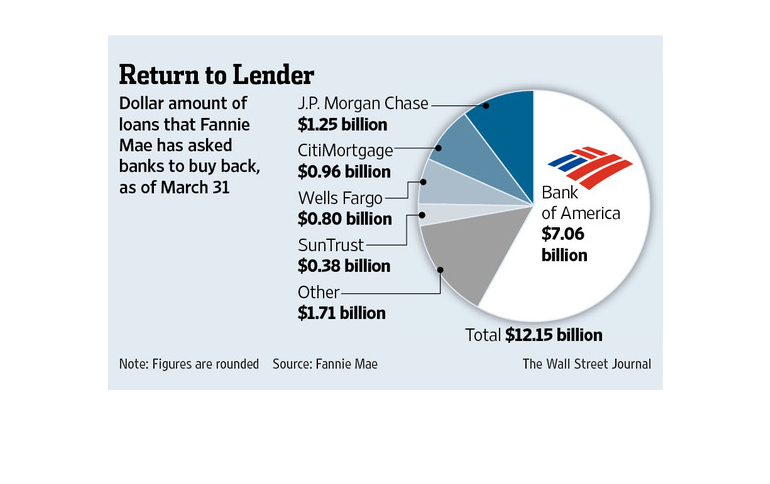

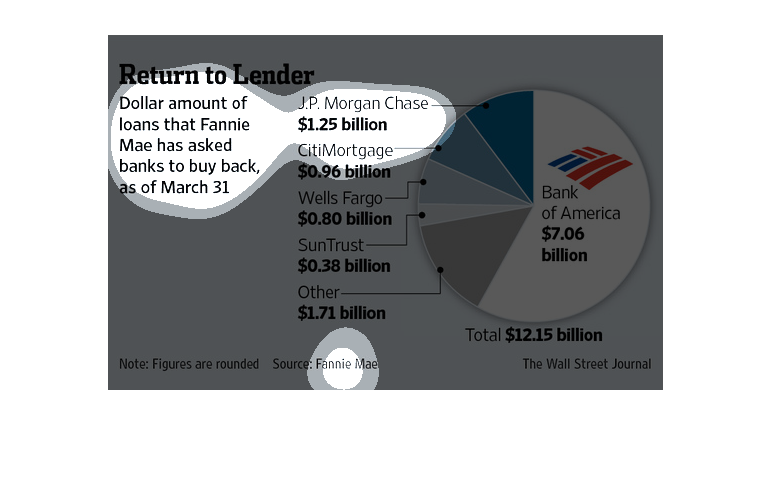

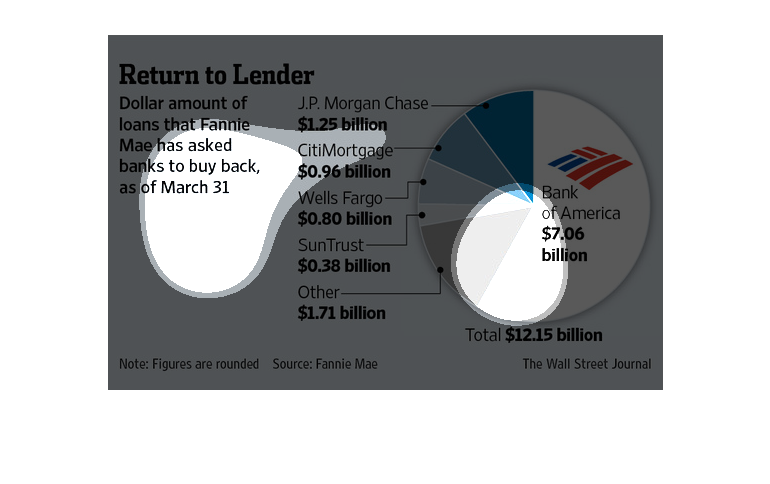

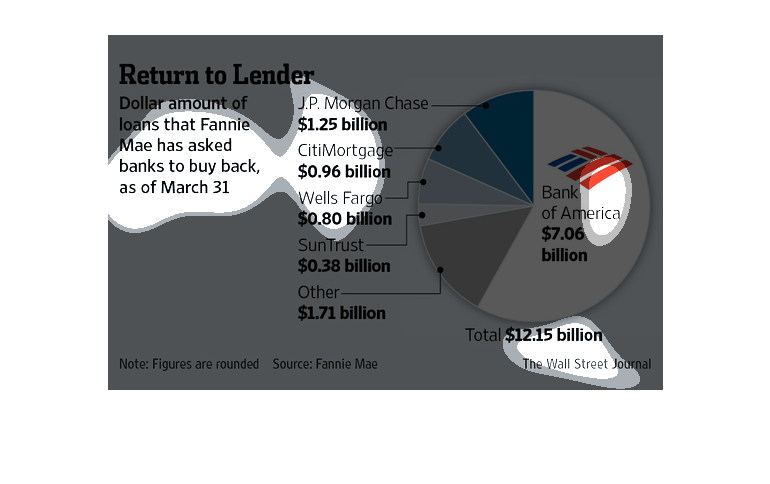

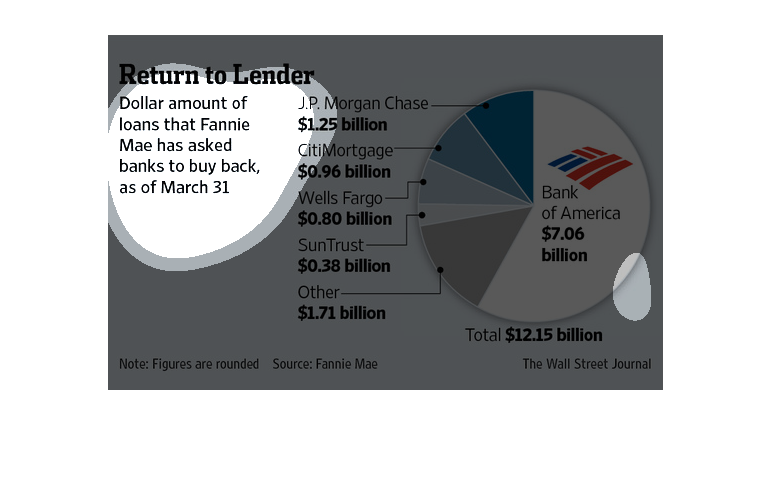

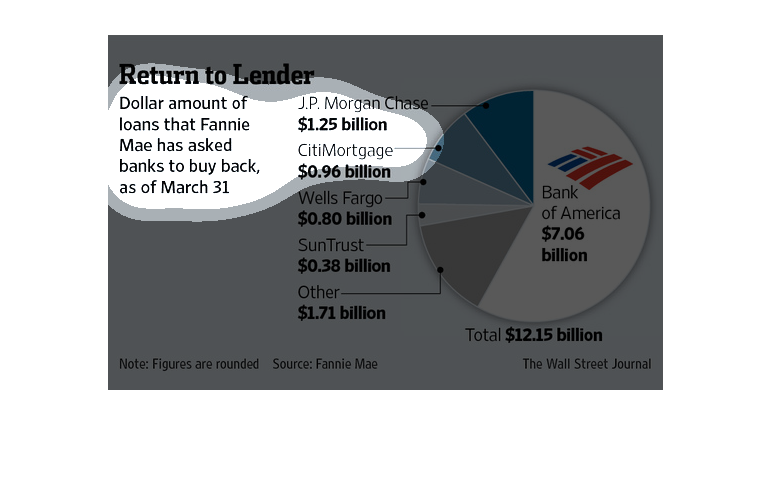

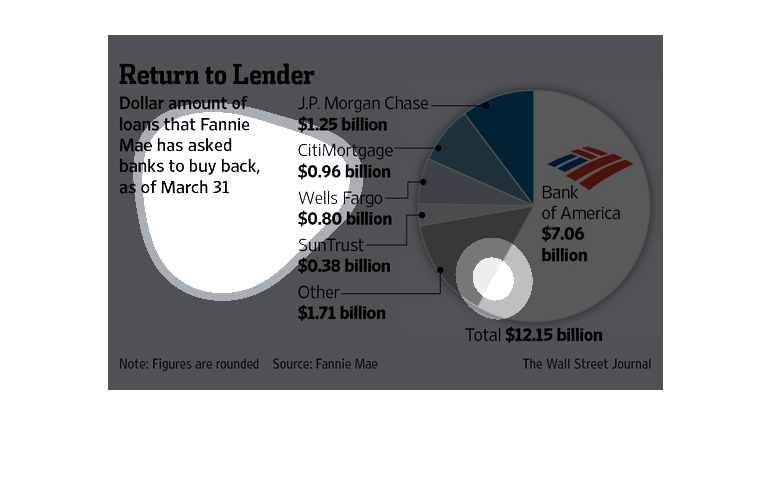

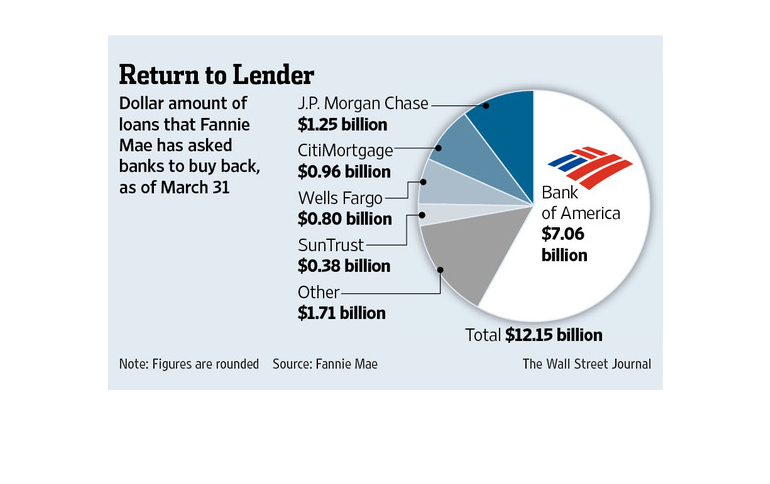

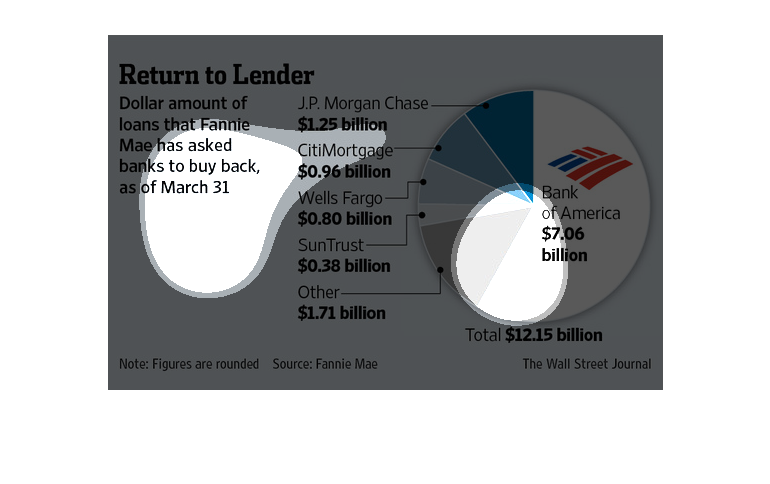

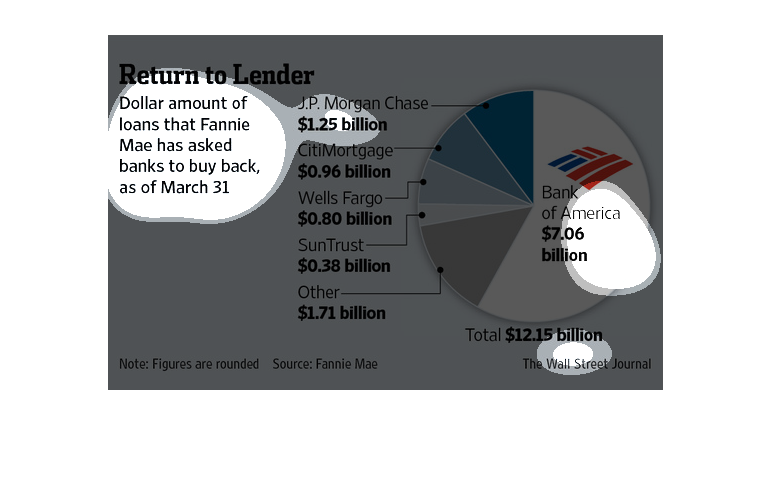

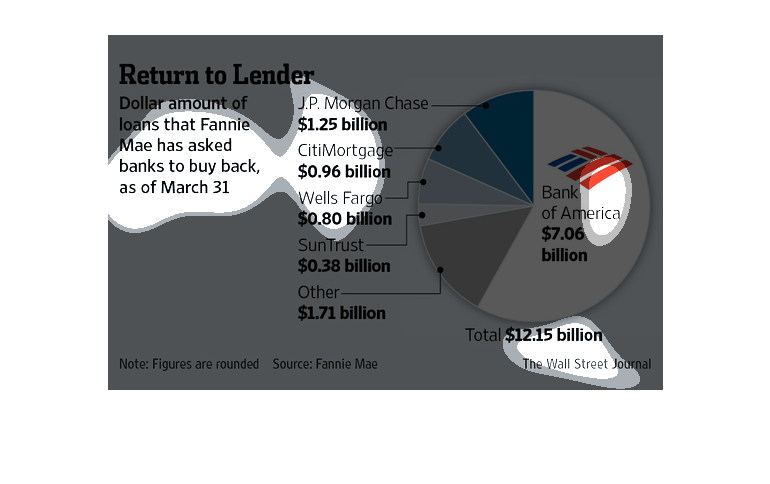

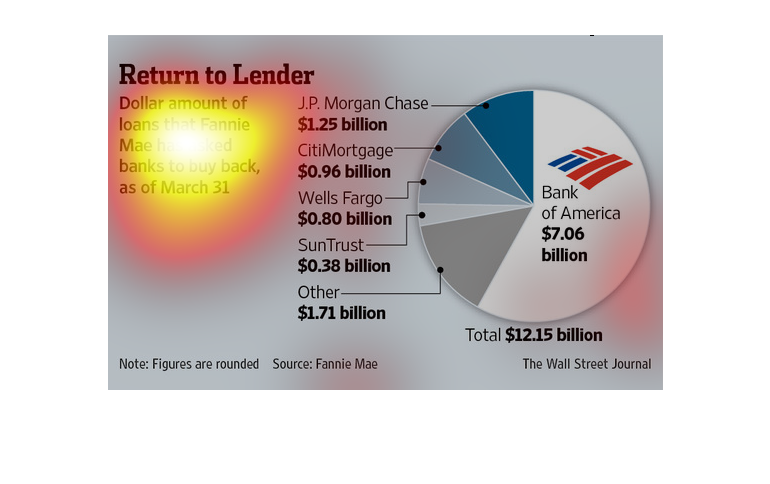

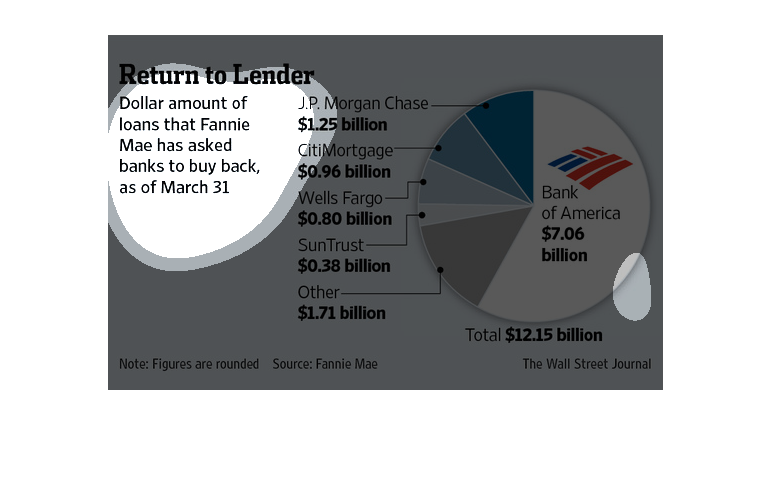

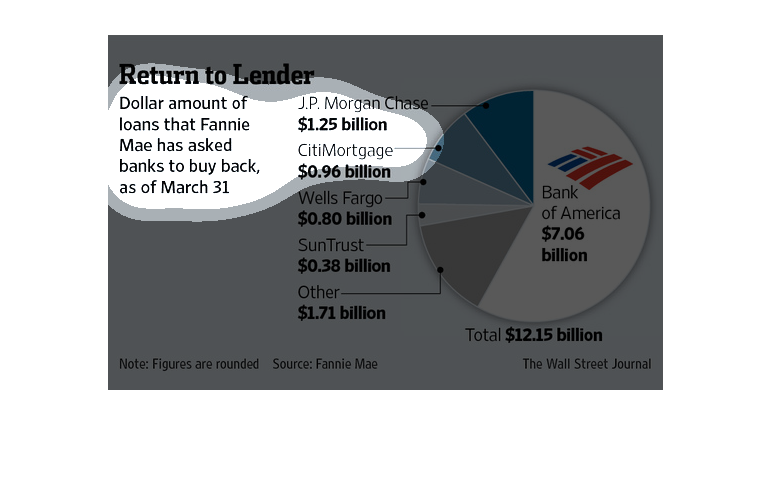

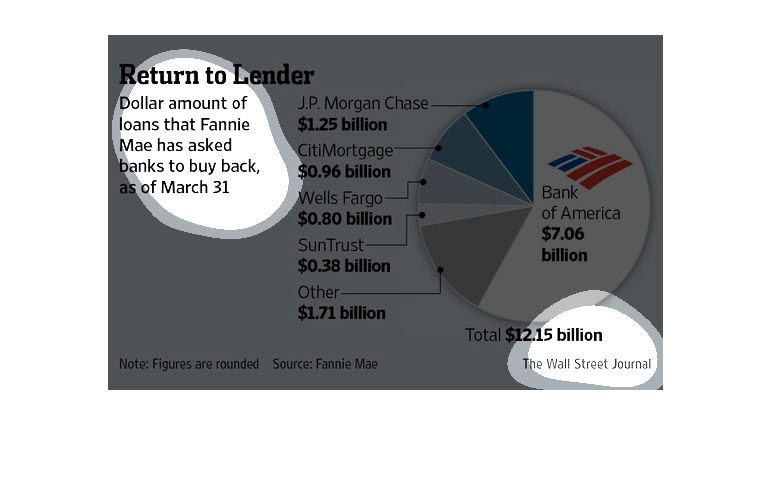

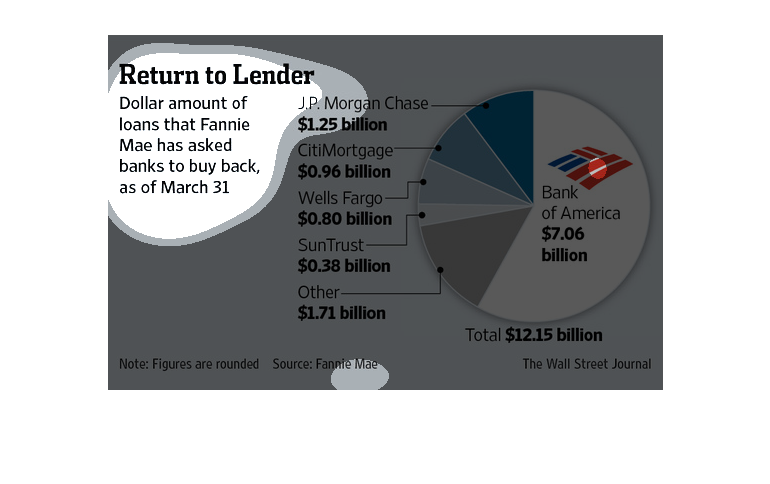

