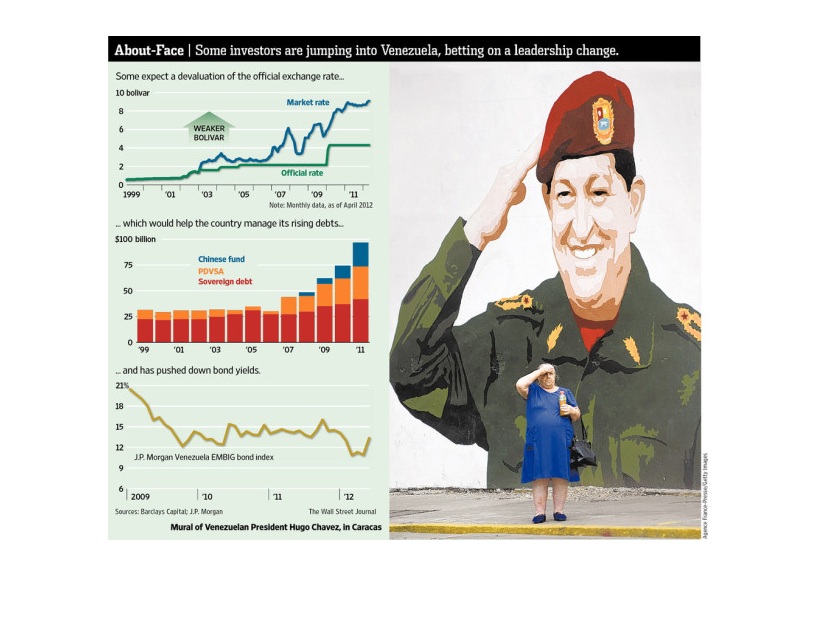

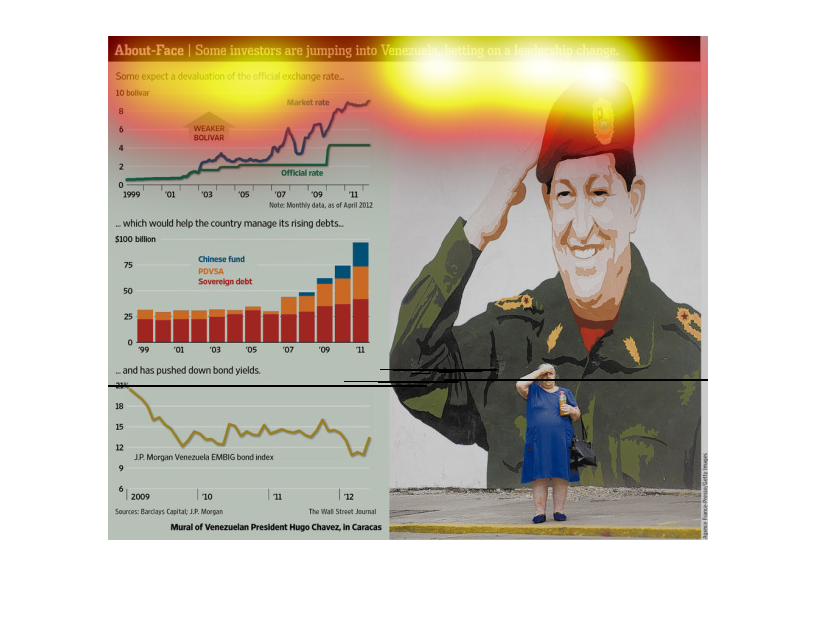

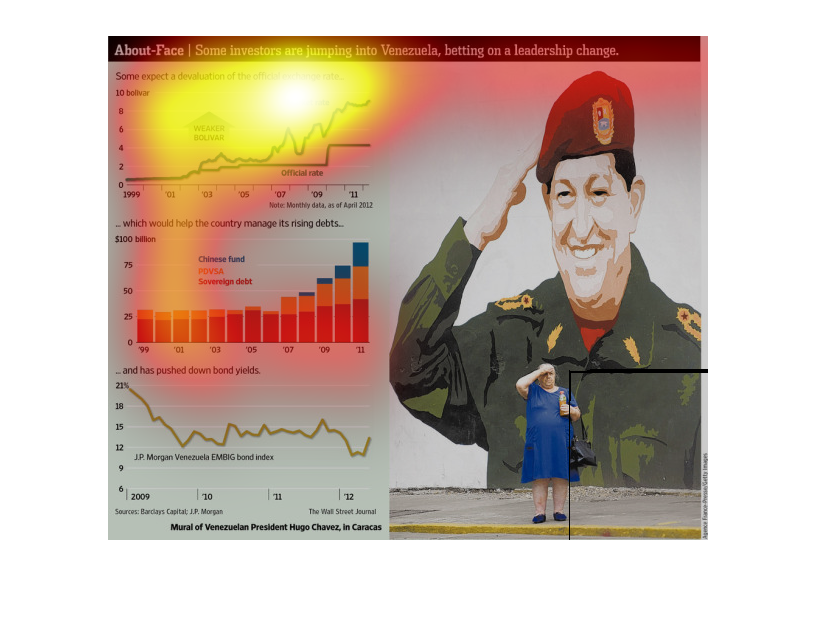

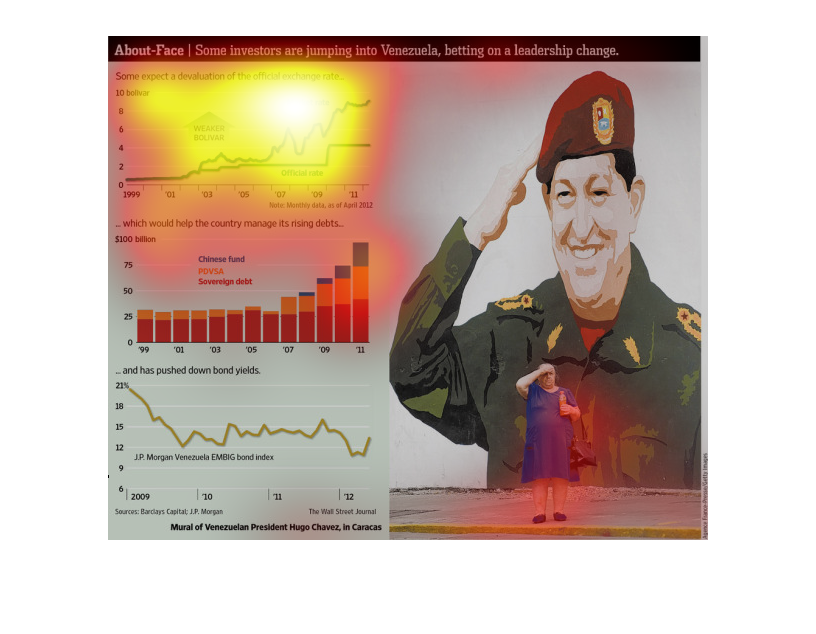

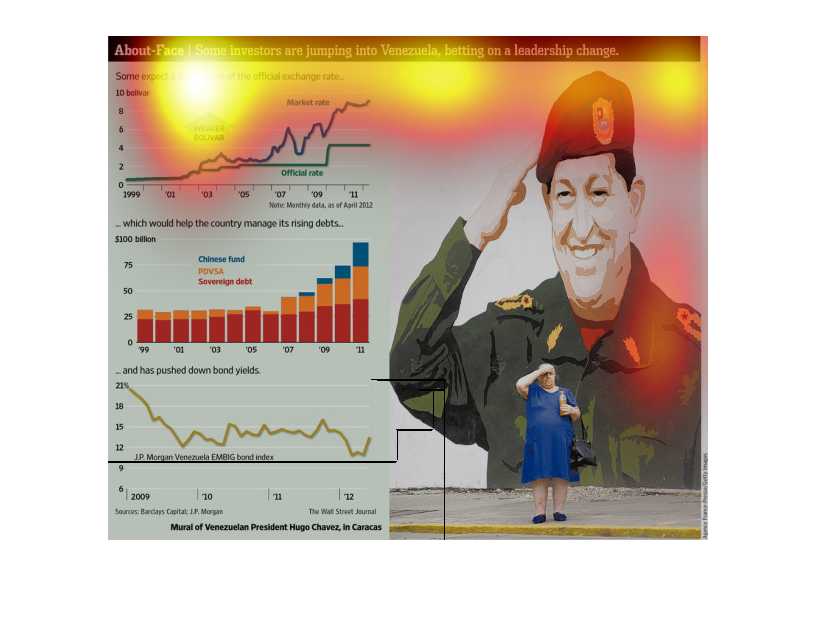

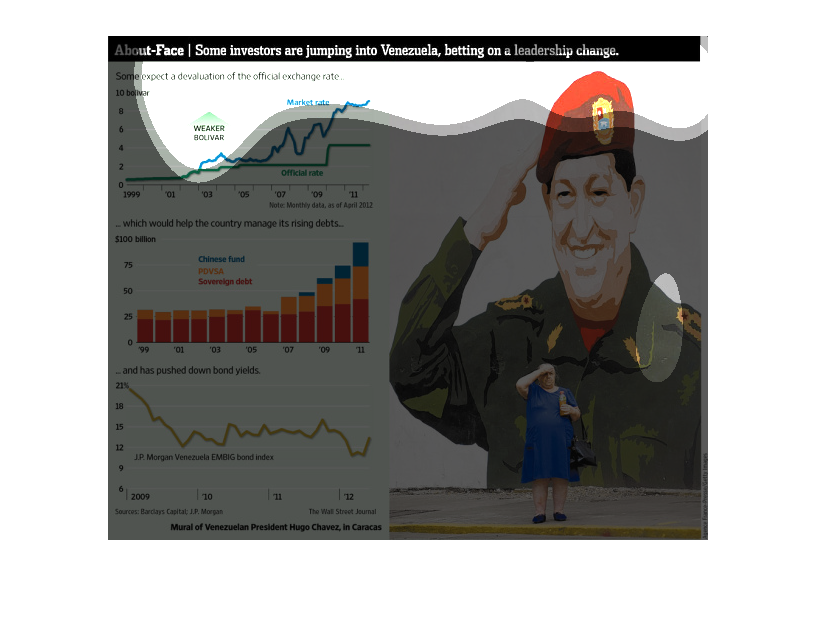

