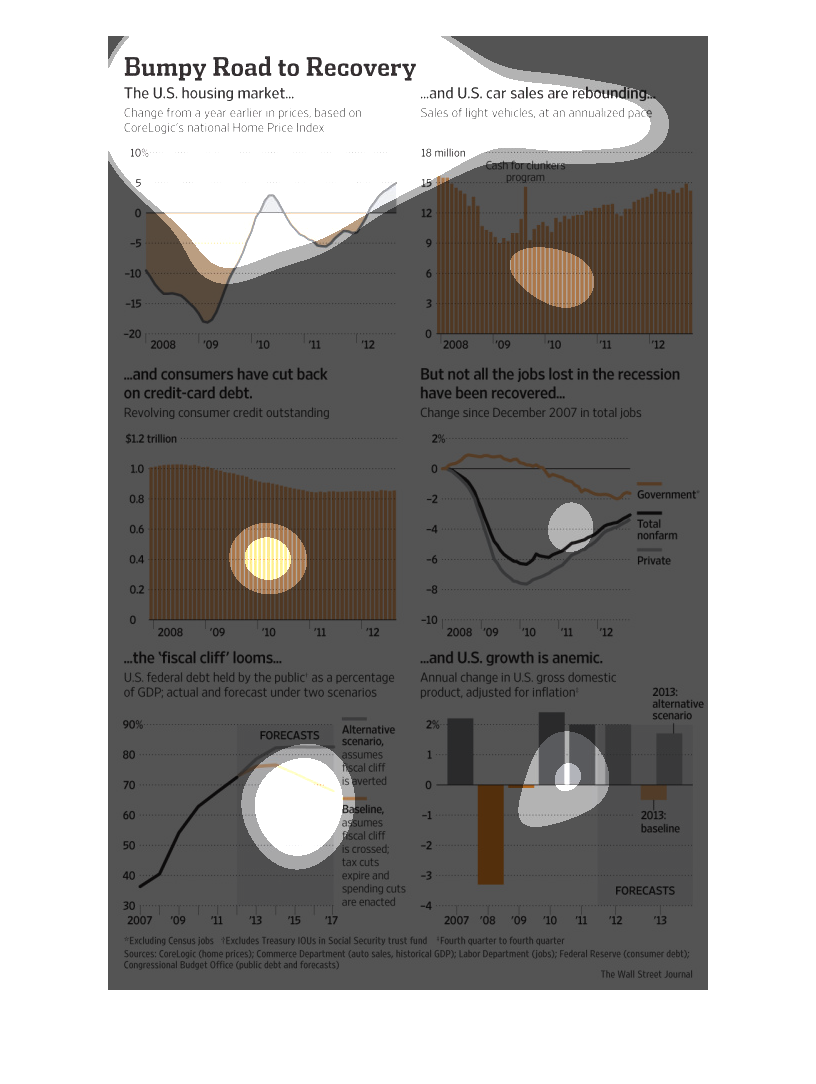

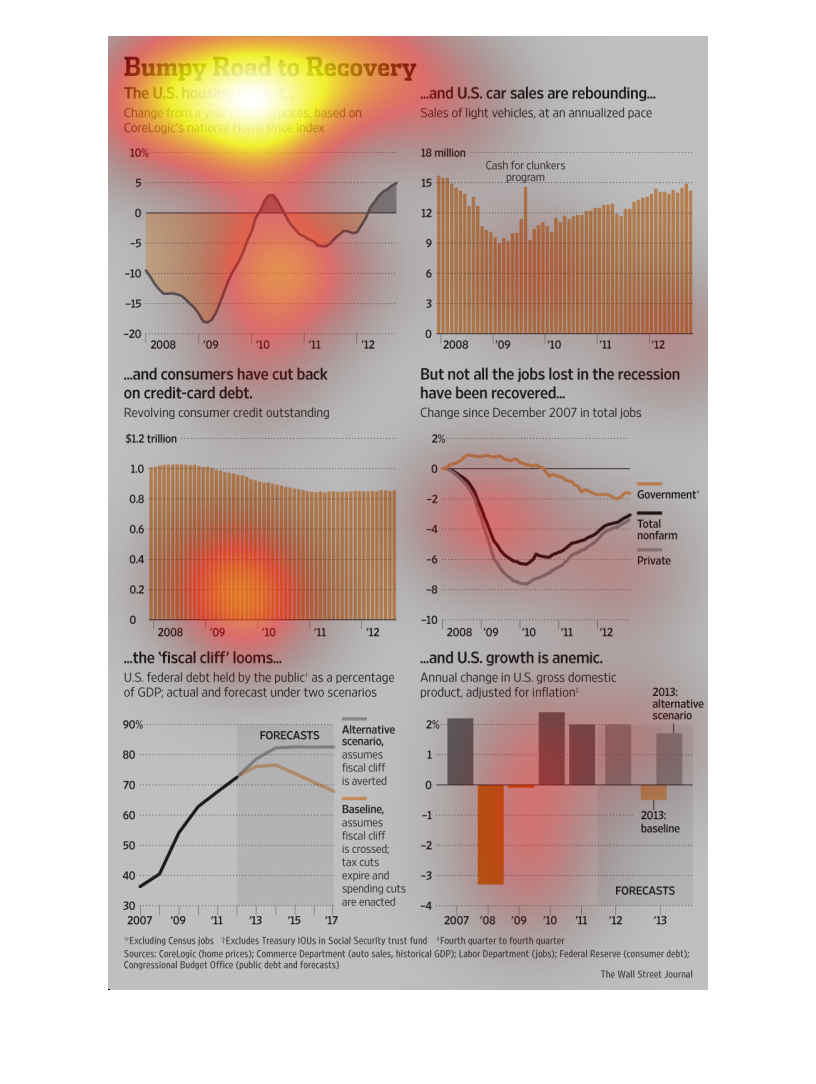

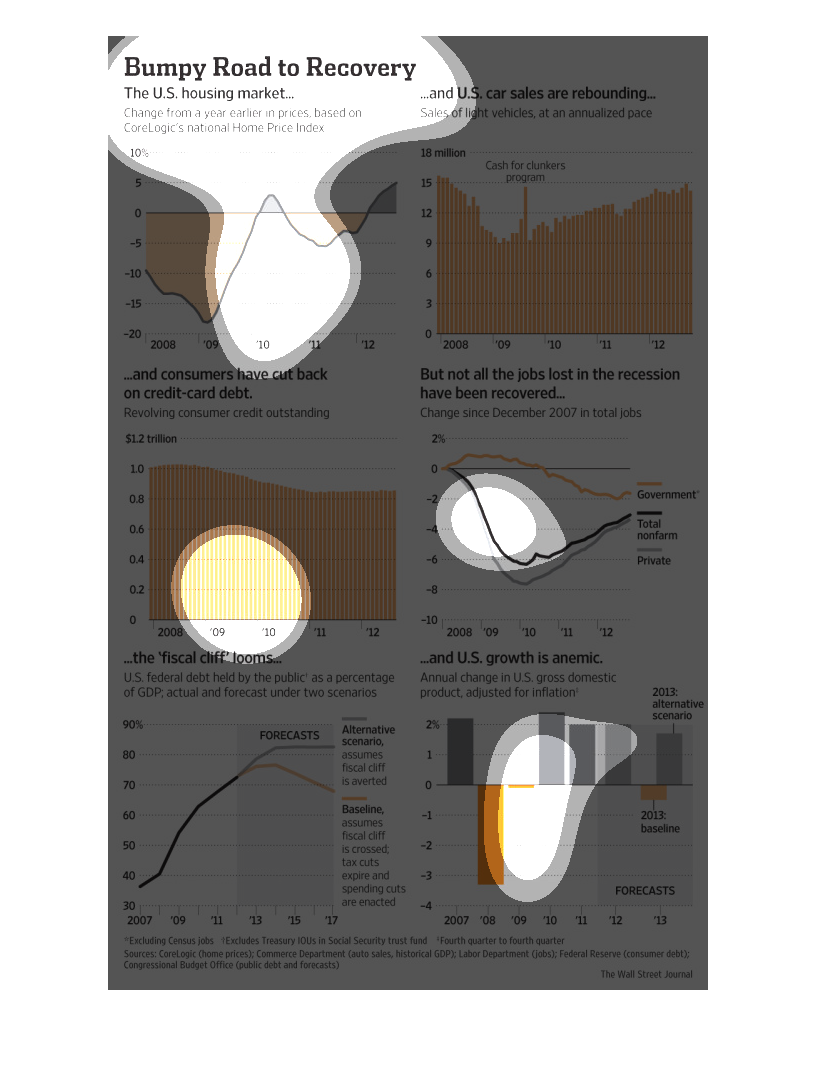

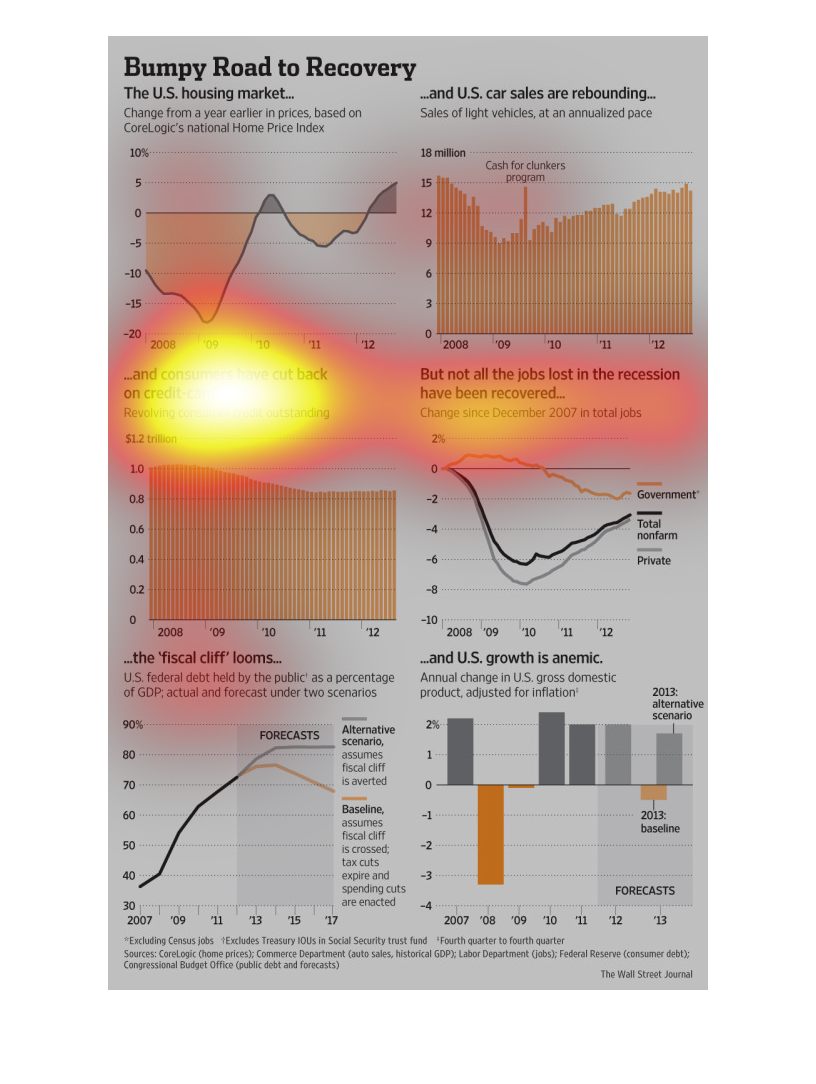

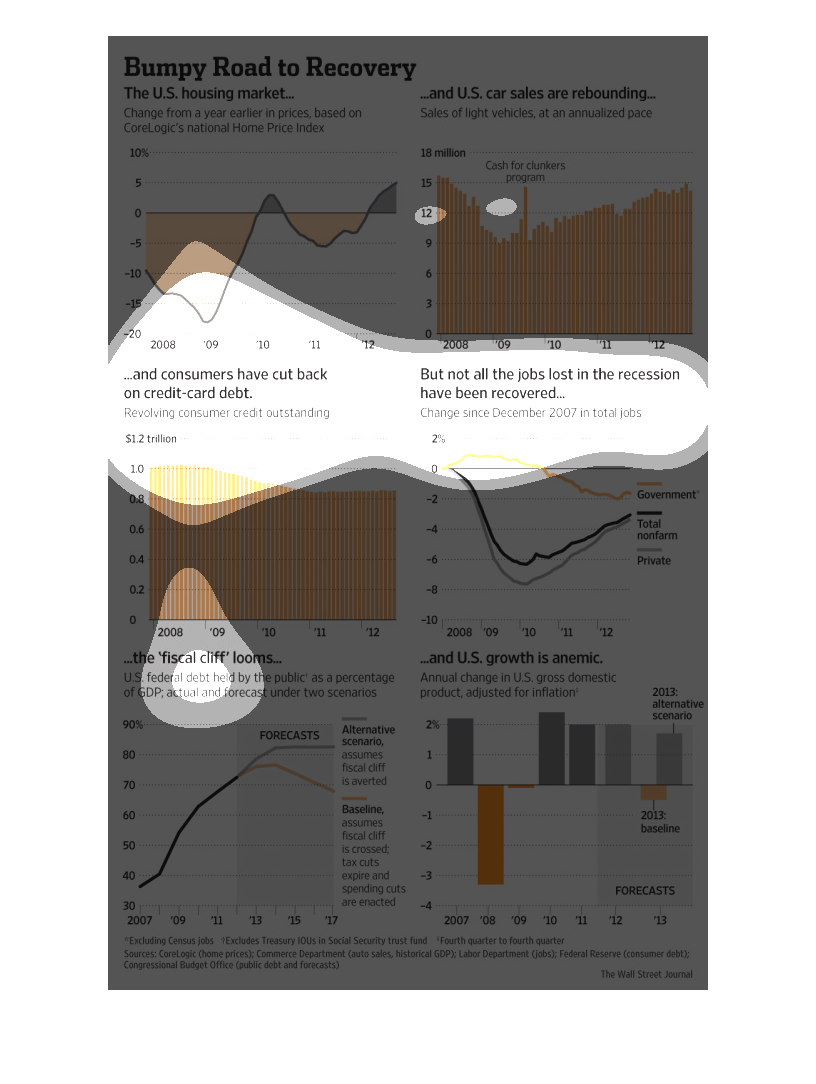