This chart shows the dollar amount of loans that Fannie Mae has asked banks to buy back as

of March 31. J.P. Morgan has the highest sum being one point two five billion.

The image shown is titled Return to the Lender and shows the amount of money that the bank

Fannie May has asked for the government to buy back as of March 31

This chart from the Wall Street Journal shows how major US banks are buying back bad mortgages

sold to Fannie Mae during the financial crisis in 2008

This chart shows the amount in loans Fannie Mae is asking for banks to buy back. With a total

of 12.15 billion being asked between all banks, Bank of America was asked to buy back the

highest amount set at 7.06 Billion.

This graph shows the dollar amounts of the loans owned by different banks that Fannie Mae

requested banks buy back as of March 31st. Bank of Amercia has the largest portion. J.P. Morgan

comes in second, followed by CitiMortgage and then Wells Fargo, followed by a few others.

Overall, banks were asked to buy back 12.15 billion dollars.

The image depicts the dollar amount of loans that Fannie Mae has asked banks to buy back as

of March 31. Bank of America was asked to buy 7.06 billion, coming in first, with other firms

nowhere near that amount.

This pie chart shows the dollar amount of loans that Fannie Mae has asked banks to buy back

as of March 31st with Bank of America at 7.06 billion and the highest amount.

This chart from the Wall Street Journal shows how Fannie Mae, a GSE, has requested banks to

buy back the bad loans they sold to Fannie Mae during the downturn

Return to Lender Infograph. Money Fanny Mae has asked banks to buy back. J.P. Morgan has the

most at $1.25 billion with the overall total noted to be $12.15 billion.

This pie graph is titled Return to Lender. It's focus is the dollar amount of loans that Fannie

Mae has asked banks to buy back, as of March 31st, totaling $12.15 Billion.

This chart describes return to lender. Specifically, dollar amount of loans that Fannie Mae

has asked banks to buy. Categories on the chart include Wells Fargo.

In this study conducted by the Wall Street Journal- from sources obtained from Fannie Mae-

we see that the buy out of loans is fragmented within the banking system of the United States

of America, and the numerous debts the organization has asked banks to buy back.

This image tracks the dollar amount of loads that Fannie Mae has asked backs to buy back as

of March 31. The graphic is a pie chart which illustrates this point. J.P Morgan has one

of the biggest slices, as does CitiMortgage, of the $12 billion or so amount.