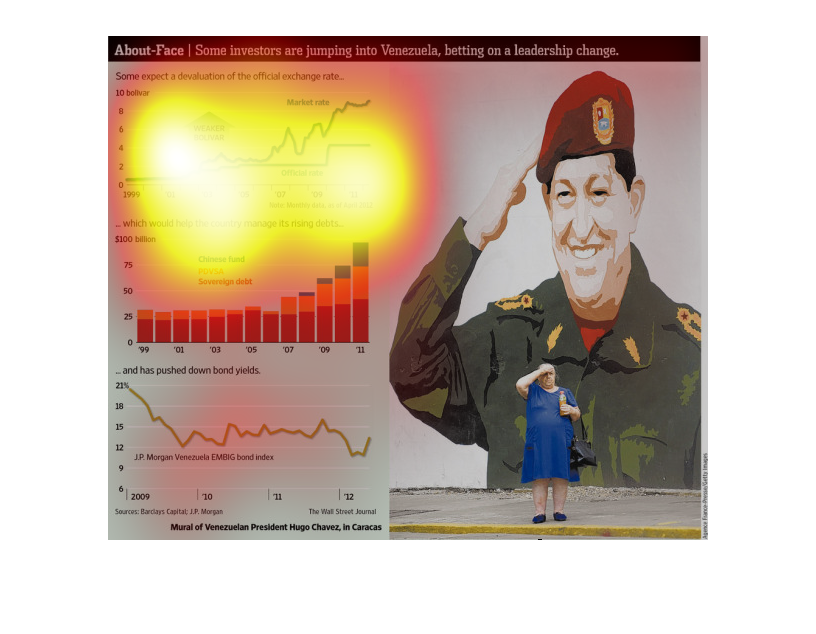

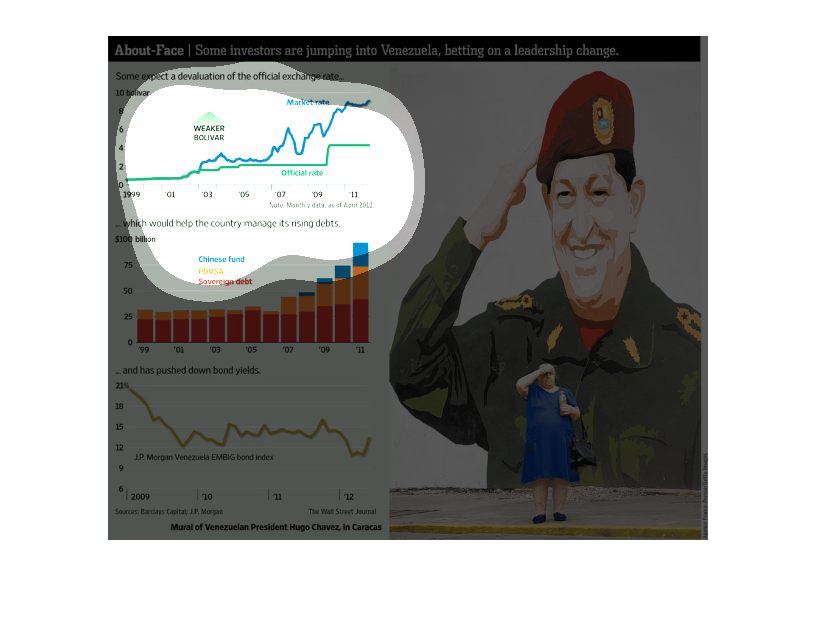

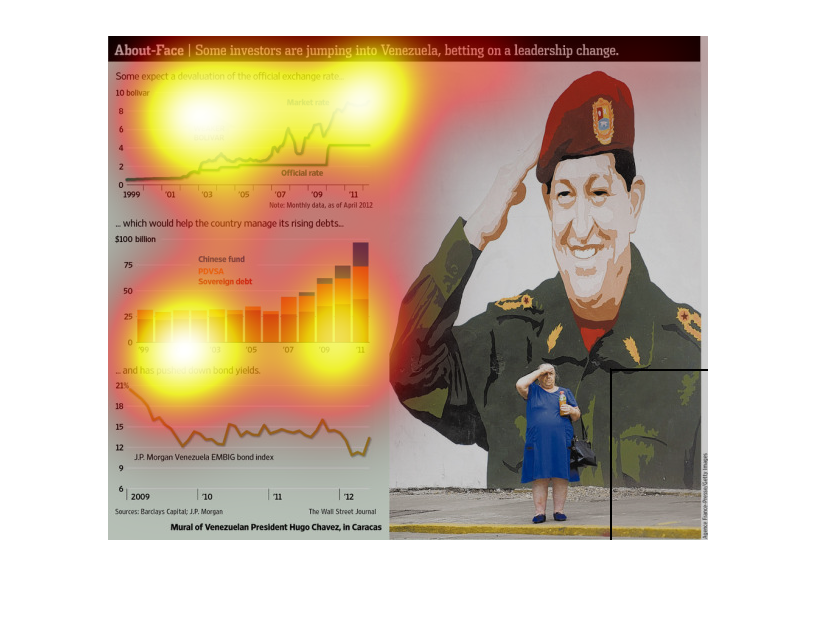

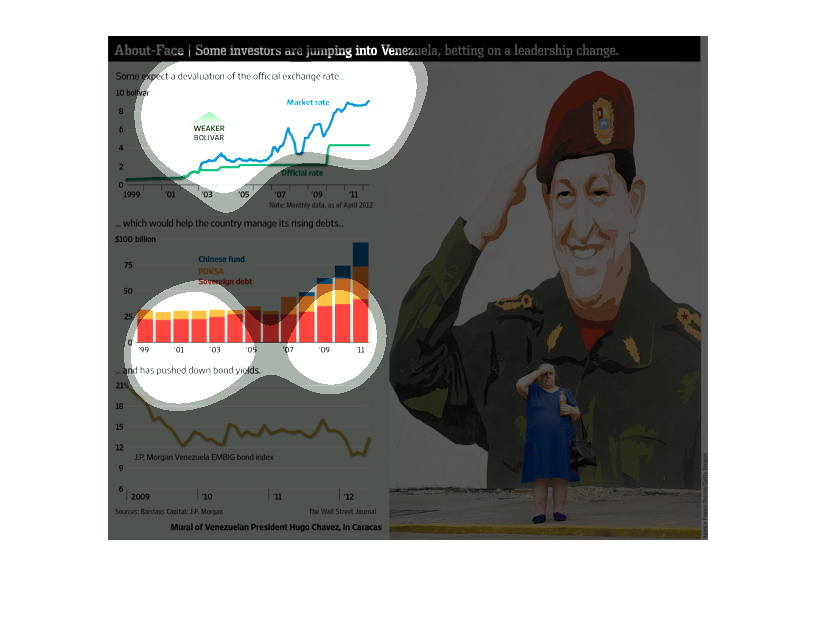

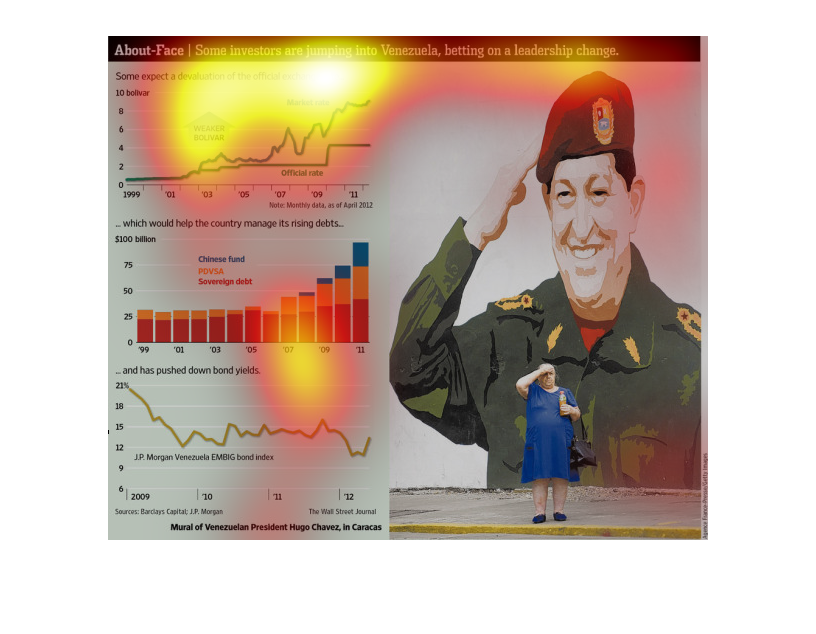