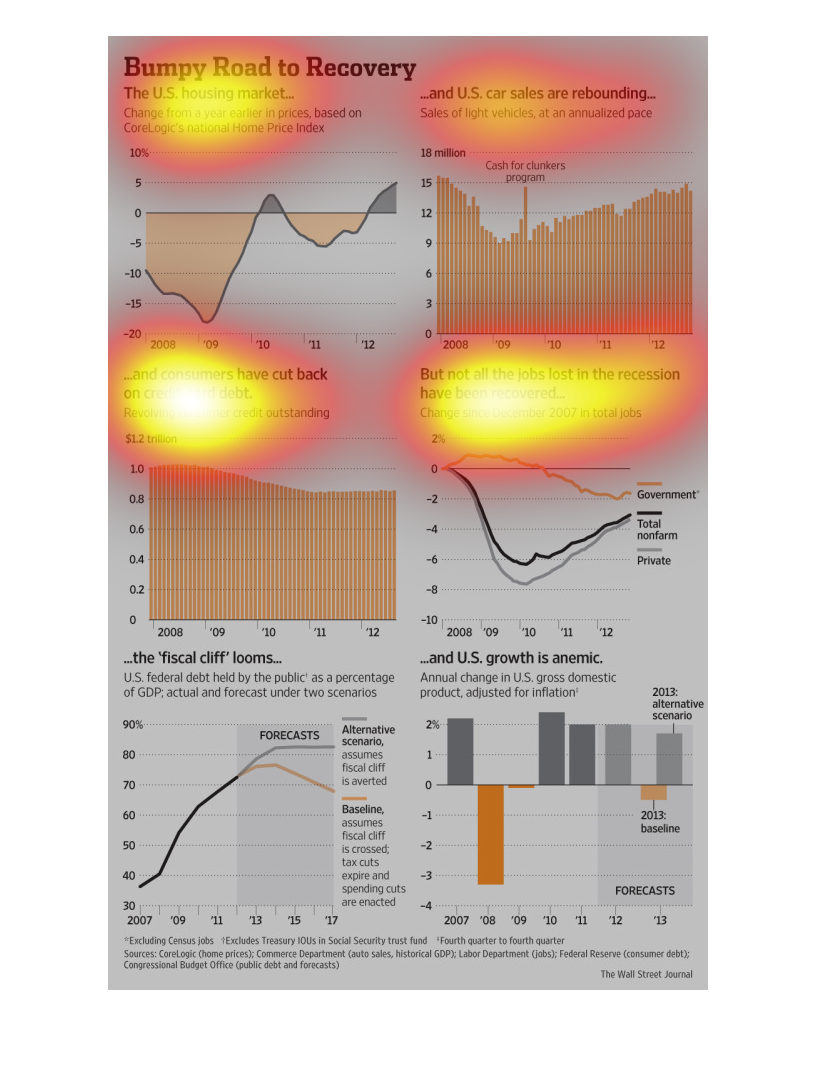

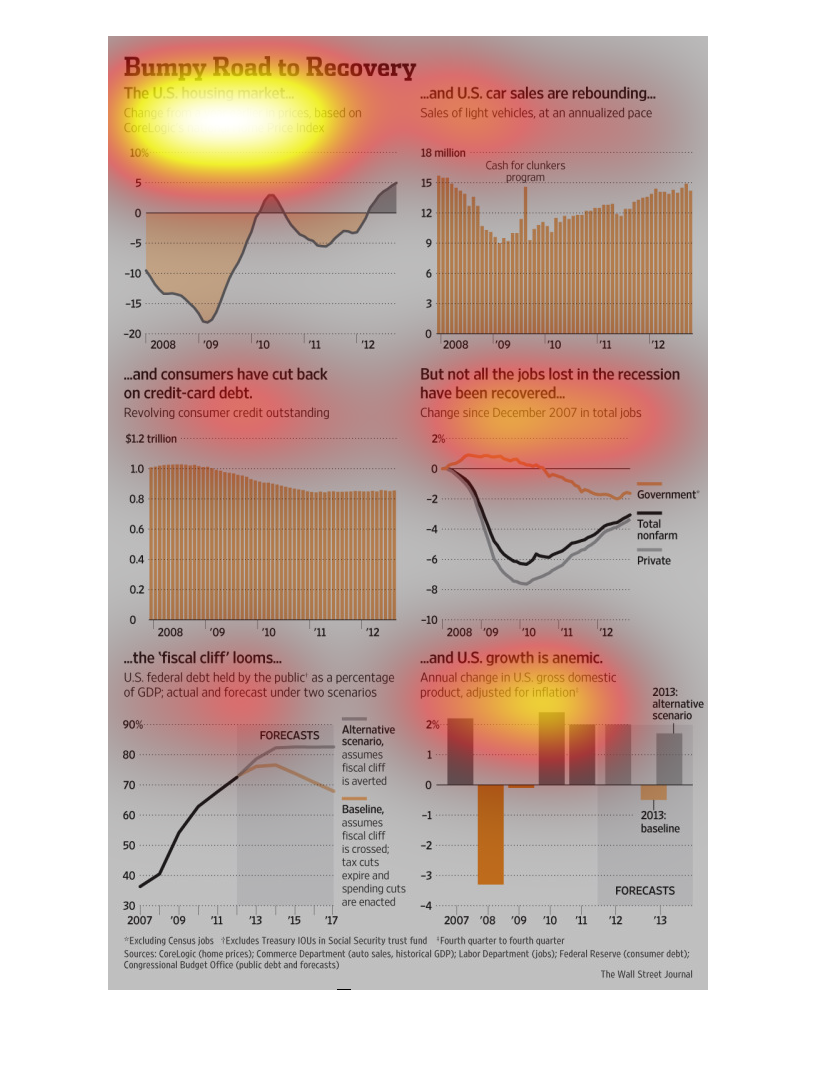

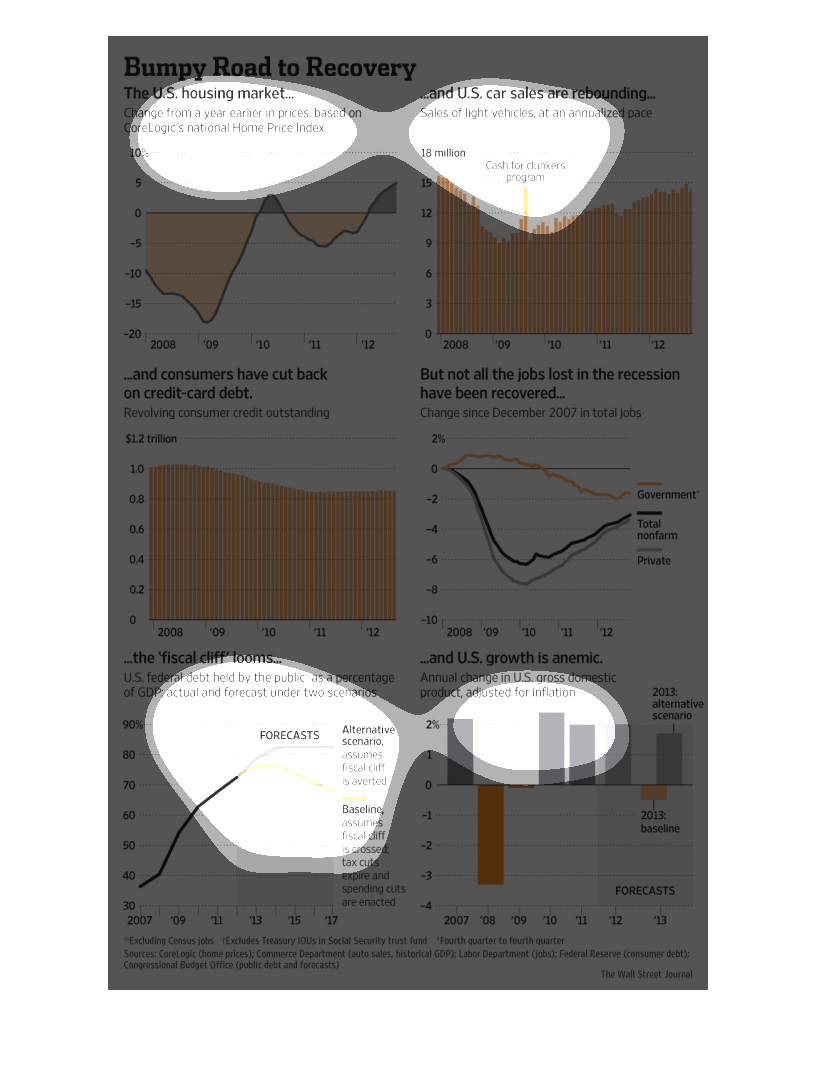

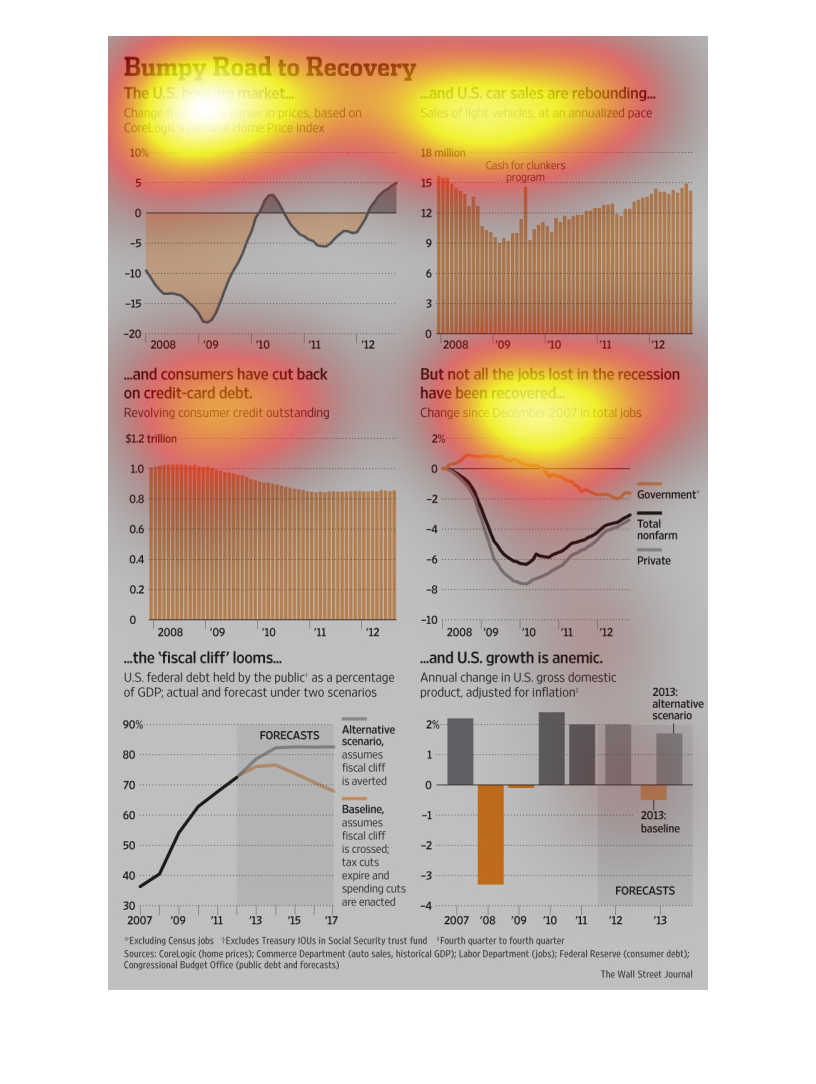