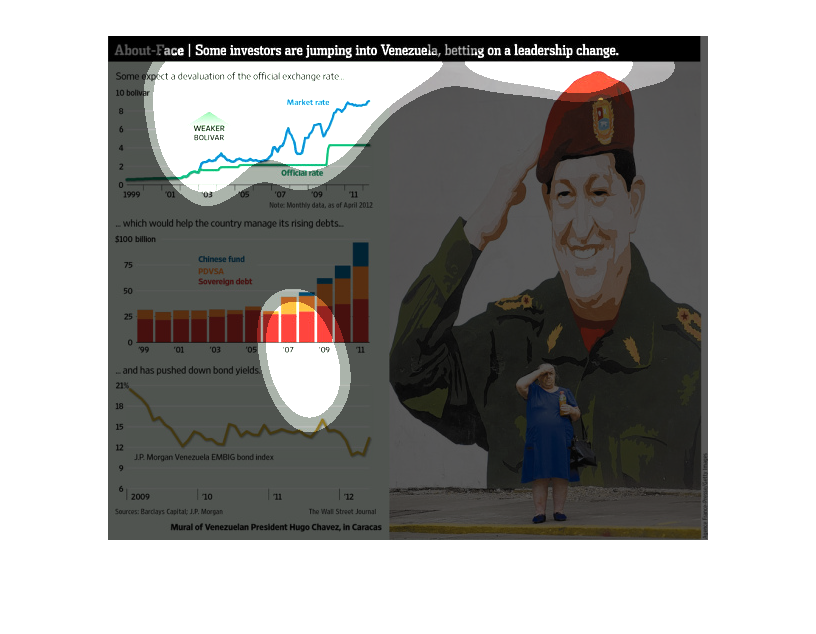

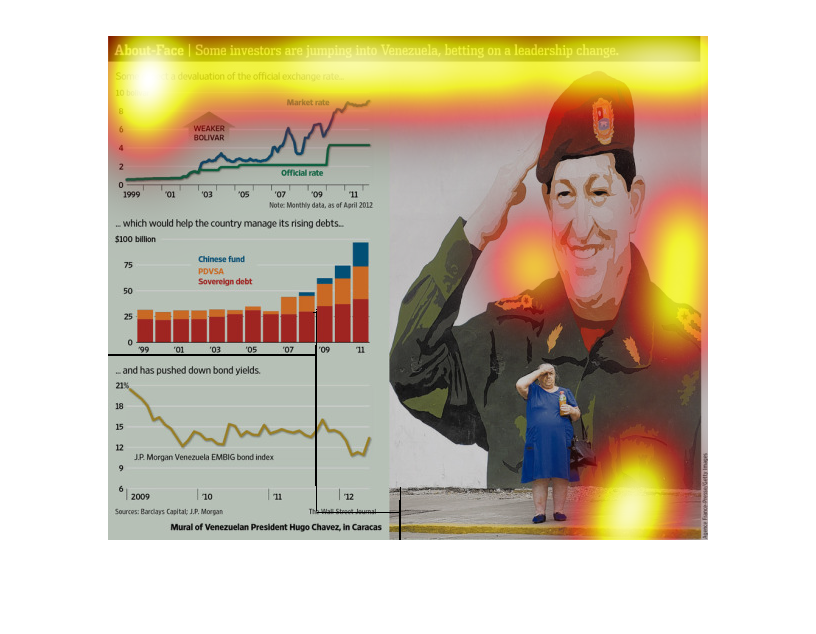

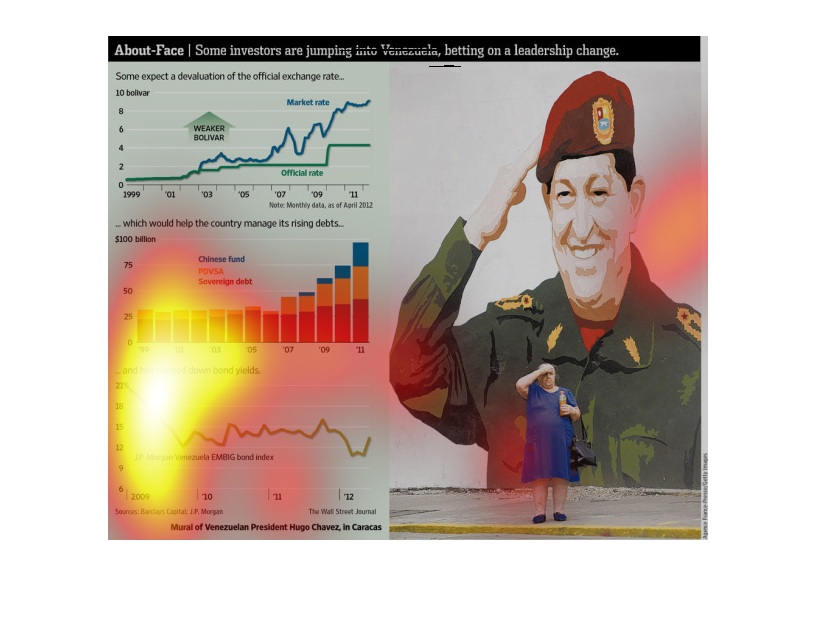

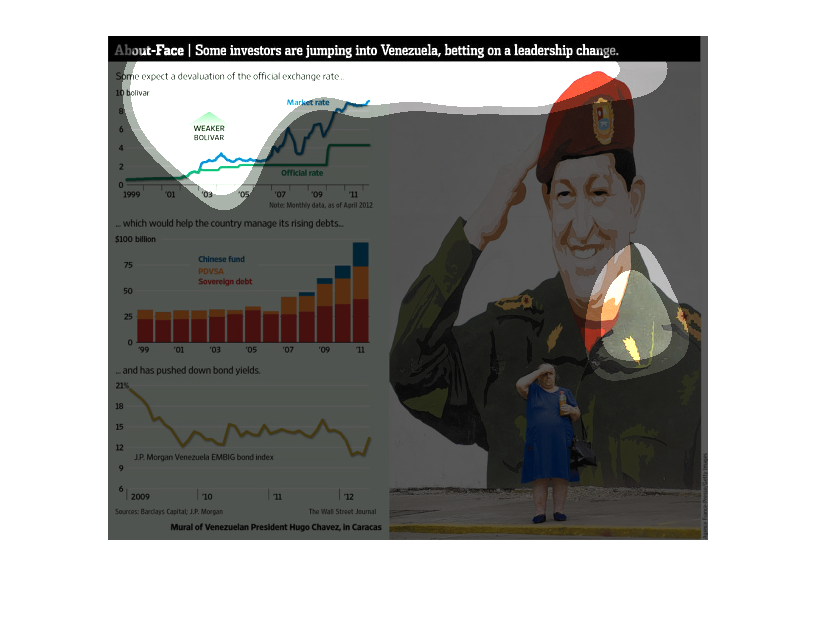

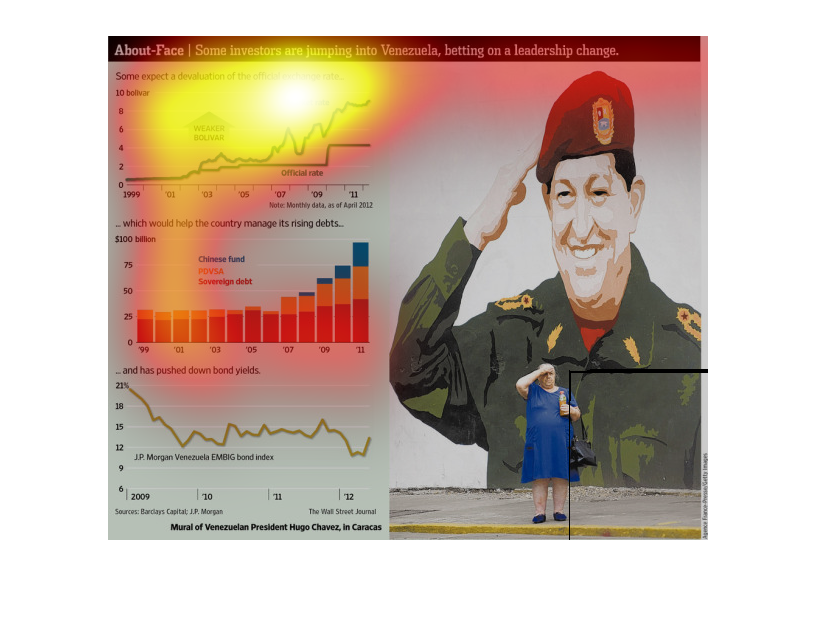

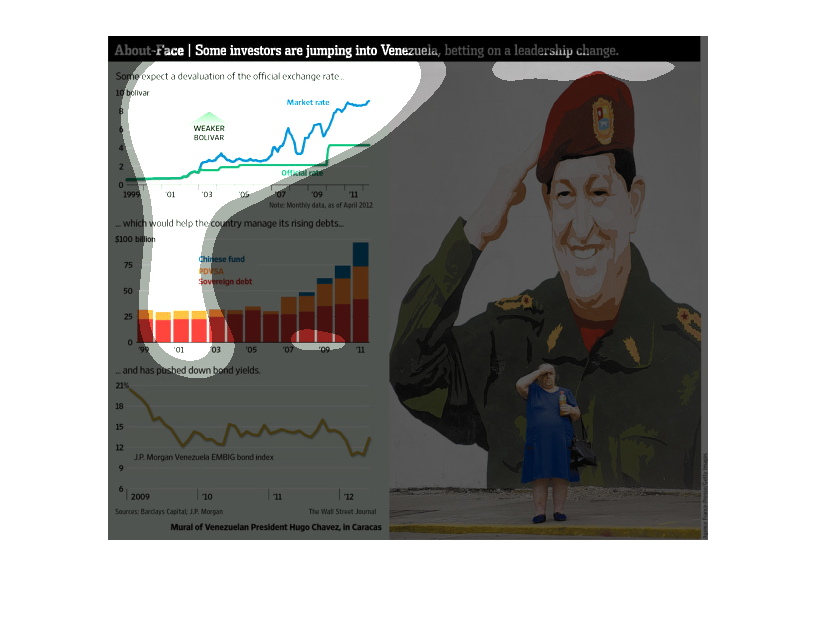