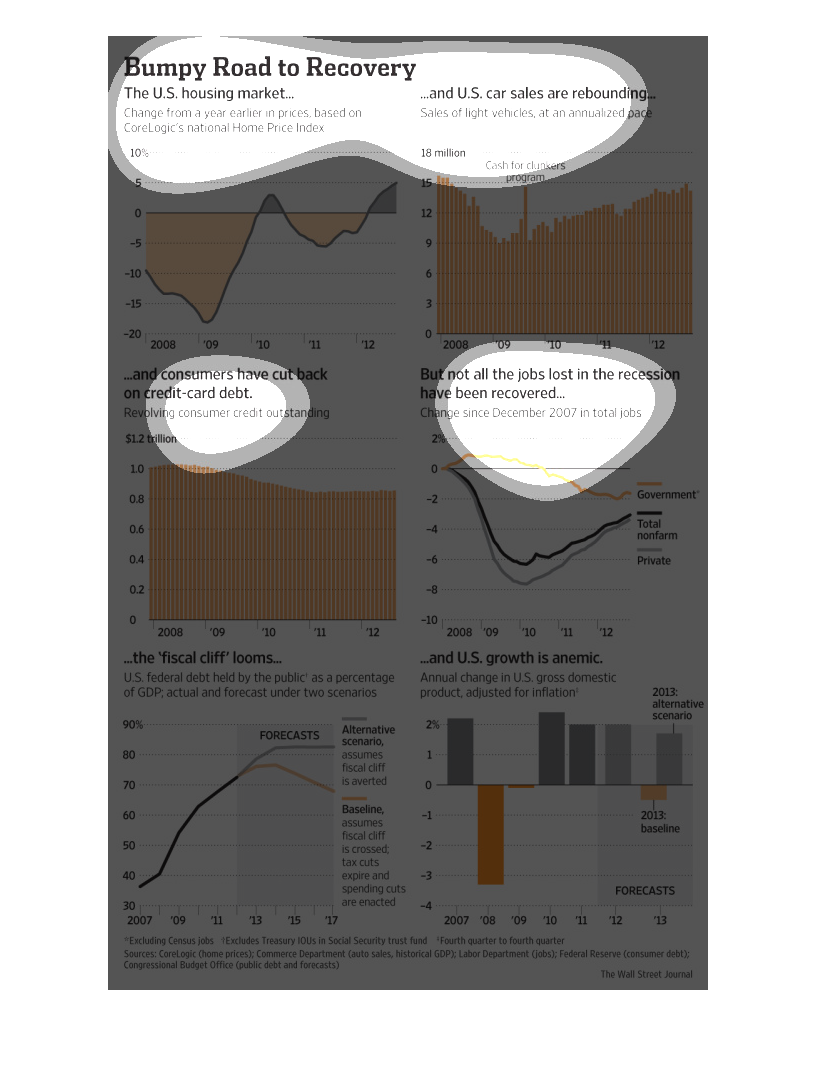

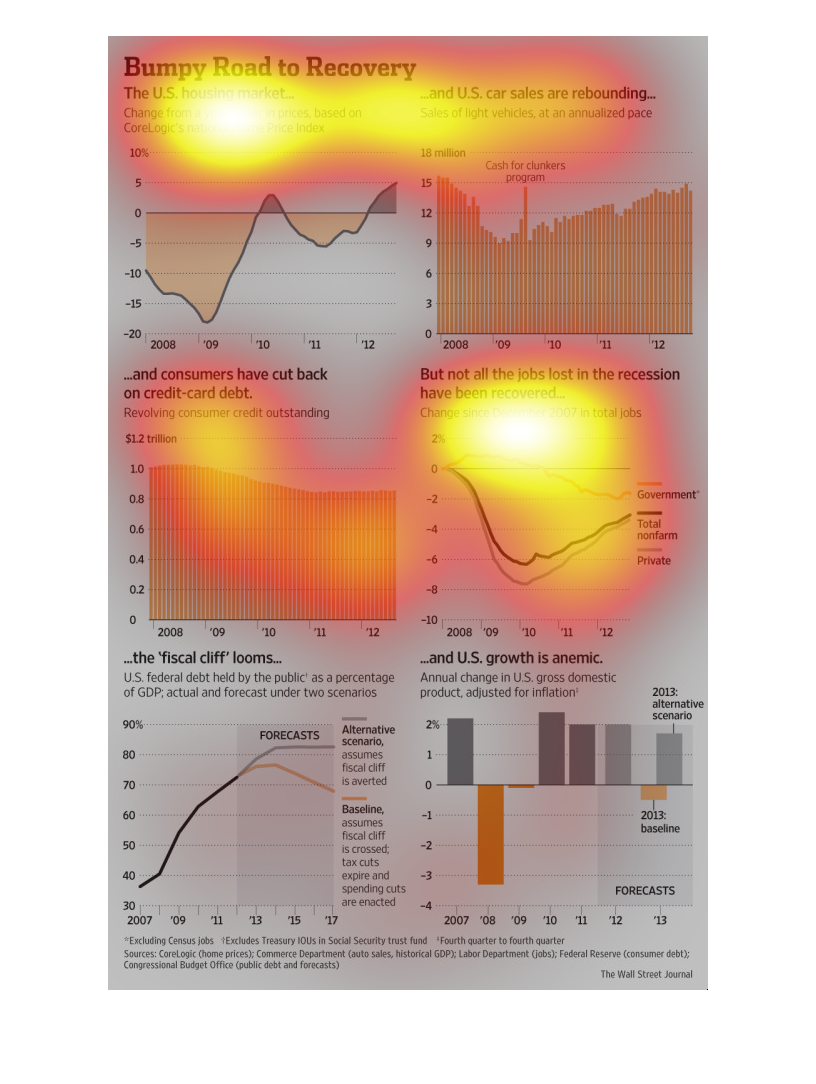

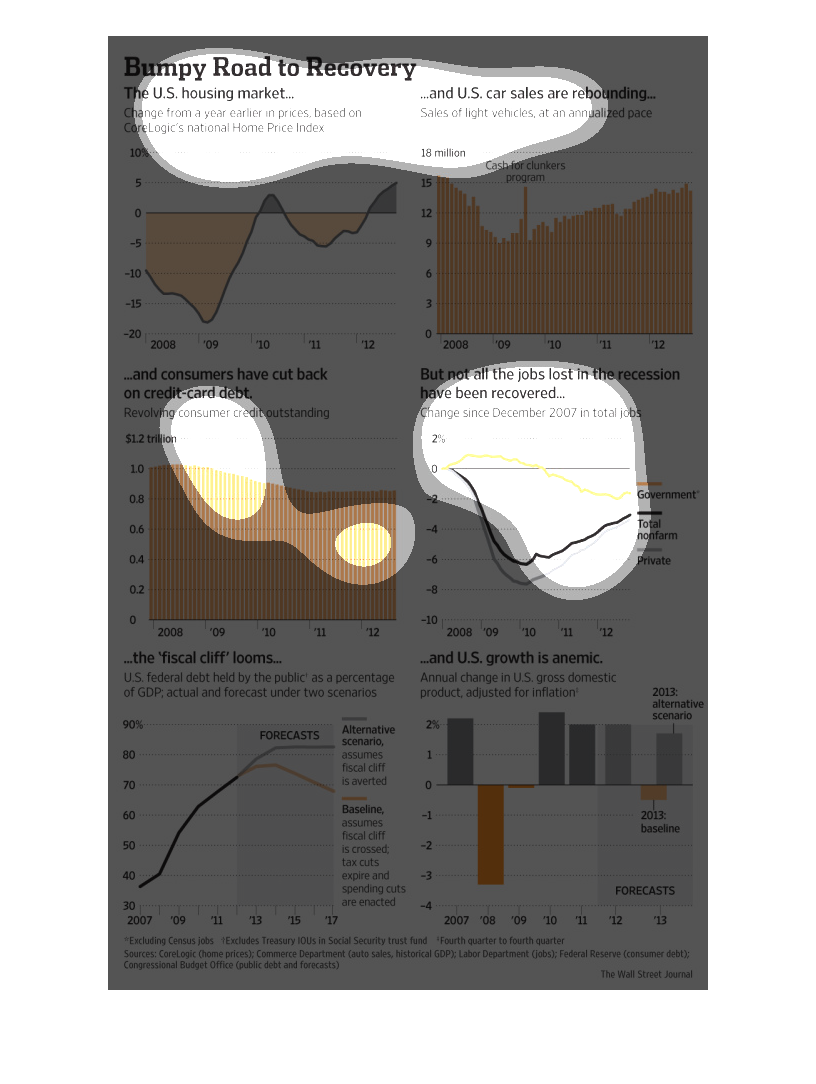

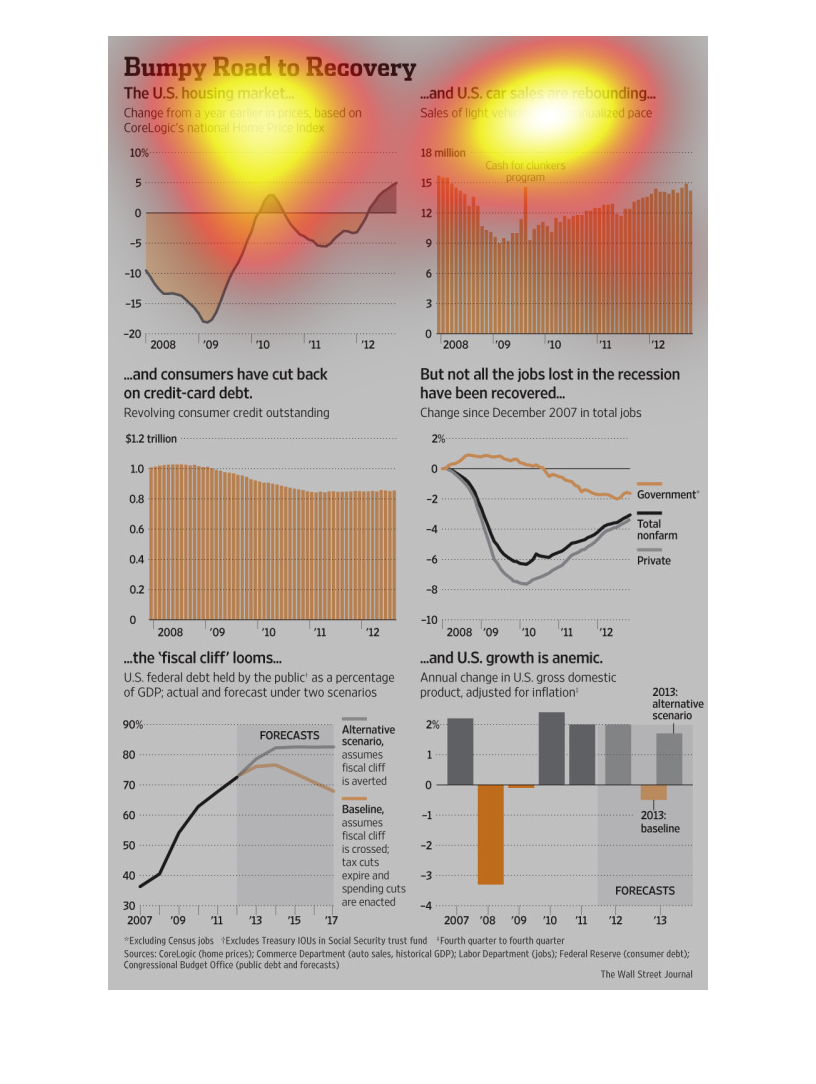

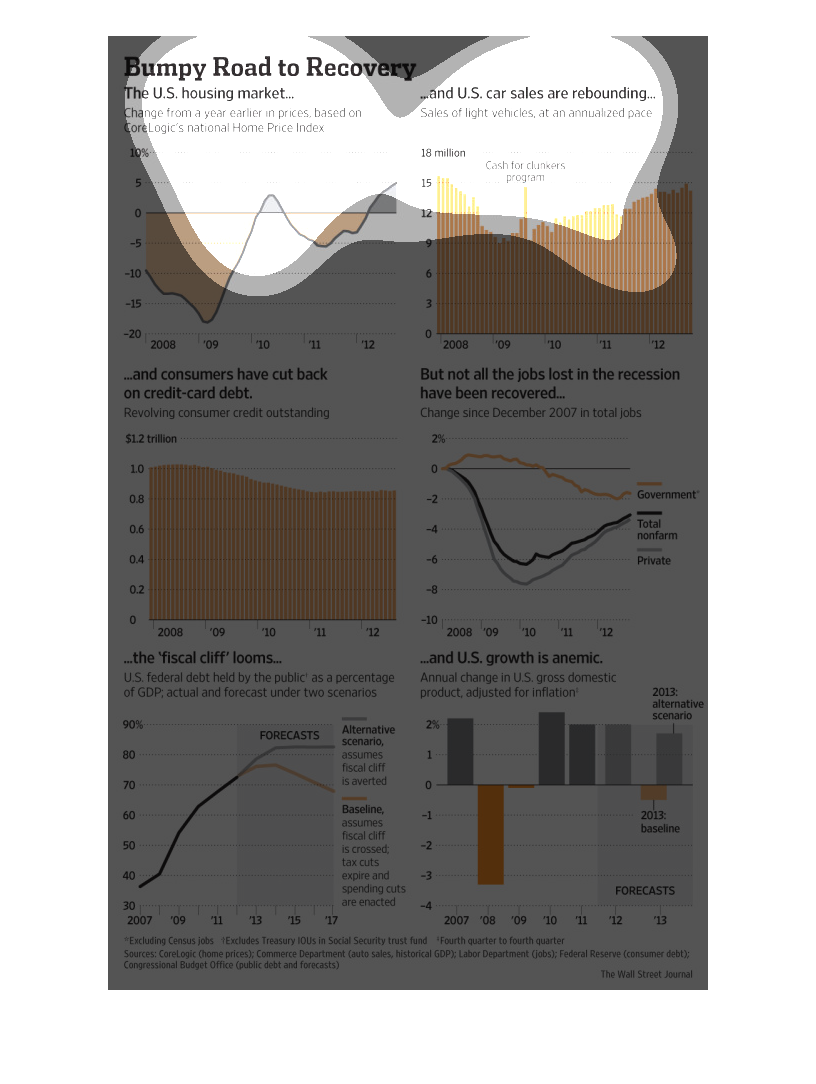