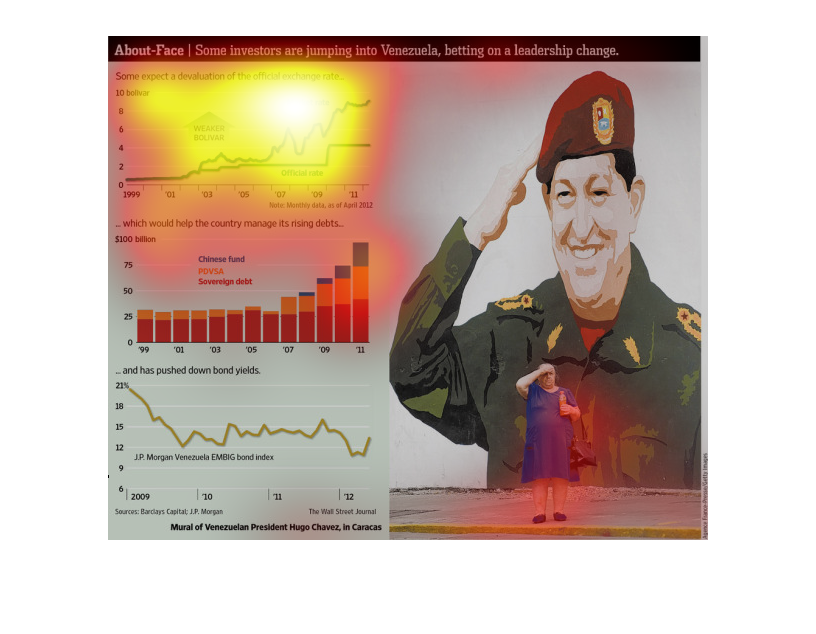

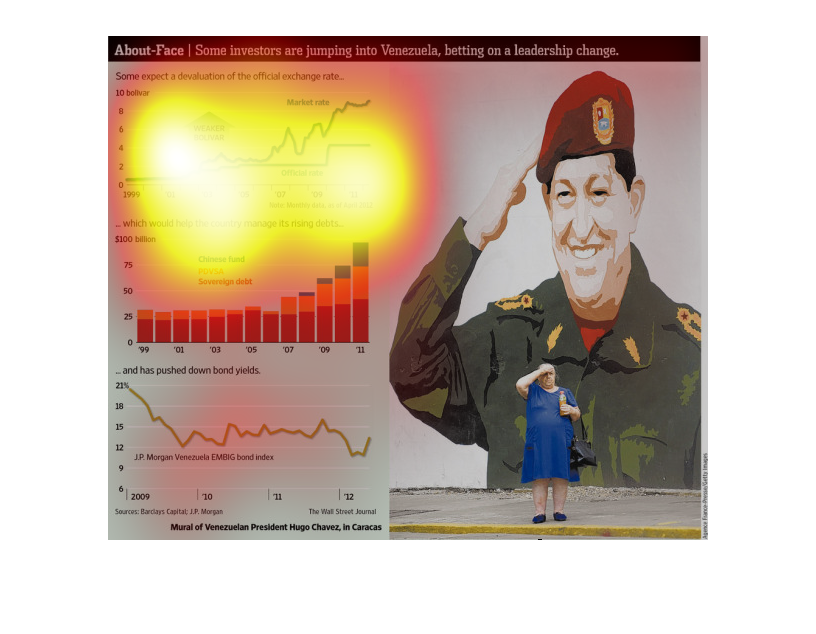

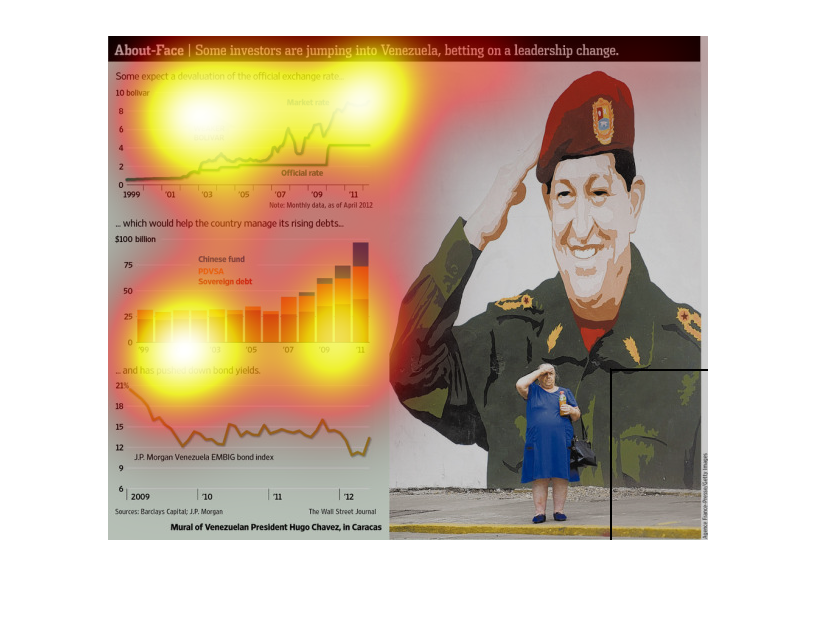

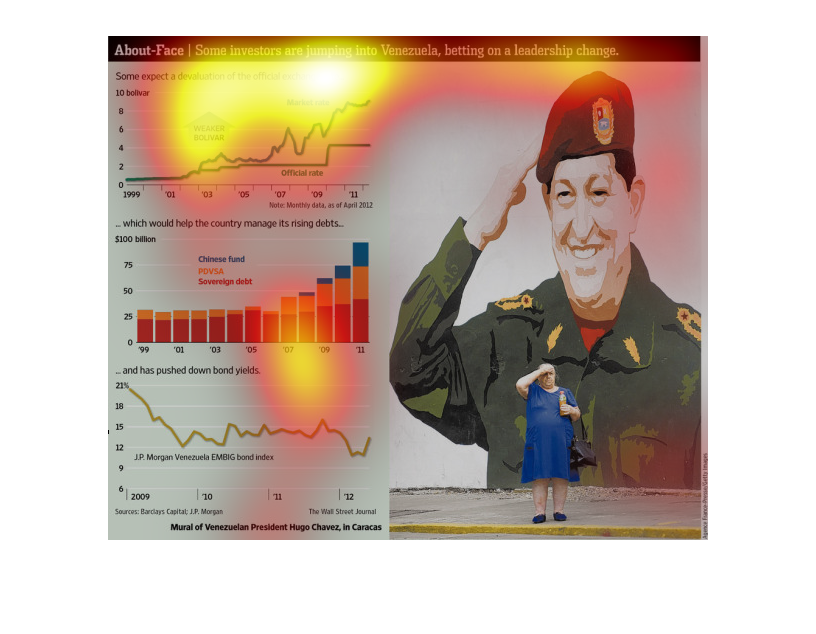

This image reports optimism with Venuzuela.Investors are reportedly taking a chance and investing

in the country, betting on a leadership change that could correct the debt crisis. A graphic

of one of its leaders is displayed on the right, while graphical data is displayed to the

left to back up the claim.