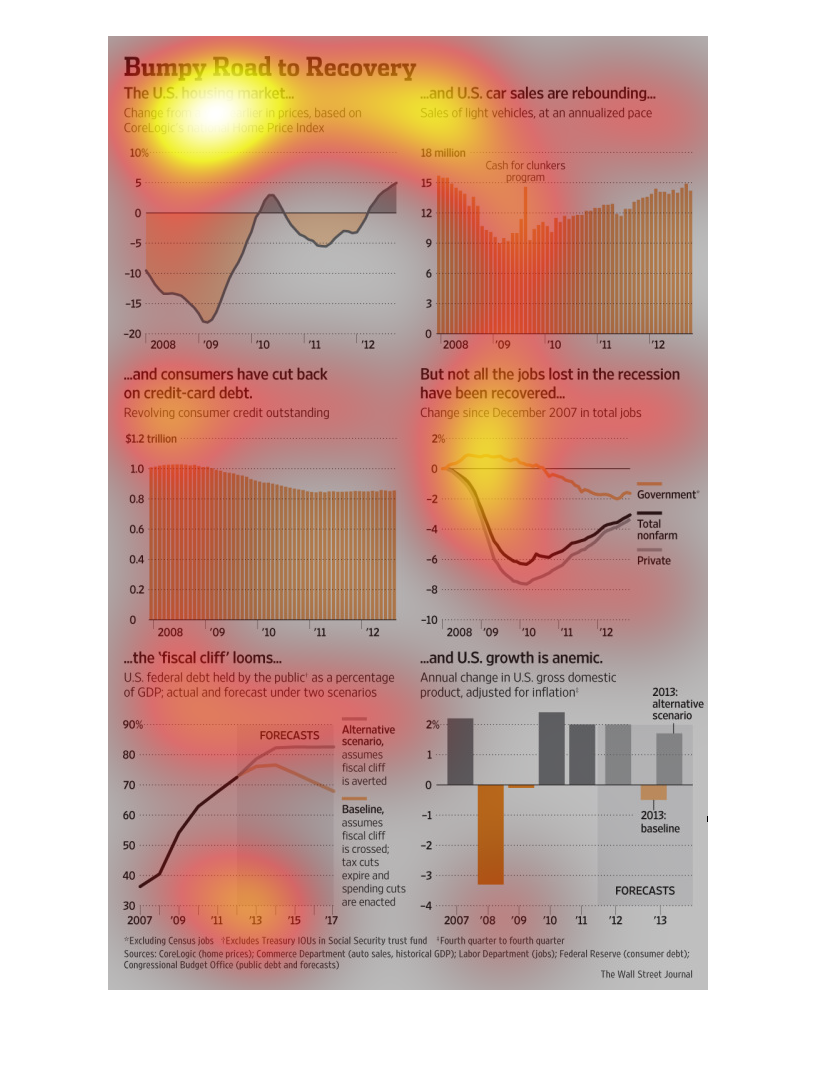

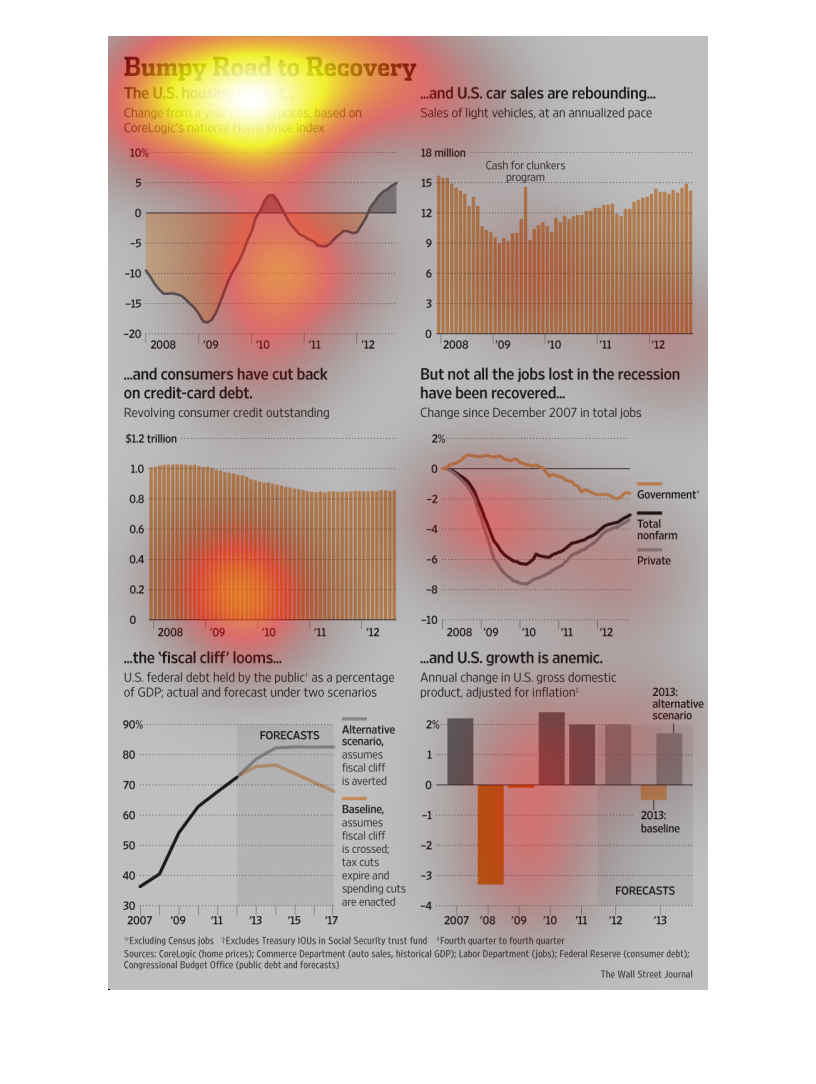

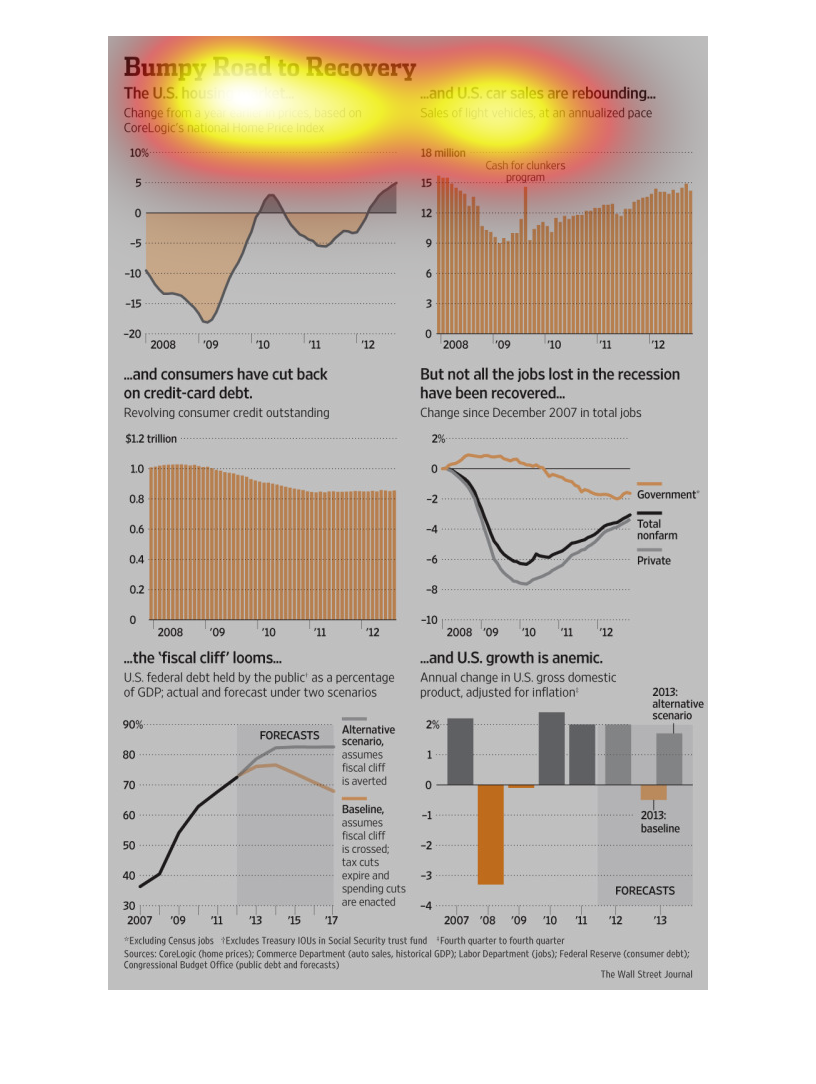

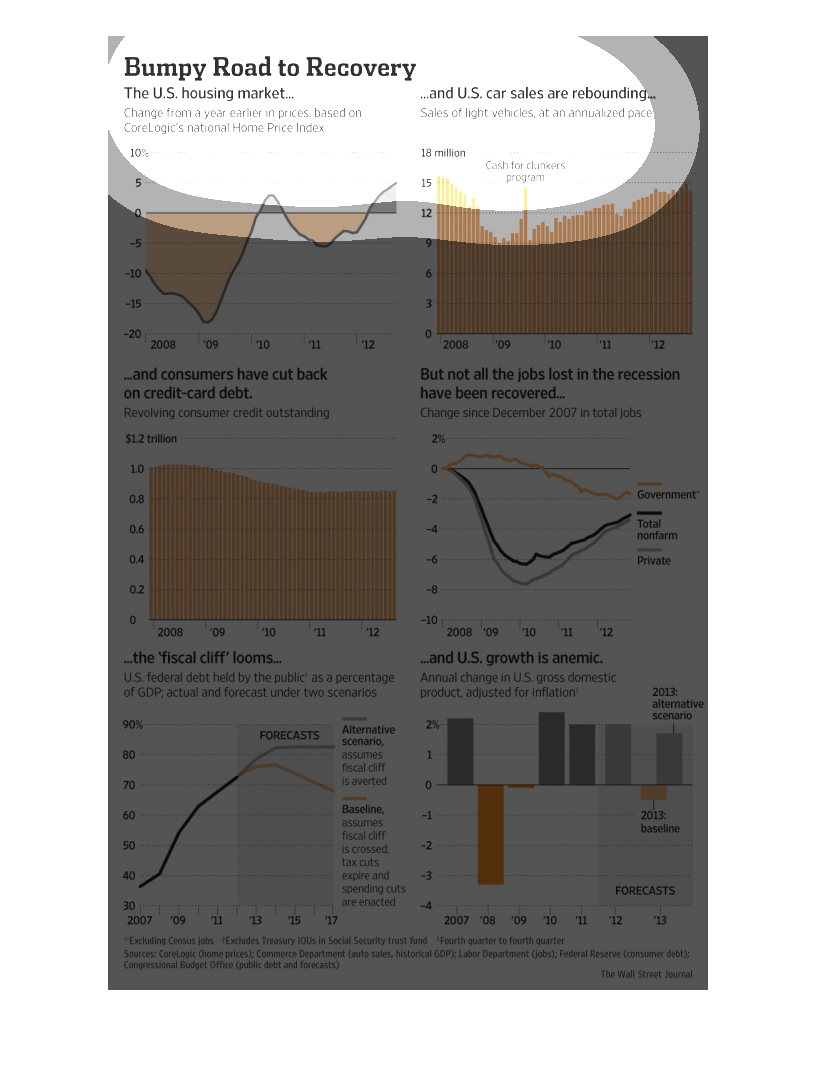

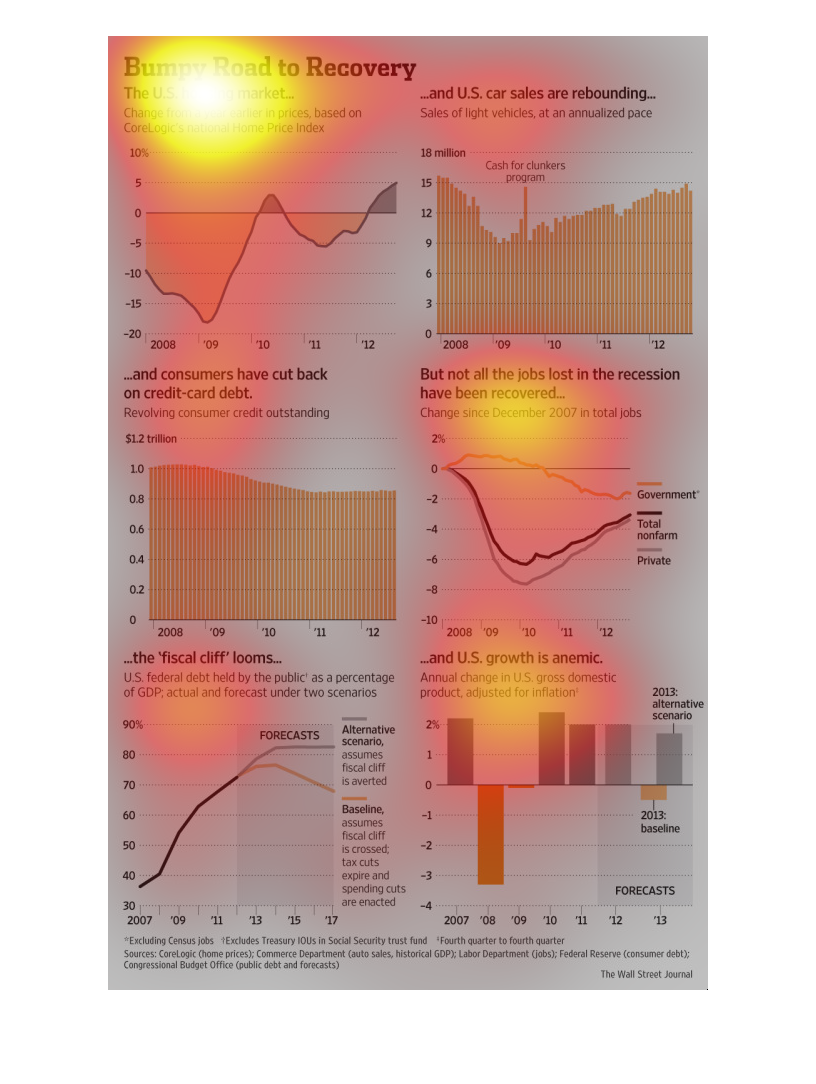