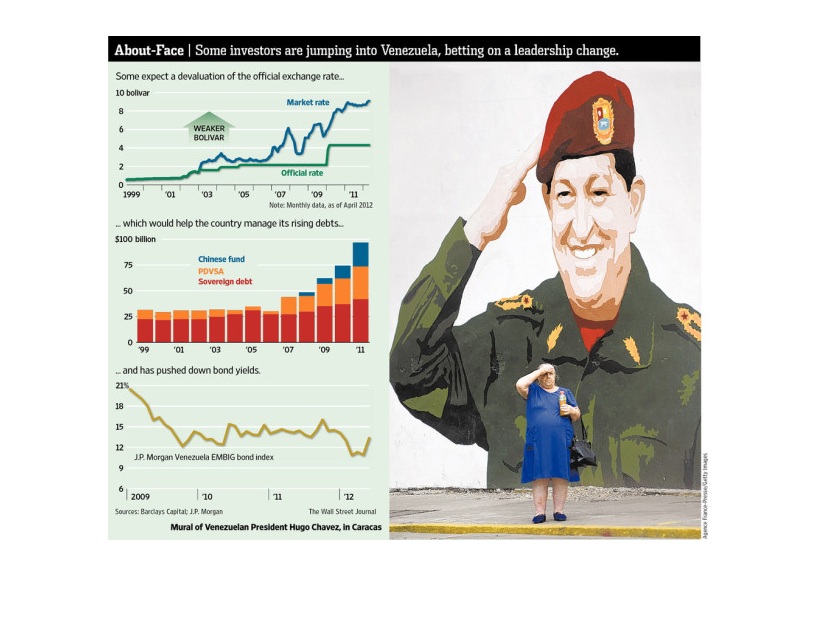

This chart from the Wall Street Journal shows how institutional investors are starting to

invest in venezuelan bonds because of a perceived chance of regime change

This chart shows ways that Cuba could get improved imagine of its country it also shows a

picture of the dictator. It has several suggestions for improvement of images

This image shows or depicts in both line and bar graph statistical formats data concerning

the hopes and expectations of how some investors jumping into Venezuela hoping for a leadership

change.

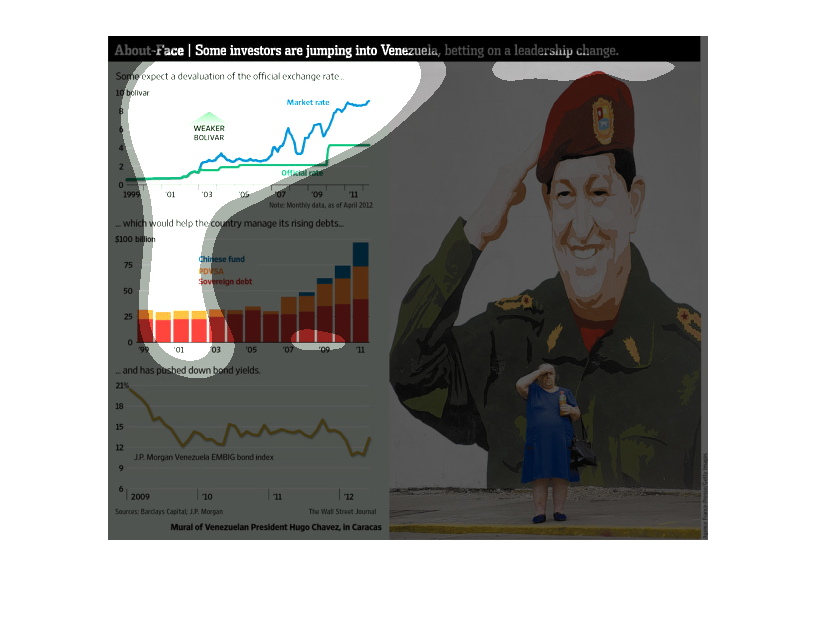

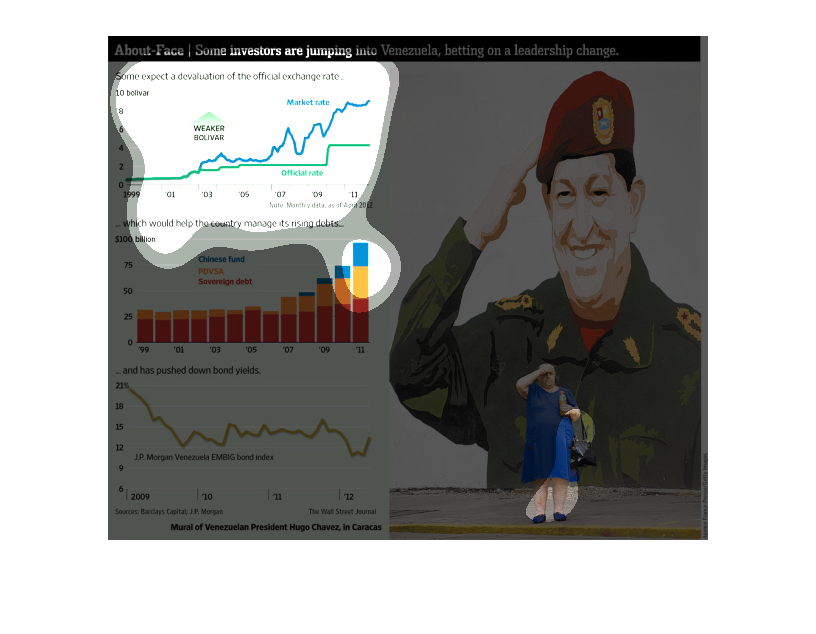

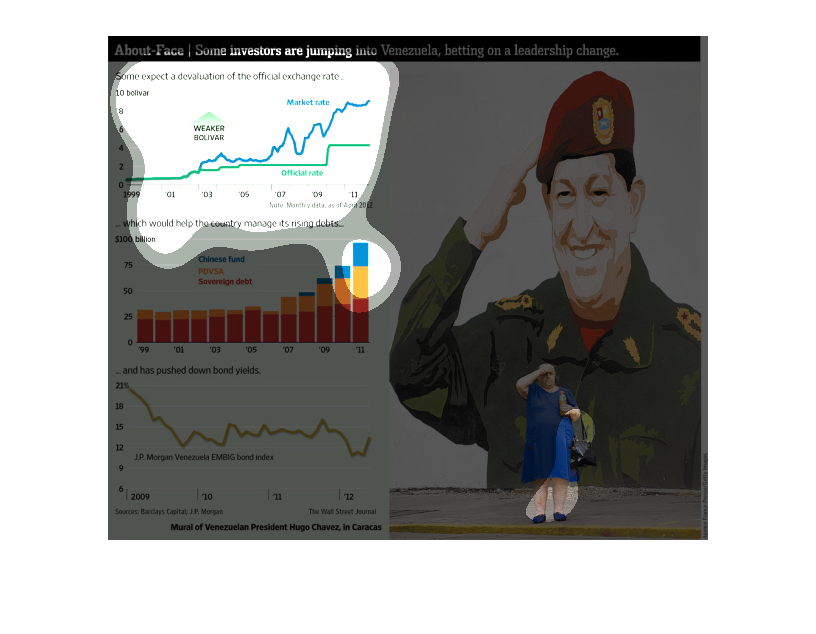

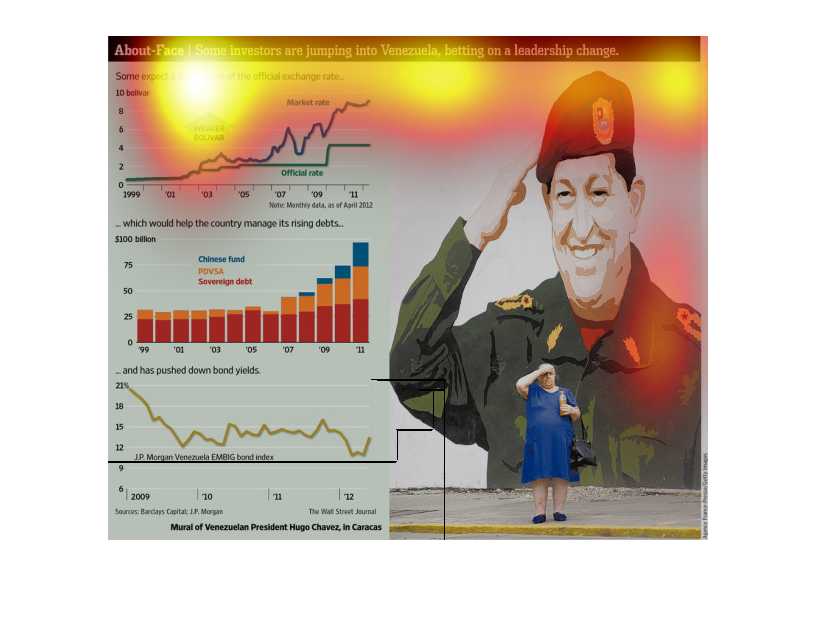

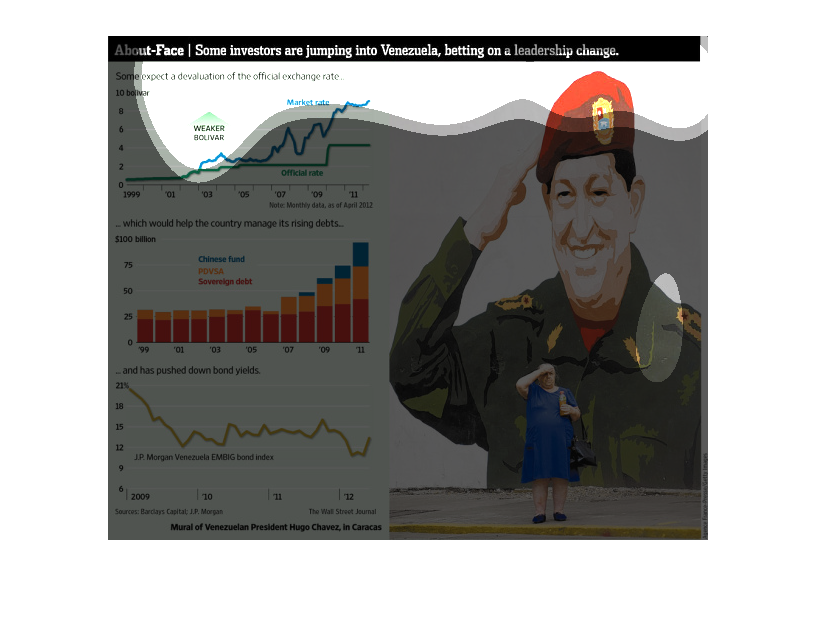

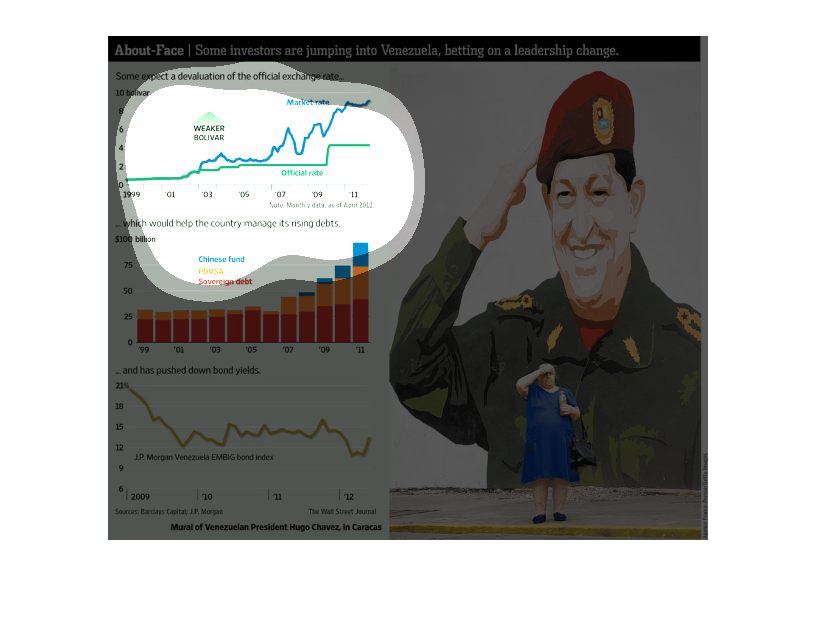

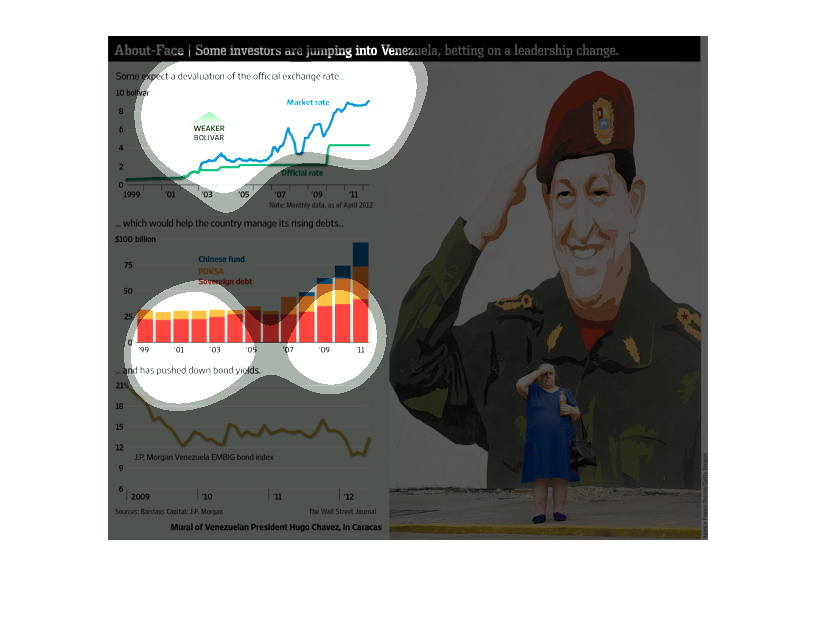

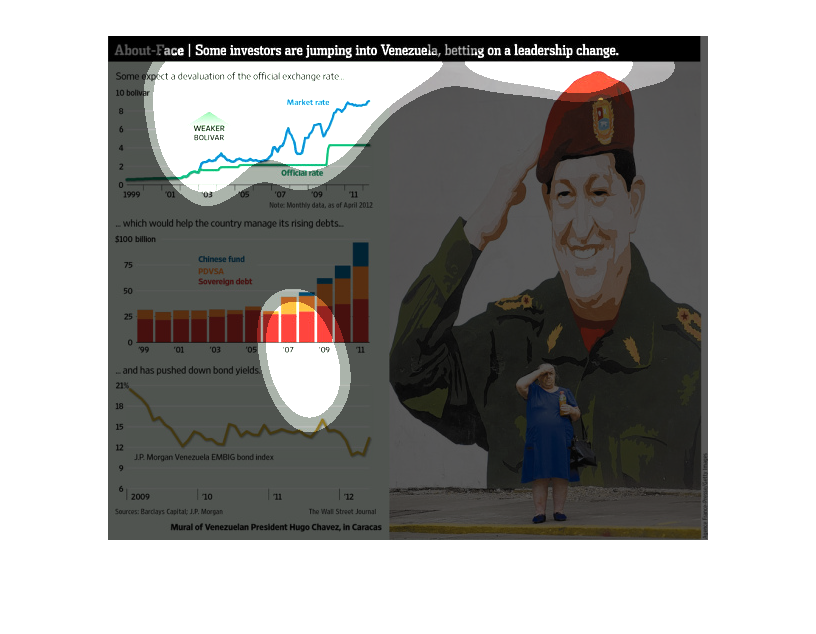

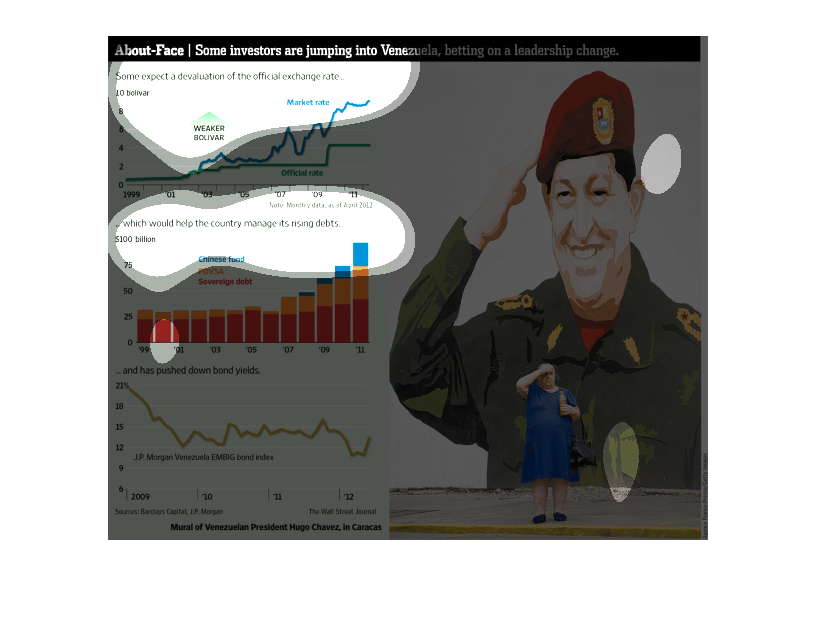

This chart illustrates how investors are jumping into Venezuela with the hopes of a change

in leadership. It shows the expected change in the expected official exchange rate and comparison

to current debt.

This image shows a graph depicting market rates and official rates of the exchange rate in

Venezuela. This chart is compared to the levels of debt in Venezuela from different loaners.

This chart from the Wall Street Journal shows how private investors are more bullish on Venezuela

because of a possible regime change that is friendlier to business

This chart says investors are investing in Venezuela on the hope of a change in leadership.