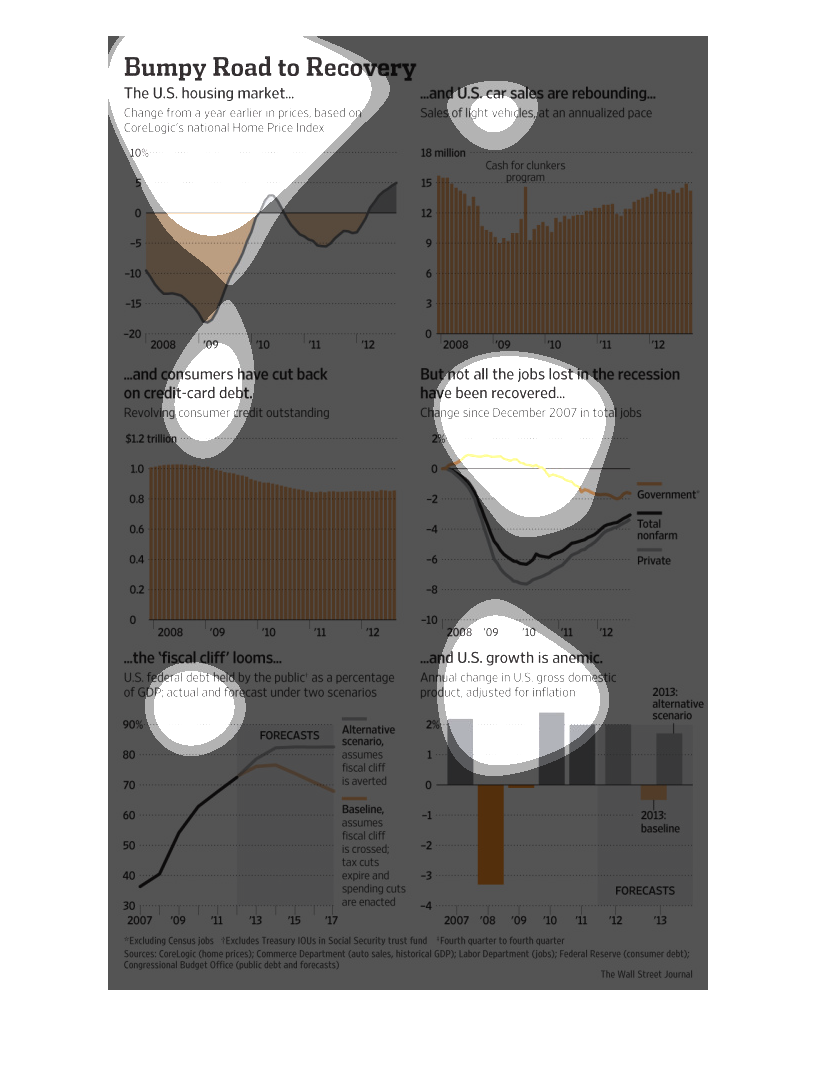

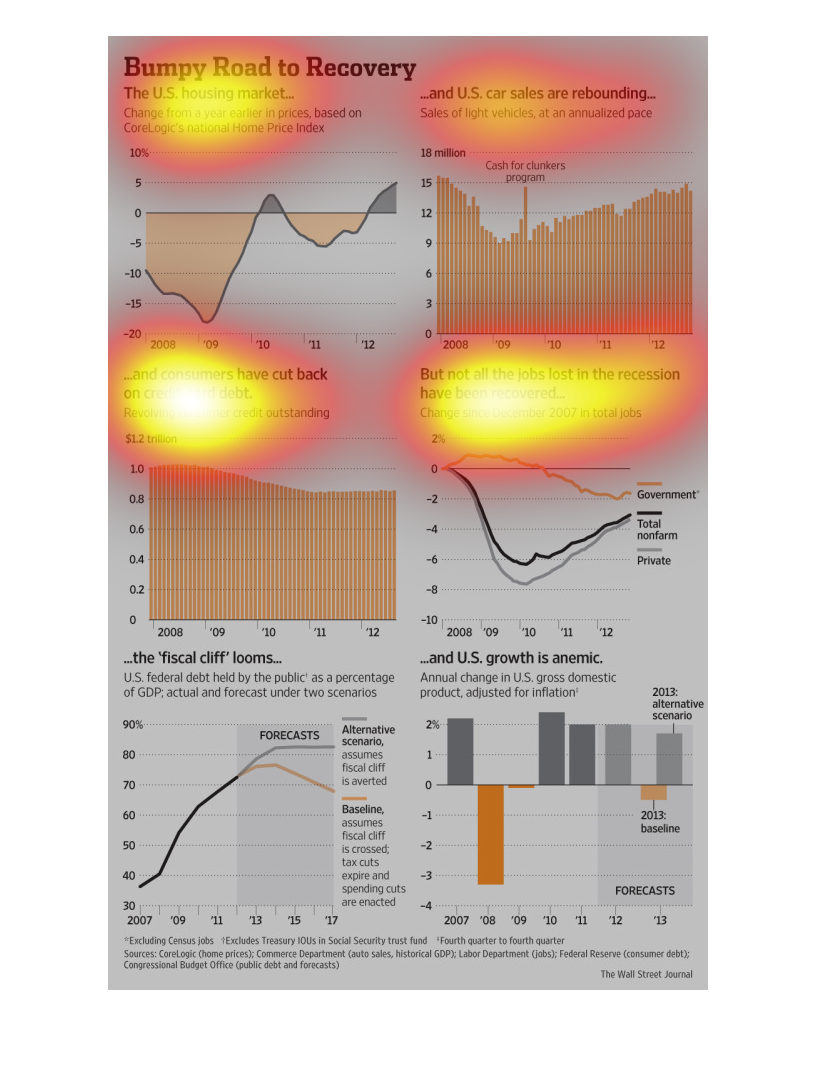

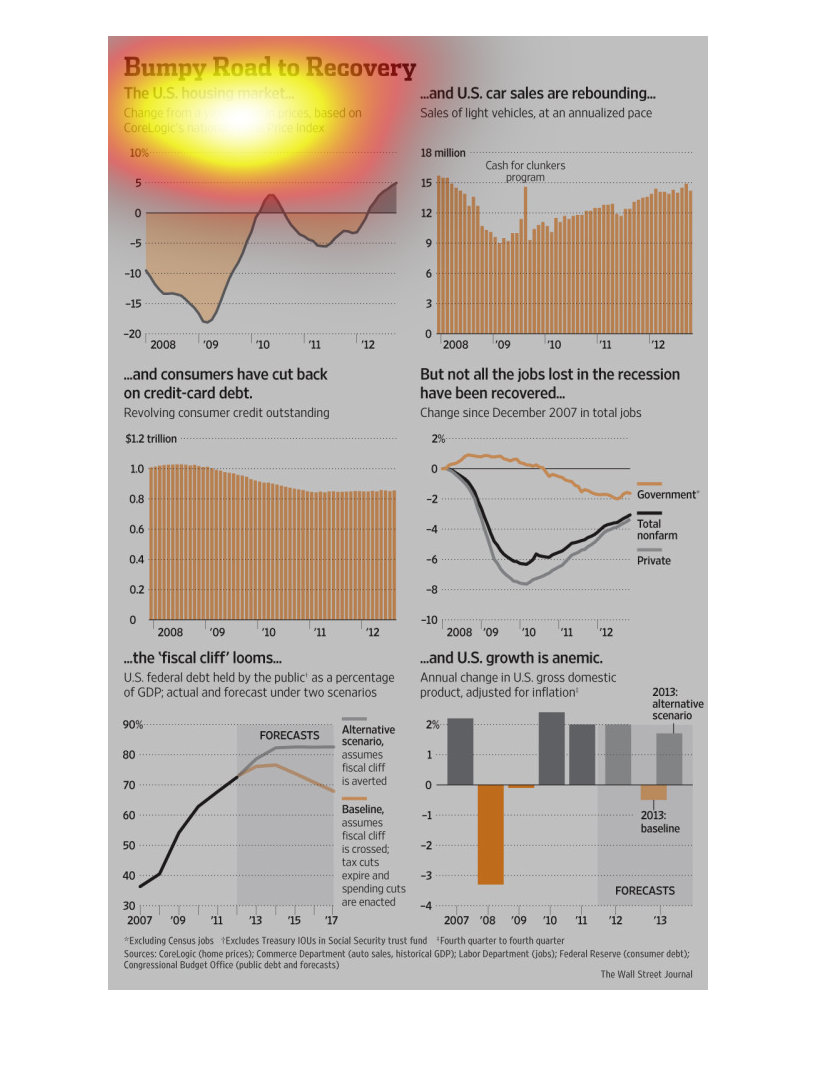

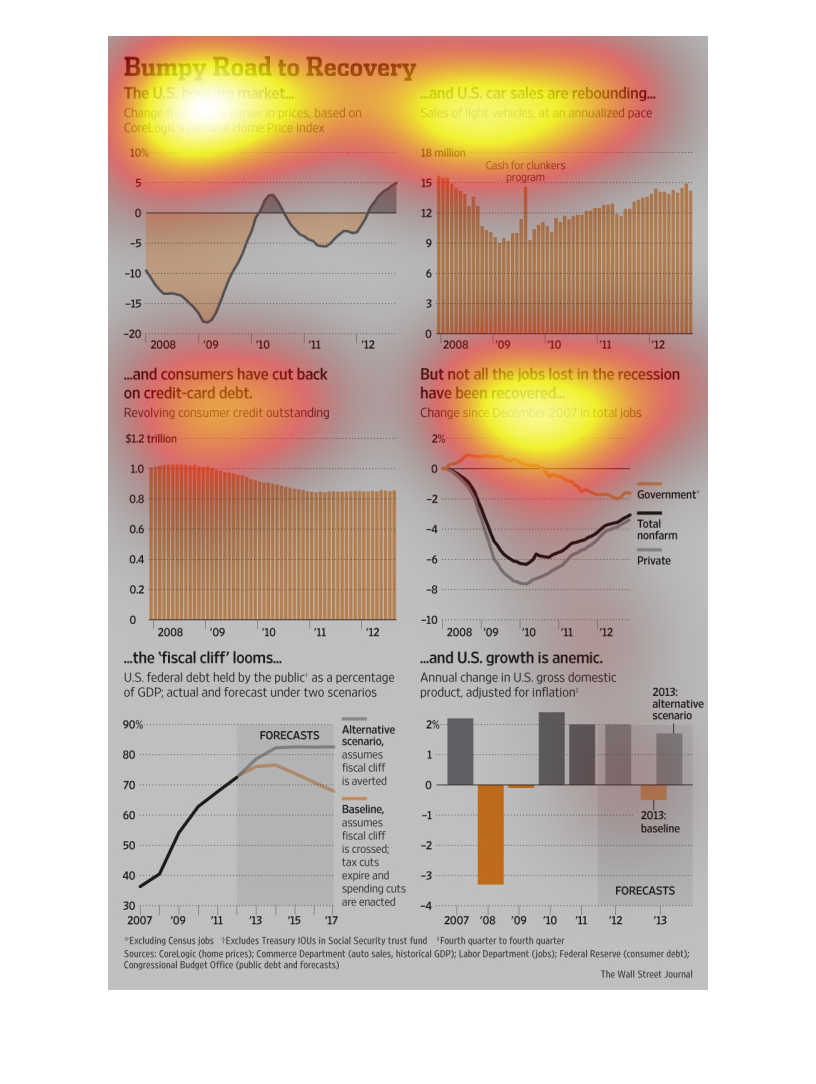

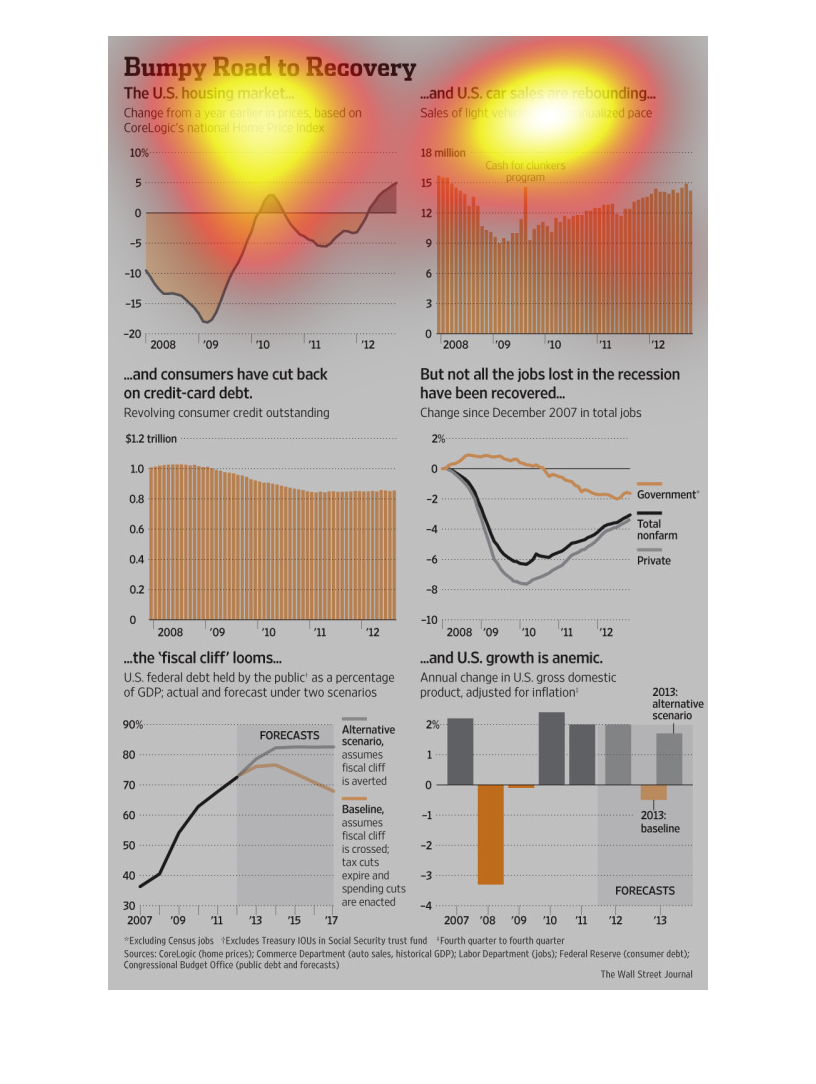

This image shows or depicts line and bar graph statistical format data concerning the bumpy

road to recovery. How the U.S. housing market in decline based on home price index.