The From 1999 to 2011 the Bolivar has been growing in strength with the official rate being

4, and the market rate being close to 10.

The image depicts how some investors are jumping into Venezuela, betting on leadership change

to spur market growth. A devaluation of the exchange rate is expected to help manage the countries

rising debt.

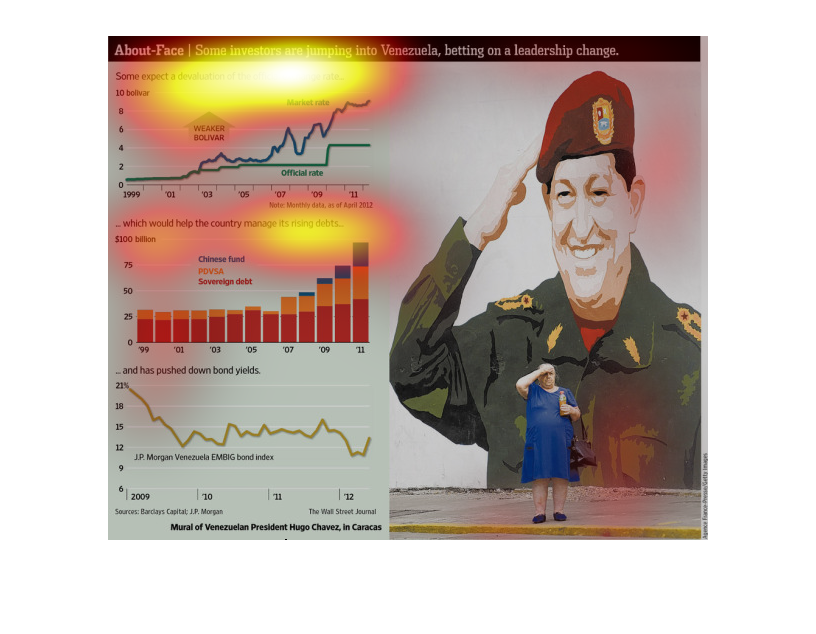

This image shows or depicts in line and bar graph statistical formats data concerning how

some investors are hoping for better returns in Venezuela if they change their leadership

there.

The image depicts how some investors are jumping into Venezuela, hoping that leadership change

will benefit the markets. Some expect a devaluation of the exchange rate to benefit the management

of the countries rising debt.

This figure shows that some investors are jumping into the Venezuelan market in the hopes

of a leadership change. Some people expect a devaluation of the current exchange rate, which

would help the country manage it's debts. This has pushed down bond yields.