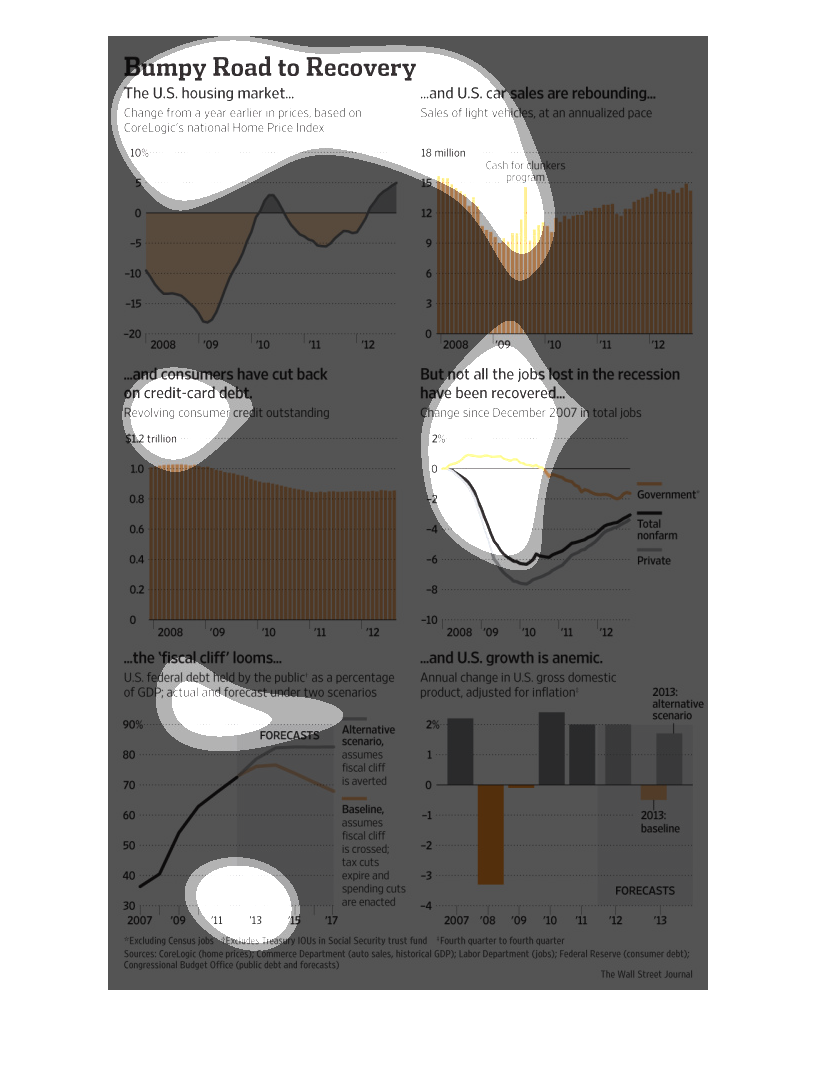

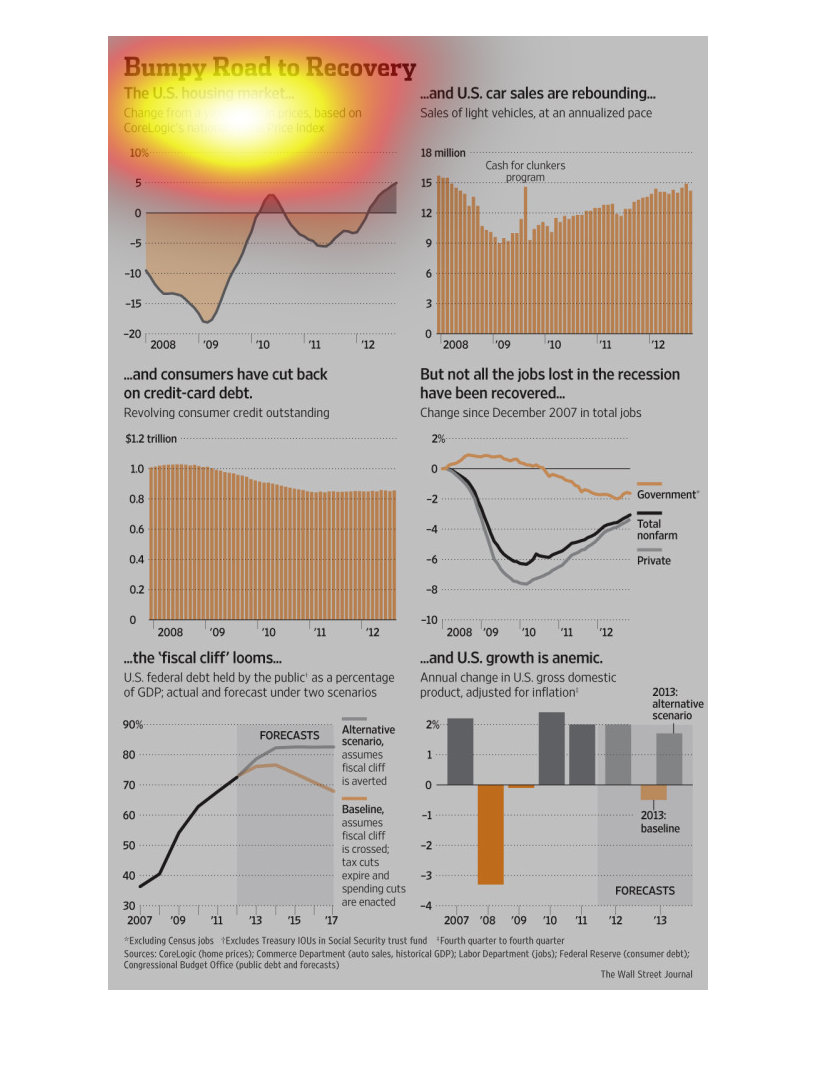

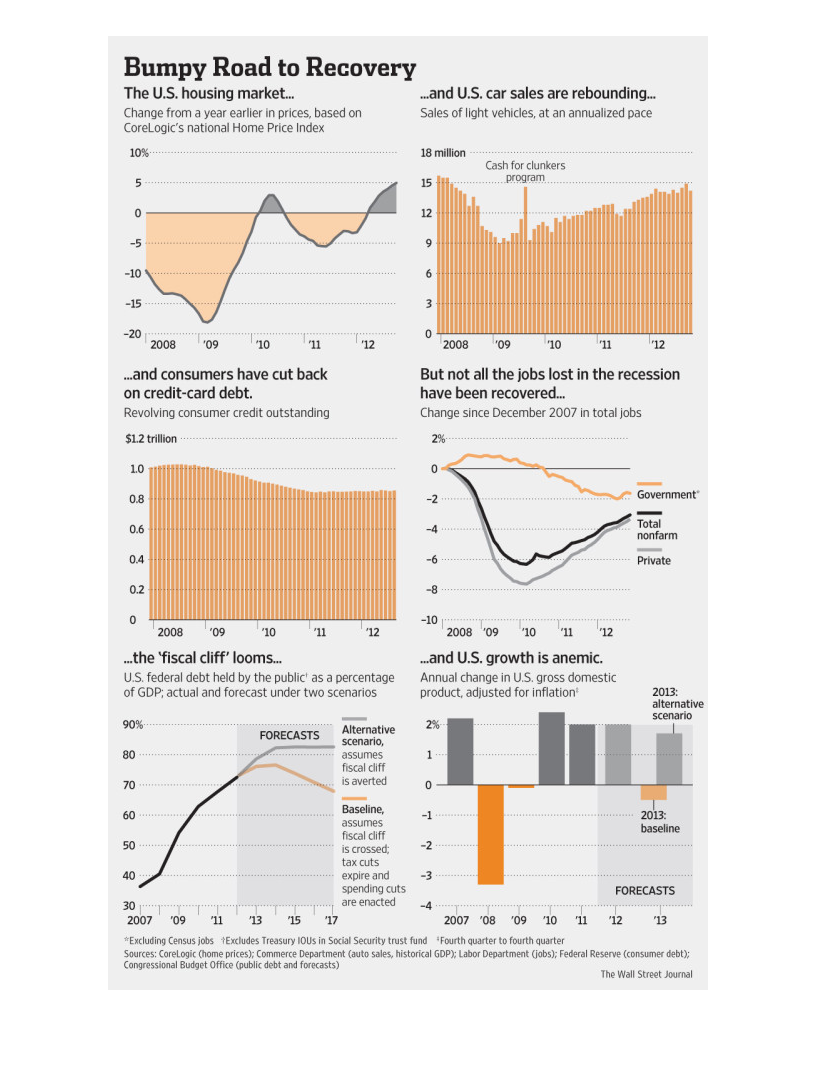

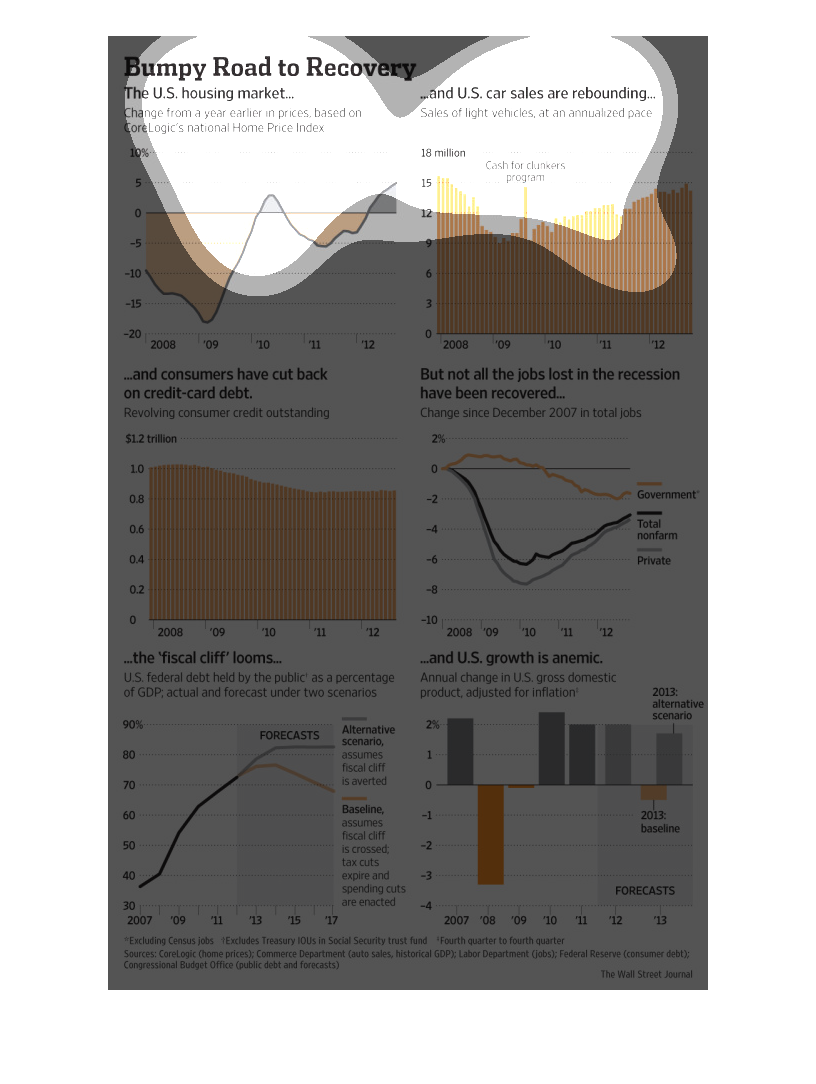

This image shows or depicts in various line and bar graph statistical formats information

about the bumpy road to recovery for the U.S. housing market.

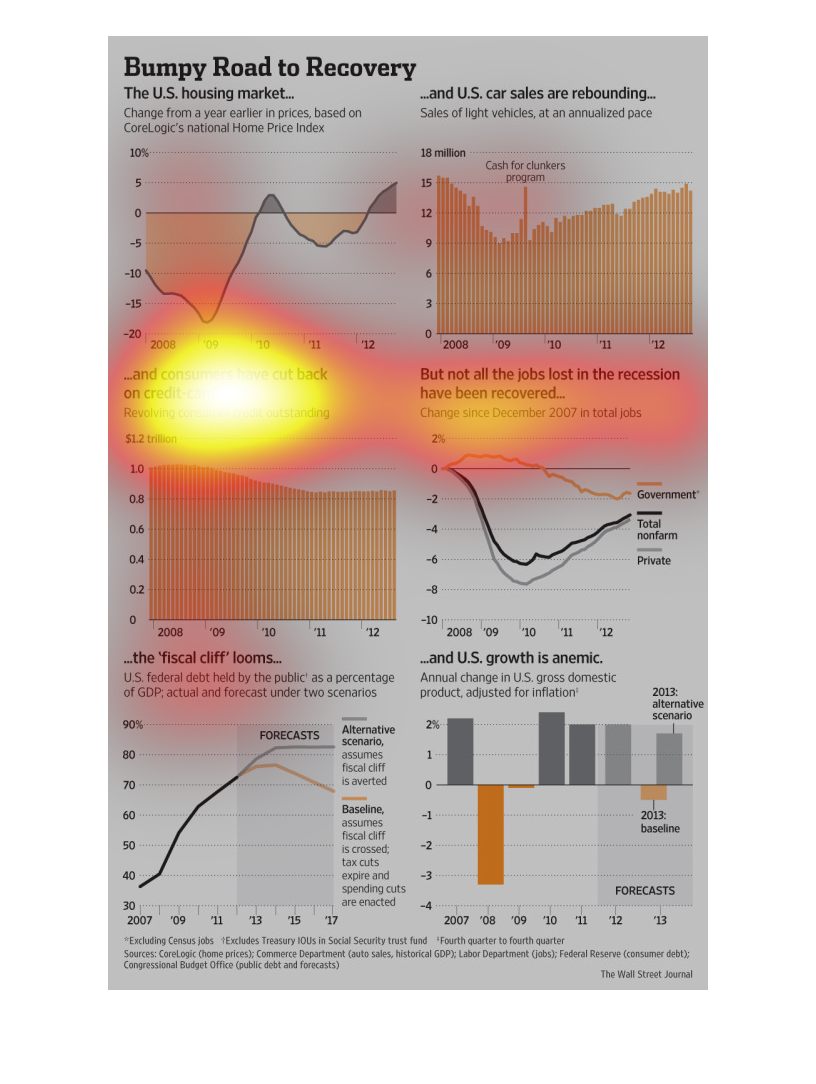

This chart shows the amount of credit card debt and employment loss during the recession it

also shows how the debt and job rate changes once the economy recovers

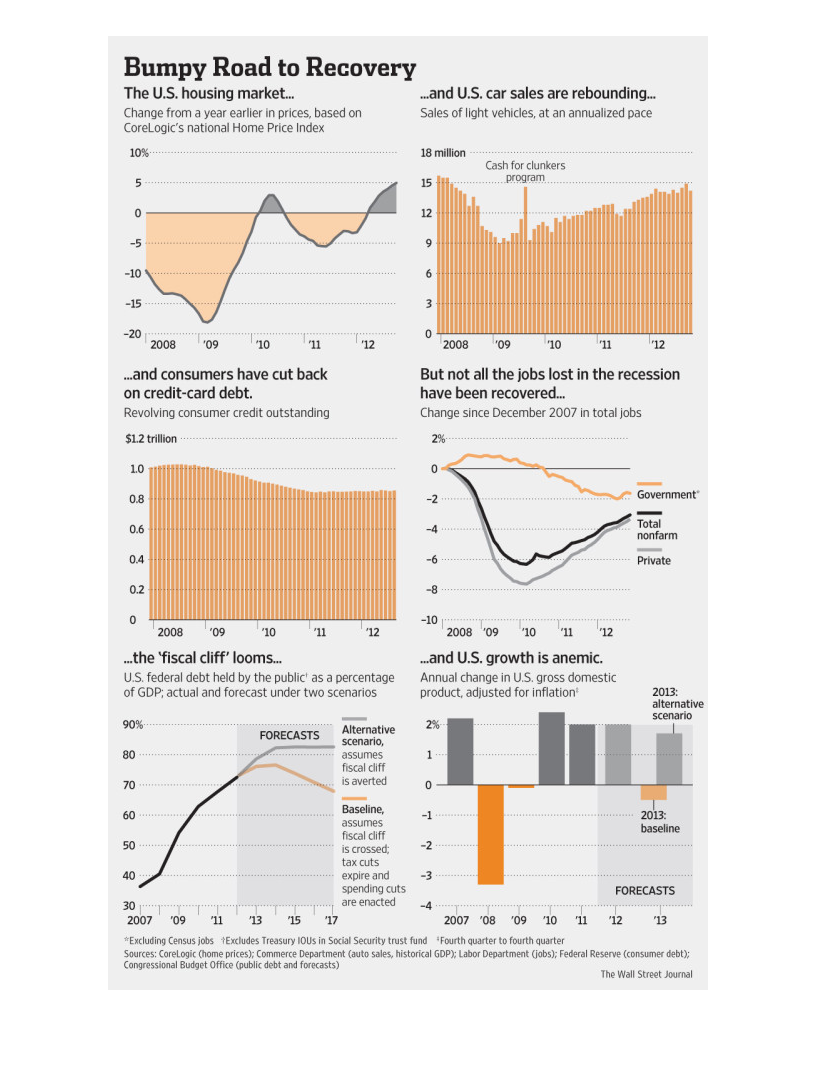

This chart from the Wall Street Journal shows how the US economic recovery is bumpy as measured

by home sales and prices as well as new automobile sales

There are 6 graphs in article covering different topics including consumers cutting back on

credit card debt. There is one graph stating that not all jobs have been recovered from the

recession. This whole article is about the U.S Housing market.

The image depicts the US housing market and US car sales rebounding, with consumers decreasing

their credit card debt, but the jobs lost during the recession have yet to be fully recovered

as of 2012.

According to the charts, the U.S. housing market will have a bumpy road to recovery. At the

same time, U.S. car sales are rebounding. Also, not all the jobs that were lost in the recession

have been recovered and consumers have cut back on credit card debt. A fiscal cliff looms

and overall growth is anemic.

The image shown is titled The Bumpy Road to recovery. alluding to the U.S.'s unstable housing

market and it's slow process of stabilizing and becoming profitable once again.

CoreLogic's national Home Price Index displays the market crash of 2008 and the following

rise. In a similar trend, autos are gradually being sold more. Consumer credit card debt has

also decreased. However, jobs haven't been completely recovered. Financial national forecasts

are made.

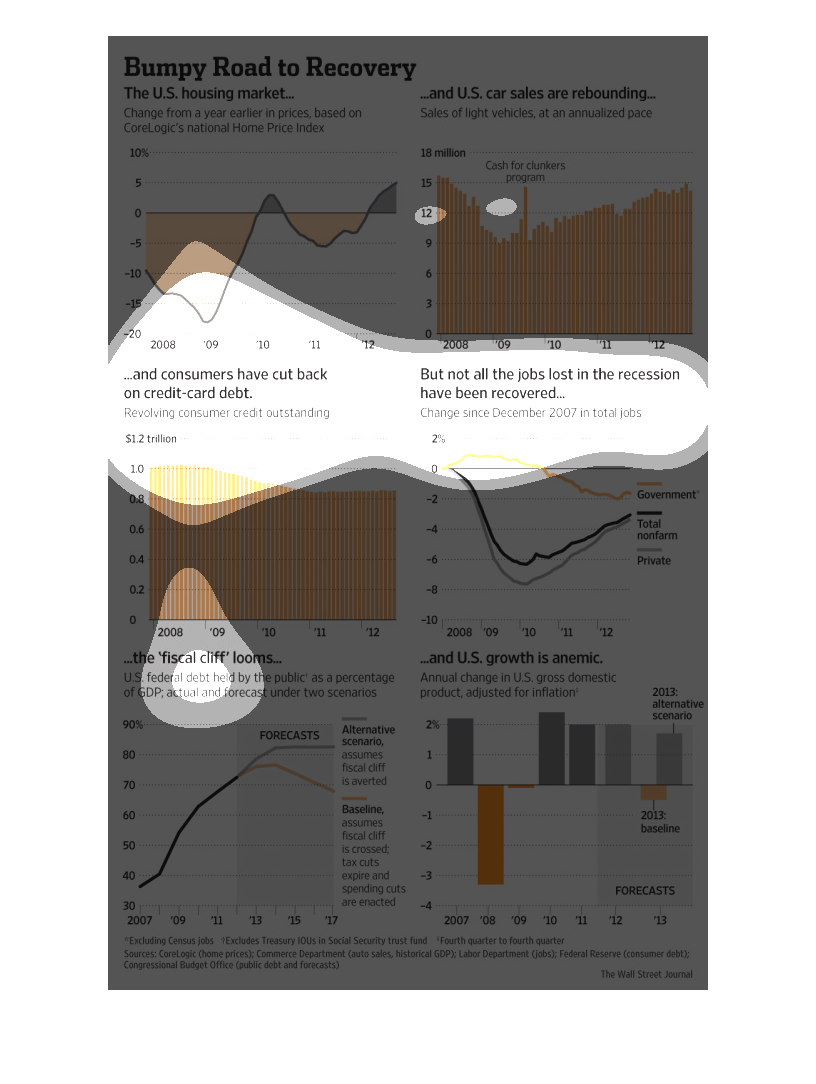

The image shows how the US housing market and US car sales are rebounding, with consumers

decreasing their credit card debt, with jobs lost during the recession yet to be fully recovered

as of yet.

According to the graph, the US housing market is slowly starting to recover, as well as the

US auto industry. The data seems to confirm this, but in the regard of specific jobs. Credit

card debt seems to be going down as well.

This chart from the Wall Street Journal shows how the US housing and car sales market is bumpy

and still not as healthy as it was pre recession in 2008

This image explains why there has been a bumpy road to recovery for the US economy after the

Great Recession. It shows how consumers are spending less on things like credit card purchases,

though some areas are bouncing back, such as car purchases. Some jobs have been regained,

but not all jobs.